Factors Influencing Bitcoin’s Price in March 2025

Predicting Bitcoin’s price in March 2025 requires considering a complex interplay of macroeconomic factors, regulatory landscapes, technological advancements, and market sentiment. While no one can definitively state the price, analyzing these key influencers provides a framework for informed speculation.

Global Economic Conditions and Bitcoin’s Price

Global economic conditions will significantly impact Bitcoin’s price in March 2025. High inflation, for example, could drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing its value. Conversely, a prolonged recession might lead to risk-averse behavior, causing investors to sell off assets like Bitcoin to cover losses in other investments, thus depressing its price. The severity and duration of any economic downturn will be a crucial determinant. For instance, the 2008 financial crisis saw a significant drop in many asset classes, including early Bitcoin, before a subsequent recovery. The response of central banks to inflationary pressures – through interest rate hikes or quantitative easing – will also play a crucial role, impacting both fiat currency values and investor appetite for riskier assets like Bitcoin.

Regulatory Developments and Bitcoin’s Value

Regulatory developments worldwide will heavily influence Bitcoin’s price. Clear and favorable regulatory frameworks in major economies could boost institutional investment and mainstream adoption, driving up the price. Conversely, overly restrictive or unclear regulations could stifle growth and lead to price volatility or even decline. The example of China’s crackdown on cryptocurrency mining in 2021 illustrates the significant impact of regulatory actions on Bitcoin’s price. Similar actions or conversely, the implementation of supportive legislation in other significant markets like the US or EU, will have profound effects. The level of regulatory clarity and consistency across different jurisdictions will also play a role in investor confidence.

Technological Advancements and Bitcoin’s Price

Technological advancements within the Bitcoin ecosystem and the broader cryptocurrency landscape will impact Bitcoin’s price. The successful implementation of layer-2 scaling solutions, such as the Lightning Network, could significantly improve transaction speeds and reduce fees, making Bitcoin more accessible and user-friendly, potentially increasing demand. The emergence of competing cryptocurrencies with superior technology or features could, however, divert investment away from Bitcoin, potentially putting downward pressure on its price. The development of new consensus mechanisms or improvements in security protocols could also influence investor confidence and, consequently, the price.

Institutional Adoption versus Retail Investor Sentiment

The balance between institutional adoption and retail investor sentiment will shape Bitcoin’s price trajectory. Increased institutional investment, characterized by large-scale purchases by corporations and financial institutions, generally provides price stability and upward pressure. However, retail investor sentiment, often driven by hype cycles and market speculation, can lead to significant price volatility. For example, the 2017 Bitcoin bull run was largely fueled by retail investor enthusiasm, while subsequent corrections reflected shifting sentiment. A sustained increase in institutional holdings, coupled with positive retail sentiment, would likely lead to a more stable and upward price trend, while the opposite could result in significant volatility and potential price declines.

Analyzing Historical Bitcoin Price Trends: Bitcoin Price Prediction 2025 March

Bitcoin’s price history is characterized by extreme volatility and significant growth punctuated by sharp corrections. Understanding these past trends, the events driving them, and the inherent volatility is crucial for any attempt to predict its future price, even as far out as March 2025. Analyzing historical data allows us to identify potential patterns and assess the likelihood of similar scenarios unfolding in the future, although it’s important to remember that past performance is not necessarily indicative of future results.

Analyzing past price movements reveals a cyclical pattern of bull and bear markets. Bull markets are characterized by rapid price increases, often fueled by hype, technological advancements, and increasing institutional adoption. Bear markets, conversely, involve significant price declines, typically driven by factors such as regulatory uncertainty, market corrections, or macroeconomic downturns. These cycles vary in length and intensity, making precise predictions challenging.

Significant Historical Events and Their Impact

Several key events have profoundly impacted Bitcoin’s price. The 2017 bull run, for instance, saw Bitcoin’s price surge to nearly $20,000, largely driven by increasing mainstream media attention and speculative investment. This period was followed by a significant correction, with the price plummeting in 2018. Similarly, the 2020-2021 bull run, reaching highs above $60,000, was fueled by factors such as institutional adoption, the ongoing COVID-19 pandemic, and a general increase in investor interest in digital assets. This period, too, was followed by a substantial price drop in 2022. Understanding the interplay of these factors – hype cycles, regulatory changes, macroeconomic conditions, and technological developments – is vital to analyzing historical trends and their potential relevance to future price movements. For example, the potential for increased regulatory clarity or further institutional adoption in the coming years could significantly influence Bitcoin’s price trajectory in 2025.

Bitcoin Price Volatility and Investor Implications

Bitcoin’s price volatility is a defining characteristic. Sharp price swings, both upward and downward, are common. This high volatility presents both opportunities and risks for investors. While the potential for significant gains is attractive, investors must be prepared for substantial losses. A diversified investment portfolio, coupled with a long-term investment horizon and a thorough understanding of risk tolerance, is crucial for navigating Bitcoin’s volatile market. The potential for significant price fluctuations necessitates a cautious approach, with investors advised to avoid emotional decision-making based on short-term price movements.

Visual Representation of Historical Bitcoin Price Trends, Bitcoin Price Prediction 2025 March

Imagine a line graph depicting Bitcoin’s price over time, starting from its inception in 2009. The x-axis represents time (years), and the y-axis represents the Bitcoin price in US dollars. The line itself would show a fluctuating pattern, with distinct periods of sharp upward trends (bull markets) followed by steep downward trends (bear markets). Key events, such as the 2017 and 2021 bull runs and the subsequent corrections, would be clearly visible as prominent peaks and troughs on the graph. Furthermore, the graph would illustrate the increasing price volatility over time, particularly in the early years of Bitcoin’s existence. The graph would be labeled clearly with dates and price points, providing a visual summary of Bitcoin’s historical price movements, showcasing the cyclical nature of its price behavior and the significant price volatility characteristic of the asset. For example, the period between late 2017 and late 2018 would show a steep downward trend following a dramatic price surge, while the period between late 2020 and late 2021 would similarly show a sharp increase followed by a subsequent decrease. The graph would effectively communicate the significant price swings and the need for careful risk management when investing in Bitcoin.

Potential Scenarios for Bitcoin’s Price in March 2025

Predicting Bitcoin’s price with certainty is impossible; however, by analyzing historical trends, current market conditions, and potential future events, we can construct plausible scenarios for its price in March 2025. These scenarios represent a range of possibilities, from highly optimistic to pessimistic, and a neutral middle ground. It’s crucial to remember that these are speculative projections and not financial advice.

Bullish Scenario: Bitcoin Surges to New Heights

This scenario assumes continued widespread adoption of Bitcoin as a store of value and a medium of exchange, fueled by positive regulatory developments, increasing institutional investment, and growing global economic uncertainty. Further technological advancements, such as the Lightning Network’s maturation, could also significantly boost transaction speeds and reduce fees, driving wider adoption. We posit a scenario where Bitcoin’s price could reach $200,000 or more by March 2025. This would be driven by sustained institutional demand, positive regulatory frameworks in key markets, and a flight to safety from traditional assets during a period of global economic instability. This scenario mirrors the rapid price appreciation seen in previous bull runs, albeit on a potentially larger scale. For example, the 2017 bull run saw Bitcoin increase in value by over 1,000% in a short period. While a similar percentage increase from current prices would be less dramatic in absolute terms, a price of $200,000 is still a significant increase.

Bearish Scenario: Bitcoin Experiences a Significant Correction

This pessimistic scenario anticipates a considerable price drop, potentially driven by several factors. Increased regulatory scrutiny, a major security breach impacting trust in the network, or a broader cryptocurrency market crash could all contribute to a decline. A global economic recession, leading investors to liquidate assets to cover losses, could also significantly impact Bitcoin’s price. In this bearish scenario, Bitcoin’s price might fall to as low as $20,000 or even lower by March 2025. This scenario draws parallels to the 2018 bear market, where Bitcoin experienced a significant price correction after the 2017 bull run. The factors leading to such a correction could include a loss of investor confidence due to negative news or regulatory crackdowns. This scenario highlights the inherent volatility of the cryptocurrency market.

Neutral Scenario: Bitcoin Consolidates and Experiences Moderate Growth

This scenario assumes a period of consolidation and moderate growth for Bitcoin. While not experiencing the explosive growth of a bull market, it also avoids a significant correction. This could be due to a balance between positive and negative factors, such as some regulatory hurdles being overcome while others remain, or a period of relatively stable global economic conditions. In this scenario, Bitcoin’s price could settle around $50,000-$70,000 by March 2025, representing a moderate increase from current levels. This scenario is a more realistic representation of potential price action given the inherent uncertainty in the cryptocurrency market. It represents a steady, rather than dramatic, growth trajectory. The price range is based on an extrapolation of moderate historical growth rates, adjusted for potential market fluctuations.

Impact on Other Cryptocurrencies and the Broader Market

The impact of each Bitcoin scenario on other cryptocurrencies and the broader market would be significant. In the bullish scenario, altcoins (alternative cryptocurrencies) would likely experience substantial gains, often correlating positively with Bitcoin’s price. However, the correlation isn’t always perfect; some altcoins might outperform Bitcoin while others lag behind. A bearish scenario for Bitcoin would likely trigger a broader market downturn, dragging down most altcoins, particularly those with high correlations to Bitcoin. The neutral scenario would suggest a relatively stable market for altcoins, with some experiencing moderate growth while others might stagnate or experience minor corrections. The overall cryptocurrency market capitalization would reflect the dominant trend set by Bitcoin in each of these scenarios.

Risks and Opportunities Associated with Bitcoin in March 2025

Predicting the future of Bitcoin, or any asset for that matter, is inherently uncertain. However, by analyzing historical trends, technological advancements, and macroeconomic factors, we can identify potential risks and opportunities associated with Bitcoin investment in March 2025. Understanding these aspects is crucial for informed decision-making.

Investing in Bitcoin in March 2025 presents a complex risk-reward profile, demanding a careful evaluation of potential gains against possible losses. The highly volatile nature of the cryptocurrency market necessitates a thorough understanding of the inherent uncertainties involved.

Market Volatility and Regulatory Uncertainty

Bitcoin’s price has historically been extremely volatile, experiencing significant price swings in short periods. This volatility stems from various factors, including market sentiment, regulatory announcements, technological developments, and macroeconomic conditions. Regulatory uncertainty remains a significant risk. Different jurisdictions have varying approaches to regulating cryptocurrencies, leading to potential legal and operational challenges for investors. For example, a sudden shift in regulatory policy in a major market could trigger a sharp price correction. Furthermore, the decentralized nature of Bitcoin, while a strength in many ways, also makes it susceptible to manipulation and price manipulation schemes, which could dramatically impact prices.

Long-Term Growth Potential and Technological Advancements

Despite the risks, Bitcoin’s potential for long-term growth remains a compelling opportunity. Its limited supply (21 million coins) and increasing adoption as a store of value and a medium of exchange contribute to its potential appreciation. Technological advancements, such as the Lightning Network, which aims to improve transaction speed and scalability, could further enhance Bitcoin’s utility and drive demand. The increasing integration of Bitcoin into traditional financial systems, including the emergence of Bitcoin ETFs, could also significantly impact its price. For example, the successful launch of a major Bitcoin ETF could inject substantial institutional investment, potentially driving significant price increases.

Risk-Reward Profile Compared to Other Investments

Compared to traditional investments like stocks and bonds, Bitcoin offers a significantly higher potential for both gains and losses. While stocks and bonds generally exhibit lower volatility, their returns are typically more modest. Gold, often considered a safe haven asset, also offers a lower risk-reward profile than Bitcoin. The risk-reward profile of Bitcoin is best suited for investors with a high risk tolerance and a long-term investment horizon who understand and accept the potential for substantial losses. A diversified portfolio, which includes a small allocation to Bitcoin alongside more traditional assets, may be a suitable approach for risk mitigation.

Summary of Key Risks and Opportunities

- Significant Risks: Market volatility, regulatory uncertainty, security risks (e.g., hacking, scams), technological disruptions, macroeconomic factors (inflation, recession).

- Significant Opportunities: Long-term growth potential driven by scarcity and increasing adoption, technological advancements enhancing utility, potential for significant returns exceeding those of traditional assets, increasing institutional interest.

The potential for both substantial gains and significant losses underscores the importance of thorough due diligence, risk assessment, and a well-defined investment strategy before investing in Bitcoin. The March 2025 Bitcoin price will depend on the interplay of these risks and opportunities.

Frequently Asked Questions (FAQ)

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently challenging due to the volatile nature of the market and the influence of numerous unpredictable factors. The following FAQs aim to address common concerns regarding Bitcoin’s price in March 2025, providing insights while acknowledging the inherent uncertainty.

Bitcoin’s Most Likely Price in March 2025

Pinpointing a precise Bitcoin price for March 2025 is impossible. Numerous factors, including regulatory changes, technological advancements, and macroeconomic conditions, will significantly influence its value. While some analysts might offer price targets based on various models, these should be viewed with considerable skepticism. Historical price trends can offer some context, but past performance is not indicative of future results. A balanced approach acknowledges the significant range of potential outcomes, from substantial gains to considerable losses. For example, extrapolating past bull and bear market cycles might suggest a price range, but unforeseen events could easily push the actual price significantly above or below these projections. It’s crucial to remember that any prediction is speculative.

Factors Impacting Bitcoin’s Price in March 2025

Several key factors are likely to significantly impact Bitcoin’s price in March 2025. Regulatory developments globally will play a crucial role; stricter regulations could suppress price growth, while supportive frameworks might encourage investment. Technological advancements, such as the scalability and efficiency improvements in the Bitcoin network, can positively influence adoption and, consequently, price. Macroeconomic conditions, including inflation rates, interest rates, and overall economic growth, will also be influential. For instance, high inflation might drive investors towards Bitcoin as a hedge against inflation, while rising interest rates could divert capital towards more traditional assets. Finally, widespread adoption and market sentiment, including news coverage and social media trends, will contribute to price fluctuations.

Wisdom of Investing in Bitcoin in March 2025

Whether investing in Bitcoin in March 2025 is “wise” depends entirely on individual risk tolerance, financial goals, and investment strategy. Bitcoin offers the potential for substantial returns but also carries significant risk. The high volatility of the cryptocurrency market means substantial losses are possible. Before investing, thorough research is essential. Understanding the technology behind Bitcoin, the regulatory landscape, and the various market forces at play is crucial. Diversification of your investment portfolio is strongly recommended to mitigate risk. Only invest what you can afford to lose. Consider consulting with a qualified financial advisor to assess your risk tolerance and develop a suitable investment strategy.

Protecting Against Bitcoin Price Volatility

Mitigating the risk associated with Bitcoin’s price volatility requires a multi-pronged approach. Diversification is paramount; don’t put all your eggs in one basket. Allocate only a small percentage of your overall investment portfolio to Bitcoin. Dollar-cost averaging (DCA) is another effective strategy. This involves investing a fixed amount of money at regular intervals, regardless of the price. This reduces the impact of buying high and selling low. Furthermore, understanding your risk tolerance and setting stop-loss orders can help limit potential losses. A stop-loss order automatically sells your Bitcoin if the price falls below a predetermined level. Finally, staying informed about market trends and news affecting Bitcoin is crucial for making informed investment decisions.

Bitcoin Price Prediction 2025 March – Predicting the Bitcoin price for March 2025 requires considering various factors, including market sentiment and technological advancements. To gain a clearer perspective on potential price fluctuations throughout the year, understanding the predicted trajectory in subsequent months is crucial. For instance, examining the predicted price in May provides valuable context; you can find a detailed analysis of this at Bitcoin Price Prediction In May 2025.

This analysis helps refine our understanding of the broader Bitcoin Price Prediction 2025 March forecast.

Predicting the Bitcoin price for March 2025 involves considering various factors, including market sentiment and technological advancements. To get a clearer picture of potential year-end performance, it’s helpful to consider longer-term predictions; for example, check out this detailed analysis on Bitcoin Price Prediction Christmas 2025 to gain further insights. Understanding the potential trajectory towards the end of 2025 can inform projections for March of the same year.

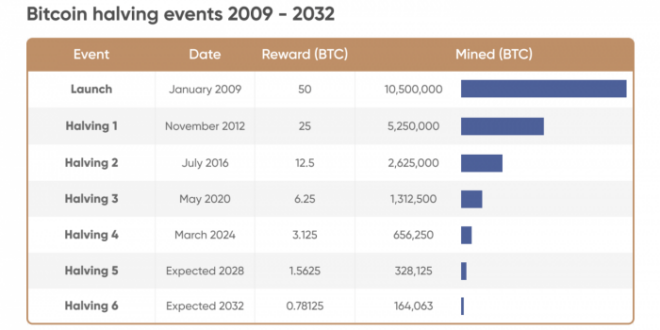

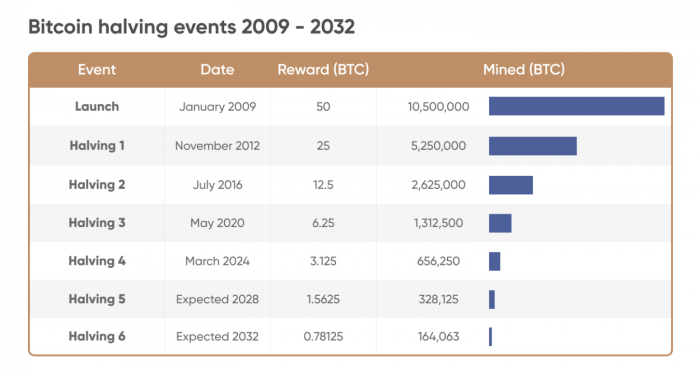

Predicting the Bitcoin price in March 2025 is a complex undertaking, significantly influenced by various market factors. A key element to consider is the impact of the upcoming Bitcoin halving, which will undoubtedly affect future price movements. For a detailed analysis of potential halving dates, check out this insightful prediction: Bitcoin Halving Date 2025 Prediction. Understanding the timing of the halving is crucial for refining any Bitcoin price prediction for March 2025 and beyond.

Predicting the Bitcoin price for March 2025 requires considering various factors, including market sentiment and regulatory changes. A strong indicator of potential March performance might be gleaned from the preceding month’s trends; to that end, understanding the Bitcoin Prediction For February 2025, as detailed in this insightful analysis Bitcoin Prediction For February 2025 , could offer valuable context.

Ultimately, the Bitcoin price prediction for March 2025 remains speculative, dependent on numerous variables beyond February’s performance.

Speculating on the Bitcoin price in March 2025 is a complex endeavor, involving numerous factors influencing its trajectory. A key aspect to consider when examining a Bitcoin Price Prediction 2025 March is the broader market sentiment at that time. For detailed insights into potential price movements, you might find the analysis at March 2025 Bitcoin Prediction helpful.

Returning to our initial question of Bitcoin Price Prediction 2025 March, remember that any prediction remains speculative and subject to market volatility.

Predicting the Bitcoin price in March 2025 is challenging, heavily influenced by various market factors. A significant event impacting this prediction is the anticipated Bitcoin Price Halving in 2025, as detailed in this informative article: Bitcoin Price Halving 2025. This halving event, reducing the rate of new Bitcoin creation, often historically leads to price increases, thus significantly influencing the Bitcoin Price Prediction for March 2025.

Predicting the Bitcoin price in March 2025 is challenging, heavily influenced by various market factors. A significant event impacting this prediction is the anticipated Bitcoin Price Halving in 2025, as detailed in this informative article: Bitcoin Price Halving 2025. This halving event, reducing the rate of new Bitcoin creation, often historically leads to price increases, thus significantly influencing the Bitcoin Price Prediction for March 2025.