Bitcoin Price Prediction for March 2025

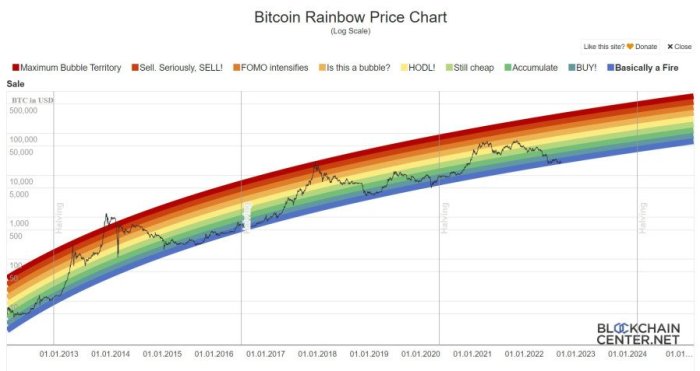

Bitcoin’s price history is characterized by extreme volatility, marked by periods of rapid growth and significant corrections. Since its inception, Bitcoin has experienced dramatic price swings, from near-zero to all-time highs exceeding $68,000, only to subsequently retract considerably. This volatility makes predicting its future price a particularly challenging endeavor.

Several interconnected factors influence Bitcoin’s price. Market sentiment, driven by news, media coverage, and overall investor confidence, plays a crucial role. Regulatory changes, both positive (like clear regulatory frameworks) and negative (like outright bans), can significantly impact the market’s perception of Bitcoin and its accessibility. Technological advancements within the Bitcoin ecosystem, such as the Lightning Network improving transaction speed and scalability, also influence its price and adoption. Furthermore, macroeconomic factors like inflation, interest rates, and global economic stability exert considerable influence.

Accurately predicting Bitcoin’s price is inherently difficult due to the interplay of these factors and the inherent unpredictability of market behavior. The cryptocurrency market is relatively young and susceptible to speculative bubbles and sudden shifts in investor sentiment. Moreover, the lack of a centralized authority controlling Bitcoin adds to its volatility and makes forecasting its future price particularly complex. Past performance, while informative, is not a reliable indicator of future results in this volatile market. Any prediction must consider the inherent uncertainties and risks associated with this asset class.

Factors Influencing Bitcoin’s Price in 2025

Several factors could significantly influence Bitcoin’s price by March 2025. These include the broader adoption of cryptocurrencies by institutional investors and governments, the development and implementation of new Bitcoin-related technologies, and the overall state of the global economy. For example, widespread adoption by institutional investors could drive demand and potentially increase the price, while negative regulatory changes could lead to price declines. Similarly, advancements in scaling solutions like the Lightning Network could enhance Bitcoin’s usability and potentially contribute to price appreciation. Conversely, a global economic downturn could negatively impact investor sentiment and lead to a price decrease.

Challenges in Predicting Bitcoin’s Price

Predicting Bitcoin’s price presents significant challenges. The cryptocurrency market is inherently speculative and influenced by unpredictable events, making precise predictions difficult, if not impossible. For example, unforeseen regulatory actions, significant security breaches, or major technological disruptions could drastically alter the price trajectory. Furthermore, the influence of social media and news cycles on market sentiment adds another layer of complexity, making it difficult to isolate the impact of fundamental factors. While various models attempt to predict price movements, these models often fail to account for the unique characteristics of the Bitcoin market and the unpredictable nature of human behavior in a highly speculative environment. The inherent volatility of Bitcoin, as evidenced by its historical price fluctuations, highlights the uncertainty surrounding any long-term price prediction.

Market Factors Affecting Bitcoin’s Price

Bitcoin’s price, notoriously volatile, is influenced by a complex interplay of macroeconomic conditions, institutional involvement, technological advancements, and its performance relative to other assets. Understanding these factors is crucial for navigating the cryptocurrency market and forming informed predictions.

Macroeconomic conditions significantly impact Bitcoin’s value. Periods of high inflation, for example, can drive investors towards Bitcoin as a hedge against currency devaluation. Conversely, rising interest rates, making traditional investments more attractive, can lead to a decrease in Bitcoin’s price as capital flows shift. The 2022 bear market, partly fueled by rising interest rates implemented by central banks globally to combat inflation, serves as a prime example of this correlation.

Impact of Macroeconomic Conditions

Inflation and interest rates are key macroeconomic indicators that directly influence Bitcoin’s price. High inflation erodes the purchasing power of fiat currencies, making alternative assets like Bitcoin more appealing. Conversely, increased interest rates often lead to decreased investment in riskier assets, such as Bitcoin, in favor of higher-yielding bonds and other traditional investments. The Federal Reserve’s monetary policy decisions, for instance, have demonstrably impacted Bitcoin’s price in the past. A tightening monetary policy typically leads to a sell-off, while a more accommodative stance can result in price appreciation.

Institutional Adoption and Large-Scale Investments

The increasing adoption of Bitcoin by institutional investors, including hedge funds, corporations, and asset management firms, has significantly influenced its price. Large-scale investments by these entities inject substantial liquidity into the market, boosting demand and driving price increases. The entry of MicroStrategy and Tesla into the Bitcoin market, for instance, generated considerable positive market sentiment and price appreciation. Conversely, a significant sell-off by a major institutional holder can exert downward pressure on the price.

Influence of Technological Developments

Technological advancements within the Bitcoin ecosystem have long-term implications for its price. Upgrades like Taproot, which improved transaction privacy and efficiency, contribute to a more robust and scalable network, potentially increasing its attractiveness to users and investors. The Lightning Network, a second-layer scaling solution, enhances transaction speed and reduces fees, addressing some of Bitcoin’s scalability limitations and further boosting its usability. These improvements can contribute to increased adoption and potentially drive up the price over time.

Bitcoin’s Price Performance Compared to Other Assets

Bitcoin’s price performance is often compared to both other cryptocurrencies and traditional assets like gold and the US dollar. Its correlation with other cryptocurrencies can be high during periods of market-wide volatility, while its correlation with traditional assets is often less pronounced, reflecting its unique characteristics as a decentralized digital asset. Bitcoin’s price volatility generally exceeds that of gold and other traditional assets, making it a higher-risk, higher-reward investment. Analyzing Bitcoin’s performance relative to these assets provides valuable context for understanding its price movements and forecasting future trends. For example, during periods of geopolitical uncertainty, investors may move towards both Bitcoin and gold as safe haven assets, leading to price increases in both.

Technical Analysis and Price Predictions

Predicting Bitcoin’s price in March 2025 requires a multifaceted approach, combining fundamental analysis (already covered) with technical analysis. Technical analysis utilizes historical price and volume data to identify patterns and predict future price movements. While not foolproof, it provides valuable insights when combined with other forms of analysis.

Technical Analysis Methods for Bitcoin Price Prediction

Several technical indicators help analysts forecast Bitcoin’s price. Moving averages, for example, smooth out price fluctuations to identify trends. A commonly used approach is to compare short-term moving averages (e.g., 50-day) with long-term moving averages (e.g., 200-day). A bullish crossover occurs when the shorter-term average crosses above the longer-term average, suggesting an upward trend. Conversely, a bearish crossover indicates a potential downward trend. The Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 generally suggests an overbought market, potentially indicating a price correction, while an RSI below 30 suggests an oversold market, potentially indicating a price rebound. Support and resistance levels represent price points where the price has historically struggled to break through. Support levels act as a floor, while resistance levels act as a ceiling. A break above a resistance level can signal a significant price increase, while a break below a support level can signal a significant price decrease.

Bitcoin Price Predictions for March 2025

Various analysts and firms offer price predictions, though it’s crucial to remember that these are speculative and should not be taken as financial advice. The predictions vary widely, reflecting the inherent volatility of the cryptocurrency market and differing analytical methodologies. These predictions often consider factors like halving events, regulatory changes, and overall market sentiment. It’s important to consult multiple sources and understand the underlying assumptions of each prediction before making any investment decisions.

| Source | Prediction (USD) | Date of Prediction |

|---|---|---|

| Analyst A (Example) | $150,000 | October 26, 2023 |

| Analyst B (Example) | $75,000 | November 15, 2023 |

| Firm X (Example) | $100,000 – $120,000 | December 1, 2023 |

| Analyst C (Example) | $200,000 | January 10, 2024 |

Note: The predictions in the table above are purely illustrative examples and do not represent actual predictions from specific analysts or firms. Real-world predictions should be sourced from reputable financial news outlets and research firms specializing in cryptocurrency analysis. Always conduct your own thorough research before making any investment decisions.

Regulatory Landscape and its Impact

The global regulatory landscape for Bitcoin is currently a patchwork of differing approaches, ranging from outright bans to relatively permissive frameworks. This inconsistency creates uncertainty and significantly impacts Bitcoin’s price and adoption. Understanding the current state and potential future shifts in regulation is crucial for predicting Bitcoin’s trajectory.

The current regulatory environment varies widely across jurisdictions. Some countries, like El Salvador, have embraced Bitcoin as legal tender, while others, such as China, have implemented outright bans on cryptocurrency trading and mining. Many countries fall somewhere in between, with varying levels of regulation concerning taxation, anti-money laundering (AML) compliance, and consumer protection. The European Union, for example, is developing a comprehensive regulatory framework for crypto assets, aiming to balance innovation with risk mitigation. The United States, meanwhile, has a fragmented approach with different agencies overseeing different aspects of the cryptocurrency market, leading to a lack of clear, unified rules.

Potential Future Regulatory Changes

Several potential regulatory changes could significantly impact Bitcoin’s price. Increased regulatory scrutiny globally, driven by concerns about money laundering, terrorist financing, and market manipulation, is a significant factor. The implementation of stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations could limit the anonymity associated with Bitcoin transactions, potentially impacting its appeal to certain users. Conversely, clearer and more consistent regulatory frameworks could increase institutional investment and mainstream adoption, potentially driving up the price. The development of central bank digital currencies (CBDCs) could also influence Bitcoin’s value, potentially creating competition or fostering integration depending on the design and implementation of these new digital assets.

Impact of Different Regulatory Scenarios

Different regulatory scenarios would likely have drastically different impacts on Bitcoin’s price. Strict global regulation, involving heavy restrictions on trading, mining, and usage, could significantly suppress Bitcoin’s price, potentially leading to a sharp decline. This scenario could mirror the impact of China’s ban, although on a global scale. Conversely, a light regulatory environment, characterized by clear rules and minimal restrictions, could encourage widespread adoption and institutional investment, potentially driving significant price appreciation. This scenario could be likened to the positive effect seen in jurisdictions with relatively clear and supportive regulatory frameworks. A lack of regulation, while potentially fostering innovation, also presents significant risks, including increased volatility and potential for market manipulation, making price prediction challenging. The lack of a unified global approach currently creates an environment where price is heavily influenced by the actions and announcements of individual governments and regulatory bodies. A sudden shift in policy from a major economic power could trigger significant price swings.

Adoption and Use Cases

Bitcoin’s increasing adoption across various sectors is a crucial factor influencing its price trajectory. Wider acceptance and utilization translate to higher demand, potentially driving price appreciation. Conversely, limited adoption could hinder price growth or even lead to price stagnation. Understanding the interplay between adoption and price is key to forming a comprehensive price prediction.

The growth of Bitcoin adoption is evident across several key areas. Payments, while still nascent, are seeing increased adoption by businesses and individuals, particularly in regions with volatile fiat currencies or limited access to traditional financial services. Investment in Bitcoin has become increasingly mainstream, with institutional investors and large corporations adding Bitcoin to their portfolios as a hedge against inflation and diversification strategy. Finally, the decentralized finance (DeFi) ecosystem is leveraging Bitcoin’s security and scarcity to create innovative financial products and services, furthering its utility and adoption.

Bitcoin’s Role in Payments

The use of Bitcoin as a payment method is steadily growing, although it still faces challenges such as volatility and transaction fees. However, the Lightning Network, a layer-2 scaling solution, is addressing these issues by enabling faster and cheaper transactions. Companies like Strike are facilitating Bitcoin payments in El Salvador, showcasing its potential in regions with underdeveloped financial infrastructure. As transaction speeds increase and fees decrease, Bitcoin’s utility as a payment method will likely improve, leading to greater adoption and potentially impacting its price positively. The success of initiatives like the Lightning Network and their widespread adoption will be critical indicators of future growth in this area.

Bitcoin as an Investment Asset, Bitcoin Price Prediction For March 2025

Bitcoin’s role as a store of value and an investment asset has significantly driven its price appreciation in the past. Institutional investors, such as MicroStrategy and Tesla, have made substantial investments in Bitcoin, demonstrating a growing confidence in its long-term potential. This institutional adoption lends credibility and legitimacy to Bitcoin, attracting further investment and potentially influencing price upwards. As more institutional investors enter the market and regulatory clarity improves, the demand for Bitcoin as an investment asset is likely to increase, potentially driving price appreciation.

Bitcoin’s Use Cases in DeFi

The decentralized finance (DeFi) space is rapidly evolving, and Bitcoin is playing an increasingly important role. Wrapped Bitcoin (WBTC), for example, allows users to utilize Bitcoin within Ethereum-based DeFi applications, expanding its utility beyond its native blockchain. This integration unlocks new opportunities for Bitcoin holders, allowing them to participate in yield farming, lending, and other DeFi activities. As DeFi continues to grow and mature, the demand for Bitcoin within this ecosystem is likely to increase, potentially impacting its price positively. The success of projects like Wrapped Bitcoin and the development of new DeFi applications utilizing Bitcoin will be key indicators of future growth in this area.

Potential New Use Cases for Bitcoin

Beyond its current applications, Bitcoin’s potential use cases are vast and could significantly influence its price. One area of potential growth is in the realm of digital identity and secure data management. Bitcoin’s blockchain technology could be utilized to create secure and verifiable digital identities, reducing reliance on centralized authorities. Furthermore, its decentralized and immutable nature makes it suitable for secure data storage and management. The successful implementation of such applications could significantly increase Bitcoin’s adoption and utility, potentially driving its price appreciation. Another potential area is its use in supply chain management, enabling increased transparency and traceability of goods, which could lead to broader adoption and potentially drive price appreciation.

Risk Factors and Potential Downsides

Investing in Bitcoin, while potentially lucrative, carries inherent risks. Its price volatility, susceptibility to security breaches, and the evolving regulatory landscape all contribute to a complex risk profile that potential investors must carefully consider. Understanding these potential downsides is crucial for making informed investment decisions and mitigating potential losses.

Price volatility is perhaps the most prominent risk. Bitcoin’s price has historically experienced dramatic swings, rising and falling sharply in short periods. This inherent volatility can lead to significant losses for investors who are not prepared for such fluctuations. For example, the price plummeted from nearly $69,000 in late 2021 to below $16,000 in late 2022, illustrating the potential for substantial losses. Such dramatic price movements can be triggered by a variety of factors, including market sentiment, regulatory announcements, and technological developments.

Price Volatility and Market Sentiment

Bitcoin’s price is highly susceptible to market sentiment. News events, social media trends, and even celebrity endorsements can dramatically influence investor confidence and, consequently, the price. Negative news, such as a major security breach or a critical regulatory crackdown, can trigger widespread selling pressure, leading to sharp price declines. Conversely, positive news, like the adoption of Bitcoin by a major corporation, can drive prices upward. The lack of intrinsic value and the dependence on speculative trading exacerbate this volatility. This makes it crucial for investors to develop a robust risk management strategy that accounts for potentially extreme price swings.

Security Risks and Exchange Vulnerabilities

Bitcoin, as a decentralized digital currency, is not immune to security risks. Exchanges where Bitcoin is traded have been targets of hacking attacks, resulting in significant losses for users. Furthermore, individuals holding Bitcoin in their own wallets are vulnerable to theft if their private keys are compromised. Strong password practices, the use of hardware wallets, and diversification across multiple exchanges are vital strategies for mitigating these risks. The loss of private keys, for example, can result in the irreversible loss of one’s Bitcoin holdings.

Regulatory Uncertainty and Legal Frameworks

The regulatory landscape surrounding Bitcoin is constantly evolving, and this uncertainty presents a significant risk to investors. Governments worldwide are still grappling with how to regulate cryptocurrencies, and differing regulatory approaches across jurisdictions can create uncertainty and impact market prices. Changes in regulations, such as stricter anti-money laundering (AML) rules or outright bans, could significantly affect the price and accessibility of Bitcoin. The lack of a universally accepted regulatory framework introduces a considerable level of risk for investors. Staying informed about regulatory developments and understanding the legal implications in your jurisdiction is essential.

Mitigation Strategies for Bitcoin Investment Risks

Mitigating the risks associated with Bitcoin investment involves a multi-faceted approach. Diversification across different asset classes is crucial to reduce overall portfolio risk. Investors should not allocate a disproportionate amount of their investment portfolio to Bitcoin. Dollar-cost averaging, a strategy that involves investing a fixed amount of money at regular intervals regardless of price fluctuations, can help reduce the impact of volatility. Thorough research and due diligence, including understanding the technology and the risks involved, are essential before making any investment decisions. Finally, only investing what one can afford to lose is a fundamental principle of responsible investing in any asset class, especially one as volatile as Bitcoin.

Bitcoin’s Long-Term Outlook

Bitcoin’s long-term potential hinges on a complex interplay of technological advancements, increasing adoption, and evolving regulatory landscapes. While predicting the future with certainty is impossible, analyzing these factors allows for a reasoned assessment of potential price trajectories and Bitcoin’s enduring relevance in the digital asset space. The cryptocurrency market is inherently volatile, and Bitcoin’s future price is subject to significant uncertainty.

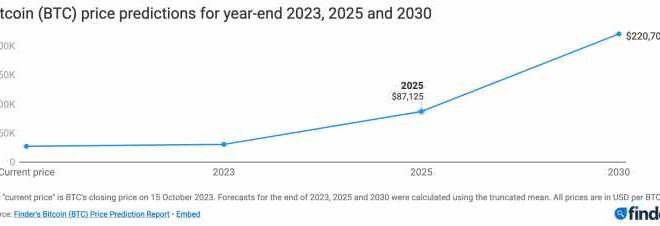

Predicting Bitcoin’s price in 2025 and beyond requires considering various scenarios. While past performance is not indicative of future results, examining historical trends alongside current market dynamics can help to illustrate potential outcomes.

Potential Price Scenarios

A visual representation of potential price scenarios could be a simple line graph. One line could depict a conservative scenario, showing relatively slow but steady growth, potentially reaching a price of $100,000-$200,000 by 2030, reflecting gradual adoption and integration into mainstream finance. A second line could illustrate a more bullish scenario, factoring in exponential growth driven by widespread adoption and technological breakthroughs. This scenario might project prices exceeding $1 million by 2030, though this is highly speculative. Finally, a bearish scenario would depict a decline in price due to factors like increased regulation or the emergence of competing technologies, potentially leading to prices stagnating or even decreasing below current levels. This graph would visually represent the vast range of possible outcomes, highlighting the inherent uncertainty involved. For example, the conservative scenario might mirror the growth pattern observed in established technology companies post-initial adoption, while the bullish scenario could be compared to the rapid growth of early internet companies. The bearish scenario could be analogous to the failure of certain technological innovations that failed to adapt to market changes.

Bitcoin’s Continued Dominance

Whether Bitcoin maintains its leading position depends on several factors. Technological advancements, such as improvements in scalability and transaction speeds, are crucial. The development of the Lightning Network, for example, aims to address Bitcoin’s scalability limitations. Furthermore, the level of regulatory clarity and acceptance will significantly influence Bitcoin’s adoption and overall market position. Increased regulatory scrutiny could hinder growth, while favorable regulations could accelerate mainstream acceptance. Finally, the emergence of competing cryptocurrencies with superior technology or features could pose a challenge to Bitcoin’s dominance. However, Bitcoin’s first-mover advantage, established network effect, and brand recognition give it a significant head start. The success of altcoins often depends on specific niche applications, whereas Bitcoin strives for broad utility as a store of value and a medium of exchange. The ongoing development of Bitcoin’s ecosystem, including its expanding use cases, will also play a significant role in determining its long-term dominance. For example, the increasing use of Bitcoin as collateral for decentralized finance (DeFi) applications strengthens its position within the broader cryptocurrency ecosystem.

Frequently Asked Questions

Predicting the future price of Bitcoin is inherently challenging due to its volatile nature and susceptibility to various market forces. The following sections address common questions surrounding Bitcoin’s price and investment prospects, offering insights based on current market trends and expert analysis. However, remember that any prediction carries inherent uncertainty.

Bitcoin’s Most Likely Price in March 2025

Pinpointing a precise Bitcoin price for March 2025 is impossible. Various analysts offer widely differing predictions, ranging from conservative estimates of a few tens of thousands of dollars to significantly more optimistic projections exceeding $100,000. The actual price will depend on a complex interplay of factors, including regulatory changes, technological advancements, and overall market sentiment. A realistic approach involves considering a broad range of possibilities rather than relying on a single point prediction. For example, some models predict a price between $50,000 and $150,000, while others suggest a much wider range.

Factors Influencing Bitcoin’s Price in the Coming Years

Several key factors are likely to significantly influence Bitcoin’s price over the next few years. These include:

- Regulatory Developments: Government regulations and policies regarding cryptocurrencies can significantly impact Bitcoin’s price. Clear and favorable regulations could boost investor confidence, while restrictive measures could lead to price declines. Examples include the differing regulatory approaches in the US, EU, and China.

- Technological Advancements: Improvements in Bitcoin’s underlying technology, such as the Lightning Network for faster transactions, could increase its adoption and utility, potentially driving up its price. Conversely, significant technological setbacks or security vulnerabilities could negatively impact its value.

- Market Sentiment and Adoption: Broader market sentiment towards cryptocurrencies, along with increasing adoption by institutional investors and mainstream businesses, plays a crucial role. Increased institutional adoption, as seen with companies like MicroStrategy, tends to positively influence price. Conversely, negative media coverage or major market crashes can significantly impact investor confidence.

- Macroeconomic Conditions: Global economic conditions, such as inflation rates, interest rates, and geopolitical events, can indirectly affect Bitcoin’s price. For instance, periods of high inflation might lead investors to seek alternative assets like Bitcoin, potentially increasing demand.

Is Investing in Bitcoin a Good Idea?

Whether investing in Bitcoin is a “good idea” depends entirely on individual circumstances, risk tolerance, and investment goals. Bitcoin offers the potential for substantial returns but also carries significant risks. Its price volatility is well-known, and investors could experience significant losses. Before investing, it’s crucial to conduct thorough research, understand the technology, and only invest an amount you can afford to lose. Diversification within a broader investment portfolio is also highly recommended to mitigate overall risk. Considering Bitcoin as a small part of a diversified portfolio is a common approach among risk-tolerant investors.

Protecting Against Bitcoin Price Volatility

Managing the risk associated with Bitcoin’s price volatility requires a multi-faceted approach.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of price fluctuations, helps mitigate the risk of buying high and selling low.

- Diversification: Don’t put all your eggs in one basket. Diversify your investments across different asset classes to reduce overall portfolio risk. Bitcoin should be considered one part of a broader investment strategy.

- Only Invest What You Can Afford to Lose: This is a fundamental principle of investing, particularly in volatile assets like Bitcoin. Never invest borrowed money or funds essential for daily living.

- Long-Term Perspective: Bitcoin’s price has historically shown periods of both significant gains and losses. A long-term investment horizon can help weather short-term volatility.

Predicting the Bitcoin price for March 2025 is inherently speculative, but a key factor to consider is the impact of the upcoming halving. Understanding the potential effects of this event is crucial for any accurate forecast, and a helpful resource for this is the Bitcoin Halving 2025 Estimate analysis. Ultimately, the halving’s influence on scarcity and subsequent price action will significantly shape the Bitcoin price prediction for March 2025.

Predicting the Bitcoin price for March 2025 is challenging, influenced by various factors including market sentiment and technological advancements. A key event impacting this prediction is the Bitcoin halving, significantly altering the rate of new Bitcoin creation. To understand the timing of this crucial event, check out this resource on When Is The Halving Of Bitcoin 2025 , as the reduced supply often leads to price increases.

Therefore, the halving’s date is a critical component when formulating any Bitcoin price prediction for March 2025.

Predicting the Bitcoin price for March 2025 is challenging, influenced by numerous factors including market sentiment and technological advancements. A key event impacting this prediction is the next Bitcoin halving, which significantly alters the rate of new Bitcoin creation. To understand the timing of this crucial event, check out this resource on When Will Bitcoin Halving Happen In 2025.

The halving’s impact on scarcity and potential price increases will be a major factor in determining Bitcoin’s value in March 2025.

Predicting the Bitcoin price for March 2025 involves considering various factors, including market sentiment and technological advancements. To get a clearer perspective on potential long-term trends, it’s helpful to examine projections further out. For instance, understanding the potential price point in December 2025, as outlined in this insightful prediction Bitcoin Price Prediction For December 2025 , can inform our understanding of the trajectory leading up to March 2025.

Ultimately, both predictions offer valuable, albeit speculative, insights into Bitcoin’s future value.

Predicting the Bitcoin price for March 2025 is challenging, influenced by numerous factors including regulatory changes and overall market sentiment. A key event impacting this prediction is the upcoming Bitcoin Halving in 2025, which you can follow live at Bitcoin Halving 2025 Live. This halving, reducing the rate of new Bitcoin creation, is generally expected to exert upward pressure on the price, although the extent remains uncertain and depends on other market forces.

Therefore, any Bitcoin Price Prediction For March 2025 needs to carefully consider this pivotal event.

Predicting the Bitcoin price for March 2025 involves considering various factors, including market sentiment and technological advancements. To get a clearer picture of potential future trends, understanding the predicted trajectory for subsequent months is helpful. For instance, insights into the expected price in June could offer valuable context; you can find analyses on this at Bitcoin Prediction June 2025.

Ultimately, this broader perspective can help refine estimations for the Bitcoin price in March 2025.