Potential Scenarios for Bitcoin’s Price in 2025

Predicting Bitcoin’s price is inherently speculative, given its volatility and dependence on numerous interconnected factors. However, by considering various macroeconomic conditions, technological advancements, and regulatory changes, we can Artikel plausible scenarios for its price in 2025. These scenarios are not exhaustive, and the actual outcome may differ significantly.

Bitcoin Price Significantly Exceeds Current Projections

This scenario envisions Bitcoin’s price substantially surpassing current market predictions, potentially reaching or exceeding $100,000 by 2025. Several factors could contribute to such a dramatic rise. Widespread institutional adoption, driven by increasing confidence in Bitcoin’s long-term value proposition as a store of value and hedge against inflation, could fuel significant price increases. Furthermore, a global macroeconomic shift towards decentralized finance (DeFi) and a growing recognition of Bitcoin’s role in this ecosystem could further propel its value. Increased regulatory clarity in key jurisdictions, coupled with advancements in Bitcoin’s underlying technology (like the Lightning Network for improved scalability), could also significantly boost market confidence and attract new investors. This scenario assumes a positive global economic outlook, with continued technological innovation and increasing institutional and retail investor participation. Similar to the dot-com boom, a period of rapid technological advancement and investor enthusiasm could lead to a significant price surge.

Bitcoin Price Remains Relatively Stagnant or Experiences Moderate Growth

In this scenario, Bitcoin’s price experiences either modest growth or remains relatively flat throughout 2025. This outcome could result from a combination of factors, including a period of macroeconomic uncertainty, increased regulatory scrutiny leading to market hesitancy, or a lack of significant technological breakthroughs to address scalability and transaction speed issues. Competition from other cryptocurrencies and the emergence of alternative investment vehicles could also divert investor interest away from Bitcoin. This scenario assumes a more conservative market sentiment, with investors prioritizing stability and diversification over high-risk, high-reward investments. A situation mirroring the post-2017 cryptocurrency bubble period, where prices consolidated for an extended time before another surge, is a possible analogy.

Bitcoin Price Experiences a Significant Decline

This pessimistic scenario anticipates a substantial drop in Bitcoin’s price by 2025. Several factors could trigger such a decline. A major security breach affecting a significant Bitcoin exchange or a series of negative regulatory announcements globally could severely damage investor confidence. A global economic recession or a major financial crisis could lead to a widespread sell-off of risk assets, including Bitcoin. Furthermore, the emergence of a superior cryptocurrency with significantly better technological capabilities or a more compelling value proposition could divert significant market share from Bitcoin, leading to a price decline. This scenario is reminiscent of the 2018 cryptocurrency bear market, characterized by significant price drops and investor uncertainty.

Summary of Potential Scenarios

| Scenario | Price Prediction (USD) | Contributing Factors | Analogous Historical Event |

|---|---|---|---|

| Significant Price Increase | >$100,000 | Widespread institutional adoption, DeFi growth, regulatory clarity, technological advancements | Dot-com boom |

| Stagnant or Moderate Growth | <$50,000 | Macroeconomic uncertainty, regulatory scrutiny, competition from altcoins, lack of technological breakthroughs | Post-2017 cryptocurrency market consolidation |

| Significant Price Decline | <<$20,000 | Security breaches, negative regulatory announcements, global economic recession, superior competitor emergence | 2018 cryptocurrency bear market |

The Role of Bitcoin Adoption in Price Prediction

Bitcoin’s price is intrinsically linked to its adoption rate. Widespread acceptance by businesses and governments would significantly impact its value, potentially driving substantial price increases. Conversely, slow or limited adoption could constrain its growth. Understanding this relationship is crucial for any realistic price prediction.

Increased usage of Bitcoin across various sectors could dramatically influence its value. Greater demand stemming from everyday transactions, institutional investments, and government recognition would inevitably push the price higher due to the principles of supply and demand. For example, if a major retailer like Amazon started accepting Bitcoin, the increased demand would likely cause a price surge. Similarly, if a country like El Salvador, which already accepts Bitcoin as legal tender, were to be joined by other nations, this would further boost adoption and likely drive up the price.

Increased Usage and Bitcoin’s Value

Increased usage of Bitcoin manifests in several ways, each impacting its value differently. Increased transaction volume directly indicates higher demand. The integration of Bitcoin into financial systems by institutions like banks or payment processors signifies a shift towards mainstream acceptance. Governmental recognition, such as legal tender status, boosts legitimacy and confidence, driving further adoption. These factors, in combination, would exert upward pressure on the price. For instance, if Bitcoin becomes a widely accepted international payment system, reducing transaction fees and delays compared to traditional methods, the demand would skyrocket.

Hurdles to Widespread Bitcoin Adoption

Several hurdles hinder widespread Bitcoin adoption. Regulatory uncertainty in various jurisdictions remains a significant obstacle. Concerns about Bitcoin’s volatility and its potential for use in illicit activities also deter widespread acceptance. Scalability issues, concerning the speed and cost of transactions, need to be addressed for broader adoption. Furthermore, the technical complexity of Bitcoin can be a barrier for many users. The lack of widespread education and understanding about Bitcoin and cryptocurrency in general also presents a challenge. For example, the regulatory crackdown on cryptocurrency exchanges in some countries directly impacts adoption rates.

Bitcoin’s Network Effects and Long-Term Price Trajectory

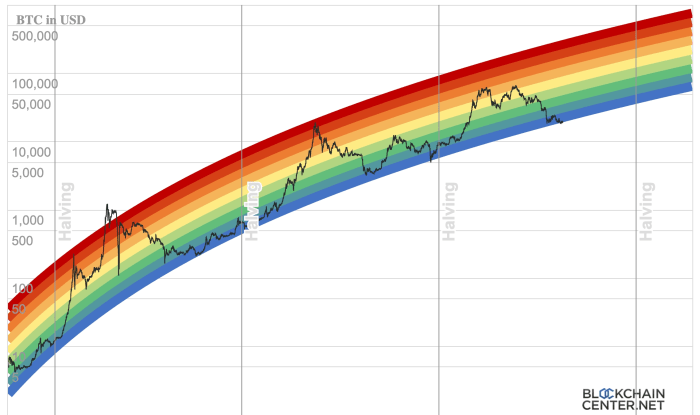

Bitcoin’s network effect is a powerful driver of its long-term price trajectory. The more users and businesses adopt Bitcoin, the more valuable and secure the network becomes. This creates a positive feedback loop: increased adoption leads to increased value, which attracts more users, further increasing value. This relationship can be visualized as an upward-sloping curve, where the x-axis represents the level of adoption (measured by the number of users, transactions, or institutional acceptance) and the y-axis represents Bitcoin’s price. The curve starts slowly, then accelerates as network effects take hold, resulting in exponential growth in price with increasing adoption. This exponential growth is not necessarily linear, but rather exhibits periods of rapid growth followed by consolidation or correction, reflecting the inherent volatility of the cryptocurrency market. However, the overall trend, driven by network effects, is generally upward in the long term, assuming continued adoption.

Risks and Uncertainties in Bitcoin Price Prediction: Bitcoin Price Prediction 2025 Cathie Wood

Predicting the price of Bitcoin in 2025, or any future date, is inherently fraught with risk and uncertainty. The cryptocurrency market is notoriously volatile, influenced by a complex interplay of factors that are often difficult, if not impossible, to fully anticipate. While various models and analyses attempt to forecast future price movements, it’s crucial to understand the limitations and potential pitfalls of these predictions.

The unpredictable nature of the cryptocurrency market stems from its relatively young age and the lack of established historical patterns to draw upon for reliable forecasting. Unlike traditional asset classes with longer histories, Bitcoin’s price trajectory has been characterized by periods of extreme volatility, rapid price surges, and equally sharp corrections. This volatility is amplified by factors such as speculative trading, news events, and regulatory developments, making accurate long-term predictions exceptionally challenging.

Market Volatility and Speculative Trading

Bitcoin’s price is heavily influenced by speculative trading, where investors buy and sell based on anticipated price movements rather than fundamental value. This creates a self-fulfilling prophecy effect; positive news can trigger a buying frenzy, driving prices up, while negative news can trigger sell-offs, leading to sharp price drops. The lack of intrinsic value tied to Bitcoin, compared to assets like gold or real estate, further contributes to this volatility, as its value is largely determined by market sentiment and supply and demand dynamics. The 2017 Bitcoin bubble, followed by a significant price correction, serves as a stark example of this inherent market risk.

Technological Disruptions and Regulatory Changes

Predicting Bitcoin’s price also requires anticipating technological advancements and regulatory changes, both of which are inherently unpredictable. The emergence of competing cryptocurrencies, improvements in blockchain technology, or the development of more efficient payment systems could significantly impact Bitcoin’s market share and price. Similarly, regulatory actions by governments around the world, ranging from outright bans to comprehensive regulatory frameworks, could drastically alter the landscape of the cryptocurrency market and Bitcoin’s future. The varying regulatory approaches taken by different countries highlight the difficulty in accurately forecasting the impact of global regulatory changes on Bitcoin’s price.

Unforeseen Events and Security Risks, Bitcoin Price Prediction 2025 Cathie Wood

Finally, unforeseen events, such as major security breaches affecting Bitcoin exchanges or the discovery of critical vulnerabilities in the Bitcoin blockchain itself, pose significant risks. A large-scale security breach could erode investor confidence and trigger a sharp price decline. Similarly, the discovery of previously unknown vulnerabilities could compromise the integrity of the Bitcoin network, potentially impacting its value and adoption. The Mt. Gox hack in 2014, which resulted in the loss of a significant number of Bitcoins, serves as a cautionary tale of the potential impact of security breaches on the cryptocurrency market.

Frequently Asked Questions

This section addresses common queries regarding Cathie Wood’s Bitcoin outlook, the reliability of price predictions, key price drivers, and the wisdom of investing based on her predictions. Understanding these aspects is crucial for informed decision-making in the volatile cryptocurrency market.

Cathie Wood’s Current Bitcoin Outlook

Cathie Wood, CEO of Ark Invest, has consistently expressed a bullish outlook on Bitcoin. While specific price targets vary across her pronouncements, she generally anticipates significant long-term growth for Bitcoin, often citing its potential as a store of value and its role in a decentralized financial system. Her projections frequently involve substantial price increases over the coming years, although she has not provided a specific price prediction for 2025 recently. It’s important to note that her views are based on her firm’s analysis and should not be taken as financial advice.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable. The cryptocurrency market is exceptionally volatile and influenced by a multitude of unpredictable factors, including regulatory changes, technological advancements, market sentiment, macroeconomic conditions, and even social media trends. Past performance is not indicative of future results, and even sophisticated models struggle to accurately forecast Bitcoin’s price due to its nascent nature and susceptibility to speculative bubbles. For example, predictions made in 2020 vastly underestimated the price surge in 2021, highlighting the inherent difficulty in predicting this asset’s trajectory.

Key Factors Driving Bitcoin’s Price

Several factors influence Bitcoin’s price. Technical factors, such as supply and demand dynamics, trading volume, and market capitalization, play a significant role. Fundamental factors include adoption rates by businesses and institutions, regulatory developments (positive or negative), technological improvements, and macroeconomic conditions such as inflation and interest rates. For instance, increased institutional adoption can drive up demand, while negative regulatory news can trigger sell-offs. The interplay of these technical and fundamental elements creates a complex and dynamic pricing environment.

Wisdom of Investing in Bitcoin Based on Cathie Wood’s Predictions

Investing in Bitcoin based solely on any individual’s prediction, including Cathie Wood’s, is inherently risky. While her optimistic outlook might be considered, investors must conduct their own thorough due diligence, understand the inherent volatility of the cryptocurrency market, and assess their own risk tolerance. Bitcoin’s price can fluctuate dramatically in short periods, leading to substantial gains or losses. Therefore, any investment decision should be based on a comprehensive understanding of the risks involved and should align with the investor’s financial goals and risk profile. Diversification is also a crucial aspect of risk management in any investment portfolio.