Bitcoin Price Prediction 2025 (INR)

Predicting the price of Bitcoin in any currency, especially the volatile Indian Rupee (INR), is inherently speculative. However, by analyzing various influencing factors, we can construct potential price scenarios for Bitcoin in 2025. These scenarios are based on current trends and expert opinions, acknowledging the inherent uncertainty involved in long-term cryptocurrency price forecasts.

Factors Influencing Bitcoin’s Price in 2025 (INR)

Several interconnected factors will significantly impact Bitcoin’s price in INR by 2025. These include global macroeconomic conditions, regulatory changes in India and globally, technological advancements in the Bitcoin ecosystem, and the overall adoption rate of cryptocurrencies in India. Fluctuations in the INR against the US dollar will also play a crucial role, as Bitcoin is primarily priced in USD. For example, a strengthening dollar against the INR would likely lead to a higher INR price for Bitcoin, assuming the USD price remains constant. Conversely, a weakening dollar would have the opposite effect. Increased adoption among institutional investors and wider public acceptance within India would likely drive up demand, thus influencing price.

Potential Price Scenarios for Bitcoin in 2025 (INR)

We can Artikel three potential scenarios: bullish, bearish, and neutral. These scenarios are highly speculative and should not be considered financial advice.

A bullish scenario assumes continued global adoption of Bitcoin, positive regulatory developments in India, and a generally positive global economic climate. In this scenario, Bitcoin could reach significantly higher prices in INR, potentially exceeding ₹500 lakhs (₹50 million) or more, depending on the INR/USD exchange rate. This scenario is based on the potential for continued technological advancements and increasing institutional investment.

A bearish scenario, on the other hand, considers negative factors such as increased regulatory scrutiny in India leading to tighter restrictions, a global economic downturn, or a significant security breach impacting Bitcoin’s reputation. This scenario might see Bitcoin’s price in INR fall below current levels, potentially reaching ₹10 lakhs or even lower, depending on the INR/USD exchange rate and overall market sentiment. This scenario considers the possibility of reduced investor confidence and a decline in demand.

A neutral scenario represents a more moderate outlook. This assumes a relatively stable global economic climate, with neither significant positive nor negative developments impacting Bitcoin’s price. In this scenario, Bitcoin’s price in INR might fluctuate within a range, perhaps between ₹20 lakhs and ₹40 lakhs, depending on the INR/USD exchange rate and overall market sentiment. This scenario anticipates a period of consolidation and sideways price movement.

Hypothetical Bitcoin Price Chart (INR) in 2025

The following is a hypothetical illustration of potential Bitcoin price fluctuations in INR throughout 2025. This is a simplified representation and should not be interpreted as a precise prediction.

Imagine a chart with the x-axis representing the months of 2025 (January to December) and the y-axis representing the Bitcoin price in INR.

* January-March: The price starts around ₹25 lakhs, reflecting the existing market conditions.

* April-June: A period of growth fueled by positive news and increased adoption, pushing the price to approximately ₹35 lakhs.

* July-September: A slight correction occurs due to market volatility, bringing the price down to ₹30 lakhs.

* October-December: A strong bullish run driven by positive regulatory developments in India and increased institutional investment propels the price to ₹45 lakhs by year-end. This is a hypothetical scenario and the actual price may differ significantly.

Potential Regulatory Impacts on Bitcoin’s Price in India by 2025

The Indian government’s stance on cryptocurrencies will significantly influence Bitcoin’s price in INR. A clear and favorable regulatory framework could lead to increased investor confidence and higher prices. Conversely, stricter regulations or a complete ban could negatively impact the price. For instance, a well-defined regulatory framework that clarifies taxation and allows for institutional participation could lead to a surge in investment, driving the price upwards. Conversely, a ban or overly restrictive regulations could lead to a significant price drop, as seen in some other countries with similar actions. The potential for a central bank digital currency (CBDC) in India could also influence Bitcoin’s price, potentially leading to increased competition or a shift in investor sentiment.

Factors Affecting Bitcoin’s INR Value

Predicting Bitcoin’s price in Indian Rupees (INR) is complex, influenced by a multitude of interconnected global and local factors. Understanding these influences is crucial for navigating the volatile cryptocurrency market. The interplay between global macroeconomic trends, cryptocurrency market dynamics, technological advancements, and significant Bitcoin-specific events all contribute to the fluctuating INR value.

Global Economic Conditions and Bitcoin’s Correlation with the INR, Bitcoin Price In 2025 In Inr

Bitcoin’s price often exhibits an inverse correlation with the performance of traditional financial markets. During periods of economic uncertainty or inflation, investors may view Bitcoin as a hedge against inflation or a safe haven asset, driving up demand and consequently its price in INR. Conversely, strong global economic growth might lead investors to shift their focus back to traditional assets, potentially reducing Bitcoin’s appeal and its INR value. The exchange rate between the US dollar (USD) and the INR also plays a significant role; a weakening INR against the USD will generally increase the INR price of Bitcoin, as Bitcoin is primarily priced in USD. For instance, during periods of high inflation in India, investors might seek refuge in Bitcoin, leading to an increased demand and higher price in INR, even if the USD price remains relatively stable.

Cryptocurrency Market Trends and Adoption Rates

The overall sentiment and trends within the broader cryptocurrency market significantly impact Bitcoin’s price. Positive news, increased regulatory clarity, or mass adoption of cryptocurrencies can lead to a surge in demand for Bitcoin, boosting its INR value. Conversely, negative news, regulatory crackdowns, or a general market downturn can negatively impact Bitcoin’s price in INR. The increasing adoption of Bitcoin by institutional investors and larger companies also influences its price positively. For example, the entry of PayPal into the cryptocurrency market significantly boosted overall market sentiment and positively affected Bitcoin’s price across various fiat currencies, including the INR.

Technological Advancements and their Impact on Bitcoin’s INR Value

Technological advancements within the Bitcoin ecosystem can significantly influence its price. Layer-2 scaling solutions, for example, aim to improve transaction speed and reduce fees, making Bitcoin more user-friendly and potentially increasing its adoption rate. Successful implementations of such solutions can lead to a rise in Bitcoin’s value, as it addresses some of the key limitations of the original Bitcoin protocol. The development and adoption of the Lightning Network, a layer-2 scaling solution, is a prime example. Its success in improving Bitcoin’s scalability and transaction speed could contribute to a positive price movement in INR.

Impact of Major Events on Bitcoin’s Price and their Influence on the INR

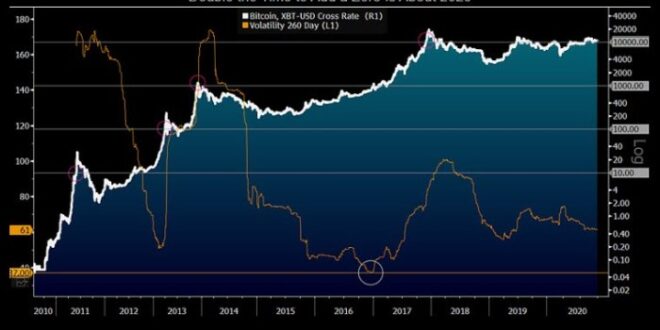

Bitcoin’s price is significantly affected by scheduled events like the halving, which reduces the rate at which new Bitcoins are created. Historically, halvings have been followed by periods of price appreciation, as the reduced supply often outweighs the demand. This effect is further amplified by the speculative nature of the cryptocurrency market. The 2020 Bitcoin halving, for example, was followed by a substantial price increase, although other factors also contributed to this rise. The anticipation leading up to these events also influences the price, creating volatility in the lead-up to and immediately following the event, impacting its INR value.

Investing in Bitcoin in India

Investing in Bitcoin in India presents both significant opportunities and considerable risks. The volatile nature of cryptocurrency markets, coupled with the evolving regulatory landscape in India, necessitates a cautious yet informed approach. This section Artikels a practical guide to navigating the complexities of Bitcoin investment in India, focusing on safe purchasing, storage, investment strategies, and risk assessment.

Safe Purchase and Storage of Bitcoin in India

Purchasing and securely storing Bitcoin in India requires diligence. Begin by choosing a reputable cryptocurrency exchange registered with the relevant Indian authorities. Verify the exchange’s security measures, including two-factor authentication (2FA) and cold storage options. Once you’ve chosen an exchange, complete the KYC (Know Your Customer) process, which involves verifying your identity. Then, fund your account via bank transfer or other accepted methods. After purchasing Bitcoin, transfer it to a secure hardware wallet, a physical device designed for storing cryptocurrencies offline. This minimizes the risk of hacking compared to keeping Bitcoin on an exchange. Regularly back up your hardware wallet’s seed phrase, which is crucial for recovering your Bitcoin if the device is lost or damaged. Never share your seed phrase with anyone.

Bitcoin Investment Strategies in 2025

Two primary strategies exist for Bitcoin investment: long-term holding (HODLing) and short-term trading. Long-term holding involves buying and holding Bitcoin for an extended period, typically years, anticipating price appreciation over time. This strategy mitigates the impact of short-term market volatility. In contrast, short-term trading involves frequent buying and selling of Bitcoin to capitalize on short-term price fluctuations. This requires significant market knowledge, technical analysis skills, and a higher risk tolerance. Consider your risk profile and investment goals before choosing a strategy. For example, a risk-averse investor might favor long-term holding, while a more risk-tolerant investor might engage in short-term trading, potentially using leverage (borrowing funds to increase investment).

Risks and Rewards of Bitcoin Investment in India in 2025

Investing in Bitcoin carries inherent risks. Price volatility is a major concern; Bitcoin’s price can fluctuate significantly in short periods. Regulatory uncertainty in India also poses a risk; changes in government policy could impact the legality and accessibility of Bitcoin. Security risks, such as hacking and scams, are prevalent in the cryptocurrency space. However, potential rewards can be substantial. If Bitcoin’s price appreciates as predicted by some analysts, investors could realize significant returns. The decentralized nature of Bitcoin offers a degree of financial freedom, reducing reliance on traditional financial institutions. Diversification is key to mitigating risks; avoid investing your entire portfolio in Bitcoin.

Risk Assessment Matrix for Bitcoin Investment in INR

The following matrix illustrates the interplay between Bitcoin price volatility and INR fluctuation, impacting investment risk:

| Bitcoin Price Movement | INR Appreciation Against USD | INR Depreciation Against USD | Risk Level |

|---|---|---|---|

| Appreciation | Low | Medium | Moderate to High |

| Depreciation | Medium to High | High | High |

This matrix suggests that a combination of Bitcoin price depreciation and INR depreciation against the USD presents the highest risk. Conversely, Bitcoin price appreciation coupled with INR appreciation against the USD presents the lowest risk. It is crucial to monitor both Bitcoin’s price in USD and the INR/USD exchange rate to effectively assess your investment risk. Remember that this is a simplified representation and actual risk may vary based on individual circumstances and investment strategies.

Bitcoin’s Role in the Indian Economy (2025)

By 2025, Bitcoin’s potential integration into the Indian financial system remains a complex and evolving landscape. While widespread adoption as a primary currency is unlikely, its role as an alternative investment asset and a potential facilitator of cross-border payments could become increasingly significant. The interplay between regulatory frameworks, technological advancements, and public perception will shape its ultimate impact.

Bitcoin’s adoption in India by 2025 could bring about both positive and negative consequences for the national economy. A potential positive impact lies in its ability to enhance financial inclusion, particularly in underserved areas with limited access to traditional banking services. Furthermore, increased liquidity and investment in the cryptocurrency market could stimulate economic activity. However, potential negative consequences include volatility risks, the potential for money laundering and illicit activities, and the challenge of integrating Bitcoin into the existing regulatory structure. The overall economic effect will depend heavily on the level of adoption and the effectiveness of regulatory measures.

Bitcoin as a Store of Value in India

Comparing Bitcoin’s potential as a store of value against traditional assets like gold or the Indian Rupee in 2025 requires a nuanced perspective. While gold has historically served as a safe haven asset in India, its liquidity and accessibility are limited compared to Bitcoin. The Indian Rupee, susceptible to inflation and currency fluctuations, offers less stability as a long-term store of value. Bitcoin, though volatile, offers the potential for significant returns and its decentralized nature makes it less susceptible to government control. However, its volatility presents a considerable risk, making it unsuitable for all investors. The optimal choice will depend on individual risk tolerance and investment goals. For example, a younger investor with a longer time horizon might view Bitcoin’s volatility as a potential advantage, while an older investor closer to retirement might prefer the relative stability of gold.

Bitcoin as a Payment Method in India: Advantages and Disadvantages

The use of Bitcoin as a payment method in India by 2025 presents a mixed bag of advantages and disadvantages. Its decentralized nature could reduce reliance on traditional financial intermediaries, potentially lowering transaction costs and processing times. International remittances could become significantly cheaper and faster. However, the inherent volatility of Bitcoin poses a significant risk to merchants and consumers alike. The lack of widespread merchant adoption and regulatory uncertainty also hinder its broader acceptance. Furthermore, the technical expertise required to use Bitcoin effectively might exclude a significant portion of the population.

| Advantages | Disadvantages |

|---|---|

| Reduced transaction costs | High volatility and price fluctuations |

| Faster transaction speeds | Lack of widespread merchant adoption |

| Increased financial inclusion | Regulatory uncertainty and potential legal risks |

| Potential for cheaper international remittances | Technical complexity and potential for scams |

Frequently Asked Questions (FAQs): Bitcoin Price In 2025 In Inr

Investing in Bitcoin, especially in a developing market like India, involves navigating a unique set of challenges and opportunities. Understanding the potential risks, legal landscape, and tax implications is crucial for making informed investment decisions. The following sections address common concerns regarding Bitcoin investment in India.

Potential Risks of Investing in Bitcoin in India

Investing in Bitcoin carries inherent risks, amplified by the regulatory uncertainty and market volatility in India. Price volatility is a primary concern; Bitcoin’s value can fluctuate dramatically in short periods, leading to significant losses. Furthermore, the lack of robust consumer protection mechanisms in the cryptocurrency market leaves investors vulnerable to scams, fraud, and theft. Security risks associated with storing Bitcoin, whether through exchanges or personal wallets, are also substantial. Hacking, loss of private keys, and exchange failures can result in the complete loss of investment. Finally, the evolving regulatory landscape in India adds another layer of risk, with potential changes in laws impacting the legality and taxation of Bitcoin investments. Consider the case of Mt. Gox, a prominent Bitcoin exchange that collapsed in 2014, highlighting the risk of exchange failure. Investors who held their Bitcoin on that exchange suffered substantial losses.

Protecting Against Bitcoin Price Volatility in INR

Mitigating the risk of Bitcoin’s price volatility requires a diversified investment strategy and a cautious approach. Dollar-cost averaging (DCA), a strategy involving investing a fixed amount of money at regular intervals regardless of price, can help reduce the impact of short-term fluctuations. This method lessens the risk of investing a large sum at a price peak. Another approach is to only invest what you can afford to lose. Avoid investing borrowed money or funds essential for other financial obligations. Furthermore, understanding your risk tolerance is crucial. Investors with a low risk tolerance might consider allocating only a small percentage of their portfolio to Bitcoin. Diversification across other asset classes, such as stocks, bonds, and real estate, further reduces overall portfolio risk. Finally, staying informed about market trends and regulatory developments is essential for making well-informed investment decisions.

Bitcoin’s Legal Status and Regulatory Landscape in India

The legal status of Bitcoin in India remains somewhat unclear. While not explicitly banned, it lacks specific legal recognition as a currency or an asset class. The Reserve Bank of India (RBI) has issued circulars in the past expressing concerns about the risks associated with cryptocurrencies, but these have faced legal challenges and been overturned. Currently, there’s ongoing discussion and deliberation within the government regarding the creation of a comprehensive regulatory framework for cryptocurrencies. This regulatory uncertainty creates challenges for investors, as the legal landscape can shift unexpectedly. It is essential to monitor official announcements from the RBI and the Indian government to stay updated on any regulatory changes that might affect Bitcoin investments.

Tax Implications of Bitcoin Investments in India

The tax implications of Bitcoin investments in India are complex and depend on how the investments are treated. Profits from Bitcoin trading are generally considered as income from “speculative business” and are taxed as capital gains. The tax rate depends on the holding period of the Bitcoin. Short-term capital gains (holding period less than 36 months) are taxed at the investor’s applicable income tax slab rate. Long-term capital gains (holding period exceeding 36 months) are taxed at 20% with indexation benefits. Losses incurred on Bitcoin investments can be offset against capital gains from other assets. However, it’s crucial to maintain meticulous records of all Bitcoin transactions to comply with tax regulations. Consulting with a tax professional is highly recommended to ensure accurate tax reporting and compliance with the current regulations.

Predicting the Bitcoin price in 2025 in INR is challenging, depending heavily on various market factors. To understand potential future values, it’s helpful to consider broader global predictions; for instance, check out this insightful analysis on What Will Bitcoin Be Worth 2025 to get a better sense of the overall market sentiment. Ultimately, the Bitcoin price in 2025 in INR will be influenced by the global Bitcoin price and the INR exchange rate.

Predicting the Bitcoin price in 2025 in INR is challenging, depending on various market factors. For a deeper dive into potential price movements, a comprehensive analysis is needed, such as the one provided in this insightful report: Bitcoin Price Analysis 2025. Understanding the global trends discussed there will better inform any estimations of Bitcoin’s value in INR by 2025.

Predicting the Bitcoin price in 2025 in INR is challenging, depending on various market factors. A key component of this prediction involves understanding the potential price trajectory throughout the year, particularly in December. To gain insight into this, checking the projected Bitcoin Price Dec 2025 can be helpful. This data point, in turn, will offer a more complete picture when assessing the overall Bitcoin price in INR for the entire year 2025.

Predicting the Bitcoin price in 2025 in INR is challenging, dependent on numerous market factors. To gain a visual understanding of potential price trajectories, refer to this helpful resource: Bitcoin Price Prediction 2025 Chart. Analyzing this chart can provide valuable insights to better inform your understanding of the potential Bitcoin price in INR by 2025.

Predicting the Bitcoin price in 2025 in INR is challenging, dependent on numerous factors influencing its value. For a comprehensive overview of potential price movements, check out this insightful resource on Bitcoin Price Prediction 2025 Re: Bitcoin Price Prediction 2025 Re. Ultimately, the Bitcoin price in 2025 in INR will likely depend on global market trends and regulatory developments.