Bitcoin Price Prediction for September 2025

Predicting the price of Bitcoin in September 2025 is a challenging endeavor. Bitcoin’s history is marked by extreme volatility, with periods of dramatic price increases followed by equally sharp corrections. Accurately forecasting its long-term value requires navigating a complex interplay of technological, economic, regulatory, and psychological factors, making any prediction inherently uncertain. While historical data can provide some context, the cryptocurrency market is still relatively young and susceptible to unforeseen events that can significantly impact its trajectory.

Bitcoin, launched in 2009, is a decentralized digital currency utilizing blockchain technology. This technology, which records transactions across a distributed network, ensures transparency and security. However, its decentralized nature also means Bitcoin’s price is not subject to the control of any central authority, making it vulnerable to speculative bubbles and market manipulation. Key features such as its limited supply (21 million coins) and increasing adoption by businesses and institutions contribute to price fluctuations, but also introduce complexities in predicting future value. Understanding these features and their potential impact is crucial for any price prediction attempt.

Factors Influencing Bitcoin’s Price

Several interconnected factors contribute to Bitcoin’s price volatility and make accurate long-term prediction difficult. These include macroeconomic conditions (global economic growth, inflation rates, interest rate policies), regulatory developments (government regulations and legal frameworks concerning cryptocurrencies), technological advancements (scaling solutions, new applications of blockchain technology), and market sentiment (investor confidence, media coverage, and overall market psychology). For example, a period of high inflation could drive investors towards Bitcoin as a hedge against inflation, potentially increasing its price. Conversely, stringent government regulations could dampen investor enthusiasm and lead to a price decline. Similarly, technological breakthroughs enhancing Bitcoin’s scalability and efficiency could boost its adoption and, consequently, its price. Finally, negative media coverage or a significant security breach could trigger a sell-off and a price drop. Analyzing these factors and their potential interactions is essential for a more informed, though still uncertain, prediction.

Factors Influencing Bitcoin’s Price: Bitcoin Price Prediction For September 2025

Bitcoin’s price is a complex interplay of various factors, constantly shifting and influencing its value. Understanding these dynamics is crucial for navigating the volatile cryptocurrency market. While predicting the precise price remains challenging, analyzing these contributing elements provides valuable insight into potential price movements.

Macroeconomic Conditions

Macroeconomic factors significantly impact Bitcoin’s price, often acting as a counter-cyclical asset. During periods of high inflation, investors may seek refuge in Bitcoin, perceiving it as a hedge against currency devaluation. Conversely, rising interest rates can decrease Bitcoin’s appeal, as investors might find higher returns in traditional, interest-bearing assets. Recessionary fears can also drive investors towards safer havens, potentially impacting Bitcoin’s price negatively depending on the severity and perceived risk. For example, the 2022 bear market saw a significant price drop partially attributed to rising inflation and interest rates globally.

Regulatory Changes and Government Policies

Government regulations and policies play a crucial role in shaping Bitcoin’s price. Positive regulatory developments, such as clearer legal frameworks or the adoption of Bitcoin by central banks, can boost investor confidence and drive price increases. Conversely, negative news, like stricter regulations or outright bans, can trigger sell-offs and price declines. The differing regulatory approaches of various countries illustrate this impact, with some countries embracing cryptocurrencies while others maintain a cautious or restrictive stance. The impact of regulatory uncertainty is also significant, often leading to price volatility.

Technological Advancements

Technological advancements within the Bitcoin ecosystem significantly influence its adoption and price. Layer-2 scaling solutions, such as the Lightning Network, aim to improve transaction speed and reduce fees, making Bitcoin more user-friendly and potentially increasing its adoption. Other innovations, like improved wallet security or the development of new applications built on Bitcoin, can also positively impact its price by enhancing its utility and appeal. The successful implementation and widespread adoption of these advancements are key to long-term price growth.

Institutional Investor Adoption

The growing adoption of Bitcoin by institutional investors, such as large corporations and investment funds, has a substantial impact on its price. These large-scale investments can significantly increase demand, leading to price appreciation. The entry of institutional investors often signals a shift in market perception, lending credibility and driving further investment. Examples include MicroStrategy’s significant Bitcoin holdings, demonstrating the growing acceptance of Bitcoin as a viable asset class among institutional players.

Public Sentiment, Media Coverage, and Social Media Trends

Public sentiment, media coverage, and social media trends significantly influence Bitcoin’s price volatility. Positive news coverage and enthusiastic social media discussions can create FOMO (fear of missing out), driving up demand and price. Conversely, negative news or widespread criticism can lead to panic selling and price drops. The influence of prominent figures and influencers on social media is particularly noteworthy, highlighting the importance of carefully considering the information sources shaping public opinion. For instance, Elon Musk’s tweets have historically been correlated with significant Bitcoin price swings.

Supply and Demand Dynamics, Bitcoin Price Prediction For September 2025

The fundamental principle of supply and demand significantly impacts Bitcoin’s price trajectory. Bitcoin’s fixed supply of 21 million coins creates scarcity, potentially driving up its value over time, especially as demand increases. However, factors like mining activity, exchange listings, and regulatory changes can influence the available supply and overall market liquidity, leading to fluctuations in price. Increased demand without a corresponding increase in supply typically results in price appreciation, while decreased demand can lead to price declines. The halving events, which reduce the rate of Bitcoin mining, are prime examples of how supply dynamics influence the price.

Analyzing Historical Price Trends and Patterns

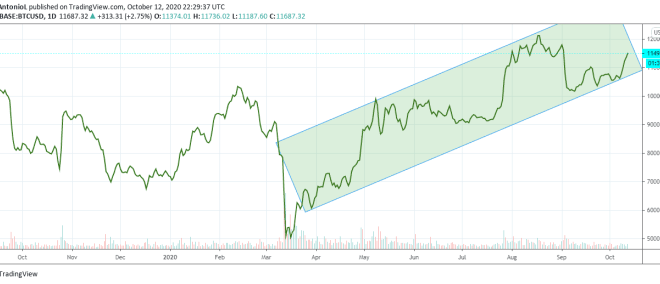

Bitcoin’s price history is marked by periods of dramatic growth (“bull runs”) interspersed with significant corrections (“bear markets”). Understanding these cycles and the events that triggered them is crucial for informed speculation about future price movements. Analyzing these patterns, in conjunction with macroeconomic factors and technological advancements, provides a more complete picture for price prediction.

Bitcoin’s price performance demonstrates significant volatility, unlike more traditional assets. This volatility stems from its relatively young age, its limited supply, and its susceptibility to both speculative fervor and regulatory uncertainty. Comparing its performance against established asset classes like gold and stocks reveals both similarities and stark differences.

Bitcoin’s Price Performance Compared to Other Asset Classes

Bitcoin’s price trajectory has often diverged significantly from that of gold and stocks. While gold typically acts as a safe haven asset during times of economic uncertainty, Bitcoin’s price can be highly correlated with broader market sentiment and technological developments within the cryptocurrency space. Stocks, on the other hand, are influenced by a wide array of factors, including company performance, interest rates, and geopolitical events. During periods of market downturn, Bitcoin has sometimes mirrored the volatility of the stock market, while at other times it has moved independently. This lack of consistent correlation highlights Bitcoin’s unique characteristics as an asset class.

Historical Relationship Between Bitcoin’s Price and Market Events

Several key events have demonstrably impacted Bitcoin’s price. For example, the 2017 bull run was fueled by increased mainstream media attention, the rise of initial coin offerings (ICOs), and the increasing adoption of Bitcoin by institutional investors. Conversely, regulatory crackdowns in various countries, alongside major exchange hacks and periods of intense market uncertainty, have triggered significant price drops. The COVID-19 pandemic, for instance, initially caused a sharp decline, followed by a substantial recovery fueled by both increased economic uncertainty and the stimulus packages implemented by governments worldwide. These instances illustrate how external events can significantly influence Bitcoin’s price.

Key Bitcoin Price Points and Associated Events

The following table illustrates some key price points in Bitcoin’s history and the events that coincided with those price movements. Note that these are just a few examples, and a comprehensive analysis would require a far more extensive dataset.

| Date | Price (USD) | Event | Impact on Price |

|---|---|---|---|

| November 2013 | ~ $1,100 | Increased media attention and early adoption | Sharp price increase |

| January 2018 | ~$17,000 | Peak of 2017 bull run; increased regulatory scrutiny | Subsequent significant price decline |

| March 2020 | ~$5,000 | COVID-19 pandemic market crash | Initial sharp price drop, followed by recovery |

| November 2021 | ~$69,000 | Increased institutional adoption and broader market optimism | All-time high |

Exploring Different Price Prediction Models

Predicting Bitcoin’s price is a complex endeavor, fraught with uncertainty. Numerous models exist, each with its own strengths and weaknesses, and none offer foolproof accuracy. Understanding these models and their limitations is crucial for navigating the volatile cryptocurrency market. This section explores several prominent approaches to Bitcoin price prediction, highlighting their methodologies, advantages, disadvantages, and historical performance.

Predicting the future price of Bitcoin relies heavily on two primary analytical approaches: technical analysis and fundamental analysis. These methods, while distinct, can be used in conjunction to form a more comprehensive prediction.

Technical Analysis in Bitcoin Price Prediction

Technical analysis focuses on historical price and volume data to identify patterns and trends, predicting future price movements. This approach utilizes charts, indicators, and other visual tools to identify support and resistance levels, trendlines, and momentum shifts. Common technical indicators include moving averages, relative strength index (RSI), and MACD. While widely used, technical analysis is subjective and relies heavily on interpretation, leading to potentially differing conclusions among analysts. For example, a head-and-shoulders pattern, often interpreted as a bearish reversal, might be seen differently by another analyst. Past performance is not necessarily indicative of future results, and the market’s reaction to identified patterns can vary. A successful prediction using technical analysis in one instance doesn’t guarantee future success.

Fundamental Analysis in Bitcoin Price Prediction

Fundamental analysis focuses on factors that might influence Bitcoin’s underlying value. This involves assessing the adoption rate, regulatory developments, technological advancements, macroeconomic conditions, and market sentiment. A bullish outlook might be driven by increasing institutional adoption or positive regulatory news, while bearish sentiment could stem from a major security breach or negative regulatory announcements. For example, the 2017 Bitcoin bull run was fueled by increasing mainstream media attention and growing institutional investment, while the 2022 bear market was partly driven by macroeconomic factors like rising inflation and interest rate hikes. The inherent challenge with fundamental analysis is accurately weighing the impact of these diverse and often interconnected factors. Predicting future regulatory changes or the speed of technological adoption, for instance, remains highly speculative.

Limitations of Price Prediction Models and Inherent Uncertainties

All price prediction models, regardless of methodology, carry significant limitations. The cryptocurrency market is exceptionally volatile, influenced by a multitude of unpredictable factors – from sudden regulatory changes to social media-driven hype cycles. No model can perfectly account for unforeseen events, such as a major security flaw or a significant shift in public perception. Even models that have historically shown some degree of accuracy can fail dramatically during periods of extreme market volatility. For instance, many predictions in late 2017 vastly overestimated Bitcoin’s long-term price, failing to account for the subsequent market correction. The inherent uncertainty involved means that any prediction should be treated with considerable caution, viewed as a potential outcome rather than a guaranteed certainty.

Examples of Past Predictions and Their Accuracy

Numerous analysts and platforms have offered Bitcoin price predictions, with varying degrees of success. Many predictions made in early 2021, for example, anticipated Bitcoin reaching significantly higher prices within a shorter timeframe than actually occurred. Conversely, some predictions made during the 2018 bear market underestimated the subsequent recovery. These discrepancies highlight the inherent difficulties in predicting Bitcoin’s price and the limitations of even the most sophisticated models. The lack of consistent accuracy across different predictions, even those employing similar methodologies, underscores the unpredictable nature of the market. It’s crucial to remember that past performance is not a reliable indicator of future results in the highly volatile cryptocurrency market.

Potential Scenarios for Bitcoin’s Price in September 2025

Predicting the price of Bitcoin in September 2025 involves considerable uncertainty, given the volatile nature of the cryptocurrency market. Several factors, including regulatory changes, technological advancements, macroeconomic conditions, and overall market sentiment, can significantly impact its price. The following scenarios Artikel plausible price ranges, based on different combinations of these influencing factors. It is crucial to remember that these are speculative scenarios and should not be considered financial advice.

Bullish Scenario: Continued Adoption and Institutional Investment

This scenario assumes widespread adoption of Bitcoin as a store of value and a medium of exchange, coupled with increased institutional investment. Positive regulatory developments and advancements in Bitcoin’s underlying technology, such as the Lightning Network’s widespread adoption, could further fuel this growth. This optimistic outlook considers a significant increase in demand outpacing supply, driving the price upwards.

- Price Prediction: $200,000 – $300,000

- Underlying Assumptions: Global macroeconomic stability, positive regulatory landscape, significant institutional adoption, increased retail investor confidence, and successful scaling solutions for Bitcoin transactions.

- Example: Similar to the period between late 2020 and late 2021, where a confluence of factors led to a significant price surge, a repeat of such conditions, albeit on a larger scale, could drive the price to this range.

Neutral Scenario: Consolidation and Gradual Growth

This scenario suggests a period of consolidation following previous price volatility. While Bitcoin experiences gradual growth, it avoids dramatic price swings, either upward or downward. This relatively stable growth reflects a period of market maturity and balanced buying and selling pressure. Regulatory uncertainty and macroeconomic headwinds could contribute to this slower pace of growth.

- Price Prediction: $100,000 – $150,000

- Underlying Assumptions: Moderate institutional investment, stable macroeconomic conditions, neither significantly bullish nor bearish regulatory developments, and a gradual increase in Bitcoin adoption.

- Example: This scenario mirrors the relatively stable growth seen in certain periods of the stock market, where long-term trends prevail over short-term fluctuations. A similar pattern could emerge for Bitcoin, leading to a steady, albeit less dramatic, price increase.

Bearish Scenario: Regulatory Crackdown and Market Correction

This pessimistic scenario anticipates a significant market correction triggered by stricter regulations, a global economic downturn, or a major security breach impacting confidence in the Bitcoin network. Negative regulatory developments and a loss of investor confidence could lead to a substantial price decline.

- Price Prediction: $30,000 – $60,000

- Underlying Assumptions: Stringent regulatory frameworks globally limiting Bitcoin’s use, a significant global economic recession, loss of investor confidence due to a major security incident, or a combination of these factors.

- Example: The 2018 bear market, which saw Bitcoin’s price plummet from its all-time high, serves as a potential example of a scenario where negative news and market sentiment led to a sharp correction. A similar, albeit potentially less severe, correction could occur.

Risks and Uncertainties Associated with Bitcoin Price Predictions

Predicting the price of Bitcoin in 2025, or any future date, is inherently fraught with risk and uncertainty. Numerous factors, both predictable and unpredictable, can significantly influence Bitcoin’s price trajectory, making accurate long-term forecasts exceptionally challenging. This section will explore some of the key risks and uncertainties involved.

The inherent volatility of Bitcoin’s price is a major source of uncertainty. Unlike traditional assets with established valuation models, Bitcoin’s price is driven by a complex interplay of factors, many of which are difficult to quantify or predict with precision. This volatility makes it susceptible to dramatic price swings, often driven by market sentiment, regulatory changes, and technological developments.

Unforeseen Events and Black Swan Events

Black swan events – highly improbable events with significant consequences – pose a considerable risk to Bitcoin price predictions. The 2008 global financial crisis, for example, highlighted the potential for unforeseen events to dramatically alter market dynamics. Similarly, a major security breach affecting a major cryptocurrency exchange, a significant regulatory crackdown on cryptocurrencies in a major market, or a widespread adoption of a competing cryptocurrency could all trigger unexpected and substantial price movements. The unpredictable nature of these events makes it virtually impossible to accurately incorporate them into predictive models. Consider the sudden collapse of FTX in 2022, a significant event that dramatically impacted the entire cryptocurrency market and highlighted the fragility of the ecosystem. Such events underscore the inherent unpredictability inherent in long-term price forecasting.

Technological Advancements and Their Impact

Accurately predicting technological advancements and their impact on Bitcoin’s price is another significant challenge. The development of more energy-efficient mining technologies, for instance, could affect the cost of mining and subsequently influence the price. Similarly, the emergence of competing cryptocurrencies with superior technology or features could divert investment away from Bitcoin, potentially depressing its price. Furthermore, advancements in quantum computing pose a theoretical long-term threat to the security of Bitcoin’s cryptographic infrastructure. While the timeline for such advancements remains uncertain, the potential impact on Bitcoin’s value is substantial and difficult to assess. The introduction of the Lightning Network, aimed at improving transaction speeds and reducing fees, is a real-world example of a technological advancement that has impacted, albeit gradually, Bitcoin’s usability and thus potentially its price. However, accurately predicting the scale and timing of such impacts remains a significant challenge.

Regulatory Uncertainty

Government regulations play a crucial role in shaping the cryptocurrency market. Changes in regulatory frameworks, whether supportive or restrictive, can significantly impact Bitcoin’s price. The lack of clear and consistent regulatory approaches across different jurisdictions introduces a substantial level of uncertainty. For instance, a sudden ban on Bitcoin trading in a major market could lead to a significant price drop. Conversely, clear and favorable regulations could boost investor confidence and drive price increases. The evolving regulatory landscape makes accurate price prediction even more difficult. The varied regulatory approaches in different countries, from outright bans to supportive frameworks, exemplify this challenge.

Disclaimer and Responsible Investing

Investing in Bitcoin, like any other cryptocurrency, carries significant risk. Price volatility is a defining characteristic, meaning the value can fluctuate dramatically in short periods, leading to substantial gains or losses. This prediction for September 2025, while based on analysis, is inherently speculative and should not be considered financial advice. It’s crucial to understand that past performance is not indicative of future results.

The information presented here is for educational purposes only and should not be interpreted as a recommendation to buy, sell, or hold Bitcoin. Before making any investment decisions, you must conduct your own thorough research and consider your individual risk tolerance and financial situation. Remember, you could lose some or all of your investment.

Understanding Investment Risks

Bitcoin’s price is susceptible to various factors, including regulatory changes, market sentiment, technological advancements, and macroeconomic conditions. Unexpected events, such as security breaches, regulatory crackdowns, or significant market corrections, can severely impact Bitcoin’s value. For example, the collapse of FTX in 2022 demonstrated the potential for rapid and significant price declines within the cryptocurrency market, impacting investor confidence and leading to substantial losses for many. Understanding these risks is paramount before committing any capital.

Responsible Investment Strategies

Responsible investing in Bitcoin begins with diversification. Don’t put all your eggs in one basket. Diversify your portfolio across different asset classes, including traditional investments like stocks and bonds, to mitigate the risk associated with Bitcoin’s volatility. Only invest an amount you can afford to lose without jeopardizing your financial well-being. This means never investing borrowed money or funds essential for daily living expenses.

The Importance of Due Diligence

Before investing in Bitcoin or any other cryptocurrency, conduct thorough research. Understand the underlying technology, the risks involved, and the potential rewards. Evaluate the credibility of different sources of information, being wary of misleading or biased information often found online. Consider consulting with a qualified financial advisor who understands the complexities of cryptocurrency investments. They can help you assess your risk tolerance and develop an investment strategy aligned with your financial goals. Remember, informed decision-making is key to mitigating potential losses and maximizing potential gains.

Frequently Asked Questions (FAQs)

This section addresses some common questions regarding Bitcoin’s price and investment. Understanding these factors is crucial for making informed decisions in the volatile cryptocurrency market. The information provided here is for educational purposes only and should not be considered financial advice.

Biggest Factors Affecting Bitcoin’s Price

Bitcoin’s price is influenced by a complex interplay of factors. Supply and demand dynamics play a significant role, with increased demand driving prices up and vice versa. Regulatory actions by governments worldwide can significantly impact investor sentiment and market stability. Furthermore, technological advancements within the Bitcoin network itself, such as upgrades or scaling solutions, can affect its adoption and, consequently, its price. Lastly, macroeconomic factors like inflation, economic uncertainty, and investor confidence in traditional markets also influence Bitcoin’s appeal as an alternative asset. For example, during periods of high inflation, investors may turn to Bitcoin as a hedge against inflation, driving its price upwards.

Accuracy of Bitcoin Price Prediction

Accurately predicting Bitcoin’s price is inherently challenging, if not impossible. The cryptocurrency market is highly volatile and susceptible to unpredictable events, such as regulatory changes, technological disruptions, and shifts in market sentiment. While various prediction models exist, they rely on historical data and assumptions that may not hold true in the future. Therefore, any price prediction should be treated with a high degree of skepticism. For instance, predictions made during the 2017 bull run significantly overestimated Bitcoin’s long-term trajectory.

Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries substantial risks due to its extreme volatility. The price can fluctuate dramatically in short periods, leading to significant potential for both substantial gains and substantial losses. Furthermore, the cryptocurrency market is relatively young and lacks the established regulatory frameworks of traditional financial markets, increasing the risk of fraud and scams. Security breaches, such as hacking of exchanges, also pose a considerable threat to investors. For example, the Mt. Gox exchange collapse in 2014 resulted in massive losses for many Bitcoin holders.

Reliable Sources of Bitcoin Information

Reliable information on Bitcoin can be found from several reputable sources. Peer-reviewed academic papers on blockchain technology and cryptocurrency economics provide in-depth analysis. Reputable financial news outlets that specialize in cryptocurrency reporting often offer insightful commentary and market analysis, though it’s crucial to critically evaluate their perspectives. Finally, official documentation from Bitcoin developers and the Bitcoin Core project itself provides technical details about the network and its ongoing development. It is important to be discerning and avoid sources that promote unsubstantiated claims or financial schemes.

Bitcoin Price Prediction For September 2025 – Accurately predicting the Bitcoin price for September 2025 is challenging, requiring analysis of various factors influencing its value. To gain a broader perspective on potential future price movements, it’s helpful to consider longer-term forecasts, such as those found in the comprehensive analysis at Prediction Bitcoin 2025. Understanding the overall trajectory of Bitcoin’s price over the next few years can help inform more specific predictions for September 2025, allowing for a more nuanced assessment.

Accurately predicting the Bitcoin price for September 2025 is challenging, influenced by numerous factors. A key element impacting potential price movements is the Bitcoin halving event, scheduled for sometime in 2024, which will significantly reduce the rate of new Bitcoin creation. To understand the potential impact on price, it’s essential to check the projected date by reviewing this resource on the Halving Date Bitcoin 2025.

This information is crucial for informed speculation regarding the Bitcoin price prediction for September 2025 and beyond.

Predicting the Bitcoin price for September 2025 is inherently speculative, but a significant factor influencing any forecast is the upcoming halving. Understanding the exact timing is crucial, and you can find details on the Bitcoin Halving Block Number 2025 to help refine your predictions. This event, historically impacting Bitcoin’s price trajectory, will undoubtedly play a key role in shaping the market by September 2025.

Therefore, accurate prediction requires close monitoring of this halving event.

Predicting the Bitcoin price for September 2025 is inherently speculative, but a significant factor influencing any forecast is the upcoming halving. Understanding the exact timing is crucial, and you can find details on the Bitcoin Halving Block Number 2025 to help refine your predictions. This event, historically impacting Bitcoin’s price trajectory, will undoubtedly play a key role in shaping the market by September 2025.

Therefore, accurate prediction requires close monitoring of this halving event.

Predicting the Bitcoin price for September 2025 is inherently speculative, but a significant factor influencing any forecast is the upcoming halving. Understanding the exact timing is crucial, and you can find details on the Bitcoin Halving Block Number 2025 to help refine your predictions. This event, historically impacting Bitcoin’s price trajectory, will undoubtedly play a key role in shaping the market by September 2025.

Therefore, accurate prediction requires close monitoring of this halving event.

Predicting the Bitcoin price for September 2025 is inherently speculative, but a key factor to consider is the impact of the upcoming halving. Understanding the precise timing of this event, as detailed on the Bitcoin Halving 2025 Datum page, is crucial. This halving significantly reduces Bitcoin’s inflation rate, potentially influencing the price trajectory and making accurate price prediction for September 2025 even more complex.