Monthly Bitcoin Price Predictions for 2025

Predicting Bitcoin’s price with certainty is impossible, as it’s influenced by numerous intertwined factors. However, by analyzing historical trends, market sentiment, and anticipated events, we can formulate potential price scenarios for July-September 2025. This analysis considers seasonal effects, institutional involvement, and potential regulatory impacts. It’s crucial to remember these are estimations, not guarantees.

Bitcoin Price Fluctuations: July – September 2025

Historical data shows Bitcoin often experiences price volatility throughout the year, influenced by various factors including seasonal trading patterns and macroeconomic conditions. Summer months have historically shown mixed results, sometimes exhibiting periods of consolidation after a previous surge or a period of decline. Based on this, we can anticipate a range of possibilities. A bullish scenario might see Bitcoin maintaining a relatively high price range, perhaps consolidating around a certain level before a potential upswing in the later part of the year. Conversely, a bearish scenario could see a period of price correction or sideways trading, possibly due to profit-taking or general market uncertainty. A moderate scenario might involve a fluctuating price range, characterized by periods of both gains and losses, ultimately leading to a relatively flat price by the end of September. The actual outcome will depend on a confluence of factors.

Institutional Investment Impact on Bitcoin Price (July – September 2025)

Institutional investors have significantly impacted Bitcoin’s price in the past. Their involvement often brings stability and liquidity to the market, potentially mitigating sharp price drops. However, their actions can also influence price direction. For instance, a large-scale institutional sell-off could trigger a downward trend, while substantial buying pressure could push prices higher. During July-September 2025, the level of institutional involvement will be a key determinant of price movements. If major institutional players increase their Bitcoin holdings, it could bolster the price, potentially offsetting negative pressures from other market factors. Conversely, a reduction in institutional investment could lead to price declines. The extent of this influence will depend on various factors, including overall market sentiment and regulatory developments.

Regulatory Changes and Their Potential Impact on Bitcoin’s Price (July – September 2025), Bitcoin Price Prediction 2025 Monthly

Regulatory clarity or uncertainty significantly influences Bitcoin’s price. Positive regulatory developments, such as the establishment of clear guidelines for cryptocurrency trading and taxation, could boost investor confidence and drive up prices. Conversely, negative regulatory actions, such as increased restrictions or bans, could lead to significant price drops. The period between July and September 2025 could see pivotal regulatory decisions in various jurisdictions. For example, if a major global economy introduces favorable regulations for cryptocurrencies, we might see a significant price increase. Conversely, increased regulatory scrutiny or a ban in a significant market could lead to a considerable price decline. The impact of these potential regulatory shifts is difficult to predict with precision, but their potential influence is undeniable.

Monthly Bitcoin Price Predictions for 2025

This section presents potential Bitcoin price movements for October, November, and December 2025, considering the upcoming halving event and potential year-end economic forecasts. These predictions are speculative and based on various market analyses and historical trends, and should not be considered financial advice.

Bitcoin Price Movement Visualization: October – December 2025

Imagine a graph charting Bitcoin’s price. October starts with a relatively stable period, depicted as a slightly upward-sloping line, fluctuating between $50,000 and $60,000. November shows a steeper incline, representing a potential surge driven by anticipation of the halving event, reaching a peak around $70,000-$80,000. December’s trajectory is less certain, potentially showing a slight correction downwards to the $60,000-$70,000 range, as investors consolidate gains after the November surge, reflecting typical post-halving market behavior. This visual representation is a simplified model; actual price movements will be far more volatile.

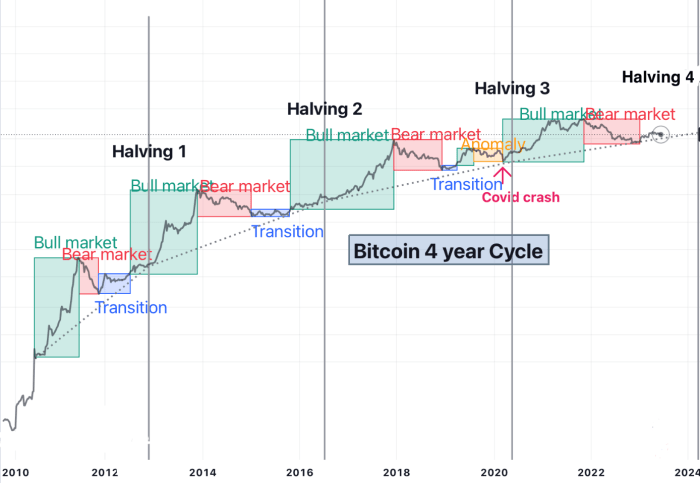

Impact of the 2024 Halving Event on Bitcoin Price

The Bitcoin halving, scheduled for 2024, significantly reduces the rate of new Bitcoin creation. This historically has led to periods of price appreciation due to decreased supply. The anticipation of this event often starts influencing the market months in advance. We can look at previous halving events; the 2012 and 2016 halvings were followed by substantial price increases, though the timing and magnitude varied. The 2024 halving’s impact on the October-December 2025 period is likely to be a continuation of this upward trend, although the extent of the price increase will depend on broader macroeconomic factors.

Market Reactions to Year-End Economic Forecasts

Year-end economic forecasts, particularly those concerning inflation, interest rates, and overall global economic health, can substantially impact Bitcoin’s price. Negative forecasts, suggesting a recession or persistent inflation, might lead to investors seeking safe haven assets, potentially driving up Bitcoin’s price as a hedge against economic uncertainty. Conversely, positive forecasts, signaling economic stability and growth, might cause investors to shift funds into more traditional investments, potentially leading to a slight dip in Bitcoin’s price. The interplay between these economic forecasts and the halving’s effect will be crucial in determining the actual price movement during the final quarter of 2025. For example, a positive economic forecast coupled with the halving anticipation could still result in a significant price increase, albeit perhaps a less dramatic one than if the economic outlook were more pessimistic.

Factors Influencing Bitcoin Price Predictions

Predicting Bitcoin’s price is a complex undertaking, influenced by a multitude of interconnected factors. These factors range from broad macroeconomic trends to specific technological developments within the cryptocurrency ecosystem itself. Accurately forecasting Bitcoin’s value requires a nuanced understanding of these interacting forces.

Macroeconomic Factors Influencing Bitcoin Price

Macroeconomic conditions significantly impact Bitcoin’s price. For example, periods of high inflation often see investors seeking alternative assets, potentially driving up demand for Bitcoin as a hedge against inflation. Conversely, periods of economic uncertainty or recession can lead to risk-averse behavior, causing investors to sell off assets like Bitcoin to secure more stable investments. Government monetary policies, interest rate changes, and geopolitical events all play a role. A tightening monetary policy by central banks, for instance, might decrease the attractiveness of riskier assets like Bitcoin, leading to price declines. Conversely, a major geopolitical event could trigger a flight to safety, potentially increasing Bitcoin’s value as investors seek refuge in decentralized assets.

Analyst Views on Bitcoin’s Future Price

Cryptocurrency analysts offer a diverse range of Bitcoin price predictions, often reflecting differing methodologies and underlying assumptions. Some analysts employ technical analysis, studying historical price charts and trading volume to identify patterns and predict future price movements. Others use fundamental analysis, focusing on factors like adoption rates, network growth, and regulatory developments. The range of predictions is vast. For instance, some analysts might predict a price of $100,000 by 2025 based on anticipated increased institutional adoption, while others might predict a lower price, citing potential regulatory headwinds or market corrections. These differing perspectives highlight the inherent uncertainty in forecasting Bitcoin’s future value. It’s crucial to consider the source’s methodology and potential biases when evaluating these predictions.

Technological Advancements and Bitcoin’s Price

Technological advancements within the Bitcoin ecosystem can significantly influence its price trajectory. Improvements in scalability, such as the Lightning Network, could lead to wider adoption and increased transaction volume, potentially driving up the price. Conversely, significant security breaches or technological limitations could negatively impact Bitcoin’s value. The development of new, competing cryptocurrencies could also affect Bitcoin’s dominance and, consequently, its price. For example, the introduction of faster and more energy-efficient blockchains could potentially divert investment away from Bitcoin. Furthermore, the integration of Bitcoin into mainstream financial systems and applications could positively impact its price by increasing its accessibility and utility.

Risks and Uncertainties in Bitcoin Price Prediction

Predicting Bitcoin’s price is inherently risky and uncertain. Numerous factors influence its volatility, making accurate long-term predictions extremely challenging, if not impossible. While various models attempt to forecast price movements, their limitations must be carefully considered before making any investment decisions.

The inherent volatility of Bitcoin makes any prediction susceptible to significant error. Unlike traditional assets with established valuation models, Bitcoin’s price is driven by a complex interplay of factors, including market sentiment, regulatory changes, technological advancements, and macroeconomic conditions. These factors are often unpredictable and can shift dramatically in short periods.

Limitations of Prediction Models

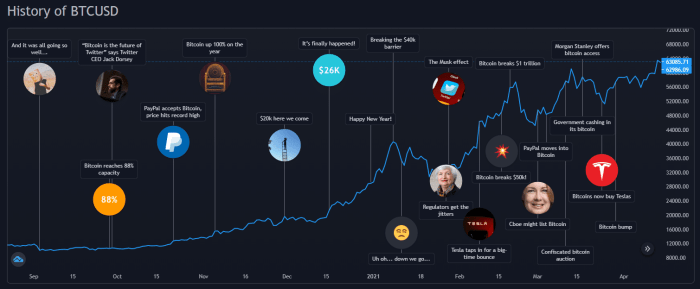

Various prediction models exist, ranging from simple technical analysis to sophisticated algorithms incorporating machine learning. However, each model has inherent limitations. Technical analysis, for example, relies on historical price data and assumes past performance will indicate future trends, a premise often invalidated by Bitcoin’s unpredictable nature. More complex models, while incorporating additional data points, are still limited by the availability and accuracy of the input data. Furthermore, unforeseen events—such as a major security breach or a sudden shift in regulatory landscape—can render even the most sophisticated models ineffective. For instance, the 2021 bull run was largely driven by institutional adoption and hype, factors that were difficult to accurately predict through traditional quantitative models. Similarly, the sharp price drops experienced in 2022 were partly influenced by macroeconomic factors like rising interest rates and inflation, events that are difficult to perfectly integrate into predictive algorithms.

The Importance of Thorough Research

Before making any investment decisions related to Bitcoin, conducting thorough research is paramount. This involves understanding not only the technical aspects of the cryptocurrency but also the broader economic and regulatory environment. Investors should carefully evaluate their own risk tolerance and understand that the potential for substantial losses is significant. Relying solely on predictions, regardless of their source, is unwise. A balanced approach involving diversification, risk management, and a clear understanding of the inherent uncertainties is crucial for navigating the volatile Bitcoin market. For example, an investor might consider diversifying their portfolio by investing only a small percentage of their capital in Bitcoin, reducing the overall risk of significant losses. Alternatively, they might employ strategies like dollar-cost averaging to mitigate the impact of price volatility.

Disclaimer and Responsible Investing

Investing in Bitcoin, or any cryptocurrency for that matter, carries significant risk. The cryptocurrency market is highly volatile, meaning prices can fluctuate dramatically in short periods. Past performance is not indicative of future results, and predictions, even those based on sophisticated analysis, are inherently uncertain. It’s crucial to understand this before committing any capital.

Responsible investment strategies for Bitcoin involve a careful assessment of your personal financial situation and risk tolerance. Never invest more than you can afford to lose. Diversification across different asset classes, including traditional investments like stocks and bonds, is a key element of a well-rounded portfolio. This helps mitigate the risk associated with the volatility of Bitcoin. Avoid impulsive decisions based on hype or short-term price movements. Thorough research and a long-term perspective are essential.

Risk Management Strategies

Effective risk management involves understanding the various factors that can influence Bitcoin’s price, such as regulatory changes, technological advancements, and market sentiment. Implementing stop-loss orders, which automatically sell your Bitcoin if the price drops below a predetermined level, can limit potential losses. Regularly reviewing your investment strategy and adjusting it as needed, based on market conditions and your own financial goals, is also crucial. Consider using dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy can reduce the impact of volatility. For example, instead of investing a lump sum of $10,000 at once, you could invest $1,000 per month for 10 months. This method mitigates the risk of buying high and potentially losing money.

Resources for Further Learning

Several reputable sources offer information on Bitcoin and cryptocurrency investing. These include educational websites dedicated to finance and investing, government regulatory agencies, and established financial news outlets. Many offer free resources such as articles, tutorials, and educational videos. It’s vital to critically evaluate the information you find, ensuring it comes from credible and unbiased sources. Always be wary of investment advice found on social media platforms or from unknown sources, as these can often be misleading or even fraudulent. Seeking advice from a qualified financial advisor can also be beneficial, particularly for those new to investing. A financial advisor can help you create a personalized investment plan that aligns with your risk tolerance and financial goals.

Frequently Asked Questions (FAQ): Bitcoin Price Prediction 2025 Monthly

This section addresses common questions regarding Bitcoin’s price and investment. Understanding these factors is crucial for making informed decisions. We will explore the key drivers of Bitcoin’s price, the reliability of predictions, associated risks, and resources for reliable information.

Major Factors Influencing Bitcoin’s Price in 2025

Several interconnected factors will likely influence Bitcoin’s price in 2025. These include macroeconomic conditions (e.g., inflation, recessionary fears), regulatory developments (e.g., government policies, adoption by financial institutions), technological advancements (e.g., scalability solutions, new applications), and market sentiment (e.g., media coverage, investor confidence). For example, widespread adoption by major financial institutions could significantly boost demand and price, while increased regulatory scrutiny could dampen investor enthusiasm. Conversely, a global recession could lead to investors seeking safer assets, potentially lowering Bitcoin’s price. The interplay of these factors makes accurate prediction challenging.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable. The cryptocurrency market is highly volatile and influenced by numerous unpredictable factors. While analysts may offer forecasts based on technical indicators, historical data, and market trends, these are not guarantees. Past performance is not indicative of future results, and unforeseen events can dramatically impact price. For instance, the 2022 cryptocurrency market crash demonstrated the significant impact of macroeconomic factors and regulatory uncertainty. Treat all predictions with a healthy dose of skepticism.

Potential Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries substantial risks. Price volatility is a major concern; Bitcoin’s price can fluctuate dramatically in short periods. Regulatory uncertainty poses another risk, as governments worldwide are still developing frameworks for cryptocurrencies. Security risks, including hacking and theft from exchanges or personal wallets, are also significant. Furthermore, the lack of intrinsic value compared to traditional assets makes Bitcoin susceptible to speculative bubbles and crashes. Consider diversifying your portfolio and only investing what you can afford to lose.

Reliable Information Sources About Bitcoin

Reliable information about Bitcoin can be found from reputable sources such as established financial news outlets (e.g., Bloomberg, Reuters, The Wall Street Journal), cryptocurrency research firms (e.g., CoinMetrics, Glassnode), and academic publications focusing on blockchain technology and finance. Always critically evaluate information from less established sources and be wary of biased or promotional content. Official government websites and regulatory bodies can also provide valuable insights into the regulatory landscape. Remember to verify information from multiple credible sources before making any investment decisions.

Accurately predicting the Bitcoin price in 2025 on a monthly basis is challenging, influenced by numerous factors. However, understanding the impact of the upcoming halving is crucial for any prediction. A useful tool to consider is the Bitcoin Halving 2025 Calculator , which can help model potential price changes based on historical trends. Ultimately, though, the Bitcoin Price Prediction 2025 Monthly remains speculative.

Accurately predicting the Bitcoin price in 2025 monthly is challenging, influenced by numerous factors. A key event impacting these predictions is the Bitcoin Halving, significantly altering the rate of new Bitcoin creation. To understand the potential timing of this event and its subsequent market effects, it’s helpful to consult resources like this one on the Bitcoin Halving 2025 Prediction Date.

Therefore, understanding the halving’s projected date is crucial for refining Bitcoin price prediction models for 2025.

Accurately predicting the Bitcoin price monthly in 2025 is challenging, influenced by numerous factors. A key event impacting these predictions is the Bitcoin Halving, significantly affecting the supply dynamics. For a detailed analysis of its market consequences, refer to this insightful resource: Bitcoin Halving:Impact On The Market 2025. Understanding the halving’s effects is crucial for refining Bitcoin Price Prediction 2025 Monthly estimations and forming more informed market outlooks.

Accurately predicting the Bitcoin price for 2025 on a monthly basis is challenging, relying on numerous factors. Understanding historical trends, however, provides valuable insight; a key element is the impact of Bitcoin halvings. To gain a better understanding of this influence, reviewing the historical data on Bitcoin halvings is crucial, as seen in this comprehensive resource: Bitcoin Halving History 2025.

This historical analysis can then inform more refined Bitcoin Price Prediction 2025 Monthly models.

Predicting the Bitcoin price for 2025 on a monthly basis is challenging, with various factors influencing its volatility. A key event to consider when formulating these predictions is the Bitcoin halving, scheduled for 2025; understanding this event is crucial. For a detailed explanation, refer to this informative resource: Que Es El Halving Bitcoin 2025. The halving’s impact on Bitcoin’s scarcity and, consequently, its potential price, is a significant factor in any 2025 price prediction model.

Predicting the Bitcoin price on a monthly basis for 2025 is challenging, requiring analysis of various market factors. To get a broader perspective, it’s helpful to consider the overall Bitcoin Value Prediction 2025 , which provides a yearly outlook. Understanding the projected yearly value aids in formulating more accurate monthly price predictions, refining our understanding of potential fluctuations throughout 2025.