Risks and Uncertainties

Predicting the price of Bitcoin in 2025, or any asset for that matter, is inherently risky. Numerous factors, both predictable and unpredictable, can significantly influence its value. While bullish predictions might paint a rosy picture, a thorough understanding of the potential downsides is crucial for any investor considering exposure to this volatile cryptocurrency. Ignoring these risks could lead to substantial financial losses.

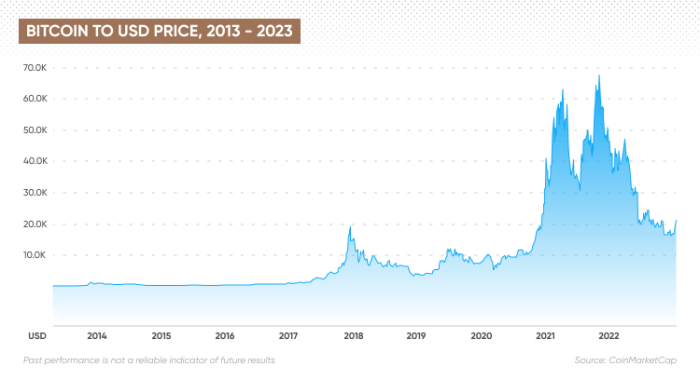

The inherent volatility of Bitcoin is a primary concern. Its price has historically experienced dramatic swings, sometimes exceeding 10% in a single day. These fluctuations are driven by a complex interplay of market sentiment, regulatory actions, technological advancements, and macroeconomic factors. This extreme price volatility presents a significant risk to investors who may not be prepared for sudden and substantial losses. For instance, the 2017-2018 Bitcoin bubble saw prices rise to almost $20,000 before crashing to under $4,000 within a year, wiping out significant wealth for many investors.

Volatility and Market Sentiment

Bitcoin’s price is heavily influenced by market sentiment, which can shift rapidly and unpredictably. Positive news, such as widespread adoption by major corporations or positive regulatory developments, can drive prices upward. Conversely, negative news, such as security breaches, regulatory crackdowns, or negative media coverage, can trigger sharp price declines. This sensitivity to sentiment makes it difficult to accurately predict long-term price movements, and even short-term forecasts can be unreliable. The rapid rise and fall of memecoins like Dogecoin, influenced heavily by social media trends and hype, exemplifies this volatility driven by sentiment.

Security Concerns and Hacks

Bitcoin’s decentralized nature, while a strength in terms of censorship resistance, also presents security vulnerabilities. Exchanges and wallets holding significant amounts of Bitcoin have been targets of hacking attacks in the past, resulting in substantial losses for users. These security breaches can negatively impact investor confidence and trigger price drops. The infamous Mt. Gox hack in 2014, which resulted in the loss of hundreds of thousands of Bitcoins, serves as a stark reminder of this risk.

Regulatory Uncertainty

The regulatory landscape surrounding Bitcoin is constantly evolving and varies significantly across different jurisdictions. Governments worldwide are still grappling with how to regulate cryptocurrencies, and the lack of clear regulatory frameworks creates uncertainty for investors. Changes in regulations, such as bans on Bitcoin trading or increased taxation, could significantly impact its price. The differing regulatory approaches taken by China (which has largely banned cryptocurrency trading) and El Salvador (which has adopted Bitcoin as legal tender) highlight the significant impact of regulatory decisions on Bitcoin’s price.

Black Swan Events

The potential for unforeseen events to drastically alter the Bitcoin market is substantial. These “black swan” events, characterized by their rarity, impact, and unpredictability, can have a profound and lasting effect on the cryptocurrency’s price. Examples include a major global financial crisis triggering a flight to safety away from risky assets like Bitcoin, the emergence of a superior competing cryptocurrency, or a significant technological flaw being discovered in the Bitcoin network itself. The sudden collapse of the Terra Luna ecosystem in 2022, which triggered a significant downturn in the broader cryptocurrency market, is a recent example of such a black swan event.

Disclaimer and Conclusion

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently speculative. Market volatility is a defining characteristic of the cryptocurrency market, and substantial price swings, both upward and downward, are commonplace. The information presented in this analysis should not be interpreted as financial advice, and any investment decisions made based on this prediction are solely at your own risk. Remember that past performance is not indicative of future results. You could lose a significant portion, or even all, of your investment.

This analysis explored potential Bitcoin price movements for November 2025, considering several key factors. While a precise prediction is impossible, the analysis aimed to provide a reasonable range of outcomes based on current market trends and anticipated developments. The following summarizes the key findings and influential factors:

Key Findings and Influential Factors

Bitcoin Price Prediction For November 2025 – The analysis considered a multitude of factors to arrive at a potential price range. These factors interact in complex ways, making precise prediction impossible but allowing for a reasoned estimation.

- Adoption Rate: Widespread institutional and retail adoption could drive significant price increases. For example, increased acceptance by major financial institutions and the expansion of Bitcoin’s use cases in everyday transactions could boost demand. Conversely, a slowdown in adoption could limit price appreciation.

- Regulatory Landscape: Clear and favorable regulatory frameworks in major jurisdictions could enhance investor confidence and fuel price growth. Conversely, stricter regulations or outright bans could negatively impact the price. The ongoing regulatory uncertainty in many countries represents a significant risk factor.

- Technological Developments: Innovations within the Bitcoin ecosystem, such as the Lightning Network’s improvement in transaction speed and scalability, could positively influence the price. Conversely, security breaches or technological limitations could negatively impact investor sentiment.

- Macroeconomic Conditions: Global economic factors, such as inflation, interest rates, and geopolitical events, significantly influence Bitcoin’s price. Periods of economic uncertainty often lead to increased demand for Bitcoin as a safe haven asset, while periods of economic stability might see reduced demand.

- Market Sentiment: Investor sentiment, driven by news events, media coverage, and overall market psychology, plays a crucial role in price fluctuations. Positive sentiment can lead to price rallies, while negative sentiment can trigger significant sell-offs. For instance, a major security breach could trigger a substantial price drop.

Based on the interplay of these factors, the analysis suggests a potential price range for Bitcoin in November 2025. However, it is crucial to reiterate the high degree of uncertainty inherent in such predictions.

Frequently Asked Questions (FAQ): Bitcoin Price Prediction For November 2025

This section addresses common queries regarding Bitcoin’s price and the broader cryptocurrency market, providing insights into the factors influencing its value and the inherent risks involved in investment. Understanding these aspects is crucial for making informed decisions.

Major Factors Influencing Bitcoin’s Price

Bitcoin’s price is a complex interplay of various factors. Macroeconomic conditions, such as inflation rates and overall economic stability, significantly impact investor sentiment and the flow of capital into cryptocurrencies. Stringent regulations or supportive government policies can dramatically alter the market’s trajectory. Technological advancements, including scalability solutions and new applications built on the Bitcoin network, can influence its long-term value proposition. Finally, market sentiment, driven by news events, social media trends, and overall investor confidence, plays a pivotal role in short-term price fluctuations. For example, a period of high inflation might drive investors towards Bitcoin as a hedge against inflation, increasing demand and price. Conversely, negative news about regulatory crackdowns can trigger significant sell-offs.

Accuracy of Bitcoin Price Prediction

Accurately predicting Bitcoin’s price is exceptionally challenging, if not impossible. The cryptocurrency market is highly volatile and influenced by unpredictable events, making precise forecasting extremely difficult. Numerous factors, including those mentioned above, interact in complex and often unforeseen ways. While technical analysis and fundamental analysis can offer insights, they cannot definitively predict future price movements. Past performance is not indicative of future results, and relying solely on predictions can lead to significant financial losses. Consider the example of the 2017 Bitcoin bull run, which was followed by a substantial correction; accurately predicting the peak and subsequent drop was impossible for even the most sophisticated analysts.

Risks Associated with Investing in Bitcoin, Bitcoin Price Prediction For November 2025

Investing in Bitcoin carries substantial risks. Its price volatility is notorious, with significant price swings occurring within short periods. This inherent volatility can lead to substantial gains but also significant losses. Security risks are also present, with the potential for hacking, theft, and loss of private keys. Furthermore, regulatory uncertainty remains a major concern, as governments worldwide grapple with how to regulate cryptocurrencies. Changes in regulations can significantly impact Bitcoin’s price and accessibility. For example, the collapse of FTX, a major cryptocurrency exchange, highlighted the security and regulatory risks inherent in the market.

Alternative Cryptocurrencies

Beyond Bitcoin, several alternative cryptocurrencies, or altcoins, exist, each with its own unique features and functionalities. Ethereum, for example, is known for its smart contract capabilities and decentralized application ecosystem, differentiating it from Bitcoin’s primary focus on digital currency. Other prominent altcoins, such as Solana and Cardano, offer distinct advantages in terms of transaction speed and scalability. However, it’s important to note that altcoins generally carry even higher risk than Bitcoin due to their smaller market capitalization and often less established technology. Investing in altcoins requires thorough research and an understanding of their specific characteristics and associated risks.

Accurately predicting the Bitcoin price for November 2025 is challenging, depending heavily on various market factors. A key element influencing this prediction is the impact of the 2025 halving, which you can read more about in this insightful article: Bitcoin Prediction After Halving 2025. Understanding the post-halving effects is crucial for formulating a reasonable Bitcoin price prediction for November 2025, as it significantly impacts supply and potentially, demand.

Accurately predicting the Bitcoin price for November 2025 is challenging, influenced by numerous factors. A key element to consider is the impact of the upcoming Bitcoin Halving Cycles, which significantly affect the supply of new Bitcoins. For a deeper understanding of these cycles and their potential effects on the market, check out this insightful resource on Bitcoin Halving Cycles 2025.

Ultimately, the halving’s influence on scarcity will likely play a considerable role in shaping the Bitcoin price prediction for November 2025.

Predicting the Bitcoin price for November 2025 is challenging, involving numerous factors. A key element influencing this prediction is the anticipated impact of the 2025 halving event. To understand potential price movements after the halving, it’s helpful to consult resources like this analysis on Bitcoin Price Prediction After Halving 2025 , which can inform our understanding of the Bitcoin price prediction for November 2025 and beyond.

Predicting the Bitcoin price for November 2025 is challenging, involving numerous factors. A key element influencing this prediction is the anticipated impact of the 2025 halving event. To understand potential price movements after the halving, it’s helpful to consult resources like this analysis on Bitcoin Price Prediction After Halving 2025 , which can inform our understanding of the Bitcoin price prediction for November 2025 and beyond.

Predicting the Bitcoin price for November 2025 is challenging, involving numerous factors. A key element influencing this prediction is the anticipated impact of the 2025 halving event. To understand potential price movements after the halving, it’s helpful to consult resources like this analysis on Bitcoin Price Prediction After Halving 2025 , which can inform our understanding of the Bitcoin price prediction for November 2025 and beyond.

Predicting the Bitcoin price for November 2025 is challenging, involving numerous factors. A key element influencing this prediction is the anticipated impact of the 2025 halving event. To understand potential price movements after the halving, it’s helpful to consult resources like this analysis on Bitcoin Price Prediction After Halving 2025 , which can inform our understanding of the Bitcoin price prediction for November 2025 and beyond.