Bitcoin Halving 2025: Bitcoin Price Prediction After Halving 2025

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, and it’s a significant event that has historically influenced Bitcoin’s price. The upcoming halving in 2025 is generating considerable market anticipation.

Bitcoin Halving Event and Historical Price Impact

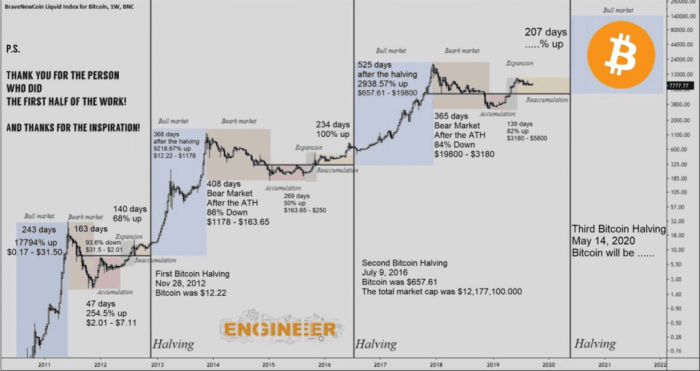

The Bitcoin halving mechanism is designed to control inflation. Every 210,000 blocks mined, the reward given to miners for validating transactions is cut in half. This reduces the influx of new Bitcoins into circulation. Historically, the halving events have been followed by periods of increased Bitcoin price. For instance, the 2012 halving preceded a significant bull market, and a similar pattern, although less pronounced, was observed after the 2016 halving. However, it is important to note that correlation does not equal causation; other market factors also influence Bitcoin’s price.

Anticipated Supply Reduction in 2025 and Potential Effects

The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC. This represents a 50% decrease in the rate of new Bitcoin issuance. This reduction in supply, coupled with relatively consistent demand, is anticipated to create upward pressure on the price. The magnitude of this price increase is subject to considerable debate, however, and depends on various factors including overall market sentiment, regulatory developments, and macroeconomic conditions. Past halvings have shown varying degrees of price appreciation, ranging from modest increases to substantial rallies. Predicting the precise outcome for 2025 is challenging.

Typical Market Reactions Following Previous Halvings

Following previous halvings, the Bitcoin market has exhibited a range of reactions. While there has been a general upward trend in price following the halving events, the timing and magnitude of the price increase have varied significantly. Sometimes, the price increase has been gradual, occurring over several months or even years. In other instances, the price has experienced a more rapid and dramatic surge. This variability highlights the complex interplay of various factors influencing Bitcoin’s price beyond just the halving event itself. The market’s response is also influenced by the prevailing macroeconomic climate and broader investor sentiment towards cryptocurrencies.

Factors Influencing Bitcoin’s Price Post-Halving

Predicting Bitcoin’s price after the 2025 halving is inherently complex, as numerous interconnected factors exert significant influence. While the halving itself reduces the rate of new Bitcoin entering circulation, impacting supply, other macroeconomic conditions, regulatory actions, and technological developments play equally crucial roles in shaping the price trajectory. Understanding these diverse influences is key to forming a well-informed perspective.

Macroeconomic Factors

Global macroeconomic conditions significantly impact Bitcoin’s price. High inflation, for example, can drive investors towards Bitcoin as a hedge against inflation, increasing demand and potentially pushing prices upward. Conversely, rising interest rates, making traditional investments more attractive, could lead to a decrease in Bitcoin investment and a subsequent price decline. The correlation between Bitcoin’s price and the performance of the US dollar, a major reserve currency, is also frequently observed, reflecting the interconnectedness of global financial markets. For instance, a weakening US dollar could potentially boost Bitcoin’s price as investors seek alternative assets.

Regulatory Developments, Bitcoin Price Prediction After Halving 2025

Regulatory clarity and actions by governments worldwide profoundly affect Bitcoin’s price. Favorable regulations, such as the establishment of clear legal frameworks for cryptocurrency trading and usage, can increase institutional investment and boost market confidence, leading to price appreciation. Conversely, restrictive regulations, such as outright bans or excessive taxation, can dampen investor enthusiasm and negatively impact the price. The differing regulatory approaches taken by various countries, like El Salvador’s adoption of Bitcoin as legal tender versus China’s ban, highlight the significant impact of government policy on market dynamics.

Technological Advancements and Adoption Rates

Technological advancements within the Bitcoin ecosystem and broader cryptocurrency space play a pivotal role in price fluctuations. Improvements in scalability, transaction speed, and security can enhance Bitcoin’s usability and attract more users and investors. Increased adoption by businesses and institutions, particularly for payments and other applications, can also lead to greater demand and potentially higher prices. Conversely, technological setbacks or security breaches can erode confidence and negatively impact the price. The development of the Lightning Network, for example, aims to address Bitcoin’s scalability limitations, and its successful adoption could significantly impact its price.

Market Sentiment Before and After Previous Halvings

Comparing market sentiment before and after previous halvings provides valuable insights. Historically, the period leading up to a halving often sees increased anticipation and price speculation, driven by the expectation of future scarcity and price appreciation. However, the actual price movements post-halving have varied considerably, influenced by other concurrent market factors. For example, while the 2012 and 2016 halvings were followed by significant price increases, the 2020 halving saw a more gradual price appreciation, demonstrating the interplay of various factors beyond the halving itself. Analyzing investor behavior and media narratives surrounding previous halvings offers a historical context for assessing potential future scenarios.

Impact of Competing Cryptocurrencies

The emergence and development of competing cryptocurrencies, particularly those with innovative technological features or specific use cases, can influence Bitcoin’s price. These competitors can attract investors and developers away from Bitcoin, potentially reducing demand and impacting its price. The rise of Ethereum, for example, introduced smart contract functionality, attracting developers and investors who sought functionalities not available in Bitcoin. However, Bitcoin’s established position as the leading cryptocurrency, its brand recognition, and its perceived security continue to be significant factors. The overall market capitalization of the entire cryptocurrency space also plays a role, as a general downturn in the crypto market can affect Bitcoin irrespective of its own unique attributes.