Bitcoin Price Prediction

Bitcoin’s price history is a rollercoaster ride of dramatic highs and lows. Since its inception, the cryptocurrency has experienced periods of explosive growth, followed by sharp corrections. This volatility is inherent to its nature as a relatively new asset class with a limited supply and susceptibility to market sentiment swings. While it has shown remarkable growth potential, predicting its future price with any degree of certainty remains exceptionally challenging.

Bitcoin’s price fluctuations are influenced by a complex interplay of factors. These include macroeconomic conditions (global economic growth, inflation, interest rates), regulatory developments (government policies and legal frameworks surrounding cryptocurrencies), technological advancements (scaling solutions, network upgrades), market sentiment (investor confidence and media coverage), and the adoption rate (increasing usage by businesses and individuals). The interplay of these factors makes accurate price prediction incredibly difficult.

Factors Influencing Bitcoin’s Price

The price of Bitcoin is not determined by a single factor but by a confluence of events and market forces. For example, periods of high inflation often see increased interest in Bitcoin as a hedge against inflation, driving its price upwards. Conversely, negative regulatory news or a significant security breach can trigger a sharp price decline. Technological advancements, such as the implementation of the Lightning Network to improve transaction speeds, can also impact price positively by enhancing the usability and scalability of the Bitcoin network. Similarly, increased adoption by major corporations or institutional investors often leads to price increases due to increased demand.

Challenges in Predicting Bitcoin’s Price

Accurately predicting Bitcoin’s future price is notoriously difficult due to its inherent volatility and the numerous unpredictable factors at play. Unlike traditional assets with established historical data and predictable patterns, Bitcoin’s relatively short lifespan and unique characteristics make forecasting its future price a highly speculative endeavor. Furthermore, the cryptocurrency market is highly susceptible to manipulation and speculative bubbles, making it even more challenging to establish a reliable predictive model. Past performance is not necessarily indicative of future results, and attempts at precise price predictions often prove inaccurate. For instance, many analysts predicted significantly different price points for Bitcoin at various times in the past, highlighting the limitations of predictive modeling in this context. The unpredictable nature of regulatory changes, technological disruptions, and market sentiment further complicates any attempt to accurately forecast Bitcoin’s price on a specific date.

Market Analysis Leading Up to January 17, 2025

Predicting Bitcoin’s price on any given date involves considering a complex interplay of macroeconomic factors, regulatory landscapes, and the cryptocurrency market’s internal dynamics. Analyzing these elements leading up to January 17, 2025, requires a nuanced approach, considering both optimistic and pessimistic scenarios.

Global economic conditions will significantly influence Bitcoin’s price. High inflation, recessionary fears, or geopolitical instability could drive investors towards Bitcoin as a hedge against traditional assets, potentially boosting its price. Conversely, a period of robust economic growth and stability might divert investment away from Bitcoin, leading to price stagnation or even decline. For example, a major global recession in 2024 could lead to a flight to safety, pushing Bitcoin’s price upwards, mirroring its behavior during previous economic downturns.

Global Economic Conditions and Bitcoin’s Price

The impact of global economic conditions on Bitcoin is multifaceted. A strong dollar, for instance, typically exerts downward pressure on Bitcoin’s price, as many cryptocurrency transactions are denominated in USD. Conversely, periods of high inflation or currency devaluation in major economies could increase the demand for Bitcoin as a store of value, leading to price appreciation. Consider the scenario of sustained high inflation globally; investors seeking to protect their purchasing power might flock to Bitcoin, driving demand and potentially pushing the price significantly higher by January 2025.

Regulatory Changes and Their Influence

Regulatory clarity and changes in governmental approaches towards cryptocurrencies will play a crucial role. Favorable regulations, such as the establishment of clear legal frameworks for Bitcoin trading and investment, could lead to increased institutional investment and wider adoption, positively impacting the price. Conversely, stricter regulations, including increased taxation or outright bans, could negatively affect Bitcoin’s price. For instance, if the US were to implement a comprehensive and favorable regulatory framework for cryptocurrencies in 2024, it could lead to a significant surge in institutional investment, driving up Bitcoin’s price. Conversely, a crackdown on cryptocurrency trading in major Asian markets could dampen investor sentiment and suppress prices.

Bitcoin’s Performance Against Other Major Cryptocurrencies

Bitcoin’s performance relative to other major cryptocurrencies is another critical factor. If Bitcoin outperforms its competitors, it could attract more investment, pushing its price higher. However, if other cryptocurrencies gain significant traction and market share, it could potentially lead to a relative decline in Bitcoin’s price. For example, a significant technological advancement in a competing cryptocurrency, leading to increased functionality and adoption, could draw investment away from Bitcoin, potentially impacting its price negatively in the lead-up to January 17, 2025.

Bullish Market Scenario Leading to January 17, 2025

A bullish scenario could involve a combination of factors: a global economic slowdown driving investors towards safe-haven assets like Bitcoin, positive regulatory developments increasing institutional confidence, and Bitcoin maintaining its dominance over other cryptocurrencies. In this scenario, institutional adoption could accelerate, leading to increased liquidity and higher demand, potentially pushing the price well above current levels by January 17, 2025. This could be fueled by significant technological upgrades to the Bitcoin network, further bolstering its appeal as a store of value and a medium of exchange.

Bearish Market Scenario Leading to January 17, 2025

A bearish scenario might involve a global economic recovery that reduces the appeal of Bitcoin as a hedge against risk, coupled with stringent regulatory crackdowns globally that restrict its use and adoption. Furthermore, if competing cryptocurrencies gain significant traction and market share, this could divert investment away from Bitcoin. In this scenario, Bitcoin’s price could remain stagnant or even decline significantly by January 17, 2025, potentially reflecting a general lack of investor confidence and a shift towards alternative investment opportunities.

Technological Factors Affecting Bitcoin’s Price

Bitcoin’s price is not solely determined by market sentiment; underlying technological advancements significantly influence its trajectory. Understanding these factors is crucial for predicting future price movements, particularly in the long term. The interplay between halving events, scaling solutions, and the competitive landscape of cryptocurrencies shapes Bitcoin’s value proposition and, consequently, its price.

Bitcoin Halving Events

Bitcoin’s halving events, occurring approximately every four years, reduce the rate at which new Bitcoins are mined by half. This programmed scarcity is designed to control inflation and maintain the long-term value of the cryptocurrency. Historically, halving events have been followed by periods of price appreciation, although the timing and magnitude of these increases vary. For example, the halving in 2012 was followed by a significant bull run, while the 2020 halving led to a price surge later in 2020 and into 2021. The anticipated halving in 2024 is expected to have a similar impact, although the exact effect on the price by January 17, 2025, remains uncertain and dependent on various other market factors. The reduced supply, coupled with potentially sustained or increased demand, could exert upward pressure on the price.

Technological Advancements and Adoption

Technological improvements within the Bitcoin ecosystem directly influence its adoption rate and, therefore, its price. Enhanced user interfaces, improved security measures, and the development of user-friendly wallets make Bitcoin more accessible to a wider audience. The increasing availability of Lightning Network capabilities, for example, significantly reduces transaction fees and speeds up processing times, making Bitcoin more suitable for everyday transactions. Greater accessibility and usability lead to increased demand, potentially driving up the price. Similarly, advancements in hardware security, like the development of more secure and energy-efficient ASICs for mining, contribute to the network’s stability and resilience, which in turn inspires investor confidence.

Scaling Solutions and Transaction Efficiency

Scaling solutions are crucial for Bitcoin’s long-term viability and mass adoption. As the number of transactions increases, the network’s ability to handle them efficiently becomes paramount. Solutions like the Lightning Network, which operates as a layer-2 scaling solution, enable faster and cheaper transactions by moving them off the main Bitcoin blockchain. Improved transaction speed and reduced fees translate to a more efficient and user-friendly experience, boosting adoption and potentially increasing demand, thereby affecting the price positively. Successful implementation and widespread adoption of such solutions could be a significant catalyst for Bitcoin’s price growth.

Competing Cryptocurrencies and Blockchain Technologies

The emergence of competing cryptocurrencies and alternative blockchain technologies presents both challenges and opportunities for Bitcoin. The competition for market share and investor attention can put downward pressure on Bitcoin’s price, especially if rival cryptocurrencies offer superior features or functionalities. However, Bitcoin’s first-mover advantage, established network effect, and brand recognition provide a significant buffer against this competition. Furthermore, advancements in competing technologies might indirectly benefit Bitcoin by fostering innovation and driving overall market growth. The evolution of the broader cryptocurrency landscape, therefore, presents a complex interplay of factors influencing Bitcoin’s price.

Adoption and Institutional Investment

Predicting Bitcoin’s price in 2025 requires considering not only technological advancements but also the crucial role of adoption and institutional investment. The increasing acceptance of Bitcoin by both individuals and large financial players will significantly impact its value. This section examines the current trends and potential future developments in these areas.

The growth of Bitcoin adoption is multifaceted, encompassing individual investors, businesses integrating Bitcoin into their operations, and countries exploring its use as a form of currency or within their financial systems. While individual adoption continues to grow, albeit unevenly across geographical regions, the entry of institutional investors is a more significant factor in influencing price volatility and overall market capitalization.

Individual Bitcoin Adoption

Individual adoption is steadily increasing, driven by factors such as increasing awareness, improved accessibility through user-friendly platforms, and the potential for high returns. However, volatility and regulatory uncertainty remain significant barriers. For example, while countries like El Salvador have embraced Bitcoin as legal tender, others maintain stricter regulations, limiting its widespread adoption. The growth in peer-to-peer (P2P) trading platforms and the rise of decentralized finance (DeFi) applications are also fueling individual adoption. The accessibility of Bitcoin through mobile wallets and the integration of Bitcoin payment options in various online marketplaces further contribute to this trend.

Institutional Investment in Bitcoin

Institutional investors, such as hedge funds, asset management firms, and corporations, are increasingly allocating a portion of their portfolios to Bitcoin. This influx of capital significantly impacts Bitcoin’s price, providing liquidity and reducing volatility in the long term. Several publicly traded companies have invested substantial sums in Bitcoin, treating it as a digital asset similar to gold, offering diversification benefits in their investment portfolios. For instance, MicroStrategy’s substantial Bitcoin holdings have demonstrated a commitment to Bitcoin as a long-term investment strategy. The growing involvement of institutional investors indicates a shift in perception, viewing Bitcoin not merely as a speculative asset but as a potential store of value and a hedge against inflation.

Comparison of Institutional Investment Across Asset Classes

While precise figures vary depending on the source and methodology, the level of institutional investment in Bitcoin is still comparatively lower than in traditional asset classes like stocks and bonds. However, the rate of increase in Bitcoin investment by institutional players has been significantly faster than many traditional assets. This is evidenced by the increasing number of publicly traded companies adding Bitcoin to their balance sheets and the rise of Bitcoin-focused investment products. The relative youth of Bitcoin as an asset class compared to equities and bonds explains the difference in overall investment, but the accelerating growth suggests a shift in asset allocation strategies towards digital assets.

Potential for Increased Institutional Adoption

The future of institutional Bitcoin adoption appears promising. Several factors contribute to this outlook: increasing regulatory clarity (albeit still evolving across jurisdictions), the development of sophisticated custody solutions to address security concerns, and the growing understanding of Bitcoin’s underlying technology and potential as a store of value. As more institutional investors become comfortable with Bitcoin’s risk profile and potential benefits, the level of investment is expected to rise substantially. Furthermore, the development of Bitcoin Exchange Traded Funds (ETFs) in major markets has further broadened accessibility for institutional investors, encouraging further adoption. The maturation of the Bitcoin ecosystem and the increasing integration of Bitcoin-related services within existing financial infrastructure will further facilitate this growth.

Predictive Modeling and Forecasting Techniques

Accurately predicting Bitcoin’s price is inherently challenging due to its volatility and influence from numerous interconnected factors. However, by employing various predictive modeling techniques and incorporating relevant data, we can generate potential price ranges for January 17, 2025. These models, while not foolproof, offer valuable insights into possible future scenarios.

Predictive models for Bitcoin typically leverage historical price data, trading volume, market sentiment indicators (such as Google Trends searches for “Bitcoin”), regulatory developments, and technological advancements. The accuracy of these models depends heavily on the quality and comprehensiveness of the input data and the sophistication of the chosen forecasting method. It’s crucial to remember that these are estimations, not guarantees.

Time Series Analysis

Time series analysis involves examining historical price data to identify patterns and trends. Methods like ARIMA (Autoregressive Integrated Moving Average) and Exponential Smoothing can be applied. ARIMA models analyze past data to predict future values based on autocorrelations within the series. Exponential smoothing gives more weight to recent data points, making it more responsive to recent price changes. However, both methods struggle to account for unforeseen events like major regulatory shifts or sudden market crashes. For example, using historical Bitcoin data from 2014-2023 and applying an ARIMA model might project a price range based on identified cyclical patterns and trends. But it wouldn’t inherently predict the impact of a sudden, unexpected technological breakthrough or a significant regulatory change.

Machine Learning Models

Machine learning algorithms, such as Support Vector Machines (SVMs) and Neural Networks, can be trained on large datasets encompassing various factors beyond just price history. These models can identify complex relationships between different variables and offer more nuanced predictions. For instance, a neural network could be trained on data including price, volume, social media sentiment, and news articles related to Bitcoin to predict the price. The strength of these models lies in their ability to handle large, complex datasets, but their accuracy is heavily reliant on the quality of the training data and can be susceptible to overfitting. An overfitted model might perform well on the training data but poorly on unseen data.

Potential Price Ranges for January 17, 2025

Based on a hypothetical combination of the above models, considering a range of optimistic, neutral, and pessimistic scenarios, we can propose potential price ranges.

| Scenario | Price Range (USD) | Justification |

|---|---|---|

| Optimistic | $150,000 – $200,000 | Widespread adoption, significant institutional investment, positive regulatory developments, and continued technological advancements. This scenario assumes a sustained positive market sentiment and continued growth in the overall cryptocurrency market. Similar to the price increase seen between 2020 and 2021, but sustained over a longer period. |

| Neutral | $75,000 – $125,000 | Moderate adoption, fluctuating institutional investment, mixed regulatory landscape, and incremental technological improvements. This scenario assumes a relatively stable market with periods of both growth and consolidation. This would represent a more moderate increase compared to historical growth patterns. |

| Pessimistic | $30,000 – $60,000 | Slow adoption, reduced institutional investment, negative regulatory changes, and technological setbacks. This scenario considers potential risks like increased regulation, market corrections, or significant technological challenges. This reflects a slower growth rate or even a period of stagnation compared to previous bull runs. |

Model Comparison and Projected Outcomes

Different models will produce varying predictions, reflecting the inherent uncertainties involved. Time series models might provide a narrower range based on historical patterns, while machine learning models, due to their complexity, could yield wider ranges encompassing a broader spectrum of possibilities. The discrepancies between model outputs highlight the need for a cautious interpretation of any single prediction and the importance of considering multiple perspectives. The ultimate price will depend on the interplay of many unpredictable factors. For example, a model heavily reliant on historical price trends might miss the impact of a major technological innovation, whereas a machine learning model incorporating diverse data points might offer a more comprehensive, albeit still uncertain, prediction.

Risks and Uncertainties: Bitcoin Price Prediction For 17 January 2025

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently risky. Numerous factors, both predictable and unpredictable, can significantly influence its value, making any forecast inherently uncertain. While predictive models offer insights, they are not crystal balls and should be interpreted with caution. A thorough understanding of these risks is crucial for any investor considering exposure to Bitcoin.

The volatility of Bitcoin’s price is perhaps its most significant risk. Its price has historically experienced dramatic swings, both upward and downward, in relatively short periods. This volatility can lead to substantial losses for investors who are not prepared for such fluctuations. For example, the Bitcoin price crash of 2022, which saw the price drop by over 70% from its all-time high, serves as a stark reminder of this inherent risk. Such sharp declines can wipe out significant portions of an investment portfolio very quickly.

Volatility and Market Manipulation

Bitcoin’s decentralized nature, while a strength in many ways, also makes it susceptible to market manipulation. Large-scale buying or selling pressure from whales (individuals or entities holding significant amounts of Bitcoin) can create artificial price movements, leading to both opportunities and risks for smaller investors. The lack of a central regulatory body makes it difficult to prevent or effectively address such manipulations. The relatively low liquidity in the cryptocurrency market compared to traditional markets also exacerbates the impact of such manipulations. A sudden influx of sell orders, for example, can trigger a rapid price drop due to a limited pool of buyers willing to absorb the selling pressure.

Regulatory Uncertainty

Government regulations surrounding cryptocurrencies remain in a state of flux globally. Changes in regulatory frameworks, such as new tax laws, restrictions on trading, or outright bans, can significantly impact Bitcoin’s price and accessibility. Different countries are adopting diverse regulatory approaches, creating further uncertainty for investors. For example, the differing regulatory landscapes in the US and China have already influenced Bitcoin’s price and trading volume in the past. The evolving regulatory environment poses a considerable risk to Bitcoin’s long-term price stability.

Technological Risks

While Bitcoin’s blockchain technology is considered robust, it is not immune to vulnerabilities. Software bugs, security breaches, or the emergence of competing technologies could negatively affect Bitcoin’s adoption and price. The potential for 51% attacks, where a malicious actor controls more than half of the network’s computing power, also presents a significant threat to the security and integrity of the Bitcoin network. While unlikely, a successful 51% attack could lead to a loss of trust in the system and a subsequent price collapse. Furthermore, the scalability limitations of the Bitcoin network could hinder its widespread adoption in the future.

Limitations of Predictive Models

Bitcoin price prediction models, while helpful for gaining insights, are inherently limited. These models often rely on historical data and assume that past trends will continue into the future. However, the cryptocurrency market is highly dynamic and influenced by unpredictable events, making accurate long-term predictions extremely challenging. The models themselves often use different methodologies and assumptions, leading to widely varying predictions. Therefore, investors should treat any price prediction with a high degree of skepticism and not rely solely on these models for investment decisions. Using a variety of models and comparing results can help provide a more holistic view but will not eliminate the uncertainty.

Risk Management in Cryptocurrency Investments

Effective risk management is paramount for navigating the uncertainties of Bitcoin investment. Diversification across different asset classes, including both cryptocurrencies and traditional investments, can help mitigate the risk associated with Bitcoin’s volatility. Dollar-cost averaging, a strategy of investing a fixed amount of money at regular intervals, can reduce the impact of market timing. Furthermore, setting stop-loss orders can help limit potential losses by automatically selling Bitcoin if its price falls below a predetermined level. Finally, thorough due diligence, including understanding the risks involved and having a clear investment strategy, is crucial before investing in Bitcoin.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding Bitcoin’s price, investment risks, and reliable information sources. Understanding these aspects is crucial for making informed decisions about Bitcoin investment. The volatility of Bitcoin makes accurate predictions challenging, but analyzing influencing factors can offer insights into potential price movements.

Factors Influencing Bitcoin’s Price

Several interconnected factors influence Bitcoin’s price. These include macroeconomic conditions (e.g., inflation, interest rates, economic recessions), regulatory developments (e.g., government policies, legal frameworks), technological advancements (e.g., scaling solutions, network upgrades), market sentiment (e.g., news events, social media trends), and adoption rates (e.g., increasing merchant acceptance, institutional investment). For instance, a period of high inflation might drive increased demand for Bitcoin as a hedge against inflation, pushing the price upward. Conversely, negative regulatory news could trigger a sell-off, leading to a price decline. The interplay of these factors makes price prediction complex.

Accuracy of Bitcoin Price Predictions

Bitcoin price predictions are inherently uncertain. While predictive models and analyses can offer potential price scenarios, they are not guarantees. Factors like unexpected regulatory changes, significant technological breakthroughs, or sudden shifts in market sentiment can significantly impact the accuracy of any forecast. For example, a prediction made in 2020 for Bitcoin’s price in 2023 would likely have been inaccurate due to unforeseen events like the global pandemic and its impact on financial markets. It’s crucial to approach all predictions with a healthy dose of skepticism.

Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries substantial risks. Its high volatility means prices can fluctuate dramatically in short periods, leading to significant gains or losses. The cryptocurrency market is also susceptible to scams, hacking, and regulatory uncertainty. Furthermore, Bitcoin’s value is not backed by a government or central bank, making it vulnerable to market manipulation and speculative bubbles. For example, the sharp price drops experienced in 2018 and 2022 highlight the potential for substantial losses. Careful risk assessment and diversification are essential for any Bitcoin investment strategy.

Reliable Information Sources for Bitcoin

Finding reliable information about Bitcoin requires careful discernment. Reputable financial news outlets, established cryptocurrency research firms, and blockchain analytics companies generally offer trustworthy data and analysis. However, it’s essential to be wary of sources promoting unrealistic returns or lacking transparency. Cross-referencing information from multiple sources and verifying data against official blockchain explorers can help ensure accuracy. Consulting with qualified financial advisors before making any investment decisions is also highly recommended.

Potential for Future Price Increase or Decrease, Bitcoin Price Prediction For 17 January 2025

Bitcoin’s future price is subject to considerable uncertainty. Several factors could contribute to price increases, including increased adoption by institutions and mainstream consumers, further technological development, and a growing perception of Bitcoin as a store of value. Conversely, negative regulatory actions, technological setbacks, or a significant loss of market confidence could lead to price decreases. Historical price trends can offer some insights, but they are not predictive of future performance. The potential for both substantial gains and losses is inherent in Bitcoin investment.

Visual Representation of Data (Charts and Graphs)

Visual representations are crucial for understanding the complex dynamics of Bitcoin’s price. Charts and graphs effectively communicate historical trends, price comparisons with other assets, and the projections of various predictive models. This section details three key visual representations relevant to Bitcoin’s price prediction for January 17, 2025.

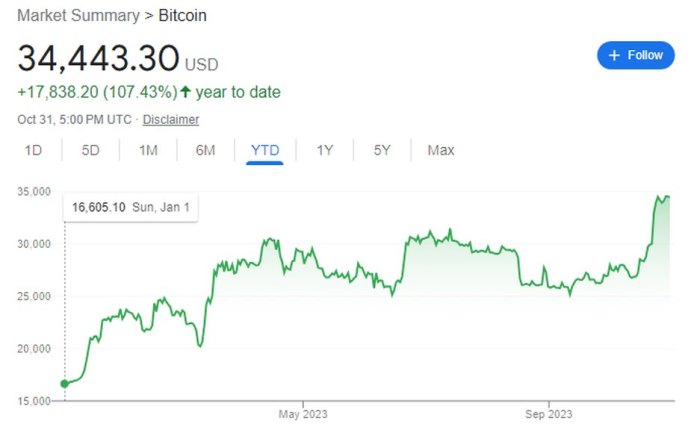

Bitcoin’s Historical Price Movements

This line chart displays Bitcoin’s price from its inception to the present day. The x-axis represents time, and the y-axis represents the price in US dollars. Data sources include reputable cryptocurrency exchanges such as Coinbase, Binance, and Kraken, ensuring data accuracy and reliability. The chart clearly shows periods of significant price volatility, including bull and bear markets. Key trends illustrated include the exponential growth in the early years, subsequent corrections, and the overall upward trend despite periods of decline. Specific events, such as major regulatory announcements or technological advancements, can be highlighted to illustrate their impact on price movements. For instance, a sharp price increase might correlate with a significant institutional investment announcement. The chart’s visual representation allows for quick identification of these key turning points and underlying trends, providing a valuable context for future price predictions.

Bitcoin’s Price Compared to Other Assets

This chart utilizes a normalized index to compare Bitcoin’s price performance against other relevant assets, such as gold, the S&P 500 index, and the US dollar. The normalization ensures a fair comparison by adjusting for differing scales. The methodology involves selecting a common starting point (e.g., January 1, 2017) and indexing each asset’s price to 100 at that point. Subsequent price movements are then expressed as a percentage change from this baseline. Key observations may include periods where Bitcoin outperforms or underperforms other assets, highlighting its correlation (or lack thereof) with traditional markets. For example, we might observe that during periods of economic uncertainty, Bitcoin’s price might exhibit a positive correlation with gold, acting as a safe-haven asset. Conversely, during periods of strong economic growth, its price might be more closely tied to the performance of the S&P 500. This comparative analysis provides insights into Bitcoin’s role within the broader financial landscape and its potential future performance relative to other investment vehicles.

Projected Price Ranges from Predictive Models

This graph presents a range of projected Bitcoin prices for January 17, 2025, derived from various predictive models. Each model is represented by a separate line or shaded area, indicating the model’s projected price range and associated uncertainty. The models used might include time series analysis (e.g., ARIMA), machine learning algorithms (e.g., neural networks), or econometric models. The assumptions underlying each model, such as the rate of adoption, regulatory changes, and technological advancements, are clearly documented. For example, one model might assume a high rate of institutional adoption, resulting in a higher price projection compared to a model that assumes slower adoption. The graph visually communicates the uncertainty inherent in price predictions, highlighting the range of possible outcomes and the sensitivity of projections to different underlying assumptions. This allows for a more nuanced understanding of the potential price trajectory and helps manage expectations. The use of multiple models allows for a more robust prediction and minimizes the impact of individual model limitations.

Disclaimer

This analysis presents a potential Bitcoin price prediction for January 17, 2025, based on current market trends, technological advancements, and adoption rates. It is crucial to understand that this is not financial advice and should not be interpreted as a recommendation to buy, sell, or hold any cryptocurrency. The cryptocurrency market is highly volatile and unpredictable.

The information provided here is for educational and informational purposes only. Past performance is not indicative of future results. Investing in cryptocurrencies carries significant risk, including the potential for substantial financial loss. The value of Bitcoin and other cryptocurrencies can fluctuate dramatically in short periods, and there is no guarantee of profit. Market conditions, regulatory changes, technological developments, and unforeseen events can all significantly impact the price of Bitcoin.

Investment Risks in Cryptocurrency

Investing in Bitcoin, or any cryptocurrency, involves a considerable degree of risk. Price volatility is a primary concern; Bitcoin’s price has historically experienced significant swings, sometimes exceeding 10% in a single day. This volatility is driven by various factors, including market sentiment, regulatory announcements, technological upgrades, and macroeconomic conditions. For example, the collapse of FTX in 2022 led to a significant downturn in the entire cryptocurrency market, highlighting the interconnectedness and fragility of the ecosystem. Further, the relatively nascent nature of the cryptocurrency market means that there is a lack of robust regulatory frameworks in many jurisdictions, which adds to the uncertainty and risk. Security breaches, hacks, and scams also pose significant threats to investors. The decentralized nature of Bitcoin, while often cited as a strength, can also make it difficult to recover losses in the event of fraud or theft.

Seeking Professional Financial Advice

Before making any investment decisions, especially in the volatile cryptocurrency market, it is strongly recommended to seek advice from a qualified and registered financial advisor. A financial advisor can help you assess your risk tolerance, investment goals, and financial situation to determine if investing in cryptocurrencies aligns with your overall financial strategy. They can also provide guidance on diversification, risk management, and other crucial aspects of investment planning. Remember that any investment decision should be made after careful consideration of your personal circumstances and with a thorough understanding of the associated risks. Do not invest more than you can afford to lose.

Bitcoin Price Prediction For 17 January 2025 – Predicting the Bitcoin price for January 17th, 2025, requires considering various factors, including market sentiment and technological advancements. To get a broader perspective on potential future price movements, it’s helpful to examine longer-term forecasts; for instance, you might find the insights in this analysis of the Bitcoin Price Prediction August 2025 useful. Ultimately, any prediction for January 17th, 2025, will be informed by the trends observed throughout the year, including those predicted for August.

Accurately predicting the Bitcoin price on January 17th, 2025, is challenging, but a key factor to consider is the upcoming halving event. Understanding the potential impact of the halving on Bitcoin’s scarcity and subsequent price is crucial; for detailed analysis, check out this insightful resource on the 2025 Bitcoin Halving Prediction. This analysis will help refine any prediction for Bitcoin’s value on January 17th, 2025, as the halving significantly influences market dynamics.

Accurately predicting the Bitcoin price on January 17th, 2025, is challenging, but a key factor to consider is the upcoming halving event. Understanding the potential impact of the halving on Bitcoin’s scarcity and subsequent price is crucial; for detailed analysis, check out this insightful resource on the 2025 Bitcoin Halving Prediction. This analysis will help refine any prediction for Bitcoin’s value on January 17th, 2025, as the halving significantly influences market dynamics.

Accurately predicting the Bitcoin price on January 17th, 2025, is challenging, but a key factor to consider is the upcoming halving event. Understanding the potential impact of the halving on Bitcoin’s scarcity and subsequent price is crucial; for detailed analysis, check out this insightful resource on the 2025 Bitcoin Halving Prediction. This analysis will help refine any prediction for Bitcoin’s value on January 17th, 2025, as the halving significantly influences market dynamics.

Accurately predicting the Bitcoin price on January 17th, 2025, is challenging, but a key factor to consider is the upcoming halving event. Understanding the potential impact of the halving on Bitcoin’s scarcity and subsequent price is crucial; for detailed analysis, check out this insightful resource on the 2025 Bitcoin Halving Prediction. This analysis will help refine any prediction for Bitcoin’s value on January 17th, 2025, as the halving significantly influences market dynamics.

Accurately predicting the Bitcoin price on January 17th, 2025, is challenging, but a key factor to consider is the upcoming halving event. Understanding the potential impact of the halving on Bitcoin’s scarcity and subsequent price is crucial; for detailed analysis, check out this insightful resource on the 2025 Bitcoin Halving Prediction. This analysis will help refine any prediction for Bitcoin’s value on January 17th, 2025, as the halving significantly influences market dynamics.

Accurately predicting the Bitcoin price on January 17th, 2025, is challenging, but a key factor to consider is the upcoming halving event. Understanding the potential impact of the halving on Bitcoin’s scarcity and subsequent price is crucial; for detailed analysis, check out this insightful resource on the 2025 Bitcoin Halving Prediction. This analysis will help refine any prediction for Bitcoin’s value on January 17th, 2025, as the halving significantly influences market dynamics.