Bitcoin Price Prediction 2025

Bitcoin, since its inception, has demonstrated remarkable price volatility, swinging wildly from near-zero to record highs. Its journey has been characterized by periods of explosive growth punctuated by sharp corrections, making accurate price prediction a challenging, yet constantly pursued, endeavor. Understanding this volatility requires examining the multifaceted factors influencing its value.

Bitcoin’s price is not solely determined by supply and demand; it’s a complex interplay of technological advancements, regulatory landscapes, and overall market sentiment. Technological upgrades, such as the implementation of the Lightning Network aimed at improving transaction speed and scalability, can positively impact price. Conversely, negative regulatory actions, like outright bans or stringent restrictions on cryptocurrency trading, can trigger significant price drops. Market sentiment, driven by news coverage, social media trends, and investor confidence, plays a crucial role, often leading to speculative bubbles and subsequent crashes.

Factors Influencing Bitcoin’s Price

The price of Bitcoin is a dynamic reflection of several interconnected forces. Technological advancements, such as improved scalability solutions or the development of new applications built on the Bitcoin blockchain, often lead to increased adoption and subsequently, higher prices. Conversely, technological setbacks or security vulnerabilities can negatively impact investor confidence and cause price declines. Regulatory clarity, or lack thereof, significantly influences investor behavior. Favorable regulations can attract institutional investment, boosting prices, while harsh regulations can stifle growth and depress prices. Finally, the broader macroeconomic environment and prevailing market sentiment play a considerable role. Periods of economic uncertainty or risk aversion can see investors flock to Bitcoin as a safe haven asset, driving up prices. Conversely, during periods of economic prosperity, investors might shift their focus to other asset classes, potentially leading to price corrections.

Bitcoin Price Timeline: Key Events

Several significant events have shaped Bitcoin’s price trajectory. For example, the 2017 bull run saw Bitcoin’s price surge to nearly $20,000, fueled by increased media attention and speculation. This period was followed by a significant correction in 2018. The 2020-2021 bull run, partially driven by institutional adoption and macroeconomic uncertainty, saw Bitcoin reach new all-time highs, exceeding $60,000. These cycles highlight the inherent volatility of the cryptocurrency market and the influence of external factors on Bitcoin’s price. The halving events, which occur approximately every four years and reduce the rate of Bitcoin mining rewards, have historically been associated with subsequent price increases, although the impact is not always immediate or directly proportional. For instance, the halving event in 2020 was followed by a significant price increase in 2021. However, it is important to note that other factors contribute to price fluctuations, and the halving event alone doesn’t guarantee price appreciation.

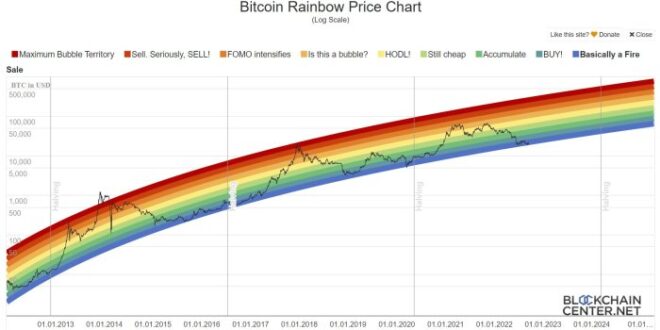

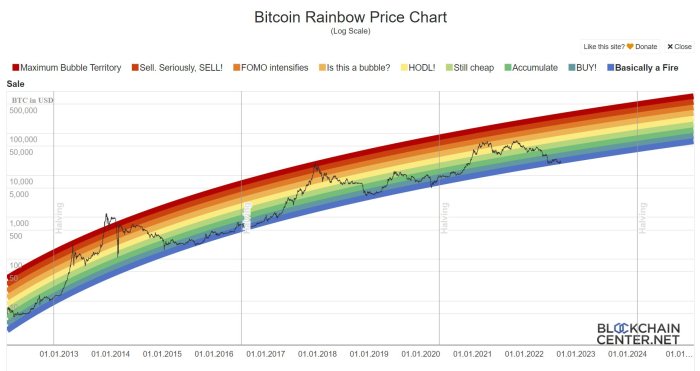

Analyzing Historical Trends & Predicting Future Price Movements: Bitcoin Price Prediction 2025 Chart

Bitcoin’s price history is characterized by extreme volatility, punctuated by periods of significant growth (bull markets) and sharp declines (bear markets). Understanding these historical trends is crucial for attempting to predict future price movements, although it’s important to remember that no prediction is guaranteed. Analyzing past performance, however, can offer valuable insights and inform various predictive models.

Predicting the future price of Bitcoin involves complex considerations and relies on several approaches, each with its strengths and weaknesses. These models often combine historical data analysis with economic factors and market sentiment to arrive at a projected price. While none can definitively predict the future, they can help us understand potential price trajectories and associated risks.

Bitcoin’s Historical Price Performance

Bitcoin’s price has experienced dramatic fluctuations since its inception. The initial years saw relatively low prices and slow growth. The first major bull market occurred in 2013, peaking at around $1,100 before a significant correction. Another substantial bull run materialized in late 2017, reaching an all-time high of nearly $20,000, followed by a prolonged bear market that lasted into 2018 and 2019. A subsequent bull market began in 2020, culminating in a new all-time high exceeding $60,000 in late 2021, after which another correction ensued. This cyclical pattern of bull and bear markets highlights the inherent volatility of the cryptocurrency market. Analyzing the duration and magnitude of these cycles can inform potential future price movements, though it is vital to remember that past performance is not indicative of future results.

Comparison of Price Prediction Models

Several methods are employed to predict cryptocurrency prices, each with its own methodology and limitations. These models often incorporate different types of data and analytical techniques.

| Prediction Method | Description | Strengths | Weaknesses |

|---|---|---|---|

| Technical Analysis | Uses historical price and volume data to identify patterns and trends, such as support and resistance levels, moving averages, and indicators like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence). | Relatively simple to understand and implement; can identify short-term price movements. | Relies heavily on past data, which may not accurately reflect future market conditions; subjective interpretation of chart patterns. |

| Fundamental Analysis | Focuses on the underlying value of Bitcoin, considering factors such as adoption rate, network effects, regulatory developments, and technological advancements. | Provides a long-term perspective on Bitcoin’s value; less susceptible to short-term market fluctuations. | Difficult to quantify and predict future adoption rates and regulatory changes; subject to qualitative judgments. |

| Machine Learning | Employs algorithms to identify patterns and relationships in large datasets, including price data, news sentiment, and social media activity. | Can analyze vast amounts of data to identify complex relationships; potential for improved accuracy compared to traditional methods. | Requires significant computational resources and expertise; model accuracy depends heavily on data quality and algorithm selection; prone to overfitting. |

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of technological advancements, regulatory landscapes, and adoption rates. While precise prediction is impossible, analyzing these key factors provides a framework for understanding potential price movements. The following sections delve into the significant influences shaping Bitcoin’s future value.

Technological Upgrades and Scalability

The scalability of the Bitcoin network is a crucial factor impacting its price. Current transaction speeds and fees can be limiting for widespread adoption. Technological upgrades, such as the Lightning Network, aim to address these issues. The Lightning Network operates as a layer-2 solution, enabling faster and cheaper transactions off the main Bitcoin blockchain. Successful implementation and widespread adoption of the Lightning Network could significantly increase Bitcoin’s usability, potentially driving up demand and price. Conversely, failure to overcome scalability challenges could hinder growth and limit price appreciation. For example, if the Lightning Network struggles to gain mainstream acceptance due to complexity or security concerns, Bitcoin’s price might be negatively affected. A successful scaling solution could potentially allow Bitcoin to process millions of transactions per second, comparable to existing payment systems, thus significantly increasing its appeal.

Regulatory Frameworks and Government Policies

Government regulations and policies play a pivotal role in shaping Bitcoin’s price trajectory. Favorable regulatory environments, such as clear legal frameworks for cryptocurrency transactions and taxation, can boost investor confidence and increase institutional adoption. Conversely, restrictive regulations, including outright bans or overly stringent KYC/AML requirements, can dampen investor enthusiasm and limit price appreciation. The regulatory landscape varies considerably across jurisdictions. For instance, El Salvador’s adoption of Bitcoin as legal tender demonstrated a positive impact on its price, while China’s crackdown on cryptocurrency mining resulted in a temporary price dip. The future regulatory climate will significantly influence Bitcoin’s price, with clear, consistent, and supportive regulations likely leading to increased price stability and potential growth.

Adoption Rates Among Institutions and Individuals

The rate of Bitcoin adoption by both institutions and individuals is a major determinant of its future price. Increased institutional investment, such as that seen from companies like MicroStrategy and Tesla, signals growing confidence in Bitcoin as a store of value and an asset class. Similarly, rising individual adoption, fueled by factors like increasing financial literacy and greater access to cryptocurrency exchanges, contributes to price appreciation. However, a slowdown in adoption, potentially caused by market volatility or negative media coverage, could lead to price stagnation or decline. For example, the significant price increase in 2020 and 2021 was largely driven by increased institutional and individual adoption, while subsequent price corrections were partly attributed to decreased investor confidence and regulatory uncertainty. Sustained and widespread adoption is crucial for long-term price appreciation.

Potential Scenarios for Bitcoin’s Price in 2025

Predicting Bitcoin’s price with certainty is impossible, but by analyzing historical trends, current market conditions, and potential future catalysts, we can construct plausible scenarios for its price in 2025. These scenarios represent a range of possibilities, from highly optimistic to pessimistic, and a more neutral middle ground. It’s crucial to remember that these are speculative projections, and the actual price may deviate significantly.

The following scenarios consider factors like regulatory changes, technological advancements, macroeconomic conditions, and the overall adoption rate of Bitcoin. Each scenario Artikels the underlying assumptions and market conditions that would need to prevail for the predicted price range to materialize.

Bullish Scenario: Continued Adoption and Institutional Investment

This scenario assumes widespread institutional adoption, positive regulatory developments, and sustained technological advancements that further enhance Bitcoin’s utility and security. Increased demand from institutional investors, coupled with a growing number of retail investors, would drive the price significantly higher. We might also see a strengthening narrative around Bitcoin as a hedge against inflation and a store of value, further fueling demand. Global macroeconomic instability could also contribute to increased demand for Bitcoin as a safe haven asset. This scenario envisions a continued upward trend, potentially fueled by positive news and increasing adoption in emerging markets.

Bearish Scenario: Regulatory Crackdown and Market Correction

Conversely, a bearish scenario anticipates significant regulatory hurdles, a broader economic downturn, or a loss of investor confidence. Increased regulatory scrutiny and potential bans in key markets could dramatically reduce demand. A major security breach or a significant technological flaw in the Bitcoin network could also trigger a sharp price decline. Furthermore, a general contraction in the cryptocurrency market, potentially triggered by a broader economic recession, could lead to a substantial sell-off. This scenario would involve a prolonged period of price stagnation or decline, possibly below current levels.

Neutral Scenario: Gradual Growth and Consolidation

This scenario assumes a more balanced outlook, where neither extreme bullish nor bearish factors dominate. We would see moderate growth, punctuated by periods of consolidation and volatility. Regulatory developments would be mixed, with some jurisdictions adopting a more favorable stance while others remain cautious. Technological advancements would continue, but without any major breakthroughs that significantly alter the market dynamics. The overall adoption rate would increase steadily, but at a more moderate pace compared to the bullish scenario. This scenario anticipates a gradual price increase, with periods of sideways trading and corrections.

Scenario Summary Table

| Scenario | Price Range (USD) | Supporting Factors |

|---|---|---|

| Bullish | $150,000 – $250,000+ | Widespread institutional adoption, positive regulatory developments, technological advancements, strong macroeconomic tailwinds, increased demand from retail and institutional investors. |

| Bearish | Below $10,000 | Significant regulatory crackdowns, major security breach, broader economic downturn, loss of investor confidence, negative macroeconomic conditions. |

| Neutral | $30,000 – $70,000 | Moderate growth in adoption, mixed regulatory landscape, steady technological advancements, relatively stable macroeconomic environment. |

Risks and Uncertainties Associated with Bitcoin Price Predictions

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently fraught with risk and uncertainty. The volatile nature of the cryptocurrency market, coupled with the influence of numerous unpredictable factors, makes accurate long-term forecasting exceptionally challenging. Even the most sophisticated models can only offer probabilities, not certainties.

The limitations of various prediction models stem from their reliance on historical data and assumptions about future market behavior. These models often struggle to account for unforeseen events, such as regulatory changes, technological breakthroughs, or significant shifts in investor sentiment. For example, a sudden negative news story about a major cryptocurrency exchange could trigger a sharp price drop that no model could have accurately predicted. Furthermore, the relatively short history of Bitcoin compared to traditional assets limits the amount of reliable historical data available for analysis, making predictions even more precarious.

Limitations of Predictive Models

Many prediction models, including those based on technical analysis, fundamental analysis, or machine learning, rely on past performance to forecast future trends. However, the cryptocurrency market is known for its extreme volatility and susceptibility to unpredictable events. These models may accurately reflect past trends, but fail to account for “black swan” events – highly improbable but potentially impactful occurrences that can dramatically alter market dynamics. For instance, the 2022 cryptocurrency market crash, which saw Bitcoin lose a significant portion of its value, highlighted the limitations of models that didn’t account for macroeconomic factors like rising interest rates and increased regulatory scrutiny. Such unforeseen events demonstrate the inherent unpredictability of the cryptocurrency market and the limitations of relying solely on predictive models.

Impact of External Factors

External factors, beyond the internal dynamics of the cryptocurrency market itself, exert significant influence on Bitcoin’s price. Government regulations, for instance, can significantly impact investor confidence and market liquidity. A country’s decision to ban or heavily regulate cryptocurrency trading can lead to price fluctuations. Similarly, macroeconomic conditions, such as inflation rates and interest rate changes, can affect the overall investment landscape, impacting the attractiveness of Bitcoin as an asset. Geopolitical events, such as international conflicts or political instability, can also introduce significant uncertainty and volatility into the market. The interconnectedness of global markets means that even events seemingly unrelated to cryptocurrency can have a substantial impact on its price.

Mitigating Investment Risks

Investors seeking to mitigate the risks associated with Bitcoin price predictions should adopt a diversified investment strategy. This involves spreading investments across various asset classes, not just focusing solely on Bitcoin. Furthermore, a thorough understanding of one’s own risk tolerance is crucial. Investors should only invest an amount they are comfortable losing, acknowledging the inherent volatility of the market. Regularly reviewing and adjusting investment portfolios based on market conditions and personal financial goals is also essential. Staying informed about market trends, regulatory developments, and technological advancements through reputable news sources and analytical reports can help investors make more informed decisions and better navigate the uncertainties inherent in the cryptocurrency market. Finally, it’s crucial to avoid emotional decision-making and stick to a well-defined investment plan.

Investment Strategies and Considerations

Investing in Bitcoin requires careful consideration of risk tolerance and financial goals. Different strategies cater to varying levels of risk appetite and desired returns, ranging from conservative approaches to more aggressive ones. Understanding these strategies is crucial for making informed investment decisions.

Bitcoin’s volatility presents both opportunities and challenges. A well-defined strategy, combined with a realistic understanding of the market’s inherent risks, can significantly improve the chances of achieving your investment objectives. This section explores various investment approaches and highlights the importance of diversification.

Diversification Strategies for Bitcoin Investment

Diversification is a key principle in managing investment risk. Including Bitcoin in a broader portfolio, rather than dedicating all funds to it, can mitigate potential losses. This approach reduces reliance on a single asset’s performance. For example, a balanced portfolio might allocate a percentage of the investment to Bitcoin, while the remainder is distributed across stocks, bonds, and real estate. The specific allocation depends on individual risk tolerance and investment goals.

Examples of Diversified Portfolios Incorporating Bitcoin, Bitcoin Price Prediction 2025 Chart

A conservative investor might allocate only 5% of their portfolio to Bitcoin, with the majority invested in stable, low-risk assets like government bonds and index funds. A more aggressive investor, comfortable with higher risk, might allocate 15-20%, balancing it with growth stocks and potentially alternative investments. Another example could involve a portfolio with 10% in Bitcoin, 40% in a mix of established stocks, 30% in bonds, and 20% in real estate. The proportions should be adjusted based on individual circumstances and risk assessment.

Long-Term Bitcoin Investment: Risks and Benefits

Bitcoin Price Prediction 2025 Chart – Long-term Bitcoin investment presents a unique set of risks and benefits. The long-term nature of the investment can help mitigate some of the short-term volatility, but other risks remain.

- Benefits: Potential for significant returns over the long term, driven by increasing adoption and limited supply. Historical data shows Bitcoin’s price appreciation over several years, despite periods of significant volatility.

- Risks: Volatility remains a significant concern. Regulatory uncertainty and potential technological disruptions pose threats. Furthermore, the market is susceptible to speculative bubbles and sudden price crashes. The long-term value is uncertain, and past performance does not guarantee future results. Security risks associated with storing Bitcoin are also considerable.

Illustrative 2025 Bitcoin Price Chart

This section presents a hypothetical Bitcoin price chart for 2025, depicting three potential price scenarios: bullish, bearish, and neutral. These scenarios are based on an analysis of historical trends, technological advancements, regulatory changes, and macroeconomic factors. It’s crucial to remember that these are illustrative examples and should not be considered financial advice.

Illustrative Bitcoin Price Chart Scenarios for 2025

Bullish Scenario

This scenario assumes widespread adoption of Bitcoin as a store of value and a medium of exchange, coupled with positive regulatory developments and continued technological innovation. The chart would show a steady, upward trend throughout 2025, potentially exceeding previous all-time highs. We can imagine a starting price around $30,000 at the beginning of the year, gradually climbing to reach a peak of around $150,000 by the end of 2025. Support levels would be established at key psychological price points ($40,000, $60,000, $100,000), while resistance would be less prominent due to the strong upward momentum. The overall trend line would exhibit a consistent upward slope, with minor corrections along the way. This bullish projection mirrors the growth experienced by other assets during periods of significant adoption and positive market sentiment, such as the early days of the internet boom.

Bearish Scenario

The bearish scenario reflects a less optimistic outlook. This could be driven by factors such as increased regulatory scrutiny, a significant macroeconomic downturn, or a loss of investor confidence. The chart would show a downward trend, potentially dipping below current prices. We might see a starting price of $30,000, falling to a low of $15,000 by the year’s end, possibly even lower. Strong support levels would be tested at $15,000 and potentially even lower, representing significant buying pressure. Resistance levels would be observed at the starting price and any brief rallies encountered during the year. The trend line would have a clear downward slope, illustrating a sustained bearish market. This pessimistic scenario is comparable to the dot-com bubble burst, where valuations plummeted due to market correction and regulatory concerns.

Neutral Scenario

This scenario assumes a relatively stable market with moderate price fluctuations. The chart would depict a sideways trend, with the price oscillating within a defined range throughout the year. Starting at $30,000, the price might fluctuate between $25,000 and $40,000, demonstrating consolidation. Support and resistance levels would be clearly defined within this range, indicating periods of buying and selling pressure. The overall trend line would be relatively flat, showing limited directional movement. This neutral projection mirrors the market behavior of established assets during periods of economic uncertainty, where investors remain cautious, resulting in minimal price changes.

Assumptions and Data

The hypothetical charts are constructed using a combination of qualitative and quantitative data. Qualitative factors include the anticipated regulatory landscape, the pace of technological adoption, and general market sentiment. Quantitative data includes historical price movements, trading volume, and on-chain metrics. These hypothetical charts are built upon simplified models, and do not take into account the full complexity of the cryptocurrency market. They represent simplified possibilities, not precise predictions. The actual price of Bitcoin in 2025 will depend on a multitude of unpredictable factors.

Frequently Asked Questions (FAQ)

This section addresses common queries regarding Bitcoin’s price prediction for 2025 and related investment considerations. Understanding the inherent volatility and influencing factors is crucial for informed decision-making.

Bitcoin’s Expected Price in 2025

Predicting Bitcoin’s price in 2025 is inherently challenging due to the cryptocurrency’s volatile nature and susceptibility to various market forces. While numerous analysts offer projections, ranging from significantly lower to substantially higher than current values, it’s crucial to remember that these are merely educated guesses, not guarantees. Several factors, including regulatory changes, technological advancements, and overall market sentiment, could significantly impact the final price. For example, widespread adoption by major institutions could drive prices upwards, while a major security breach or regulatory crackdown could lead to a sharp decline. Therefore, any specific numerical prediction should be treated with considerable caution.

Bitcoin as a Long-Term Investment

Bitcoin’s potential as a long-term investment is a subject of ongoing debate. On one hand, its limited supply and growing adoption suggest potential for significant price appreciation over the long term. The decentralized nature of Bitcoin and its resistance to traditional financial institutions’ control are also attractive features for some investors. However, Bitcoin’s price volatility poses significant risk. Sharp price drops can occur suddenly and unexpectedly, potentially leading to substantial losses for investors. Furthermore, the regulatory landscape surrounding cryptocurrencies remains uncertain and could negatively impact Bitcoin’s value. Successful long-term investment in Bitcoin requires a high risk tolerance and a thorough understanding of the market’s complexities.

Major Factors Affecting Bitcoin’s Price

Several interconnected factors influence Bitcoin’s price. These include macroeconomic conditions (global economic growth, inflation rates, and interest rate policies), regulatory developments (government regulations and legal frameworks), technological advancements (scaling solutions and network upgrades), market sentiment (investor confidence and media coverage), and adoption rates (increasing usage by businesses and individuals). For example, positive regulatory announcements often lead to price increases, while negative news or market downturns can cause significant price drops. The interplay of these factors makes predicting Bitcoin’s price a complex undertaking.

Mitigating Risks in Bitcoin Investment

Managing risk when investing in Bitcoin is crucial. A key strategy is diversification – don’t invest all your funds in Bitcoin. Spread your investments across different asset classes to reduce the impact of potential losses in one area. Another crucial aspect is conducting thorough research before investing. Understand the technology behind Bitcoin, its potential risks and rewards, and the overall market dynamics. Consider dollar-cost averaging, which involves investing smaller amounts of money regularly rather than making a large lump-sum investment. This strategy helps to mitigate the impact of price volatility. Finally, only invest what you can afford to lose. Bitcoin’s high volatility means there’s a significant chance of losing some or all of your investment.