Bitcoin Price Prediction 2025: Bitcoin Price Prediction Next Bull Run 2025

Bitcoin, the world’s first and most well-known cryptocurrency, is renowned for its extreme volatility. Its price has swung wildly, from near-worthlessness to record highs, captivating investors and sparking fervent debate about its future. The cryptocurrency’s inherent unpredictability makes predicting its price a challenging but undeniably compelling task, especially as we approach the anticipated 2025 bull run. This article will delve into the potential price trajectory of Bitcoin during this period, examining historical trends and market factors to offer a reasoned assessment.

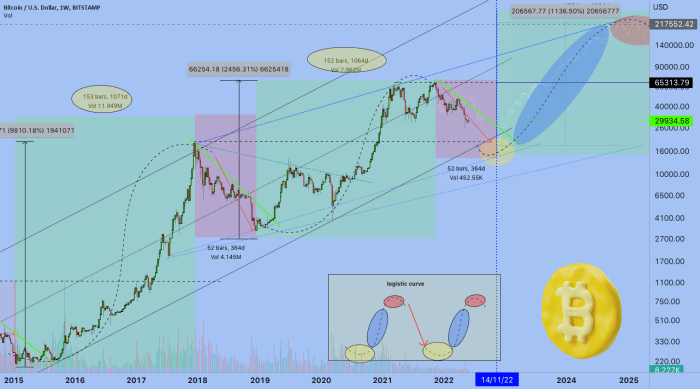

Bitcoin’s history is punctuated by several distinct bull runs, each marked by significant price surges followed by periods of consolidation or correction. The first major bull run occurred in 2013, culminating in a price exceeding $1,100. The subsequent bull run, starting in 2016 and peaking in late 2017, saw Bitcoin’s price skyrocket to nearly $20,000, a phenomenal increase fueled by increasing mainstream adoption and speculative investment. The most recent bull run, beginning in 2020 and reaching its apex in late 2021, took Bitcoin to an all-time high of over $68,000, driven by factors such as institutional investment and the growing acceptance of cryptocurrencies as an asset class. Analyzing these previous cycles, identifying common patterns and differentiating factors, is crucial to forming a prediction for 2025.

Bitcoin Price Prediction Models and Their Limitations, Bitcoin Price Prediction Next Bull Run 2025

Predicting Bitcoin’s price is inherently difficult due to the influence of numerous unpredictable factors. Various models exist, ranging from technical analysis based on chart patterns and trading volume to fundamental analysis considering macroeconomic conditions and technological advancements. However, no model can definitively predict future price movements with complete accuracy. Past performance, while informative, is not necessarily indicative of future results. For instance, while the previous bull runs exhibited a roughly four-year cycle, this pattern might not repeat precisely. Unforeseen events, such as regulatory changes, technological disruptions, or major geopolitical shifts, can significantly impact Bitcoin’s price. Therefore, any prediction should be viewed as a reasoned estimate, not a guaranteed outcome. Consider, for example, the 2022 crypto winter, which significantly impacted the market and defied many predictions based solely on past cyclical trends.

Factors Influencing the 2025 Bitcoin Bull Run

Several factors could contribute to a Bitcoin bull run in 2025. Halving events, which reduce the rate at which new Bitcoins are created, historically have preceded bull runs, creating scarcity and potentially driving up demand. Increased institutional adoption, with larger financial institutions integrating Bitcoin into their portfolios, could also boost the price. Furthermore, technological advancements, such as the development of the Lightning Network, which improves transaction speed and scalability, could enhance Bitcoin’s usability and appeal. Conversely, negative regulatory actions, macroeconomic instability, or the emergence of competing cryptocurrencies could hinder a bull run. The interplay of these factors will ultimately determine the extent and timing of any price increase.

Potential Price Targets for Bitcoin in 2025

Given the inherent uncertainties, providing a precise price target for Bitcoin in 2025 is speculative. However, by considering historical trends, market dynamics, and the aforementioned factors, a range of potential scenarios can be explored. Some analysts suggest a price range between $100,000 and $200,000, while others posit more conservative estimates. The actual price will depend on a confluence of events and market sentiment. It is crucial to remember that these are estimations, not guarantees, and the actual price could fall significantly outside of these ranges. For instance, a scenario involving widespread regulatory crackdowns could drastically lower the price, while widespread adoption could push it much higher than the highest estimations.