Bitcoin Price Prediction 2025

Bitcoin’s price journey has been nothing short of dramatic since its inception. From a fraction of a cent to its all-time high exceeding $68,000 in late 2021, its value has fluctuated wildly, influenced by a complex interplay of factors. Significant events like the 2017 bull run, the 2021 surge, and various regulatory announcements have profoundly impacted its price. Understanding this history is crucial for any attempt at future price prediction, though, as we will see, such predictions are inherently fraught with uncertainty.

Bitcoin’s price volatility stems from its relatively small market capitalization compared to traditional asset classes, its decentralized nature, and the speculative nature of much of the investment. News events, regulatory changes, technological advancements, and even social media trends can trigger significant price swings in a short period. The lack of intrinsic value, unlike gold or other commodities, adds another layer of complexity, making it susceptible to market sentiment shifts.

Challenges in Predicting Bitcoin’s Price

Accurately predicting the price of any asset, especially a volatile one like Bitcoin, is exceptionally difficult. Numerous unpredictable factors influence its price, making any prediction inherently speculative. For example, predicting the impact of future regulatory changes, technological breakthroughs, or macroeconomic shifts on Bitcoin’s price is virtually impossible. While sophisticated models and analyses can provide insights, they are limited by the inherent unpredictability of these external forces. Past performance is not indicative of future results; the price history, while informative, does not provide a reliable basis for predicting future movements. Consider, for example, the numerous price predictions made in 2021 which failed to anticipate the subsequent significant price correction. These examples highlight the inherent challenges and limitations in predicting Bitcoin’s future price.

Forbes’ Perspective on Bitcoin’s Future

Forbes, a prominent business and finance publication, has consistently covered Bitcoin, offering a range of perspectives from its expert contributors. Their analyses haven’t always aligned on precise price predictions, reflecting the inherent volatility and uncertainty within the cryptocurrency market. However, certain recurring themes and approaches emerge from their coverage.

Forbes’ articles on Bitcoin often emphasize the importance of understanding the underlying technology, its potential for disruption, and the associated risks. While some contributors have offered bullish price projections, often based on adoption rates, technological advancements, and macroeconomic factors, others have expressed caution, highlighting regulatory uncertainty, market manipulation, and the potential for significant price corrections. The publication tends to present a balanced view, presenting both optimistic and pessimistic viewpoints alongside relevant market data and expert opinions.

Recurring Themes in Forbes’ Bitcoin Analyses

Forbes’ coverage frequently highlights several key aspects influencing Bitcoin’s future price. These include the growing adoption of Bitcoin by institutional investors, the ongoing development of Bitcoin’s underlying technology, and the impact of macroeconomic events such as inflation and geopolitical instability. For example, articles have explored the correlation between Bitcoin’s price and the US dollar’s value, suggesting a potential safe-haven role for Bitcoin during periods of economic uncertainty. Another recurring theme is the influence of regulatory frameworks on Bitcoin’s price, with stricter regulations potentially impacting its accessibility and value. Finally, the ongoing debate surrounding Bitcoin’s energy consumption and environmental impact is also a frequently discussed topic in Forbes’ articles.

Comparison with Other Financial Publications

Compared to other reputable financial publications like Bloomberg or the Wall Street Journal, Forbes’ approach to Bitcoin reporting often exhibits a similar blend of cautious optimism and risk assessment. While Bloomberg might focus more on the technical analysis and market data, and the Wall Street Journal might emphasize the regulatory and macroeconomic impacts, Forbes often attempts to synthesize these perspectives, offering a broader, more accessible overview for its readership. However, the level of bullishness or bearishness in predictions can vary considerably across these publications, reflecting the differing analytical methodologies and the inherent subjectivity in forecasting cryptocurrency prices. For instance, while some publications might project extremely high price targets based on speculative factors, Forbes tends to present a range of potential outcomes, acknowledging the considerable uncertainty involved. This cautious approach is often reflected in the use of qualifiers and hedging language in their articles.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently complex, depending on a confluence of technological, regulatory, market, and macroeconomic factors. These factors are interconnected and their influence can be both synergistic and antagonistic, leading to unpredictable price fluctuations. Understanding these influences is crucial for informed speculation and investment strategies.

Technological Advancements

Technological advancements in the Bitcoin ecosystem will significantly impact its price. Improvements in scalability, such as the Lightning Network’s wider adoption, could reduce transaction fees and increase processing speed, potentially boosting Bitcoin’s usability and attractiveness to a broader range of users. Conversely, the emergence of competing cryptocurrencies with superior technological features could negatively affect Bitcoin’s dominance and, consequently, its price. For example, if a new blockchain technology offers significantly faster transaction speeds and lower energy consumption, it could attract investors away from Bitcoin. The development of more sophisticated and user-friendly wallets and exchanges also plays a crucial role in driving adoption and increasing price.

Regulatory Changes and Government Policies

Government regulations and policies concerning cryptocurrencies are another key determinant of Bitcoin’s price. Favorable regulations, such as clear legal frameworks and tax policies, could legitimize Bitcoin as an asset class and encourage institutional investment, leading to price appreciation. Conversely, stringent regulations, bans, or excessive taxation could stifle adoption and drive the price down. The regulatory landscape varies significantly across countries. For example, El Salvador’s adoption of Bitcoin as legal tender had a short-term positive impact on its price, while China’s ban on cryptocurrency trading had a negative effect. Future regulatory decisions in major economies like the US and EU will heavily influence Bitcoin’s price trajectory.

Adoption Rates and Market Sentiment

The rate of Bitcoin adoption among individuals and institutions is directly correlated with its price. Increased adoption, driven by factors such as greater awareness, improved usability, and institutional investment, typically leads to higher demand and price increases. Conversely, decreased adoption, possibly fueled by negative news, security breaches, or regulatory uncertainty, can depress prices. Market sentiment, encompassing investor confidence and speculation, plays a crucial role in driving price volatility. Periods of intense optimism can lead to price bubbles, while periods of fear and uncertainty can trigger sharp price corrections, as witnessed in several past market cycles.

Macroeconomic Factors

Macroeconomic factors, such as inflation and economic recession, can significantly influence Bitcoin’s price. During periods of high inflation, Bitcoin, often perceived as a hedge against inflation, may experience increased demand and price appreciation. Investors might see Bitcoin as a store of value, protecting their purchasing power from inflation. However, during economic recessions, investors may liquidate their Bitcoin holdings to cover losses in other assets, leading to a price decline. The correlation between Bitcoin’s price and traditional financial markets is not always consistent, making it difficult to predict the precise impact of macroeconomic events. For instance, the 2022 market downturn saw both Bitcoin and traditional assets decline, suggesting some level of correlation, but the degree of this correlation remains a subject of ongoing debate.

Impact of Factors on Bitcoin’s Price in 2025

| Factor | Positive Impact | Negative Impact | Likelihood |

|---|---|---|---|

| Technological Advancements | Increased scalability, usability, and adoption; competition from superior alternatives | Reduced transaction fees, faster processing; emergence of competing cryptocurrencies with superior features | Medium to High |

| Regulatory Changes | Clear legal frameworks, favorable tax policies, increased institutional investment | Stringent regulations, bans, excessive taxation, stifled adoption | Medium |

| Adoption Rates & Market Sentiment | Increased adoption by individuals and institutions, positive investor sentiment, price appreciation | Decreased adoption, negative news, security breaches, price corrections | High |

| Macroeconomic Factors | High inflation, Bitcoin as an inflation hedge, increased demand | Economic recession, investor liquidation, price decline | Medium |

Different Price Prediction Models

Predicting Bitcoin’s price is a complex undertaking, with no single foolproof method. Various models, each with its own strengths and weaknesses, attempt to forecast future price movements. Understanding these different approaches is crucial for interpreting any price prediction, recognizing their inherent limitations, and forming your own informed opinion.

Predicting the future price of Bitcoin relies heavily on two primary analytical approaches: technical analysis and fundamental analysis. These methods, while distinct, can be used in conjunction to create a more comprehensive view.

Technical Analysis

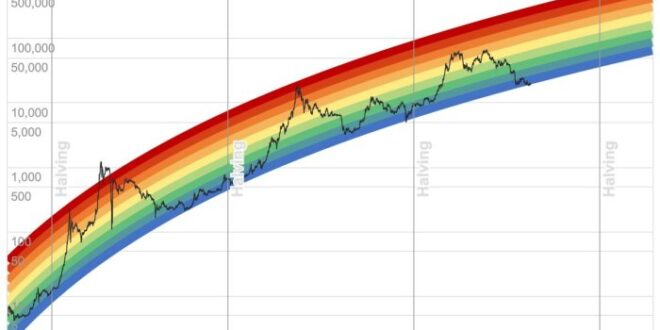

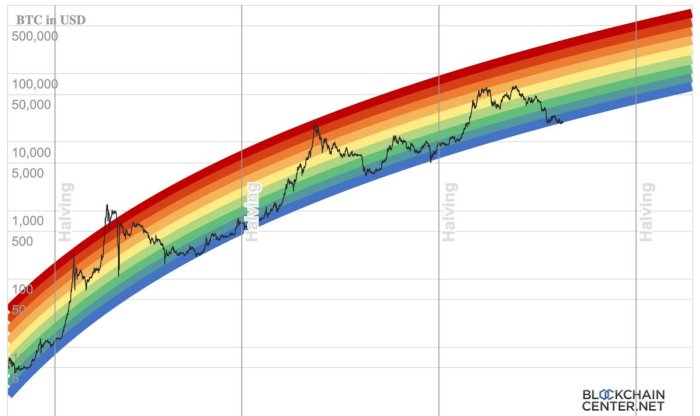

Technical analysis focuses on historical price and volume data to identify patterns and trends. It assumes that past market behavior provides clues to future price movements. Analysts use various charts, indicators, and tools to identify potential support and resistance levels, trendlines, and momentum shifts. Common technical indicators include moving averages, relative strength index (RSI), and MACD.

Strengths of technical analysis include its relative simplicity and the ability to identify short-term price movements. Weaknesses include its reliance on past data, which may not be indicative of future performance, and the subjective interpretation of charts and indicators. For example, a “head and shoulders” pattern might be interpreted differently by two different analysts, leading to conflicting predictions. Moreover, technical analysis struggles to account for significant external events that could dramatically impact Bitcoin’s price, such as regulatory changes or major technological advancements.

Fundamental Analysis

Fundamental analysis focuses on the underlying factors that influence Bitcoin’s value, such as adoption rates, network security, regulatory landscape, and macroeconomic conditions. It attempts to determine the intrinsic value of Bitcoin based on these factors and compare it to its current market price. For instance, an increase in institutional adoption or the development of new use cases for Bitcoin could be viewed as positive fundamental factors, suggesting potential for price appreciation.

Fundamental analysis offers a more holistic view than technical analysis, considering broader economic and technological factors. However, it’s often challenging to accurately quantify the impact of these factors on Bitcoin’s price. Furthermore, predicting future adoption rates or regulatory changes is inherently speculative, making precise price forecasts difficult. For example, predictions based on anticipated mass adoption have often been overly optimistic in the past.

Examples of Past Predictions and Their Accuracy

Numerous analysts and platforms have made Bitcoin price predictions in the past, with varying degrees of accuracy. Many predictions made in 2017, during the peak of the last bull market, significantly overestimated Bitcoin’s future price. For instance, some analysts predicted prices exceeding $100,000 within a short timeframe, a prediction that proved inaccurate. Conversely, some predictions made during bear markets underestimated Bitcoin’s resilience and subsequent price recoveries. The inherent volatility of Bitcoin makes accurate long-term predictions exceptionally difficult. The accuracy of past predictions serves as a cautionary tale, highlighting the limitations of any predictive model and the need for critical evaluation of all forecasts.

Potential Price Ranges for Bitcoin in 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, given the cryptocurrency’s volatile nature and susceptibility to various market forces. However, by considering historical trends, technological advancements, regulatory changes, and macroeconomic factors, we can Artikel a range of plausible scenarios. These scenarios represent a spectrum of possibilities, from highly optimistic to pessimistic outlooks, along with a most likely scenario based on current trends and reasonable projections.

Several factors contribute to the uncertainty. Adoption rates among institutional and retail investors, the development and impact of competing cryptocurrencies, and the regulatory landscape in key markets all play significant roles. Macroeconomic conditions, such as inflation and interest rates, will also influence investor sentiment and Bitcoin’s price. Therefore, any prediction should be viewed as a possibility, not a certainty.

Bitcoin Price Scenarios for 2025

The following scenarios Artikel potential Bitcoin price ranges for 2025, each justified by supporting evidence and reasoning. These are not exhaustive, and other outcomes are certainly possible.

- Optimistic Scenario: $150,000 – $200,000: This scenario assumes widespread institutional adoption, continued technological innovation (such as Layer-2 scaling solutions improving transaction speeds and reducing fees), and a generally positive macroeconomic environment. Strong demand from institutional investors, coupled with limited supply, could drive the price significantly higher. Similar to the surge seen in late 2020 and early 2021, driven by increased institutional interest and retail FOMO, this scenario anticipates a similar, though potentially more sustained, period of growth. However, such a dramatic increase would require substantial further adoption and overcoming potential regulatory hurdles.

- Pessimistic Scenario: $20,000 – $40,000: This scenario assumes a less favorable macroeconomic environment, increased regulatory scrutiny leading to stricter rules impacting Bitcoin’s accessibility and usage, and potentially a significant downturn in the broader cryptocurrency market. A global recession or a significant cryptocurrency market crash could depress Bitcoin’s price, similar to the bear market of 2018-2020. This scenario also considers the potential emergence of a more dominant competitor, overshadowing Bitcoin’s market share. This would require a significant shift in the cryptocurrency landscape.

- Most Likely Scenario: $70,000 – $100,000: This scenario represents a more balanced view, incorporating elements of both optimistic and pessimistic scenarios. It assumes moderate growth in adoption, ongoing technological development, and a relatively stable macroeconomic environment. This range reflects a continuation of the historical trend of cyclical price movements, with periods of growth followed by corrections. The price would likely be influenced by factors like network upgrades, regulatory clarity in major jurisdictions, and overall investor confidence. This range accounts for potential market corrections while still reflecting a positive long-term outlook.

Risks and Uncertainties Associated with Bitcoin Price Predictions

Predicting the price of Bitcoin, or any cryptocurrency for that matter, over a period as long as five years is inherently fraught with risk and uncertainty. Numerous factors, both predictable and unpredictable, can significantly impact the market, rendering even the most sophisticated forecasting models potentially inaccurate. The volatile nature of the cryptocurrency market necessitates a cautious approach to any long-term price projection.

The inherent volatility of Bitcoin’s price makes long-term predictions exceptionally challenging. Numerous unforeseen events can drastically alter the market landscape, rendering forecasts obsolete. These predictions rely on assumptions about future market behavior, technological advancements, and regulatory changes, all of which are inherently uncertain. Even seemingly minor shifts in any of these areas can create significant ripple effects, leading to price movements that deviate substantially from projections.

Impact of Unexpected Events on Price Forecasts

Unexpected events can dramatically impact Bitcoin’s price. For example, a major technological breakthrough, such as the widespread adoption of a more energy-efficient consensus mechanism, could significantly boost Bitcoin’s appeal and drive its price upwards. Conversely, a sudden and unexpected regulatory crackdown in a major market, like a complete ban on Bitcoin trading, could severely depress the price. The 2021 China mining ban serves as a real-world example of how swift regulatory action can negatively impact Bitcoin’s price. Similarly, unforeseen security breaches or significant hacks could erode investor confidence, leading to a sharp price decline. The Mt. Gox hack in 2014 serves as a stark reminder of the potential for catastrophic events to negatively impact the cryptocurrency market.

Importance of Diversification and Risk Management in Cryptocurrency Investments

Given the inherent risks involved, diversification and robust risk management strategies are crucial for anyone investing in Bitcoin or other cryptocurrencies. Diversification involves spreading investments across various asset classes, not just concentrating solely on Bitcoin. This can help mitigate potential losses should the price of Bitcoin decline significantly. Risk management involves understanding your own risk tolerance and setting appropriate investment limits. It’s essential to only invest an amount you can afford to lose entirely. This approach reduces the potential for significant financial setbacks in the event of unforeseen market fluctuations. Strategies like dollar-cost averaging (investing a fixed amount at regular intervals) can help smooth out the impact of volatility and reduce the risk of investing a large sum at a market peak.

Investing in Bitcoin: Bitcoin Price Prediction 2025 Usd Forbes

Investing in Bitcoin, like any other investment, requires careful consideration of your risk tolerance and financial goals. The cryptocurrency market is highly volatile, meaning prices can fluctuate dramatically in short periods. Understanding this volatility is crucial before committing any capital. This section Artikels various investment strategies and emphasizes the importance of responsible practices.

Bitcoin Price Prediction 2025 Usd Forbes – Successful Bitcoin investment hinges on a well-defined strategy aligned with your individual circumstances. There’s no one-size-fits-all approach; the optimal strategy depends on factors such as your investment horizon, risk appetite, and overall portfolio diversification.

Numerous sources, including Forbes, offer Bitcoin price predictions for 2025, varying widely depending on the underlying assumptions. To gain a broader perspective on potential price trajectories, it’s helpful to consult other analyses, such as this insightful piece on What Price Will Bitcoin Reach In 2025. Ultimately, the accuracy of any Bitcoin Price Prediction 2025 USD Forbes forecast remains speculative, influenced by market dynamics and technological advancements.

Bitcoin Investment Strategies

Several strategies exist for investing in Bitcoin, each carrying different levels of risk and potential reward. Choosing the right strategy depends on your individual circumstances and risk tolerance.

Numerous sources, including Forbes, offer Bitcoin price predictions for 2025, varying widely in their estimations. For a contrasting perspective, consider the model proposed by Plan B, detailed in this insightful analysis: Bitcoin Price 2025 Plan B. Understanding Plan B’s methodology helps contextualize the range of forecasts seen in publications like Forbes, providing a more nuanced view of potential future Bitcoin valuation.

- Dollar-Cost Averaging (DCA): This involves investing a fixed amount of money at regular intervals (e.g., weekly or monthly), regardless of the price. This mitigates the risk of investing a large sum at a market peak. For example, investing $100 per week consistently reduces the impact of price fluctuations compared to a lump-sum investment.

- Lump-Sum Investment: This strategy involves investing a significant amount of money at once. While potentially lucrative if the market trends upwards, it carries a higher risk of significant losses if the price drops sharply after the investment.

- Trading: This involves actively buying and selling Bitcoin based on short-term price movements. This strategy requires significant market knowledge, technical analysis skills, and a high-risk tolerance. Successful trading demands constant monitoring and a deep understanding of market dynamics.

- Hodling: This long-term strategy involves buying and holding Bitcoin for an extended period, regardless of short-term price fluctuations. It relies on the belief that Bitcoin’s value will appreciate over time. This approach requires patience and resilience to withstand market volatility.

Responsible Investment Practices

Responsible investment in the cryptocurrency market involves several key practices to minimize risks and maximize potential returns. Prioritizing these practices is essential for long-term success.

Numerous analysts offer Bitcoin price predictions for 2025, often diverging widely in their USD estimations. To gain a broader perspective beyond singular Bitcoin forecasts, it’s helpful to consult a comprehensive overview like this Crypto Price Forecast 2025 resource, which includes various cryptocurrency projections. Understanding the wider crypto market context significantly aids in refining any Bitcoin Price Prediction 2025 Usd Forbes analysis.

- Diversification: Don’t put all your eggs in one basket. Diversify your investment portfolio across different asset classes, including traditional investments like stocks and bonds, to reduce overall risk.

- Risk Management: Only invest an amount you can afford to lose. Cryptocurrency investments are inherently risky, and losses are possible. Never invest borrowed money or funds crucial for essential expenses.

- Security: Secure your Bitcoin holdings using robust security measures, such as hardware wallets and strong passwords. Be wary of phishing scams and other fraudulent activities prevalent in the cryptocurrency space.

- Stay Informed: Keep up-to-date with market trends, regulatory changes, and technological advancements affecting Bitcoin. Continuous learning is crucial for informed decision-making.

Importance of Thorough Research and Due Diligence

Before investing in Bitcoin, thorough research and due diligence are paramount. Understanding the technology, market dynamics, and potential risks is crucial for making informed investment decisions. This involves more than just reading news articles; it requires a deep dive into the underlying principles.

While Forbes’ Bitcoin price prediction for 2025 in USD offers a global perspective, regional factors significantly influence the cryptocurrency’s trajectory. Understanding these nuances is crucial, and for a detailed look at the predicted price in India, you should check out this insightful resource: Bitcoin Price Prediction 2025 In India. Ultimately, comparing these regional predictions with the broader USD forecasts from Forbes provides a more complete picture of Bitcoin’s potential future value.

- Understand Bitcoin’s Technology: Familiarize yourself with blockchain technology, Bitcoin’s underlying architecture, and its limitations. This knowledge helps you assess the long-term viability of the asset.

- Analyze Market Trends: Study historical price charts, market capitalization, and trading volume to understand past performance and potential future trends. However, remember that past performance is not indicative of future results.

- Assess Regulatory Landscape: Research the regulatory environment surrounding Bitcoin in your jurisdiction and globally. Regulations can significantly impact the price and accessibility of Bitcoin.

- Evaluate Risks: Understand the inherent risks associated with Bitcoin, including volatility, security breaches, and regulatory uncertainty. This awareness allows you to make informed decisions based on your risk tolerance.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding Bitcoin price predictions and investment considerations, drawing upon available data and expert analyses. Understanding these aspects is crucial for making informed decisions about potential Bitcoin investments.

Bitcoin’s Most Likely Price in 2025 According to Forbes

Predicting Bitcoin’s price with certainty is impossible. Forbes, like other financial publications, offers various price predictions based on different models and expert opinions, often presenting a range rather than a single figure. These predictions vary significantly depending on the underlying assumptions about factors like adoption rate, regulatory changes, and macroeconomic conditions. Therefore, no single “most likely” price from Forbes can be definitively stated. It’s more accurate to say that Forbes’ coverage reflects a spectrum of possibilities, highlighting the inherent uncertainty in such forecasts. For example, one analysis might project a price range between $100,000 and $200,000, while another might suggest a more conservative estimate. These differences underscore the complexities involved.

Reliability of Bitcoin Price Predictions, Bitcoin Price Prediction 2025 Usd Forbes

Bitcoin price predictions are inherently unreliable. The cryptocurrency market is exceptionally volatile and influenced by a multitude of unpredictable factors, including technological advancements, regulatory shifts, investor sentiment, and macroeconomic events. Predictions often rely on complex algorithms and historical data, but the future behavior of Bitcoin is not guaranteed to follow past patterns. Furthermore, differing methodologies and underlying assumptions lead to widely divergent forecasts. Consequently, any single prediction should be viewed with considerable skepticism. It’s crucial to remember that past performance is not indicative of future results. Consider multiple perspectives and be prepared for significant price fluctuations.

Biggest Risks of Investing in Bitcoin

Investing in Bitcoin carries substantial risks. High volatility is a primary concern, with Bitcoin’s price experiencing dramatic swings in short periods. This volatility can lead to significant losses for investors. Regulatory uncertainty represents another major risk, as governments worldwide are still developing frameworks for regulating cryptocurrencies. Changes in regulations could significantly impact Bitcoin’s value and accessibility. Security risks, such as hacking and theft from exchanges or personal wallets, are also prevalent. Furthermore, the decentralized and unregulated nature of Bitcoin means that there is limited recourse in case of fraud or loss. Finally, the speculative nature of Bitcoin’s value increases the likelihood of market bubbles and subsequent crashes. Thorough research and careful risk assessment are vital before investing.

Alternative Investment Options to Bitcoin

Several alternative investment options exist, each with its own risk profile and potential returns. These include traditional investments like stocks and bonds, which offer diversification and relative stability. Real estate, while less liquid, can provide long-term growth and income. Precious metals like gold and silver are often seen as safe haven assets during times of economic uncertainty. Exchange-traded funds (ETFs) offer diversified exposure to various asset classes. Finally, other cryptocurrencies offer potential but come with even higher volatility and risk than Bitcoin. The choice of investment should depend on individual risk tolerance, financial goals, and investment horizon.

Disclaimer

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently speculative. The cryptocurrency market is notoriously volatile, influenced by a complex interplay of factors that are often unpredictable. No one can definitively say what the price of Bitcoin will be in 2025, or any future date. Any prediction presented should be viewed with a significant degree of skepticism and understood within the context of its inherent limitations.

The information provided in this document is for educational purposes only and should not be considered financial advice. Investing in cryptocurrencies like Bitcoin carries substantial risk, including the potential for significant financial losses. The value of Bitcoin can fluctuate dramatically in short periods, and there’s a real possibility of losing your entire investment. Before making any investment decisions, you should conduct thorough research, understand your risk tolerance, and, ideally, seek advice from a qualified financial advisor. Past performance is not indicative of future results.

Investment Risks

Investing in Bitcoin involves several key risks. Price volatility is a major concern, with Bitcoin’s price experiencing sharp increases and decreases. Regulatory uncertainty also poses a threat, as governments worldwide are still developing their approaches to regulating cryptocurrencies. Security risks, such as hacking and theft from exchanges or personal wallets, are another significant factor to consider. Furthermore, the relatively nascent nature of the Bitcoin market means there is a lack of historical data to reliably predict long-term trends, contributing to the inherent uncertainty. For example, the dramatic price drop in 2022 serves as a stark reminder of the potential for substantial and rapid losses. The lack of intrinsic value, unlike traditional assets, further amplifies the risk profile.

Many sources, including Forbes, offer Bitcoin price predictions for 2025 in USD, often varying widely. Understanding these predictions requires considering global economic factors and various market analyses. To gain a more comprehensive perspective, it’s helpful to also examine predictions in other major currencies, such as the Euro; for instance, you can check out this resource on Bitcoin Price Euro 2025 for a different viewpoint.

Ultimately, Bitcoin Price Prediction 2025 USD Forbes estimates should be considered alongside these international comparisons for a more nuanced understanding.