Risk Factors and Investment Considerations

Investing in Bitcoin, like any other asset class, carries inherent risks. Understanding these risks is crucial before allocating any capital. While the potential for high returns is attractive, the volatility and regulatory uncertainty associated with Bitcoin necessitate a cautious and informed approach. This section Artikels key risk factors and provides guidance on mitigating them.

Bitcoin Volatility and its Implications for Investors

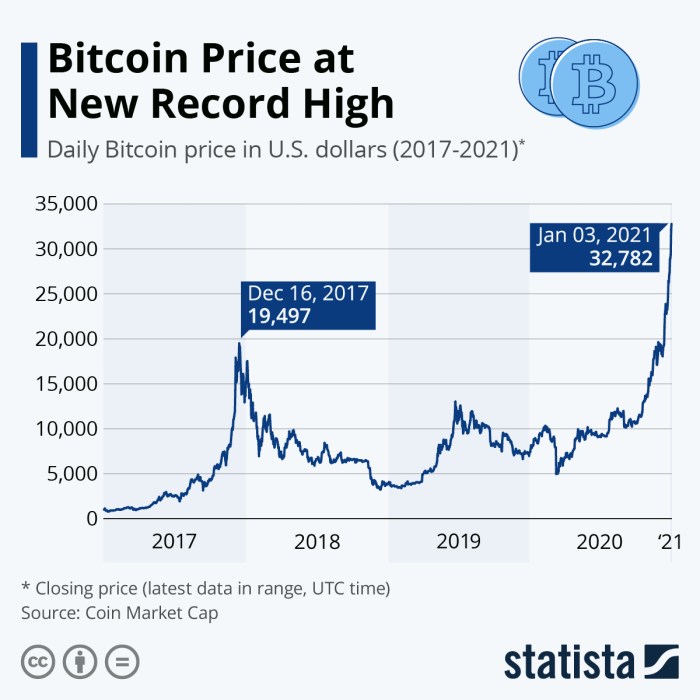

Bitcoin’s price is notoriously volatile, experiencing significant price swings in short periods. This volatility stems from several factors, including regulatory changes, market sentiment, technological developments, and macroeconomic conditions. For example, the price of Bitcoin can fluctuate by hundreds of dollars in a single day, impacting investor portfolios significantly. This high volatility makes Bitcoin a risky investment, especially for those with a low risk tolerance or short-term investment horizons. Investors should carefully consider their risk appetite and only invest an amount they are comfortable potentially losing. A common strategy to manage this risk is dollar-cost averaging, where investors invest a fixed amount of money at regular intervals, regardless of the price. This strategy helps to mitigate the impact of volatility by averaging the purchase price over time.

Diversification Strategies for Bitcoin Investors

Diversification is a fundamental principle of risk management in investing. Instead of concentrating investments solely in Bitcoin, a diversified portfolio can help reduce overall risk. This could involve allocating a portion of your investment portfolio to Bitcoin while investing the remainder in other asset classes, such as stocks, bonds, real estate, or other cryptocurrencies. The optimal allocation depends on individual risk tolerance and financial goals. For instance, a risk-averse investor might allocate only a small percentage (e.g., 5%) of their portfolio to Bitcoin, while a more risk-tolerant investor might allocate a larger percentage (e.g., 15-20%). It’s important to remember that even with diversification, Bitcoin’s volatility can still impact the overall portfolio.

Resources and Tools for Bitcoin Research

Thorough research is essential before investing in Bitcoin. Several resources can help investors gain a better understanding of the cryptocurrency market and assess the risks involved. These include reputable financial news websites, cryptocurrency exchanges (for price tracking and market analysis), blockchain explorers (to verify transactions and assess network activity), and educational resources offered by financial institutions and educational platforms. Investors should also familiarize themselves with white papers and technical documentation related to Bitcoin to understand its underlying technology and functionality. Consulting with a qualified financial advisor is highly recommended before making any investment decisions, especially concerning cryptocurrencies like Bitcoin. They can provide personalized guidance based on individual circumstances and risk tolerance.

Bitcoin’s Long-Term Potential

Bitcoin’s long-term potential hinges on its ability to fulfill its original design: a decentralized, secure, and transparent digital currency. While its volatility remains a significant concern, its underlying technology and growing adoption suggest a future where it plays a more substantial role in the global financial landscape. This section explores Bitcoin’s potential as a store of value and medium of exchange, comparing it to other asset classes and analyzing factors that could influence its future trajectory.

Bitcoin’s potential as a store of value rests on its limited supply of 21 million coins. This inherent scarcity, coupled with increasing demand, could drive its price upwards over time, mirroring the behavior of precious metals like gold. As a medium of exchange, Bitcoin’s adoption is still nascent but growing, with an increasing number of merchants accepting it as payment. The speed and low cost of international transactions are key advantages over traditional systems. However, its volatility and regulatory uncertainty present challenges to its widespread adoption as a daily currency.

Bitcoin’s Value Proposition Compared to Other Asset Classes

Bitcoin’s long-term potential can be analyzed by comparing it to established asset classes such as gold, real estate, and equities. Gold, a traditional store of value, has a long history of price stability, though it lacks the potential for rapid growth seen in Bitcoin. Real estate provides both a store of value and income generation through rental yields, but it is less liquid and geographically constrained compared to Bitcoin. Equities offer higher growth potential but are subject to market fluctuations and company-specific risks. Bitcoin, therefore, occupies a unique position, offering a blend of potential growth, scarcity, and global accessibility, although with higher volatility than traditional assets. The comparison highlights the trade-offs inherent in different investment choices.

Factors Contributing to Bitcoin’s Long-Term Growth or Decline

Several factors could significantly influence Bitcoin’s long-term price. Positive factors include increased institutional adoption, regulatory clarity in major markets, technological advancements improving scalability and transaction speeds, and growing public awareness and understanding of its underlying technology. Conversely, negative factors include increased regulatory scrutiny and potential bans, the emergence of competing cryptocurrencies with superior technology, major security breaches impacting user trust, and unforeseen technological limitations. Government regulation, in particular, is a double-edged sword: while clear, supportive regulations could boost adoption, overly restrictive measures could stifle growth.

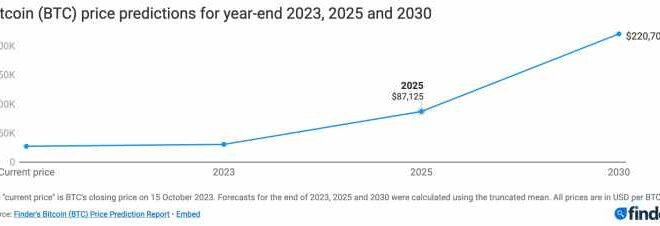

Visual Representation of Bitcoin’s Potential Trajectory, Bitcoin Price Prediction 2025 December

Imagine a graph charting Bitcoin’s price over the next decade. The X-axis represents time (in years), and the Y-axis represents the price in USD. The line starts at the current price and initially exhibits significant volatility, characterized by sharp peaks and troughs. Over time, however, the volatility gradually decreases, with the overall trend showing a positive upward trajectory, although not necessarily linear. The line might experience periods of consolidation or even temporary declines, reflecting the influence of market cycles and external factors. However, the long-term trend is one of gradual, sustained growth, representing Bitcoin’s potential to establish itself as a significant long-term asset. The overall shape resembles a somewhat smoothed-out hockey stick, reflecting the initial volatility and the eventual stabilization around a long-term growth trend. This is a simplified representation, and the actual trajectory could vary significantly depending on the factors discussed above.

Frequently Asked Questions (FAQs): Bitcoin Price Prediction 2025 December

This section addresses some of the most common questions surrounding Bitcoin price predictions and investment strategies for 2025 and beyond. Understanding these points is crucial for making informed decisions about your potential Bitcoin investment.

Bitcoin’s Most Likely Price in December 2025

Predicting the exact price of Bitcoin in December 2025 is impossible. The cryptocurrency market is highly volatile and influenced by numerous factors, including regulatory changes, technological advancements, macroeconomic conditions, and overall market sentiment. While various analysts offer price predictions, ranging from extremely bullish to quite bearish, these should be viewed with considerable skepticism. Past performance is not indicative of future results. Instead of focusing on a specific price target, it’s more prudent to consider Bitcoin’s potential for long-term growth based on its underlying technology and adoption rate. For example, a scenario where Bitcoin gains wider acceptance as a payment method and store of value could lead to significant price appreciation. Conversely, negative regulatory actions or a major security breach could drastically impact its value.

Investing in Bitcoin in 2024: A Timely Decision?

Whether or not 2024 is “too late” to invest in Bitcoin depends entirely on your individual risk tolerance, investment goals, and financial situation. Investing at any point carries inherent risk, but the potential for significant returns also exists. A positive aspect is that Bitcoin’s technology continues to mature, and its adoption is expanding globally. However, the cryptocurrency market’s volatility remains a significant drawback. Sharp price drops are common, and investors need to be prepared for potential losses. Thorough research and a well-defined investment strategy are crucial before committing any funds. Consider the potential for significant price fluctuations and only invest what you can afford to lose.

Biggest Risks Associated with Bitcoin Investment

Bitcoin investment carries substantial risks. Price volatility is the most prominent, with significant price swings occurring frequently. Regulatory uncertainty, differing legal frameworks across countries, and the potential for government crackdowns represent considerable risk factors. Security breaches, including hacks of exchanges or individual wallets, can lead to the loss of funds. Furthermore, the lack of intrinsic value and reliance on market demand makes Bitcoin susceptible to speculative bubbles and subsequent crashes. The decentralized nature, while a strength, also means that there is less recourse if something goes wrong compared to traditional financial assets.

Protecting Against Bitcoin Price Volatility

Managing risk in a volatile market like Bitcoin requires a multi-faceted approach. Diversification is key; don’t put all your eggs in one basket. Investing only a portion of your portfolio in Bitcoin and allocating the rest to other asset classes (stocks, bonds, real estate) can mitigate potential losses. Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals regardless of price, can help reduce the impact of volatility. Holding Bitcoin for the long term, rather than engaging in short-term trading, can also be beneficial, allowing time to weather price fluctuations. Finally, securing your Bitcoin using a reliable hardware wallet and practicing sound security measures is crucial to minimize the risk of theft or loss.

Predicting the Bitcoin price in December 2025 is challenging, heavily influenced by various market factors. A key element to consider is the impact of the 2025 halving, which you can read more about at Price Of Bitcoin At Halving 2025. Understanding the potential price shift after the halving is crucial for any accurate Bitcoin Price Prediction 2025 December forecast.

Ultimately, the December 2025 price will depend on a complex interplay of these and other economic forces.

Predicting the Bitcoin price in December 2025 is challenging, with various factors influencing its trajectory. A key event impacting this prediction is the Bitcoin Halving 2025 , which is expected to significantly reduce the rate of new Bitcoin entering circulation. This halving event usually leads to increased scarcity and often precedes periods of price appreciation, thus playing a major role in shaping the Bitcoin price prediction for December 2025.

Predicting the Bitcoin price in December 2025 is challenging, influenced by numerous factors. A key event impacting this prediction is the upcoming Bitcoin halving, which significantly affects the rate of new Bitcoin entering circulation. To understand the timing of this crucial event, you should check out this resource on when the 2025 Bitcoin halving will occur: 2025 Bitcoin Halving Ne Zaman.

Understanding the halving’s timing is vital for any serious Bitcoin price prediction for December 2025.

Predicting the Bitcoin price in December 2025 is challenging, heavily influenced by various factors. Understanding the impact of the upcoming halving is crucial for any accurate forecast; for detailed information on this, check out the comprehensive Halving Bitcoin Data 2025 resource. Ultimately, the halving’s effect on scarcity will likely play a significant role in shaping the Bitcoin price prediction for December 2025.

Predicting the Bitcoin price in December 2025 is challenging, with various factors influencing its trajectory. A key element to consider is the impact of the upcoming Bitcoin halving, and understanding the historical data surrounding these events is crucial. For detailed information on the expected effects of the 2025 halving, check out this resource on Bitcoin Halving 2025 Data ; this analysis can help inform more accurate predictions regarding Bitcoin’s price in December 2025.

Ultimately, many variables contribute to the final price.

Predicting the Bitcoin price in December 2025 is challenging, with various factors influencing its trajectory. A key event impacting this prediction is the Bitcoin Halving in 2025, the date of which you can find detailed information on Bitcoin Halving 2025 Daye. This halving, reducing the rate of new Bitcoin creation, historically has led to price increases; therefore, understanding its timing is crucial for any accurate 2025 December price forecast.