Bitcoin Price Prediction Dec 2025

Bitcoin’s price has been a rollercoaster ride since its inception. From its humble beginnings worth mere cents, it has experienced periods of explosive growth, reaching all-time highs, punctuated by equally dramatic crashes. This inherent volatility is a defining characteristic, making it both a lucrative investment opportunity and a source of considerable risk. Understanding this volatility is crucial when attempting any price prediction.

Factors Influencing Bitcoin’s Price are multifaceted and interconnected. Regulatory actions by governments worldwide significantly impact market confidence and trading volume. Positive regulatory developments, such as the clear establishment of legal frameworks for cryptocurrency trading, tend to boost prices, while stricter regulations or outright bans can lead to sharp declines. Market sentiment, driven by news cycles, technological advancements, and overall economic conditions, plays a pivotal role. Positive news and widespread adoption generally correlate with price increases, whereas negative news or market uncertainty can trigger sell-offs. Technological improvements, such as scaling solutions or the development of new applications built on the Bitcoin blockchain, can also influence the price by increasing efficiency and usability.

The inherent difficulty in accurately predicting Bitcoin’s price stems from its complex and dynamic nature. Unlike traditional assets, Bitcoin’s value isn’t directly tied to tangible assets or company performance. It’s influenced by a confluence of factors that are often unpredictable and difficult to quantify. Furthermore, the cryptocurrency market is susceptible to manipulation and speculative bubbles, making it challenging to discern long-term trends from short-term fluctuations. Any prediction involves inherent uncertainty and should be treated with caution.

Bitcoin’s Price History and Volatility

Bitcoin’s price history showcases periods of significant growth followed by substantial corrections. For example, the price surged from under $1,000 in 2017 to nearly $20,000 by the end of the year, only to plummet significantly in the following months. Similar patterns have repeated, highlighting the volatile nature of the cryptocurrency. This volatility is driven by a combination of factors including regulatory uncertainty, market speculation, and technological developments. Analyzing historical price movements, while informative, doesn’t provide a reliable basis for precise future price predictions due to the ever-changing nature of the market and influencing factors.

Factors Affecting Bitcoin’s Price: A Deeper Dive

Regulatory changes across the globe have consistently impacted Bitcoin’s price. For instance, positive regulatory announcements from major economies have historically led to price increases, reflecting growing institutional acceptance. Conversely, negative regulatory actions or uncertainty have often resulted in market corrections. Market sentiment, often fueled by media coverage and social media trends, can create powerful price swings. Positive news and narratives around adoption drive upward pressure, while negative news or fear, uncertainty, and doubt (FUD) can trigger significant sell-offs. Technological advancements, like the implementation of the Lightning Network for faster transactions, can positively influence price by enhancing Bitcoin’s functionality and scalability.

Challenges in Predicting Bitcoin’s Price

Predicting Bitcoin’s price with any degree of accuracy is exceptionally challenging due to the market’s inherent volatility and the multitude of influencing factors. The cryptocurrency market is susceptible to speculative bubbles and manipulation, making it difficult to identify sustainable long-term trends. Furthermore, the lack of a strong correlation between Bitcoin’s price and traditional economic indicators further complicates prediction models. External factors, such as macroeconomic conditions and geopolitical events, also play a significant role, adding another layer of complexity to any forecasting attempt. The decentralized nature of Bitcoin, while a strength, also makes it difficult to predict its price using traditional market analysis methods.

Market Factors Influencing Bitcoin’s Price

Bitcoin’s price is a complex interplay of various economic, technological, and social factors. Understanding these influences is crucial for navigating the volatile cryptocurrency market and forming informed predictions. This section will explore key macroeconomic conditions, institutional involvement, significant events, and comparative performance against traditional assets to provide a comprehensive overview of the forces shaping Bitcoin’s value.

Macroeconomic Conditions and Bitcoin’s Value

Macroeconomic factors, such as inflation and interest rates, significantly impact Bitcoin’s price. High inflation often drives investors towards alternative assets like Bitcoin, perceived as a hedge against inflation’s eroding purchasing power. Conversely, rising interest rates can decrease Bitcoin’s attractiveness as investors may shift towards higher-yielding traditional investments. For example, the 2022 rise in interest rates by the Federal Reserve coincided with a significant Bitcoin price drop, reflecting this inverse relationship. The strength of the US dollar, a global reserve currency, also plays a role; a strengthening dollar can negatively impact the price of Bitcoin, which is often traded in USD pairs.

Institutional Investment and Adoption

The involvement of institutional investors, including large corporations and hedge funds, is a pivotal factor in Bitcoin’s price movements. Increased institutional adoption leads to greater liquidity and price stability, as large-scale purchases and holdings can absorb market volatility. Conversely, significant institutional sell-offs can trigger sharp price declines. Examples include MicroStrategy’s substantial Bitcoin holdings and Tesla’s past investments, which significantly influenced market sentiment and price action. Regulatory clarity and the development of institutional-grade custody solutions are also crucial for fostering further institutional adoption and consequently, price stability and growth.

Influence of Major Events: The Halving

Bitcoin’s price is periodically influenced by its pre-programmed halving events. A halving reduces the rate at which new Bitcoins are mined, decreasing the supply and potentially increasing scarcity. Historically, halving events have been followed by periods of price appreciation, although the timing and magnitude of the price increase vary. The 2016 and 2020 halvings, for instance, were followed by significant bull runs, although other factors also contributed to these price increases. The next halving is expected to influence price, but the extent of that influence remains uncertain.

Bitcoin’s Price Performance Compared to Other Assets

Comparing Bitcoin’s performance with traditional assets like gold and stocks provides valuable context. Bitcoin is often touted as “digital gold,” a decentralized store of value. However, its price volatility is significantly higher than that of gold. While gold’s price typically moves more slowly and is often seen as a safe haven during times of uncertainty, Bitcoin exhibits much greater price fluctuations. Similarly, comparing Bitcoin’s price performance to major stock indices reveals contrasting patterns. While stocks often correlate with broader economic indicators, Bitcoin’s price is driven by a unique set of factors, resulting in periods of both outperformance and underperformance relative to the stock market. This comparison highlights Bitcoin’s distinct risk profile and potential for both significant gains and losses.

Technological Advancements and Their Impact

Technological advancements are crucial for Bitcoin’s continued growth and wider adoption. Improvements in scalability, transaction speeds, and mining efficiency all directly influence Bitcoin’s price and overall utility. The following sections detail how specific innovations are shaping Bitcoin’s future.

Layer-2 Scaling Solutions and Bitcoin Adoption

Layer-2 scaling solutions are designed to alleviate the burden on Bitcoin’s base layer, allowing for faster and cheaper transactions without compromising the security of the main blockchain. Solutions like the Lightning Network, which operates on top of the Bitcoin blockchain, process transactions off-chain, significantly increasing throughput. This increased efficiency leads to a more user-friendly experience, potentially attracting a broader range of users and driving up demand, thereby impacting the price positively. For example, if a merchant can accept Bitcoin payments instantly and with minimal fees using a Layer-2 solution, the likelihood of them adopting Bitcoin increases dramatically, stimulating further demand and potentially pushing the price upwards.

The Lightning Network’s Role in Transaction Efficiency

The Lightning Network is a prime example of a layer-2 solution that tackles Bitcoin’s scalability limitations. It allows for near-instantaneous and low-cost transactions by creating payment channels between users. Instead of broadcasting each transaction to the entire network, users can settle payments off-chain, only needing to update the main blockchain periodically. This significantly reduces transaction fees and speeds up confirmation times, making Bitcoin more practical for everyday use. Imagine paying for a coffee with Bitcoin instantly and without paying exorbitant fees – this is the promise of the Lightning Network, and its widespread adoption could substantially influence Bitcoin’s price.

Innovations in Mining Technology and Bitcoin’s Price, Bitcoin Price Prediction Dec 2025

Advances in mining hardware and techniques directly impact Bitcoin’s mining difficulty and energy consumption. More efficient mining equipment, such as ASICs with improved hash rates and lower power consumption, reduce the cost of mining, potentially leading to increased mining profitability and a more stable network. However, this increased efficiency could also lead to a higher hash rate, which increases the difficulty of mining and thus impacts the profitability. The overall effect on Bitcoin’s price is complex and depends on several interacting factors, including the rate of technological advancement, the price of electricity, and the overall demand for Bitcoin. A scenario where mining becomes significantly cheaper, with no corresponding increase in demand, could lead to a decrease in Bitcoin’s price as the incentive to mine decreases.

Taproot’s Potential Influence on Bitcoin’s Future

Taproot, a significant upgrade to the Bitcoin protocol implemented in late 2021, improved the efficiency and privacy of transactions. It simplifies script execution, making smart contracts on Bitcoin more efficient and cost-effective. This enhanced functionality opens doors for more sophisticated applications on the Bitcoin blockchain, potentially attracting developers and increasing the network’s utility. By making Bitcoin more versatile and developer-friendly, Taproot has the potential to boost adoption and drive up the price in the long term. The success of Taproot will largely depend on its adoption rate by developers and its effectiveness in attracting new applications built on top of the Bitcoin blockchain.

Different Prediction Models and Approaches

Predicting Bitcoin’s price in December 2025, or any future date, is inherently challenging. No model guarantees accuracy, and various approaches exist, each with its own strengths and weaknesses. Understanding these different methodologies is crucial for interpreting any price prediction.

Predicting the price of Bitcoin involves a combination of quantitative and qualitative methods, primarily falling under technical analysis and fundamental analysis. Each approach leverages different types of data and analytical techniques, offering varying levels of insight into potential future price movements.

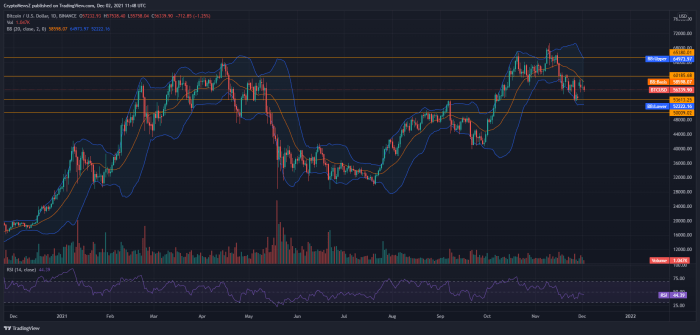

Technical Analysis

Technical analysis focuses on historical price and volume data to identify patterns and trends. It assumes that past market behavior can predict future movements. Common tools include chart patterns (e.g., head and shoulders, triangles), technical indicators (e.g., moving averages, RSI, MACD), and candlestick patterns. While technical analysis can identify potential support and resistance levels and short-term trends, its reliance on historical data limits its predictive power, particularly in highly volatile markets like Bitcoin’s. For instance, a head and shoulders pattern might suggest a price reversal, but unexpected news or regulatory changes could invalidate this prediction.

Fundamental Analysis

Fundamental analysis examines factors influencing Bitcoin’s underlying value. This includes assessing adoption rates, regulatory developments, technological advancements (such as the Lightning Network’s scalability improvements), macroeconomic conditions (inflation, interest rates), and the overall sentiment within the cryptocurrency market. For example, increased institutional adoption could signal increased demand and potential price appreciation. Conversely, negative regulatory announcements might trigger a sell-off. While fundamental analysis offers a more holistic perspective than technical analysis, it’s difficult to quantify the impact of these factors precisely, leading to subjective interpretations and varied predictions. It’s also challenging to predict the timing of these impacts on the price.

Limitations of Historical Data

Using historical data to predict future Bitcoin prices faces significant limitations. The cryptocurrency market is relatively young and highly volatile, making past performance a poor indicator of future results. Unforeseen events, such as regulatory crackdowns, significant technological breakthroughs, or large-scale market manipulations, can drastically alter price trajectories. Furthermore, the relatively small market capitalization of Bitcoin compared to traditional asset classes makes it susceptible to large price swings driven by relatively small trading volumes. Extrapolating trends from limited historical data in such a volatile market is inherently risky. For example, the 2017 Bitcoin bull run, followed by a significant price correction, demonstrates the limitations of relying solely on past price patterns.

Hypothetical Prediction Model

A more robust prediction model could incorporate elements of both technical and fundamental analysis, along with other relevant factors. Such a model might use machine learning algorithms to analyze historical price data, technical indicators, and fundamental data (e.g., adoption rates, regulatory sentiment, macroeconomic indicators). The model would need to be continuously updated to incorporate new information and adapt to changing market conditions. For instance, the model could assign weights to different factors based on their historical impact and current relevance. This approach acknowledges the limitations of relying on any single method and attempts to create a more comprehensive and nuanced prediction. The weights assigned to different factors would be continuously adjusted based on their predictive power, using techniques like backtesting and model validation. However, even such a sophisticated model cannot eliminate uncertainty; it can only provide a probabilistic estimate of potential price movements.

Potential Price Scenarios for December 2025

Predicting the price of Bitcoin in December 2025 involves considerable uncertainty, given the volatile nature of the cryptocurrency market. Numerous factors, including regulatory changes, technological advancements, and macroeconomic conditions, can significantly impact Bitcoin’s price. The following scenarios represent plausible, yet speculative, outcomes based on different assumptions about these factors. It’s crucial to remember that these are not guarantees, but rather potential trajectories.

Bitcoin Price Scenarios in December 2025

The following table Artikels three distinct price scenarios for Bitcoin in December 2025: a bullish scenario, a bearish scenario, and a neutral scenario. Each scenario is based on a set of specific assumptions regarding market forces and technological developments.

| Scenario | Price Prediction | Rationale |

|---|---|---|

| Bullish | $200,000 | This scenario assumes widespread institutional adoption, continued technological advancements (like the successful implementation of Layer-2 scaling solutions), and a generally positive global macroeconomic environment. Increased regulatory clarity and a growing understanding of Bitcoin’s role as a store of value could also contribute to a significant price surge. This outcome mirrors the optimistic predictions of some analysts who anticipate Bitcoin becoming a mainstream asset class, similar to gold’s position in traditional portfolios. A successful Bitcoin halving event in 2024 could further fuel this bullish momentum. |

| Bearish | $30,000 | This bearish scenario assumes a combination of negative factors. Increased regulatory scrutiny leading to tighter restrictions on cryptocurrency trading, a global economic downturn impacting investor risk appetite, and significant security breaches or negative news impacting investor confidence could all contribute to a substantial price decline. Furthermore, the emergence of competing cryptocurrencies or disruptive technologies could also negatively affect Bitcoin’s market dominance and price. This scenario reflects the concerns of analysts who believe Bitcoin’s price is highly susceptible to external macroeconomic factors and regulatory pressures. A lack of institutional adoption could also contribute to this outcome. |

| Neutral | $75,000 | The neutral scenario represents a more moderate outlook. It assumes a relatively stable macroeconomic environment, with neither significant positive nor negative shocks impacting the market. This scenario assumes a balance between positive and negative factors, with continued adoption and technological advancements offset by regulatory uncertainties and competition from other cryptocurrencies. This price prediction suggests a consolidation period, with Bitcoin finding a new equilibrium price point after periods of volatility. This is based on the historical trend of Bitcoin to consolidate after significant price movements. |

Risks and Uncertainties Associated with Predictions: Bitcoin Price Prediction Dec 2025

Predicting the price of Bitcoin, or any cryptocurrency for that matter, over a period as long as five years is inherently fraught with uncertainty. Numerous factors, both internal to the cryptocurrency market and external to it, can significantly influence Bitcoin’s price, making accurate long-term forecasting extremely difficult, if not impossible. While various models attempt to quantify these factors, their limitations must be acknowledged.

The inherent volatility of Bitcoin is a primary source of uncertainty. Unlike traditional assets, Bitcoin’s price can experience dramatic swings in short periods, driven by factors ranging from regulatory announcements and market sentiment to technological developments and macroeconomic conditions. These rapid price movements make predicting its future value exceptionally challenging. Any prediction model, no matter how sophisticated, is ultimately a simplification of a complex, dynamic system.

Limitations of Prediction Models

Bitcoin price prediction models rely on historical data, statistical analysis, and assumptions about future market behavior. However, the cryptocurrency market is relatively young, and its past performance may not be a reliable indicator of future trends. Many models struggle to account for unforeseen events, such as unexpected regulatory changes, major security breaches, or significant shifts in investor sentiment. For instance, a sudden, widespread adoption of Bitcoin by a large institutional investor could dramatically inflate the price, while a major security flaw could trigger a significant price drop. These are factors often not fully captured within the models. Furthermore, the assumptions underlying these models, such as constant growth rates or stable market sentiment, are often unrealistic.

Impact of Unexpected Events

The unpredictable nature of global events significantly impacts Bitcoin’s price. Geopolitical instability, economic recessions, and changes in monetary policy can all influence investor behavior and, consequently, Bitcoin’s value. The “Black Thursday” crash of March 2020, triggered partly by the initial COVID-19 pandemic-related market panic, serves as a stark reminder of how unexpected events can drastically alter the cryptocurrency landscape. Similarly, regulatory changes in major markets can dramatically impact Bitcoin’s price, as seen in past instances where regulatory uncertainty has led to both significant price increases and decreases. The potential for unforeseen events makes any long-term price prediction inherently speculative.

Inherent Volatility of Cryptocurrencies

Bitcoin’s price volatility stems from its decentralized nature, limited supply, and speculative demand. Unlike traditional assets with established valuation frameworks, Bitcoin’s value is largely determined by market sentiment and supply and demand dynamics. This can lead to significant price fluctuations in response to news, social media trends, and even celebrity endorsements. The relatively small market capitalization compared to traditional assets also exacerbates volatility, making it more susceptible to large price swings based on relatively small trading volumes. For example, a significant influx of new investors can quickly drive up the price, while a sudden wave of selling pressure can lead to sharp declines.

Importance of Thorough Research and Risk Assessment

Before investing in Bitcoin, thorough research and a careful risk assessment are crucial. Investors should understand the inherent risks associated with cryptocurrency investments, including the potential for complete loss of capital. They should not rely solely on price predictions but rather on a comprehensive understanding of the technology, the market, and the potential for unexpected events. Diversification of investments and a clear understanding of one’s own risk tolerance are essential components of any responsible investment strategy in the volatile cryptocurrency market. It’s advisable to only invest what one can afford to lose and to seek advice from qualified financial professionals before making any investment decisions.

Frequently Asked Questions (FAQs)

Predicting Bitcoin’s price is inherently complex, involving numerous interacting factors. This section addresses common questions regarding Bitcoin’s future price and the associated risks and uncertainties. Understanding these aspects is crucial for any potential investor.

Key Factors Influencing Bitcoin’s Price in 2025

Several macroeconomic and microeconomic factors will significantly impact Bitcoin’s price in 2025. These include the overall state of the global economy (recessions, inflation, interest rates), regulatory developments (government policies concerning cryptocurrency), technological advancements within the Bitcoin network itself (scaling solutions, layer-2 technologies), and market sentiment (investor confidence and speculation). For example, a global recession could negatively impact investor appetite for risk assets like Bitcoin, leading to price declines. Conversely, widespread adoption of Bitcoin by institutional investors could drive prices upward. The interplay of these factors will determine the ultimate price trajectory.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable. Numerous models exist, each employing different assumptions and methodologies, resulting in widely varying forecasts. Past performance is not indicative of future results, and unforeseen events can dramatically alter market dynamics. While some prediction models may offer plausible scenarios, they should be viewed with significant skepticism. Consider the predictions made in 2017 for Bitcoin’s price in 2023 – they were vastly inaccurate. This underscores the volatility and unpredictability of the cryptocurrency market.

Potential Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries substantial risks. Its price is notoriously volatile, subject to sharp and sudden price swings. Regulatory uncertainty poses another significant risk, with governments worldwide still grappling with how to regulate cryptocurrencies. Furthermore, the cryptocurrency market is susceptible to scams, hacks, and security breaches. The decentralized nature of Bitcoin, while a strength, also means that there is no central authority to protect investors in case of losses. Finally, the inherent speculative nature of Bitcoin means that its value is largely dependent on market sentiment and investor confidence, which can change rapidly and unpredictably.

Sources of Reliable Information on Bitcoin Price Predictions

Finding truly reliable Bitcoin price predictions is challenging. While numerous websites and analysts offer predictions, it’s crucial to approach them critically. Focus on sources with a proven track record of accurate financial analysis and transparency in their methodologies. Reputable financial news outlets, research firms specializing in cryptocurrencies, and academic studies analyzing Bitcoin’s price behavior can offer more insightful perspectives than individual speculative predictions. However, even these sources should be considered as providing potential scenarios rather than definitive forecasts. Remember to always conduct your own thorough research before making any investment decisions.