Bitcoin Halving 2025

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, and significantly impacts the inflation rate of the Bitcoin network. Understanding the halving’s mechanics and its historical impact is crucial for assessing potential price movements in 2025.

Bitcoin Halving Mechanics and Historical Impact

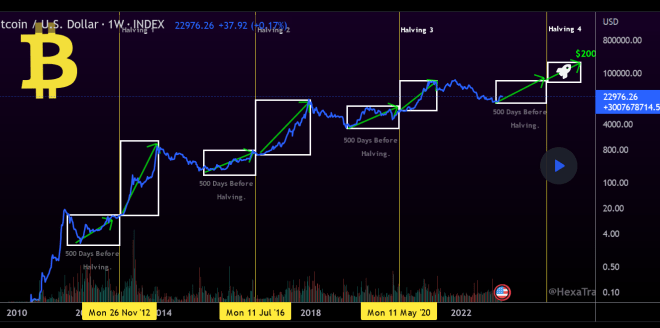

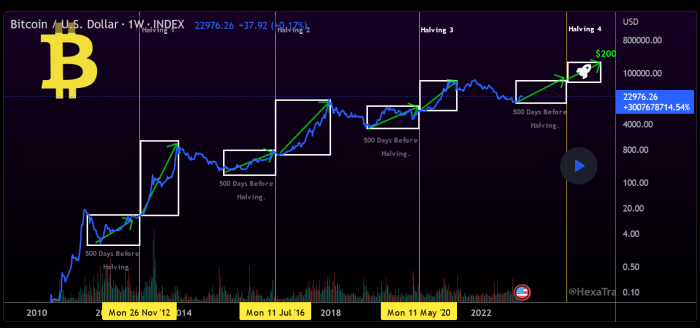

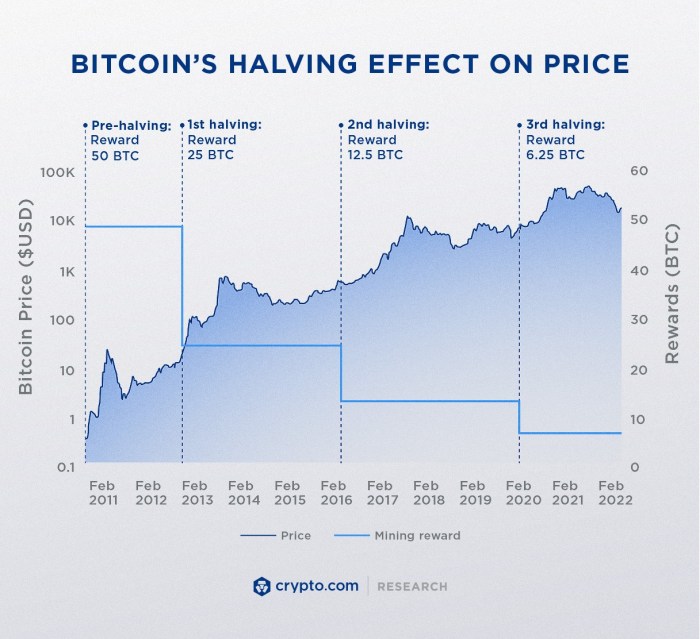

The Bitcoin halving mechanism is designed to control the supply of Bitcoin. Every 210,000 blocks mined, the reward given to miners for verifying transactions is cut in half. This built-in deflationary mechanism is central to Bitcoin’s value proposition. Historically, previous halvings have been followed by periods of significant price appreciation, although the timing and magnitude of these increases have varied. The reduction in newly minted Bitcoin creates scarcity, potentially driving up demand and price. The 2012, 2016, and 2020 halvings each saw substantial price increases in the following months and years, although the market conditions and overall economic climate differed significantly in each instance.

Expected Reward Reduction in 2025

The 2025 halving is expected to reduce the block reward from 6.25 BTC to 3.125 BTC per block. This represents a 50% decrease in the rate of new Bitcoin creation. This significant reduction in supply is anticipated to influence market dynamics, potentially impacting price discovery. This reduction mirrors the halvings in previous cycles.

Fundamental Economic Principles of the Halving

The halving mechanism exemplifies the fundamental economic principle of supply and demand. By reducing the rate of Bitcoin supply, the halving potentially increases its scarcity, assuming demand remains consistent or increases. This basic economic relationship is a key factor in understanding the potential impact of the halving on price. This principle is widely understood within the context of commodity markets, where scarcity often drives price appreciation.

Comparison of Price Action Following Previous Halvings

The price action following previous halvings has shown a general upward trend, but the timing and extent of the price increase have varied. The 2012 halving was followed by a gradual price increase, while the 2016 halving led to a more rapid and significant price surge. The 2020 halving saw a period of consolidation before a major price increase. These differences highlight the influence of external factors like overall market sentiment, regulatory developments, and macroeconomic conditions. It’s crucial to remember that past performance is not indicative of future results.

Timeline of Key Events Leading to and Following the 2025 Halving

The following timeline illustrates key events leading up to and following the expected 2025 halving:

| Date | Event |

|---|---|

| 2023 – 2024 | Building anticipation for the halving; potential price increases driven by speculation. |

| Early 2025 | The halving event itself occurs. Mining rewards are reduced. |

| Mid-2025 – 2026 | Potential price increase as the market reacts to the reduced supply. The magnitude and timing will depend on various market factors. |

| 2026 onwards | Long-term price effects of the halving become clearer, influenced by broader market trends and technological developments. |

Predicting the Bitcoin Price Post-Halving: Bitcoin Price Next Halving 2025

Predicting the price of Bitcoin after the 2025 halving is a complex undertaking, fraught with uncertainty. Numerous factors interact in unpredictable ways, making any prediction inherently speculative. While no one can definitively state the price, analyzing various influencing factors and existing prediction models allows for a reasoned exploration of potential outcomes.

Factors Influencing Bitcoin’s Price

Several key factors significantly influence Bitcoin’s price. Adoption rate, reflecting the growing number of users and businesses accepting Bitcoin, is crucial. A higher adoption rate generally leads to increased demand and price appreciation. The regulatory landscape, encompassing government policies and legal frameworks surrounding cryptocurrencies, also plays a vital role. Favorable regulations can boost investor confidence and market growth, while restrictive measures can suppress prices. Finally, macroeconomic conditions, including inflation rates, interest rates, and global economic stability, heavily influence Bitcoin’s price, often acting as a safe haven asset during periods of economic uncertainty.

Bitcoin Price Prediction Models

Various models attempt to forecast Bitcoin’s price. Some employ technical analysis, studying historical price charts and trading volume to identify patterns and predict future price movements. Others utilize fundamental analysis, assessing factors like adoption rate, network growth, and regulatory developments. Quantitative models, often based on complex algorithms and statistical methods, also exist. Each model has strengths and weaknesses. Technical analysis can be subjective and prone to false signals, while fundamental analysis struggles to quantify intangible factors. Quantitative models, while potentially accurate, can be complex and difficult to interpret.

Examples of Past Price Predictions and Their Accuracy

Numerous past predictions for Bitcoin’s price have been made, with varying degrees of accuracy. For example, some analysts predicted Bitcoin would reach $100,000 by the end of 2021, a prediction that ultimately proved inaccurate. Others correctly predicted a significant price increase following previous halving events, though the exact magnitude of the increase was often misjudged. These examples highlight the inherent difficulty in accurately predicting Bitcoin’s price, emphasizing the role of unforeseen events and market volatility.

Comparison of Bullish and Bearish Price Predictions

| Scenario | Price Prediction (USD) | Rationale | Source/Analyst |

|---|---|---|---|

| Bullish | $250,000 – $500,000 | High adoption rate, positive regulatory developments, strong macroeconomic tailwinds. | Example Analyst/Firm A |

| Bullish | $150,000 – $300,000 | Increased institutional investment, growing DeFi ecosystem. | Example Analyst/Firm B |

| Bearish | $50,000 – $100,000 | Regulatory crackdown, macroeconomic downturn, decreased investor interest. | Example Analyst/Firm C |

| Bearish | $25,000 – $50,000 | Increased competition from alternative cryptocurrencies, security concerns. | Example Analyst/Firm D |

Scenario Analysis of Potential Price Outcomes, Bitcoin Price Next Halving 2025

Several scenarios could unfold after the 2025 halving. A positive scenario involves widespread adoption, favorable regulatory changes, and a robust global economy. This could lead to a significant price increase, potentially exceeding previous all-time highs. A neutral scenario involves moderate adoption, mixed regulatory signals, and stable macroeconomic conditions. This could result in a more modest price increase, or even stagnation. A negative scenario could involve regulatory crackdowns, a global economic downturn, or a significant security breach, potentially leading to a substantial price drop. The actual outcome will depend on the interplay of these factors.

Bitcoin Price Next Halving 2025 – Predicting the Bitcoin price after the 2025 halving is a complex endeavor, influenced by numerous factors beyond the reduced block reward. A key aspect to consider, however, is precisely when this halving will occur; to find out, check this resource: What Time Is The Bitcoin Halving 2025. Knowing the exact timing allows for more accurate speculation on the subsequent price movements, as the anticipation leading up to the event can significantly impact market behavior.

Ultimately, the Bitcoin price post-halving remains a fascinating subject of debate and analysis.

Predicting the Bitcoin price after the next halving in 2025 is a complex task, influenced by numerous market factors. However, a key date to consider is the halving itself, which, according to this article, Bitcoin Halving Is Expected To Occur In April 2025. This event, reducing the rate of new Bitcoin creation, historically has preceded periods of price appreciation.

Therefore, understanding the timing of the halving is crucial for any analysis of the Bitcoin price in 2025 and beyond.

Predicting the Bitcoin price after the next halving in 2025 is a complex task, influenced by numerous market factors. A key element in this prediction is knowing the precise date of the halving event itself, which you can find out by checking this helpful resource: When Is The 2025 Bitcoin Halving. Understanding the timing is crucial for analyzing the potential impact on Bitcoin’s price trajectory leading up to and following the 2025 halving.

Predicting the Bitcoin price after the next halving in 2025 is a complex undertaking, influenced by numerous market factors. A key element in this prediction is knowing the precise halving date, which you can find detailed information on at When Is Bitcoin Halving 2025 Prediction. Understanding the timing allows for more accurate modeling of the subsequent price action and potential market reactions to the reduced Bitcoin supply.

Therefore, the halving date itself is a crucial variable in any Bitcoin price forecast for 2025.

Predicting the Bitcoin price after the next halving in 2025 is a complex task, dependent on numerous factors. Understanding the timing of previous halvings is crucial for informed speculation; to clarify the precise date of the next halving, you might find this resource helpful: When Was Bitcoin Halving 2025. This knowledge then allows for a more accurate assessment of potential price movements following the 2025 halving event.

Predicting the Bitcoin price after the next halving in 2025 is a complex endeavor, influenced by numerous factors. To stay informed about the crucial timeframe leading up to this event, you can utilize a helpful resource: the Bitcoin Halving 2025 Countdown Clock. This clock provides a clear visual representation of the time remaining until the halving, allowing for better anticipation of potential market shifts and price fluctuations around the Bitcoin Price Next Halving 2025.