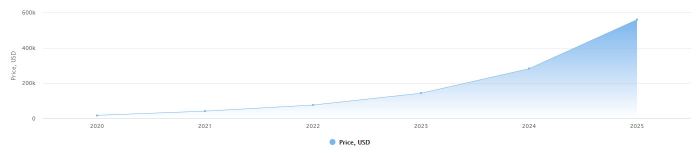

Bitcoin Price Prediction 2025

Bitcoin, since its inception in 2009, has experienced remarkable price volatility, ranging from near-zero to record highs exceeding $68,000. Its journey has been marked by periods of explosive growth interspersed with significant corrections, reflecting the inherent risks and rewards associated with this nascent asset class. Understanding these past trends is crucial for attempting to forecast its future price, though it’s important to remember that predicting the future price of any asset, particularly one as volatile as Bitcoin, is inherently speculative.

Bitcoin’s price is influenced by a complex interplay of factors. These include macroeconomic conditions (like inflation and interest rates), regulatory developments (government policies concerning cryptocurrencies), technological advancements (scaling solutions and network upgrades), market sentiment (investor confidence and media coverage), and adoption rates (increasing usage by businesses and individuals). A confluence of positive factors can propel its price upwards, while negative news or events can trigger sharp declines. The decentralized nature of Bitcoin, while a strength, also contributes to its volatility as it is not subject to the same regulatory oversight or market manipulation controls as traditional assets.

Factors Influencing Bitcoin Price Volatility

The inherent volatility of Bitcoin stems from several key sources. Firstly, its relatively small market capitalization compared to traditional asset classes means that even relatively small amounts of trading volume can cause significant price swings. Secondly, Bitcoin’s limited supply (21 million coins) creates scarcity, potentially driving up prices as demand increases. Thirdly, regulatory uncertainty in various jurisdictions adds to the volatility, as changes in government policies can have a significant impact on investor sentiment and market liquidity. Finally, the speculative nature of Bitcoin, often driven by hype and fear, contributes significantly to its price fluctuations. For example, the 2017 bull run saw Bitcoin’s price surge dramatically, fueled by media attention and speculation, only to experience a significant correction in the following years. This highlights the importance of considering these factors when attempting to forecast future price movements.

Challenges and Opportunities in Predicting Bitcoin’s Future Price

Accurately predicting Bitcoin’s price in 2025 is a challenging endeavor. The cryptocurrency market is still relatively young and subject to rapid changes. Predictive models, while useful, often fail to account for unexpected events, such as sudden regulatory shifts or significant technological breakthroughs. Furthermore, predicting investor sentiment and market psychology remains a significant hurdle. However, opportunities for informed prediction exist through analyzing historical price data, understanding market trends, considering macroeconomic indicators, and assessing technological advancements impacting the Bitcoin ecosystem. For example, the successful implementation of layer-2 scaling solutions could significantly enhance Bitcoin’s transaction throughput and potentially drive up demand. Conversely, a major security breach or regulatory crackdown could severely depress its price. Ultimately, any prediction must acknowledge the inherent uncertainty and risks associated with the cryptocurrency market.

Factors Affecting Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of macroeconomic conditions, regulatory landscapes, technological advancements, and market dynamics. While precise forecasting is impossible, understanding these key factors offers valuable insight into potential price trajectories.

Macroeconomic Factors

Global macroeconomic conditions significantly influence Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, rising interest rates, making traditional investments more attractive, could reduce Bitcoin’s appeal, potentially leading to price declines. The overall global economic outlook – recessionary fears or robust growth – also plays a crucial role, influencing risk appetite and investment flows into cryptocurrencies. For example, the 2022 economic downturn saw a significant drop in Bitcoin’s price, reflecting investors’ risk aversion during periods of uncertainty.

Regulatory Changes

Regulatory clarity and changes in governmental policies worldwide are pivotal in shaping Bitcoin’s future. Favorable regulations, such as clear tax frameworks and licensing for cryptocurrency exchanges, could boost institutional investment and mainstream adoption, driving price appreciation. Conversely, restrictive regulations, including outright bans or excessive taxation, could stifle growth and depress prices. The varying regulatory approaches across different jurisdictions highlight the significant impact of government policies on Bitcoin’s price. For instance, the relatively clear regulatory framework in some parts of Europe has contributed to a more stable and mature Bitcoin market compared to regions with more ambiguous or restrictive approaches.

Technological Advancements

Technological advancements, particularly layer-2 scaling solutions like the Lightning Network, are crucial for Bitcoin’s long-term viability and price. These solutions address Bitcoin’s scalability limitations, enabling faster and cheaper transactions, thereby enhancing its usability for everyday payments and potentially boosting adoption. Increased transaction speed and reduced fees can attract a wider range of users and businesses, leading to increased demand and potentially higher prices. The success of layer-2 solutions will directly impact Bitcoin’s ability to compete with other cryptocurrencies and its overall appeal as a transactional asset.

Institutional Investment and Adoption

The growing involvement of institutional investors, such as hedge funds and asset management firms, significantly impacts Bitcoin’s price. Large-scale institutional investments can inject substantial liquidity into the market, driving up demand and prices. Conversely, a significant withdrawal of institutional capital can trigger price corrections. The increasing acceptance of Bitcoin as a legitimate asset class by institutional players is a key factor driving its long-term price appreciation potential. Examples include the investments made by MicroStrategy and Tesla, which significantly influenced Bitcoin’s price at the time of their announcements.

Bitcoin’s Supply and Demand Dynamics

The inherent scarcity of Bitcoin, with a fixed supply of 21 million coins, plays a significant role in its price. Increased demand in the face of a limited supply will inevitably drive prices higher. Conversely, reduced demand or an increase in supply (through unexpected events like a significant number of lost keys being recovered) could exert downward pressure on prices. The halving events, which reduce the rate of Bitcoin creation, are prime examples of how supply dynamics influence price. Historically, Bitcoin’s price has tended to increase in the periods leading up to and following halving events.

Bitcoin Price Target Scenarios for 2025

Predicting the price of Bitcoin is inherently speculative, influenced by a complex interplay of technological advancements, regulatory changes, macroeconomic factors, and market sentiment. While no one can definitively state the price of Bitcoin in 2025, exploring potential scenarios provides valuable insight into the range of possibilities. The following Artikels three distinct scenarios – bullish, neutral, and bearish – based on various assumptions and potential catalysts.

Bitcoin Price Scenarios: Bullish, Neutral, and Bearish

The following table summarizes three distinct price scenarios for Bitcoin by the end of 2025. Each scenario is based on different assumptions regarding technological adoption, regulatory developments, and overall market conditions.

| Scenario | Price Target (USD) | Assumptions | Potential Catalysts |

|---|---|---|---|

| Bullish | $200,000 – $300,000 | Widespread institutional adoption, positive regulatory developments, sustained macroeconomic growth, technological advancements leading to increased scalability and efficiency. Significant increase in Bitcoin’s use as a store of value and medium of exchange. | Successful Bitcoin ETF approval, major corporations adding Bitcoin to their balance sheets, growing adoption in emerging markets, a significant global macroeconomic shift favoring decentralized assets. A significant technological breakthrough enhancing Bitcoin’s utility. |

| Neutral | $50,000 – $100,000 | Moderate institutional adoption, mixed regulatory landscape, fluctuating macroeconomic conditions, continued technological improvements, but at a slower pace than the bullish scenario. Bitcoin remains a significant asset class, but its growth is more gradual. | Stable macroeconomic conditions, ongoing institutional investment, gradual regulatory clarity in key markets, continued technological development, increased use of Bitcoin in specific sectors. |

| Bearish | Below $20,000 | Limited institutional adoption, negative regulatory developments, a prolonged period of macroeconomic uncertainty or downturn, significant technological setbacks, or the emergence of a superior competitor. Decreased investor confidence in Bitcoin as a viable investment. | Significant regulatory crackdown on cryptocurrencies, a major security breach impacting Bitcoin’s network, a prolonged global recession, the emergence of a more efficient and scalable blockchain technology, a loss of investor confidence due to market manipulation or unforeseen events. |

Bullish Scenario Rationale

A bullish scenario assumes significant positive developments across multiple fronts. Widespread institutional adoption, fueled by positive regulatory clarity (such as the approval of a Bitcoin ETF in major markets) and increased understanding of Bitcoin’s utility as a hedge against inflation, could drive substantial price increases. Technological advancements improving transaction speeds and scalability would also be crucial for broader adoption. This scenario mirrors the rapid growth experienced in previous bull markets, though the scale of this prediction is significantly higher, requiring exceptional market conditions. Similar growth, though on a smaller scale, has been seen in previous cycles.

Neutral Scenario Rationale

The neutral scenario represents a more conservative outlook, reflecting a balance between positive and negative factors. Moderate institutional adoption and gradual technological improvements would contribute to steady, albeit less dramatic, price growth. This scenario assumes a relatively stable macroeconomic environment and a mixed regulatory landscape, neither overly supportive nor overtly hostile to cryptocurrencies. The price range reflects a continuation of existing trends without major disruptions or breakthroughs. This scenario is consistent with historical periods of consolidation following significant price increases.

Bearish Scenario Rationale

A bearish scenario anticipates unfavorable developments that could significantly depress Bitcoin’s price. This includes potential regulatory crackdowns, macroeconomic instability (such as a prolonged global recession), or the emergence of a competing technology that surpasses Bitcoin in terms of efficiency or scalability. A major security breach affecting the Bitcoin network could also erode investor confidence, leading to a significant price decline. This scenario aligns with periods of heightened risk aversion in financial markets, where investors move away from higher-risk assets like Bitcoin. The 2018 bear market serves as a real-world example of such a scenario.

Analyzing Bitcoin’s Market Sentiment and Predictions

Gauging the future price of Bitcoin is a complex undertaking, fraught with inherent uncertainties. However, by examining the predictions of prominent analysts and the methodologies they employ, we can gain a better understanding of the prevailing market sentiment and the potential range of outcomes for Bitcoin’s price in 2025. This analysis considers both the optimistic and pessimistic viewpoints, acknowledging the limitations of any predictive model.

Bitcoin Price Target 2025 Usd – The cryptocurrency market is notoriously volatile, influenced by a multitude of factors ranging from regulatory changes and technological advancements to macroeconomic trends and investor sentiment. Therefore, any price prediction should be viewed as a potential scenario rather than a guaranteed outcome.

Predicting the Bitcoin price target for 2025 in USD is challenging, involving numerous factors influencing its value. To gain a broader perspective, understanding international market fluctuations is crucial; for example, checking the Bitcoin Coin Price Prediction 2025 In Inr provides valuable insight into the Indian Rupee’s impact on the overall global price. Ultimately, the USD Bitcoin price target for 2025 will depend on a complex interplay of global economic conditions and market sentiment.

Prominent Analysts’ Bitcoin Price Predictions for 2025

Several analysts and experts have offered their predictions for Bitcoin’s price in 2025. These predictions vary significantly, reflecting the diverse methodologies and underlying assumptions used in their analyses. It’s crucial to remember that these are just predictions, not guarantees, and the actual price may differ considerably.

Predicting the Bitcoin price target for 2025 in USD is challenging, with various analysts offering widely differing figures. To gain a better understanding of the potential price range, it’s helpful to consider broader market trends and forecasts, such as those explored in this insightful article on Bitcoin Price In 2025 Year. Ultimately, the Bitcoin Price Target 2025 USD will depend on a confluence of factors influencing cryptocurrency markets.

- Analyst A (Example): Predicts a price range of $150,000 – $200,000 based on adoption rates and technological advancements. This prediction is based on a combination of fundamental and technical analysis, considering factors such as increasing institutional adoption and the limited supply of Bitcoin.

- Analyst B (Example): Forecasts a more conservative price range of $75,000 – $100,000, citing potential regulatory hurdles and macroeconomic uncertainties as key factors influencing their outlook. Their methodology primarily focuses on fundamental analysis, evaluating the underlying value proposition of Bitcoin relative to other assets.

- Analyst C (Example): Offers a bullish prediction of $250,000 or more, highlighting the potential for Bitcoin to become a dominant store of value in a decentralized financial system. This prediction relies heavily on technical analysis, identifying key support and resistance levels on the price chart and extrapolating past trends.

Comparison of Bitcoin Price Prediction Methodologies

Two primary methodologies are commonly used for Bitcoin price prediction: technical analysis and fundamental analysis. Each has its strengths and weaknesses, and a comprehensive approach often involves a combination of both.

Predicting the Bitcoin price target for 2025 in USD is a complex endeavor, influenced by numerous factors. For broader cryptocurrency market perspectives, including Bitcoin, you might find the analysis from Crypto Price Prediction 2025 Forbes helpful. Ultimately, any Bitcoin price target for 2025 remains speculative, dependent on technological advancements and overall market sentiment.

Technical Analysis focuses on chart patterns, indicators, and historical price data to identify trends and predict future price movements. Technical analysts look for patterns like support and resistance levels, moving averages, and relative strength index (RSI) to gauge momentum and potential price reversals. While this approach can be effective in identifying short-term trends, its predictive power for long-term price movements is limited, as it doesn’t consider the underlying economic factors influencing Bitcoin’s value.

Predicting the Bitcoin price target for 2025 in USD is challenging, involving numerous factors influencing its trajectory. A key element in this prediction involves understanding the market sentiment and price movements throughout the year. To gain insight into potential price fluctuations, reviewing the projected Bitcoin Price July 2025 can provide valuable context for formulating a more informed 2025 price target.

Ultimately, analyzing short-term trends like July’s price contributes to a broader understanding of the long-term Bitcoin price target for 2025.

Fundamental Analysis, on the other hand, focuses on the intrinsic value of Bitcoin. This involves evaluating factors such as its scarcity, adoption rate, network security, and its role as a store of value and a medium of exchange. Fundamental analysts often develop complex models to estimate Bitcoin’s fair market value based on these factors. While this approach offers a more long-term perspective, it’s difficult to precisely quantify the impact of future developments and accurately predict the market’s reaction to them. For example, unexpected regulatory changes or technological breakthroughs can significantly impact Bitcoin’s price, making it challenging to predict its future value based solely on fundamental factors.

Predicting the Bitcoin price target for 2025 in USD is challenging, depending heavily on various market factors and technological advancements. To gain further insight into potential future valuations, exploring resources like this article on How Much Is Bitcoin Worth In 2025 can be beneficial. Ultimately, the Bitcoin Price Target 2025 USD remains speculative, yet informed analysis helps refine estimations.

Limitations and Uncertainties in Bitcoin Price Prediction

Predicting Bitcoin’s price is inherently uncertain due to the numerous factors influencing its value and the inherent volatility of the cryptocurrency market. Several limitations hinder accurate prediction:

- Market Volatility: Bitcoin’s price is highly volatile, susceptible to sudden and significant price swings driven by news events, regulatory changes, and investor sentiment. This volatility makes accurate long-term price predictions exceptionally challenging.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is constantly evolving, with different jurisdictions adopting varying approaches. Changes in regulations can significantly impact Bitcoin’s price, making it difficult to incorporate these uncertainties into predictive models.

- Technological Advancements: The cryptocurrency space is characterized by rapid technological advancements. New technologies, such as layer-2 scaling solutions or improvements in consensus mechanisms, can significantly affect Bitcoin’s adoption and price, yet are difficult to predict accurately.

- Macroeconomic Factors: Global macroeconomic events, such as inflation, interest rate changes, and economic recessions, can also significantly influence Bitcoin’s price, adding another layer of complexity to price prediction.

Risks and Opportunities Associated with Bitcoin Investment in 2025

Investing in Bitcoin in 2025 presents a complex landscape of potential rewards and significant risks. While the cryptocurrency’s adoption continues to grow, investors must carefully weigh the opportunities against the inherent volatility and uncertainties. Understanding these factors is crucial for making informed investment decisions.

Key Risks Associated with Bitcoin Investment, Bitcoin Price Target 2025 Usd

Bitcoin’s price is notoriously volatile, experiencing dramatic swings in value within short periods. This volatility stems from several factors, including market sentiment, regulatory changes, and technological developments. For example, the 2022 bear market saw Bitcoin’s price plummet by over 60%, wiping out significant portions of investors’ portfolios. This inherent risk necessitates a high tolerance for uncertainty and potential significant losses. Furthermore, regulatory uncertainty surrounding Bitcoin remains a major concern. Governments worldwide are still grappling with how to classify and regulate cryptocurrencies, leading to potential changes in tax policies, trading restrictions, or even outright bans. The lack of clear regulatory frameworks creates an unpredictable environment for Bitcoin investors. Finally, security risks associated with Bitcoin, such as hacking of exchanges or individual wallets, are also substantial. The decentralized nature of Bitcoin doesn’t eliminate the risk of theft or loss of funds due to security breaches. Investors need to employ robust security measures to protect their holdings.

Potential Opportunities for Bitcoin Investors in 2025

Despite the risks, Bitcoin also presents significant opportunities for investors in 2025. The continued growth in Bitcoin adoption, both among individuals and institutions, is a key driver of potential future price appreciation. As more businesses and individuals integrate Bitcoin into their operations and portfolios, demand is likely to increase, potentially pushing prices higher. The increasing involvement of institutional investors, such as large corporations and investment firms, adds further weight to this trend. Institutional adoption provides a degree of legitimacy and stability to the market, attracting more mainstream investors. For example, MicroStrategy’s significant Bitcoin purchases have signaled a growing confidence in Bitcoin as a long-term asset. This institutional interest is likely to continue in 2025, potentially fueling further price growth.

Comparative Table of Risks and Opportunities

| Factor | Type | Potential Impact | Mitigation Strategies |

|---|---|---|---|

| Price Volatility | Risk | Significant capital losses; emotional stress | Diversification, dollar-cost averaging, long-term investment horizon |

| Regulatory Uncertainty | Risk | Changes in tax policies, trading restrictions, or bans | Stay informed about regulatory developments, consider geographically diversified holdings |

| Security Risks | Risk | Theft or loss of funds due to hacking or other security breaches | Use secure wallets, enable two-factor authentication, diversify storage locations |

| Adoption Growth | Opportunity | Increased demand, potentially higher prices | Long-term investment strategy, research emerging use cases |

| Institutional Investment | Opportunity | Increased market stability, potentially higher prices | Monitor institutional investment trends, consider exposure to Bitcoin-related companies |

Bitcoin’s Long-Term Potential and its Role in the Future of Finance: Bitcoin Price Target 2025 Usd

Bitcoin’s long-term potential rests on its unique properties as a decentralized, digitally scarce asset. Its future role in finance hinges on its ability to overcome current limitations and gain wider adoption as a store of value, medium of exchange, and unit of account. This section explores these possibilities and the potential impact on traditional financial systems.

Bitcoin’s potential as a store of value stems from its limited supply of 21 million coins. This inherent scarcity, coupled with increasing demand, could drive its price upwards over time, mirroring the behavior of precious metals like gold. However, its price volatility remains a significant hurdle to widespread adoption as a reliable store of value. The success of Bitcoin in this role will depend on its ability to demonstrate consistent long-term price stability, perhaps through increased institutional investment and regulatory clarity.

Bitcoin as a Medium of Exchange

The use of Bitcoin as a medium of exchange is currently limited by its volatility and transaction processing speed. While some merchants already accept Bitcoin, widespread adoption as a daily payment method requires faster, cheaper transactions and greater price stability. Technological advancements, such as the Lightning Network, aim to address these limitations by enabling faster and cheaper transactions. However, significant improvements are still needed before Bitcoin can compete effectively with established payment systems like credit cards or mobile payment apps. The success of Bitcoin in this area depends on technological improvements and increased merchant acceptance. Consider, for example, the growing number of businesses accepting Bitcoin in El Salvador, showcasing a potential path for wider adoption, though it is still a limited example.

Bitcoin as a Unit of Account

Bitcoin’s potential as a unit of account, a standard measure of value for goods and services, faces even greater challenges than its adoption as a medium of exchange. The inherent volatility of Bitcoin makes it unsuitable for widespread use in pricing and accounting. For Bitcoin to function as a reliable unit of account, its price stability must significantly improve, requiring widespread adoption and a substantial reduction in price fluctuations. The example of using Bitcoin to denominate contracts or invoices is currently limited to niche use cases, highlighting the considerable hurdles to overcome.

Bitcoin’s Impact on Traditional Financial Systems

Bitcoin’s potential to disrupt traditional financial systems is substantial. Its decentralized nature challenges the centralized control of banks and governments over monetary policy and financial transactions. This could lead to increased financial inclusion, particularly in regions with limited access to traditional banking services. However, the potential for Bitcoin to be used for illicit activities, such as money laundering, poses a significant risk to traditional financial systems and necessitates robust regulatory frameworks. The future interaction between Bitcoin and traditional finance will likely involve a complex interplay of cooperation and regulation. The ongoing debate surrounding central bank digital currencies (CBDCs) demonstrates the ongoing efforts to navigate the challenges posed by cryptocurrencies and to develop new financial systems.

Bitcoin’s Potential as a Mainstream Asset Class

For Bitcoin to become a mainstream asset class, it needs to gain acceptance among institutional investors and retail investors alike. This requires addressing concerns about volatility, security, and regulatory uncertainty. Increased institutional investment, improved regulatory clarity, and the development of user-friendly investment vehicles could all contribute to its mainstream adoption. The increasing interest from institutional investors, such as MicroStrategy’s significant Bitcoin holdings, indicates a growing acceptance of Bitcoin as a viable asset class. However, significant challenges remain before it achieves widespread acceptance on par with established asset classes like stocks and bonds.

Frequently Asked Questions (FAQs)

This section addresses common questions regarding Bitcoin’s price, investment risks, and future prospects. Understanding these factors is crucial for making informed investment decisions.

Factors Influencing Bitcoin’s Price

Bitcoin’s price is a complex interplay of various factors. Supply and demand dynamics play a significant role; increased demand relative to limited supply tends to drive the price upward. Regulatory developments, both globally and within specific jurisdictions, significantly impact investor confidence and market liquidity. For example, positive regulatory announcements in a major economy can lead to a price surge, while negative news can trigger a sell-off. Market sentiment, driven by media coverage, social media trends, and overall economic conditions, also influences investor behavior and, consequently, price fluctuations. Technological advancements, such as upgrades to the Bitcoin network, can also affect the price positively by enhancing scalability and security. Finally, macroeconomic factors, such as inflation, interest rates, and geopolitical events, can indirectly impact Bitcoin’s price as investors seek alternative assets during times of economic uncertainty. The 2022 bear market, for instance, was partially attributed to rising inflation and increasing interest rates.

Potential Risks of Investing in Bitcoin

Investing in Bitcoin carries inherent risks. Price volatility is a major concern; Bitcoin’s price has historically experienced significant swings, leading to potential substantial losses for investors. Regulatory uncertainty remains a risk, as governments worldwide are still developing their approaches to cryptocurrency regulation. Security risks, including hacking and theft from exchanges or personal wallets, are also present. Furthermore, the lack of intrinsic value compared to traditional assets makes Bitcoin’s value entirely dependent on market sentiment and adoption. Mitigation strategies include diversifying investments, only investing what you can afford to lose, using secure storage methods like hardware wallets, and staying informed about regulatory developments. For example, diversifying into other asset classes can reduce overall portfolio risk, while using a hardware wallet significantly reduces the risk of theft compared to leaving Bitcoin on an exchange.

Accuracy of Bitcoin Price Prediction

Accurately predicting Bitcoin’s price is extremely challenging, if not impossible. The cryptocurrency market is highly speculative and influenced by numerous unpredictable factors. While technical analysis and fundamental analysis can provide insights, they are not foolproof predictors. Past performance is not indicative of future results, and any prediction should be treated with caution. Numerous predictions for Bitcoin’s price in previous years have proven inaccurate, highlighting the inherent difficulty in forecasting this volatile market. For example, predictions made in 2017 for a price of $100,000 by the end of 2018 were significantly off the mark.

Long-Term Outlook for Bitcoin

Bitcoin’s long-term outlook is a subject of ongoing debate. Proponents argue that Bitcoin’s decentralized nature, limited supply, and growing adoption could lead to significant price appreciation over the long term. They point to its potential as a store of value and a hedge against inflation. However, skeptics raise concerns about its volatility, regulatory uncertainty, and the potential for technological disruption. The long-term trajectory will likely depend on several factors, including widespread adoption by institutions, advancements in blockchain technology, and the overall evolution of the global financial system. Different scenarios are possible, ranging from mainstream adoption leading to significant price increases to a decline in relevance due to technological advancements or tighter regulation.