Technological Factors Affecting Bitcoin’s Price

Bitcoin’s price is not solely determined by market speculation; underlying technological advancements and regulatory landscapes significantly influence its trajectory. Understanding these factors is crucial for navigating the complexities of the cryptocurrency market and forming informed predictions. The interplay between technological improvements, regulatory changes, and inherent Bitcoin mechanics like halving events creates a dynamic environment impacting price volatility and long-term growth.

Bitcoin Halving Events and Price Impact

Bitcoin’s protocol is designed to undergo halving events approximately every four years. These events reduce the rate at which new Bitcoins are mined, effectively decreasing the supply entering the market. Historically, halving events have been followed by periods of price appreciation, although the magnitude and duration of these increases vary. The 2012 and 2016 halvings, for instance, were followed by significant price rallies, albeit with subsequent corrections. The underlying mechanism is simple: reduced supply, coupled with relatively consistent demand, often leads to price increases based on basic economic principles of supply and demand. However, it’s important to note that other market factors can influence the price reaction to a halving, and the effect isn’t guaranteed to be immediate or dramatic. For example, the 2020 halving saw a period of price appreciation, but the overall market conditions at the time, including macroeconomic factors and broader investor sentiment, also played a role.

Technological Advancements and Their Influence, Bitcoin Price Prediction October 2025

The development and adoption of technologies designed to improve Bitcoin’s scalability and usability have a significant impact on its price. The Lightning Network, for example, is a layer-2 scaling solution that allows for faster and cheaper transactions compared to the main Bitcoin blockchain. Widespread adoption of the Lightning Network could potentially alleviate transaction congestion and reduce fees, thereby making Bitcoin more attractive for everyday use and potentially boosting its price. Other technological advancements, such as improved wallet security features and enhanced mining hardware, also contribute to the overall health and stability of the Bitcoin ecosystem, which indirectly influences investor confidence and price. For example, the increased efficiency of mining hardware could lead to a more decentralized network, making it more resistant to manipulation and thus more attractive to investors.

Regulatory Changes and Their Price Effect

Regulatory decisions and policies concerning Bitcoin vary significantly across jurisdictions. Favorable regulations, such as those that provide clarity and legitimacy to cryptocurrency businesses, tend to positively influence Bitcoin’s price by increasing investor confidence and reducing uncertainty. Conversely, restrictive regulations or outright bans can lead to price drops, as seen in various instances where governments have imposed limitations on Bitcoin trading or usage. The regulatory landscape is constantly evolving, and the impact of specific regulatory changes can be difficult to predict precisely. However, a clear and consistent regulatory framework, even if restrictive in some aspects, generally fosters a more stable and predictable market environment, which can, in the long run, contribute to price stability and potentially growth. The ongoing debate around Bitcoin’s regulatory status in different countries highlights the significant influence that governmental policies can have on its price.

Macroeconomic and Geopolitical Influences

Bitcoin’s price, while often touted as independent of traditional financial markets, is demonstrably influenced by macroeconomic factors and global geopolitical events. Understanding these influences is crucial for any attempt at price prediction, as they can significantly impact investor sentiment and market dynamics. These factors often operate in complex interplay, making precise forecasting challenging but nonetheless essential to consider.

Bitcoin’s price and inflation share a complex, often inverse relationship. During periods of high inflation, investors may seek alternative stores of value, potentially driving up demand for Bitcoin as a hedge against currency devaluation. This is because Bitcoin’s supply is capped at 21 million coins, creating a scarcity that contrasts with inflationary fiat currencies. Conversely, periods of low inflation or economic stability might lead to reduced demand for Bitcoin as investors shift their focus to other asset classes perceived as less risky. The relationship, however, isn’t always straightforward; other factors such as regulatory changes and technological advancements can override this correlation. For example, the high inflation in 2021-2022 did not lead to a direct and sustained surge in Bitcoin’s price, suggesting the existence of more influential factors at play.

Bitcoin’s Price and Inflation

High inflation erodes the purchasing power of fiat currencies, making alternative assets like Bitcoin attractive. This increased demand can drive up Bitcoin’s price. Conversely, low inflation might reduce the appeal of Bitcoin as a hedge, potentially leading to price stagnation or even decline. The strength of this correlation, however, is often debated, and other factors frequently outweigh the direct influence of inflation rates. For instance, the 2008 financial crisis, marked by significant inflation in some countries, saw a period of both Bitcoin price increase and decrease, demonstrating the complexity of these interactions. The interplay between inflation, investor confidence, and regulatory environment significantly shapes the final impact on Bitcoin’s price.

Impact of Global Economic Events

Major global economic events, such as recessions, market crashes, or significant changes in monetary policy, can profoundly impact Bitcoin’s price. These events often trigger increased volatility and uncertainty in financial markets, leading investors to either flock to or flee from perceived “safe haven” assets, including Bitcoin. A global recession, for example, could cause investors to sell Bitcoin to cover losses in other investments, leading to a price drop. Conversely, a significant market crash could lead investors to seek alternative assets, potentially driving up Bitcoin’s price as they seek diversification or a hedge against traditional market risks. The 2020 COVID-19 pandemic, for example, initially caused a sharp drop in Bitcoin’s price, followed by a significant recovery and surge as investors sought safer, less correlated assets.

Effects of Geopolitical Instability

Geopolitical instability, including wars, political upheavals, and international sanctions, can create uncertainty in global financial markets, significantly influencing Bitcoin’s price. Investors may view Bitcoin as a safe haven asset during periods of geopolitical turmoil, driving up demand and price. Conversely, periods of extreme uncertainty might lead to a sell-off as investors seek liquidity. The ongoing war in Ukraine, for instance, initially saw increased volatility in Bitcoin’s price as investors reacted to the unfolding events and the subsequent sanctions imposed on Russia. The impact of geopolitical events on Bitcoin’s price depends on various factors, including the severity and duration of the instability, the investor perception of risk, and the availability of alternative safe haven assets.

Market Sentiment and Investor Behavior

Market sentiment and investor behavior significantly influence Bitcoin’s price, often acting as a powerful catalyst for both dramatic price increases and equally sharp declines. These factors are intertwined with technological advancements, macroeconomic conditions, and geopolitical events, creating a complex interplay that shapes Bitcoin’s trajectory. Understanding these dynamics is crucial for any attempt to predict Bitcoin’s price in October 2025.

Social Media and News Coverage Influence on Bitcoin’s Price

Social media platforms and mainstream news outlets wield considerable power in shaping public perception of Bitcoin. Positive news, such as regulatory approvals or significant institutional adoption, can trigger buying frenzies and price surges. Conversely, negative news, including security breaches, regulatory crackdowns, or prominent figures expressing skepticism, can lead to sell-offs and price drops. For example, Elon Musk’s tweets about Bitcoin have historically shown a strong correlation with short-term price volatility. The rapid spread of information and the amplification effect of social media can exacerbate both bullish and bearish trends, creating a volatile market environment. A single influential tweet or a widely circulated news article can trigger significant price swings within hours.

The Role of Institutional Investors in Bitcoin’s Price

Institutional investors, including hedge funds, asset management firms, and corporations, are increasingly investing in Bitcoin. Their participation brings a degree of stability and legitimacy to the market, often leading to sustained price increases. Large-scale purchases by institutional investors can absorb significant selling pressure and provide a solid foundation for price appreciation. Conversely, large-scale institutional selling can trigger significant downward pressure. The entry of firms like MicroStrategy and Tesla into the Bitcoin market has been cited as a factor in previous price rallies. The influence of these large players is significant because their trading volumes can dwarf those of retail investors.

Retail Investor Sentiment and its Influence on Bitcoin’s Price

Retail investor sentiment plays a significant role in Bitcoin’s price fluctuations. Periods of widespread enthusiasm and “fear of missing out” (FOMO) can drive up prices, even in the face of negative news or technical indicators. Conversely, periods of fear and uncertainty, often fueled by market corrections or negative media coverage, can lead to panic selling and sharp price declines. The “hodl” culture within the Bitcoin community, which emphasizes long-term holding, can mitigate some of the effects of short-term sentiment shifts. However, the collective behavior of retail investors, especially in highly volatile markets, can still significantly impact Bitcoin’s price. For example, the 2017 Bitcoin bubble was largely driven by retail investor enthusiasm and speculation, leading to a dramatic price surge followed by a sharp correction.

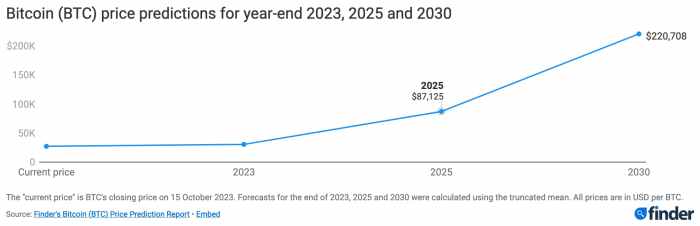

Potential Price Scenarios for October 2025: Bitcoin Price Prediction October 2025

Predicting the price of Bitcoin in October 2025 is inherently speculative, given the volatile nature of the cryptocurrency market. However, by considering various factors – technological advancements, macroeconomic conditions, geopolitical events, and investor sentiment – we can construct plausible price scenarios. These scenarios are not predictions, but rather illustrative possibilities based on current trends and potential future developments.

Bullish Scenario: Bitcoin Surges Past $200,000

This scenario envisions a significant surge in Bitcoin’s price, driven by widespread adoption, institutional investment, and positive macroeconomic factors. A successful Bitcoin ETF approval in major markets, coupled with continued technological advancements like the Lightning Network’s improvement and scaling solutions, could unlock substantial institutional investment. Furthermore, a global shift towards decentralized finance (DeFi) and a growing recognition of Bitcoin as a hedge against inflation could fuel significant price appreciation. Positive global economic growth and a stable geopolitical landscape would further contribute to this bullish outlook. This scenario is analogous to the rapid price increases seen in 2020 and 2021, though sustained over a longer period. We can imagine a scenario where Bitcoin’s market capitalization surpasses that of gold, driving the price to well above $200,000.

Bearish Scenario: Bitcoin Price Remains Below $50,000

Conversely, a bearish scenario suggests that Bitcoin’s price could remain significantly below its all-time high. This could be driven by a confluence of negative factors, including increased regulatory scrutiny, a global economic downturn, and a lack of widespread institutional adoption. A major security breach impacting a major cryptocurrency exchange, or a series of high-profile hacks, could also significantly damage investor confidence. Moreover, the emergence of competing cryptocurrencies with superior technology or more favorable regulatory environments could divert investment away from Bitcoin. This scenario is comparable to the prolonged bear market experienced after the 2017 bull run.

Neutral Scenario: Bitcoin Consolidates Around $100,000

A neutral scenario suggests a period of consolidation and sideways trading, with Bitcoin’s price fluctuating around a specific range. This could be the result of a balance between positive and negative factors. While technological advancements and institutional interest might provide upward pressure, regulatory uncertainty, macroeconomic headwinds, and potential market corrections could prevent a dramatic price increase. This scenario is similar to periods of market stability seen in other asset classes, where prices fluctuate within a defined range before experiencing a significant upward or downward trend. In this case, Bitcoin’s price might stabilize around $100,000, representing a significant increase from current levels but a less dramatic move compared to the bullish scenario.

Price Scenario Comparison

| Scenario | Price Range (October 2025) | Supporting Factors |

|---|---|---|

| Bullish | >$200,000 | Widespread adoption, significant institutional investment, positive macroeconomic conditions, successful ETF approval, technological advancements. |

| Bearish | <$50,000 | Increased regulatory scrutiny, global economic downturn, lack of widespread institutional adoption, security breaches, emergence of competing cryptocurrencies. |

| Neutral | ~$100,000 | Balance between positive and negative factors; technological advancements and institutional interest offset by regulatory uncertainty, macroeconomic headwinds, and potential market corrections. |

Risk Assessment and Disclaimer

Investing in Bitcoin, like any other asset class, carries significant risks. Its price volatility is well-known, and substantial gains can be quickly offset by equally dramatic losses. Understanding these risks is crucial before considering any investment. This section details the inherent dangers and the importance of responsible financial decision-making.

The inherent volatility of Bitcoin makes it a high-risk investment. Price fluctuations can be dramatic and unpredictable, influenced by a range of factors including technological advancements, regulatory changes, market sentiment, and macroeconomic conditions. For example, the price of Bitcoin has experienced periods of rapid growth followed by sharp corrections, exceeding 80% in some instances. These swings can lead to substantial financial losses for investors who are not prepared for such volatility.

Bitcoin Price Volatility and Market Risk

Bitcoin’s price is notoriously volatile, subject to rapid and significant changes. News events, regulatory announcements, and even social media trends can trigger substantial price swings. This inherent volatility creates substantial market risk, meaning the potential for significant losses is always present. Investors should be prepared for substantial price drops and have a clear risk tolerance before investing. For instance, the Bitcoin price crash of 2022 demonstrated the potential for significant and rapid losses. Investors who lacked a robust risk management strategy suffered considerable financial setbacks.

Regulatory Uncertainty and Legal Risks

The regulatory landscape surrounding Bitcoin is still evolving globally. Different countries have varying approaches to regulating cryptocurrencies, creating legal uncertainty. Changes in regulations can significantly impact the price and accessibility of Bitcoin. This regulatory uncertainty represents a significant legal risk for investors. For example, stricter regulations in a major market could lead to decreased demand and a price drop. Conversely, favorable regulatory changes in a significant jurisdiction could boost demand and lead to a price increase.

Security Risks and Exchange Vulnerabilities

Bitcoin exchanges and wallets are potential targets for hacking and theft. Security breaches can result in the loss of investor funds. Furthermore, the decentralized nature of Bitcoin does not eliminate the risk of fraud or scams. Investors should exercise caution when choosing exchanges and wallets and implement strong security measures to protect their investments. The Mt. Gox exchange hack in 2014, which resulted in the loss of millions of dollars worth of Bitcoin, serves as a stark reminder of the security risks involved.

Disclaimer Regarding Price Predictions

The price predictions presented earlier in this document are purely speculative and should not be interpreted as financial advice. Bitcoin’s price is influenced by numerous complex and unpredictable factors, making accurate long-term predictions extremely challenging, if not impossible. Past performance is not indicative of future results. Any investment decision should be based on thorough research, a comprehensive understanding of the risks involved, and your individual financial circumstances. Reliance on these predictions could lead to significant financial losses.

Responsible Investing and Diversification

Responsible investing involves careful consideration of your risk tolerance, investment goals, and financial situation. It is crucial to only invest what you can afford to lose. Diversification is a key principle of responsible investing. Spreading your investments across different asset classes reduces the overall risk to your portfolio. Including Bitcoin as part of a diversified portfolio can help manage risk, but it should not be the sole focus of your investment strategy. For example, a well-diversified portfolio might include stocks, bonds, real estate, and a small allocation to Bitcoin, reflecting the investor’s risk tolerance and investment goals.

Frequently Asked Questions (FAQs)

This section addresses common questions regarding Bitcoin’s price and its potential as a long-term investment. Understanding these factors is crucial for making informed investment decisions. We will explore the key influences on Bitcoin’s price, the reliability of predictions, and the inherent risks involved.

Major Factors Influencing Bitcoin’s Long-Term Price

Bitcoin’s price is influenced by a complex interplay of factors. Technological advancements, such as improvements in scalability and transaction speed, directly impact its usability and adoption. Macroeconomic conditions, including inflation rates and monetary policy, play a significant role, as Bitcoin is often viewed as a hedge against inflation. Geopolitical events, such as regulatory changes or international conflicts, can create uncertainty and volatility. Finally, market sentiment and investor behavior, driven by news cycles, social media trends, and overall market confidence, significantly impact price fluctuations. For example, positive news about institutional adoption can lead to price increases, while negative regulatory announcements can cause sharp declines. The interplay of these factors creates a dynamic and often unpredictable market.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable. The cryptocurrency market is highly volatile and influenced by numerous unpredictable factors. While analysts may use various models and historical data to make projections, these are ultimately educated guesses. Factors such as unforeseen technological breakthroughs, regulatory changes, or major shifts in investor sentiment can significantly alter the predicted trajectory. Consider the example of the 2017 Bitcoin bull run, which far exceeded most predictions, and the subsequent crash, which highlighted the unpredictable nature of the market. Therefore, it’s crucial to approach any price prediction with a healthy dose of skepticism.

Bitcoin as a Long-Term Investment: Pros and Cons

Bitcoin’s potential as a long-term investment presents both advantages and disadvantages. On the one hand, its limited supply, decentralized nature, and growing adoption suggest potential for long-term appreciation. The historical price appreciation, despite volatility, supports this argument. On the other hand, the extreme price volatility, regulatory uncertainty, and the potential for technological disruptions pose significant risks. The lack of intrinsic value, unlike traditional assets, is another factor to consider. Therefore, a long-term Bitcoin investment strategy should be carefully considered in light of one’s risk tolerance and financial goals.

Potential Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries several notable risks. High volatility is a primary concern, with prices fluctuating dramatically in short periods. Regulatory uncertainty, varying across jurisdictions, presents another challenge, as governments may impose restrictions or taxes that could negatively impact its value. Security risks, such as hacking and theft from exchanges or personal wallets, are also significant. Finally, the speculative nature of the market, driven by hype and FOMO (fear of missing out), can lead to irrational price bubbles and subsequent crashes. These risks necessitate a thorough understanding of the market before investing.

Illustrative Example

This section details a hypothetical investment scenario to illustrate the potential financial outcomes and emotional impact of investing in Bitcoin in October 2025, considering various price predictions. We’ll examine scenarios based on different price points and explore the investor’s emotional journey. Remember, this is a hypothetical example and should not be interpreted as financial advice.

Let’s consider Sarah, a 35-year-old investor with a moderate risk tolerance. In October 2023, she decides to allocate $10,000 of her savings into Bitcoin, anticipating long-term growth.

Scenario 1: Bullish Market – Bitcoin reaches $150,000

In this scenario, Bitcoin experiences a significant bull run, reaching $150,000 by October 2025. Sarah’s initial $10,000 investment would be worth significantly more, assuming a linear increase, this would result in a return of approximately $150,000. This substantial gain would likely lead to feelings of elation, relief, and perhaps even a sense of validation for her investment strategy. She might feel confident and empowered, potentially leading to further investment in cryptocurrency. However, she might also experience anxiety about the volatility of the market and the possibility of future losses.

Scenario 2: Bearish Market – Bitcoin falls to $25,000

Conversely, if the market takes a downturn, and Bitcoin’s price drops to $25,000 by October 2025, Sarah’s investment would experience a substantial loss. Her $10,000 would be worth significantly less, resulting in a loss of approximately $7,500. This scenario would likely trigger feelings of disappointment, frustration, and potentially regret. She might question her investment decisions and experience a loss of confidence in the cryptocurrency market. This could lead to risk aversion in future investment strategies.

Scenario 3: Moderate Growth – Bitcoin stabilizes at $50,000

A more moderate scenario sees Bitcoin stabilizing around $50,000 by October 2025. In this case, Sarah’s $10,000 investment would have approximately doubled in value, resulting in a profit of roughly $10,000. This outcome would likely bring a sense of satisfaction and contentment, confirming a successful, albeit less spectacular, investment. The emotional impact would be less intense compared to the extreme scenarios, allowing for a more balanced assessment of her investment strategy.

Emotional Impact Analysis

The emotional rollercoaster associated with Bitcoin investment is a significant factor to consider. The potential for substantial gains can lead to euphoria and increased risk-taking, while significant losses can trigger fear, anxiety, and potentially impulsive decision-making. It’s crucial for investors to maintain a balanced perspective, understanding that volatility is inherent in the cryptocurrency market and that long-term investment strategies often require patience and resilience. Professional financial advice is always recommended before making significant investment decisions.