Potential Price Scenarios for Bitcoin in 2025

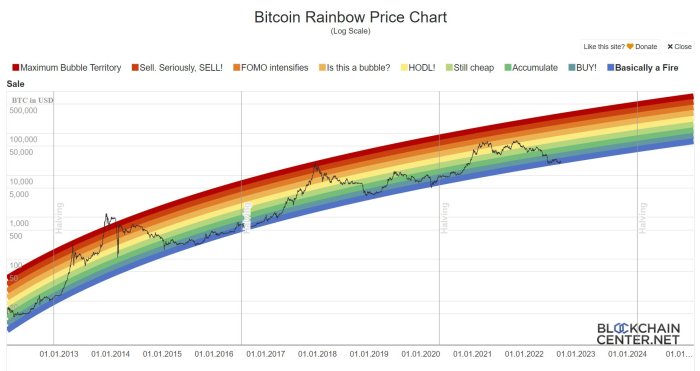

Predicting the price of Bitcoin is inherently speculative, influenced by a complex interplay of technological advancements, regulatory changes, macroeconomic factors, and market sentiment. While no one can definitively state Bitcoin’s price in 2025, exploring plausible scenarios based on current trends and historical data offers valuable insights. The following Artikels three distinct possibilities: a bullish, a bearish, and a neutral scenario.

Bullish Scenario: Bitcoin Surges to New Highs

This scenario assumes continued widespread adoption of Bitcoin as a store of value and a medium of exchange. Factors contributing to this optimistic outlook include growing institutional investment, increasing regulatory clarity (or at least a lack of significant negative regulatory action) in key markets, and further technological advancements improving scalability and transaction speeds. The narrative here centers on Bitcoin solidifying its position as digital gold, attracting a substantial influx of capital from both individual and institutional investors. A successful Bitcoin halving event in 2024, reducing the rate of new Bitcoin creation, could also contribute significantly to price appreciation. This scenario envisions a substantial increase in demand exceeding the relatively constrained supply, driving the price significantly higher. Real-world examples of similar market dynamics can be observed in the history of gold, where periods of increased demand and limited supply have led to substantial price increases.

Bearish Scenario: Bitcoin Experiences a Significant Correction

Conversely, a bearish scenario suggests a significant price decline. This could stem from several factors, including increased regulatory pressure leading to stricter controls or outright bans in major jurisdictions. A global economic downturn, impacting investor risk appetite and diverting capital away from riskier assets like Bitcoin, could also contribute to a bearish trend. Furthermore, the emergence of competing cryptocurrencies with superior technology or more compelling use cases could erode Bitcoin’s market dominance. A lack of widespread adoption, particularly among institutional investors, would further dampen price growth. This scenario assumes a negative confluence of factors leading to a substantial decrease in demand and a potential market panic. The 2018 crypto winter serves as a stark reminder of the potential volatility and susceptibility to market sentiment shifts in the cryptocurrency space.

Neutral Scenario: Bitcoin Consolidates and Experiences Moderate Growth

This scenario assumes a period of consolidation and moderate growth for Bitcoin. It represents a middle ground between the bullish and bearish scenarios, characterized by neither significant price increases nor drastic declines. This outcome suggests a period of relatively stable growth, potentially driven by steady adoption among individual investors and a gradual increase in institutional interest. Regulatory uncertainty could persist, preventing a major surge in price but also averting a significant crash. Technological advancements continue, but at a pace that doesn’t drastically alter the market dynamics. This scenario reflects a more balanced perspective, acknowledging both the potential for growth and the inherent risks associated with the cryptocurrency market. The price movement would likely be influenced by macroeconomic conditions and general market sentiment, with relatively smaller price swings compared to the bullish or bearish scenarios.

| Scenario | Price Range (USD) | Underlying Factors |

|---|---|---|

| Bullish | $100,000 – $250,000+ | Widespread adoption, institutional investment, regulatory clarity, successful halving event, technological advancements |

| Bearish | Below $20,000 | Increased regulatory pressure, global economic downturn, competition from other cryptocurrencies, lack of widespread adoption |

| Neutral | $30,000 – $60,000 | Steady adoption, gradual institutional interest, persistent regulatory uncertainty, moderate technological advancements |

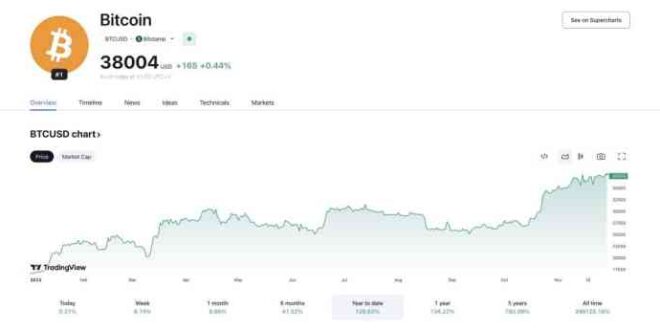

Technical Analysis of Bitcoin’s Price

Predicting Bitcoin’s price in 2025 requires analyzing historical price patterns and employing technical indicators. While no prediction is guaranteed, technical analysis provides valuable insights into potential price movements based on past market behavior. This analysis considers Bitcoin’s volatility and its susceptibility to various market forces.

Bitcoin’s price history reveals periods of significant growth punctuated by sharp corrections. These cycles, often linked to market sentiment, technological advancements, and regulatory developments, inform our understanding of potential future trajectories. Analyzing these patterns can help identify potential support and resistance levels.

Key Technical Indicators for Bitcoin Price Prediction, Bitcoin Price Prediction Daily 2025

Technical indicators offer a quantitative approach to evaluating market momentum and potential price reversals. These tools, while not foolproof, provide a framework for interpreting price action and identifying potential trading opportunities. Understanding their limitations is crucial; they should be used in conjunction with fundamental analysis for a more comprehensive view.

- Moving Averages (MA): Moving averages, such as the 50-day and 200-day MA, smooth out price fluctuations and identify trends. A bullish crossover (shorter MA crossing above the longer MA) often signals a potential uptrend, while a bearish crossover suggests a potential downtrend. For example, a bullish crossover of the 50-day MA above the 200-day MA in 2020 preceded a significant price increase.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Readings above 70 generally indicate an overbought market, suggesting a potential price correction. Readings below 30 suggest an oversold market, potentially indicating a price rebound. For instance, during the 2018 bear market, the RSI consistently fell below 30, eventually leading to a price recovery.

- Moving Average Convergence Divergence (MACD): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages. A bullish signal occurs when the MACD line crosses above the signal line, suggesting upward momentum. A bearish signal occurs when the MACD line crosses below the signal line, suggesting downward momentum. The MACD’s divergence from price action can also be a significant indicator of potential trend reversals.

Assessing Potential Upward and Downward Movements

By combining these indicators, we can develop a more nuanced understanding of potential price movements. For example, a bullish crossover of moving averages combined with an RSI reading below 30 might suggest a strong buying opportunity. Conversely, a bearish crossover of moving averages coupled with an RSI reading above 70 might indicate a potential sell signal.

It is crucial to remember that these indicators are not predictive tools in isolation. They provide valuable insights into market sentiment and momentum but should be considered alongside fundamental analysis, macroeconomic factors, and regulatory developments to form a well-rounded prediction. Unexpected events, such as regulatory changes or major technological breakthroughs, can significantly impact Bitcoin’s price, regardless of technical indicator signals.

Risks and Challenges Associated with Bitcoin Investment

Investing in Bitcoin, while potentially lucrative, carries significant risks. Understanding these risks is crucial for making informed investment decisions and mitigating potential losses. This section Artikels key challenges and explores effective risk management strategies.

Price Volatility is a defining characteristic of Bitcoin. Its price can fluctuate dramatically in short periods, influenced by factors ranging from news events and regulatory announcements to market sentiment and technological developments. For example, Bitcoin’s price experienced a significant drop in 2022, highlighting the potential for substantial losses. Investors need to be prepared for these unpredictable swings and only invest what they can afford to lose.

Price Volatility and its Impact

Bitcoin’s price history demonstrates considerable volatility. Sharp increases followed by equally dramatic decreases are common. This volatility stems from several factors including the relatively small market capitalization compared to traditional assets, the speculative nature of much of the investment, and the lack of inherent value backing the currency. This volatility creates both opportunities for significant gains and substantial risks of losses. Successful Bitcoin investors are typically those who can manage their exposure to these fluctuations effectively.

Regulatory Uncertainty

The regulatory landscape surrounding Bitcoin remains uncertain and varies significantly across jurisdictions. Governments worldwide are still grappling with how to classify and regulate cryptocurrencies, leading to potential legal and compliance challenges for investors. Changes in regulations could impact the accessibility, taxation, and even the legality of Bitcoin in different regions, creating uncertainty for investors. For example, a sudden ban on Bitcoin trading in a major market could drastically impact its price.

Security Risks

Bitcoin’s decentralized nature, while a strength, also presents security vulnerabilities. Exchanges and individual wallets can be targets for hacking and theft. Investors must carefully choose secure storage solutions and practice good security hygiene to protect their investments. The loss of private keys, for instance, results in the irreversible loss of access to Bitcoin holdings. Furthermore, the anonymity associated with Bitcoin can make it attractive for illicit activities, which can indirectly affect its value and reputation.

Risk Management Strategies for Bitcoin Investors

Effective risk management is paramount for Bitcoin investment. Diversification, not putting all your eggs in one basket, is crucial. Spreading investments across different asset classes, including traditional investments, can reduce the overall portfolio risk. Dollar-cost averaging, a strategy of investing a fixed amount of money at regular intervals regardless of price, helps mitigate the impact of price volatility. Setting stop-loss orders, which automatically sell Bitcoin when the price falls to a predetermined level, can limit potential losses. Thorough research and due diligence are also essential before making any investment decisions.

Ethical Considerations

The environmental impact of Bitcoin mining, due to its energy consumption, raises ethical concerns for some investors. The potential use of Bitcoin for illicit activities, such as money laundering and financing terrorism, also presents ethical dilemmas. Investors should consider the broader implications of their investments and align their choices with their personal values. Supporting environmentally friendly mining initiatives or investing in companies that prioritize ethical practices within the cryptocurrency space can help mitigate these concerns.

Frequently Asked Questions (FAQ): Bitcoin Price Prediction Daily 2025

This section addresses common queries regarding Bitcoin investment, covering potential benefits, risks, storage, trading platforms, and its differentiation from other cryptocurrencies. Understanding these aspects is crucial before making any investment decisions.

Potential Benefits of Investing in Bitcoin

Investing in Bitcoin offers several potential benefits, though it’s important to remember that these are not guaranteed and depend on market conditions. One key advantage is the potential for high returns. Bitcoin’s price has historically shown significant volatility, leading to substantial gains for early investors. However, this volatility also represents a significant risk (discussed below). Another benefit is decentralization. Unlike traditional currencies controlled by central banks, Bitcoin operates on a decentralized blockchain network, making it resistant to government manipulation or censorship. This aspect appeals to individuals seeking financial freedom and privacy. Finally, Bitcoin’s limited supply (21 million coins) could potentially drive its value higher over time due to increasing demand. For example, the scarcity of certain precious metals, like gold, often influences their price, and Bitcoin shares a similar attribute in its finite supply.

Risks Associated with Investing in Bitcoin

Bitcoin investment carries substantial risks. The foremost is price volatility. Bitcoin’s price can fluctuate dramatically in short periods, leading to significant losses. News events, regulatory changes, and market sentiment can all impact its value. For instance, the collapse of FTX in 2022 demonstrated the fragility of the cryptocurrency market and triggered a sharp downturn in Bitcoin’s price. Another risk is security. Bitcoin exchanges and wallets can be targets for hacking, leading to the loss of funds. Regulatory uncertainty also presents a challenge. Governments worldwide are still developing their approaches to regulating cryptocurrencies, and changes in regulations can significantly impact Bitcoin’s price and usability. Furthermore, Bitcoin’s technology is complex and requires a certain level of technical understanding, and a lack of this understanding can lead to uninformed investment decisions.

Safe Storage of Bitcoin

Safeguarding your Bitcoin requires careful consideration. Hardware wallets, physical devices designed to store cryptocurrency offline, are generally considered the most secure option. These wallets use cryptographic keys to protect your Bitcoin and are resistant to hacking attempts. Software wallets, which store your Bitcoin digitally on your computer or smartphone, are more convenient but are vulnerable to malware and hacking if not properly secured. Exchanges, while convenient for buying and selling, are not ideal for long-term storage due to their vulnerability to hacking and potential security breaches. Choosing a reputable exchange and using strong passwords and two-factor authentication is essential if you choose this route. It is crucial to diversify your storage methods and not keep all your Bitcoin in a single location.

Buying and Selling Bitcoin

Numerous platforms facilitate Bitcoin trading. Cryptocurrency exchanges, such as Coinbase, Kraken, and Binance, are popular choices, allowing you to buy and sell Bitcoin using various payment methods. Peer-to-peer (P2P) platforms connect buyers and sellers directly, offering a degree of anonymity but potentially carrying higher risks. It’s essential to choose a reputable exchange with robust security measures and a good track record. Before engaging with any platform, thoroughly research its fees, security features, and user reviews. Remember that each platform has its own set of rules and regulations, so understanding them before engaging in trading is crucial.

Difference Between Bitcoin and Other Cryptocurrencies

While Bitcoin is the most well-known cryptocurrency, many others exist. Bitcoin is often considered the “original” cryptocurrency, pioneering blockchain technology and establishing many of the core concepts used by others. However, other cryptocurrencies, known as altcoins, offer different features and functionalities. Some altcoins aim to improve upon Bitcoin’s limitations, such as transaction speed or scalability. Others focus on specific applications, such as decentralized finance (DeFi) or non-fungible tokens (NFTs). Bitcoin’s main differentiator is its established market dominance, brand recognition, and its first-mover advantage. This doesn’t inherently make it superior, but it does contribute to its stability and liquidity relative to many other cryptocurrencies.

Disclaimer

This Bitcoin price prediction for 2025, along with the accompanying technical analysis and discussion of potential scenarios, is presented for educational purposes only. It is crucial to understand that predicting the future price of Bitcoin, or any cryptocurrency for that matter, is inherently speculative and subject to a high degree of uncertainty. The information provided here should not be interpreted as financial advice, a recommendation to buy or sell Bitcoin, or a guarantee of any particular outcome.

The cryptocurrency market is highly volatile and influenced by a multitude of factors, including regulatory changes, technological advancements, macroeconomic conditions, and market sentiment. These factors are often unpredictable and can significantly impact Bitcoin’s price in ways that are difficult, if not impossible, to foresee accurately. Past performance is not indicative of future results, and any projections presented should be considered hypothetical scenarios, not certainties. Investing in Bitcoin involves significant risk, including the potential for substantial financial losses. Before making any investment decisions, it is strongly recommended that you conduct your own thorough research, seek advice from a qualified financial advisor, and carefully consider your own risk tolerance and financial circumstances.

Risk Factors Associated with Bitcoin Investment

Investing in Bitcoin carries a range of inherent risks. These include, but are not limited to, price volatility, regulatory uncertainty, security risks associated with cryptocurrency exchanges and wallets, and the potential for scams and fraudulent activities. The decentralized nature of Bitcoin, while offering certain advantages, also means that there is limited consumer protection in the event of losses. For example, the collapse of the FTX exchange highlighted the significant risks associated with centralized custodians of cryptocurrency assets. The lack of a central authority overseeing the Bitcoin network means that investors are solely responsible for securing their own holdings and understanding the associated risks. Furthermore, the speculative nature of Bitcoin investments means that prices can fluctuate dramatically in short periods, leading to substantial gains or losses. This volatility is amplified by news events, market sentiment shifts, and technological developments within the cryptocurrency ecosystem. Consider, for instance, the significant price drops Bitcoin experienced in 2018 and 2022, which underscored the potential for rapid and significant losses.