Bitcoin Price Prediction 2025: Bitcoin Stock Price Prediction 2025

Bitcoin, the pioneering cryptocurrency, has captivated the world with its volatile price swings and potential for massive returns. Its journey has been a rollercoaster, marked by periods of explosive growth followed by dramatic corrections. Predicting its future price, particularly as far out as 2025, is inherently speculative, yet the potential rewards—and risks—drive intense interest in long-term forecasts. Understanding the forces shaping Bitcoin’s value is crucial for navigating this unpredictable market.

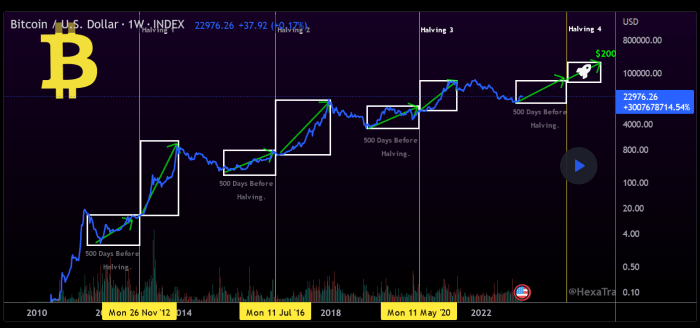

Bitcoin’s history is a testament to its volatility. Launched in 2009 with a negligible value, it experienced its first significant price surge in 2011, reaching around $30. The following years saw further fluctuations, punctuated by major milestones like the Mt. Gox hack in 2014, which significantly impacted market sentiment, and the remarkable rise to nearly $20,000 in late 2017, followed by a sharp correction. Subsequent years witnessed periods of consolidation and renewed growth, demonstrating the cryptocurrency’s resilience and unpredictable nature.

Factors Influencing Bitcoin’s Price

Several interconnected factors contribute to Bitcoin’s price fluctuations. These factors are constantly interacting, making accurate prediction extremely challenging. Ignoring any of these elements would lead to an incomplete and potentially inaccurate forecast.

Adoption rate plays a crucial role. Wider acceptance by businesses, institutions, and governments translates to increased demand and, consequently, higher prices. For example, the growing number of companies accepting Bitcoin as payment, coupled with the increasing institutional investment, has historically been correlated with price increases.

Regulatory landscapes significantly impact Bitcoin’s price. Favorable regulations in major economies can boost investor confidence and fuel price appreciation. Conversely, stricter regulations or outright bans can lead to price drops. The varying regulatory approaches across different countries highlight the complexities of this factor.

Technological advancements within the Bitcoin network itself, such as the implementation of the Lightning Network to improve transaction speed and scalability, can influence its price. These upgrades often enhance Bitcoin’s functionality and attract new users, potentially driving up demand. Conversely, significant security breaches or technological setbacks could negatively impact its price.

Factors Influencing Bitcoin’s Future Price

Predicting Bitcoin’s price in 2025, or any year for that matter, is inherently complex. Numerous intertwined factors, ranging from global economic conditions to technological advancements and regulatory decisions, significantly impact its value. Understanding these influences is crucial for navigating the volatile cryptocurrency market.

Macroeconomic Factors and Bitcoin’s Value

Macroeconomic conditions, such as inflation and interest rates, exert considerable influence on Bitcoin’s price. High inflation, eroding the purchasing power of fiat currencies, can drive investors towards Bitcoin as a hedge against inflation. Conversely, rising interest rates, making traditional investments more attractive, might divert capital away from riskier assets like Bitcoin. For example, the significant rise in inflation globally in 2021-2022 coincided with a surge in Bitcoin’s price, while subsequent interest rate hikes by central banks led to a correction in the market. The correlation isn’t always direct, however, as other factors also play a significant role.

Technological Advancements and Bitcoin Adoption

Technological improvements are vital for Bitcoin’s long-term viability and broader adoption. The Lightning Network, for instance, aims to address Bitcoin’s scalability limitations by enabling faster and cheaper transactions off the main blockchain. Successful implementation and widespread adoption of the Lightning Network could significantly increase Bitcoin’s usability for everyday transactions, boosting its price. Similarly, advancements in mining technology, improving energy efficiency and reducing environmental concerns, could enhance Bitcoin’s appeal to a wider range of investors and users.

Bitcoin Compared to Other Cryptocurrencies and Traditional Assets, Bitcoin Stock Price Prediction 2025

Bitcoin’s position relative to other cryptocurrencies and traditional assets is dynamic. While Bitcoin remains the dominant cryptocurrency by market capitalization, the emergence of alternative cryptocurrencies with potentially superior features could challenge its dominance. The comparison with traditional assets like gold, often viewed as a safe haven, is also relevant. Bitcoin’s limited supply, akin to gold’s scarcity, contributes to its appeal as a store of value, but its volatility remains a significant differentiating factor. Comparing Bitcoin’s performance against established asset classes like stocks and bonds helps investors assess its risk-return profile and make informed decisions.

Regulatory Hurdles and Their Impact

Regulatory uncertainty poses a significant risk to Bitcoin’s price trajectory. Varying regulatory approaches across different jurisdictions create uncertainty and can impact investor confidence. Clearer and more consistent regulatory frameworks, while potentially limiting certain aspects of Bitcoin’s use, could foster greater institutional investment and increase price stability in the long run. Conversely, overly restrictive regulations could stifle innovation and adoption, negatively affecting Bitcoin’s price. The evolving regulatory landscape in countries like the US and China illustrates the considerable impact of government policies on the cryptocurrency market.

Institutional Investment and Bitcoin’s Price

The growing involvement of institutional investors, such as hedge funds and corporations, has significantly impacted Bitcoin’s price. Large-scale investments by institutional players can drive up demand and increase price volatility. However, institutional adoption also brings increased scrutiny and potential for regulatory intervention. The entry of MicroStrategy and Tesla into the Bitcoin market serves as notable examples of how large-scale institutional investment can influence the cryptocurrency’s price, demonstrating both the potential for growth and the inherent risks.

Predictive Models and Their Limitations

Predicting Bitcoin’s future price is a complex undertaking, fraught with uncertainty. Numerous methods exist, each with its own strengths and weaknesses, and none offer foolproof accuracy. Understanding these methods and their inherent limitations is crucial for interpreting any price forecast.

Predicting the price of Bitcoin relies heavily on two primary analytical approaches: technical analysis and fundamental analysis. Both offer insights, but neither guarantees accurate predictions due to the volatile nature of the cryptocurrency market and the influence of external factors.

Technical Analysis and its Limitations

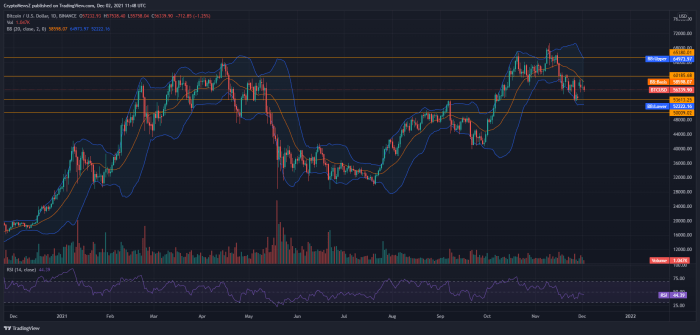

Technical analysis focuses on historical price and volume data to identify patterns and trends, predicting future price movements. Tools like moving averages, relative strength index (RSI), and chart patterns are commonly used. While identifying potential support and resistance levels can be helpful, technical analysis is inherently reactive, relying on past performance which isn’t always indicative of future results. Unexpected events, regulatory changes, or shifts in market sentiment can easily invalidate technical predictions. For example, the prediction in late 2017 that Bitcoin would reach $100,000 based purely on technical indicators failed to account for the subsequent market correction.

Fundamental Analysis and its Limitations

Fundamental analysis examines factors influencing Bitcoin’s underlying value, such as adoption rate, network security, regulatory environment, and technological advancements. It attempts to determine whether the current price accurately reflects Bitcoin’s intrinsic worth. However, quantifying these factors and predicting their future impact is challenging. The lack of a clear valuation model for Bitcoin further complicates the process. For instance, predictions based on increasing adoption rates in 2020-2021 failed to account for the subsequent market downturn caused by macroeconomic factors.

Examples of Past Price Predictions and Their Accuracy

Many analysts and platforms have offered Bitcoin price predictions in the past. Some predictions, like those made during the 2017 bull run, significantly overestimated the price, while others underestimated the extent of market corrections. The accuracy of these predictions varied greatly, highlighting the difficulty in accurately forecasting Bitcoin’s price. The inherent volatility and influence of external factors render many past predictions inaccurate.

Comparison of Predictive Models

| Model | Strengths | Weaknesses | Example Prediction (Illustrative) |

|---|---|---|---|

| Technical Analysis | Identifies potential support and resistance levels; reveals short-term trends | Reactive; relies on past performance; susceptible to market manipulation; ignores fundamental factors | Prediction of a price increase based on a bullish head and shoulders pattern, which later proved inaccurate due to a market crash. |

| Fundamental Analysis | Considers underlying value; accounts for long-term factors | Difficult to quantify factors; relies on assumptions about future adoption and regulation; slow to react to market shifts | Prediction of a gradual price increase based on growing institutional adoption, which was partially accurate but didn’t account for short-term volatility. |

Potential Scenarios for Bitcoin’s Price in 2025

Predicting Bitcoin’s price is inherently speculative, influenced by a complex interplay of technological advancements, regulatory changes, and market sentiment. While no one can definitively state Bitcoin’s price in 2025, exploring potential scenarios based on current trends and plausible future developments offers valuable insight. The following Artikels three distinct possibilities: a bullish, a bearish, and a neutral scenario.

Bullish Scenario: Bitcoin Surpasses $100,000

This scenario envisions a significantly positive outlook for Bitcoin, driven by widespread adoption and institutional investment. Several factors contribute to this optimistic projection.

Bitcoin Stock Price Prediction 2025 – Several factors could propel Bitcoin’s price to exceed $100,000 by 2025. These factors are interconnected and build upon each other to create a powerful upward momentum.

Predicting the Bitcoin stock price in 2025 involves considering numerous factors, including overall market trends and technological advancements. Understanding the performance of related cryptocurrencies, such as gaining insight into the potential trajectory of Bitcoin Cash, is also crucial; you can explore projections for this at Bitcoin Cash Future Price 2025. Ultimately, these interconnected factors influence the broader cryptocurrency market and thus affect Bitcoin’s predicted value in 2025.

- Increased Institutional Adoption: Continued growth in institutional investment, with larger corporations and financial institutions adding Bitcoin to their balance sheets, will increase demand and drive price appreciation. This mirrors the trend observed with companies like MicroStrategy and Tesla already holding significant Bitcoin reserves.

- Global Regulatory Clarity: The development of clearer and more favorable regulatory frameworks in major economies could significantly boost investor confidence and unlock substantial institutional capital currently hesitant to enter the market due to regulatory uncertainty. This could resemble the gradual acceptance of cryptocurrencies witnessed in some jurisdictions.

- Technological Advancements: Improvements in Bitcoin’s scalability and transaction speed through solutions like the Lightning Network could address current limitations and increase its usability for everyday transactions, potentially leading to wider adoption among consumers.

- Deflationary Nature of Bitcoin: The limited supply of 21 million Bitcoin continues to act as a strong deflationary pressure, driving up its value as demand increases. This inherent scarcity is a fundamental characteristic that distinguishes Bitcoin from fiat currencies.

Bearish Scenario: Bitcoin Falls Below $20,000

This scenario Artikels a less optimistic outlook, potentially resulting from significant negative events impacting the cryptocurrency market.

A number of factors could contribute to a bearish market and significantly lower Bitcoin’s price by 2025. These are interconnected risks that, if realized, could severely impact the market’s confidence.

Predicting the Bitcoin stock price in 2025 is a complex endeavor, influenced by numerous factors including technological advancements and regulatory changes. A key aspect to consider when forming this prediction is understanding the potential trajectory of the Bitcoin price itself, which you can explore further by reviewing this insightful analysis on Bitcoin Price In 2025 Year.

Ultimately, the Bitcoin stock price prediction for 2025 will depend on a convergence of these and other market dynamics.

- Stringent Regulatory Crackdowns: A wave of harsh regulatory actions across multiple jurisdictions, potentially including outright bans or excessively restrictive regulations, could severely dampen investor enthusiasm and trigger a significant price decline. This would be similar to the impact of past regulatory uncertainty on the market.

- Major Security Breach or Hack: A large-scale security breach affecting a major cryptocurrency exchange or the Bitcoin network itself could erode investor trust and lead to a significant sell-off. The consequences of such an event could be comparable to the Mt. Gox collapse in 2014.

- Macroeconomic Downturn: A global recession or prolonged economic instability could negatively impact risk appetite among investors, leading to a sell-off in riskier assets, including Bitcoin. This could mirror the correlation observed between Bitcoin and traditional markets during periods of economic uncertainty.

- Emergence of a Dominant Competitor: The rise of a new cryptocurrency with superior technology or features could divert investment away from Bitcoin, leading to a decline in its market dominance and price. This would be analogous to the competition observed between various cryptocurrencies.

Neutral Scenario: Bitcoin Trades Between $30,000 and $60,000

This scenario suggests a relatively stable price range for Bitcoin in 2025, reflecting a balance between positive and negative factors.

This scenario assumes a relatively balanced market, with neither overwhelming bullish nor bearish pressures dominating. The price range reflects a degree of uncertainty and market consolidation.

Predicting the Bitcoin stock price in 2025 involves considering numerous factors, including technological advancements and regulatory changes. A key aspect of this prediction relies on understanding broader market expectations, which is thoroughly explored in this insightful article on Bitcoin Price Expectations 2025. Ultimately, Bitcoin’s stock price prediction for 2025 hinges on the successful navigation of these market forces and the overall adoption rate of the cryptocurrency.

- Moderate Institutional Adoption: Gradual, rather than explosive, growth in institutional investment, coupled with continued retail interest, maintains demand without driving excessive price volatility.

- Mixed Regulatory Landscape: A diverse regulatory environment across different countries, with some jurisdictions adopting favorable policies while others remain cautious, results in a relatively stable market.

- Technological Progress and Limitations: Continued technological advancements in Bitcoin’s infrastructure are offset by persistent scalability challenges, limiting widespread adoption and preventing significant price surges.

- Economic Stability with Moderate Risk Appetite: A relatively stable global economy with moderate investor risk appetite prevents both significant price booms and crashes.

Investing in Bitcoin

Investing in Bitcoin presents a unique opportunity with significant potential rewards, but it also carries substantial risks. Understanding both sides of this equation is crucial for making informed investment decisions. This section will explore the inherent risks and potential benefits of Bitcoin investment, helping to clarify the complexities involved.

Bitcoin’s volatility is well-documented. Its price can fluctuate dramatically in short periods, influenced by factors ranging from regulatory announcements and market sentiment to technological developments and macroeconomic conditions. For instance, the price of Bitcoin has experienced significant increases and decreases exceeding 50% within a single year on multiple occasions. This inherent volatility makes it a high-risk investment, unsuitable for risk-averse individuals or those with short-term investment horizons.

Risks Associated with Bitcoin Investment

The risks associated with Bitcoin extend beyond its volatility. Security concerns are paramount. The decentralized nature of Bitcoin, while a strength in terms of censorship resistance, also means that users are solely responsible for securing their private keys. Loss or theft of these keys results in the irreversible loss of funds. Furthermore, the relative infancy of the cryptocurrency ecosystem means that regulatory landscapes are still evolving. Varying legal frameworks across jurisdictions create uncertainty, potentially impacting the accessibility and legality of Bitcoin trading and investment in different regions. For example, some countries have outright banned Bitcoin trading, while others have implemented strict regulations concerning its use.

Potential Rewards of Bitcoin Investment

Despite the inherent risks, Bitcoin investment offers potential rewards. The most significant is the potential for long-term growth. Since its inception, Bitcoin has shown a remarkable tendency for long-term appreciation, although punctuated by periods of sharp decline. This potential for growth is driven by factors such as increasing adoption, limited supply, and its position as a store of value, albeit a volatile one. Moreover, Bitcoin can act as a diversifier within a broader investment portfolio. Its price movements are often uncorrelated with traditional asset classes, potentially mitigating overall portfolio risk. This diversification benefit is particularly appealing to investors seeking to reduce their dependence on traditional financial markets.

Balancing Risks and Rewards

Ultimately, the decision to invest in Bitcoin requires a careful assessment of individual risk tolerance and financial goals. While the potential for substantial returns exists, the inherent volatility, security concerns, and regulatory uncertainties necessitate a cautious approach. Thorough research, a well-defined investment strategy, and a clear understanding of one’s risk tolerance are essential. It is also advisable to only invest an amount of money that one can afford to lose entirely. Consider consulting a financial advisor before making any significant investment decisions related to Bitcoin or other cryptocurrencies.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding Bitcoin’s price prediction for 2025 and the associated risks and rewards of investing in this cryptocurrency. Understanding these points is crucial before making any investment decisions.

Bitcoin’s Most Likely Price in 2025

Predicting Bitcoin’s price with certainty is impossible. Numerous factors, including regulatory changes, technological advancements, and overall market sentiment, influence its value. While various prediction models exist, they are inherently limited by their reliance on historical data and assumptions about future events. For example, a model might predict a price based on past adoption rates, but unforeseen technological disruptions could significantly alter this trajectory. Instead of focusing on a single price point, it’s more prudent to consider a range of potential outcomes, acknowledging the significant volatility inherent in cryptocurrency markets. Historical precedent suggests that Bitcoin’s price can experience dramatic swings, both upward and downward, in relatively short periods.

Bitcoin as a Long-Term Investment

Bitcoin’s potential as a long-term investment is a subject of ongoing debate. Arguments in favor often center on its limited supply (21 million coins), increasing adoption as a store of value, and the potential for future technological advancements to enhance its utility. Proponents point to its historical performance, showing significant growth over the long term, despite periods of substantial volatility. Conversely, arguments against long-term Bitcoin investment highlight its extreme price volatility, regulatory uncertainty in various jurisdictions, and the potential for technological disruption by competing cryptocurrencies or blockchain technologies. The inherent risk associated with holding Bitcoin necessitates a thorough understanding of its potential downsides before committing funds. The lack of intrinsic value, unlike traditional assets, is another key concern.

Safely Investing in Bitcoin

Safe Bitcoin investment requires a multi-faceted approach. Choosing a reputable and regulated cryptocurrency exchange is paramount. These exchanges offer varying levels of security, so researching their track record and security measures is crucial before depositing funds. Similarly, selecting a secure and reliable wallet for storing your Bitcoin is essential. Hardware wallets, offering offline storage, generally provide the highest level of security against hacking and theft. Diversification of investments, rather than placing all funds in Bitcoin, is another vital aspect of risk management. Regularly reviewing and updating security protocols for both your exchange account and wallet is also recommended. Never share your private keys or seed phrases with anyone.

Biggest Risks Associated with Bitcoin

Bitcoin investment carries substantial risks. Price volatility is arguably the most significant. Bitcoin’s price has experienced dramatic swings in the past, and these fluctuations can lead to significant losses for investors. Regulatory uncertainty poses another major challenge. Governments worldwide are still developing their regulatory frameworks for cryptocurrencies, and changes in regulations can significantly impact Bitcoin’s value and accessibility. Technological risks, including potential vulnerabilities in the Bitcoin network or the emergence of superior blockchain technologies, are also considerable. Furthermore, the lack of intrinsic value, unlike traditional assets like gold or real estate, makes Bitcoin vulnerable to market sentiment and speculative bubbles. Finally, the risk of theft or loss due to hacking or compromised wallets remains a constant concern.

Illustrative Examples

Visual representations can help understand the potential price trajectories of Bitcoin in 2025. Three scenarios—bullish, bearish, and neutral—are presented below, each with its own set of assumptions and influencing factors. These are illustrative examples and should not be considered financial advice.

Bitcoin Price Trajectories: Visual Representations

The following table presents simplified visual representations of potential Bitcoin price paths for 2025. Remember that these are hypothetical scenarios and actual price movements may differ significantly. The charts are conceptual and lack the precision of actual market data visualizations.

| Scenario | Description | Visual Representation (Conceptual) |

|---|---|---|

| Bullish | This scenario assumes continued widespread adoption, positive regulatory developments, and sustained institutional investment. It projects significant price appreciation driven by increasing demand and limited supply. Real-world examples include the 2017 bull run, although past performance is not indicative of future results. | Imagine a line graph starting at a hypothetical current price and steeply rising throughout 2025, potentially reaching significantly higher levels than the current price. The line would show a consistent upward trend with minor corrections. |

| Bearish | This scenario assumes negative regulatory changes, a significant macroeconomic downturn, or a loss of investor confidence. It projects a substantial price decline due to decreased demand and potential selling pressure. The 2018-2019 bear market serves as a relevant (though not predictive) example of a prolonged downturn. | Imagine a line graph starting at a hypothetical current price and steadily declining throughout 2025, potentially reaching significantly lower levels than the current price. The line would show a consistent downward trend with minor rallies. |

| Neutral | This scenario assumes a period of consolidation and sideways trading. It projects moderate price fluctuations around the current price level, with neither significant gains nor losses. This scenario assumes a balance between buying and selling pressure, with no major catalysts for significant price movements. | Imagine a line graph starting at a hypothetical current price and fluctuating within a relatively narrow range throughout 2025, showing neither a strong upward nor downward trend. The line would oscillate around a central price point. |

Scenario Assumptions and Influencing Factors

Each scenario’s visual representation is based on specific assumptions and factors influencing Bitcoin’s price. These factors are complex and interconnected, making accurate predictions challenging. The bullish scenario relies on positive market sentiment and technological advancements. The bearish scenario is predicated on negative news and macroeconomic headwinds. The neutral scenario assumes a balanced market with no dominant factors driving price movements in either direction. It’s crucial to remember that unforeseen events could drastically alter these trajectories.

Predicting the Bitcoin stock price in 2025 involves considering numerous factors, including adoption rates and regulatory changes. For a comprehensive perspective on potential USD values, it’s helpful to consult reputable analyses such as those found in a piece like the Bitcoin Price Prediction 2025 Usd Forbes article. Understanding these predictions can inform your own assessment of Bitcoin’s future stock price in 2025.

Predicting the Bitcoin stock price for 2025 involves considering numerous factors, including adoption rates and regulatory changes. A crucial element in this prediction is understanding the trajectory of Bitcoin’s price in the near term; for insights into this, check out this detailed analysis of the Bitcoin Price By January 2025: Bitcoin Price By January 2025. This short-term forecast can significantly inform broader predictions for Bitcoin’s value by 2025, providing a valuable foundation for longer-term estimations.