Bitcoin Price Prediction

Bitcoin’s price history is a rollercoaster ride of dramatic highs and lows. Since its inception, the cryptocurrency has experienced periods of explosive growth, followed by significant corrections. For example, Bitcoin’s price surged from under $1 in 2010 to nearly $70,000 in late 2021, only to subsequently decline considerably. This inherent volatility is a defining characteristic of Bitcoin, making it both attractive and risky.

Several interconnected factors influence Bitcoin’s price. These include macroeconomic conditions (like inflation and interest rates), regulatory developments (government policies and legal frameworks), technological advancements (such as scaling solutions and network upgrades), market sentiment (investor confidence and media coverage), and the overall supply and demand dynamics within the cryptocurrency market. For instance, increased institutional adoption often leads to price increases, while negative news or regulatory crackdowns can trigger sharp declines.

Accurately predicting Bitcoin’s price in 2025, or any future date, presents significant challenges. The cryptocurrency market is highly speculative and influenced by numerous unpredictable variables. Many prediction models rely on historical data and technical analysis, which are not always reliable predictors of future performance in such a volatile market. Furthermore, unforeseen events, such as global economic crises or significant technological breakthroughs, can dramatically alter the price trajectory. Any prediction therefore carries a considerable degree of uncertainty.

Factors Influencing Bitcoin’s Price

The price of Bitcoin is a complex interplay of several key factors. Economic factors such as inflation and interest rate changes influence investor behavior and capital flows into Bitcoin, which is often viewed as a hedge against inflation. Regulatory decisions by governments worldwide also play a critical role, with supportive regulations generally boosting prices, and restrictive ones leading to declines. Technological advancements, such as improved scalability and transaction speeds, can increase Bitcoin’s adoption and utility, potentially driving up its price. Finally, public perception and media coverage, along with the overall supply and demand dynamics in the market, are crucial in shaping the price.

Challenges in Predicting Bitcoin’s Price

Predicting Bitcoin’s future price is inherently difficult due to its high volatility and the influence of numerous unpredictable factors. The speculative nature of the cryptocurrency market means that prices can fluctuate wildly based on news, sentiment, and market manipulation. Traditional financial modeling techniques often prove inadequate in predicting Bitcoin’s behavior because its price is not directly tied to traditional economic indicators in the same way that stocks or bonds are. Furthermore, unforeseen events, such as regulatory changes, security breaches, or technological disruptions, can significantly impact the price, making accurate long-term predictions extremely challenging. Even sophisticated algorithms and machine learning models often struggle to account for the unpredictable nature of the market.

Market Analysis for May 2025

Predicting the Bitcoin price in May 2025 requires analyzing potential macroeconomic factors that could significantly influence its value. The global economic landscape in 2025 remains uncertain, with several key variables impacting Bitcoin’s performance. This analysis explores potential scenarios and their implications.

Global Economic Conditions and their Impact on Bitcoin

The state of the global economy in 2025 will be a crucial determinant of Bitcoin’s price. Several factors, including inflation rates, interest rate policies, and the potential for a recession, will play significant roles. A strong global economy, characterized by steady growth and low inflation, could boost investor confidence in riskier assets like Bitcoin, potentially driving its price upwards. Conversely, a recessionary environment, marked by high inflation and uncertainty, might lead investors to seek safer havens, potentially causing Bitcoin’s price to decline. The interplay between these factors will shape the overall market sentiment towards Bitcoin.

Inflation’s Influence on Bitcoin Value

High inflation erodes the purchasing power of fiat currencies. Historically, periods of high inflation have seen increased interest in alternative assets, including Bitcoin, as a hedge against inflation. If inflation remains elevated in 2025, it could potentially increase demand for Bitcoin, driving its price higher. For example, the hyperinflation experienced in Venezuela led to a surge in Bitcoin adoption as citizens sought to protect their savings. However, the relationship isn’t always straightforward; high inflation can also lead to increased uncertainty and risk aversion, potentially negatively impacting Bitcoin’s price.

Interest Rate Policies and Bitcoin’s Price

Central banks’ interest rate policies significantly impact the overall financial market. Higher interest rates generally increase the attractiveness of traditional investments like bonds, potentially drawing investment away from riskier assets such as Bitcoin. Conversely, lower interest rates could make Bitcoin more appealing, leading to increased investment. The Federal Reserve’s actions in the US, for instance, have historically influenced the global financial markets, including Bitcoin’s price. A restrictive monetary policy in 2025 could put downward pressure on Bitcoin’s price, while an accommodative policy might have the opposite effect.

Recessionary Risks and Bitcoin’s Performance

The risk of a global recession in 2025 is a significant factor. During economic downturns, investors often move towards safer assets, potentially causing a decline in the price of Bitcoin. The 2008 financial crisis, for example, saw a significant drop in Bitcoin’s value (although Bitcoin was in its early stages then). However, some argue that Bitcoin could act as a safe haven asset during a recession, similar to gold, as it is not directly tied to traditional financial systems. The outcome would depend on investor sentiment and the severity of the recession.

Regulatory Impact on Bitcoin’s Value

Regulatory clarity and acceptance of Bitcoin vary significantly across jurisdictions. A positive regulatory environment, characterized by clear guidelines and supportive policies, could increase investor confidence and potentially boost Bitcoin’s price. Conversely, stricter regulations or outright bans could negatively impact its value. The evolving regulatory landscape in different countries, including the US, EU, and China, will play a crucial role in shaping Bitcoin’s price in 2025. For example, a country adopting Bitcoin as legal tender could dramatically impact its price, while a complete ban could lead to a significant drop.

Market Analysis for May 2025

Predicting the Bitcoin price in May 2025 requires considering various factors, including technological advancements that could significantly influence market sentiment and adoption rates. While precise price prediction remains speculative, analyzing the impact of these advancements allows for a more informed assessment of potential market scenarios.

Layer-2 Scaling Solutions and Bitcoin Adoption

The scalability of the Bitcoin network has been a recurring concern. Layer-2 solutions, such as the Lightning Network, aim to address this by processing transactions off-chain, thereby increasing transaction speed and reducing fees. Widespread adoption of these solutions could significantly boost Bitcoin’s usability for everyday transactions, attracting a broader range of users and potentially driving up demand. For example, if the Lightning Network achieves widespread integration into popular payment platforms, we could see a surge in Bitcoin usage for micro-transactions, impacting its price positively. The increased efficiency and lower costs associated with Layer-2 solutions would also make Bitcoin more competitive with other cryptocurrencies and traditional payment systems.

Institutional Adoption and Bitcoin ETFs

The entry of institutional investors into the Bitcoin market is a crucial factor influencing price. The approval of Bitcoin Exchange-Traded Funds (ETFs) by major regulatory bodies would likely trigger substantial institutional investment, leading to increased demand and potentially higher prices. The 2024-2025 timeframe could see significant regulatory developments in this area, with several ETF applications pending approval. A positive regulatory outcome could mirror the effect seen in the gold market, where ETFs significantly increased accessibility and liquidity, leading to higher prices. The influx of institutional capital, guided by professional risk management and analysis, would bring a level of stability and legitimacy that could attract even more investors.

Technological Upgrades within the Bitcoin Network

Ongoing development and upgrades within the Bitcoin network itself can also influence its price. While Bitcoin’s core protocol changes are infrequent, improvements in areas such as security, efficiency, and privacy could positively affect investor confidence and demand. For example, successful implementation of Taproot, a significant upgrade that enhanced transaction privacy and efficiency, demonstrated the network’s capacity for improvement and adaptation, influencing market sentiment positively. Future upgrades, if successfully implemented and adopted, could have a similar effect, further solidifying Bitcoin’s position as a leading cryptocurrency. This continuous improvement can help to maintain a positive narrative around Bitcoin’s long-term viability and attract new investors.

Market Analysis for May 2025

Predicting the Bitcoin price and market sentiment in May 2025 requires considering several interacting factors. While precise forecasting is impossible, analyzing potential catalysts for adoption and understanding the influence of public perception provides a framework for informed speculation. This analysis will explore key drivers of Bitcoin’s market performance, focusing on adoption rates and the prevailing sentiment within the cryptocurrency community and broader financial markets.

Potential catalysts for increased Bitcoin adoption in 2025 are multifaceted and interconnected. Several factors could significantly influence the trajectory of Bitcoin’s price and overall market acceptance.

Catalysts for Increased Bitcoin Adoption

Increased institutional investment, coupled with growing regulatory clarity in key markets, could significantly boost Bitcoin’s legitimacy and attract a wider range of investors. The development and wider adoption of Bitcoin-based financial products, such as exchange-traded funds (ETFs), could also normalize Bitcoin ownership and increase liquidity. Furthermore, advancements in Bitcoin’s underlying technology, such as the Lightning Network’s improved scalability and transaction speed, could lead to wider adoption for everyday payments. Finally, macroeconomic factors, such as persistent inflation or geopolitical instability, might drive investors towards Bitcoin as a hedge against traditional assets. For example, the 2022 global inflationary pressures led to increased Bitcoin investment as a store of value.

Influence of Public Sentiment and Media Coverage

Public sentiment and media narratives play a crucial role in shaping Bitcoin’s price. Positive media coverage, emphasizing Bitcoin’s potential as a decentralized and secure asset, can attract new investors and fuel price increases. Conversely, negative news, such as regulatory crackdowns or high-profile security breaches, can trigger sell-offs and dampen investor enthusiasm. The impact of social media, influencer marketing, and online forums cannot be underestimated. A shift in overall public perception, perhaps driven by successful real-world applications of Bitcoin technology or endorsements from influential figures, could profoundly affect the market. For example, Elon Musk’s tweets have historically shown a strong correlation with short-term Bitcoin price fluctuations.

Comparison of Market Sentiment Indicators

Various market sentiment indicators provide insights into investor confidence and potential price movements. These indicators include the Bitcoin Fear & Greed Index, which measures overall market sentiment based on factors like volatility, social media activity, and market momentum. On-chain metrics, such as the number of active addresses and transaction volume, can also reflect underlying market activity and investor interest. Comparing these indicators with historical price data can reveal potential correlations and help to assess the predictive power of each metric. However, it’s crucial to remember that these indicators are not foolproof predictors and should be interpreted within a broader context of market fundamentals and macroeconomic conditions. For instance, a high Fear & Greed Index score does not guarantee a price increase, and vice-versa. A holistic approach, incorporating multiple indicators and qualitative factors, is essential for a more comprehensive analysis.

Bitcoin Price Prediction Models and Methods

Predicting the price of Bitcoin, a highly volatile asset, is a complex undertaking. Numerous models exist, each with its strengths and weaknesses, and none offer foolproof accuracy, especially over the long term. Understanding the methodologies and limitations of these models is crucial for informed decision-making. This section will explore several prominent models and their applicability to forecasting Bitcoin’s price in May 2025.

Comparison of Bitcoin Price Prediction Models

The following table compares various price prediction models commonly used in analyzing Bitcoin’s price. It’s important to note that the effectiveness of each model can vary significantly depending on market conditions and the skill of the analyst.

| Model | Methodology | Strengths | Weaknesses |

|---|---|---|---|

| Technical Analysis | Uses historical price and volume data (charts, indicators like RSI, MACD) to identify patterns and predict future price movements. | Relatively simple to understand and apply; can identify short-term trends effectively. | Highly subjective; susceptible to manipulation; struggles with long-term predictions due to the emergence of unforeseen market forces; relies heavily on past performance which may not be indicative of future results. |

| Fundamental Analysis | Evaluates the intrinsic value of Bitcoin based on factors like adoption rate, network effects, regulatory changes, and macroeconomic conditions. | Provides a more holistic view of Bitcoin’s value proposition; can identify long-term trends based on underlying fundamentals. | Difficult to quantify many of the factors; highly subjective in weighting different factors; long-term predictions are still uncertain due to the evolving nature of the cryptocurrency market. |

| Quantitative Analysis (Statistical Models) | Employs statistical methods like time series analysis, machine learning algorithms (e.g., ARIMA, LSTM) to model price behavior based on historical data. | Can identify complex patterns and relationships in data; potentially more objective than technical analysis. | Requires large datasets and significant computational power; model accuracy is highly dependent on data quality and model selection; susceptible to overfitting and may not generalize well to future, unforeseen circumstances. |

| On-Chain Analysis | Analyzes data from the Bitcoin blockchain itself (transaction volume, mining activity, address activity) to gauge market sentiment and predict price movements. | Provides insights into the underlying network activity and user behavior; less susceptible to manipulation than price-based models. | Requires specialized knowledge and tools; correlation doesn’t equal causation – on-chain data may not directly translate to price predictions; the interpretation of on-chain data can be subjective. |

Limitations of Long-Term Bitcoin Price Prediction Models

All models mentioned above face significant challenges in predicting Bitcoin’s price over the long term (like May 2025). Unexpected events – regulatory changes, technological breakthroughs, macroeconomic shocks, or even significant shifts in public perception – can drastically alter the market landscape, rendering even the most sophisticated models inaccurate. Furthermore, the inherent volatility of Bitcoin makes long-term predictions extremely difficult. The longer the time horizon, the greater the uncertainty. Past performance is not necessarily indicative of future results.

Detailed Explanation of Fundamental Analysis for Bitcoin Price Prediction

Fundamental analysis focuses on the intrinsic value of Bitcoin, attempting to determine its “fair” price based on underlying factors. For Bitcoin, these factors could include: the growing adoption rate by businesses and individuals, network effects (the value increases as more people use it), the security and decentralization of the network, regulatory developments impacting cryptocurrency markets, and the broader macroeconomic environment (inflation, interest rates).

Applying fundamental analysis to predict Bitcoin’s price in May 2025 requires forecasting these factors. For example, if we assume continued mainstream adoption, increased institutional investment, and a generally positive regulatory environment, we might project a higher price than if we anticipate significant regulatory hurdles or a decline in user adoption. However, quantifying the impact of each factor is inherently challenging. Analysts often use subjective weighting schemes, which introduces a degree of uncertainty. For example, a scenario with moderate adoption and positive regulatory sentiment might lead to a price prediction of, say, $100,000 – $150,000 in May 2025. However, a scenario with slower adoption and negative regulatory developments could result in a significantly lower prediction, perhaps in the range of $50,000 – $75,000. These are just illustrative examples, and the actual price will depend on the interplay of numerous complex and unpredictable factors. The inherent uncertainty and subjective nature of assigning weights to these factors are significant limitations of this approach for long-term forecasting.

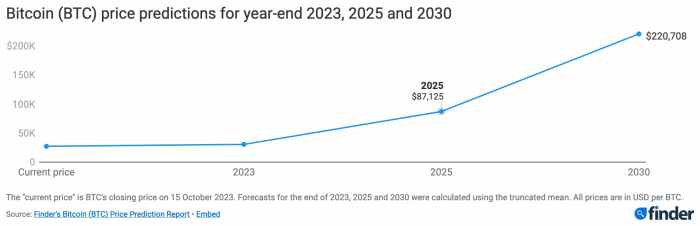

Potential Price Ranges for May 2025: Bitcoin Price Prediction In May 2025

Predicting the price of Bitcoin with certainty is impossible. However, by considering various macroeconomic factors and historical trends, we can construct plausible price ranges for May 2025, acknowledging the inherent uncertainty involved. These ranges are based on different assumptions regarding the adoption rate, regulatory environment, and overall market sentiment. It’s crucial to remember that these are educated guesses, not guarantees.

Predicting Bitcoin’s price requires considering several intertwined factors. The following scenarios Artikel potential price ranges based on varying levels of these factors. Remember that unexpected events can significantly impact the actual price.

Scenario-Based Price Ranges

The following scenarios illustrate potential Bitcoin price ranges for May 2025, based on different market conditions and assumptions. Each scenario considers a combination of factors impacting Bitcoin’s price, resulting in a distinct price prediction.

- Scenario 1: Bullish Market with Widespread Adoption: This scenario assumes continued mainstream adoption of Bitcoin as a store of value and a payment method, coupled with positive regulatory developments globally. Increased institutional investment and a generally positive macroeconomic climate also contribute to this bullish outlook. Price Range: $150,000 – $250,000. This range is supported by the historical precedent of Bitcoin’s previous bull runs and the increasing number of countries exploring the use of blockchain technology. For example, El Salvador’s adoption of Bitcoin as legal tender, while controversial, demonstrates a potential path for broader acceptance.

- Scenario 2: Moderate Growth with Regulatory Uncertainty: This scenario accounts for moderate growth in Bitcoin’s adoption, but also considers the potential for regulatory hurdles and increased volatility in the broader financial markets. This scenario assumes a less optimistic macroeconomic climate than the bullish scenario, with some uncertainty surrounding the future of crypto regulation. Price Range: $75,000 – $125,000. This range reflects a more cautious outlook, acknowledging the possibility of setbacks in the crypto market. The ongoing regulatory scrutiny of various cryptocurrencies worldwide serves as a realistic counterpoint to the bullish predictions. For instance, the differing regulatory approaches between the US and the EU highlight the potential for uneven market growth.

- Scenario 3: Bearish Market with Negative Macroeconomic Factors: This scenario assumes a downturn in the global economy, leading to reduced risk appetite among investors. Increased regulatory pressure and negative news surrounding cryptocurrencies could also contribute to a bearish market. Price Range: $30,000 – $60,000. This range considers the possibility of a significant market correction, similar to the bear market of 2018-2020. Historical precedents, such as the dot-com bubble burst, demonstrate the impact of macroeconomic factors on asset prices. The impact of high inflation rates and potential recessions on investor confidence in riskier assets like Bitcoin could significantly influence its price in this scenario.

Risk Factors and Considerations

Predicting Bitcoin’s price in May 2025 involves inherent uncertainty. Several factors, ranging from regulatory changes to macroeconomic shifts, could significantly influence the cryptocurrency’s trajectory. Understanding these risks is crucial for informed decision-making. While previous price movements can offer some insight, they do not guarantee future performance. Unexpected events, or “black swan” events, can drastically alter the market landscape.

The following analysis explores key risk factors, their likelihood, potential impact on Bitcoin’s price, and possible mitigation strategies. It’s important to remember that these are estimations, and the actual impact of any given risk factor could vary significantly.

Regulatory Uncertainty

Government regulations worldwide play a substantial role in shaping the cryptocurrency market. Changes in regulatory frameworks, such as stricter KYC/AML rules, outright bans, or the introduction of new tax policies, can trigger significant price volatility. For example, China’s crackdown on cryptocurrency mining in 2021 led to a considerable price drop. Conversely, regulatory clarity and acceptance in certain jurisdictions can positively impact Bitcoin’s price.

Macroeconomic Factors

Global economic conditions, including inflation, interest rates, and recessionary fears, significantly influence Bitcoin’s price. During periods of high inflation, investors may view Bitcoin as a hedge against inflation, driving up demand. However, rising interest rates can make other investment options more attractive, potentially leading to capital outflow from the cryptocurrency market. The 2008 financial crisis, for instance, highlighted the interconnectedness of traditional finance and emerging assets like Bitcoin.

Technological Risks

Bitcoin’s underlying technology is constantly evolving. Potential security breaches, scalability issues, or the emergence of competing cryptocurrencies with superior technology could negatively impact Bitcoin’s price. A major security flaw, for example, could erode investor confidence and lead to a price decline. Conversely, successful upgrades and improvements to the Bitcoin network could boost its appeal and price.

Market Manipulation and Volatility, Bitcoin Price Prediction In May 2025

The cryptocurrency market is susceptible to manipulation by large investors or coordinated trading activities. Sudden price swings, often driven by speculation or news events, are common. These events can cause significant short-term price fluctuations, impacting both long-term and short-term investors. The Mt. Gox hack in 2014, for example, demonstrated the vulnerability of exchanges and the potential for significant price drops due to security breaches.

Black Swan Events

Unforeseen events, often with a low probability but high impact, can dramatically affect Bitcoin’s price. These “black swan” events could include unexpected geopolitical crises, major technological disruptions, or significant changes in public perception. The COVID-19 pandemic, for instance, initially caused a sharp drop in Bitcoin’s price, but later saw a period of significant growth as investors sought alternative assets.

| Risk Factor | Likelihood | Potential Impact | Mitigation Strategies |

|---|---|---|---|

| Regulatory Uncertainty | Medium to High | Significant price volatility, potential bans | Diversification, staying informed about regulatory developments |

| Macroeconomic Factors | High | Significant price fluctuations, potentially large drops during recessions | Diversification, hedging strategies |

| Technological Risks | Medium | Price drops due to security breaches or competing technologies | Due diligence, research into project security and development |

| Market Manipulation and Volatility | High | Short-term price swings, potential losses | Risk management, diversification, avoiding panic selling |

| Black Swan Events | Low | Potentially catastrophic price drops | Diversification, careful risk assessment |

Disclaimer and Conclusion

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently speculative. The cryptocurrency market is volatile and influenced by a complex interplay of factors, including technological advancements, regulatory changes, macroeconomic conditions, and market sentiment. Any price prediction, including those presented in this analysis, should be considered a potential outcome among many possibilities, not a guaranteed future.

It’s crucial to remember that past performance is not indicative of future results. The information provided here is for educational and informational purposes only and should not be interpreted as financial advice. Making investment decisions based solely on predictions can lead to significant financial losses. Always conduct your own thorough research and consider seeking advice from a qualified financial advisor before investing in any cryptocurrency, including Bitcoin.

Reputable Sources for Bitcoin Market Information

Reliable information is essential for informed decision-making in the volatile cryptocurrency market. Relying on credible sources can significantly reduce the risk of misinformation. Below are some examples of reputable sources that provide data and analysis on Bitcoin and the broader cryptocurrency market:

- CoinMarketCap: A widely used website that provides real-time cryptocurrency pricing, market capitalization, and trading volume data across various exchanges.

- CoinGecko: Similar to CoinMarketCap, CoinGecko offers comprehensive cryptocurrency data, including price charts, historical data, and market rankings.

- TradingView: A platform offering charting tools, technical analysis indicators, and community-driven analysis for a wide range of financial assets, including cryptocurrencies. Users can access both free and paid features.

- Messari: A research firm providing in-depth analysis and reports on the cryptocurrency market, focusing on institutional investors and professional analysts.

- Bloomberg and Reuters: Major financial news outlets providing regular coverage of the cryptocurrency market, including news, analysis, and expert opinions.

Remember, even with information from reputable sources, it’s vital to critically evaluate the information and cross-reference it with multiple sources to form your own informed opinion. Never invest more than you can afford to lose.

Bitcoin Price Prediction In May 2025 – Predicting the Bitcoin price in May 2025 is challenging, but a key factor to consider is the upcoming halving event. Understanding the historical impact of halvings on Bitcoin’s price is crucial, and for insightful analysis, check out this report on the Bitcoin Halving:Impact On The Market 2025 Ocean News. This resource should help refine your perspective on the potential price movements, ultimately aiding in your Bitcoin price prediction for May 2025.

Predicting the Bitcoin price in May 2025 is challenging, influenced by various factors including macroeconomic conditions and technological advancements. A key event impacting price predictions is the Bitcoin halving, which significantly alters the rate of new Bitcoin creation. To understand the potential impact on the May 2025 price, it’s crucial to know when exactly this halving occurred; you can find that information here: When Was Bitcoin Halving In 2025.

Understanding the halving’s timing is vital for more accurate Bitcoin price predictions in May 2025.

Predicting the Bitcoin price in May 2025 is challenging, influenced by numerous factors including adoption rates and regulatory changes. A key event impacting this prediction is the next Bitcoin halving, which significantly affects the rate of new Bitcoin entering circulation. To understand the timing of this crucial event, check out this resource on When Does Bitcoin Halving 2025.

This halving’s impact on scarcity and potential price increases is a major consideration when forecasting Bitcoin’s value in May 2025.

Predicting the Bitcoin price in May 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the Bitcoin halving, expected to significantly impact the price. For insightful analysis on the potential price at this halving, check out this resource: Bitcoin Price At Halving 2025. Understanding the likely price impact of the halving is crucial for forming a more complete Bitcoin price prediction in May 2025.

Predicting the Bitcoin price in May 2025 is inherently speculative, but a key factor influencing this prediction is the upcoming halving event. Understanding the impact of the reduced Bitcoin supply after the Bitcoin April 2025 Halving is crucial for any reasonable price forecast. Therefore, analyzing the halving’s historical effects on price is essential to forming a well-informed opinion on Bitcoin’s value next May.

Predicting the Bitcoin price in May 2025 is challenging, involving numerous factors. A key element to consider is the anticipated impact of the 2025 Bitcoin halving, which will significantly reduce the rate of new Bitcoin creation. For a deeper dive into this crucial event and its potential consequences, check out this insightful analysis on the Bitcoin Halving 2025 Impact.

Understanding this halving’s effect is vital for any serious Bitcoin price prediction for May 2025.