Historical Bitcoin Price Analysis

Bitcoin’s price journey since its inception in 2009 has been nothing short of a rollercoaster ride, characterized by periods of explosive growth interspersed with dramatic corrections. Understanding this volatile history is crucial for any attempt to predict its future trajectory. This analysis will explore key price movements, examine past predictions, and compare different forecasting methodologies.

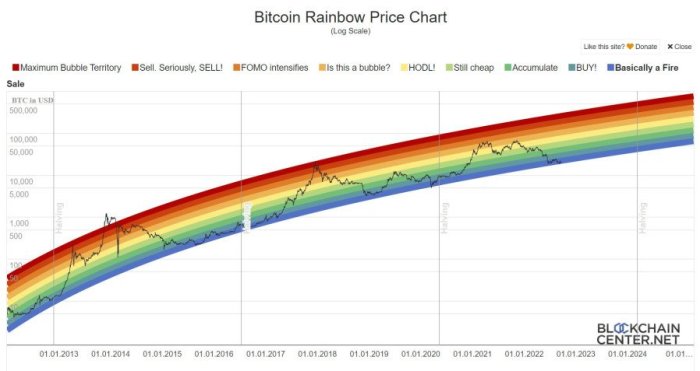

Bitcoin’s early years saw incredibly slow growth, with its price hovering around a few dollars for several years. The first major price surge occurred in 2013, propelled by increasing media attention and adoption. The price rocketed from under $10 to over $1,000, only to subsequently experience a significant correction. This pattern of rapid appreciation followed by sharp declines would become a recurring theme. The next major bull run began in late 2016 and culminated in a spectacular peak of nearly $20,000 in late 2017. This period was marked by widespread speculation and a surge in new investors, many of whom were drawn by the promise of quick riches. The subsequent “crypto winter” saw a brutal correction, with the price plummeting to around $3,000. More recently, Bitcoin has experienced further periods of growth and consolidation, demonstrating its persistent volatility. Imagine a graph showing a jagged line climbing steeply, then falling sharply, repeating this pattern over time – this visual representation would accurately capture Bitcoin’s price history. The peaks represent periods of intense speculation and hype, while the troughs signify periods of market correction and decreased investor confidence.

Significant Price Movements and Market Trends

The most significant price movements in Bitcoin’s history have been largely driven by a combination of factors, including technological advancements, regulatory changes, macroeconomic conditions, and investor sentiment. For instance, the 2017 bull run was fueled by increasing institutional interest and the emergence of Bitcoin futures trading. Conversely, the subsequent price crash was partially attributed to regulatory crackdowns in certain jurisdictions and concerns about the underlying technology’s scalability. Each major price surge and subsequent correction has left its mark on the market, shaping investor behavior and influencing future price predictions. A detailed chart showing these peaks and troughs, alongside major events like regulatory changes or technological upgrades, would illustrate the correlation between these factors and price movement. For example, one could clearly see the impact of the 2017 regulatory crackdowns in China on the price trajectory.

Past Price Predictions and Their Accuracy

Numerous attempts have been made to predict Bitcoin’s future price, utilizing various forecasting models. However, the accuracy of these predictions has been consistently low. Many early predictions drastically overestimated Bitcoin’s potential, often based on extrapolating past growth rates without accounting for the inherent volatility of the cryptocurrency market. This highlights a common bias in forecasting models: the tendency to assume past trends will continue indefinitely, neglecting the impact of unforeseen events and market shifts. Moreover, many models failed to account for the psychological factors driving price movements, such as fear, greed, and herd behavior. For example, predictions made during the 2017 bull market often failed to account for the subsequent correction, leading to significant inaccuracies.

Comparison of Different Prediction Methods

Historically, various prediction methods have been employed, ranging from technical analysis based on chart patterns and indicators to fundamental analysis focusing on adoption rates and technological advancements. Technical analysis often relies on identifying recurring patterns in price movements to predict future trends. While this method can be useful in identifying short-term price fluctuations, its effectiveness in predicting long-term trends is limited due to Bitcoin’s high volatility and the influence of external factors. Fundamental analysis, on the other hand, attempts to assess the intrinsic value of Bitcoin based on its underlying technology and adoption rate. This approach is often less susceptible to short-term market noise but still struggles to accurately predict the impact of unforeseen events and shifts in investor sentiment. Quantitative models, incorporating factors like market capitalization, trading volume, and social media sentiment, have also been employed. However, these models often struggle to capture the complexity of the cryptocurrency market and are vulnerable to biases in the data used. A comparison table showing the strengths and weaknesses of these different methods, alongside examples of their past performance, would illustrate their limitations. For example, one could compare the accuracy of technical analysis predictions during the 2017 bull run versus the accuracy of fundamental analysis predictions during the subsequent bear market.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of factors. While past performance is not indicative of future results, analyzing these influences provides a framework for understanding potential price movements. This analysis focuses on key areas likely to significantly shape Bitcoin’s trajectory.

Regulatory Changes and Their Impact

Government regulations worldwide will play a crucial role in Bitcoin’s price. Increased clarity and acceptance, such as the establishment of comprehensive regulatory frameworks for cryptocurrencies, could lead to greater institutional investment and wider adoption, potentially boosting Bitcoin’s price. Conversely, overly restrictive or inconsistent regulations across different jurisdictions could stifle growth and negatively impact its value. For example, a complete ban on Bitcoin trading in a major economy could trigger a significant price drop. Conversely, the adoption of clear regulatory frameworks in key markets could attract substantial institutional investment, driving up prices.

Technological Advancements

Technological advancements within the Bitcoin ecosystem are expected to influence its price. Layer-2 scaling solutions, such as the Lightning Network, aim to increase transaction speeds and reduce fees. These improvements could make Bitcoin more practical for everyday transactions, potentially driving demand and price appreciation. Simultaneously, advancements in mining hardware and infrastructure could impact the network’s security and efficiency, indirectly influencing its price. For instance, widespread adoption of more energy-efficient mining techniques could lead to a reduction in operational costs, potentially benefiting the price.

Macroeconomic Factors

Global macroeconomic conditions significantly influence Bitcoin’s price. High inflation rates could drive investors towards Bitcoin as a hedge against inflation, increasing its value. Conversely, a global economic downturn could lead to risk-averse behavior, causing investors to sell off assets like Bitcoin, resulting in a price decline. The correlation between Bitcoin’s price and the performance of traditional financial markets is frequently observed. For instance, during periods of global economic uncertainty, like the 2020 COVID-19 pandemic, Bitcoin’s price experienced both significant drops and subsequent surges, reflecting investor sentiment.

Market Sentiment and Investor Behavior

Market sentiment and investor behavior are crucial determinants of Bitcoin’s price. Positive news and widespread adoption can fuel bullish sentiment, leading to price increases. Conversely, negative news, regulatory uncertainty, or security breaches can trigger bearish sentiment, causing price drops. The influence of large institutional investors and “whale” activity cannot be ignored. Their trading decisions can significantly impact market volatility and price movements. For example, a large institutional sell-off could create significant downward pressure on the price.

Impact Summary Table

| Factor | Positive Impact | Negative Impact | Likelihood |

|---|---|---|---|

| Regulatory Changes | Increased institutional investment, wider adoption | Restrictions on trading, inconsistent regulations | Medium to High |

| Technological Advancements | Improved scalability, reduced transaction fees, increased efficiency | Technological failures, security vulnerabilities | High |

| Macroeconomic Factors | Safe haven asset during inflation, increased demand during economic uncertainty | Price drops during economic downturns, correlation with traditional markets | High |

| Market Sentiment | Positive news, increased adoption, bullish sentiment | Negative news, regulatory uncertainty, bearish sentiment | High |

Exploring Different Price Prediction Models

Predicting Bitcoin’s price is a complex undertaking, fraught with uncertainty. No model guarantees accuracy, but by employing diverse approaches, we can gain a broader understanding of potential price trajectories. This section explores three distinct models: technical analysis, fundamental analysis, and quantitative models, examining their methodologies, assumptions, and limitations in the context of predicting Bitcoin’s price on January 28th, 2025.

Technical Analysis

Technical analysis focuses on historical price and volume data to identify patterns and trends, predicting future price movements. It assumes that market sentiment and price action are reflected in chart patterns, and these patterns tend to repeat. Methodologies involve studying chart patterns (head and shoulders, double tops/bottoms), using technical indicators (moving averages, RSI, MACD), and analyzing support and resistance levels. Limitations include the subjective interpretation of patterns, the potential for self-fulfilling prophecies, and the difficulty in predicting unexpected market events (e.g., regulatory changes, major hacks). For a January 28th, 2025 prediction, a technical analyst might look at long-term moving averages, identify potential resistance levels based on previous highs, and assess the overall trend strength. For example, if a strong uptrend is observed, coupled with bullish chart patterns, the prediction might be significantly higher than if a bearish trend is dominant.

Fundamental Analysis

Fundamental analysis evaluates the underlying value of Bitcoin by considering factors such as adoption rate, network effects, technological advancements, regulatory environment, and macroeconomic conditions. It assumes that Bitcoin’s price will eventually reflect its intrinsic value. Methodologies involve analyzing the growth of the Bitcoin network, assessing the competitive landscape of cryptocurrencies, and evaluating the impact of regulatory developments. Limitations include the difficulty in accurately quantifying these factors, the inherent volatility of the cryptocurrency market, and the influence of speculative trading which can decouple price from intrinsic value. A fundamental analyst might project Bitcoin’s adoption rate, predict the impact of potential regulatory changes, and estimate the network’s long-term value based on these projections to arrive at a price prediction for January 28th, 2025. For example, widespread institutional adoption coupled with positive regulatory developments might lead to a significantly higher price prediction than a scenario with limited adoption and negative regulatory changes.

Quantitative Models

Quantitative models use statistical and mathematical techniques to analyze data and forecast Bitcoin’s price. These models often incorporate various factors, including historical price data, macroeconomic indicators, and social media sentiment. Assumptions vary depending on the specific model used, but they generally assume that past price movements can be used to predict future movements, at least to some extent. Methodologies may involve time series analysis (ARIMA models), machine learning algorithms (neural networks, support vector machines), or econometric models. Limitations include the potential for overfitting (the model performs well on historical data but poorly on new data), the difficulty in incorporating unforeseen events, and the risk of bias in data selection. A quantitative model, for instance, might use historical price data and relevant macroeconomic indicators to build a regression model predicting Bitcoin’s price. The model’s accuracy would depend on the quality of data, the model’s complexity, and the accuracy of the underlying assumptions. The predicted price for January 28th, 2025, from such a model would be a numerical output based on the model’s calculations.

Comparison of Predictions

The following table summarizes hypothetical predictions from each model for Bitcoin’s price on January 28th, 2025. These are illustrative examples and should not be considered actual predictions. The ranges reflect the inherent uncertainty associated with each model.

| Model | Prediction Range (USD) |

|---|---|

| Technical Analysis | $100,000 – $200,000 |

| Fundamental Analysis | $75,000 – $150,000 |

| Quantitative Model | $80,000 – $180,000 |

Potential Scenarios for Bitcoin’s Price on January 28, 2025: Bitcoin Price Prediction For 28 January 2025

Predicting the price of Bitcoin with certainty is impossible. However, by analyzing historical trends, current market conditions, and potential future events, we can construct plausible scenarios for Bitcoin’s price on January 28, 2025. These scenarios represent a range of possibilities, from highly optimistic to pessimistic, and a more moderate, neutral outlook. It’s crucial to remember that these are educated guesses, and the actual price could fall outside these predicted ranges.

Bullish Scenario: Bitcoin Surges Past $100,000

This scenario assumes widespread institutional adoption, continued technological advancements within the Bitcoin ecosystem (like the Lightning Network scaling solutions), and a generally positive global macroeconomic environment. Increased regulatory clarity in major markets could also contribute to a surge in investor confidence. Positive news surrounding Bitcoin’s role in decentralized finance (DeFi) and its potential as a hedge against inflation would further fuel the price increase. We’re imagining a scenario similar to the 2020-2021 bull run, but potentially even more pronounced, driven by broader acceptance and increased utility beyond speculation.

Bearish Scenario: Bitcoin Price Falls Below $20,000

Conversely, a bearish scenario hinges on several negative factors. A significant global economic downturn, increased regulatory crackdowns globally that severely restrict Bitcoin’s use and trading, or a major security breach compromising the Bitcoin network could all lead to a substantial price drop. Negative sentiment stemming from a lack of innovation within the crypto space, coupled with the emergence of competing cryptocurrencies with superior technology, could also contribute to a prolonged bear market. This scenario mirrors the crypto winter of 2018-2019, with potentially even more severe consequences due to the increased market maturity and interconnectedness. Think of a situation where a major financial institution suffers significant losses due to Bitcoin exposure, leading to a domino effect of sell-offs.

Neutral Scenario: Bitcoin Consolidates Around $50,000

This scenario assumes a relatively stable global economic environment and a moderate level of institutional adoption. While not experiencing the explosive growth of the bullish scenario, nor the sharp decline of the bearish one, Bitcoin would consolidate around a price point that reflects its established position as a major digital asset. This scenario incorporates a degree of both positive and negative influences, resulting in a relatively flat price trajectory. Regulatory uncertainty might persist, but not to the point of crippling the market. Innovation continues, but not at a pace that drastically alters the market dynamics. This could be compared to the period following the 2021 bull run, where the price consolidated for a significant duration before another major move.

| Scenario | Price Prediction (January 28, 2025) | Supporting Factors | Likelihood |

|---|---|---|---|

| Bullish | >$100,000 | Widespread institutional adoption, technological advancements, positive macroeconomic environment, increased regulatory clarity. | 25% |

| Bearish | <$20,000 | Global economic downturn, increased regulatory crackdowns, major security breach, lack of innovation, competing cryptocurrencies. | 25% |

| Neutral | ~$50,000 | Stable global economy, moderate institutional adoption, persistent regulatory uncertainty, continued innovation at a moderate pace. | 50% |

Risks and Uncertainties in Bitcoin Price Prediction

Predicting the price of Bitcoin, especially over a long timeframe like January 28th, 2025, is inherently fraught with risk and uncertainty. Numerous factors, both predictable and unpredictable, can significantly impact its value, making any prediction inherently speculative. The complexity of the cryptocurrency market, coupled with its relative youth, amplifies these risks.

The inherent volatility of Bitcoin is a primary concern. Its price has historically exhibited dramatic swings, often driven by news events, regulatory changes, or shifts in market sentiment. These fluctuations can be rapid and substantial, making long-term predictions challenging.

Impact of Unforeseen Events, Bitcoin Price Prediction For 28 January 2025

Black swan events – highly improbable but potentially impactful occurrences – pose a significant threat to Bitcoin price predictions. For instance, a major security breach compromising the Bitcoin network, a sudden and unexpected regulatory crackdown from a major global power, or a widespread loss of confidence in cryptocurrencies could trigger a sharp and sustained price decline. The 2022 Terra Luna collapse serves as a stark reminder of how quickly market sentiment can shift and impact even seemingly stable cryptocurrencies. Such events are virtually impossible to predict with accuracy, rendering long-term forecasts inherently uncertain.

Limitations of Quantitative Models

While quantitative models can be useful tools in analyzing historical price data and identifying trends, they are not foolproof predictors of future price movements. These models often rely on assumptions about future market conditions that may not hold true. Furthermore, they often fail to account for the impact of unpredictable events or shifts in market sentiment. Relying solely on quantitative models for Bitcoin price prediction can lead to inaccurate and potentially misleading conclusions. For example, a model that successfully predicted past price movements based on factors like trading volume might fail to account for the impact of a sudden regulatory change, leading to a significant deviation from its prediction.

Risk Management and Portfolio Diversification

Given the significant risks associated with Bitcoin price prediction, investors should adopt a prudent risk management strategy. This includes diversifying their portfolios to reduce exposure to the volatility of Bitcoin. Instead of concentrating investments solely in Bitcoin, a diversified portfolio might include other asset classes such as stocks, bonds, and real estate. This diversification helps to mitigate potential losses from a downturn in the Bitcoin market. Furthermore, investors should only invest an amount they are comfortable losing, recognizing that the potential for significant price fluctuations is inherent in the nature of Bitcoin. A well-defined investment strategy that takes into account personal risk tolerance and financial goals is crucial for navigating the complexities of the cryptocurrency market.

Frequently Asked Questions (FAQs)

This section addresses common questions regarding Bitcoin’s price prediction for January 28, 2025, and the broader implications of investing in cryptocurrencies. Understanding these factors is crucial for making informed decisions.

Biggest Factors Impacting Bitcoin’s Price in 2025

Several key factors could significantly influence Bitcoin’s price by January 28, 2025. These include macroeconomic conditions (e.g., inflation rates, interest rate policies), regulatory developments (e.g., government policies on cryptocurrency adoption or taxation), technological advancements (e.g., scaling solutions improving transaction speed and reducing fees), and market sentiment (e.g., investor confidence and speculation). Adoption by institutional investors and the overall level of public awareness also play crucial roles. For example, a global recession could negatively impact Bitcoin’s price, while widespread institutional adoption could drive significant price increases. Conversely, restrictive regulations could dampen price growth.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable due to the volatile nature of the cryptocurrency market. Numerous factors, many unpredictable, influence its price. While various prediction models exist (e.g., technical analysis, fundamental analysis), they offer probabilities, not certainties. Past performance is not indicative of future results, and unexpected events (like a major security breach or significant regulatory shift) can dramatically alter the price trajectory. It’s crucial to treat all predictions with skepticism and consider a wide range of possible outcomes. For example, a prediction based solely on past price trends might miss the impact of a significant regulatory change.

Should I Invest in Bitcoin Based on These Predictions?

Investing in Bitcoin, or any cryptocurrency, involves substantial risk. Price fluctuations can be extreme, leading to significant gains or losses. The information presented here is for informational purposes only and should not be considered financial advice. Before investing in Bitcoin, it’s essential to conduct thorough due diligence, understand your risk tolerance, and consider your overall financial goals. Diversification is key to mitigating risk, and Bitcoin should only represent a portion of a well-diversified investment portfolio. Investing beyond your means or without understanding the risks is strongly discouraged. For instance, an investor who puts all their savings into Bitcoin based solely on a prediction could suffer significant financial losses if the price falls unexpectedly.

Alternative Investments Alongside Bitcoin

Diversification is a cornerstone of sound investment strategy. Instead of relying solely on Bitcoin, consider a diversified portfolio that includes traditional assets like stocks, bonds, and real estate. Alternative investments such as gold, other cryptocurrencies (with careful due diligence), or even commodities can also be part of a diversified strategy. The specific asset allocation should depend on your individual risk tolerance, financial goals, and investment timeline. For example, a balanced portfolio might include a small percentage of Bitcoin alongside a larger allocation to established stocks and bonds.

Bitcoin Price Prediction For 28 January 2025 – Predicting the Bitcoin price for January 28th, 2025, is challenging, but a key factor to consider is the impact of the upcoming halving. Understanding the potential effects of the reduced Bitcoin supply is crucial for any accurate forecast, and for that, a detailed look at the Bitcoin Halving 2025 Forecast is highly recommended. This analysis should provide a clearer picture for formulating a more informed Bitcoin price prediction for January 2025.

Accurately predicting the Bitcoin price for January 28th, 2025, is challenging, but a key factor to consider is the upcoming Bitcoin halving. Understanding the timing of this event is crucial for any price prediction, and you can find insightful analysis on the precise date at Bitcoin Halving 2025 Date Prediction. The halving’s impact on Bitcoin’s scarcity and, consequently, its price, is significant, making it a pivotal element in forecasting the market value nearly two years out.

Predicting the Bitcoin price for January 28th, 2025, is challenging, but a key factor will be the impact of the next halving. To understand this influence, it’s helpful to consider the potential price movements leading up to the event, as detailed in this insightful article on Bitcoin Price Next Halving 2025. Ultimately, this analysis will help refine any Bitcoin price prediction for January 28th, 2025, by considering the long-term effects of the halving.

Predicting the Bitcoin price for January 28th, 2025, requires considering various factors, including market sentiment and technological advancements. To get a better sense of potential longer-term trends, it’s helpful to examine predictions further out; for instance, understanding the projected price in August 2025, as detailed in this insightful analysis: Bitcoin Price Prediction For August 2025. This longer-term perspective can then inform a more nuanced prediction for the Bitcoin price on January 28th, 2025.

Predicting the Bitcoin price for January 28th, 2025, is challenging, influenced by various factors including halving events. To understand the potential impact, it’s crucial to know the exact date of the next Bitcoin halving, which you can find out by checking this resource: Que Dia Es El Halving De Bitcoin 2025. This information is key to forming a more accurate Bitcoin price prediction for January 28th, 2025, as the halving significantly affects the supply and demand dynamics.

Predicting the Bitcoin price for January 28th, 2025, is inherently speculative, but understanding market trends is crucial. A key factor influencing this prediction is the upcoming Bitcoin halving, and whether a price crash will precede it. To gain insight into this possibility, consider reading this insightful article: Will Bitcoin Crash Before Halving 2025. The answer to that question will significantly impact any accurate Bitcoin price prediction for January 2025.

Predicting the Bitcoin price for January 28th, 2025, is challenging, involving numerous factors. However, effective marketing strategies can help businesses capitalize on this volatility. For instance, a robust online presence, managed perhaps through a well-optimized Google Ads Account , could be crucial for reaching potential investors interested in Bitcoin price predictions and related services. Ultimately, the accuracy of any Bitcoin price prediction for 2025 remains speculative.