Bitcoin Price Prediction 2025 in India

Bitcoin, the world’s first decentralized cryptocurrency, has captivated investors and tech enthusiasts alike with its volatile nature and potential for substantial returns. Its price fluctuations have been dramatic, offering both immense opportunities and significant risks. The Indian market, a burgeoning economy with a rapidly growing tech-savvy population, presents a particularly intriguing case study for understanding Bitcoin’s future trajectory. This article focuses specifically on predicting the price of Bitcoin in India by 2025, considering the unique factors influencing its adoption and value within the Indian context.

Bitcoin’s journey has been marked by periods of explosive growth and sharp corrections. Originating in 2009 as a response to the 2008 financial crisis, it has gradually gained acceptance, albeit with regulatory hurdles in many countries, including India. While the Indian government has yet to fully embrace Bitcoin as legal tender, its adoption is steadily increasing, driven by factors such as increasing internet penetration, a young and tech-savvy population, and a growing awareness of alternative investment options. The current status of Bitcoin in India is one of cautious optimism, with a significant number of users despite regulatory uncertainty. This article will delve into the various factors that could influence Bitcoin’s price in India over the next few years, leading up to 2025.

Factors Influencing Bitcoin’s Price in India by 2025

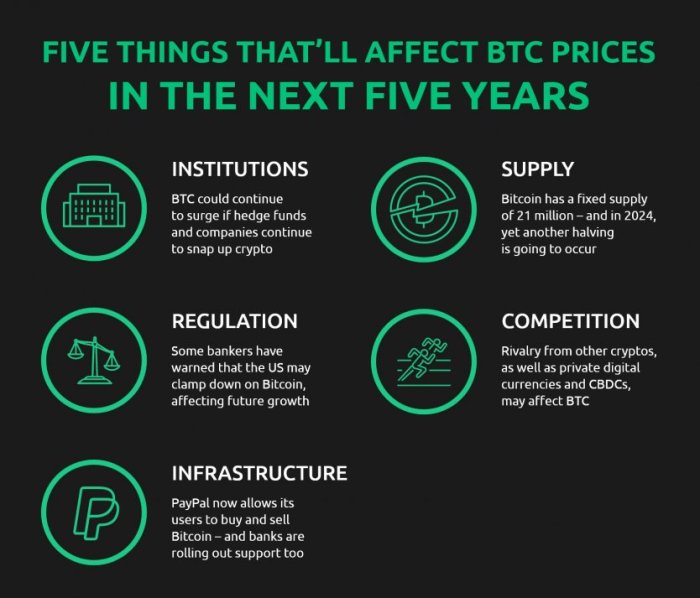

Several key factors will likely shape Bitcoin’s price in India by 2025. These include regulatory developments, technological advancements within the cryptocurrency space, global macroeconomic conditions, and the overall adoption rate of Bitcoin within the Indian population. Analyzing these factors will provide a more comprehensive understanding of potential price scenarios.

Regulatory Landscape and its Impact

The Indian government’s stance on cryptocurrencies will significantly impact Bitcoin’s price. While currently uncertain, any clear regulatory framework – whether supportive or restrictive – will provide much-needed clarity for investors, potentially leading to increased or decreased adoption and consequently affecting the price. For example, a clear regulatory framework similar to that of some other countries could lead to increased institutional investment and wider acceptance, driving up the price. Conversely, a highly restrictive approach could limit adoption and suppress price growth. The current ambiguity contributes to volatility.

Technological Advancements and Bitcoin Adoption

Technological advancements within the cryptocurrency space, such as improvements in scalability and transaction speed, could also influence Bitcoin’s price. Increased efficiency and lower transaction fees would make Bitcoin more appealing to a wider range of users, potentially boosting demand and price. Conversely, the emergence of competing cryptocurrencies with superior technology could potentially divert investment away from Bitcoin, affecting its price negatively. The widespread adoption of layer-2 scaling solutions, for instance, could significantly improve Bitcoin’s usability and therefore its price.

Global Macroeconomic Conditions and their Influence

Global macroeconomic factors, such as inflation rates, interest rates, and economic growth, will also play a crucial role in determining Bitcoin’s price. Periods of high inflation or economic uncertainty could drive investors towards Bitcoin as a hedge against inflation, increasing demand and potentially pushing the price higher. Conversely, a strong global economy and low inflation could reduce the appeal of Bitcoin as a safe haven asset, leading to a price decline. For instance, the 2022 bear market was partly attributed to rising interest rates globally.

Bitcoin Adoption Rate in India

The rate of Bitcoin adoption within India will be a key determinant of its price in the country. Increased awareness, improved infrastructure, and greater accessibility will all contribute to higher adoption. Factors like increased merchant acceptance, greater integration with existing financial systems, and successful educational campaigns aimed at demystifying Bitcoin will play a significant role. The higher the adoption rate, the greater the demand, and the higher the potential price. Conversely, low adoption rates would likely suppress price growth.

Factors Influencing Bitcoin’s Price in India

Predicting Bitcoin’s price is inherently complex, influenced by a confluence of global and local factors. In India, a rapidly developing cryptocurrency market, these influences are particularly pronounced, shaped by the country’s unique economic landscape and regulatory environment. Understanding these factors is crucial for navigating the volatility and potential of Bitcoin investment in India.

Macroeconomic Factors Affecting Bitcoin’s Price in India

India’s macroeconomic environment significantly impacts Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation. Conversely, a strengthening rupee might reduce the appeal of Bitcoin as an investment, as its value in rupees would decrease. Government regulations, including taxation policies and the overall stance towards cryptocurrencies, play a pivotal role in shaping investor confidence and market liquidity. For example, a more favorable regulatory framework could attract greater institutional investment, boosting Bitcoin’s price. Conversely, stricter regulations could lead to reduced trading volume and price suppression.

Technological Advancements and Adoption Rates

Technological advancements in the Bitcoin ecosystem, such as improvements in transaction speed and scalability (e.g., the Lightning Network), can positively influence its price. Increased adoption rates, particularly among businesses and institutions, further contribute to price appreciation. Wider acceptance of Bitcoin as a payment method, for example, could lead to increased demand and consequently, a higher price. Conversely, technological setbacks or security breaches could trigger negative price movements.

Investor Sentiment and Market Speculation

Investor sentiment and market speculation are powerful drivers of Bitcoin’s price volatility. Periods of heightened optimism and bullish forecasts can lead to price surges, while fear and uncertainty can trigger sharp declines. News events, social media trends, and pronouncements from influential figures in the cryptocurrency space all contribute to shaping investor sentiment. For example, positive news regarding Bitcoin adoption by major corporations or positive regulatory developments can generate significant price increases. Conversely, negative news such as regulatory crackdowns or security vulnerabilities can cause sharp price drops.

Comparison of the Indian Bitcoin Market with Global Trends, Bitcoin Price Prediction 2025 In India

While the Indian Bitcoin market largely mirrors global trends, it exhibits unique characteristics. Regulatory uncertainty in India can cause price deviations from global markets. Furthermore, the Indian market’s relatively lower liquidity compared to more established markets like the US can lead to amplified price swings in response to news and events. However, India’s large population and growing interest in cryptocurrency suggest a significant potential for future growth and price appreciation, potentially exceeding global trends in the long term.

Summary of Factors Influencing Bitcoin’s Price in India

| Factor | Potential Influence on Price | Example | Impact on Indian Market |

|---|---|---|---|

| Inflation | Positive (hedge against devaluation) | High inflation in India could drive investors towards Bitcoin. | Increased demand, potentially higher prices. |

| Rupee Value | Negative (strengthening rupee reduces Bitcoin’s rupee value) | A stronger rupee could make Bitcoin less attractive. | Reduced demand, potentially lower prices. |

| Government Regulations | Variable (depends on the nature of regulations) | Favorable regulations could attract institutional investment. | Could significantly impact both liquidity and price. |

| Technological Advancements | Positive (increased efficiency and scalability) | Improvements in transaction speed could increase adoption. | Increased demand, potentially higher prices. |

| Adoption Rates | Positive (higher adoption leads to increased demand) | Increased merchant acceptance of Bitcoin. | Increased demand, potentially higher prices. |

| Investor Sentiment | Highly Variable (bullish sentiment drives prices up, bearish sentiment drives prices down) | Positive news about Bitcoin adoption can lead to price surges. | Amplified price swings due to market volatility. |

Analyzing Historical Bitcoin Price Trends in India

Analyzing Bitcoin’s price history in India reveals a volatile yet fascinating journey mirroring global trends but with unique local nuances. Understanding these past movements provides valuable context for predicting future price action. While precise figures fluctuate depending on the exchange and data source, the overall pattern remains consistent.

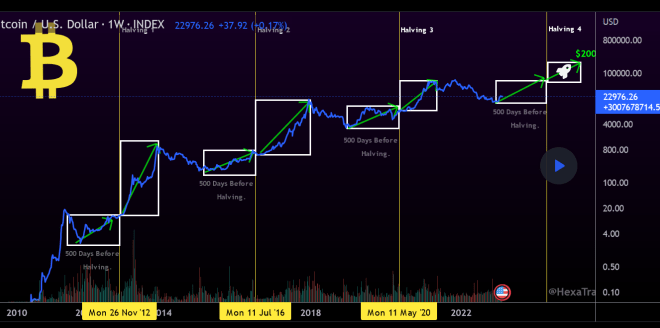

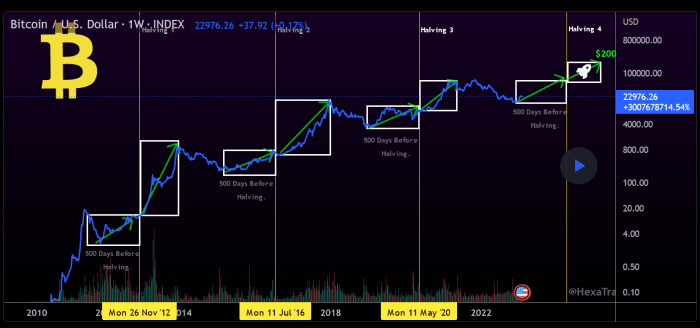

Bitcoin’s introduction to India saw relatively slow adoption initially, with prices tracking closely to global trends but with lower trading volumes. The first significant price surge occurred around 2017, mirroring the global bull market. This period saw a sharp increase in interest and media coverage, leading to a rapid price appreciation, followed by a substantial correction. This volatility highlighted the inherent risks associated with investing in cryptocurrencies.

Significant Price Movements and Their Causes

The 2017 bull run in India was primarily driven by global factors, including increasing institutional interest and growing awareness of Bitcoin’s potential as a decentralized digital asset. However, the subsequent price crash was partly influenced by regulatory uncertainty in India. Government pronouncements regarding the legality and taxation of cryptocurrencies caused significant market anxiety and contributed to the price decline. Subsequent years saw a more gradual, though still volatile, upward trend punctuated by periods of consolidation and correction, often reflecting global market sentiment and regulatory developments. For instance, positive news regarding crypto regulations globally often led to price increases in India, while negative news or regulatory crackdowns in other major markets impacted Indian prices negatively.

Illustrative Price Trend Graph

Imagine a graph charting Bitcoin’s price in Indian Rupees (INR) over time. The X-axis represents time (e.g., years from 2014 to 2024), and the Y-axis represents the price in INR. The graph would show a relatively flat line initially, representing the early years of low adoption. Then, a sharp, almost vertical ascent would represent the 2017 bull run, followed by a steep drop illustrating the subsequent correction. After this, the graph would show a series of smaller peaks and valleys, indicating periods of growth and decline, with the overall trend exhibiting a gradual upward trajectory punctuated by periods of consolidation and corrections. Key turning points would be clearly visible on the graph, representing significant regulatory announcements, major global market events, or changes in investor sentiment.

Bitcoin Price Volatility in India: A Visual Representation

A box plot would effectively illustrate Bitcoin’s price volatility in India. This chart type displays the median, quartiles, and outliers of the price data over a specific period (e.g., yearly or quarterly). The box represents the interquartile range (IQR), containing 50% of the data. The whiskers extend to the most extreme data points within 1.5 times the IQR, and outliers are shown as individual points beyond the whiskers. This visualization clearly shows the range and distribution of Bitcoin’s prices over time, highlighting periods of high and low volatility. A higher IQR and more outliers would indicate greater volatility, reflecting the risk inherent in investing in Bitcoin in the Indian market. For example, the 2017-2018 period would likely show a much wider box and more outliers compared to a period of relative market stability.

Potential Risks and Opportunities: Bitcoin Price Prediction 2025 In India

Investing in Bitcoin, like any other asset class, presents a unique blend of risks and opportunities. The Indian market, with its burgeoning digital economy and growing crypto adoption, offers a specific context for evaluating these factors. Understanding both the potential downsides and the upside potential is crucial for any investor considering Bitcoin exposure. This section will delineate the key risks and opportunities associated with Bitcoin investment in India.

Bitcoin Price Prediction 2025 In India – The cryptocurrency market is inherently volatile, and Bitcoin is no exception. This volatility is amplified in emerging markets like India, where regulatory uncertainty and macroeconomic factors can significantly impact investor sentiment and price movements. However, India’s large and young population, coupled with increasing financial inclusion initiatives, presents a substantial opportunity for Bitcoin adoption and price appreciation. This section aims to provide a balanced perspective, weighing the potential gains against the associated risks.

Predicting the Bitcoin price in India for 2025 is challenging, given the cryptocurrency’s volatile nature and the influence of global economic factors. To gain some insight into potential price movements, you might find a detailed analysis helpful; check out this resource on Bitcoin Price 2025 In India for a comprehensive overview. Ultimately, any Bitcoin price prediction for 2025 in India remains speculative, dependent on various market forces.

Regulatory Uncertainty in India

The regulatory landscape surrounding cryptocurrencies in India remains unclear. While not outright banned, the government’s stance is evolving, and the lack of a clear legal framework creates uncertainty for investors. This ambiguity could lead to sudden policy changes impacting Bitcoin’s price and accessibility. For instance, a sudden ban or imposition of heavy taxation could severely impact the value of Bitcoin holdings in India. Conversely, the establishment of a clear regulatory framework could boost investor confidence and lead to increased adoption. This uncertainty represents a significant risk, particularly for long-term investors.

Market Volatility and Price Fluctuations

Bitcoin’s price is notoriously volatile, experiencing sharp swings in both directions. Factors ranging from global macroeconomic events to social media trends can significantly influence its price. This inherent volatility poses a substantial risk to investors, particularly those with a lower risk tolerance. For example, the price of Bitcoin plummeted during the 2022 crypto winter, wiping out billions of dollars in market capitalization. Conversely, periods of rapid price appreciation can offer substantial returns, but also increased risk of significant losses if the market corrects.

Security Risks Associated with Bitcoin Investment

Investing in Bitcoin involves inherent security risks. These include the risk of hacking, theft, and scams related to cryptocurrency exchanges and wallets. The decentralized nature of Bitcoin makes it difficult to recover lost funds in case of fraud or security breaches. Investors need to exercise extreme caution when choosing exchanges and employing robust security measures for their wallets. For example, a significant security breach on a major exchange could result in the loss of investor funds and a negative impact on Bitcoin’s price.

Opportunities for Growth and Returns in the Indian Market

Despite the risks, the Indian market presents significant opportunities for Bitcoin growth and returns. India’s young and tech-savvy population is increasingly adopting digital technologies, including cryptocurrencies. Furthermore, the government’s push for digital financial inclusion could indirectly boost Bitcoin adoption, as it expands access to financial services for a larger segment of the population. The potential for substantial returns, driven by increased adoption and a potential positive regulatory shift, represents a key opportunity. For example, the growing popularity of peer-to-peer (P2P) Bitcoin trading in India indicates a strong underlying demand.

Risk vs. Opportunity Comparison

A balanced assessment requires comparing the identified risks and opportunities. The following bullet points summarize the key pros and cons:

- Risks:

- Regulatory uncertainty and potential for policy changes.

- High market volatility and potential for significant price fluctuations.

- Security risks associated with hacking, theft, and scams.

- Opportunities:

- Potential for high returns driven by increasing adoption in a large and growing market.

- Government initiatives promoting digital financial inclusion could indirectly boost Bitcoin adoption.

- Positive regulatory changes could significantly increase investor confidence and market growth.

Bitcoin’s Role in the Indian Economy

Bitcoin’s potential impact on the Indian economy is a complex issue with both promising upsides and potential downsides. While still nascent, its influence is growing, demanding careful consideration of its effects on various sectors and the overall financial landscape. The decentralized nature of Bitcoin presents both opportunities and challenges for a nation striving for financial inclusion and sustainable economic growth.

Bitcoin’s introduction could potentially revolutionize several aspects of the Indian economy. Its decentralized nature offers an alternative to traditional banking systems, potentially bypassing the existing infrastructure limitations and fostering greater financial inclusion, especially in rural areas with limited access to banking services. This could stimulate economic activity by enabling easier and faster transactions, reducing reliance on cash, and potentially lowering transaction costs. However, the volatility inherent in Bitcoin’s price poses a significant risk, potentially destabilizing the economy if widespread adoption leads to large-scale price fluctuations impacting investment and savings.

Bitcoin Adoption in Various Sectors

The potential for Bitcoin adoption varies across different sectors in India. In the remittance market, Bitcoin could offer a faster, cheaper, and more transparent alternative to traditional methods, significantly benefiting the millions of Indians working abroad and sending money home. The retail sector could also see increased adoption, with businesses potentially accepting Bitcoin as a form of payment, broadening their customer base and potentially reducing transaction fees. However, regulatory uncertainty and the lack of widespread understanding of cryptocurrency technology remain significant barriers to broader adoption. The potential for use in supply chain management, through improved traceability and transparency, is also being explored, although this is still in its early stages.

Implications for Financial Inclusion and Economic Growth

Increased Bitcoin usage could significantly impact financial inclusion in India. By providing access to financial services for the unbanked and underbanked population, Bitcoin could empower individuals and communities, fostering economic growth and reducing reliance on informal financial systems. This could lead to increased participation in the formal economy, improved access to credit, and greater economic opportunities for marginalized communities. However, the lack of regulatory clarity and the potential for misuse, such as money laundering and illicit activities, pose significant challenges that need to be addressed to ensure responsible and beneficial adoption. Successful implementation would require robust regulatory frameworks and public education initiatives to mitigate these risks. For example, the success of mobile payment systems like PhonePe and Paytm demonstrates the potential for digital financial inclusion in India; Bitcoin could potentially build upon this progress, but requires similar levels of user-friendliness and trust to achieve widespread adoption.

Government Regulations and Policies

India’s regulatory landscape for cryptocurrencies, including Bitcoin, is currently evolving and characterized by a cautious approach. The government has expressed concerns about the potential for money laundering, terrorist financing, and market volatility associated with cryptocurrencies. However, there’s also recognition of the potential benefits of blockchain technology. This creates a dynamic environment where regulations are constantly being shaped and reshaped.

The current regulatory framework lacks a comprehensive, unified law specifically addressing cryptocurrencies. Instead, various government bodies have issued pronouncements and guidelines impacting the sector. This fragmented approach contributes to uncertainty and has influenced investor sentiment and market behavior. The lack of clarity makes it difficult for businesses operating in the crypto space to plan long-term strategies and comply fully with the existing regulations.

Current Regulatory Landscape for Bitcoin in India

Currently, there’s no specific law that explicitly legalizes or bans Bitcoin in India. However, the Reserve Bank of India (RBI) has previously issued circulars advising banks to refrain from dealing with entities involved in cryptocurrency transactions. While these circulars have been challenged and partially overturned in court, the overall regulatory stance remains cautious and uncertain. This lack of clear legal framework creates a complex environment for individuals and businesses involved in the Bitcoin market in India. The government is actively exploring the possibility of introducing a comprehensive regulatory framework that balances the potential risks and benefits of cryptocurrencies. Several parliamentary committees are examining the issue, indicating a shift towards a more formalized approach.

Potential Impact of Future Regulations on Bitcoin’s Price and Adoption

The introduction of a clear regulatory framework in India could significantly impact Bitcoin’s price and adoption. A supportive regulatory environment, such as a licensing system for crypto exchanges and clear tax guidelines, could lead to increased investor confidence and wider adoption. This could potentially drive up Bitcoin’s price in India. Conversely, overly restrictive regulations, such as an outright ban, could significantly suppress the market, leading to a price decline and reduced adoption. The specific impact will depend heavily on the nature and stringency of the regulations implemented. For example, a well-defined regulatory framework similar to that seen in some other countries could lead to a more stable and mature market, potentially boosting investor confidence and increasing the price. Conversely, a poorly designed or overly restrictive framework could lead to uncertainty and price volatility.

Legal and Political Factors Influencing the Bitcoin Market in India

Several legal and political factors influence the Bitcoin market in India. These include the government’s overall stance on financial technology, the concerns about money laundering and terrorist financing, and the political pressure from various stakeholders, including financial institutions and consumer protection groups. The ongoing debates within the government and parliament regarding cryptocurrency regulation significantly impact investor sentiment and market stability. The evolving understanding of blockchain technology and its potential applications within the Indian economy also influences the political discourse and subsequent regulatory decisions. The interplay between these legal and political forces determines the overall regulatory climate, which in turn significantly affects the price and adoption of Bitcoin in India.

Investing in Bitcoin in India

Investing in Bitcoin in India presents both exciting opportunities and significant risks. This guide provides a practical, step-by-step approach for Indian residents interested in navigating the Bitcoin market responsibly. Understanding the regulatory landscape, choosing a reputable platform, and implementing sound risk management strategies are crucial for success.

Choosing a Bitcoin Exchange in India

Selecting a suitable exchange is the first step. Several platforms operate in India, each with its strengths and weaknesses. Factors to consider include security measures, fees, trading volume, user interface, and customer support. It’s vital to research thoroughly and choose a platform with a strong reputation and a proven track record of security. Avoid exchanges with questionable histories or poor user reviews. Always prioritize security and verify the legitimacy of the platform before depositing funds.

Step-by-Step Guide to Investing in Bitcoin in India

- Research and Due Diligence: Thoroughly research Bitcoin and the cryptocurrency market before investing. Understand the technology, its volatility, and the potential risks involved. Consider consulting with a financial advisor before making any investment decisions.

- Choose a Reputable Exchange: Select a regulated and reputable cryptocurrency exchange operating in India. Compare fees, security features, and user reviews to make an informed choice.

- Account Creation and Verification: Create an account on your chosen exchange and complete the Know Your Customer (KYC) verification process. This usually involves providing identification documents and proof of address.

- Funding Your Account: Deposit funds into your exchange account using methods supported by the platform. This typically includes bank transfers, UPI payments, or other digital payment options.

- Buying Bitcoin: Once your account is funded, you can purchase Bitcoin. Specify the amount you wish to buy and execute the trade. The exchange will facilitate the transaction, and your Bitcoin will be credited to your account.

- Storing Your Bitcoin: Securely store your Bitcoin using a hardware wallet or a reputable software wallet. Avoid leaving significant amounts of Bitcoin on the exchange for extended periods due to security risks.

- Monitoring Your Investment: Regularly monitor your Bitcoin investment and adjust your strategy as needed. Stay informed about market trends and news that could impact the price of Bitcoin.

Risk Management and Responsible Investing

Bitcoin’s price is notoriously volatile. Investing in Bitcoin involves a high degree of risk, and losses can be substantial. Therefore, implementing robust risk management practices is paramount. Diversification is key; avoid investing your entire savings in Bitcoin. Only invest an amount you can afford to lose completely. Regularly review your portfolio and adjust your holdings based on market conditions and your risk tolerance. Avoid emotional decision-making, and stick to your investment plan. Consider setting stop-loss orders to limit potential losses. Stay informed about market trends and regulatory developments to mitigate risks. Remember, past performance is not indicative of future results.

FAQ

This section addresses frequently asked questions regarding Bitcoin price predictions in India for 2025, encompassing factors influencing its price, associated risks and rewards, regulatory landscape, and trading avenues. Understanding these aspects is crucial for informed decision-making.

Key Factors Influencing Bitcoin’s Price in India

Several interconnected factors influence Bitcoin’s price in India. Global market trends significantly impact the price, as Bitcoin is a global asset. Regulatory changes in India, adoption rates within the country, and macroeconomic conditions (such as inflation and interest rates) all play crucial roles. Furthermore, investor sentiment and media coverage contribute to price volatility. For example, positive news about Bitcoin adoption by large corporations or positive regulatory shifts can drive prices up, while negative news or regulatory crackdowns can cause price drops.

Potential Risks of Investing in Bitcoin in India

Investing in Bitcoin carries inherent risks. Its price volatility is substantial, meaning significant gains can be quickly erased by equally significant losses. Regulatory uncertainty in India remains a concern, with the potential for future changes impacting the legality and accessibility of Bitcoin. The decentralized nature of Bitcoin also exposes it to security risks, such as hacking and theft. Finally, the lack of consumer protection in the cryptocurrency market adds another layer of risk for investors. For instance, the collapse of major cryptocurrency exchanges has demonstrated the potential for significant losses.

Potential Rewards of Investing in Bitcoin in India

Despite the risks, Bitcoin offers potential rewards. Its historical price appreciation has been significant, offering the possibility of substantial returns for early investors. Bitcoin’s decentralized nature and resistance to inflation make it an attractive asset for some investors seeking diversification beyond traditional markets. As adoption grows in India, the potential for increased liquidity and accessibility could further enhance its appeal. The possibility of significant price appreciation, as seen in past market cycles, remains a key draw for many investors.

Current Regulations Surrounding Bitcoin in India

Currently, Bitcoin is not explicitly banned in India, but it’s also not officially recognized as legal tender. The government is developing a regulatory framework for cryptocurrencies, aiming to balance innovation with consumer protection and financial stability. While the lack of clear regulations creates uncertainty, it also presents an opportunity for future clarity and potential growth in the market. Tax implications for Bitcoin transactions are also evolving, and investors need to stay informed about current and future tax policies.

Where to Buy and Sell Bitcoin in India

Several cryptocurrency exchanges operate in India, providing platforms for buying and selling Bitcoin. These exchanges vary in terms of fees, security measures, and available features. It is crucial for investors to conduct thorough due diligence before choosing an exchange, considering factors like security, reputation, and regulatory compliance. Examples of such exchanges include WazirX, CoinDCX, and CoinSwitch Kuber, although the availability and suitability of specific exchanges may change over time. It’s vital to select a reputable and regulated platform to mitigate risks.

Predicting the Bitcoin price in India for 2025 involves considering numerous global and local factors. Understanding broader market trends is key, and a helpful resource for this is the analysis provided in the Bitcoin Bx Price Prediction 2025 report. This gives valuable context for assessing the potential trajectory of Bitcoin’s value within the Indian market in 2025, considering its unique regulatory landscape and adoption rate.

Predicting the Bitcoin price in India for 2025 requires considering various factors, including global market trends and regulatory changes within the country. A key element in this prediction involves understanding the broader global outlook, which is why examining resources like this analysis of Bitcoin Price At 2025 is beneficial. Ultimately, the Indian Bitcoin market’s performance in 2025 will likely be intertwined with these larger global price movements, making accurate prediction challenging but not impossible.

Predicting the Bitcoin price in India for 2025 is challenging, influenced by global market trends and regulatory changes. To understand potential long-term growth, it’s helpful to consider broader forecasts; for instance, checking out this analysis on What Will Bitcoin Price Be In 2030 offers valuable context. Ultimately, the 2025 Bitcoin price in India will likely depend on the overall trajectory suggested by such long-term projections.

Predicting the Bitcoin price in India for 2025 requires considering global market trends. A key factor will be the overall Bitcoin value, which is explored in detail on this helpful resource: What Will Bitcoin Price Be In 2025. Understanding the global outlook is crucial for any accurate prediction of Bitcoin’s performance within the Indian market in 2025, considering factors like regulatory changes and adoption rates.