Bitcoin Price Prediction 2025: Bitcoin Price Prediction 2025 Youtube

The cryptocurrency market, particularly Bitcoin, remains a hot topic, generating significant interest and speculation. YouTube serves as a primary platform for disseminating price predictions, often attracting millions of views. Analyzing the trends in these videos provides insight into public sentiment and the methodologies employed in forecasting Bitcoin’s future value.

YouTube Bitcoin Price Prediction Video Analysis

A review of popular Bitcoin price prediction videos on YouTube in 2024 reveals several recurring themes. Many videos utilize technical analysis, charting historical price movements and identifying potential support and resistance levels to extrapolate future price action. Fundamental analysis, focusing on factors such as adoption rates, regulatory developments, and macroeconomic conditions, is also frequently incorporated. Some videos even incorporate on-chain metrics, analyzing data from the Bitcoin blockchain itself to gauge network activity and predict future price trends. A common element across many videos is the inclusion of bullish scenarios, projecting significant price increases, alongside more conservative or bearish predictions.

Comparison of Prediction Ranges

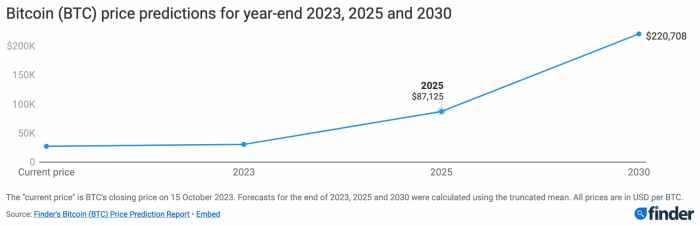

The range of Bitcoin price predictions for 2025 varies considerably across different YouTube channels. While some prominent analysts predict prices exceeding $100,000 or even $200,000, others offer far more conservative estimates, ranging from $50,000 to $80,000. These discrepancies stem from differences in methodologies, the weight given to various factors, and, ultimately, differing perspectives on the future of Bitcoin and the broader cryptocurrency market. For example, a video focusing primarily on technical analysis might project a higher price than one emphasizing macroeconomic risks. The considerable divergence highlights the inherent uncertainty in predicting cryptocurrency prices.

Audience Engagement with Bitcoin Price Prediction Videos

The audience engaging with these videos is diverse. Comments sections often reveal a mix of experienced investors, novice traders, and casual viewers simply curious about Bitcoin. Channel demographics often show a skew towards a younger, male audience, reflecting the general demographics of the cryptocurrency community. However, the comments also reveal a wide range of opinions, from enthusiastic optimism to cautious skepticism. Many viewers engage in discussions about the methodologies used, highlighting the importance of critical evaluation of information presented in these videos.

Hypothetical YouTube Thumbnail Design

A high-performing YouTube thumbnail for a Bitcoin price prediction video would need to be visually striking and immediately communicate the video’s core message. A possible design could feature a bold graphic of a Bitcoin logo, perhaps with a futuristic cityscape in the background, implying technological advancement and growth. The title overlay could use large, easily readable font, clearly stating “Bitcoin Price Prediction 2025: [Price Range]?” The use of vibrant colors, especially shades of gold and green (associated with wealth and growth), could further enhance click-through rates. The overall design should aim to create a sense of excitement and anticipation, enticing viewers to learn more about the predicted price range.

Influencers and Their Predictions

The cryptocurrency market, particularly Bitcoin, is heavily influenced by online personalities who offer price predictions. These predictions, while not financial advice, significantly impact investor sentiment and can potentially influence market behavior. Understanding the methodologies and potential biases of these influencers is crucial for navigating the volatile world of Bitcoin investment.

Prominent Bitcoin Price Prediction YouTubers

Several YouTube personalities have gained significant followings by providing Bitcoin price analyses and predictions. While their predictions vary, understanding their approaches offers valuable insight into the diversity of forecasting techniques within the crypto space. It’s important to remember that these are just opinions and should not be considered financial advice.

Comparison of Prediction Methodologies

Let’s examine three prominent figures: Ben Cowen, PlanB, and Tone Vays. Each employs a distinct approach to forecasting Bitcoin’s future price.

Ben Cowen, known for his in-depth technical analysis, primarily uses on-chain metrics, such as transaction volume, mining difficulty, and network activity, to support his predictions. His strength lies in his meticulous data analysis and his focus on objective indicators. However, a weakness is that on-chain data alone may not fully capture the impact of macroeconomic factors or regulatory changes.

PlanB, a pseudonymous analyst, is famous for his stock-to-flow model. This model uses the ratio of Bitcoin’s existing supply to its newly mined supply to project future price. The strength of this model is its simplicity and the apparent correlation it has shown historically. However, a major weakness is that it assumes a consistent rate of adoption and doesn’t account for unexpected events, such as regulatory crackdowns or technological disruptions.

Tone Vays, a seasoned trader, combines technical analysis with macroeconomic considerations to form his predictions. He analyzes charts, trading volume, and market sentiment alongside broader economic trends. His strength lies in his holistic approach, considering multiple factors. However, the complexity of his methodology can make it difficult for less experienced investors to follow and understand, and his predictions can be highly subjective.

Impact of Influencer Sentiment on Bitcoin Price

The collective sentiment expressed by these and other cryptocurrency influencers can significantly impact Bitcoin’s price. Positive predictions can fuel buying pressure, leading to price increases, while negative predictions can trigger selling and price declines. This effect is amplified by the herd mentality often seen in the cryptocurrency market, where investors tend to follow the opinions of well-known figures. The influence is not always direct or immediate; however, consistent positive or negative sentiment over time can contribute to noticeable price movements. For example, a widely publicized prediction of a significant price drop can lead to a self-fulfilling prophecy as investors rush to sell, causing the predicted drop to occur.

Comparison of 2025 Bitcoin Price Predictions

| Influencer | 2025 Bitcoin Price Prediction | Reasoning |

|---|---|---|

| Ben Cowen | (Example: $150,000 – $200,000) | Based on on-chain metrics suggesting sustained growth and adoption. |

| PlanB | (Example: $288,000) | Based on the stock-to-flow model projection, assuming consistent adoption rates. |

| Tone Vays | (Example: $100,000 – $300,000) | Based on a combination of technical analysis and macroeconomic factors, with a wide range due to inherent uncertainty. |

Factors Influencing Predictions

Predicting Bitcoin’s price in 2025 is inherently complex, relying on a confluence of macroeconomic trends, technological advancements, regulatory landscapes, and unpredictable events. While no prediction is guaranteed, understanding these influencing factors provides a more nuanced perspective on the potential price trajectory.

Macroeconomic Factors

Macroeconomic conditions significantly impact Bitcoin’s price. Factors such as inflation, interest rates, and overall economic growth play crucial roles. For instance, high inflation often drives investors towards alternative assets like Bitcoin, potentially increasing demand and price. Conversely, rising interest rates can make holding Bitcoin less attractive compared to interest-bearing accounts, potentially leading to price declines. Many YouTube predictors frequently cite the correlation between the US dollar’s strength or weakness and Bitcoin’s price movement as a key indicator. A weakening dollar often leads to increased Bitcoin investment, while a strengthening dollar can have the opposite effect. The global economic outlook, including potential recessions or periods of robust growth, also influences investor sentiment and consequently, Bitcoin’s price.

Technological Advancements

Technological improvements within the Bitcoin ecosystem significantly affect its usability and adoption rate, influencing price. The Lightning Network, for example, aims to improve transaction speed and reduce fees, making Bitcoin more suitable for everyday transactions. Widespread adoption of the Lightning Network could potentially increase Bitcoin’s utility and drive price appreciation. Other technological advancements, such as improved mining hardware or the development of new scaling solutions, could also impact Bitcoin’s price by increasing transaction throughput and efficiency. Successful integration of these advancements would likely increase investor confidence and attract new users.

Regulatory Changes

Government regulations significantly influence Bitcoin’s price. Jurisdictions adopting a more favorable regulatory framework often see increased Bitcoin adoption and price appreciation. For example, El Salvador’s adoption of Bitcoin as legal tender initially led to a price surge, although the long-term effects were mixed. Conversely, stricter regulations, such as outright bans or excessive taxation, can dampen investor enthusiasm and negatively impact price. The regulatory landscape is constantly evolving, and differing approaches across countries create varying degrees of uncertainty and impact the overall price. For instance, the differing regulatory stances of the US, China, and the European Union on cryptocurrencies directly influence market sentiment and investor behavior.

Black Swan Events

Unforeseen events, often termed “black swan” events, can drastically alter Bitcoin’s price. These are unpredictable occurrences with significant consequences. Examples include a major security breach compromising the Bitcoin network, a sudden and unexpected change in government policy towards Bitcoin on a global scale, or a significant technological disruption rendering the current Bitcoin infrastructure obsolete. A major geopolitical event, such as a large-scale conflict, could also trigger a significant price shift depending on investor reaction and market sentiment. These unpredictable events are inherently difficult to forecast, highlighting the inherent risk associated with Bitcoin investment.

Analyzing Prediction Methods

Predicting Bitcoin’s price is a complex endeavor, and YouTube channels often employ a mix of technical and fundamental analysis, sometimes incorporating on-chain metrics. Understanding the strengths and weaknesses of each approach is crucial for evaluating the credibility of these predictions. This section will compare and contrast these methods, highlighting their limitations and biases, and examining the role of on-chain data.

Technical analysis and fundamental analysis represent two distinct approaches to Bitcoin price prediction. Technical analysis focuses on historical price and volume data to identify patterns and trends, while fundamental analysis assesses the underlying value of Bitcoin based on factors like adoption, regulation, and technological advancements. Both methods have their limitations and inherent biases, and their effectiveness varies depending on market conditions.

Technical Analysis in Bitcoin Price Predictions

Technical analysis utilizes charts and indicators to predict future price movements. Common tools include moving averages, relative strength index (RSI), and support/resistance levels. While proponents claim that these patterns repeat, critics argue that past performance doesn’t guarantee future results, and the subjective interpretation of charts can lead to significant biases. For example, a YouTuber might interpret a head-and-shoulders pattern as a bearish signal, while another might see it differently. The lack of a strong theoretical foundation also contributes to the limitations of this method. Overreliance on technical indicators without considering fundamental factors can lead to inaccurate predictions.

Fundamental Analysis in Bitcoin Price Predictions

Fundamental analysis attempts to determine the intrinsic value of Bitcoin by considering factors beyond price charts. This includes assessing the adoption rate, the regulatory environment, the development of the Bitcoin network, and the overall macroeconomic climate. A YouTuber might, for example, predict a price increase based on growing institutional adoption or positive regulatory developments. However, fundamental analysis is also subject to biases. Predictions can be influenced by personal opinions and beliefs, and it’s challenging to accurately quantify the impact of various fundamental factors. For instance, accurately predicting regulatory changes is inherently difficult, introducing significant uncertainty into any prediction.

On-Chain Metrics and Bitcoin Price Predictions, Bitcoin Price Prediction 2025 Youtube

On-chain metrics provide valuable insights into the underlying activity of the Bitcoin network. These metrics include transaction volume, hash rate, and the number of active addresses. High transaction volume and hash rate generally suggest strong network activity and potential for price increases. Conversely, a decrease in these metrics might indicate a weakening of the network and potentially lower prices. However, interpreting on-chain data requires expertise and caution. Correlation doesn’t equal causation; while these metrics often correlate with price movements, they don’t always predict them accurately. Furthermore, on-chain data can be manipulated or misinterpreted, leading to flawed predictions.

Examples of Successful and Unsuccessful Predictions

Many YouTubers have made both successful and unsuccessful Bitcoin price predictions. A successful prediction might involve a YouTuber accurately forecasting a price surge based on a confluence of technical and fundamental factors, such as a significant halving event combined with increasing institutional investment. For instance, some YouTubers correctly predicted the general upward trend of Bitcoin in 2020-2021. Conversely, unsuccessful predictions often stem from overreliance on a single indicator or neglecting crucial macroeconomic factors. For example, predictions based solely on technical patterns without considering the impact of a global economic downturn often prove inaccurate. The reasoning behind successful predictions usually involves a well-rounded approach, incorporating multiple factors and acknowledging inherent uncertainties, while unsuccessful predictions often show a lack of comprehensive analysis or an overestimation of predictive power.

Risk and Disclaimer Considerations

Investing in Bitcoin, like any other asset, carries significant risk. This video presents potential price predictions for Bitcoin in 2025, but these are speculative and should not be considered financial advice. It’s crucial to understand the inherent volatility of the cryptocurrency market and the potential for substantial losses before making any investment decisions.

Disclaimer

This video is for informational and entertainment purposes only. It does not constitute financial advice. The Bitcoin price predictions presented are based on analysis and interpretation of market trends and should not be taken as guarantees of future performance. Past performance is not indicative of future results. Investing in Bitcoin involves significant risk, including the potential for total loss of your investment. You are solely responsible for your investment decisions. Consult with a qualified financial advisor before making any investment decisions. We are not liable for any losses incurred as a result of relying on the information provided in this video. The creators of this video have no financial interest in any specific outcome of Bitcoin’s price.

Inherent Risks of Bitcoin Investment

Bitcoin’s price is notoriously volatile. It can experience significant price swings in short periods, influenced by factors such as regulatory changes, market sentiment, technological developments, and macroeconomic conditions. For example, Bitcoin’s price plummeted by over 50% in 2022, highlighting the potential for substantial losses. Furthermore, the cryptocurrency market is relatively unregulated in many jurisdictions, increasing the risk of scams and fraud. The security of your Bitcoin holdings also depends on the security of your chosen exchange or wallet, which are vulnerable to hacking and theft. Finally, the long-term viability of Bitcoin itself is uncertain, and its value could potentially decline to zero.

Responsible Investing Practices

Responsible Bitcoin investing involves careful risk management and due diligence. This includes only investing what you can afford to lose, diversifying your investment portfolio across various asset classes, and conducting thorough research before making any investment decisions. It is essential to understand the technology behind Bitcoin, the risks involved, and the regulatory landscape before investing. Using reputable exchanges and secure storage methods is also crucial to mitigate the risk of theft or loss. Regularly reviewing your investment strategy and adjusting it based on market conditions and your own risk tolerance is another key aspect of responsible investing. For instance, a responsible investor might allocate only a small percentage of their portfolio to Bitcoin, diversifying into more stable assets like stocks or bonds.

Ethical Considerations of Presenting Financial Predictions

Presenting financial predictions on YouTube requires a high degree of ethical responsibility. It’s crucial to avoid misleading or deceptive claims, to clearly state the limitations of the predictions, and to emphasize the inherent risks involved. Transparency about potential conflicts of interest, such as affiliations with specific cryptocurrency exchanges or projects, is also essential. Presenting predictions without proper disclaimer or acknowledging the speculative nature of the forecast is unethical and potentially harmful to viewers. For example, a responsible YouTuber would explicitly state that their predictions are not financial advice and that viewers should conduct their own research before making investment decisions. They would also clearly present the data and methodology used in their analysis, allowing viewers to critically assess the validity of the predictions.

FAQ

This section addresses frequently asked questions regarding Bitcoin price predictions for 2025 as found on YouTube, focusing on reliability, influencing factors, and legal considerations. Understanding these aspects is crucial for navigating the often-volatile landscape of cryptocurrency predictions.

Common Bitcoin Price Predictions for 2025 on YouTube

YouTube hosts a wide spectrum of Bitcoin price predictions for 2025. While precise figures vary dramatically depending on the source, a common range observed is between $100,000 and $500,000. The variance stems from differing methodologies, underlying assumptions about adoption rates, regulatory changes, and macroeconomic factors. Some predictions lean towards the lower end, citing potential market corrections or regulatory hurdles. Others project significantly higher prices, often based on optimistic scenarios of mass adoption and institutional investment. These variations highlight the inherent uncertainty in long-term price forecasting.

Reliability of YouTube Bitcoin Price Predictions

The reliability of YouTube Bitcoin price predictions is highly variable and generally low. Many predictions lack transparency in their methodologies, relying on speculation rather than rigorous analysis. Influencers may exhibit confirmation bias, focusing on information supporting their pre-existing beliefs. Furthermore, some channels may prioritize engagement over accuracy, making sensationalized predictions to attract viewers. External factors like market manipulation and unforeseen global events can also significantly impact price movements, rendering many predictions inaccurate. It’s crucial to remember that no one can definitively predict the future price of Bitcoin.

Factors to Consider Before Trusting a YouTube Bitcoin Price Prediction

Viewers should critically evaluate the credibility of any YouTube Bitcoin price prediction before considering it. Several key factors are vital. First, examine the source’s track record: has the predictor accurately forecasted prices in the past? Second, assess the methodology: is the prediction based on sound financial analysis, or merely speculation and conjecture? Third, consider potential biases: does the presenter have a vested interest in a particular price outcome? Fourth, look for transparency: does the prediction explain its underlying assumptions and limitations? Finally, remember that even with rigorous analysis, unforeseen events can drastically alter the price. A holistic assessment of these factors is essential.

Legal Implications for Providing Bitcoin Price Predictions on YouTube

Providing Bitcoin price predictions on YouTube carries potential legal implications, primarily concerning securities laws and consumer protection regulations. While expressing opinions is generally permissible, presenting predictions as guaranteed outcomes or financial advice without the necessary qualifications can lead to legal issues. Creators should clearly state that their predictions are opinions, not financial advice, and include comprehensive disclaimers emphasizing the inherent risks involved in cryptocurrency investments. Failure to do so could result in legal action from investors who suffer losses based on misleading information. Compliance with relevant regulations and the inclusion of robust disclaimers are paramount.

Many YouTube channels offer Bitcoin price predictions for 2025, varying widely in their methodologies and conclusions. For a different perspective, consider checking out reputable financial sources; for instance, you might find insightful analysis in the Bitcoin Price Prediction 2025 Forbes article. Comparing these different viewpoints can help you form a more well-rounded understanding before making any investment decisions based on Bitcoin Price Prediction 2025 Youtube videos.

Many YouTube channels offer Bitcoin price predictions for 2025, often presenting diverse and sometimes conflicting viewpoints. For a more established financial perspective, you might want to cross-reference these predictions with analyses from reputable sources like Forbes; check out their insights on the subject at Bitcoin Price Prediction 2025 Usd Forbes. Comparing these different approaches can provide a more well-rounded understanding before forming your own conclusions about Bitcoin’s potential trajectory in 2025 as discussed on YouTube.

Many YouTube channels offer Bitcoin Price Prediction 2025 analyses, often focusing on global trends. However, for a more regionally specific outlook, considering the UK market is crucial; you might find helpful information at this link for Bitcoin Price Prediction 2025 Uk which can then be compared to the broader predictions found on YouTube channels dedicated to Bitcoin price forecasting.

Many YouTube channels offer Bitcoin price predictions for 2025, varying wildly in their methodologies and conclusions. For a different perspective, you might find the projections from a reputable source like Bitcoin Price Prediction 2025 Walletinvestor helpful in comparing data. Ultimately, comparing various sources, including YouTube analyses and dedicated financial prediction sites, provides a more well-rounded understanding of potential Bitcoin price movements in 2025.

Many YouTube channels offer Bitcoin price predictions for 2025, often employing varying methodologies and resulting in a wide range of forecasts. To understand potential price movements, focusing on specific months within that year can be helpful; for example, you might want to check out a dedicated analysis of the Bitcoin Price February 2025 to gain a more granular perspective.

This detailed look can then inform your broader interpretation of the numerous Bitcoin Price Prediction 2025 YouTube videos available.