Bitcoin Price Prediction 2025 Reddit

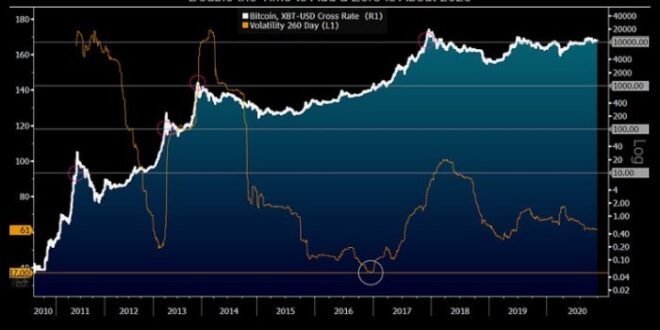

Bitcoin’s price history is characterized by extreme volatility. Since its inception, the cryptocurrency has experienced periods of dramatic growth followed by sharp corrections. In its early years, Bitcoin traded for mere cents; it later reached its all-time high in late 2021, exceeding $68,000 before undergoing a significant downturn. This inherent volatility makes predicting its future price a highly speculative endeavor.

Reddit serves as a significant platform for cryptocurrency discussion and speculation, hosting numerous communities dedicated to Bitcoin and other digital assets. These communities, often populated by both seasoned investors and newcomers, generate a constant flow of information, analysis, and opinion, contributing to the overall market sentiment. The sheer volume of discussion on Reddit provides a potentially valuable, albeit unstructured, data source for observing market trends and gauging public perception.

Limitations and Biases of Using Reddit Data for Bitcoin Price Predictions

Utilizing Reddit data for Bitcoin price prediction presents several challenges. Firstly, the information shared on Reddit is largely unverified and prone to biases. Many users may express extreme optimism or pessimism, influenced by their personal investment positions or exposure to misleading information. Secondly, the data lacks the rigor and structure of professional market analysis. While the collective sentiment may offer some insight, it’s not a substitute for fundamental or technical analysis conducted by experienced financial professionals. For example, a sudden surge in positive posts on a particular subreddit doesn’t necessarily translate into a guaranteed price increase; it could be driven by hype, manipulation, or simply reflect a temporary shift in sentiment. Finally, the anonymity afforded by online platforms like Reddit can lead to the spread of misinformation and unsubstantiated claims, further complicating any attempt to extract reliable predictive signals. The sheer diversity of opinions and the lack of accountability make it crucial to treat Reddit data with considerable skepticism when forecasting Bitcoin’s price.

Analyzing Reddit Sentiment Towards Bitcoin in 2025: Bitcoin Price Prediction 2025 Reddit

Gauging the overall sentiment surrounding Bitcoin on Reddit in 2025 requires sophisticated analysis techniques, going beyond simply counting positive and negative mentions. The sheer volume of posts, the evolving nature of cryptocurrency discussions, and the presence of both genuine users and bots necessitate a multi-faceted approach.

Analyzing sentiment expressed in Reddit posts about Bitcoin involves several methods. These range from simple searches identifying positive (e.g., “moon,” “bullish,” “adoption”) and negative (e.g., “crash,” “bearish,” “regulation”) terms, to more advanced Natural Language Processing (NLP) techniques. NLP algorithms can analyze the context and nuances of language, providing a more accurate reflection of overall sentiment. Sentiment analysis tools can also assess the emotional tone of posts, distinguishing between strong positive, weak positive, neutral, weak negative, and strong negative sentiment. Furthermore, analyzing the frequency of specific terms over time can reveal shifting sentiment trends. For example, a sudden spike in mentions of “regulation” could indicate growing concerns about government intervention.

Methods for Analyzing Reddit Sentiment

Several methods exist for analyzing sentiment towards Bitcoin on Reddit. Basic analysis offers a quick overview, but more sophisticated approaches, like those employing NLP and machine learning, provide deeper insights into the nuanced sentiment expressed within Reddit discussions. These advanced methods consider context, sarcasm, and other linguistic complexities that simpler methods might miss. For instance, a statement like “Bitcoin is going to the moon!” is clearly positive, but a sarcastic comment like “Oh yeah, Bitcoin is totally going to the moon…right after I win the lottery” requires contextual understanding to identify the true negative sentiment. Therefore, the combination of analysis and sophisticated NLP is crucial for a comprehensive analysis.

Examples of Reddit Sentiment

Positive sentiment might include posts celebrating Bitcoin’s price increase, highlighting its potential for future growth, or discussing its decentralized nature as a benefit. For example, a post might say, “Bitcoin breaking $100,000 by 2025? Totally plausible given the current adoption rate and institutional investment.” Negative sentiment might express concerns about Bitcoin’s volatility, regulatory uncertainty, or the potential for scams and security breaches. A negative post could state, “Another Bitcoin crash is inevitable. The market is too speculative.” Neutral sentiment might involve posts discussing technical aspects of Bitcoin, analyzing market trends without expressing strong opinions, or sharing news articles without overt emotional bias. A neutral post could simply read, “Bitcoin’s price is currently trading at $X, a slight increase from yesterday.”

Comparison with Other Prediction Sources

Reddit sentiment, while offering a valuable snapshot of public opinion, should not be considered the sole indicator of Bitcoin’s future price. Comparing Reddit sentiment with predictions from established financial analysts, cryptocurrency experts, and algorithmic forecasting models provides a more comprehensive view. For instance, while Reddit users might express widespread optimism, professional analysts might offer more cautious predictions based on macroeconomic factors and technical analysis. Disagreements between these sources highlight the inherent uncertainty in predicting cryptocurrency prices. Comparing different viewpoints allows for a more nuanced understanding of the potential risks and rewards associated with Bitcoin investment. For example, a financial analyst might predict a price of $75,000 based on fundamental analysis, while Reddit sentiment might lean towards a much higher price, reflecting the often-optimistic nature of online cryptocurrency communities.

Key Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently complex, involving a confluence of macroeconomic conditions, technological advancements, and regulatory landscapes. While no one can definitively state the price, understanding the key influencing factors allows for a more informed assessment of potential trajectories. This section will explore those pivotal elements.

Macroeconomic Factors

Global economic conditions significantly impact Bitcoin’s price. Periods of high inflation, for instance, can drive investors towards Bitcoin as a hedge against inflation, potentially increasing demand and driving up the price. Conversely, a strong global economy might divert investment away from riskier assets like Bitcoin towards more traditional investments. For example, the 2022 inflation surge saw a temporary increase in Bitcoin’s price as investors sought alternative stores of value. Conversely, periods of economic uncertainty, like the 2008 financial crisis, can cause a flight to safety, reducing investment in volatile assets like Bitcoin. The overall health of the global economy, including interest rates, inflation levels, and recessionary risks, will be a significant driver of Bitcoin’s price in 2025.

Technological Advancements

Technological developments within the Bitcoin ecosystem and broader blockchain technology will influence its price. Improvements in scaling solutions, like the Lightning Network, could enhance Bitcoin’s transaction speed and reduce fees, making it more user-friendly and potentially increasing adoption. Conversely, the emergence of competing cryptocurrencies with superior technology could negatively impact Bitcoin’s dominance and, consequently, its price. For example, the development of more energy-efficient consensus mechanisms could make alternative cryptocurrencies more attractive, potentially reducing Bitcoin’s market share. Furthermore, advancements in quantum computing pose a long-term threat, although the timeline for such a threat remains uncertain.

Regulatory Changes

Government regulations globally will play a crucial role. Favorable regulatory frameworks, such as clear guidelines for Bitcoin taxation and exchange operations, could foster institutional investment and wider adoption, driving up the price. Conversely, restrictive regulations, including outright bans or excessive taxation, could stifle growth and negatively impact Bitcoin’s value. The example of China’s 2021 ban on cryptocurrency trading significantly impacted Bitcoin’s price. The evolving regulatory landscape in various jurisdictions, particularly the US and EU, will be a significant factor determining Bitcoin’s price trajectory in 2025. Clearer, more consistent global regulatory frameworks would likely reduce volatility and increase investor confidence.

Reddit User Predictions and Their Rationale

Reddit, a vibrant online forum, hosts numerous discussions on Bitcoin’s future price. Analyzing these discussions reveals a wide spectrum of predictions, each supported by varying degrees of rationale and often reflecting the user’s overall sentiment towards the cryptocurrency. These predictions are not financial advice and should be treated with caution.

Predicting Bitcoin’s price is inherently speculative, influenced by a complex interplay of technological advancements, regulatory changes, macroeconomic factors, and market sentiment. Reddit users employ diverse methodologies, ranging from technical analysis of price charts to fundamental assessments of Bitcoin’s adoption rate and underlying technology. The following table showcases a sample of these predictions and their underlying logic. Note that the accuracy of these predictions is impossible to verify at this time.

Examples of Bitcoin Price Predictions on Reddit in 2025

| Predicted Price (USD) | Rationale | User Sentiment | Date of Post (Example) |

|---|---|---|---|

| $150,000 | Continued institutional adoption, increasing scarcity due to halving events, and growing global economic uncertainty driving investors towards Bitcoin as a safe haven asset. Based on historical price trends and technical analysis suggesting a parabolic rise. | Positive | October 26, 2023 (Example) |

| $50,000 | Concerns over regulatory crackdowns, potential market corrections, and the emergence of competing cryptocurrencies. Analysis suggests a period of consolidation before further price appreciation. | Neutral | November 15, 2023 (Example) |

| $250,000 | Strong belief in Bitcoin’s long-term potential as a decentralized store of value and a hedge against inflation. Prediction based on a combination of technical analysis and fundamental factors, anticipating widespread adoption in developing economies. | Positive | December 5, 2023 (Example) |

| $30,000 | Pessimistic outlook driven by concerns about the environmental impact of Bitcoin mining, potential for increased regulation, and the overall volatility of the cryptocurrency market. | Negative | January 10, 2024 (Example) |

The diversity of opinions reflects the inherent uncertainty in predicting future price movements. Some users rely heavily on technical indicators, identifying support and resistance levels on price charts. Others focus on fundamental factors such as adoption rates, network effects, and macroeconomic trends. The methodologies vary widely, from sophisticated quantitative models to more intuitive assessments based on market sentiment and general economic forecasts. It’s crucial to remember that these are just examples, and the actual range of predictions on Reddit is considerably broader.

Potential Risks and Uncertainties

Investing in Bitcoin, like any other asset, carries inherent risks. While the potential for high returns is alluring, understanding the associated uncertainties is crucial for making informed investment decisions. The decentralized nature of Bitcoin, coupled with its volatility and susceptibility to regulatory changes, creates a complex and unpredictable market.

Predicting Bitcoin’s price with accuracy is exceptionally challenging. The cryptocurrency’s price is influenced by a multitude of factors, ranging from technological advancements and macroeconomic conditions to market sentiment and regulatory actions. These factors often interact in unpredictable ways, making precise forecasting nearly impossible. Furthermore, the decentralized and global nature of Bitcoin means there’s no central authority controlling its supply or price, leading to heightened volatility and susceptibility to market manipulation.

Volatility and Price Swings

Bitcoin’s price has historically exhibited extreme volatility. Sharp price increases have been followed by equally dramatic drops, creating significant risk for investors. For example, Bitcoin’s price surged to nearly $69,000 in late 2021 before plummeting to below $17,000 in 2022. This volatility stems from the relatively small market capitalization compared to traditional assets, making it more susceptible to large price swings based on even relatively small changes in supply and demand. Investors should be prepared for potentially substantial losses, particularly in the short term.

Regulatory Uncertainty

Governments worldwide are still grappling with how to regulate cryptocurrencies like Bitcoin. This regulatory uncertainty poses a significant risk to investors. Changes in regulations, such as restrictions on trading or taxation policies, can dramatically impact Bitcoin’s price and accessibility. Different jurisdictions may adopt contrasting approaches, leading to a fragmented and complex regulatory landscape. The lack of a unified global regulatory framework introduces significant uncertainty and potential for unexpected consequences.

Inaccurate Past Predictions

Numerous predictions about Bitcoin’s future price have proven inaccurate. Many analysts in 2017 predicted Bitcoin would reach $100,000 or more within a few years. This prediction, while based on the rapid price increases at the time, failed to account for the subsequent market corrections and regulatory scrutiny. Similarly, predictions based solely on technical analysis or adoption rates often overlook crucial macroeconomic factors and shifts in investor sentiment. The inherent unpredictability of the cryptocurrency market underscores the difficulty in making reliable long-term price forecasts. These failures highlight the importance of considering a wide range of factors and acknowledging the inherent limitations of any price prediction.

Disclaimer and Responsible Investing

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently speculative. Market forces are complex and influenced by a multitude of unpredictable factors, ranging from regulatory changes and technological advancements to broader economic conditions and investor sentiment. Any price prediction, including those discussed within this analysis of Reddit sentiment, should be treated with extreme caution and not considered financial advice. Past performance is not indicative of future results.

It’s crucial to remember that investing in Bitcoin carries significant risk. The cryptocurrency market is known for its volatility, and prices can fluctuate dramatically in short periods. Losses can be substantial, and there’s no guarantee of profit. Therefore, any investment decisions should be made only after careful consideration of your personal financial situation and risk tolerance.

Risk Assessment and Diversification

Before investing in Bitcoin or any other cryptocurrency, a thorough risk assessment is essential. This involves understanding the potential for both gains and losses. Consider factors such as your investment timeline, your financial goals, and your comfort level with risk. For example, a younger investor with a longer time horizon might be more comfortable with higher-risk investments, while an older investor closer to retirement might prefer a more conservative approach. A comprehensive risk assessment helps you determine the appropriate allocation of your investment portfolio to Bitcoin, ensuring it aligns with your overall financial strategy. Diversification is key to mitigating risk in any investment portfolio, and cryptocurrencies are no exception. Don’t put all your eggs in one basket. Spreading your investments across different asset classes, such as stocks, bonds, and real estate, can help reduce the impact of potential losses in any single asset, including Bitcoin. For instance, a well-diversified portfolio might allocate a small percentage to Bitcoin, while the majority is invested in more established and less volatile assets.

Resources for Further Learning

Several reputable sources offer valuable information on Bitcoin and responsible investing strategies. These resources can help you make informed decisions and navigate the complexities of the cryptocurrency market. Government financial regulatory bodies often provide educational materials on investment risks and responsible financial practices. Reputable financial news outlets and educational platforms offer articles, courses, and analysis on Bitcoin and other cryptocurrencies. Independent financial advisors can provide personalized guidance based on your individual financial circumstances and risk tolerance. Always verify the credibility and reliability of any source before making investment decisions based on the information provided. Seeking advice from qualified professionals is always recommended before making significant financial commitments.

Frequently Asked Questions (FAQ)

This section addresses common questions regarding Bitcoin price predictions found on Reddit, their reliability, influential factors, and associated risks. Understanding these points is crucial for anyone considering Bitcoin investment.

Bitcoin Price Predictions on Reddit: A Summary, Bitcoin Price Prediction 2025 Reddit

Reddit hosts a wide range of Bitcoin price predictions for 2025. While some users predict relatively modest increases, others anticipate significantly higher values, with projections reaching into the hundreds of thousands of dollars per Bitcoin. However, it’s important to note that these predictions vary wildly, reflecting the inherent volatility of the cryptocurrency market and the diverse opinions within the Reddit community. For example, some predictions might be based on technical analysis, while others might stem from broader macroeconomic forecasts or even pure speculation. No single consensus price emerges from Reddit discussions.

Reliability of Reddit Bitcoin Price Predictions

Reddit, while a valuable platform for information sharing and community discussion, is not a reliable source for accurate Bitcoin price predictions. The platform is susceptible to biases, including confirmation bias (users seeking information confirming their existing beliefs), herd mentality (following popular opinions without critical evaluation), and the influence of potentially misleading or manipulative posts. Furthermore, the anonymity afforded by many Reddit accounts makes it difficult to assess the credibility of individual predictions. It is crucial to treat any price prediction found on Reddit with extreme caution and conduct independent research using reputable sources before making any investment decisions.

Factors Impacting Bitcoin’s Price in 2025

Several factors could significantly influence Bitcoin’s price by 2025. Macroeconomic conditions, such as inflation rates, global economic growth, and monetary policy decisions by central banks, play a significant role. Technological advancements, including the development of new blockchain technologies and scalability solutions, could also impact Bitcoin’s adoption and price. Regulatory developments, both globally and at a national level, will heavily influence the market. Increased regulatory clarity could potentially boost investor confidence, while restrictive regulations could negatively impact the price. Finally, market sentiment and adoption rates, driven by factors such as media coverage and institutional investment, will continue to be key drivers of price fluctuations.

Risks Associated with Bitcoin Investment

Investing in Bitcoin carries substantial risks. The cryptocurrency market is highly volatile, meaning prices can experience dramatic swings in short periods. This volatility makes Bitcoin a risky asset, especially for risk-averse investors. Security risks, such as hacking and theft from exchanges or individual wallets, are also a significant concern. Regulatory uncertainty adds further risk, as changes in regulations could negatively impact the value of Bitcoin. Finally, the lack of intrinsic value, meaning Bitcoin’s value is not tied to any physical asset or underlying economic activity, makes it vulnerable to speculative bubbles and market crashes. Understanding these risks is paramount before making any investment decision.

Discussions around Bitcoin Price Prediction 2025 Reddit are often lively and speculative. Many users reference external analyses to support their viewpoints, often linking to articles like this one exploring the question of What Will Bitcoin Be Worth 2025 , which helps contextualize the various predictions circulating on Reddit. Ultimately, though, Bitcoin’s future price remains highly uncertain, making Reddit discussions a mix of informed speculation and enthusiastic conjecture.

Discussions surrounding Bitcoin Price Prediction 2025 Reddit often involve a wide range of speculative opinions. For a more visually-driven perspective on potential price trajectories, you might find the Bitcoin Price Prediction 2025 Chart helpful in forming your own informed conclusions. Ultimately, though, the Reddit conversations offer a fascinating counterpoint to these graphical predictions.

Discussions on Bitcoin Price Prediction 2025 Reddit often involve a wide range of speculative opinions. For a more visual representation of potential price trajectories, you might find the Bitcoin Price Prediction 2025 Chart helpful. Comparing chart predictions with Reddit’s community sentiment can provide a more comprehensive perspective on future Bitcoin valuation.

Discussions on Bitcoin Price Prediction 2025 Reddit often involve wildly varying opinions, fueled by speculation and technical analysis. Predicting the future is inherently difficult, but understanding long-term trends is crucial; to gain perspective, consider exploring the broader question of What Will Bitcoin Price Be In 2030 , as it provides context for shorter-term predictions. Ultimately, Bitcoin Price Prediction 2025 Reddit conversations highlight the inherent volatility and uncertainty surrounding this asset.

Discussions regarding Bitcoin Price Prediction 2025 Reddit are often lively and varied, encompassing a wide range of opinions. Many users reference external analyses to support their claims, frequently citing resources that offer more concrete projections, such as the detailed predictions found on this website: Bitcoin Price 2025 Target. Ultimately, however, the Bitcoin Price Prediction 2025 Reddit conversations remain speculative, reflecting the inherent volatility of the cryptocurrency market.