Bitcoin Price Prediction 2025

Bitcoin, the pioneering cryptocurrency, has experienced a turbulent yet fascinating journey since its inception in 2009. From a niche digital asset to a globally recognized phenomenon, its price has demonstrated extreme volatility, swinging wildly from near-zero to record highs and back again. This volatility stems from a complex interplay of factors, making accurate price prediction a challenging, yet highly sought-after, endeavor.

Bitcoin’s price is influenced by a multitude of interconnected factors. Technological advancements, such as the implementation of the Lightning Network for faster and cheaper transactions, can positively impact its adoption and, consequently, its price. Conversely, regulatory changes, ranging from outright bans to comprehensive frameworks, significantly affect investor confidence and market liquidity. Market sentiment, driven by news cycles, social media trends, and overall economic conditions, plays a crucial role, often leading to dramatic price swings based on speculation and fear rather than fundamental value. For example, positive news regarding institutional adoption can drive prices upward, while negative news about security breaches or regulatory crackdowns can trigger sharp declines.

Factors Influencing Bitcoin’s Price

The price of Bitcoin is not determined by a single factor but rather a dynamic interaction of several key elements. Technological improvements, such as increased transaction speeds and scalability solutions, enhance Bitcoin’s utility and appeal, potentially increasing demand and price. Conversely, regulatory uncertainty and negative government pronouncements can create a climate of fear, uncertainty, and doubt (FUD), leading to price drops. Finally, broader macroeconomic trends, such as inflation fears or shifts in investor risk appetite, also significantly influence Bitcoin’s price trajectory. For instance, during periods of high inflation, investors may seek refuge in Bitcoin as a hedge against currency devaluation, leading to price appreciation.

Understanding Price Predictions and Their Limitations

While Bitcoin price predictions abound, it’s crucial to approach them with a healthy dose of skepticism. No prediction is guaranteed, and many factors are beyond the control of even the most sophisticated forecasting models. Predictions often rely on assumptions about future technological advancements, regulatory landscapes, and market sentiment – all of which are inherently uncertain. For example, a prediction based on widespread institutional adoption might be invalidated by unexpected regulatory hurdles. Therefore, while predictions can offer a potential range of outcomes, they should be viewed as speculative scenarios rather than definitive forecasts. It’s essential to consider the limitations and underlying assumptions of any prediction before making investment decisions based on them. Past performance, while informative, is not indicative of future results. The inherent volatility of Bitcoin makes long-term predictions particularly challenging, and any forecast should be treated with caution.

Analyzing Historical Bitcoin Price Trends

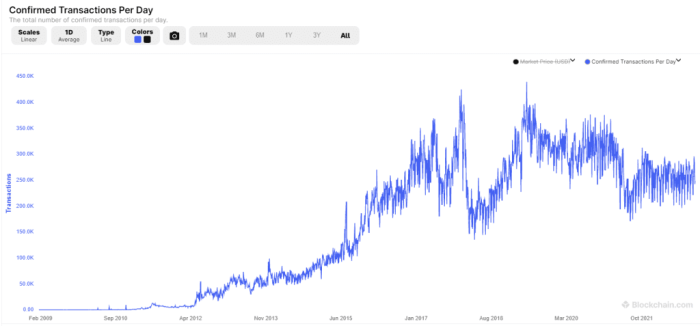

Understanding Bitcoin’s past price movements is crucial for informed speculation about its future. Analyzing historical data allows us to identify recurring patterns, significant events influencing price volatility, and potential indicators of future price action. While past performance is not indicative of future results, studying historical trends provides valuable context for evaluating potential scenarios.

By examining Bitcoin’s price fluctuations over the past five years, we can observe distinct cyclical patterns and the impact of various external factors. This analysis incorporates both quantitative data, such as price changes, and qualitative data, such as significant market events.

Bitcoin Price Fluctuations (2019-2023): A Visual Representation

Imagine a line chart depicting Bitcoin’s price from January 2019 to December 2023. The y-axis represents the Bitcoin price in USD, ranging from, say, $3,000 to $69,000, depending on the specific scale. The x-axis represents time, marked in yearly increments. The line itself would show a volatile pattern, with significant peaks and troughs. Key markers would be visually represented: the halving events of May 2020 and April 2024 would be denoted by distinct vertical lines, perhaps with small labels indicating the date and the event. Major market crashes, such as the one in March 2020 (the COVID-19 crash) and the downturn in late 2021/early 2022, would be indicated by clear downward spikes on the line, potentially labeled with the approximate date and a brief description. The chart would clearly illustrate the cyclical nature of Bitcoin’s price, showing periods of rapid growth followed by sharp corrections.

Comparison of Past Bitcoin Price Cycles

Bitcoin’s price history reveals distinct cyclical patterns. Each cycle typically comprises a period of accumulation, followed by a rapid price increase (bull market), a peak, and a subsequent correction (bear market). The duration and intensity of these cycles vary, but some similarities exist. For instance, the bull market leading up to the 2017 peak and the one leading to the 2021 peak shared similarities in terms of the rate of price increase and the level of public excitement and media coverage. Similarly, the subsequent bear markets also displayed some parallels in their duration and depth. However, it’s important to note that each cycle is influenced by unique macroeconomic factors and market sentiment. The 2020 crash, for example, was heavily influenced by the global pandemic, unlike previous crashes primarily driven by internal market dynamics.

Key Indicators Correlating with Bitcoin Price Movements

Several factors historically correlate with Bitcoin’s price movements. These include macroeconomic conditions (e.g., inflation, interest rates, global economic uncertainty), regulatory developments (e.g., government pronouncements on cryptocurrency regulation), technological advancements (e.g., the introduction of new cryptocurrencies or significant upgrades to the Bitcoin network), and market sentiment (e.g., social media trends, news coverage, institutional investment). For example, periods of high inflation have often been associated with increased Bitcoin adoption as a hedge against inflation, leading to price increases. Conversely, negative regulatory announcements or significant security breaches have typically led to price drops. Analyzing the interplay of these factors helps to provide a more comprehensive understanding of Bitcoin’s price behavior.

Factors Influencing Bitcoin’s Future Price

Predicting Bitcoin’s price in 2025, or any year for that matter, is inherently complex. Numerous interconnected factors, ranging from technological advancements to global economic shifts, play a significant role. Understanding these influences is crucial for navigating the volatile cryptocurrency market.

Technological Advancements

Technological improvements within the Bitcoin ecosystem can significantly impact its price. The Lightning Network, for instance, aims to address Bitcoin’s scalability limitations by enabling faster and cheaper transactions off the main blockchain. Widespread adoption of the Lightning Network could boost Bitcoin’s usability for everyday payments, potentially increasing demand and driving up the price. Similarly, Taproot, a significant upgrade to Bitcoin’s scripting language, enhances transaction privacy and efficiency, making it more attractive to both individuals and institutions. These enhancements reduce transaction fees and increase transaction speeds, making Bitcoin a more practical and competitive payment system. The success of these upgrades hinges on their adoption rate and integration within existing Bitcoin infrastructure.

Regulatory Frameworks and Government Policies

Government regulations and policies significantly influence Bitcoin’s adoption and price. Favorable regulatory environments, such as those seen in some jurisdictions that have embraced Bitcoin as a legitimate asset class, can lead to increased institutional investment and broader public acceptance. Conversely, restrictive regulations, including outright bans or heavy taxation, can stifle growth and depress the price. The regulatory landscape is constantly evolving, and its impact on Bitcoin’s price is unpredictable, often resulting in short-term volatility but potentially long-term effects on market sentiment and overall adoption. Examples include El Salvador’s adoption of Bitcoin as legal tender, which initially caused a price surge, or China’s ban on cryptocurrency trading, which resulted in a temporary price drop.

Macroeconomic Factors

Macroeconomic conditions, such as inflation and interest rates, play a substantial role in Bitcoin’s price. During periods of high inflation, Bitcoin, often perceived as a hedge against inflation, may see increased demand as investors seek to preserve their purchasing power. Conversely, rising interest rates can make other investment options, like bonds, more attractive, potentially diverting capital away from Bitcoin and causing its price to fall. For example, during periods of high inflation in 2021, Bitcoin’s price surged as investors sought alternative assets. However, the subsequent rise in interest rates in 2022 led to a significant price correction. The interplay between these macroeconomic factors and Bitcoin’s price is dynamic and complex.

Institutional Investment versus Individual Investor Sentiment

The influence of institutional investors and individual investor sentiment on Bitcoin’s price is distinct yet intertwined. Large institutional investments, such as those from corporations or investment firms, can provide significant price support and drive up demand. However, these investments are often strategic and less susceptible to short-term market fluctuations. Individual investor sentiment, on the other hand, can be highly volatile, leading to rapid price swings based on news, market trends, and overall confidence in the cryptocurrency market. For example, Tesla’s investment in Bitcoin in 2021 significantly boosted the price, while subsequent negative news about Bitcoin often leads to sell-offs driven by individual investor fear. The balance between institutional stability and individual investor emotion significantly shapes Bitcoin’s price trajectory.

Exploring Different Price Prediction Models: Bitcoin Price Prediction Chart 2025

Predicting Bitcoin’s price is inherently complex, relying on various methodologies with their own strengths and weaknesses. No single model guarantees accuracy, and combining insights from multiple approaches often yields a more comprehensive understanding. The following Artikels three prominent prediction models, examining their applications and limitations in forecasting Bitcoin’s price in 2025.

Technical Analysis

Technical analysis uses historical price and volume data to identify patterns and predict future price movements. It focuses on chart patterns, indicators (like RSI, MACD), and support/resistance levels. This approach is entirely data-driven, ignoring fundamental factors.

| Aspect | Strengths | Weaknesses | Application to 2025 Prediction |

|---|---|---|---|

| Methodology | Relatively simple to understand and apply; identifies potential trend reversals and support/resistance levels. | Subjective interpretation of charts; susceptible to manipulation; doesn’t consider underlying fundamentals. | Analyzing historical Bitcoin price charts, identifying long-term trends, and projecting potential price targets based on identified patterns and support/resistance levels. For example, identifying a potential breakout above a long-term resistance level could suggest a significant price increase in 2025. |

Fundamental Analysis

Fundamental analysis evaluates Bitcoin’s intrinsic value by considering factors like adoption rate, network security, regulatory environment, and macroeconomic conditions. It seeks to determine whether the current price accurately reflects Bitcoin’s underlying value.

| Aspect | Strengths | Weaknesses | Application to 2025 Prediction |

|---|---|---|---|

| Methodology | Provides a broader context for price movements; considers factors beyond just price history. | Difficult to quantify many of the factors; susceptible to unforeseen events (e.g., regulatory changes). | Assessing factors like global adoption, institutional investment, and technological advancements to estimate Bitcoin’s potential market capitalization in 2025. For example, widespread institutional adoption could significantly increase demand and drive the price upwards. |

On-Chain Analysis

On-chain analysis examines data directly from the Bitcoin blockchain, such as transaction volume, mining activity, and the distribution of Bitcoin among addresses. This approach aims to identify trends and patterns within the network itself that might correlate with price movements.

| Aspect | Strengths | Weaknesses | Application to 2025 Prediction |

|---|---|---|---|

| Methodology | Provides objective, verifiable data; can identify potential shifts in market sentiment. | Correlation doesn’t equal causation; complex data requires expertise to interpret effectively. | Analyzing metrics such as the number of active addresses, transaction fees, and miner revenue to gauge network activity and predict potential price changes. For instance, a significant increase in active addresses might indicate growing adoption and potential price appreciation. |

Potential Price Scenarios for Bitcoin in 2025

Predicting the price of Bitcoin is inherently speculative, influenced by a complex interplay of technological advancements, regulatory changes, macroeconomic factors, and market sentiment. While no one can definitively say what Bitcoin’s price will be in 2025, exploring potential scenarios based on different assumptions can provide a valuable framework for understanding the possibilities. The following scenarios present three distinct paths Bitcoin’s price might take, ranging from highly optimistic to pessimistic.

Bitcoin Price Scenarios in 2025: A Comparative Analysis

The following table summarizes three distinct price scenarios for Bitcoin in 2025: a bullish scenario, a neutral scenario, and a bearish scenario. Each scenario is based on a set of specific assumptions regarding technological adoption, regulatory landscape, and macroeconomic conditions. The hypothetical price charts illustrate potential price trajectories, highlighting key inflection points and underlying drivers.

| Scenario | Price Prediction (USD) | Underlying Assumptions | Hypothetical Price Chart Description |

|---|---|---|---|

| Bullish | $150,000 – $200,000 | Widespread institutional adoption, positive regulatory developments globally, sustained macroeconomic growth, and significant technological advancements (e.g., Layer-2 scaling solutions, improved privacy features). Increased demand driven by institutional investors, retail investors, and growing acceptance as a store of value. | The chart would show a steady, upward trend from the present day to 2025. Initial growth would be moderate, followed by a period of accelerated growth driven by positive news and increased institutional investment. The chart might show some minor corrections along the way, but the overall trajectory would be strongly bullish, culminating in a price range of $150,000 to $200,000 by the end of 2025. The chart would resemble a hockey stick, with a steep incline towards the end of the period. Think of the 2017 bull run, but potentially even more pronounced. |

| Neutral | $50,000 – $75,000 | Moderate institutional adoption, mixed regulatory signals across different jurisdictions, relatively stable macroeconomic conditions, and incremental technological improvements. Growth is driven by a balance of positive and negative factors, resulting in a less volatile price movement compared to the bullish scenario. | This chart would display a more gradual and less dramatic price movement than the bullish scenario. It would show periods of both growth and consolidation, with the overall trend being relatively flat. The price would likely fluctuate within a range, potentially experiencing several minor bull and bear cycles. The chart would show a relatively smooth curve, gradually reaching a price range of $50,000 to $75,000 by 2025, without significant peaks or troughs. Similar to the price action seen in 2019-2020. |

| Bearish | $20,000 – $30,000 | Limited institutional adoption, negative regulatory actions in key markets, macroeconomic downturn (e.g., recession), and security concerns or technological setbacks. Increased selling pressure from investors concerned about the long-term prospects of Bitcoin. | This chart would show a downward trend from the present day to 2025. The initial decline might be gradual, but could accelerate due to negative news and market sentiment. The chart would display significant volatility, with several sharp drops interspersed with periods of relative stability. The price would likely struggle to break above previous highs, eventually settling in a price range of $20,000 to $30,000 by 2025. This scenario would resemble the bear market of 2018, possibly even more prolonged and severe. |

Risks and Uncertainties Associated with Predictions

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently fraught with uncertainty. Numerous factors, both internal and external to the cryptocurrency market, can significantly impact its price, making any prediction inherently speculative. While predictive models can offer insights, they should never be considered definitive forecasts.

The limitations of relying solely on predictive models are significant. These models often rely on historical data and assume past trends will continue, a risky proposition in a volatile market like cryptocurrency. Unforeseen events, such as regulatory changes, technological advancements, or macroeconomic shifts, can dramatically alter the trajectory of Bitcoin’s price, rendering even the most sophisticated models inaccurate. Furthermore, the cryptocurrency market is influenced by factors such as investor sentiment, which is notoriously difficult to quantify and predict. Over-reliance on any single model, therefore, presents a substantial risk to investors.

Limitations of Predictive Models

Predictive models, while useful tools, have inherent flaws when applied to the Bitcoin market. For instance, models based solely on historical price data might fail to account for the impact of a sudden regulatory crackdown or a major technological breakthrough. Similarly, models that incorporate market sentiment data may struggle to accurately capture the complex interplay of factors driving investor behavior. The inherent volatility of Bitcoin and the speculative nature of the cryptocurrency market further compound these limitations. A model might accurately predict a price increase based on past trends, but an unforeseen negative news event could quickly reverse this prediction. For example, a major exchange hack could trigger a significant price drop, regardless of positive predictions based on previous price action. Therefore, it’s crucial to understand that these models provide potential scenarios, not guaranteed outcomes.

Responsible Investing and Risk Management

Responsible investing in Bitcoin requires a thorough understanding of the inherent risks. Diversification is crucial; never invest more than you can afford to lose. Regularly review your investment strategy and adjust it as market conditions change. Stay informed about market developments, regulatory changes, and technological advancements that might impact Bitcoin’s price. Consider employing stop-loss orders to limit potential losses. Do not base your investment decisions solely on price predictions; instead, conduct thorough research and consider the broader context of the cryptocurrency market. For example, an investor might diversify their portfolio by investing in both Bitcoin and other cryptocurrencies with different characteristics and market sensitivities. This approach reduces the risk associated with relying on a single asset.

Bitcoin’s Role in the Future of Finance

Bitcoin’s emergence has challenged the established financial order, prompting discussions about its potential to reshape the global financial system. Its decentralized nature, transparent transaction history, and resistance to censorship offer compelling alternatives to traditional banking and payment systems. However, the extent of its influence remains a subject of ongoing debate and depends heavily on technological advancements, regulatory frameworks, and widespread adoption.

Bitcoin’s potential long-term impact on the global financial system is multifaceted. Its decentralized architecture could reduce reliance on intermediaries, potentially lowering transaction costs and increasing financial inclusion for underserved populations. The immutability of the blockchain offers enhanced security and transparency, potentially mitigating risks associated with fraud and manipulation. However, scalability challenges, volatility, and regulatory uncertainty pose significant hurdles to widespread adoption and integration into mainstream finance.

Bitcoin’s Evolution and Adaptation

Bitcoin’s future trajectory hinges on its ability to adapt to evolving technological and regulatory landscapes. Ongoing development of layer-2 scaling solutions, such as the Lightning Network, aims to address transaction speed and cost limitations. Simultaneously, the crypto industry is exploring improvements in privacy and regulatory compliance through advancements in privacy-enhancing technologies and regulatory sandboxes. The success of these adaptations will significantly influence Bitcoin’s ability to compete with established financial systems. For example, the Lightning Network’s increasing transaction volume demonstrates a practical approach to improving Bitcoin’s scalability, enabling faster and cheaper transactions.

Bitcoin’s Disruptive Potential

Bitcoin possesses the potential to disrupt traditional financial institutions by offering a decentralized alternative to centralized banking systems. Its ability to facilitate cross-border payments without intermediaries could challenge the dominance of SWIFT and other international payment networks. Moreover, the rise of decentralized finance (DeFi) built on blockchain technology offers the possibility of creating alternative financial services, such as lending and borrowing platforms, that operate independently of traditional banks. The impact of this disruption will depend on the pace of adoption and the ability of traditional institutions to adapt and compete in this evolving landscape. For instance, the growing use of stablecoins, pegged to fiat currencies, indicates a potential path for Bitcoin to integrate more seamlessly into existing financial infrastructure.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding Bitcoin’s price prediction for 2025 and the broader implications of investing in this cryptocurrency. Understanding these points is crucial for making informed decisions about your financial future.

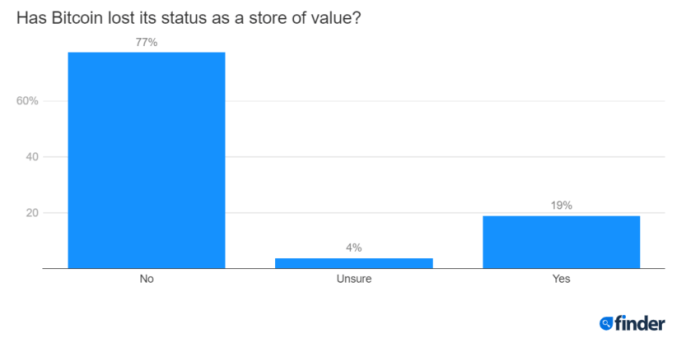

Significant Factors Impacting Bitcoin’s Price in 2025

Several interconnected factors could significantly influence Bitcoin’s price by 2025. These include regulatory developments (both positive and negative from governments worldwide), technological advancements (such as the scalability of the Bitcoin network and the emergence of layer-2 solutions), macroeconomic conditions (global inflation, recessionary fears, and the performance of traditional markets), and the overall adoption rate of Bitcoin as a payment method and store of value. For instance, widespread institutional adoption could drive prices upwards, while a major regulatory crackdown could trigger a sharp decline. The interplay of these factors makes precise prediction challenging.

Reliability of Bitcoin Price Predictions, Bitcoin Price Prediction Chart 2025

Bitcoin price predictions are inherently unreliable. The cryptocurrency market is highly volatile and susceptible to unpredictable events. While analytical models and historical trends can offer some insight, they cannot account for unforeseen circumstances like sudden regulatory changes or significant technological breakthroughs. Predictions should be viewed as speculative opinions rather than guaranteed outcomes. Consider predictions from various sources and understand their inherent limitations. For example, a prediction based solely on past price movements might fail to account for a major shift in regulatory landscape.

Potential Risks of Investing in Bitcoin

Investing in Bitcoin carries substantial risks. Its price is notoriously volatile, experiencing significant swings in short periods. The market is also susceptible to manipulation, and security breaches can lead to substantial losses. Furthermore, the regulatory environment surrounding Bitcoin remains uncertain, and changes in regulations could negatively impact its value. It’s essential to only invest what you can afford to lose and to thoroughly research the risks before entering the market. Consider the potential loss of your entire investment as a realistic possibility.

Alternative Investment Strategies

Diversification is key to mitigating risk in any investment portfolio. Alternatives to Bitcoin include traditional assets like stocks, bonds, and real estate, as well as other cryptocurrencies, precious metals, and commodities. The ideal strategy depends on individual risk tolerance, financial goals, and investment timeline. For example, a conservative investor might allocate a small percentage of their portfolio to Bitcoin, while a more aggressive investor might allocate a larger percentage. Thorough research and professional financial advice are recommended before making any investment decisions.

Reliable Information Sources on Bitcoin and its Price

Reliable information on Bitcoin and its price can be found from reputable financial news sources, cryptocurrency data websites (such as CoinMarketCap or CoinGecko), and peer-reviewed academic research. Be wary of sources that promote unrealistic returns or lack transparency. Always cross-reference information from multiple sources to ensure accuracy and avoid misinformation. Governmental and regulatory websites can also provide valuable insights into the legal and regulatory landscape surrounding Bitcoin. It is crucial to cultivate a critical and discerning approach to information gathering.

Accurately predicting the Bitcoin price in 2025 is challenging, but understanding key events is crucial. A significant factor to consider when formulating a Bitcoin Price Prediction Chart 2025 is the upcoming Bitcoin halving; for insightful analysis on this, check out this article: Bitcoin Halving:Impact On The Market 2025 Ocean News. The impact of the halving on supply and subsequent price movements will undoubtedly influence any accurate Bitcoin Price Prediction Chart 2025.

Accurately predicting the Bitcoin price in 2025 is challenging, but a key factor to consider is the upcoming halving event. Understanding the impact of this event is crucial, and a helpful resource for this is the analysis provided on Bitcoin Halving 2025 Binance. This information can significantly influence any Bitcoin Price Prediction Chart 2025 you might consult.

Accurately predicting the Bitcoin price in 2025 is challenging, with various factors influencing its trajectory. A key event to consider when examining a Bitcoin Price Prediction Chart 2025 is the upcoming halving, as detailed in this informative article on Halving Bitcoin 2025 Kapan. Understanding the impact of this halving on Bitcoin’s scarcity is crucial for any serious Bitcoin Price Prediction Chart 2025 analysis.

Predicting Bitcoin’s price for 2025 requires considering various factors, and a comprehensive Bitcoin Price Prediction Chart 2025 would ideally incorporate granular monthly data. To gain a more precise understanding of potential price movements, it’s helpful to examine specific months, such as February; for detailed predictions on that month, check out this resource: Bitcoin Price Prediction For February 2025.

This analysis can then contribute to a more accurate overall Bitcoin Price Prediction Chart 2025.

Accurately predicting the Bitcoin price in 2025 is challenging, relying on various factors influencing the market. Understanding the dynamics leading up to the halving event is crucial for informed predictions; a detailed analysis can be found in this insightful resource on Bitcoin Price Prediction Before Halving 2025. This pre-halving analysis significantly informs the broader Bitcoin Price Prediction Chart 2025, providing a valuable foundation for longer-term forecasts.

Accurately predicting the Bitcoin price in 2025 is challenging, with various charts offering different perspectives. A significant factor influencing these predictions is the upcoming halving event, which will reduce the rate of new Bitcoin creation. For more details on this crucial event, check out this insightful article on Next. Bitcoin. Halving.

2025. Understanding the halving’s impact is key to interpreting any Bitcoin Price Prediction Chart 2025.