Bitcoin Price Prediction 2025: Bitcoin Price Prediction 2025 Halving

The Bitcoin halving event, occurring approximately every four years, is a significant programmed reduction in the rate at which new Bitcoins are created. This event has historically been associated with substantial price increases in the following periods, leading many to anticipate similar effects in 2025. However, it’s crucial to understand that past performance is not indicative of future results, and numerous other factors influence Bitcoin’s price.

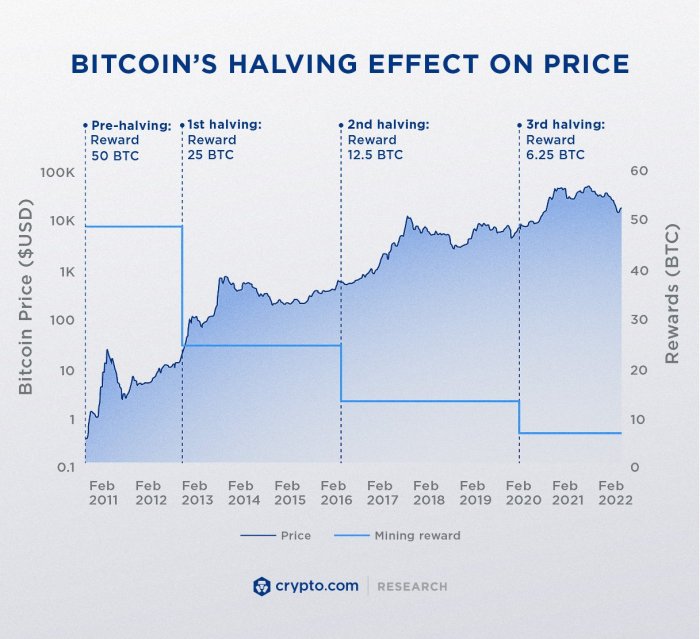

Historical Impact of Bitcoin Halving Events on Price

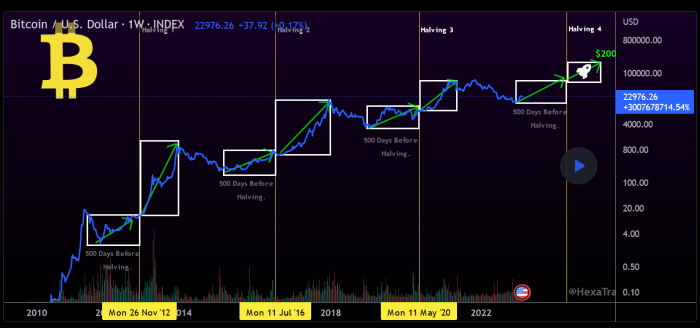

The Bitcoin halving mechanism, embedded in the Bitcoin protocol, reduces the block reward miners receive for validating transactions. This directly impacts the rate of Bitcoin inflation, creating a scarcity effect. The first halving in 2012 saw a gradual price increase in the following months and years. The second halving in 2016 was followed by a more dramatic price surge, culminating in the 2017 bull market. The third halving in 2020 also led to a significant price increase, though the subsequent market behavior was more complex, influenced by factors beyond the halving itself. Analyzing these past events offers valuable insights, but it’s vital to remember that market conditions and overall economic environments differ considerably between these periods.

Factors Influencing Bitcoin’s Price Leading up to the 2025 Halving

Several factors beyond the halving itself will likely influence Bitcoin’s price trajectory leading up to 2025. These include macroeconomic conditions (e.g., inflation rates, interest rates, and overall economic growth), regulatory developments (e.g., government policies towards cryptocurrencies), technological advancements within the Bitcoin network (e.g., the Lightning Network’s adoption), and broader market sentiment and investor behavior. For instance, a global recession could negatively impact Bitcoin’s price regardless of the halving, while increased institutional adoption could drive prices higher.

Comparison of the 2025 Halving with Previous Halvings, Bitcoin Price Prediction 2025 Halving

The 2025 halving shares similarities with previous events in its core mechanism: a reduction in the rate of new Bitcoin creation. However, key differences exist. The overall market maturity and awareness of Bitcoin are significantly higher in 2024 compared to previous halving years. Institutional investment in Bitcoin is also substantially greater. Furthermore, the global economic landscape and regulatory environment are vastly different. These factors suggest that the 2025 halving’s impact might differ from previous cycles, potentially leading to a less predictable price outcome.

Expected Supply Reduction and Its Potential Market Effects

The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC per block. This represents a 50% decrease in the rate of new Bitcoin issuance. The resulting scarcity is expected to put upward pressure on price, especially if demand remains strong or increases. However, the actual market impact will depend on the interplay of supply and demand forces. A significant increase in demand could lead to a substantial price surge, while weak demand might mitigate the impact of the reduced supply.

Key Metrics of Bitcoin Halvings

| Halving Date | Block Reward Before Halving (BTC) | Block Reward After Halving (BTC) | Approximate Price Before Halving (USD) |

|---|---|---|---|

| November 2012 | 50 | 25 | ~13 |

| July 2016 | 25 | 12.5 | ~650 |

| May 2020 | 12.5 | 6.25 | ~8700 |

| April 2024 | 6.25 | 3.125 | ~28000 (Projected) |

Macroeconomic Factors and Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of macroeconomic factors. Global economic conditions, government policies, and investor sentiment all significantly influence the cryptocurrency market. While predicting the future with certainty is impossible, analyzing these factors can provide a framework for understanding potential price movements.

Inflation’s Influence on Bitcoin’s Value

High inflation erodes the purchasing power of fiat currencies. Historically, during periods of high inflation, investors have sought alternative stores of value, potentially driving demand for Bitcoin. For example, the significant inflation experienced in several countries in 2022 correlated with increased Bitcoin adoption in those regions as individuals sought to protect their savings. However, rising interest rates, often a response to inflation, can also negatively impact Bitcoin’s price by making other investment options more attractive. The interplay between inflation and interest rates creates a dynamic and complex environment for Bitcoin’s price.

Interest Rate Impacts on Bitcoin Investment

Interest rate hikes by central banks, such as the Federal Reserve in the United States, influence Bitcoin’s price by altering investment attractiveness. Higher interest rates increase the returns on traditional assets like bonds, potentially diverting investment away from riskier assets like Bitcoin. Conversely, lower interest rates can make Bitcoin more appealing as investors seek higher returns. The 2022 interest rate hikes, for instance, significantly impacted Bitcoin’s price, causing a considerable market downturn. The future trajectory of interest rates will, therefore, be a key determinant of Bitcoin’s price in 2025.

Global Economic Growth and Bitcoin’s Price

Periods of strong global economic growth often lead to increased investor confidence and risk appetite, potentially benefiting Bitcoin’s price. Conversely, economic downturns or recessions can cause investors to move towards safer assets, leading to decreased demand for Bitcoin. The 2008 financial crisis, for example, initially negatively impacted Bitcoin’s price, but its subsequent adoption showcased its potential as a hedge against financial instability. The state of the global economy in 2025 will therefore play a significant role in shaping Bitcoin’s price.

Regulatory Changes and Their Impact

Regulatory clarity and acceptance of Bitcoin across jurisdictions are crucial factors affecting its price. Favorable regulations can boost investor confidence and increase institutional adoption, driving up the price. Conversely, restrictive regulations or bans can significantly dampen demand and lead to price declines. The evolving regulatory landscape in different countries will continue to be a significant driver of Bitcoin’s price fluctuations in 2025. The contrasting approaches of El Salvador’s adoption of Bitcoin as legal tender versus China’s ban highlight the potential range of impact.

Hypothetical Scenario: Global Recession and Bitcoin’s Price

Imagine a scenario where a significant global recession occurs in 2024, leading to increased inflation and high interest rates. This combination could initially cause a sharp decline in Bitcoin’s price as investors seek safer haven assets. However, if the recession leads to increased distrust in traditional financial institutions and fiat currencies, we could see a resurgence in Bitcoin’s price as investors seek alternative stores of value. The eventual outcome would depend on the severity and duration of the recession, along with the response of governments and central banks. This demonstrates how interconnected macroeconomic events can influence Bitcoin’s price trajectory.

Predicting the Bitcoin price in 2025, especially considering the halving event, is a complex undertaking. Many analysts are weighing in on potential scenarios, and you can find a lively discussion of various predictions on online forums; for instance, check out the ongoing conversation on Bitcoin Price 2025 Reddit for diverse perspectives. Ultimately, the Bitcoin Price Prediction 2025 Halving remains a fascinating area of speculation, with many variables influencing the outcome.

Predicting the Bitcoin price in 2025, especially considering the halving event, is a complex task with many variables. Several analysts offer their insights, and you can find a comprehensive overview of various predictions, including those from Forbes, by checking out this insightful article: Btc 2025 Price Prediction Forbes. Ultimately, the Bitcoin price in 2025 after the halving will depend on a multitude of factors beyond these predictions.

Predicting the Bitcoin price in 2025, especially around the halving event, is a complex undertaking. Many analysts consider the halving a significant factor influencing price, but daily fluctuations also play a crucial role. For a more granular view of potential daily price movements leading up to and following the halving, you might find the detailed analysis at Bitcoin Price Prediction Daily 2025 helpful.

Ultimately, Bitcoin’s price in 2025 after the halving will depend on a confluence of factors beyond just the reduced supply.

Predicting the Bitcoin price in 2025, particularly around the halving event, is a complex endeavor. Many analysts consider the halving a significant factor influencing price movements. To gain a better understanding of potential price ranges, it’s helpful to consult resources focused on predicting the Bitcoin price; for instance, you might find useful information on the projected price by checking out this detailed analysis on Bitcoin Price At 2025.

Ultimately, Bitcoin’s price in 2025 will depend on various interacting market forces beyond just the halving.

Predicting the Bitcoin price in 2025, especially considering the halving event, is a complex endeavor. Many analysts look to historical trends and various forecasting models to make informed guesses. To visually understand potential price movements, it’s helpful to consult a price chart; a useful resource is this Bitcoin Price Chart 2025 which can aid in interpreting the impact of the halving on future Bitcoin price prediction in 2025.

Ultimately, however, these are just projections, and the actual price remains highly speculative.