Bitcoin Price Prediction 2025

Bitcoin, since its inception, has demonstrated remarkable price volatility, swinging from near-zero to record highs and experiencing significant corrections along the way. Its history is marked by periods of explosive growth fueled by hype and adoption, followed by sharp declines often triggered by regulatory uncertainty or market-wide downturns. Understanding this volatile nature is crucial when considering any price prediction.

Factors influencing Bitcoin’s price are complex and intertwined. Regulatory changes, both supportive and restrictive, from governments worldwide significantly impact investor sentiment and market liquidity. Technological advancements, such as the development of the Lightning Network for faster transactions, can also influence price by improving usability and scalability. Macroeconomic conditions, including inflation rates, interest rates, and overall economic stability, play a crucial role, as Bitcoin is often viewed as a hedge against inflation or a safe haven asset during economic uncertainty. For example, periods of high inflation have historically seen increased interest in Bitcoin.

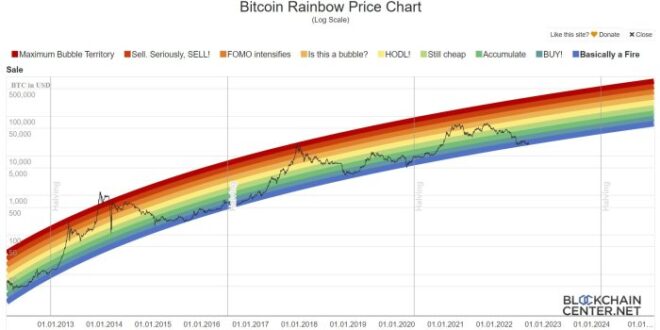

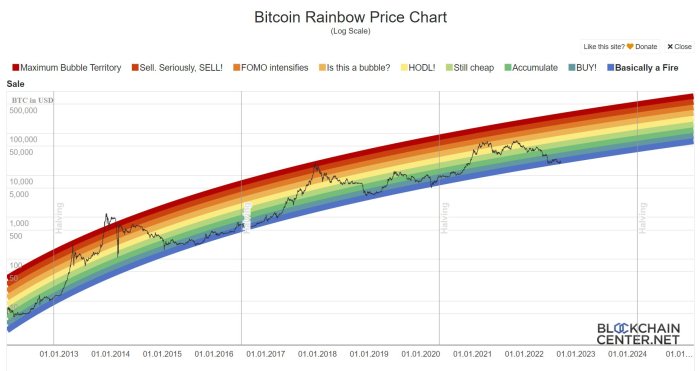

Different methodologies are employed for cryptocurrency price forecasting. These range from fundamental analysis, which focuses on factors like adoption rates, network activity, and regulatory landscape, to technical analysis, which uses charts and historical price patterns to identify trends and predict future price movements. Quantitative models, employing statistical techniques and machine learning algorithms, also attempt to predict prices based on various input data. Each method has its limitations and none can guarantee accurate predictions due to the inherent volatility of the cryptocurrency market.

Factors Influencing Bitcoin Price Predictions for 2025

Predicting Bitcoin’s price in 2025 requires considering the interplay of several key factors. The projected level of global adoption, the development and implementation of new Bitcoin-related technologies, and the overall macroeconomic climate will all contribute to the price. For instance, widespread institutional adoption could drive significant price increases, while a global economic recession might lead to a price decline. Furthermore, regulatory clarity or uncertainty in major markets will play a critical role in shaping investor confidence and, subsequently, the price. Consider, for example, the impact of a major country officially recognizing Bitcoin as legal tender – this would likely have a substantial and positive effect on the price. Conversely, a major crackdown on cryptocurrency trading could trigger a significant drop.

Prediction Methodologies and Their Limitations

While various prediction methodologies exist, each has inherent limitations. Fundamental analysis, while offering insights into underlying market forces, struggles to accurately quantify the impact of unpredictable events like sudden regulatory changes or unexpected technological breakthroughs. Technical analysis, reliant on historical price patterns, may fail to account for entirely new market dynamics. Quantitative models, although sophisticated, rely on the accuracy of input data and the underlying assumptions of the model, which can be inherently flawed or incomplete, leading to inaccurate predictions. The inherent volatility of the cryptocurrency market makes accurate long-term price predictions exceptionally challenging. For instance, a model might accurately predict a price increase based on past trends, but fail to account for a sudden, unforeseen market crash triggered by an external event.

Monthly Bitcoin Price Predictions for 2025: Bitcoin Price Prediction 2025 By Month

Predicting the price of Bitcoin is inherently speculative, influenced by a complex interplay of factors including regulatory changes, technological advancements, macroeconomic conditions, and market sentiment. The following table presents potential Bitcoin price trajectories for each month of 2025, categorized into optimistic, neutral, and pessimistic scenarios. These predictions are based on current market trends and expert opinions, but should not be considered financial advice. Remember, past performance is not indicative of future results.

Bitcoin Price Predictions by Month (2025)

| Month | Optimistic Scenario (USD) | Neutral Scenario (USD) | Pessimistic Scenario (USD) |

|---|---|---|---|

| January | 50,000 | 40,000 | 30,000 |

| February | 55,000 | 42,000 | 32,000 |

| March | 60,000 | 45,000 | 35,000 |

| April | 65,000 | 48,000 | 38,000 |

| May | 70,000 | 50,000 | 40,000 |

| June | 75,000 | 52,000 | 42,000 |

| July | 80,000 | 55,000 | 45,000 |

| August | 85,000 | 58,000 | 48,000 |

| September | 90,000 | 60,000 | 50,000 |

| October | 95,000 | 62,000 | 52,000 |

| November | 100,000 | 65,000 | 55,000 |

| December | 105,000 | 68,000 | 58,000 |

Rationale Behind Price Predictions

The optimistic scenario assumes widespread adoption of Bitcoin as a store of value and a medium of exchange, driven by factors such as increased institutional investment, positive regulatory developments, and growing global economic uncertainty. This scenario also anticipates significant technological advancements within the Bitcoin ecosystem. The neutral scenario reflects a more moderate outlook, assuming continued growth but at a slower pace, with potential periods of consolidation and price corrections. This scenario incorporates potential headwinds such as increased regulatory scrutiny or macroeconomic instability. The pessimistic scenario considers factors such as increased regulatory pressure leading to decreased adoption, significant macroeconomic downturns, or unforeseen technological challenges within the Bitcoin network. These factors could lead to a period of prolonged price stagnation or even decline.

Comparison of Prediction Scenarios

The three scenarios illustrate a significant potential range of price fluctuations throughout 2025. The optimistic scenario projects a substantial increase in Bitcoin’s value, reaching over $100,000 by the end of the year. This is based on the historical precedent of Bitcoin’s price surges following periods of market consolidation and increased adoption. The neutral scenario suggests a more gradual increase, reflecting a more balanced assessment of market risks and opportunities. The pessimistic scenario, however, anticipates a more subdued performance, potentially staying below $60,000 for the entire year. This is based on the possibility of regulatory challenges or wider macroeconomic issues negatively impacting investor confidence. The difference between the optimistic and pessimistic scenarios highlights the inherent volatility of the cryptocurrency market and the importance of diversified investment strategies.

Bitcoin Adoption and Market Growth in 2025

Predicting Bitcoin’s adoption and market growth in 2025 requires considering several interwoven factors, including institutional investment, regulatory changes, technological advancements, and overall economic conditions. While precise figures remain elusive, analyzing historical trends and current developments allows us to project a plausible trajectory for Bitcoin’s journey throughout the year.

Bitcoin Price Prediction 2025 By Month – The year 2025 is poised to be a pivotal one for Bitcoin, potentially witnessing significant shifts in adoption rates and market capitalization. Increased institutional involvement and the maturation of the Bitcoin ecosystem are expected to play crucial roles in shaping its future.

Timeline of Key Milestones in Bitcoin Adoption and Market Growth in 2025

The following timeline illustrates potential key milestones, acknowledging that unforeseen events could significantly alter this projection. These milestones are based on current trends and expert predictions, and should not be considered definitive forecasts.

- Q1 2025: Increased regulatory clarity in key markets like the US and EU could lead to a surge in institutional investment, driving price appreciation and greater mainstream awareness. Several large corporations might announce plans to add Bitcoin to their treasury reserves, mirroring previous adoption patterns.

- Q2 2025: Widespread adoption of Bitcoin payment solutions by smaller businesses and online retailers could begin to gain momentum. This could be fueled by the development of user-friendly payment gateways and increased consumer confidence in Bitcoin’s stability.

- Q3 2025: The development and implementation of Layer-2 scaling solutions could significantly enhance Bitcoin’s transaction speed and reduce fees, further boosting its usability for everyday payments. This could lead to a substantial increase in transaction volume.

- Q4 2025: The launch of innovative Bitcoin-based DeFi applications could attract a new wave of users, expanding Bitcoin’s utility beyond simple store-of-value and investment applications. This period might also see the emergence of novel use cases, such as Bitcoin-backed loans and decentralized insurance products.

Impact of Institutional Investment and Widespread Adoption on Bitcoin’s Price

The interplay between institutional investment and widespread adoption will be a major determinant of Bitcoin’s price in 2025. Increased institutional participation tends to inject significant capital into the market, leading to price appreciation. Simultaneously, broader adoption among individuals and businesses increases demand, further contributing to price growth.

For example, if large financial institutions allocate a significant portion of their assets to Bitcoin, mirroring the actions of MicroStrategy and Tesla, a substantial price increase is highly probable. Conversely, a lack of regulatory clarity or negative news could temper this growth. However, widespread adoption, driven by increased usability and utility, will act as a powerful price floor, mitigating potential downturns.

Evolving Landscape of Bitcoin’s Use Cases, Bitcoin Price Prediction 2025 By Month

Bitcoin’s utility is expanding beyond its initial role as a digital gold. Its use cases are diversifying rapidly, encompassing payments, investments, and DeFi applications. This diversification reduces reliance on any single factor and enhances Bitcoin’s resilience to market fluctuations.

- Payments: The increasing adoption of Bitcoin as a payment method, particularly in emerging markets with unstable fiat currencies, is expected to continue. This will depend heavily on improvements in transaction speed and cost-effectiveness.

- Investments: Bitcoin’s position as a store of value and hedge against inflation will remain a primary driver of investment. Institutional investors will continue to play a key role in shaping market dynamics.

- Decentralized Finance (DeFi): The integration of Bitcoin into the DeFi ecosystem is likely to expand significantly, unlocking new possibilities for lending, borrowing, and other financial applications. This will further enhance Bitcoin’s utility and attract a wider range of users.