Bitcoin Price Prediction: Bitcoin Price Prediction For 30 January 2025

Predicting the price of Bitcoin, a notoriously volatile cryptocurrency, is akin to navigating a stormy sea. Its history is punctuated by dramatic price swings, from near-worthlessness to record highs and subsequent crashes. While predicting the future with certainty is impossible, understanding the factors that influence Bitcoin’s price can help us explore potential scenarios. This article aims to analyze those factors and offer a reasoned perspective on where Bitcoin’s price might stand on January 30, 2025.

Bitcoin’s journey has been nothing short of remarkable. Launched in 2009, it initially traded at negligible values. Over the years, it experienced periods of explosive growth, reaching its all-time high in late 2021, only to subsequently undergo significant corrections. These fluctuations are driven by a complex interplay of factors, ranging from regulatory changes and macroeconomic conditions to technological advancements and market sentiment. Understanding these dynamics is crucial for any attempt at long-term price prediction.

Factors Influencing Bitcoin’s Price

Several key elements will likely shape Bitcoin’s price trajectory towards January 30, 2025. These factors are interconnected and often influence each other. A comprehensive analysis necessitates considering them in conjunction.

Adoption and Institutional Investment

The increasing adoption of Bitcoin by institutional investors and large corporations is a significant driver of price appreciation. Companies like MicroStrategy and Tesla have made substantial Bitcoin investments, signaling a growing acceptance of Bitcoin as a store of value and a potential hedge against inflation. Further mainstream adoption by financial institutions and governments could lead to increased demand and price appreciation. For example, if a major central bank were to announce a significant Bitcoin purchase, it could trigger a substantial price increase, mirroring the effect of large institutional purchases in the past.

Regulatory Landscape

The regulatory environment surrounding Bitcoin will play a pivotal role in its price. Clear and consistent regulations could boost investor confidence and attract more institutional investment. Conversely, stringent or unpredictable regulations could dampen investor enthusiasm and lead to price volatility. The example of China’s crackdown on cryptocurrency mining in 2021 resulted in a significant price drop, highlighting the sensitivity of Bitcoin’s price to regulatory actions. The evolving regulatory landscape across different jurisdictions will therefore be a crucial factor in the years leading up to 2025.

Technological Advancements

Technological developments within the Bitcoin ecosystem, such as the scaling solutions and improvements to transaction speed and efficiency, could significantly impact its price. Increased scalability and reduced transaction fees could make Bitcoin more appealing for everyday use, driving wider adoption and potentially pushing the price higher. Conversely, significant technological setbacks or security breaches could negatively impact investor confidence and suppress price growth. The ongoing development and implementation of layer-2 solutions, for instance, are expected to improve Bitcoin’s scalability and transaction throughput.

Macroeconomic Conditions

Global macroeconomic factors, including inflation, interest rates, and economic growth, exert a significant influence on Bitcoin’s price. During periods of high inflation, Bitcoin is often viewed as a hedge against inflation, potentially leading to increased demand. Conversely, rising interest rates could reduce the attractiveness of Bitcoin as an investment asset, potentially leading to lower prices. The interplay between global economic trends and Bitcoin’s price is complex and dynamic, making it a crucial aspect to consider when forecasting its future. For instance, during periods of economic uncertainty, investors often seek safe haven assets, and Bitcoin has sometimes been considered such an asset, leading to price increases.

Factors Influencing Bitcoin’s Price

Bitcoin’s price is a complex interplay of various factors, constantly shifting and influencing its value. Understanding these dynamics is crucial for navigating the cryptocurrency market. This section will delve into the key elements shaping Bitcoin’s price trajectory.

Macroeconomic Factors and Bitcoin Price

Macroeconomic conditions significantly impact Bitcoin’s price. Inflation, for example, can drive investors towards Bitcoin as a hedge against currency devaluation. High inflation erodes the purchasing power of fiat currencies, making alternative assets like Bitcoin more attractive. Conversely, periods of low inflation might reduce the demand for Bitcoin as investors seek higher returns in traditional markets. Interest rate hikes by central banks often negatively correlate with Bitcoin’s price, as higher rates make holding less-yielding assets like Bitcoin less appealing compared to higher-yielding bonds or savings accounts. Global economic downturns can also influence Bitcoin’s price, with investors often moving towards safer assets, leading to a decrease in Bitcoin’s value. For instance, the 2008 financial crisis saw a surge in interest in alternative assets, including Bitcoin (though it was still in its early stages). Similarly, global economic uncertainty surrounding the COVID-19 pandemic initially led to a Bitcoin price drop, followed by a significant recovery as investors sought inflation hedges.

Regulatory Developments and Governmental Policies

Governmental regulations and policies play a pivotal role in shaping Bitcoin’s adoption and price. Favorable regulations, such as the clear legal framework for Bitcoin trading in some jurisdictions, can boost investor confidence and increase demand, leading to price appreciation. Conversely, restrictive regulations, such as outright bans or excessive taxation, can stifle adoption and negatively impact the price. For example, China’s crackdown on cryptocurrency mining and trading in 2021 led to a significant drop in Bitcoin’s price. Conversely, El Salvador’s adoption of Bitcoin as legal tender initially caused a price surge, although the long-term impact remains to be seen. Future regulatory clarity in major economies could significantly influence Bitcoin’s price trajectory. A coordinated global regulatory framework could increase stability and attract institutional investment, potentially driving price appreciation. Conversely, fragmented or conflicting regulations could create uncertainty and negatively affect the price.

Technological Advancements and Bitcoin’s Network

Technological advancements within the Bitcoin network itself can influence its price. Layer-2 scaling solutions, such as the Lightning Network, aim to improve transaction speed and reduce fees, potentially increasing Bitcoin’s usability and attracting a wider range of users. Improvements in mining efficiency, through the development of more energy-efficient hardware, can reduce the cost of mining and potentially stabilize the network. A hypothetical scenario: A major technological breakthrough, such as the development of a highly efficient quantum-resistant cryptographic algorithm, could significantly enhance Bitcoin’s security and scalability, potentially leading to a substantial price increase due to increased confidence and wider adoption. This would require a large-scale network upgrade, but if successful, would drastically alter the landscape.

Market Sentiment, News Events, and Social Media Trends

Market sentiment, news events, and social media trends exert a considerable influence on Bitcoin’s price volatility. Positive news, such as large institutional investments or partnerships with major companies, can trigger price rallies. Conversely, negative news, such as security breaches or regulatory crackdowns, can lead to sharp price drops. The 2017 Bitcoin price surge was partly fueled by positive media coverage and increasing public awareness. Similarly, Elon Musk’s tweets have historically shown a correlation with Bitcoin price fluctuations. A comparative analysis of past events reveals a clear link between positive news and social media hype and price increases, and vice versa. The impact of these factors can be amplified by the inherent volatility of the cryptocurrency market.

Institutional Adoption and Bitcoin’s Price Stability, Bitcoin Price Prediction For 30 January 2025

The growing adoption of Bitcoin by institutional investors, such as large corporations and financial institutions, is a significant factor influencing price stability and future growth. These investments bring increased liquidity and legitimacy to the market, potentially reducing volatility and attracting further investment. Examples include MicroStrategy’s significant Bitcoin holdings and Tesla’s past investments. These investments have, in the past, often led to temporary price increases, though the long-term effects are complex and depend on a variety of other factors. Continued institutional adoption could contribute to Bitcoin’s price stability and long-term growth, making it a more established asset class.

Analyzing Historical Price Trends and Patterns

Understanding Bitcoin’s past price movements is crucial for informed speculation about its future. While past performance doesn’t guarantee future results, analyzing historical trends and patterns can offer valuable insights into potential price behavior. This analysis will examine key trends, compare Bitcoin’s performance to other assets, and acknowledge the inherent limitations of using historical data for prediction.

Bitcoin’s Historical Price Movements

Bitcoin’s price has been extraordinarily volatile since its inception. The following table illustrates some key price points and associated events, providing a snapshot of its historical performance. Note that this is a simplified representation and does not encompass every significant event. A comprehensive analysis would require a much larger dataset.

| Date | Price (USD) | Event | Analysis |

|---|---|---|---|

| 2010-07-18 | 0.0008 | First Bitcoin transaction for goods | Early adoption, low price reflecting limited awareness and usage. |

| 2013-11-29 | 1200 | First significant price surge | Increased media attention and speculation drove rapid price appreciation. |

| 2017-12-17 | 19783 | Peak of the 2017 bull market | Massive hype, institutional investment interest, and retail FOMO contributed to the all-time high at that point. |

| 2020-12-16 | 23000 | Crossing the $20,000 mark | Increased institutional adoption and macroeconomic factors contributed to price growth. |

| 2021-11-10 | 68789 | All-time high (as of October 26, 2023) | Continued institutional interest, DeFi boom, and wider adoption fueled another significant price surge. |

| 2022-11-09 | 15776 | Significant price decline | Macroeconomic headwinds, regulatory uncertainty, and the collapse of FTX contributed to a major downturn. |

Comparison with Other Asset Classes

Bitcoin’s price behavior differs significantly from traditional asset classes like gold and stocks. Gold, often seen as a safe haven asset, tends to exhibit lower volatility and a generally upward trend over the long term. Stocks, while volatile, are typically influenced by company performance, economic indicators, and investor sentiment. Bitcoin, on the other hand, is characterized by extreme volatility driven by factors such as regulatory developments, technological advancements, and market sentiment, often exhibiting characteristics of both a speculative asset and a store of value, depending on the market conditions. The lack of correlation between Bitcoin’s price and traditional markets presents both opportunities and risks.

Limitations of Using Historical Data

While historical analysis provides context, it’s crucial to acknowledge its limitations in predicting future Bitcoin prices. The cryptocurrency market is inherently volatile and susceptible to unpredictable events – technological disruptions, regulatory changes, and even social media trends can significantly impact price. For instance, numerous predictions for Bitcoin’s price in 2022 significantly overestimated its performance, failing to account for the negative impact of macroeconomic factors and the FTX collapse. Relying solely on historical data to predict future price movements can be misleading and potentially lead to significant financial losses. The complexity of the factors influencing Bitcoin’s price renders simple extrapolations of past trends unreliable.

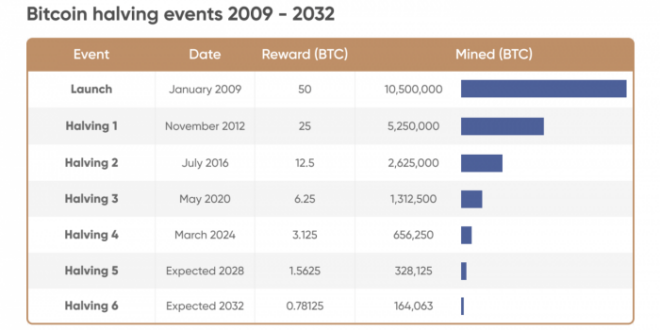

Bitcoin Price Prediction For 30 January 2025 – Predicting the Bitcoin price for January 30th, 2025, is challenging, but a key factor to consider is the impact of the upcoming halving. Accurately forecasting the Bitcoin price hinges on understanding the halving’s timeline, which you can explore further with this helpful resource on the Bitcoin Halving Date 2025 Prediction. Therefore, analyzing the projected halving date is crucial for refining any Bitcoin price prediction for late 2025.

Predicting the Bitcoin price for January 30th, 2025, is challenging, but a key factor to consider is the upcoming halving event. Understanding the impact of this significant event requires close monitoring of the Bitcoin 2025 Halving Countdown , as it’s widely believed to influence Bitcoin’s scarcity and, consequently, its potential price appreciation. Therefore, the halving’s proximity significantly impacts any Bitcoin price prediction for January 2025.

Accurately predicting the Bitcoin price for January 30th, 2025, is challenging, given the cryptocurrency’s volatility. However, understanding potential long-term trends can offer some insight. To get a sense of the broader market picture later that year, you might find the projections in this analysis helpful: Bitcoin October 2025 Prediction. This information could then inform your perspective on the Bitcoin price prediction for January 30th, 2025, allowing for a more nuanced assessment.

Accurately predicting the Bitcoin price for January 30th, 2025, is challenging, given the cryptocurrency’s volatility. However, understanding potential long-term trends can offer some insight. To get a sense of the broader market picture later that year, you might find the projections in this analysis helpful: Bitcoin October 2025 Prediction. This information could then inform your perspective on the Bitcoin price prediction for January 30th, 2025, allowing for a more nuanced assessment.

Accurately predicting the Bitcoin price for January 30th, 2025, is challenging, given the cryptocurrency’s volatility. However, understanding potential long-term trends can offer some insight. To get a sense of the broader market picture later that year, you might find the projections in this analysis helpful: Bitcoin October 2025 Prediction. This information could then inform your perspective on the Bitcoin price prediction for January 30th, 2025, allowing for a more nuanced assessment.

Accurately predicting the Bitcoin price for January 30th, 2025, is challenging, given the cryptocurrency’s volatility. However, understanding potential long-term trends can offer some insight. To get a sense of the broader market picture later that year, you might find the projections in this analysis helpful: Bitcoin October 2025 Prediction. This information could then inform your perspective on the Bitcoin price prediction for January 30th, 2025, allowing for a more nuanced assessment.

Accurately predicting the Bitcoin price for January 30th, 2025, is challenging, given the cryptocurrency’s volatility. However, understanding potential long-term trends can offer some insight. To get a sense of the broader market picture later that year, you might find the projections in this analysis helpful: Bitcoin October 2025 Prediction. This information could then inform your perspective on the Bitcoin price prediction for January 30th, 2025, allowing for a more nuanced assessment.