Bitcoin Price Prediction 2025: Bitcoin Price In 2025 Prediction

Predicting the price of Bitcoin in 2025 is a challenging endeavor, given its inherent volatility and susceptibility to a wide range of influencing factors. Bitcoin’s history is a rollercoaster of dramatic price swings, marked by periods of explosive growth followed by sharp corrections. Understanding these fluctuations and the forces driving them is crucial for any attempt at informed prediction.

Bitcoin’s journey has been characterized by significant price movements. Its initial years saw slow, steady growth, followed by a surge in 2017, reaching almost $20,000. This was driven by increased media attention and growing adoption. The subsequent crash and subsequent recovery cycles illustrate the asset’s volatile nature. The 2021 bull run, pushing Bitcoin beyond $60,000, demonstrated its potential for rapid appreciation, while subsequent market downturns highlighted its risk. These fluctuations are influenced by a complex interplay of factors.

Factors Influencing Bitcoin’s Price

Several key factors contribute to Bitcoin’s price volatility and future trajectory. Regulatory changes, for example, can significantly impact investor confidence and market liquidity. A positive regulatory environment in major economies could lead to increased institutional investment and price appreciation, while stricter regulations might dampen enthusiasm. Market sentiment, driven by news events, social media trends, and overall economic conditions, also plays a crucial role. Positive news and widespread adoption often fuel price increases, while negative news or regulatory uncertainty can trigger sell-offs. Technological advancements, such as improvements in scalability and transaction speed, can also affect Bitcoin’s price. Finally, macroeconomic conditions, such as inflation rates, interest rates, and global economic growth, can indirectly influence Bitcoin’s price as investors seek alternative assets during times of economic uncertainty. For example, the inflationary pressures of 2021-2022 led some investors to seek refuge in Bitcoin as a hedge against inflation, contributing to its price increase.

Factors Influencing Bitcoin’s Future Price

Predicting Bitcoin’s price in 2025, or any year for that matter, is inherently complex. Numerous interconnected factors, both internal to the cryptocurrency ecosystem and external to it, significantly influence its value. Understanding these factors is crucial for any assessment of potential future price movements.

Global Economic Conditions and Bitcoin’s Value

Macroeconomic conditions play a significant role in Bitcoin’s price. Periods of high inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation. The perceived scarcity of Bitcoin, with a fixed supply of 21 million coins, contrasts sharply with the potential for inflationary pressures in fiat currencies. Conversely, during economic recessions, investors may sell off riskier assets, including Bitcoin, to secure capital, leading to price drops. The 2022 bear market, coinciding with rising inflation and interest rates globally, serves as a recent example of this correlation. Conversely, during periods of economic uncertainty, Bitcoin’s decentralized and censorship-resistant nature can attract investors seeking refuge from volatile traditional markets.

Institutional Adoption and Investment

The increasing involvement of institutional investors, such as large corporations and investment funds, significantly impacts Bitcoin’s price. As more institutional players allocate capital to Bitcoin, demand increases, driving up the price. MicroStrategy’s significant Bitcoin holdings, for example, represent a major institutional commitment. This adoption legitimizes Bitcoin in the eyes of many investors, fostering broader market confidence and attracting further investment. Conversely, a significant sell-off by a major institutional holder could trigger a price correction.

Technological Advancements and Bitcoin’s Usability

Technological improvements within the Bitcoin ecosystem directly influence its usability and, consequently, its price. The Lightning Network, for example, aims to address Bitcoin’s scalability challenges by enabling faster and cheaper transactions off the main blockchain. Successful implementation and widespread adoption of the Lightning Network could lead to increased usage and, potentially, a higher price. Similarly, the Taproot upgrade enhanced Bitcoin’s privacy and smart contract capabilities, making it more attractive for developers and users. These technological advancements can increase Bitcoin’s appeal and adoption, leading to higher demand and price appreciation.

Government Regulations and Policies

Government regulations and policies around the world play a crucial role in shaping Bitcoin’s price. Favorable regulatory frameworks can increase investor confidence and institutional adoption, boosting the price. Conversely, restrictive regulations or outright bans can negatively impact Bitcoin’s price by limiting its accessibility and usage. The regulatory landscape varies considerably across jurisdictions, creating both opportunities and challenges for Bitcoin’s price trajectory. For instance, clear regulatory guidelines could attract more institutional investors, while outright bans in certain countries can reduce overall demand.

Bitcoin’s Price Performance Compared to Other Asset Classes

Bitcoin’s price performance can be compared to that of other established asset classes like gold and stocks. Often described as “digital gold,” Bitcoin shares some characteristics with gold, such as scarcity and perceived store-of-value properties. However, Bitcoin’s price volatility is significantly higher than gold’s. Compared to stocks, Bitcoin exhibits a different risk-reward profile. Its price is less correlated with traditional market indices, offering potential diversification benefits for investors. However, Bitcoin’s price is susceptible to dramatic swings driven by factors unique to the cryptocurrency market. Understanding these comparisons helps investors assess Bitcoin’s risk and potential return relative to other investment options.

Expert Opinions and Market Analyses

Predicting the price of Bitcoin in 2025 is inherently speculative, yet analyzing expert opinions and market research provides valuable insights into potential price trajectories. The following sections summarize diverse viewpoints and methodologies used to forecast Bitcoin’s future value, highlighting the range of possibilities and the underlying assumptions informing these predictions. It’s crucial to remember that these are predictions, not guarantees, and the actual price could differ significantly.

Diverse Expert Predictions and Price Ranges

Several prominent economists, financial analysts, and Bitcoin experts have offered their perspectives on Bitcoin’s potential price in 2025. These predictions often fall into three broad categories: bullish, bearish, and neutral. Bullish predictions anticipate substantial price appreciation, bearish predictions foresee a price decline or stagnation, and neutral predictions suggest moderate growth or sideways movement. The divergence in opinions underscores the complexity of predicting the cryptocurrency market.

Categorization of Expert Opinions

Bitcoin Price In 2025 Prediction – For illustrative purposes, let’s consider hypothetical examples of expert predictions. Note that these are fictional examples and do not represent actual predictions from specific individuals:

Bullish Predictions (Price above $100,000): Some experts, basing their predictions on continued adoption by institutional investors and increasing scarcity due to Bitcoin’s limited supply, foresee prices exceeding $100,000 by 2025. Their models might incorporate factors like growing global macroeconomic uncertainty and increasing demand from emerging markets.

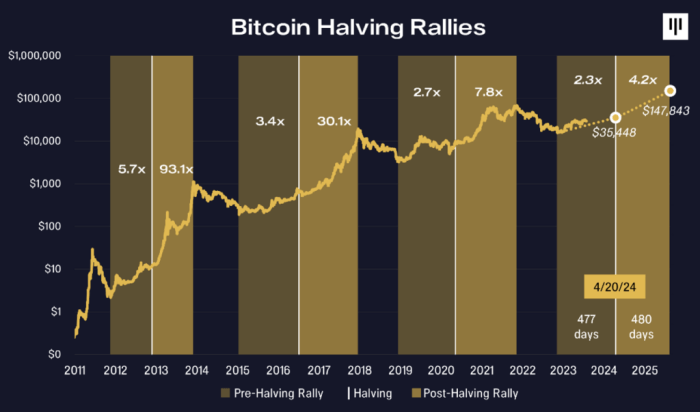

Predicting the Bitcoin price in 2025 is challenging, influenced by numerous factors including technological advancements and overall market sentiment. A key event to consider is the next halving, which will significantly impact the rate of new Bitcoin entering circulation. For more information on this crucial event, check out this resource on Next. Bitcoin. Halving.

2025. Understanding the halving’s potential effects is vital for any accurate Bitcoin price prediction in 2025.

Neutral Predictions ($50,000 – $100,000): A more conservative outlook might suggest a price range between $50,000 and $100,000. These predictions often consider factors like regulatory uncertainty, technological advancements, and potential competition from other cryptocurrencies. This group might emphasize the inherent volatility of the market and the difficulty in accurately predicting long-term trends.

Predicting the Bitcoin price in 2025 is challenging, with various factors influencing its trajectory. A key aspect to consider is the potential price movements within that year, such as the prediction for February, which you can find detailed here: Bitcoin Price Prediction For February 2025. Understanding the potential price fluctuations in individual months helps build a more comprehensive outlook for the entire year and contribute to a more informed Bitcoin Price In 2025 Prediction.

Bearish Predictions (Price below $50,000): Bearish predictions, often rooted in concerns about regulatory crackdowns, market bubbles, and the emergence of competing technologies, might forecast a price below $50,000. These predictions often highlight the risks associated with investing in cryptocurrencies and emphasize the possibility of significant price corrections.

Predicting the Bitcoin price in 2025 is a complex endeavor, influenced by numerous factors. A key element to consider is the impact of the next Bitcoin halving, which is expected to significantly reduce the rate of new Bitcoin creation. For insightful analysis on this crucial event, check out this resource on Bitcoin Price Prediction Halving 2025 to better understand how this event might shape the overall Bitcoin price in 2025.

Ultimately, the future price remains speculative, but understanding the halving’s influence is vital for informed predictions.

Comparison of Prediction Models

The following table compares different hypothetical prediction models, highlighting their underlying assumptions. Remember that these are illustrative examples, and real-world models are far more complex.

| Model Name | Price Prediction (2025) | Key Assumptions | Data Sources |

|---|---|---|---|

| Adoption-Driven Model | $150,000 | High institutional adoption, increasing global demand | Transaction volume, institutional investment data |

| Macroeconomic Model | $75,000 | Moderate inflation, global economic uncertainty | Inflation rates, GDP growth forecasts |

| Technological Model | $40,000 | Technological advancements in competing cryptocurrencies | Research papers, development timelines |

| Regulatory Model | $30,000 | Stringent regulatory frameworks, reduced market liquidity | Regulatory announcements, market capitalization data |

Potential Price Scenarios for Bitcoin in 2025

Predicting the price of Bitcoin in 2025 involves significant uncertainty, given the volatile nature of the cryptocurrency market. However, by considering various factors – including technological advancements, regulatory changes, macroeconomic conditions, and overall market sentiment – we can Artikel three plausible price scenarios: optimistic, realistic, and pessimistic. These scenarios are not predictions, but rather illustrative possibilities based on current trends and expert analysis.

Optimistic Price Scenario: Bitcoin Surges Past $100,000

This scenario envisions a highly bullish market driven by widespread institutional adoption, significant technological advancements (like Layer-2 scaling solutions improving transaction speeds and reducing fees), and continued global economic uncertainty leading investors to seek alternative assets like Bitcoin. Positive regulatory developments, particularly in major economies, would also contribute to this outcome. Increased demand coupled with a relatively limited supply would propel Bitcoin’s price significantly higher. We project a price target of $150,000 by the end of 2025 in this scenario. This would be similar to the surge seen in late 2020 and early 2021, but sustained over a longer period, reflecting a broader acceptance of Bitcoin as a store of value and a hedge against inflation.

A graph depicting this scenario would show a steep, consistent upward trend from current prices, accelerating in the latter half of 2024 and into 2025, eventually surpassing $150,000. The line would represent a consistently bullish market with minimal periods of significant correction.

Realistic Price Scenario: Bitcoin Consolidates Around $50,000

This scenario anticipates a more moderate price movement, reflecting a period of market consolidation and maturation. While institutional adoption continues, it progresses at a slower pace than in the optimistic scenario. Regulatory uncertainty persists in some regions, potentially dampening enthusiasm. Technological improvements occur, but their impact on price is less dramatic than in the optimistic case. Macroeconomic factors play a more significant role, with potential market corrections influencing Bitcoin’s price. We project a price target of approximately $50,000 by the end of 2025 under this scenario. This would represent a substantial increase from current prices, but less dramatic than the optimistic scenario, reflecting a more stable and less volatile market.

A graph illustrating this scenario would show a more gradual upward trend, with periods of consolidation and minor corrections. The overall direction is positive, but the slope is less steep than in the optimistic scenario, reflecting a more balanced market dynamic.

Pessimistic Price Scenario: Bitcoin Faces a Significant Correction

This scenario Artikels a bearish market, potentially triggered by a combination of factors. Stringent regulatory crackdowns in major economies, a prolonged cryptocurrency market downturn mirroring the 2018 bear market, or a major security breach affecting the Bitcoin network could all contribute to a significant price drop. Negative macroeconomic conditions, such as a global recession, could also exacerbate the situation. In this pessimistic scenario, we project a price target of around $20,000 by the end of 2025. This would represent a substantial correction from current levels, reflecting a period of significant market uncertainty and reduced investor confidence. This price point is similar to previous lows seen during bear markets, suggesting a potential return to levels observed in earlier market cycles.

A graph showing this scenario would depict a downward trend with significant volatility, potentially including sharp drops and prolonged periods below the $30,000 mark. The overall trajectory is negative, reflecting a bearish market sentiment and significant investor losses.

Risks and Uncertainties Associated with Bitcoin Price Predictions

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently fraught with risk and uncertainty. Numerous factors, both internal and external to the cryptocurrency market, can significantly influence its price, making accurate long-term forecasting exceptionally challenging. While various models attempt to predict future price movements, these models are often limited in their scope and accuracy.

The inherent volatility of Bitcoin makes precise price prediction extremely difficult. Unlike traditional assets with established valuation models, Bitcoin’s price is driven by a complex interplay of factors including technological developments, regulatory changes, market sentiment, and macroeconomic conditions. Furthermore, the relatively young age of Bitcoin and the cryptocurrency market as a whole means there is limited historical data to build robust predictive models upon. This lack of historical context increases the uncertainty surrounding future price movements.

Limitations of Forecasting Models

Bitcoin price forecasting models, often based on technical analysis, fundamental analysis, or a combination of both, are subject to inherent limitations. Technical analysis, relying on historical price and volume data to identify patterns, struggles to account for unforeseen events or shifts in market sentiment. Fundamental analysis, which considers factors like adoption rate, technological advancements, and regulatory landscape, can be hampered by the difficulty in accurately assessing the long-term impact of these factors. For instance, a model might accurately predict price increases based on increasing adoption, but fail to account for a sudden regulatory crackdown that could drastically alter the market. The limitations are further compounded by the fact that many models rely on assumptions about future market behavior that may not hold true.

Influence of Unpredictable Events

Unpredictable events, often referred to as “black swan” events, can have a profound and immediate impact on Bitcoin’s price. These are rare, highly impactful events that are difficult or impossible to predict. For example, the collapse of a major cryptocurrency exchange, a significant regulatory change, or a major security breach could trigger a sharp and unexpected price drop. Conversely, positive news such as widespread institutional adoption or a significant technological breakthrough could lead to a rapid price surge. The 2020 COVID-19 pandemic, for example, initially caused a significant drop in Bitcoin’s price, before subsequently experiencing a period of substantial growth, demonstrating the unpredictable nature of external factors. The inherent difficulty in anticipating such events renders long-term price predictions inherently unreliable.

Importance of Diversification and Risk Management

Given the considerable risks associated with Bitcoin price prediction, diversification and robust risk management strategies are crucial for investors. Diversifying one’s investment portfolio across various asset classes, including traditional investments like stocks and bonds, can help mitigate the risk associated with Bitcoin’s volatility. Furthermore, investors should only invest an amount they can afford to lose, and avoid using borrowed funds to invest in Bitcoin. Setting stop-loss orders, which automatically sell Bitcoin when the price reaches a predetermined level, can help limit potential losses during market downturns. Regularly reviewing and adjusting one’s investment strategy based on market conditions is also vital for effective risk management.

Potential “Black Swan” Events, Bitcoin Price In 2025 Prediction

Several potential “black swan” events could significantly disrupt Bitcoin’s price. A major security flaw discovered in the Bitcoin protocol could undermine confidence in the system and lead to a sharp price decline. A widespread regulatory crackdown on cryptocurrencies in major global economies could severely restrict Bitcoin’s adoption and depress its price. Conversely, a large-scale adoption by institutional investors could drive a significant price increase. The emergence of a superior competing cryptocurrency could also diminish Bitcoin’s dominance and negatively impact its price. Each of these scenarios highlights the unpredictable nature of the cryptocurrency market and the importance of managing risk accordingly.

Predicting the Bitcoin price in 2025 is inherently speculative, but a key factor influencing any forecast is the upcoming halving. Understanding the potential impact of this event is crucial for informed speculation; for a deeper dive into this, check out this analysis on the Bitcoin Halving 2025 Impact. Ultimately, the halving’s effect on scarcity and miner profitability will likely play a significant role in shaping Bitcoin’s price trajectory throughout 2025 and beyond.

Predicting the Bitcoin price in 2025 is a complex endeavor, influenced by numerous factors. A key element often considered is the impact of the next Bitcoin halving, and discussions around this are abundant online. For instance, you can find a wealth of speculation on the Bitcoin Halving Prediction 2025 Reddit thread. Ultimately, these discussions, along with macroeconomic conditions, will shape any reasonable price prediction for Bitcoin in 2025.

Predicting the Bitcoin price in 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the upcoming Bitcoin halving, which will significantly impact the rate of new Bitcoin entering circulation. For a detailed analysis of this event’s potential consequences, refer to this insightful resource on Data Halving Bitcoin 2025. Understanding the halving’s effects is crucial for any accurate Bitcoin price prediction in 2025.