Bitcoin Price Prediction 2025 (INR)

Predicting the price of Bitcoin in Indian Rupees by 2025 is inherently speculative, as the cryptocurrency market is volatile and influenced by numerous interconnected factors. However, by analyzing current trends, regulatory developments, and technological advancements, we can construct plausible price scenarios. This analysis will consider optimistic, pessimistic, and most likely price projections, acknowledging the inherent uncertainties involved.

Factors Influencing Bitcoin’s Price in India

Several factors uniquely affect Bitcoin’s price trajectory within the Indian market. These include the evolving regulatory landscape, the level of cryptocurrency adoption among the Indian population, and the overall economic health of the country. Government policies, particularly those concerning taxation and legal recognition of cryptocurrencies, will significantly impact investor sentiment and trading volumes. Furthermore, the increasing digital literacy and financial inclusion initiatives in India could boost Bitcoin adoption, while economic instability could drive investors towards alternative assets like Bitcoin as a hedge against inflation.

Price Prediction Scenarios (INR)

Several factors contribute to the uncertainty surrounding Bitcoin’s future price. For instance, widespread adoption could drive prices significantly higher, while negative regulatory changes could suppress them. Technological advancements and market sentiment also play critical roles. Considering these factors, we can Artikel three potential scenarios:

| Scenario | Price Range (INR) | Rationale |

|---|---|---|

| Optimistic | ₹50,00,000 – ₹75,00,000 | Widespread adoption, positive regulatory changes, and sustained technological innovation. This scenario assumes a bullish market overall, with Bitcoin establishing itself as a mainstream asset. Similar to the 2021 bull run, though potentially more sustained. |

| Pessimistic | ₹10,00,000 – ₹20,00,000 | Negative regulatory actions, economic downturn, and decreased investor confidence. This scenario assumes significant headwinds for the cryptocurrency market as a whole, potentially due to increased government scrutiny or a global financial crisis. This would mirror periods of market correction seen historically. |

| Most Likely | ₹25,00,000 – ₹40,00,000 | A moderate level of adoption, a mixed regulatory environment, and continued technological development. This represents a balanced outlook, acknowledging both the potential for growth and the risks inherent in the market. This projection considers a gradual, yet steady, increase in Bitcoin’s value, similar to its historical growth patterns. |

Bitcoin vs. Other Major Cryptocurrencies (INR Projection 2025), Bitcoin Target Price 2025 In Inr

Predicting the relative performance of different cryptocurrencies is challenging. However, based on current market trends and projected growth, we can create a comparative table showing potential values in INR for 2025. This is purely speculative and should not be considered financial advice.

| Cryptocurrency | Projected Price Range (INR) |

|---|---|

| Bitcoin (BTC) | ₹25,00,000 – ₹40,00,000 (Most Likely Scenario) |

| Ethereum (ETH) | ₹5,00,000 – ₹10,00,000 |

| Cardano (ADA) | ₹5,000 – ₹15,000 |

| Solana (SOL) | ₹20,000 – ₹50,000 |

| Binance Coin (BNB) | ₹2,00,000 – ₹4,00,000 |

Note: These are estimations based on current market trends and should not be interpreted as definitive predictions. Actual prices may vary significantly.

Risks and Opportunities in the Indian Bitcoin Market

The Indian Bitcoin market presents both significant opportunities and substantial risks. Opportunities stem from the potential for high returns in a growing market and the increasing adoption of digital currencies among a large, young population. Risks include regulatory uncertainty, volatility, and the potential for scams and fraud. The government’s stance on cryptocurrencies will be a major determining factor in the market’s future. Furthermore, the lack of widespread consumer understanding of Bitcoin and its underlying technology poses a challenge to its broader adoption.

Factors Influencing Bitcoin’s INR Value

Predicting Bitcoin’s price in Indian Rupees (INR) is complex, influenced by a confluence of global and local factors. Understanding these interconnected elements is crucial for navigating the volatility inherent in the cryptocurrency market. The following sections delve into the key drivers shaping Bitcoin’s INR value.

Global Macroeconomic Factors

Global macroeconomic conditions significantly impact Bitcoin’s price, often acting as a safe haven asset during times of economic uncertainty. High inflation, for instance, can erode the purchasing power of fiat currencies, potentially driving investors towards Bitcoin as a hedge against inflation. Conversely, rising interest rates, often implemented to combat inflation, can reduce the attractiveness of Bitcoin as investors seek higher returns in traditional financial instruments. Recessionary fears, signaling economic downturn, can lead to increased volatility and potentially decreased investment in riskier assets like Bitcoin, although some see it as a safe haven in such times. The correlation, however, isn’t always straightforward, and Bitcoin’s price can react differently depending on the specific circumstances and market sentiment. For example, the 2022 inflation spike saw Bitcoin’s price fall along with many other assets, illustrating that its inflation-hedge status is not always absolute.

Government Regulations and Policies in India

India’s regulatory stance on cryptocurrencies plays a pivotal role in shaping Bitcoin’s adoption and price in INR. A clear and consistent regulatory framework could boost investor confidence, leading to increased demand and potentially higher prices. Conversely, ambiguous or restrictive regulations can stifle adoption, impacting price negatively. The Indian government’s ongoing efforts to develop a regulatory framework, including potential taxation policies, directly influence investor sentiment and market activity. For example, the introduction of a cryptocurrency tax in India in 2022, while not directly suppressing the market, added a layer of complexity and potentially deterred some investors.

Technological Advancements

Technological advancements within the cryptocurrency space can significantly influence Bitcoin’s long-term value. Layer-2 scaling solutions, for instance, aim to improve Bitcoin’s transaction speed and reduce fees, potentially making it more attractive for everyday use and increasing demand. The emergence of new cryptocurrencies, while potentially creating competition, can also indirectly benefit Bitcoin by raising overall awareness and adoption of cryptocurrencies in general. Innovations like the Lightning Network, a layer-2 scaling solution for Bitcoin, are actively being developed and adopted, which could positively impact transaction efficiency and consequently, price.

Institutional versus Retail Investment

The balance between institutional and retail investment significantly impacts Bitcoin’s price dynamics in the Indian market. Large institutional investments can inject significant capital into the market, driving price increases. However, retail investors’ behavior, often influenced by market sentiment and speculation, can lead to greater price volatility. The entry of institutional investors like mutual funds or hedge funds, although still relatively nascent in India’s crypto space, demonstrates growing acceptance, potentially pushing prices upward over the long term. Conversely, significant retail sell-offs, fueled by fear or market manipulation, can create downward pressure on prices. A stable balance between institutional confidence and retail participation is likely to foster a more stable and sustainable Bitcoin market in India.

Bitcoin’s Historical Performance and Future Trends

Bitcoin’s journey in the Indian Rupee (INR) market has been a rollercoaster, mirroring global trends but with its own unique characteristics influenced by Indian regulatory landscapes and investor sentiment. Analyzing this history, alongside macroeconomic factors and potential future scenarios, provides a clearer picture of Bitcoin’s potential in India.

Bitcoin Price History in INR and Influencing Factors

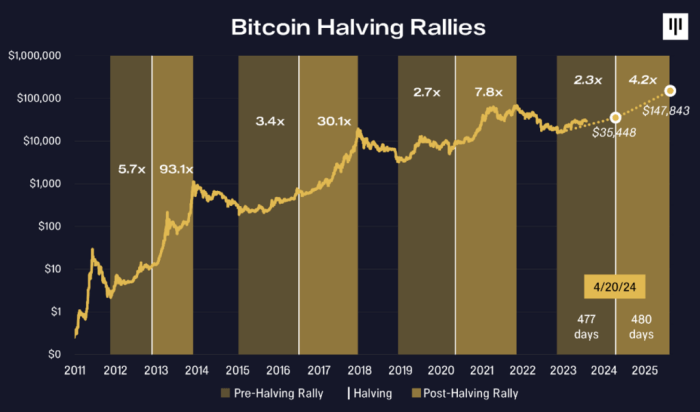

Bitcoin’s price in INR has experienced dramatic fluctuations since its introduction to the Indian market. Early adoption saw relatively slow growth, largely driven by a small, tech-savvy community. However, significant price surges occurred during periods of global market optimism, technological advancements (like the Lightning Network), and increased media attention. Conversely, periods of regulatory uncertainty in India, global market downturns, and negative news cycles have led to sharp price corrections. For example, the 2018 cryptocurrency winter saw a drastic fall in Bitcoin’s INR value, while the 2021 bull run propelled its price to record highs. These fluctuations underscore the volatility inherent in the cryptocurrency market and the influence of both internal and external factors. Specific regulatory announcements, such as those concerning taxation or trading restrictions, have demonstrably impacted Bitcoin’s price in INR, highlighting the importance of regulatory clarity in shaping investor confidence.

Bitcoin Price Performance Compared to Indian Financial Indices

The following table compares Bitcoin’s price performance against the Nifty 50 and Sensex over the past five years. Note that precise historical data requires referencing reliable financial data providers and may vary slightly depending on the source. This comparison illustrates Bitcoin’s unique risk-return profile compared to established Indian financial indices.

| Year | Bitcoin (INR) Annual Change (%) | Nifty 50 Annual Change (%) | Sensex Annual Change (%) |

|---|---|---|---|

| 2019 | [Insert Data – Percentage change in Bitcoin price from 2018 to 2019 in INR] | [Insert Data – Percentage change in Nifty 50 index from 2018 to 2019] | [Insert Data – Percentage change in Sensex index from 2018 to 2019] |

| 2020 | [Insert Data – Percentage change in Bitcoin price from 2019 to 2020 in INR] | [Insert Data – Percentage change in Nifty 50 index from 2019 to 2020] | [Insert Data – Percentage change in Sensex index from 2019 to 2020] |

| 2021 | [Insert Data – Percentage change in Bitcoin price from 2020 to 2021 in INR] | [Insert Data – Percentage change in Nifty 50 index from 2020 to 2021] | [Insert Data – Percentage change in Sensex index from 2020 to 2021] |

| 2022 | [Insert Data – Percentage change in Bitcoin price from 2021 to 2022 in INR] | [Insert Data – Percentage change in Nifty 50 index from 2021 to 2022] | [Insert Data – Percentage change in Sensex index from 2021 to 2022] |

| 2023 | [Insert Data – Percentage change in Bitcoin price from 2022 to 2023 in INR] | [Insert Data – Percentage change in Nifty 50 index from 2022 to 2023] | [Insert Data – Percentage change in Sensex index from 2022 to 2023] |

Potential Bitcoin Price Scenarios in INR (2024-2028)

Predicting future Bitcoin prices is inherently speculative. However, using different forecasting methodologies, we can Artikel potential scenarios. These scenarios are based on varying assumptions regarding regulatory developments, global macroeconomic conditions, and adoption rates.

Scenario 1: Conservative Growth. This scenario assumes moderate global adoption and continued regulatory uncertainty in India, leading to relatively slower price appreciation. It might mirror historical trends of periods of consolidation interspersed with periods of moderate growth.

Scenario 2: Moderate Growth. This scenario assumes increased institutional adoption globally and a clearer regulatory framework in India, resulting in sustained, but not explosive, price increases. This scenario would likely involve gradual integration into mainstream finance, attracting a wider range of investors.

Scenario 3: Aggressive Growth. This scenario assumes widespread global adoption, significant technological advancements, and positive regulatory developments in India. This could lead to substantial price appreciation, potentially driven by strong institutional and retail investor demand. This scenario might be similar to the 2021 bull run, but sustained over a longer period.

Bitcoin’s Potential as a Mainstream Asset Class in India

The potential for Bitcoin to become a mainstream asset class in India hinges on several factors, including regulatory clarity, increased investor education, and the development of robust infrastructure supporting cryptocurrency transactions. Greater regulatory clarity would likely reduce uncertainty and encourage wider participation. Increased financial literacy among the Indian population could lead to a greater understanding of Bitcoin’s potential and risks. Improved infrastructure, including secure and user-friendly exchanges, would make it easier for individuals to buy, sell, and hold Bitcoin. The successful integration of Bitcoin into mainstream finance in India could lead to a significant increase in its price, as demand increases and liquidity improves. However, challenges remain, including concerns about volatility and potential misuse for illicit activities.

Investing in Bitcoin in India: Bitcoin Target Price 2025 In Inr

Investing in Bitcoin, like any other asset class, presents both significant opportunities and considerable risks for Indian investors. Understanding these aspects is crucial before making any investment decisions. The Indian regulatory landscape is still evolving, adding another layer of complexity to the equation. This section details the potential rewards and risks, provides a practical guide to safe Bitcoin investment, and explores various investment strategies.

Potential Risks of Bitcoin Investment in India

The volatile nature of Bitcoin is perhaps its most prominent risk. Its price can fluctuate dramatically in short periods, leading to substantial gains or losses. For example, Bitcoin’s price has experienced significant swings, sometimes exceeding 20% in a single day. This high volatility makes it unsuitable for risk-averse investors or those with short-term investment horizons. Regulatory uncertainty in India also poses a significant risk. While the government hasn’t outright banned Bitcoin, its stance remains unclear, and future regulations could impact its accessibility and usage. This uncertainty can affect investor confidence and liquidity. Furthermore, the decentralized nature of Bitcoin makes it susceptible to security risks, including hacking, theft, and scams. Investors need to be extremely cautious about the platforms they use and the security measures they implement to protect their investments.

Potential Rewards of Bitcoin Investment in India

Despite the risks, Bitcoin offers the potential for substantial returns. Its historical performance demonstrates periods of significant price appreciation. While past performance isn’t indicative of future results, the potential for high returns attracts many investors. Moreover, Bitcoin can serve as a diversification tool within an investment portfolio. Its price often moves independently of traditional asset classes like stocks and bonds, offering the potential to reduce overall portfolio risk. For investors seeking exposure to a novel asset class with potentially high growth prospects, Bitcoin can be an attractive option.

A Step-by-Step Guide to Investing in Bitcoin in India

Investing in Bitcoin requires careful planning and execution. Here’s a step-by-step guide for Indian investors:

- Research and Due Diligence: Thoroughly research different cryptocurrency exchanges operating in India. Compare their fees, security measures, and user reviews before selecting a platform.

- Choose a Reputable Exchange: Opt for a regulated or well-established exchange with a strong track record of security and customer service. Verify the exchange’s legitimacy and ensure it complies with relevant Indian laws and regulations.

- KYC/AML Compliance: Complete the Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures required by the exchange. This is essential for verifying your identity and complying with Indian regulations.

- Secure Bitcoin Wallet: Choose a secure Bitcoin wallet to store your purchased Bitcoin. Hardware wallets offer the highest level of security, while software wallets provide convenience. Consider the security features and user-friendliness of different wallet options.

- Buy Bitcoin: Once your account is verified and your wallet is set up, you can purchase Bitcoin using Indian Rupees (INR) through your chosen exchange. Start with a small amount to gain experience and assess your risk tolerance.

- Diversify and Monitor: Don’t invest your entire savings in Bitcoin. Diversify your investments across different asset classes. Regularly monitor your Bitcoin holdings and the market conditions. Be prepared to adjust your strategy based on market changes.

- Tax Implications: Understand the tax implications of Bitcoin investment in India. Currently, profits from cryptocurrency trading are taxed as capital gains. Consult a tax professional for personalized advice.

Bitcoin Investment Strategies for Indian Investors

Different investment strategies cater to various risk tolerances and financial goals.

- Long-Term Holding (Hodling): This strategy involves buying Bitcoin and holding it for an extended period, regardless of short-term price fluctuations. It’s suitable for investors with a high risk tolerance and a long-term investment horizon. This strategy aims to benefit from potential long-term price appreciation.

- Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money at regular intervals, regardless of the price. It mitigates the risk of investing a lump sum at a market high. DCA is suitable for investors with a moderate risk tolerance and a long-term perspective.

- Short-Term Trading: This strategy involves buying and selling Bitcoin frequently to capitalize on short-term price movements. It’s a high-risk, high-reward strategy requiring significant market knowledge and expertise. This is only suitable for experienced traders with a high risk tolerance.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding Bitcoin’s projected price in Indian Rupees (INR) by 2025, encompassing investment strategies, regulatory landscapes, and risk mitigation techniques. Understanding these aspects is crucial for making informed decisions about Bitcoin investment.

| Question | Answer |

|---|---|

| Bitcoin’s Price Prediction in INR for 2025 | Predicting Bitcoin’s price with certainty is impossible. Various analysts offer widely differing projections, influenced by factors like adoption rates, regulatory changes, and macroeconomic conditions. While some predict substantial growth, others suggest more moderate increases or even potential price corrections. It’s crucial to remember that past performance is not indicative of future results. Consider a range of potential outcomes rather than relying on a single prediction. For example, some analysts might predict a range from ₹50,00,000 to ₹1,00,00,000, while others might offer a much more conservative estimate. |

| Investment Strategies for Bitcoin in India | Investing in Bitcoin involves significant risk. Strategies include dollar-cost averaging (investing a fixed amount regularly regardless of price), diversification (spreading investments across different asset classes), and setting stop-loss orders (automatically selling if the price falls below a certain level). Consult a qualified financial advisor before making any investment decisions. Consider your risk tolerance and financial goals carefully. Remember that Bitcoin is a volatile asset and losses are possible. |

| Regulatory Aspects of Bitcoin in India | India’s regulatory stance on Bitcoin is still evolving. While not explicitly banned, it’s subject to taxation and faces potential future regulations. Stay informed about updates from the Reserve Bank of India (RBI) and other relevant authorities. Understanding the tax implications of Bitcoin trading and holding is crucial for compliance. Consult with a tax professional to understand the applicable tax laws. |

| Risk Management in Bitcoin Investment | Bitcoin’s volatility necessitates robust risk management. Never invest more than you can afford to lose. Diversify your portfolio to reduce risk. Use secure storage methods like hardware wallets to protect your Bitcoin. Stay informed about market trends and potential risks. Regularly review your investment strategy and adjust as needed. Consider using limit orders to buy or sell at specific price points. |

Technological Advancements and Bitcoin’s Price

Technological advancements significantly impact Bitcoin’s price and usability. Scalability remains a key concern, as the network’s capacity to handle transactions affects transaction fees and speed. Layer-2 solutions like the Lightning Network aim to improve scalability, potentially reducing transaction fees and increasing adoption. However, successful implementation and widespread adoption of these solutions are crucial for a positive impact on Bitcoin’s price. Conversely, failures or security vulnerabilities in these technologies could negatively affect Bitcoin’s value. Furthermore, advancements in mining technology could also affect the rate of Bitcoin creation and its overall price. For example, the introduction of more efficient mining hardware could lead to a temporary increase in the supply of Bitcoin, potentially impacting its price.

Understanding Complex Financial Concepts Related to Bitcoin Investment

Investing in Bitcoin requires understanding key financial concepts like volatility, market capitalization, and blockchain technology. Volatility refers to the degree of price fluctuation, which is high for Bitcoin. Market capitalization represents the total value of all Bitcoins in circulation. Blockchain technology underpins Bitcoin, ensuring transparency and security through decentralized record-keeping. Understanding these concepts helps investors assess risks and make informed decisions. Consider using educational resources and consulting financial professionals to gain a deeper understanding of these complex financial concepts before making any investment decisions. Analogies to traditional assets can be helpful; for instance, comparing Bitcoin’s volatility to that of gold or other commodities can provide context. However, it’s crucial to understand that Bitcoin’s unique characteristics mean direct comparisons are not always accurate.

Bitcoin Target Price 2025 In Inr – Predicting the Bitcoin target price in INR for 2025 is challenging, depending heavily on various market factors. To gain a broader perspective on long-term Bitcoin value, it’s helpful to consider longer-term projections; for example, check out this insightful article on What Will Bitcoin Price Be In 2030. Understanding these longer-term trends can help contextualize potential 2025 price targets for Bitcoin in INR, though significant uncertainty remains.

Predicting the Bitcoin target price in INR for 2025 is challenging, dependent on various market factors. Understanding potential price movements requires considering related predictions, such as those found in the comprehensive analysis provided by Bitcoin Bx Price Prediction 2025. This external resource offers valuable insights that can help inform your own projections for the Bitcoin target price in INR by 2025, allowing for a more nuanced perspective.

Predicting the Bitcoin target price in INR for 2025 requires considering various factors, including global economic trends and regulatory changes. To gain a broader perspective on potential price movements, it’s helpful to consult comprehensive analyses like this one on Bitcoin Price 2025 Prediction. Understanding these broader predictions helps refine our understanding of the Bitcoin target price 2025 in INR, allowing for a more informed outlook.

Predicting the Bitcoin target price in INR for 2025 is challenging, requiring analysis of various market factors. A key component of this analysis involves understanding the potential trajectory throughout the year, and for this, a helpful resource is the detailed Bitcoin Price Prediction July 2025 report. By considering July’s predicted value, we can better extrapolate potential year-end figures for the Bitcoin target price in INR in 2025.

Predicting the Bitcoin target price in INR for 2025 is challenging, involving numerous factors influencing its value. A key aspect to consider when forming this prediction is the anticipated price trajectory in the first month of the year, as seen in this insightful analysis of Bitcoin Price 2025 January. Understanding January’s performance helps establish a baseline for projecting the Bitcoin target price in INR throughout the rest of 2025.