Bitcoin Price Prediction January 2025

Predicting Bitcoin’s price is akin to navigating a stormy sea in a paper boat. Its inherent volatility, a defining characteristic since its inception, makes definitive predictions a fool’s errand. While numerous analysts and enthusiasts offer their perspectives, it’s crucial to remember that these are informed speculations, not guarantees. Understanding the historical context and the potential influencing factors is key to navigating this unpredictable market and forming your own reasoned opinion. This article will explore some of these key factors to provide a framework for considering a potential Bitcoin price in January 2025.

Bitcoin’s journey has been marked by dramatic price swings. From its humble beginnings with a negligible value to its record highs exceeding $60,000, its trajectory has been anything but linear. Early adopters witnessed exponential growth, while later entrants experienced periods of intense volatility, including significant corrections and market crashes. This history underscores the need for caution and a thorough understanding of the market dynamics before engaging in any Bitcoin-related investment. This analysis focuses on potential factors impacting the Bitcoin price in January 2025, providing a reasoned exploration of possible scenarios rather than a definitive forecast.

Regulatory Landscape and Institutional Adoption

The regulatory environment surrounding cryptocurrencies globally will play a significant role in shaping Bitcoin’s price. Increasingly clear and consistent regulations, particularly in major economies, could lead to greater institutional adoption and increased market stability, potentially driving price appreciation. Conversely, overly restrictive or inconsistent regulations could dampen investor enthusiasm and suppress price growth. The example of El Salvador’s adoption of Bitcoin as legal tender, while initially met with optimism, ultimately highlighted the complexities and challenges of widespread governmental acceptance. The ongoing debate surrounding regulatory frameworks in the US and EU will significantly impact market sentiment and, consequently, the price.

Technological Advancements and Network Upgrades

Bitcoin’s underlying technology is constantly evolving. Upgrades and improvements to the network’s scalability, security, and efficiency can significantly influence investor confidence and market dynamics. For example, the implementation of the Lightning Network, designed to improve transaction speeds and reduce fees, has the potential to enhance Bitcoin’s usability and appeal to a broader range of users. Conversely, any significant security breaches or technological setbacks could negatively impact the price. The successful and timely execution of planned upgrades, such as those related to scaling solutions, will be crucial in determining future price trajectories.

Macroeconomic Factors and Global Events

Bitcoin’s price is also sensitive to broader macroeconomic trends and global events. Factors such as inflation, interest rates, geopolitical instability, and recessionary fears can all impact investor sentiment and the flow of capital into cryptocurrencies. For example, periods of high inflation have historically seen investors seeking alternative assets, potentially driving demand for Bitcoin as a hedge against inflation. Conversely, periods of economic uncertainty can lead to investors withdrawing from riskier assets like Bitcoin, causing price declines. The overall health of the global economy will therefore have a direct impact on Bitcoin’s value.

Factors Influencing Bitcoin’s Price

Bitcoin’s price is a complex interplay of various factors, ranging from global economic conditions to technological advancements and public perception. Understanding these influences is crucial for navigating the volatile cryptocurrency market. This section will delve into the key drivers shaping Bitcoin’s value.

Macroeconomic Factors and Bitcoin’s Price

Macroeconomic factors, such as inflation, recessionary pressures, and interest rate adjustments, significantly influence Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation. Conversely, rising interest rates, making traditional investments more attractive, can lead to a decrease in Bitcoin’s demand. The correlation isn’t always direct, however; Bitcoin’s price can sometimes decouple from traditional markets, demonstrating its own unique characteristics. For example, during periods of high inflation in 2021, Bitcoin’s price experienced substantial growth, aligning with its role as an inflation hedge. However, during periods of economic uncertainty, like the start of 2022, both Bitcoin and traditional markets experienced significant declines. This highlights the complex and sometimes unpredictable nature of this relationship.

Regulatory Changes and Government Policies

Government regulations and policies globally play a critical role in shaping Bitcoin’s adoption and, consequently, its price. Favorable regulations, such as those seen in El Salvador’s adoption of Bitcoin as legal tender, can boost investor confidence and drive price appreciation. Conversely, restrictive measures, such as outright bans or stringent Know Your Customer (KYC) requirements, can stifle adoption and negatively impact the price. The ongoing regulatory uncertainty in many jurisdictions contributes to the volatility of Bitcoin’s price. For example, China’s crackdown on cryptocurrency mining in 2021 led to a significant price drop. Conversely, positive statements from regulatory bodies in countries like the United States regarding a potential regulatory framework for cryptocurrencies could lead to increased investor confidence and price growth.

Technological Advancements and Bitcoin’s Price, Bitcoin Price Prediction January 2025

Technological advancements within the Bitcoin ecosystem significantly influence its price and adoption. Layer-2 scaling solutions, such as the Lightning Network, aim to improve transaction speeds and reduce fees, thereby increasing Bitcoin’s usability for everyday transactions. Improvements in mining efficiency, through the development of more powerful and energy-efficient mining hardware, can also impact the price by reducing the cost of securing the network. For example, the development of ASICs (Application-Specific Integrated Circuits) for Bitcoin mining drastically improved mining efficiency, leading to a more stable and secure network. The ongoing development of more sophisticated and energy-efficient mining techniques could further enhance the network’s stability and reduce environmental concerns.

Institutional Adoption and Bitcoin’s Price

The growing adoption of Bitcoin by institutional investors and large corporations is a major driver of its price. Companies like MicroStrategy’s significant investments in Bitcoin have demonstrated a growing confidence in Bitcoin as a long-term asset. This institutional investment injects significant capital into the market, increasing demand and often pushing prices upward. Data from financial reporting shows a strong correlation between large institutional purchases and subsequent price increases. This suggests that institutional investors are not only acquiring Bitcoin but are also influencing its price trajectory.

Public Sentiment and Media Coverage

Public sentiment and media coverage significantly influence Bitcoin’s price. Positive news and media portrayals can create a “fear of missing out” (FOMO) effect, driving up demand and prices. Conversely, negative news, such as security breaches or regulatory crackdowns, can trigger sell-offs and price declines. The amplification effect of social media and news outlets plays a significant role in shaping public opinion and influencing investor behavior. For example, Elon Musk’s tweets have historically been shown to have a significant, albeit volatile, impact on Bitcoin’s price.

Emerging Technologies and Bitcoin’s Future Value

Emerging technologies, such as the metaverse and NFTs, could potentially impact Bitcoin’s future value. The metaverse, with its potential for decentralized digital economies, could create increased demand for Bitcoin as a medium of exchange. Similarly, NFTs, often transacted using cryptocurrencies, could indirectly boost Bitcoin’s demand. While the synergistic effects are still developing, the potential for these technologies to integrate with Bitcoin and expand its use cases is considerable. For instance, the use of Bitcoin for in-game transactions within metaverse platforms could increase its adoption and potentially drive its price higher.

Comparative Impact of Factors on Bitcoin’s Price

| Factor | Potential Impact | Supporting Evidence |

|---|---|---|

| Macroeconomic Factors (Inflation, Recession, Interest Rates) | Positive correlation with inflation; negative correlation with high interest rates; volatile relationship during recessions. | Bitcoin’s price surge during periods of high inflation in 2021; price decline during the early 2022 economic downturn. |

| Regulatory Changes and Government Policies | Positive impact from favorable regulations; negative impact from restrictive measures. | El Salvador’s adoption of Bitcoin; China’s crackdown on cryptocurrency mining. |

| Technological Advancements (Layer-2, Mining Efficiency) | Improved scalability, reduced transaction costs, increased efficiency. | Development of the Lightning Network; advancements in ASIC mining technology. |

| Institutional Adoption | Increased demand, price appreciation. | MicroStrategy’s significant Bitcoin investments; other corporate holdings. |

| Public Sentiment and Media Coverage | High volatility based on positive or negative news. | Impact of Elon Musk’s tweets; news coverage of security breaches. |

| Emerging Technologies (Metaverse, NFTs) | Potential for increased demand and integration. | Potential use of Bitcoin for metaverse transactions; NFT sales using cryptocurrencies. |

Potential Price Scenarios for January 2025

Predicting Bitcoin’s price with certainty is impossible, but by analyzing historical trends, market sentiment, and technological advancements, we can construct plausible scenarios for January 2025. These scenarios represent a range of possibilities, from highly optimistic to pessimistic, and a more neutral middle ground. It’s crucial to remember that these are educated guesses, not guarantees.

Bullish Scenario: Bitcoin Surges to New Heights

This scenario envisions a significant surge in Bitcoin’s price, driven by widespread adoption, positive regulatory developments, and continued institutional investment. We could see a continuation of the upward trend observed in previous bull runs, potentially exceeding previous all-time highs. This scenario assumes a robust global economy, increased mainstream acceptance of cryptocurrencies, and successful scaling solutions for Bitcoin’s network. A key driver would be the growing institutional adoption, with larger firms and financial institutions further integrating Bitcoin into their portfolios. This would create a strong demand pull, pushing prices higher.

The visual representation would show an upward-sloping curve, starting from the current price and rising steadily throughout 2024. Key price points would include the breaking of previous all-time highs, followed by further significant increases. Resistance levels would be psychological milestones like $100,000, $150,000, and potentially even higher. Support levels would be gradually increasing, reflecting the growing institutional confidence and market maturity. This trajectory mirrors the sharp price increases seen during the 2017 bull run, although the rate of increase may be less dramatic due to a more mature market. For example, the 2017 bull run saw a price increase from around $1,000 to nearly $20,000 in a relatively short period. While such a rapid increase might not be repeated, a sustained upward trend is certainly plausible. The visual would show a clear upward trend with less volatility than the 2017 run.

Bearish Scenario: Bitcoin Price Consolidation and Correction

This scenario anticipates a period of consolidation and price correction for Bitcoin. Several factors could contribute to this, including macroeconomic uncertainty, increased regulatory scrutiny, or a significant security breach affecting the network’s trust. A bearish scenario could see Bitcoin’s price remaining relatively stagnant or even declining from current levels. This would involve a period of lower trading volumes and reduced investor enthusiasm.

The visual representation would depict a relatively flat or downward-sloping curve, with potential price dips below current levels. Key support levels would be identified based on previous lows and psychological price points. Resistance levels would be formed by previous highs, acting as barriers to further upward movement. This would resemble the market conditions seen in the aftermath of the 2017 bull run, where the price experienced a significant correction before recovering. The 2018 bear market saw Bitcoin’s price fall from nearly $20,000 to around $3,000. While a similar drastic decline isn’t necessarily expected, a significant correction remains a possibility in a bearish scenario. The visual would illustrate a price range with a clear downward trend and periods of consolidation.

Neutral Scenario: Bitcoin Price Trades Sideways

This scenario suggests a period of sideways trading, with the price fluctuating within a relatively narrow range. This outcome would reflect a balance between bullish and bearish forces, with neither side gaining a significant advantage. This scenario is characterized by moderate volatility and relatively low trading volume.

The visual representation would show a price range with horizontal movement, showing a relatively flat line with minor fluctuations. Key support and resistance levels would be established by the upper and lower boundaries of the trading range. This pattern could resemble the consolidation phases observed before and after previous bull and bear markets. For example, the period between late 2018 and early 2020 saw Bitcoin’s price consolidate in a relatively narrow range before the start of the next bull run. The visual would depict a relatively flat line with minor oscillations, representing a sideways trading pattern with limited upward or downward momentum.

Risks and Uncertainties

Predicting the price of Bitcoin in January 2025, or any future date, is inherently fraught with risk and uncertainty. The cryptocurrency market is notoriously volatile, influenced by a complex interplay of factors that are often unpredictable and difficult to model accurately. While various prediction models exist, they should be viewed with a healthy dose of skepticism, as they are not foolproof and often fail to account for unforeseen events.

The inherent volatility of Bitcoin and the broader cryptocurrency market stems from its relatively young age, its decentralized nature, and its susceptibility to external shocks. These factors, coupled with the limitations of current predictive models, make precise price predictions almost impossible. Understanding these limitations and the potential risks is crucial for anyone considering investing in Bitcoin.

Regulatory Uncertainty

Government regulations play a significant role in shaping the cryptocurrency market. Changes in regulatory frameworks, whether at the national or international level, can drastically impact Bitcoin’s price. For instance, a sudden ban on Bitcoin trading in a major economy could trigger a significant price drop. Conversely, the adoption of favorable regulatory frameworks could lead to price increases. The lack of a universally accepted regulatory framework for cryptocurrencies creates considerable uncertainty. Different jurisdictions have varying approaches, leading to inconsistencies and potential risks for investors.

Market Manipulation and Security Breaches

The decentralized nature of Bitcoin, while a strength, also makes it vulnerable to manipulation. Large-scale coordinated trading activities by whales (individuals or entities holding significant amounts of Bitcoin) can artificially inflate or deflate the price. Similarly, security breaches on exchanges or other platforms handling Bitcoin can lead to price volatility, as investors react to news of lost funds or compromised security. The Mt. Gox hack in 2014, for example, resulted in a significant loss of Bitcoin and impacted market confidence.

Technological Developments and Competition

Technological advancements within the cryptocurrency space can significantly impact Bitcoin’s price. The emergence of new cryptocurrencies with potentially superior features or functionalities could divert investment away from Bitcoin, putting downward pressure on its price. Conversely, significant upgrades or improvements to the Bitcoin network itself could bolster its value and attract new investors. The evolution of blockchain technology and the development of competing cryptocurrencies present ongoing risks and uncertainties.

Macroeconomic Factors and Global Events

Global macroeconomic conditions, such as inflation, recessionary fears, and geopolitical events, can have a substantial influence on Bitcoin’s price. During periods of economic uncertainty, investors may flock to Bitcoin as a safe haven asset, driving up its price. Conversely, periods of economic stability might lead to investors shifting their funds to other, more traditional assets, potentially causing Bitcoin’s price to decline. The impact of unforeseen global events, such as pandemics or wars, can be unpredictable and significantly affect market sentiment.

Risk Mitigation Strategies

Effective risk mitigation strategies are crucial for anyone investing in Bitcoin. These strategies should encompass diversification of investments across different asset classes, thorough due diligence before investing, and a clear understanding of one’s risk tolerance. Only invest what you can afford to lose and avoid emotional decision-making based on short-term price fluctuations. Consider dollar-cost averaging to mitigate the impact of volatility by investing smaller amounts regularly over time. Staying informed about market trends and regulatory developments is also vital for making informed investment decisions. It’s advisable to seek advice from qualified financial advisors before making any significant investment in Bitcoin or other cryptocurrencies.

Investment Strategies and Considerations: Bitcoin Price Prediction January 2025

Investing in Bitcoin requires careful consideration of various strategies and risk management techniques. The volatile nature of the cryptocurrency market necessitates a well-defined approach to maximize potential returns while mitigating losses. Understanding different investment strategies and implementing robust risk management practices are crucial for successful Bitcoin investment.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of the price. This strategy mitigates the risk of investing a large sum at a market peak. For example, investing $100 weekly into Bitcoin, irrespective of its price fluctuations, reduces the impact of short-term volatility. The advantage is risk reduction; the disadvantage is that you may miss out on significant gains if the price rises sharply. DCA is a suitable strategy for long-term investors with a lower risk tolerance.

Hodling

Hodling, a term derived from a typographical error, refers to a long-term buy-and-hold strategy. This approach involves purchasing Bitcoin and holding it for an extended period, regardless of short-term price fluctuations. The belief is that Bitcoin’s value will appreciate significantly over time. The advantage is potential for substantial long-term gains; the disadvantage is the risk of significant losses if the price drops considerably and the investor lacks patience. Famous examples of successful hodlers include early Bitcoin adopters who held onto their coins through periods of significant price volatility.

Trading

Bitcoin trading involves buying and selling Bitcoin based on short-term price movements. This requires technical analysis skills and a higher risk tolerance. Traders aim to profit from price fluctuations by buying low and selling high. The advantage is the potential for rapid gains; the disadvantage is the high risk of losses due to market volatility and the need for extensive market knowledge and timing. Successful Bitcoin trading necessitates thorough market research and a well-defined trading plan.

Risk Management Techniques

Effective risk management is crucial in Bitcoin investment. Diversification, limiting investment size, and setting stop-loss orders are essential techniques. Diversification involves spreading investments across different asset classes, not just focusing solely on Bitcoin. This reduces the overall portfolio risk. Limiting investment size means only investing an amount you can afford to lose. Stop-loss orders automatically sell your Bitcoin when the price falls to a predetermined level, limiting potential losses.

Portfolio Diversification

A diversified portfolio reduces overall risk by spreading investments across different asset classes. For example, an investor might allocate a portion of their investment portfolio to Bitcoin, while also investing in stocks, bonds, and real estate. This reduces the impact of any single asset’s poor performance on the overall portfolio. The degree of diversification depends on individual risk tolerance and investment goals.

Due Diligence

Thorough due diligence is crucial before investing in Bitcoin. This involves researching the technology, understanding its potential, and assessing its risks. This includes examining Bitcoin’s underlying blockchain technology, analyzing its market capitalization, and considering its regulatory landscape. It’s essential to understand the potential for price volatility and the security risks associated with storing Bitcoin. Evaluating the potential impact of technological advancements and regulatory changes on Bitcoin’s value is also crucial.

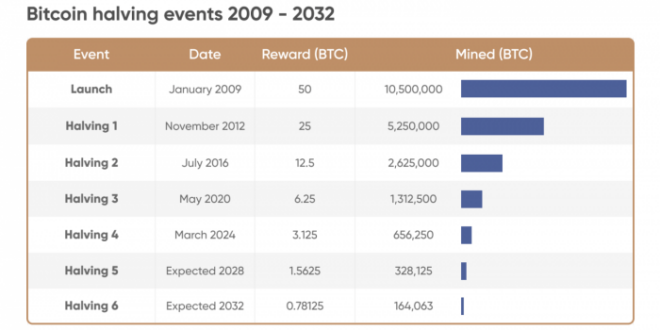

Bitcoin Price Prediction January 2025 – Accurately predicting the Bitcoin price in January 2025 is challenging, influenced by numerous factors. A key event to consider is the upcoming Bitcoin halving, which will significantly impact the cryptocurrency market. For a detailed analysis of this event’s potential consequences, refer to this insightful resource on Bitcoin Halving:Impact On The Market 2025. Understanding the halving’s effects is crucial for any serious Bitcoin price prediction for January 2025.

Predicting the Bitcoin price in January 2025 is challenging, influenced by numerous factors including market sentiment and regulatory changes. A key event impacting this prediction is the 2025 Bitcoin halving, which will reduce the rate of new Bitcoin creation. To understand its potential effect on price, exploring resources like this article on the 2025 Bitcoin Halving Price is crucial for forming a comprehensive Bitcoin Price Prediction January 2025.

Accurately predicting the Bitcoin price in January 2025 is challenging, influenced by numerous factors. A key event impacting future price is the Bitcoin halving, significantly altering the rate of new Bitcoin creation. To understand its potential effect, it’s crucial to know precisely when this halving will occur; check out this resource on When Is Bitcoin 2025 Halving for the definitive date.

This information is vital for informed speculation on Bitcoin’s price trajectory in January 2025.

Predicting the Bitcoin price in January 2025 is challenging, influenced by various factors including market sentiment and technological advancements. A key event to consider when forming any price prediction is the upcoming Bitcoin Halving, which significantly impacts the supply of new Bitcoins. To understand the timing of this crucial event, check out this resource on the Bitcoin Halving Time 2025 and how it could affect the Bitcoin Price Prediction January 2025.

Ultimately, the halving’s impact on scarcity will likely play a major role in shaping the price.

Accurately predicting the Bitcoin price in January 2025 is challenging, but a significant factor to consider is the impact of the upcoming halving event. Understanding the dynamics of the Sự Kiện Bitcoin Halving 2025 is crucial for any serious price prediction, as reduced Bitcoin supply often influences market value. Therefore, analyzing the halving’s historical effects and projected market sentiment surrounding it is essential for formulating a more informed Bitcoin Price Prediction for January 2025.

Predicting the Bitcoin price in January 2025 is inherently speculative, but a significant factor to consider is the upcoming Bitcoin Halving. A key event impacting future price is the halving, expected to occur in 2024, as detailed in this informative resource on the Bitcoin Halving 2025. This reduction in Bitcoin’s inflation rate often historically leads to increased scarcity and potential price appreciation, thus influencing Bitcoin price prediction for January 2025.