Bitcoin Price Prediction: Bitcoin Today Prediction 29 January 2025

Predicting the price of Bitcoin on any specific date, especially several years into the future, is inherently speculative. Numerous factors, often intertwined and unpredictable, influence its value. However, by considering various market scenarios and influential elements, we can Artikel a range of potential prices for Bitcoin on January 29th, 2025. This analysis should be viewed as a potential range, not a definitive forecast.

Potential Bitcoin Price Ranges on January 29, 2025

Several scenarios could play out by January 29th, 2025, leading to vastly different Bitcoin prices. A bullish scenario, characterized by widespread adoption, positive regulatory developments, and robust macroeconomic conditions, could see Bitcoin reach significantly higher prices. Conversely, a bearish scenario, marked by regulatory crackdowns, technological setbacks, or a global economic crisis, could lead to considerably lower prices. A neutral scenario represents a more balanced outlook, reflecting a continuation of current trends with moderate growth. We can illustrate these scenarios with price ranges:

* Bullish Scenario: $150,000 – $250,000. This scenario assumes significant institutional adoption, positive regulatory frameworks globally, and continued technological advancements making Bitcoin more accessible and user-friendly. A scenario similar to the 2021 bull run, but potentially more sustained.

* Neutral Scenario: $50,000 – $100,000. This reflects a continuation of the current market trends, with periods of both growth and correction. This scenario assumes moderate adoption rates, no major regulatory shifts, and relatively stable macroeconomic conditions. It resembles a more conservative growth trajectory compared to the bullish case.

* Bearish Scenario: $20,000 – $40,000. This scenario considers significant regulatory headwinds, a prolonged cryptocurrency bear market, or a severe global economic downturn. This price range reflects a potential return to, or even below, the price levels seen in previous bear markets.

Factors Influencing Bitcoin’s Price

Several key factors will significantly impact Bitcoin’s price by January 29th, 2025. These include:

* Regulatory Changes: Government regulations across the globe will play a crucial role. Favorable regulations could boost investor confidence and drive adoption, while restrictive measures could dampen enthusiasm and depress prices. The ongoing debate surrounding Bitcoin’s classification as a security or commodity is a prime example.

* Technological Advancements: Improvements in Bitcoin’s underlying technology, such as the Lightning Network’s scalability solutions, could enhance its usability and attract wider adoption. Conversely, significant security vulnerabilities could severely impact its value.

* Macroeconomic Conditions: Global economic events, such as inflation, interest rate changes, and recessionary periods, directly influence investor risk appetite. During economic uncertainty, investors might flock to safe-haven assets, potentially impacting Bitcoin’s price. The 2022 bear market, largely attributed to macroeconomic factors, serves as a case in point.

Impact of Major Global Events

Major global events can significantly impact Bitcoin’s price. For instance:

* Economic Recessions: During economic downturns, investors often seek safer investments, potentially leading to a decrease in Bitcoin’s value. However, Bitcoin’s decentralized nature and perceived hedge against inflation could also attract investors seeking to protect their wealth.

* Geopolitical Instability: Geopolitical tensions and conflicts can create uncertainty in global markets, influencing investor sentiment and potentially affecting Bitcoin’s price. However, Bitcoin’s borderless nature might also make it an attractive investment during times of political instability.

Bitcoin Price Prediction Models

| Model Name | Predicted Price (January 29, 2025) | Underlying Assumptions | Model Limitations |

|---|---|---|---|

| Stock-to-Flow Model | $100,000 – $200,000 (Estimates vary widely) | Based on Bitcoin’s scarcity and historical price trends. | Relies heavily on historical data and may not accurately predict future market behavior; susceptible to external factors. |

| Adoption-Based Model | $50,000 – $150,000 | Predicts price based on projected user adoption and network effects. | Difficult to accurately predict adoption rates; relies on numerous assumptions about future technological advancements and regulatory changes. |

| Technical Analysis | Variable, depending on the specific indicators used | Uses charts and historical price data to identify patterns and predict future price movements. | Highly subjective; prone to manipulation; past performance is not indicative of future results. |

| Fundamental Analysis | $75,000 – $125,000 | Considers macroeconomic factors, regulatory environment, and technological developments. | Difficult to accurately predict future economic and regulatory landscapes. |

Factors Influencing Bitcoin’s Future Value

Bitcoin’s future price is a complex interplay of various factors, ranging from macroeconomic conditions to technological advancements and regulatory landscapes. Understanding these influences is crucial for navigating the volatile cryptocurrency market and forming informed predictions. While predicting the future is inherently uncertain, analyzing these key factors provides a framework for assessing potential price trajectories.

Institutional and Governmental Adoption

The increasing adoption of Bitcoin by institutional investors and governments significantly impacts its price. Large-scale investments from firms like MicroStrategy and Tesla have historically boosted Bitcoin’s value, demonstrating the potential for institutional capital to drive significant price increases. Similarly, governmental recognition or regulation, even if initially cautious, can legitimize Bitcoin and increase its appeal to a broader range of investors, potentially leading to higher prices. Conversely, negative regulatory actions or statements from influential governments could trigger significant price drops. The level of adoption is a key indicator of market maturity and long-term viability, which directly correlates with price stability and growth potential.

Competition from Other Cryptocurrencies

The emergence of competing cryptocurrencies presents both a challenge and an opportunity for Bitcoin. Altcoins, offering features like faster transaction speeds or lower fees, could potentially erode Bitcoin’s market dominance. However, Bitcoin’s first-mover advantage, established brand recognition, and robust security network provide a strong foundation against competition. The impact of competing cryptocurrencies will depend on their ability to offer genuinely superior functionality and attract a significant user base. A decline in Bitcoin’s market share doesn’t necessarily translate to a proportional decline in its value, as its overall market cap might still grow even if its percentage of the total crypto market shrinks.

Technological Advancements

Technological advancements, particularly layer-2 scaling solutions like the Lightning Network, are vital for improving Bitcoin’s scalability and transaction speed. These solutions address the limitations of Bitcoin’s base protocol, allowing for faster and cheaper transactions without compromising its security. Successful implementation and widespread adoption of layer-2 solutions could significantly enhance Bitcoin’s utility, attracting more users and businesses and potentially leading to higher demand and price appreciation. Conversely, failures in implementing these technologies or security vulnerabilities could negatively impact user confidence and the price.

Key Indicators for Price Prediction

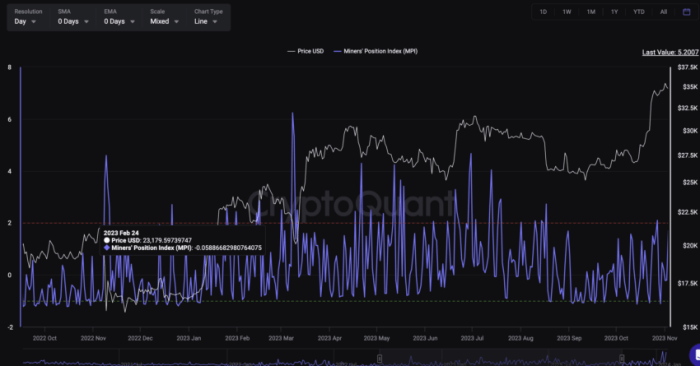

Predicting Bitcoin’s future price relies on analyzing various indicators. On-chain metrics, such as the number of active addresses, transaction volume, and the miner’s revenue, provide insights into network activity and user engagement. High levels of on-chain activity often correlate with increased demand and potential price increases. Market sentiment, gauged through social media analysis, news coverage, and investor surveys, reflects the overall market perception of Bitcoin. Positive sentiment typically drives price appreciation, while negative sentiment can trigger sell-offs. Combining these on-chain and off-chain data provides a more comprehensive picture of the market dynamics and informs potential price movements. For example, a surge in on-chain transactions coupled with positive news coverage could signal a bullish trend.

Environmental Concerns and Bitcoin Mining

The environmental impact of Bitcoin mining, primarily due to its energy consumption, poses a significant challenge to its long-term value.

- Positive Impacts: Increased adoption of renewable energy sources for mining, development of more energy-efficient mining hardware, and carbon offsetting initiatives could mitigate environmental concerns and enhance Bitcoin’s reputation, potentially boosting its price.

- Negative Impacts: Growing regulatory pressure targeting energy-intensive mining operations, negative media coverage highlighting the environmental footprint, and a decline in investor confidence due to environmental concerns could negatively impact Bitcoin’s price and adoption.

Bitcoin’s Technological Developments and their Impact

Bitcoin’s ongoing technological advancements are crucial for its continued growth and adoption. These improvements address limitations, enhance security, and ultimately shape Bitcoin’s future role in the global financial landscape. Understanding these developments is key to assessing its long-term viability and potential.

The Lightning Network’s Impact on Transaction Fees and Scalability

The Lightning Network is a layer-2 scaling solution designed to significantly improve Bitcoin’s transaction speed and reduce fees. It operates as a network of payment channels built on top of the Bitcoin blockchain, allowing for near-instantaneous and low-cost transactions. Instead of each transaction being recorded on the main blockchain, they occur off-chain within these channels, only requiring on-chain transactions to open and close channels. This dramatically increases Bitcoin’s transaction throughput, making it more suitable for everyday use cases, such as micropayments and peer-to-peer commerce. For example, a Lightning Network transaction might cost only a fraction of a cent, compared to potentially several dollars on the main Bitcoin blockchain during periods of high network congestion.

Taproot and Other Upgrades Enhance Security and Functionality, Bitcoin Today Prediction 29 January 2025

Taproot, implemented in late 2021, is a significant upgrade that improves Bitcoin’s privacy, efficiency, and smart contract capabilities. It simplifies transaction scripts, making them smaller and more efficient, reducing the blockchain’s size and improving transaction verification speed. Furthermore, it enhances privacy by masking the type of transaction being conducted. Other upgrades, such as SegWit (Segregated Witness), have also played a crucial role in improving scalability and transaction efficiency. These upgrades demonstrate Bitcoin’s capacity for ongoing improvement and adaptation, addressing its limitations and enhancing its overall performance. The success of these upgrades showcases the community’s commitment to Bitcoin’s long-term health and functionality.

Bitcoin’s Decentralization: Resilience to Censorship and Government Intervention

Bitcoin’s decentralized nature is a fundamental aspect of its design and a key source of its resilience. No single entity controls the Bitcoin network; instead, it’s maintained by a distributed network of nodes worldwide. This makes it extremely difficult for any government or organization to censor transactions or shut down the network. In contrast to centralized systems that are vulnerable to single points of failure or government control, Bitcoin’s decentralized architecture provides a robust and censorship-resistant system. Attempts to control or manipulate Bitcoin would require controlling a significant majority of the network’s nodes, a practically impossible task given its global distribution.

Bitcoin Compared to Other Cryptocurrencies and Traditional Assets

Bitcoin’s advantages lie in its established track record, first-mover advantage, and strong brand recognition. It enjoys widespread adoption and liquidity compared to many other cryptocurrencies. However, its limited functionality compared to some smart contract platforms and its slower transaction speeds are disadvantages. Compared to traditional assets, Bitcoin offers potential for higher returns but also carries higher volatility and risk. Traditional assets, such as gold or stocks, may offer more stability but potentially lower returns. The choice depends on individual risk tolerance and investment goals.

Bitcoin’s Energy Consumption Compared to Other Industries

Bitcoin mining, the process of validating transactions and adding new blocks to the blockchain, requires significant energy consumption. However, it’s crucial to compare this consumption to other energy-intensive industries to put it into perspective.

| Industry | Energy Consumption (Approximate) | Environmental Impact | Potential Solutions |

|---|---|---|---|

| Bitcoin Mining | Variable, but comparable to countries like Switzerland or Argentina | Significant carbon emissions, depending on the energy sources used. | Transition to renewable energy sources, improved mining efficiency. |

| Data Centers | A significant portion of global electricity consumption | High carbon emissions, depending on energy sources. | Improved cooling systems, renewable energy sources, virtualization. |

| Aviation | A substantial contributor to greenhouse gas emissions | Significant carbon emissions contributing to climate change. | Sustainable aviation fuels, improved aircraft efficiency, carbon offsetting. |

| Manufacturing | Highly variable depending on the industry | Significant emissions depending on processes and materials. | Improved manufacturing processes, renewable energy, waste reduction. |

Frequently Asked Questions (FAQ) about Bitcoin Price Predictions

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently complex and fraught with uncertainty. Numerous factors, both internal and external to the cryptocurrency market, influence its value, making accurate long-term predictions exceptionally challenging. This section addresses some common questions surrounding Bitcoin price predictions, providing context and clarifying potential misconceptions.

Biggest Uncertainties Affecting Bitcoin’s Price in 2025

Several key uncertainties could significantly impact Bitcoin’s price by 2025. Regulatory changes globally represent a major unknown. Increased regulatory scrutiny or outright bans in major economies could dramatically reduce demand and price. Conversely, supportive regulations or the emergence of clear, consistent frameworks could boost confidence and drive adoption. Technological developments within the Bitcoin ecosystem itself also play a crucial role. Improvements in scalability, transaction speed, and privacy features could attract new users and investors. Conversely, unforeseen technical vulnerabilities or security breaches could severely damage investor confidence. Finally, macroeconomic factors, such as global economic growth, inflation rates, and geopolitical events, will exert considerable influence. A global recession, for example, might cause investors to flee riskier assets like Bitcoin, driving down its price. Conversely, high inflation could increase demand for Bitcoin as a hedge against inflation.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions should be viewed with a high degree of skepticism. No one can accurately predict the future price of Bitcoin with certainty. Many predictions are based on speculative analysis, technical indicators, or historical price trends, all of which are inherently unreliable predictors of future performance. While some analysts may offer plausible scenarios based on current market trends and technological advancements, these scenarios are not guarantees. It’s crucial to remember that the cryptocurrency market is exceptionally volatile and prone to sudden, dramatic price swings driven by factors ranging from news events and social media sentiment to technological advancements and regulatory changes. Relying on any single prediction, especially those offering overly optimistic or pessimistic outlooks, is unwise. Instead, focus on understanding the fundamental factors that influence Bitcoin’s value and diversify your investments accordingly.

Alternative Investment Options Alongside Bitcoin

While Bitcoin offers potential for high returns, it’s crucial to diversify your investment portfolio. Alternative investment options include traditional assets like stocks, bonds, and real estate, which offer different levels of risk and return. Other cryptocurrencies also represent alternatives, but carry their own unique risks and uncertainties. Each cryptocurrency has different underlying technologies, use cases, and market dynamics. For example, Ethereum, with its smart contract functionality, offers a different investment profile compared to Bitcoin. Furthermore, investors might consider precious metals like gold and silver, which are often viewed as safe haven assets during times of economic uncertainty. The optimal diversification strategy will depend on individual risk tolerance and financial goals. Consulting with a qualified financial advisor is highly recommended before making any significant investment decisions.

Ethical Implications of Investing in Bitcoin

The ethical implications of investing in Bitcoin are multifaceted. The energy consumption associated with Bitcoin mining has raised environmental concerns. The high energy usage, particularly from older mining techniques, has led to criticism regarding its carbon footprint. However, the industry is increasingly adopting renewable energy sources and more efficient mining methods, mitigating some of these concerns. Furthermore, Bitcoin’s decentralized nature and potential for anonymity have raised concerns about its use in illicit activities, such as money laundering and funding terrorism. However, blockchain’s transparency allows for tracking of transactions, enabling law enforcement to investigate suspicious activities. Ultimately, the ethical implications of Bitcoin investment are complex and require careful consideration of its environmental and societal impacts.

Protecting Against Scams and Fraud When Investing in Bitcoin

The cryptocurrency market is unfortunately susceptible to scams and fraud. To protect yourself, it’s crucial to conduct thorough research before investing in any cryptocurrency, including Bitcoin. Be wary of get-rich-quick schemes and promises of guaranteed returns. Only use reputable and regulated cryptocurrency exchanges. Never share your private keys or seed phrases with anyone. Verify the legitimacy of any websites or platforms before providing personal information or funds. Be cautious of unsolicited investment advice or offers that seem too good to be true. If something feels suspicious, it probably is. Consider using a hardware wallet to store your Bitcoin securely, as these offer significantly enhanced protection against hacking and theft compared to software wallets. Staying informed about common scams and fraud techniques within the cryptocurrency space is also essential.

Bitcoin Today Prediction 29 January 2025 – Predicting Bitcoin’s price on January 29th, 2025, requires considering various factors, including the upcoming Bitcoin halving. Understanding the potential impact of this event on the broader crypto market is crucial, and for a deeper dive into one specific altcoin’s predicted reaction, check out this insightful analysis on Solana Price After Bitcoin Halving 2025. Returning to the Bitcoin prediction, the halving’s influence will likely be a significant factor in determining its price trajectory in the long term.

Predicting Bitcoin’s price on January 29th, 2025, requires considering various factors, including the upcoming Bitcoin halving. Understanding the potential impact of this event on the broader crypto market is crucial, and for a deeper dive into one specific altcoin’s predicted reaction, check out this insightful analysis on Solana Price After Bitcoin Halving 2025. Returning to the Bitcoin prediction, the halving’s influence will likely be a significant factor in determining its price trajectory in the long term.

Predicting Bitcoin’s price on January 29th, 2025, requires considering various factors, including the upcoming Bitcoin halving. Understanding the potential impact of this event on the broader crypto market is crucial, and for a deeper dive into one specific altcoin’s predicted reaction, check out this insightful analysis on Solana Price After Bitcoin Halving 2025. Returning to the Bitcoin prediction, the halving’s influence will likely be a significant factor in determining its price trajectory in the long term.

Predicting Bitcoin’s price on January 29th, 2025, requires considering various factors, including the upcoming Bitcoin halving. Understanding the potential impact of this event on the broader crypto market is crucial, and for a deeper dive into one specific altcoin’s predicted reaction, check out this insightful analysis on Solana Price After Bitcoin Halving 2025. Returning to the Bitcoin prediction, the halving’s influence will likely be a significant factor in determining its price trajectory in the long term.

Predicting Bitcoin’s price on January 29th, 2025, requires considering various factors, including the upcoming Bitcoin halving. Understanding the potential impact of this event on the broader crypto market is crucial, and for a deeper dive into one specific altcoin’s predicted reaction, check out this insightful analysis on Solana Price After Bitcoin Halving 2025. Returning to the Bitcoin prediction, the halving’s influence will likely be a significant factor in determining its price trajectory in the long term.

Predicting Bitcoin’s price on January 29th, 2025, requires considering various factors, including the upcoming Bitcoin halving. Understanding the potential impact of this event on the broader crypto market is crucial, and for a deeper dive into one specific altcoin’s predicted reaction, check out this insightful analysis on Solana Price After Bitcoin Halving 2025. Returning to the Bitcoin prediction, the halving’s influence will likely be a significant factor in determining its price trajectory in the long term.

Predicting Bitcoin’s price on January 29th, 2025, requires considering various factors, including the upcoming Bitcoin halving. Understanding the potential impact of this event on the broader crypto market is crucial, and for a deeper dive into one specific altcoin’s predicted reaction, check out this insightful analysis on Solana Price After Bitcoin Halving 2025. Returning to the Bitcoin prediction, the halving’s influence will likely be a significant factor in determining its price trajectory in the long term.