Bitcoin Price Predictions October 2025

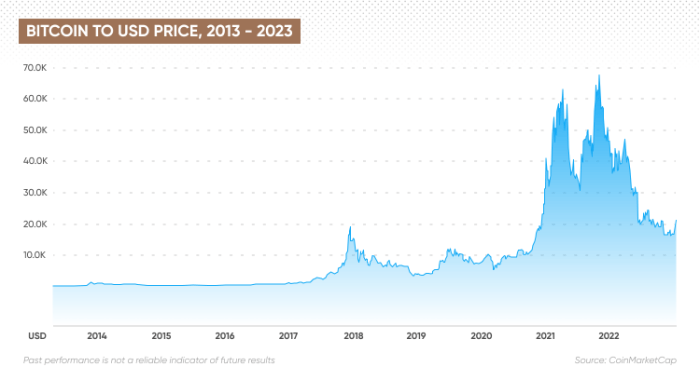

Bitcoin’s price history has been marked by extreme volatility since its inception. From its humble beginnings worth mere cents to reaching all-time highs exceeding $60,000, its journey has been characterized by periods of rapid growth punctuated by significant corrections. Numerous factors influence its price, including regulatory developments, macroeconomic conditions (inflation, interest rates), technological advancements within the cryptocurrency space, and overall market sentiment – driven by factors such as media coverage, adoption rates by businesses and individuals, and even social media trends.

Predicting Bitcoin’s price with any degree of certainty over the long term is inherently challenging. The cryptocurrency market is still relatively young and lacks the historical data that allows for robust predictive modeling used in more established asset classes like stocks or bonds. Furthermore, Bitcoin’s price is susceptible to speculative bubbles and dramatic shifts driven by unforeseen events, making long-term forecasts highly speculative. Any prediction should be viewed with a healthy dose of skepticism.

Factors Influencing Bitcoin Price Predictions

Accurate Bitcoin price forecasting requires a multi-faceted approach, considering a wide array of factors and methodologies. Ignoring any significant influence can lead to inaccurate predictions. For instance, a prediction focusing solely on technological advancements might overlook the impact of regulatory changes. Conversely, a model solely based on macroeconomic indicators may fail to account for unexpected shifts in investor sentiment. A balanced approach, incorporating technical analysis, fundamental analysis, and consideration of broader economic and geopolitical factors, is crucial for a more informed, albeit still uncertain, outlook. For example, a prediction might incorporate the potential impact of widespread institutional adoption alongside forecasts for global inflation rates. The interplay of these factors necessitates a complex analytical approach.

Factors Influencing Bitcoin Price in October 2025

Predicting the Bitcoin price in October 2025 requires considering a complex interplay of macroeconomic factors, regulatory landscapes, technological advancements, and market sentiment. While precise prediction is impossible, analyzing these key influencers provides a framework for understanding potential price movements.

Macroeconomic Conditions and Bitcoin’s Value

Global economic conditions significantly impact Bitcoin’s price. High inflation, for example, can drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, a recession could lead to risk-aversion, causing investors to sell Bitcoin and other volatile assets, depressing its price. The strength of the US dollar also plays a crucial role; a strong dollar often correlates with lower Bitcoin prices, as it makes Bitcoin less attractive to international investors. For instance, the 2022 inflationary environment saw Bitcoin initially gain traction as a safe haven, but the subsequent tightening of monetary policies by central banks led to a significant price correction.

Regulatory Developments and Governmental Policies

Governmental regulations and policies worldwide will profoundly influence Bitcoin adoption and its price. Clear, consistent regulatory frameworks that encourage innovation while mitigating risks could lead to increased institutional investment and broader acceptance, boosting Bitcoin’s price. Conversely, overly restrictive or inconsistent regulations could stifle adoption and depress the price. The varying approaches taken by different countries—from outright bans to comprehensive regulatory frameworks—will create diverse market dynamics, impacting the overall price. For example, the increasing acceptance of Bitcoin as a legitimate asset class in certain jurisdictions could lead to significant price increases, while stricter regulations in others could create volatility.

Technological Advancements and Bitcoin’s Usability

Technological advancements, particularly in layer-2 scaling solutions like the Lightning Network, are crucial for Bitcoin’s future. These solutions aim to address Bitcoin’s scalability limitations, making transactions faster, cheaper, and more efficient. Improved usability translates to increased adoption and potentially higher prices. Successful implementation and widespread adoption of layer-2 solutions could significantly alleviate current transaction bottlenecks and attract a wider range of users, thereby influencing price appreciation. Conversely, failure to effectively scale the network could hinder adoption and limit price growth.

Institutional Adoption versus Retail Investor Sentiment

The interplay between institutional adoption and retail investor sentiment is a key driver of Bitcoin’s price. Large-scale institutional investments, such as those from hedge funds and corporations, can inject significant capital into the market, driving price increases. However, retail investor sentiment, often driven by market hype and speculation, can also cause substantial price volatility. A significant shift in either institutional investment or retail sentiment could lead to substantial price swings. For example, a sudden influx of institutional investment could trigger a bull market, while a widespread loss of confidence among retail investors could lead to a sharp price decline.

Potential Game-Changing Events and Their Effects

The approval of a Bitcoin exchange-traded fund (ETF) in major markets like the US could be a game-changer. An ETF would provide a regulated and accessible investment vehicle for a broader range of investors, potentially leading to a massive influx of capital into the Bitcoin market and a significant price increase. Similarly, widespread adoption of Bitcoin by central banks or large financial institutions could fundamentally alter the market dynamics, leading to significant price appreciation. Conversely, unforeseen events such as a major security breach or a significant regulatory crackdown could negatively impact Bitcoin’s price.

Risks and Uncertainties

Predicting the price of Bitcoin in October 2025, or any future date, is inherently risky. Numerous factors, both predictable and unpredictable, can significantly impact its value, leading to substantial deviations from any forecast. The inherent volatility of cryptocurrencies, coupled with the influence of global events, makes accurate long-term predictions extremely challenging.

The complexity of the Bitcoin ecosystem makes it vulnerable to a range of risks, from regulatory changes to technological disruptions. Furthermore, the potential for unforeseen “black swan” events – highly improbable but potentially devastating occurrences – further complicates any attempt at precise price forecasting. These events can introduce sudden and dramatic shifts in market sentiment, leading to sharp price fluctuations that are difficult, if not impossible, to anticipate.

Regulatory Uncertainty

Government regulations worldwide significantly influence Bitcoin’s price. Changes in regulatory frameworks, whether supportive or restrictive, can dramatically impact investor confidence and market liquidity. For instance, a sudden ban on Bitcoin trading in a major economy could trigger a sharp price decline. Conversely, the adoption of clear and favorable regulations could lead to increased institutional investment and a price surge. The lack of a universally accepted regulatory framework introduces considerable uncertainty into any long-term price prediction. The ongoing debate and evolving regulatory landscape in various jurisdictions pose a considerable risk to Bitcoin’s price stability.

Market Volatility and Black Swan Events

Bitcoin’s price is notorious for its volatility. Sharp price swings are common, driven by factors such as news events, technological developments, and shifts in investor sentiment. These fluctuations can be amplified by leverage trading, leading to dramatic price crashes or rapid ascents. Black swan events, such as unexpected macroeconomic shocks (like a global financial crisis), major security breaches within the Bitcoin network, or significant changes in technological infrastructure, can cause unpredictable and potentially devastating impacts on the price. The 2022 crypto market crash, partially triggered by the collapse of TerraUSD, serves as a stark reminder of the potential for such unforeseen events to drastically alter market dynamics.

Technological Risks, Bitcoin Price October 2025

The Bitcoin network’s security and scalability are crucial to its long-term viability. A successful attack on the network, though highly unlikely given its decentralized nature, could severely damage investor confidence and lead to a significant price drop. Similarly, the network’s ability to handle increasing transaction volumes without significant delays or increased fees is critical. Failure to scale effectively could hinder Bitcoin’s adoption and negatively impact its price. Furthermore, the emergence of competing cryptocurrencies with superior technology could also diminish Bitcoin’s market share and price.

Macroeconomic Factors

Global macroeconomic conditions significantly influence Bitcoin’s price. Factors such as inflation, interest rates, and economic growth can impact investor appetite for riskier assets like Bitcoin. For example, periods of high inflation might drive investors towards Bitcoin as a hedge against inflation, while rising interest rates could make holding Bitcoin less attractive compared to other investments. Unexpected geopolitical events, such as wars or trade disputes, can also create uncertainty and volatility in the market, affecting Bitcoin’s price. The interconnectedness of the global economy means that macroeconomic shifts can have a profound and often unpredictable impact on cryptocurrency markets.

Investment Strategies and Considerations

Investing in Bitcoin, like any other asset, requires careful consideration of your risk tolerance and investment timeframe. Different strategies cater to varying levels of risk and potential returns. Understanding these strategies is crucial for making informed decisions and managing your investment effectively. A well-defined strategy, coupled with a realistic understanding of the market’s volatility, is key to navigating the complexities of the cryptocurrency market.

Bitcoin Investment Strategies Based on Risk Tolerance and Time Horizon

The choice of investment strategy depends heavily on individual circumstances. A conservative investor with a low risk tolerance might prefer a strategy focused on long-term holding, while a more aggressive investor might employ short-term trading strategies, accepting higher risk for the potential of greater, albeit more volatile, returns. Below are examples of different approaches:

- Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money at regular intervals (e.g., weekly or monthly), regardless of price fluctuations. This mitigates the risk of investing a large sum at a market peak. For example, investing $100 per week into Bitcoin over a year reduces the impact of price volatility compared to a lump-sum investment of $5200 at a single point in time.

- Long-Term Holding (Hodling): This involves buying Bitcoin and holding it for an extended period, typically years, anticipating long-term price appreciation. This strategy is suitable for investors with a high risk tolerance and a long time horizon, who are comfortable with potential short-term price drops. Consider the example of someone who bought Bitcoin in 2011 and held it until 2021; they would have experienced significant gains despite periods of market downturn.

- Short-Term Trading: This involves buying and selling Bitcoin frequently to capitalize on short-term price movements. This strategy requires significant market knowledge, technical analysis skills, and a higher risk tolerance. It involves a much higher degree of risk than long-term holding, as profits can be quickly wiped out by sudden market shifts. For instance, a trader might attempt to profit from short-term price increases by buying low and selling high multiple times within a day or week.

Diversification in a Cryptocurrency Portfolio

Diversification is a fundamental principle of risk management in any investment portfolio, and cryptocurrencies are no exception. Investing solely in Bitcoin exposes you to significant risk, as its price can be highly volatile. Diversification involves spreading your investment across multiple cryptocurrencies and potentially other asset classes (like stocks, bonds, or real estate) to reduce the overall risk of your portfolio. For example, an investor might allocate a portion of their portfolio to Bitcoin, Ethereum, and other promising altcoins, thus mitigating the impact of a potential Bitcoin price crash.

Long-Term Bitcoin Investment versus Short-Term Trading: Benefits and Drawbacks

Long-term Bitcoin investment and short-term trading represent contrasting approaches with distinct advantages and disadvantages.

- Long-Term Investment:

- Benefits: Lower transaction costs due to fewer trades, potential for significant long-term gains, less time-intensive.

- Drawbacks: Higher risk of missing short-term gains, potential for significant losses if the market declines for an extended period.

- Short-Term Trading:

- Benefits: Potential for quick profits, ability to react to market changes.

- Drawbacks: Higher transaction costs, higher risk of losses due to market volatility, requires significant time and expertise.

Frequently Asked Questions (FAQs): Bitcoin Price October 2025

This section addresses common queries regarding Bitcoin’s price in October 2025 and related investment considerations. Understanding the inherent uncertainties in price prediction is crucial before making any investment decisions.

Bitcoin’s Most Likely Price in October 2025

Predicting a precise Bitcoin price for October 2025 is impossible. Numerous factors, discussed earlier, could significantly influence its value. However, we can explore potential scenarios. A bullish scenario might see Bitcoin exceeding $100,000, driven by widespread adoption and positive regulatory developments. Conversely, a bearish scenario could see prices fall below $20,000, perhaps due to increased regulatory scrutiny or a broader market downturn. A more moderate scenario might place Bitcoin somewhere between these extremes, reflecting a balance of positive and negative influences. The actual price will depend on the interplay of these various factors.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable. The cryptocurrency market is exceptionally volatile and influenced by a complex web of factors, including technological advancements, regulatory changes, macroeconomic conditions, and market sentiment. Any prediction is essentially a speculative estimate based on current trends and assumptions about the future, which are often inaccurate. Past performance is not indicative of future results, and even the most sophisticated models can be significantly off the mark. For example, predictions made in 2017 for Bitcoin’s price in 2020 were wildly inaccurate.

Factors Significantly Impacting Bitcoin’s Price

Several interconnected factors influence Bitcoin’s price. Regulatory clarity or uncertainty significantly impacts investor confidence. Technological advancements, such as the development of layer-2 scaling solutions, can increase Bitcoin’s efficiency and adoption. Macroeconomic conditions, including inflation and interest rates, influence overall investor risk appetite. Market sentiment, driven by news events and social media trends, can cause significant short-term price fluctuations. Finally, the supply and demand dynamics of Bitcoin itself play a crucial role. For example, a halving event, which reduces the rate of new Bitcoin creation, can influence scarcity and potentially drive up prices. The interaction of these factors creates a complex and unpredictable environment.

Investing in Bitcoin in 2024 Considering October 2025 Predictions

Investing in Bitcoin in 2024, considering potential price movements in October 2025, requires careful consideration of your personal financial situation and risk tolerance. Bitcoin is a highly volatile asset, and you could lose a significant portion of your investment. Before investing, conduct thorough research, diversify your portfolio, and only invest what you can afford to lose. Consider seeking advice from a qualified financial advisor who can help you assess your risk tolerance and develop an investment strategy aligned with your goals. Remember that past performance is not a reliable indicator of future returns.

Disclaimer

The information presented in this document regarding Bitcoin’s potential price in October 2025 is purely for educational purposes. It is intended to provide insights into various factors that might influence Bitcoin’s price and to explore potential scenarios. This analysis should not be interpreted as financial advice, a recommendation to buy or sell Bitcoin, or a guarantee of future price movements. The cryptocurrency market is inherently volatile and unpredictable, and past performance is not indicative of future results.

Any decisions related to investing in Bitcoin or other cryptocurrencies should be made after conducting thorough independent research and considering your own risk tolerance and financial situation. It’s crucial to consult with a qualified financial advisor before making any investment decisions. The authors and publishers of this document are not liable for any financial losses incurred as a result of using the information provided herein. Remember that investing in cryptocurrencies involves significant risk, including the potential for complete loss of your investment.

Risk Acknowledgement

Investing in Bitcoin, or any cryptocurrency, carries substantial risk. Price fluctuations can be extreme, driven by factors ranging from regulatory changes and market sentiment to technological developments and macroeconomic conditions. For instance, the 2022 cryptocurrency market crash saw Bitcoin’s price plummet by over 50% in a relatively short period, highlighting the inherent volatility of the market. This volatility is not unique to Bitcoin; it is a characteristic of the entire cryptocurrency market. Therefore, it is crucial to understand and accept these risks before allocating any capital to Bitcoin.

Limitations of Predictions

The predictions and analyses presented regarding Bitcoin’s price are based on current market conditions and trends, along with various forecasting models. However, these are inherently speculative and subject to a high degree of uncertainty. Numerous unforeseen events – such as significant regulatory changes, technological breakthroughs, or global economic shifts – could significantly impact Bitcoin’s price in ways that are impossible to accurately predict. The information provided should be considered a potential scenario, not a definitive forecast. Consider the example of the unexpected collapse of FTX in 2022, which dramatically impacted the entire cryptocurrency market and was largely unforeseen by most analysts.

No Liability for Losses

The authors and publishers of this document explicitly disclaim any responsibility or liability for any losses incurred by individuals who use the information presented here to make investment decisions. The information is for educational purposes only, and readers are solely responsible for their investment choices and their associated risks. No warranty, express or implied, is given regarding the accuracy, completeness, or reliability of the information contained within. Investing in cryptocurrencies requires careful consideration and independent verification of information from multiple reputable sources.

Bitcoin Price October 2025 – Speculating on the Bitcoin price in October 2025 is inherently challenging, given the cryptocurrency’s volatility. However, to gain some insight, you might find a detailed analysis helpful; for instance, check out this insightful prediction from Forbes on the Bitcoin price in 2025 in INR: Bitcoin Price Prediction 2025 In Inr Forbes. Understanding these broader predictions can offer a context for thinking about the potential Bitcoin price in October of that year.

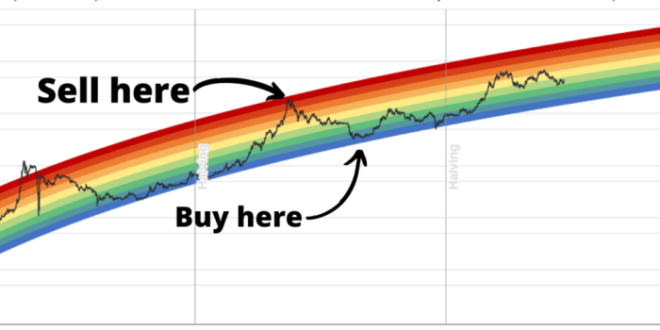

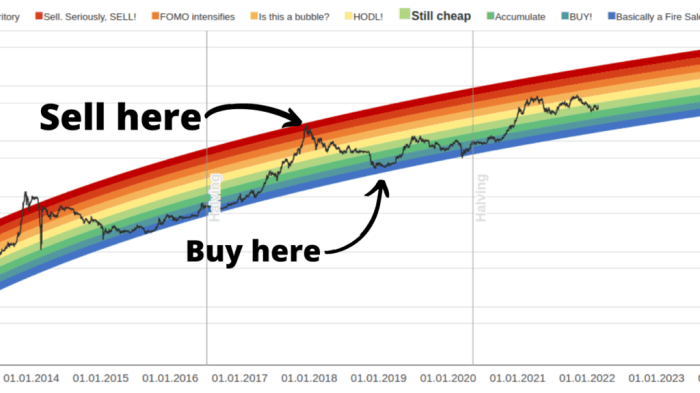

Predicting the Bitcoin price in October 2025 is inherently speculative, but various models attempt to forecast this. To gain a broader perspective on potential price movements throughout the year, you might find the Bitcoin Price Prediction 2025 Chart helpful. This chart can offer context for understanding potential price ranges and help inform your own assessment of the Bitcoin price in October 2025, though remember all predictions carry uncertainty.

Predicting the Bitcoin price in October 2025 is inherently speculative, but various models attempt to forecast this. To gain a broader perspective on potential price movements throughout the year, you might find the Bitcoin Price Prediction 2025 Chart helpful. This chart can offer context for understanding potential price ranges and help inform your own assessment of the Bitcoin price in October 2025, though remember all predictions carry uncertainty.

Predicting the Bitcoin price in October 2025 is inherently speculative, but various models attempt to forecast this. To gain a broader perspective on potential price movements throughout the year, you might find the Bitcoin Price Prediction 2025 Chart helpful. This chart can offer context for understanding potential price ranges and help inform your own assessment of the Bitcoin price in October 2025, though remember all predictions carry uncertainty.

Predicting the Bitcoin price in October 2025 is challenging, relying heavily on various market factors and technological advancements. To gain a broader perspective on potential price movements throughout the year, it’s helpful to consider overall predictions for the year; for example, you can check out this comprehensive analysis on Bitcoin Price At 2025 to inform your understanding.

Ultimately, the October 2025 price will depend on the overall trajectory established during the year.