Bitcoin Price Prediction May 2025

Predicting the price of Bitcoin in May 2025 is a challenging endeavor, given its notoriously volatile nature. The cryptocurrency market is influenced by a complex interplay of factors, making precise forecasting extremely difficult. While past performance is not necessarily indicative of future results, understanding these influencing factors is crucial to exploring potential price scenarios. Key drivers include prevailing market sentiment (bullish or bearish), evolving regulatory landscapes across different jurisdictions, significant technological advancements within the Bitcoin ecosystem, and broader macroeconomic conditions like inflation and global economic growth. This article aims to analyze these factors and present potential Bitcoin price scenarios for May 2025, drawing upon various analyses and expert opinions.

Factors Influencing Bitcoin’s Price

Several interconnected elements contribute to Bitcoin’s price fluctuations. Market sentiment, driven by news, social media trends, and investor confidence, plays a significant role. A surge in positive news, for example, the adoption of Bitcoin by a major corporation, can lead to a price increase, while negative news, such as a major security breach, could trigger a sell-off. Regulatory developments, whether supportive or restrictive, significantly impact investor confidence and market liquidity. Stringent regulations could dampen enthusiasm, while favorable regulations might attract new investors. Technological advancements, such as the implementation of the Lightning Network for faster and cheaper transactions, can also influence Bitcoin’s value proposition and, consequently, its price. Finally, macroeconomic factors such as inflation, interest rates, and global economic stability have a considerable impact on the overall investment landscape, including Bitcoin’s appeal as a hedge against inflation or a safe haven asset. For instance, during periods of high inflation, investors might flock to Bitcoin as a store of value, driving up its price.

Potential Price Scenarios

Considering the inherent uncertainties, multiple price scenarios are plausible for Bitcoin in May 2025. One scenario involves a continuation of the current upward trend, potentially driven by increased institutional adoption and growing mainstream acceptance. This optimistic scenario could see Bitcoin reaching significantly higher price points, perhaps exceeding previous all-time highs. However, a more conservative scenario might involve price consolidation or even a moderate decline, reflecting market corrections or negative regulatory developments. A pessimistic scenario, though less likely, could see a more substantial price drop, driven by unforeseen circumstances like a major security flaw or a significant shift in global macroeconomic conditions. It’s important to note that these scenarios are not exhaustive and represent a range of possibilities, rather than precise predictions. Historical price movements of Bitcoin, like the significant bull run in 2021 followed by a considerable correction, illustrate the unpredictable nature of the cryptocurrency market. These past fluctuations highlight the potential for both substantial gains and losses. Expert opinions on the matter vary significantly, reflecting the inherent difficulties in predicting future price movements. For example, some analysts might predict a price of $100,000 or more, while others might offer more conservative estimates. The actual price will ultimately depend on the complex interplay of the factors previously discussed.

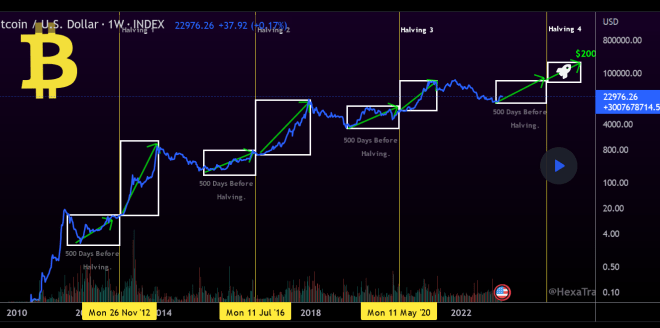

Historical Bitcoin Price Analysis: Bitcoin Price Prediction May 2025

Bitcoin’s price history is characterized by extreme volatility and significant price swings, driven by a complex interplay of technological advancements, regulatory changes, market sentiment, and macroeconomic factors. Analyzing these historical trends can provide valuable insights into potential future price movements, though it’s crucial to remember that past performance is not necessarily indicative of future results.

Understanding Bitcoin’s price evolution requires examining key periods of growth and decline, alongside the events that shaped them. This analysis will focus on significant price movements and their underlying causes, comparing past trends with current market conditions to identify potential parallels and divergences.

Bitcoin Price Movements and Influencing Events

The following table summarizes Bitcoin’s price history, highlighting key events that significantly impacted its value. Note that these are just some of the most impactful events, and many other factors contributed to the overall price fluctuations.

| Year | Price (USD) | Significant Events |

|---|---|---|

| 2009 | ~0 | Bitcoin’s creation and initial release. Limited adoption and negligible price. |

| 2010 | <$1 | Early adoption among tech enthusiasts. The infamous “pizza transaction” where 10,000 BTC were used to purchase two pizzas. |

| 2011 | ~$30 | Increased media attention and early investment. First significant price surge. |

| 2013 | ~$1,000 | Growing institutional interest and increased trading volume. Significant price increase followed by a sharp correction. |

| 2017 | ~$20,000 | Mainstream media hype, increased institutional investment, and speculation drove a massive bull market. |

| 2018-2019 | ~$3,000 – ~$7,000 | Bear market characterized by regulatory uncertainty and decreased investor confidence. |

| 2020-2021 | ~$10,000 – ~$60,000+ | The COVID-19 pandemic and increased institutional adoption fueled another bull market. Increased interest from companies like Tesla and MicroStrategy. |

| 2022-2023 | ~$15,000 – ~$30,000 | Macroeconomic headwinds, inflation concerns, and tighter regulatory scrutiny contributed to a bear market. The collapse of FTX further impacted investor sentiment. |

Comparison of Past Trends with Current Market Conditions

While Bitcoin’s price has historically followed cyclical patterns of bull and bear markets, the specific drivers and intensity of these cycles have varied. For example, the 2017 bull market was largely driven by retail investor speculation and media hype, while the 2020-2021 bull market saw increased participation from institutional investors. Currently, the market is navigating a complex landscape of macroeconomic uncertainty, regulatory developments, and evolving technological advancements, making direct comparisons challenging. However, analyzing past cycles can help to identify potential parallels, such as the influence of macroeconomic factors on investor sentiment and the cyclical nature of market enthusiasm. Divergences might include the increasing maturity of the Bitcoin ecosystem and the growing integration of Bitcoin into traditional financial systems. These factors could potentially lead to less volatile price swings in the future, although this is not guaranteed.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of macroeconomic conditions, technological advancements, regulatory changes, and market sentiment. While precise forecasting is impossible, analyzing these factors can provide a framework for understanding potential price movements.

Macroeconomic Factors and Their Impact

Macroeconomic factors significantly influence Bitcoin’s price, often acting as a counter-cyclical asset. High inflation, for example, can drive investors towards Bitcoin as a hedge against currency devaluation. Conversely, rising interest rates can make holding Bitcoin less attractive, as investors might shift towards higher-yielding assets. Global economic growth, or lack thereof, can also affect Bitcoin’s price, as investors’ risk appetite generally changes with the overall economic outlook. For instance, during periods of uncertainty or recession, investors may flock to safe-haven assets, potentially driving up Bitcoin’s price. However, during periods of strong economic growth, investors might allocate more capital to traditional markets, potentially leading to a decrease in Bitcoin’s value. The correlation between Bitcoin and traditional markets isn’t always consistent, and unexpected events can disrupt established trends.

Technological Advancements and Bitcoin’s Value

Technological advancements within the Bitcoin ecosystem play a crucial role in shaping its long-term value. Layer-2 scaling solutions, such as the Lightning Network, aim to increase transaction speed and reduce fees, making Bitcoin more practical for everyday use. Wider adoption of these solutions could lead to increased demand and, consequently, a higher price. Furthermore, increasing institutional adoption, signified by larger corporations and financial institutions investing in and utilizing Bitcoin, lends credibility and stability to the cryptocurrency, potentially boosting its price. Examples include MicroStrategy’s significant Bitcoin holdings and the growing number of Bitcoin-related investment products offered by established financial institutions. This institutional involvement adds legitimacy and reduces perceived risk, encouraging further investment.

Regulatory Developments and Market Impact

Regulatory developments globally will significantly shape Bitcoin’s trajectory. The approval of Bitcoin ETFs (Exchange-Traded Funds) in major markets would likely increase accessibility and liquidity, potentially driving up the price. Conversely, stricter regulations in various jurisdictions could stifle growth and negatively impact the price. The regulatory landscape is constantly evolving, and the outcome of regulatory decisions in key markets like the US, EU, and China will have a considerable effect. For example, the SEC’s ongoing review of Bitcoin ETF applications demonstrates the significant impact of regulatory decisions on market sentiment and, consequently, price.

Market Sentiment and Price Fluctuations

Market sentiment, encompassing investor confidence, media coverage, and social media trends, heavily influences Bitcoin’s volatility. Positive media coverage and widespread investor optimism can create a bullish market, pushing the price upward. Conversely, negative news, regulatory uncertainty, or a general downturn in the broader market can trigger sell-offs and price declines. Social media plays a significant role in shaping public perception and can amplify both positive and negative sentiment, leading to rapid price fluctuations. Examples of this include periods of intense social media hype or fear, often leading to significant price swings. Understanding the dynamics of market sentiment is critical to navigating the inherent volatility of the Bitcoin market.

Potential Bitcoin Price Scenarios for May 2025

Predicting the price of Bitcoin is inherently speculative, given its volatile nature and susceptibility to various market forces. However, by analyzing historical trends, current market conditions, and potential future developments, we can construct plausible price scenarios for May 2025. These scenarios are not guarantees but rather informed estimations based on a range of possibilities.

Bullish Scenario: Continued Adoption and Institutional Investment

This scenario assumes continued mainstream adoption of Bitcoin as a store of value and a medium of exchange, coupled with significant investment from institutional players. Factors contributing to this bullish outlook include increasing regulatory clarity in key markets, the maturation of Bitcoin’s underlying technology, and growing awareness of its potential as a hedge against inflation. The increasing use of Bitcoin in decentralized finance (DeFi) and the expansion of Lightning Network could also significantly boost transaction volume and demand. Under this scenario, we could see a sustained period of upward price momentum.

A plausible price range for Bitcoin in May 2025 under this scenario is between $150,000 and $250,000. This range is supported by the historical precedent of Bitcoin’s price increases following periods of significant adoption and institutional interest. For instance, the price surge in 2017 can be partially attributed to increased institutional investment and media attention. This scenario assumes a continuation of that trend, but on a larger scale. The higher end of the range assumes a significant acceleration in adoption and institutional investment surpassing previous cycles.

Neutral Scenario: Consolidation and Sideways Movement

This scenario anticipates a period of price consolidation, with Bitcoin trading within a relatively narrow range. This could be driven by factors such as regulatory uncertainty in some regions, macroeconomic headwinds (like potential recessions), and a period of reduced investor enthusiasm following previous price surges. The market might focus on technological advancements and developments within the Bitcoin ecosystem rather than purely speculative price increases. This period of consolidation could be seen as a necessary breather before another significant price move.

A likely price range under this neutral scenario is between $50,000 and $100,000. This range reflects a situation where Bitcoin maintains its value as a digital asset but doesn’t experience dramatic price increases or decreases. This scenario is supported by the observation that periods of consolidation are common in the history of Bitcoin and other cryptocurrencies, often preceding significant price movements. This range assumes a balance between positive and negative factors influencing the market.

Bearish Scenario: Negative Macroeconomic Conditions and Regulatory Crackdown, Bitcoin Price Prediction May 2025

This scenario considers a less optimistic outlook, assuming negative macroeconomic conditions, such as a prolonged global recession, coupled with increased regulatory pressure on cryptocurrencies. A significant regulatory crackdown, leading to stricter regulations or even outright bans in major markets, could severely impact Bitcoin’s price. A loss of investor confidence, potentially triggered by a major security breach or a significant market manipulation event, could also contribute to a bearish trend.

In a bearish scenario, the price range for Bitcoin in May 2025 could fall between $20,000 and $40,000. This range reflects a significant correction from current levels, potentially driven by the negative factors mentioned above. The lower end of the range assumes a confluence of negative factors resulting in a considerable drop in investor confidence and market capitalization. This scenario is grounded in the reality that significant negative events have historically led to sharp price drops in the cryptocurrency market. The 2018 bear market serves as an example of how macroeconomic factors and regulatory uncertainty can negatively impact Bitcoin’s price.

Bitcoin Price Prediction May 2025 – Predicting the Bitcoin price in May 2025 is challenging, heavily influenced by factors like adoption rates and regulatory changes. A key event impacting this prediction is the 2024 Bitcoin halving; to understand its potential consequences, it’s crucial to consider what will follow. For insightful analysis on this, check out this article: What Will Happen After Bitcoin Halving In 2025.

Ultimately, the post-halving effects will significantly shape the Bitcoin price prediction for May 2025.

Predicting the Bitcoin price in May 2025 is inherently challenging, influenced by numerous factors. A key event to consider is the Bitcoin Halving in 2024, which will likely impact the price significantly. Understanding the potential ripple effects on other cryptocurrencies is crucial; for a deeper dive into this, check out this insightful resource on Bitcoin Halving 2025 Altcoins.

Ultimately, the Bitcoin price prediction for May 2025 remains speculative, but the halving’s influence on the overall market will be a major contributing factor.

Predicting the Bitcoin price in May 2025 is challenging, influenced by various factors including macroeconomic conditions and technological advancements. A key event impacting this prediction is the Bitcoin halving, significantly altering the rate of new Bitcoin creation. To understand its potential influence, checking the exact date is crucial; you can find that information by visiting this helpful resource: Que Dia Es El Halving De Bitcoin 2025.

Knowing the halving date allows for more accurate modeling of future Bitcoin price fluctuations and helps refine any May 2025 price prediction.

Predicting the Bitcoin price in May 2025 is a complex endeavor, influenced by numerous factors. A key event impacting this prediction is the Bitcoin halving, scheduled for 2024, which will significantly reduce the rate of new Bitcoin creation. For detailed information on this crucial event, please refer to this comprehensive analysis on Bitcoin. Halving. 2025.

Understanding the halving’s potential effects is essential for any accurate Bitcoin price prediction in May 2025.

Predicting the Bitcoin price in May 2025 is challenging, influenced by numerous factors. A key event impacting this prediction is the Bitcoin Halving in 2024, significantly altering the supply dynamics. To understand its potential effects on price, it’s crucial to review this insightful analysis: Bitcoin Halving 2025 What To Expect. Ultimately, the halving’s impact will be a major component in determining the Bitcoin price prediction for May 2025.

Predicting the Bitcoin price in May 2025 is challenging, influenced by numerous factors. A key event impacting this prediction is the Bitcoin Halving in 2024, significantly altering the supply dynamics. To understand its potential effects on price, it’s crucial to review this insightful analysis: Bitcoin Halving 2025 What To Expect. Ultimately, the halving’s impact will be a major component in determining the Bitcoin price prediction for May 2025.