Bitcoin Price Prediction: Bitcoin Today Prediction 20 January 2025

Predicting the price of Bitcoin on January 20, 2025, is inherently speculative, given the cryptocurrency’s volatile nature and susceptibility to various market forces. However, by analyzing historical trends, considering macroeconomic factors, and examining different forecasting models, we can construct a plausible price range and explore potential scenarios. It’s crucial to remember that any prediction carries significant uncertainty.

Bitcoin Price Prediction: January 20, 2025

Several factors contribute to the difficulty of precise Bitcoin price prediction. These include the influence of regulatory changes, technological advancements, adoption rates, and overall market sentiment. Considering these variables, a reasonable price range for Bitcoin on January 20, 2025, could be between $100,000 and $250,000. A bullish scenario, characterized by widespread adoption and positive regulatory developments, could push the price towards the higher end of this range. Conversely, a bearish scenario, involving negative regulatory actions or a broader market downturn, could result in a price closer to the lower end. For example, if Bitcoin’s adoption continues to grow at a similar rate to recent years, and significant institutional investment flows in, a price exceeding $200,000 is conceivable. Conversely, a global recession or significant regulatory crackdown could dampen enthusiasm, resulting in a lower price.

Comparison of Forecasting Models

Various models attempt to predict Bitcoin’s price, each with strengths and weaknesses. Technical analysis, which relies on historical price and volume data to identify patterns, can be useful for short-term predictions but struggles with longer-term forecasting due to Bitcoin’s unique characteristics. Fundamental analysis, focusing on factors like adoption rate and regulatory landscape, offers a longer-term perspective but is less precise in pinpointing specific price levels. Machine learning models, leveraging vast datasets, can identify complex relationships but are susceptible to biases in the data and may not accurately capture unforeseen events. For instance, a technical analysis model might accurately predict short-term price fluctuations based on past trends, but fail to anticipate a sudden surge caused by a major regulatory announcement. Conversely, a fundamental model might accurately assess the long-term growth potential of Bitcoin but fail to predict short-term price volatility due to market sentiment shifts.

Predicted Price vs. Historical Data

The following table compares a potential Bitcoin price prediction for January 20, 2025, with historical yearly averages. Note that these are illustrative examples and actual values may vary.

| Year | Average Bitcoin Price (USD) | Predicted Price (USD) – January 20, 2025 (Scenario 1: Bullish) | Predicted Price (USD) – January 20, 2025 (Scenario 2: Bearish) |

|---|---|---|---|

| 2020 | 9000 | 250000 | 100000 |

| 2021 | 40000 | 250000 | 100000 |

| 2022 | 20000 | 250000 | 100000 |

| 2023 | 25000 (estimated) | 250000 | 100000 |

Macroeconomic Events Impacting Bitcoin Price, Bitcoin Today Prediction 20 January 2025

Significant macroeconomic events can substantially influence Bitcoin’s price. For example, a global recession could lead to investors seeking safe haven assets, potentially driving down Bitcoin’s price. Conversely, increased inflation could make Bitcoin, as a hedge against inflation, more attractive, potentially driving its price up. Major regulatory changes, such as the introduction of a comprehensive Bitcoin regulatory framework in a major economy, could also significantly impact the price, either positively or negatively depending on the nature of the regulations. For instance, the implementation of clear and favorable regulatory frameworks in major economies could boost investor confidence and lead to a price increase. Conversely, overly restrictive regulations could lead to a price decline.

Factors Influencing Bitcoin’s Value in 2025

Predicting Bitcoin’s value in 2025 requires considering a complex interplay of technological advancements, regulatory shifts, institutional involvement, and global events. While precise forecasting remains impossible, analyzing these key factors offers valuable insight into potential price trajectories.

Technological Advancements in the Crypto Space

The cryptocurrency landscape is constantly evolving. By 2025, we can anticipate significant improvements in scalability, transaction speeds, and energy efficiency across various blockchain networks. Layer-2 solutions, such as Lightning Network and Plasma, are expected to mature, enabling faster and cheaper Bitcoin transactions. Advancements in consensus mechanisms, potentially moving beyond Proof-of-Work, could also impact Bitcoin’s energy consumption and transaction throughput. These technological improvements could boost Bitcoin’s adoption and, consequently, its value, by addressing current limitations and making it a more practical and user-friendly payment system. For example, widespread adoption of layer-2 solutions could reduce transaction fees to levels comparable to traditional payment systems, making Bitcoin more attractive for everyday use.

Regulatory Frameworks and Their Influence

Regulatory clarity and acceptance are crucial for Bitcoin’s mainstream adoption. By 2025, we might see a more diverse regulatory landscape across different jurisdictions. Some countries may embrace Bitcoin as a legitimate asset class, potentially leading to increased institutional investment and broader acceptance. Conversely, overly restrictive regulations in other regions could stifle growth and limit price appreciation. The regulatory approach taken by major financial centers, such as the US and the EU, will significantly influence global Bitcoin adoption and its price. A clear, consistent regulatory framework globally could significantly increase investor confidence and drive price increases. Conversely, inconsistent or overly restrictive regulations could lead to price volatility and decreased investor confidence. For instance, the regulatory stance of the SEC on Bitcoin ETFs will have a significant impact on institutional adoption and therefore price.

Institutional Investment and Adoption

The increasing involvement of institutional investors, such as hedge funds and corporations, is a key factor influencing Bitcoin’s price. By 2025, we expect further institutional adoption, driven by factors like diversification needs, potential for high returns, and the growing recognition of Bitcoin as a store of value. However, institutional participation is also subject to market sentiment and regulatory developments. A significant influx of institutional capital could propel Bitcoin’s price to new highs. Conversely, a sudden withdrawal of institutional investment could trigger a price correction. For example, the increase in Bitcoin holdings by companies like MicroStrategy has already demonstrated the significant price impact of institutional investment.

Geopolitical Events and Their Impact

Geopolitical instability can significantly impact Bitcoin’s price. A major global crisis, such as a large-scale conflict or a severe economic downturn, could drive investors towards Bitcoin as a safe haven asset, increasing its demand and price. Conversely, periods of global stability could lead to a decline in Bitcoin’s appeal as investors seek higher-risk, higher-return opportunities. For example, during times of economic uncertainty, such as the initial stages of the COVID-19 pandemic, Bitcoin’s price experienced significant increases as investors sought refuge from traditional markets. Conversely, periods of economic growth and stability could see Bitcoin’s price fluctuate based on other market factors.

Frequently Asked Questions (FAQs)

Predicting the future price of Bitcoin is inherently challenging due to the cryptocurrency’s volatile nature and susceptibility to various market forces. The following FAQs aim to address common concerns and provide informed perspectives, acknowledging the inherent uncertainties involved.

Bitcoin’s Most Likely Price on January 20, 2025

Pinpointing a precise Bitcoin price for January 20, 2025, is impossible. Numerous factors, including regulatory changes, technological advancements, and macroeconomic conditions, will significantly influence its value. While various prediction models exist, they should be treated with caution. Instead of focusing on a specific price target, it’s more prudent to consider potential price ranges based on different scenarios. For example, a conservative estimate might place Bitcoin within a certain range, while a more optimistic scenario could project a significantly higher value, depending on widespread adoption and technological breakthroughs. The crucial point is to understand the significant uncertainty involved.

Biggest Risks Associated with Bitcoin Investment in 2025

Investing in Bitcoin carries substantial risks. Regulatory uncertainty remains a significant concern. Governments worldwide are still developing comprehensive frameworks for cryptocurrencies, and changes in regulations could dramatically impact Bitcoin’s price and usability. Market volatility is another major risk. Bitcoin’s price is notoriously volatile, experiencing sharp price swings in relatively short periods. This volatility can lead to substantial losses for investors, especially those with a shorter-term investment horizon. Furthermore, the risk of hacking and theft from exchanges or personal wallets remains a significant concern, requiring investors to adopt robust security measures. Finally, the overall macroeconomic climate and the adoption rate of Bitcoin by institutional investors and mainstream consumers will also influence its value. A global economic downturn, for instance, could negatively impact Bitcoin’s price.

Impact of Technological Advancements on Bitcoin’s Future

Technological advancements will likely play a crucial role in shaping Bitcoin’s future. Scaling solutions, such as the Lightning Network, aim to improve transaction speeds and reduce fees, addressing current limitations. Successful implementation of these solutions could significantly increase Bitcoin’s usability and appeal, potentially driving price appreciation. Conversely, failures in these solutions could negatively impact adoption and price. Improved security measures, including advancements in cryptographic techniques, will be vital in mitigating risks associated with hacking and theft. The development and adoption of quantum-resistant cryptography, for example, is a critical area of focus for long-term security. Ultimately, technological advancements that enhance Bitcoin’s scalability, security, and usability are likely to be positive catalysts for its future growth.

Bitcoin’s Relevance in 2025

Bitcoin’s relevance in 2025 is highly likely. Despite its volatility and challenges, Bitcoin holds a unique position as the first and most established cryptocurrency. Its decentralized nature, limited supply, and growing adoption by individuals and institutions suggest it will maintain a significant role in the evolving cryptocurrency landscape. However, its dominance may be challenged by newer cryptocurrencies offering enhanced functionalities or superior technological solutions. Therefore, while Bitcoin’s relevance is highly probable, its market share and overall importance within the broader cryptocurrency ecosystem could change significantly depending on the success of competing technologies and regulatory developments. The long-term trajectory of Bitcoin will depend on a complex interplay of technological innovation, regulatory actions, and broader macroeconomic trends.

Illustrative Examples

Predicting Bitcoin’s price in 2025 requires considering various scenarios, both positive and negative. These examples illustrate potential impacts of different factors on Bitcoin’s value and adoption.

Significant Price Surge Scenario

Imagine a future where widespread institutional adoption of Bitcoin coincides with a global economic downturn. Major corporations, seeking a hedge against inflation and currency devaluation, begin accumulating significant Bitcoin holdings. Simultaneously, a major emerging market experiences hyperinflation, driving citizens to seek refuge in Bitcoin as a store of value. This confluence of events could lead to a substantial increase in demand, pushing the Bitcoin price to unprecedented highs, potentially exceeding $100,000 or even more. The consequences would include increased mainstream media attention, further driving adoption, and a potential surge in Bitcoin-related investments and services. However, this rapid growth could also lead to increased market volatility and a higher risk of speculative bubbles.

Negative Impact of Regulatory Change

Consider a scenario where a major global economy, such as the United States, implements stringent regulations classifying Bitcoin as a security. This would necessitate strict Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance for all Bitcoin transactions, significantly increasing the cost and complexity of using Bitcoin. Furthermore, the regulatory uncertainty could deter institutional investors and reduce overall market liquidity. The result could be a sharp decline in Bitcoin’s price, potentially lasting for an extended period. This scenario mirrors, to some extent, the regulatory challenges faced by other cryptocurrencies in various jurisdictions.

Technological Advancement Impact

Let’s envision a breakthrough in layer-2 scaling solutions, significantly increasing Bitcoin’s transaction throughput and reducing fees. This could be achieved through advancements in technologies like the Lightning Network or other similar solutions. Improved scalability and faster transaction speeds would make Bitcoin more practical for everyday use, boosting adoption and potentially driving up the price. The increased efficiency could also attract businesses looking for a faster and cheaper alternative to traditional payment systems, further increasing demand. This mirrors the impact of technological advancements in other industries, which often lead to increased efficiency and adoption.

Scenario Impact on Bitcoin Price

| Scenario | Bitcoin Price (USD) | Contributing Factors | Market Impact |

|---|---|---|---|

| Widespread Institutional Adoption & Global Economic Downturn | >$100,000 | Increased demand from institutions, hyperinflation in emerging markets | Increased volatility, higher investment, potential bubble |

| Stringent Global Regulation | <$20,000 | Increased compliance costs, reduced liquidity, investor uncertainty | Reduced adoption, market downturn, potential long-term price depression |

| Major Technological Advancement (Layer-2 Scaling) | $50,000 – $75,000 | Improved scalability, faster transactions, increased usability | Increased adoption, higher transaction volume, potential price appreciation |

| Status Quo (No Major Events) | $30,000 – $40,000 | Stable market conditions, moderate adoption growth | Gradual price increase, relatively low volatility |

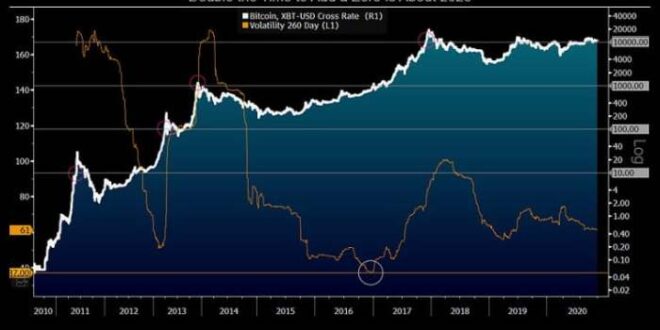

Bitcoin Today Prediction 20 January 2025 – Predicting Bitcoin’s price for today, January 20th, 2025, is challenging, but looking ahead to the entire year offers a broader perspective. To gain insights into potential future price movements, a helpful resource is the detailed Bitcoin Prediction 2025 Chart , which can inform our understanding of longer-term trends. Ultimately, however, even these charts only provide educated guesses, and today’s Bitcoin price remains subject to considerable volatility.

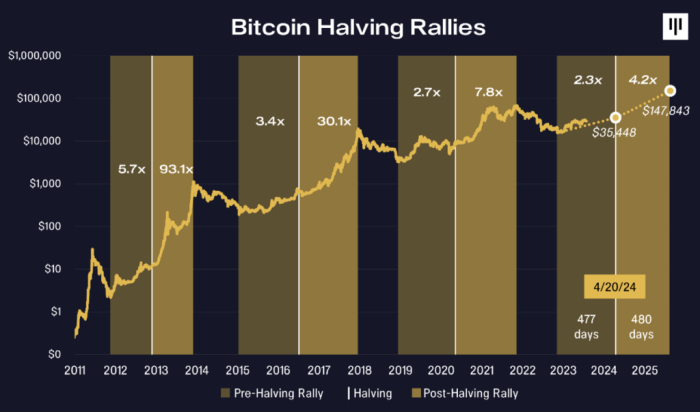

Predicting Bitcoin’s price on January 20th, 2025, is inherently speculative, but a key factor to consider is the impact of the upcoming halving. Understanding the potential effects of this significant event is crucial for any forecast, and you can learn more about it by checking out this resource on the Bitcoin Halving Period 2025. Ultimately, the Bitcoin Today Prediction for January 20, 2025, will depend on a multitude of factors beyond just the halving.

Predicting Bitcoin’s price on January 20th, 2025, is inherently speculative, but a key factor to consider is the impact of the upcoming halving. Understanding the potential effects of this significant event is crucial for any forecast, and you can learn more about it by checking out this resource on the Bitcoin Halving Period 2025. Ultimately, the Bitcoin Today Prediction for January 20, 2025, will depend on a multitude of factors beyond just the halving.

Predicting Bitcoin’s price on January 20th, 2025, is inherently speculative, but a key factor to consider is the impact of the upcoming halving. Understanding the potential effects of this significant event is crucial for any forecast, and you can learn more about it by checking out this resource on the Bitcoin Halving Period 2025. Ultimately, the Bitcoin Today Prediction for January 20, 2025, will depend on a multitude of factors beyond just the halving.

Accurately predicting Bitcoin’s price on January 20th, 2025, is challenging, requiring analysis of various market factors. To gain a broader perspective on potential future trends, it’s helpful to consider longer-term forecasts; for instance, checking out this resource on Bitcoin Prediction March 2025 can offer valuable insights. Ultimately, understanding the March prediction helps contextualize any January 20th, 2025, Bitcoin price estimations.

Accurately predicting Bitcoin’s price on January 20th, 2025, is challenging, requiring analysis of various market factors. To gain a broader perspective on potential future trends, it’s helpful to consider longer-term forecasts; for instance, checking out this resource on Bitcoin Prediction March 2025 can offer valuable insights. Ultimately, understanding the March prediction helps contextualize any January 20th, 2025, Bitcoin price estimations.

Accurately predicting Bitcoin’s price on January 20th, 2025, is challenging, requiring analysis of various market factors. To gain a broader perspective on potential future trends, it’s helpful to consider longer-term forecasts; for instance, checking out this resource on Bitcoin Prediction March 2025 can offer valuable insights. Ultimately, understanding the March prediction helps contextualize any January 20th, 2025, Bitcoin price estimations.