Bitcoin Price Prediction November 2025

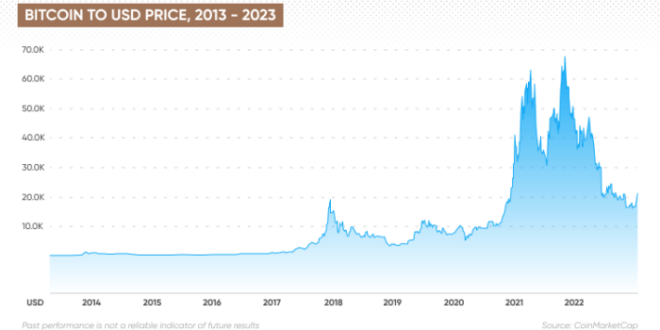

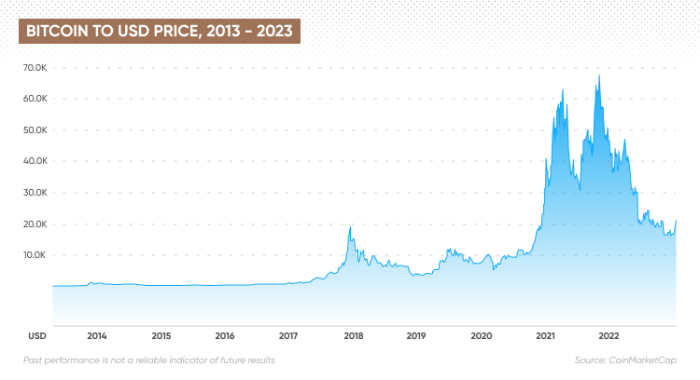

Bitcoin’s price history is characterized by extreme volatility, with periods of rapid growth interspersed with significant corrections. Since its inception, the cryptocurrency has experienced dramatic price swings, from near-zero to all-time highs exceeding $68,000, before retracting substantially. This volatility stems from a confluence of factors, making accurate price prediction a challenging endeavor.

Bitcoin’s price is influenced by a complex interplay of market sentiment, regulatory developments, and technological advancements. Positive news, such as institutional adoption or regulatory clarity, often fuels price increases, while negative news, such as regulatory crackdowns or security breaches, can trigger sharp declines. Technological upgrades to the Bitcoin network, such as the implementation of the Lightning Network, also influence price by potentially improving scalability and transaction speeds.

Factors Influencing Bitcoin’s Price

Market sentiment plays a crucial role in shaping Bitcoin’s price. Investor confidence, fueled by media coverage, social media trends, and overall market conditions, directly impacts demand and, consequently, price. For example, positive media coverage highlighting Bitcoin’s potential as a store of value can lead to increased demand and price appreciation. Conversely, negative news, such as a major exchange hack, can severely impact investor confidence and drive the price down.

Regulatory changes significantly impact Bitcoin’s price. Government regulations, varying widely across jurisdictions, can either hinder or facilitate Bitcoin’s adoption. Favorable regulations, such as clear guidelines for cryptocurrency exchanges, can boost investor confidence and increase price. Conversely, restrictive regulations, such as outright bans or heavy taxation, can lead to price declines. The regulatory landscape is constantly evolving, making it difficult to predict its future impact on Bitcoin’s price.

Technological advancements within the Bitcoin ecosystem also influence its price. Improvements in scalability, transaction speed, and security can attract more users and increase demand, leading to price appreciation. Conversely, failures in the network’s security or lack of progress in addressing scalability challenges can negatively affect price. The ongoing development of layer-2 solutions, such as the Lightning Network, aims to enhance Bitcoin’s functionality and potentially drive price growth.

Challenges in Predicting Bitcoin’s Price

Accurately predicting Bitcoin’s price is exceptionally difficult due to its inherent volatility and the multitude of unpredictable factors influencing it. The cryptocurrency market is relatively young and lacks the historical data needed to build robust predictive models. Furthermore, the market is susceptible to speculative bubbles and emotional trading, making it prone to sudden and dramatic price swings that are difficult to anticipate. External factors, such as macroeconomic conditions, geopolitical events, and unexpected technological breakthroughs, further complicate the task of forecasting Bitcoin’s price. For example, the 2020-2021 bull run was partly driven by increased institutional interest and a flight to alternative assets during the COVID-19 pandemic – an event few could have predicted accurately. Similar unpredictable events could drastically alter future price trajectories.

Analyzing Historical Trends

Predicting Bitcoin’s price in November 2025 requires a thorough understanding of its historical performance. By analyzing past price movements and correlating them with significant events, we can gain valuable insights into potential future trends. Comparing Bitcoin’s trajectory with other asset classes like gold and stocks further enhances our predictive capabilities.

Bitcoin’s price history is characterized by periods of explosive growth interspersed with significant corrections. These fluctuations are often linked to technological advancements, regulatory changes, market sentiment, and macroeconomic factors. Understanding these correlations is crucial for developing a robust price prediction model.

Significant Past Price Movements and Correlating Events

The Bitcoin price has experienced dramatic swings since its inception. For example, the 2017 bull run saw Bitcoin’s price surge to nearly $20,000, driven by increased mainstream adoption and speculation. This period was followed by a significant correction in 2018, partly attributed to regulatory uncertainty and concerns about market manipulation. Subsequent price increases were observed in 2020 and 2021, fueled by institutional investment and the growing acceptance of Bitcoin as a store of value. The 2022 downturn, however, highlighted the volatility inherent in the cryptocurrency market, influenced by factors like rising interest rates and macroeconomic instability. These examples demonstrate the complex interplay of factors driving Bitcoin’s price.

Comparison with Other Asset Classes

Comparing Bitcoin’s performance with established asset classes like gold and stocks provides valuable context. While gold is often considered a safe haven asset, its price movements are generally less volatile than Bitcoin’s. Equities, on the other hand, exhibit a different pattern of volatility, often influenced by company performance and broader economic conditions. Analyzing the correlation (or lack thereof) between Bitcoin’s price and these asset classes helps determine whether it behaves as a traditional safe haven, a speculative asset, or a unique asset class altogether. For instance, during periods of macroeconomic uncertainty, Bitcoin has sometimes shown a positive correlation with gold, suggesting investors may view it as an alternative store of value. However, at other times, its price movements have been largely independent of traditional market indicators.

Bitcoin’s Historical Price Fluctuations and Significant Milestones

A chart illustrating Bitcoin’s price history would visually represent its significant milestones and fluctuations. The chart’s x-axis would represent time (from Bitcoin’s inception to the present), and the y-axis would represent the Bitcoin price in USD. Key milestones, such as the halving events (which reduce the rate of new Bitcoin creation), major regulatory announcements, and significant market events, could be marked on the chart. The chart would clearly show the periods of rapid growth and sharp corrections, providing a visual representation of Bitcoin’s volatility and its historical performance. The visual would emphasize the cyclical nature of Bitcoin’s price, illustrating the periods of bull and bear markets. The overall visual would demonstrate the exponential growth potential alongside the inherent risk associated with Bitcoin investment.

Predictive Models and Forecasting Techniques

Predicting the price of Bitcoin, a highly volatile asset, is a complex undertaking. Numerous methods exist, each with its strengths and limitations, attempting to forecast future price movements. These range from sophisticated quantitative models to more subjective qualitative assessments. Understanding these approaches is crucial for interpreting any Bitcoin price prediction.

Predicting the future price of any asset, let alone one as volatile as Bitcoin, is inherently challenging. However, several predictive models and forecasting techniques are commonly employed, each offering a different perspective and level of accuracy. These techniques are often used in conjunction to create a more comprehensive forecast.

Technical Analysis

Technical analysis focuses on historical price and volume data to identify patterns and trends, predicting future price movements based on these patterns. Indicators like moving averages, relative strength index (RSI), and MACD are commonly used. For example, a bullish crossover of a 50-day and 200-day moving average might be interpreted as a signal for a price increase. However, the effectiveness of technical analysis is debatable, particularly in the context of Bitcoin, where market sentiment and regulatory changes can significantly impact price movements independently of historical trends. Over-reliance on any single technical indicator can lead to inaccurate predictions. A classic example of a failed prediction using technical analysis was the prediction of a Bitcoin price crash in late 2017 based solely on overbought RSI levels. The price continued to rise despite the technical signals suggesting otherwise.

Fundamental Analysis

Fundamental analysis considers factors outside of the price chart, focusing on the underlying value of the asset. For Bitcoin, this might include adoption rates, regulatory developments, mining difficulty, network security, and overall market sentiment. A strong increase in institutional adoption, for example, might be considered a bullish fundamental factor. Conversely, negative regulatory news could be viewed as bearish. However, accurately quantifying the impact of these fundamental factors on Bitcoin’s price is difficult. The unpredictable nature of regulatory changes and the fast-paced evolution of the cryptocurrency landscape make precise forecasting using fundamental analysis extremely challenging. A case in point would be the impact of Elon Musk’s tweets on Bitcoin’s price; these events are difficult to predict and incorporate into any fundamental model.

Limitations of Forecasting Methods Applied to Bitcoin

Both technical and fundamental analysis face significant limitations when applied to Bitcoin. The cryptocurrency market is relatively young and characterized by high volatility, making historical data less reliable. Furthermore, Bitcoin’s price is heavily influenced by speculative trading and market sentiment, which are difficult to model accurately. External factors, such as regulatory changes and macroeconomic events, can also significantly impact Bitcoin’s price, making any prediction inherently uncertain. The lack of a clear historical precedent for a digital asset with Bitcoin’s characteristics adds to the difficulty of developing accurate predictive models. For example, the 2020 halving event, while anticipated by many, still resulted in a price movement that varied significantly from many predictions due to unforeseen market conditions and external factors.

Impact of Macroeconomic Factors

Bitcoin’s price, while often touted as independent of traditional financial markets, is demonstrably influenced by macroeconomic conditions. Global economic trends, particularly those affecting investor sentiment and risk appetite, significantly impact the demand for and price of Bitcoin. Understanding these relationships is crucial for navigating the volatility inherent in the cryptocurrency market.

Global economic conditions such as inflation, interest rates, and recessionary fears exert a considerable influence on Bitcoin’s price. These factors affect investor behavior, capital flows, and the overall attractiveness of different asset classes, including Bitcoin. Geopolitical events, with their potential to disrupt markets and shift investor confidence, further complicate the picture.

Inflation’s Effect on Bitcoin Price

High inflation erodes the purchasing power of fiat currencies. This can drive investors towards alternative assets, including Bitcoin, perceived as a hedge against inflation. However, the correlation isn’t always direct; periods of high inflation can also lead to increased interest rates, which can negatively impact Bitcoin’s price (as discussed below). For example, during periods of high inflation in 2021 and 2022, Bitcoin saw increased demand, but the impact was also tempered by other macroeconomic factors. The narrative of Bitcoin as “digital gold,” a store of value similar to gold, often strengthens during inflationary periods.

Interest Rates and Bitcoin’s Value

Interest rate hikes by central banks typically reduce the attractiveness of riskier assets like Bitcoin. Higher interest rates make bonds and other fixed-income securities more appealing, drawing investment away from cryptocurrencies. Conversely, lower interest rates can stimulate riskier investments, potentially leading to increased demand for Bitcoin. The Federal Reserve’s interest rate hikes in 2022, for example, contributed to a significant downturn in the cryptocurrency market, including Bitcoin. This demonstrates the strong inverse relationship between interest rates and Bitcoin price in many cases.

Recessionary Fears and Bitcoin’s Price

Recessionary fears often lead investors to move towards safer assets, reducing demand for riskier assets like Bitcoin. The uncertainty associated with economic downturns can cause investors to liquidate their holdings in cryptocurrencies to secure more stable investments. However, Bitcoin’s decentralized nature and limited supply might also make it an attractive safe haven for some investors during times of economic instability. The 2008 financial crisis, while preceding Bitcoin’s widespread adoption, offers a historical parallel: investors sought refuge in alternative assets perceived as less susceptible to traditional financial system failures.

Geopolitical Events and Bitcoin

Geopolitical events, such as wars, political instability, or significant international tensions, can significantly impact Bitcoin’s price. These events often create uncertainty in global markets, leading to increased volatility and shifts in investor sentiment. For instance, the ongoing war in Ukraine caused significant market fluctuations, impacting Bitcoin’s price along with traditional assets. The perception of Bitcoin as a decentralized and censorship-resistant asset can sometimes make it a safe haven during periods of geopolitical turmoil, but this effect is not guaranteed and depends heavily on the specific event and broader market conditions.

Comparative Effects of Macroeconomic Factors on Bitcoin Price

| Macroeconomic Factor | Effect on Bitcoin Price (Generally) | Example | Caveats |

|---|---|---|---|

| Inflation | Potentially Positive (as a hedge) | Increased demand during periods of high inflation | Can be offset by rising interest rates |

| Interest Rates | Generally Negative (inverse relationship) | Price decline following interest rate hikes | Depends on the magnitude and speed of rate changes |

| Recessionary Fears | Generally Negative (risk-off sentiment) | Sell-off during periods of economic uncertainty | Potential for Bitcoin to act as a safe haven for some |

| Geopolitical Events | Highly Variable | Volatility following major geopolitical events | Dependent on the nature and severity of the event |

FAQ: Bitcoin Price Prediction November 2025

This section addresses frequently asked questions regarding Bitcoin price predictions for November 2025. Understanding the factors influencing Bitcoin’s price, the limitations of predictions, and the inherent risks is crucial for informed investment decisions.

Major Factors Influencing Bitcoin’s Price, Bitcoin Price Prediction November 2025

Bitcoin’s price is a complex interplay of various factors. Supply and demand dynamics are fundamental; increased demand relative to a fixed supply (21 million Bitcoin) pushes prices up, while decreased demand leads to price drops. Macroeconomic conditions, such as inflation rates, interest rate adjustments by central banks, and overall economic uncertainty, significantly influence investor sentiment and, consequently, Bitcoin’s price. Regulatory changes, both globally and within specific jurisdictions, create uncertainty and can trigger price volatility. Technological advancements, such as the development of layer-2 scaling solutions or new use cases for Bitcoin, can positively impact its price. Finally, the actions of large investors (“whales”) and media narratives also play a role in shaping market sentiment and price movements. For example, the 2021 bull run was partially fueled by increased institutional adoption and positive media coverage, while regulatory crackdowns in China in 2021 contributed to a significant price correction.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable. The cryptocurrency market is notoriously volatile and influenced by unpredictable events. While predictive models and technical analysis can provide insights, they cannot accurately forecast future prices. These models often rely on historical data, which may not be representative of future market conditions. Unforeseen events, such as regulatory changes, technological breakthroughs, or macroeconomic shocks, can drastically alter price trajectories. Therefore, any prediction should be treated with extreme caution. Effective risk management strategies, such as diversification and only investing what one can afford to lose, are paramount. Consider the example of the 2017 Bitcoin price surge, which saw dramatic increases followed by a significant crash. No model accurately predicted the exact timing and magnitude of these swings.

Potential Risks of Investing in Bitcoin

Investing in Bitcoin carries substantial risks. Its high volatility means significant price fluctuations in short periods. This volatility can lead to substantial losses for investors who are not prepared for sudden price drops. Regulatory uncertainty is another key risk; governments worldwide are still developing their regulatory frameworks for cryptocurrencies, and changes in regulations can significantly impact Bitcoin’s price and accessibility. Security risks are also present; exchanges and individual wallets are vulnerable to hacking and theft. Investors should carefully research and select secure storage solutions and reputable exchanges to mitigate these risks. Finally, the relatively nascent nature of the Bitcoin market means it’s susceptible to market manipulation and speculative bubbles.

Reliable Information Sources about Bitcoin

Reliable information about Bitcoin can be found from various sources. Reputable financial news outlets such as the Wall Street Journal, Bloomberg, and Reuters often provide in-depth coverage of the cryptocurrency market. Specialized cryptocurrency news websites, such as CoinDesk and Cointelegraph, offer detailed analysis and reporting. Academic research papers and white papers can provide insights into the underlying technology and economic aspects of Bitcoin. However, it’s crucial to be discerning and critical of information found online, as misinformation and biased reporting are prevalent. Always cross-reference information from multiple sources before making any investment decisions.

Bitcoin Price Prediction November 2025 – Predicting the Bitcoin price for November 2025 requires considering various factors, including adoption rates and regulatory changes. To get a broader perspective on potential price movements throughout the year, it’s helpful to consult resources examining the Bitcoin Price In 2025 Year, such as this comprehensive analysis: Bitcoin Price In 2025 Year. Understanding the overall 2025 forecast will help refine more specific predictions for November 2025.

Accurately predicting the Bitcoin price in November 2025 is challenging, given the cryptocurrency’s volatile nature. However, understanding broader market trends is crucial, and for a comprehensive overview of potential scenarios, it’s helpful to consult resources like this article on Bitcoin 2025 Predictions. This broader perspective can inform more nuanced estimations regarding the Bitcoin price prediction for November 2025, allowing for a more informed assessment.

Predicting the Bitcoin price for November 2025 involves considering various factors, including technological advancements and regulatory changes. To get a better grasp of long-term potential, it’s helpful to consider broader projections; for instance, check out this insightful piece on What Will Bitcoin Price Be In 2030 to understand the potential trajectory. Understanding longer-term trends can provide valuable context when formulating shorter-term Bitcoin price predictions like those for November 2025.

Predicting the Bitcoin price for November 2025 is challenging, given the cryptocurrency’s volatility. However, understanding broader trends is crucial; a helpful resource for this is the comprehensive analysis available at Bitcoin Price At 2025 , which provides insights into potential price movements throughout the year. This broader perspective can inform more specific predictions for November 2025, though considerable uncertainty remains.

Predicting the Bitcoin price for November 2025 is challenging, requiring analysis of various factors influencing its long-term trajectory. To gain broader perspective on potential price movements throughout the year, it’s helpful to consult resources such as the insightful article on Bitcoin Price Prediction 2025 Forbes , which provides a comprehensive overview. Understanding the overall 2025 prediction helps contextualize potential price fluctuations for November specifically.