Bitcoin USD Price Prediction

Predicting the price of Bitcoin on January 19, 2025, is inherently speculative, given the cryptocurrency’s volatile nature and the multitude of factors influencing its value. However, by analyzing potential macroeconomic conditions, regulatory landscapes, and technological advancements, we can construct plausible scenarios ranging from highly optimistic to highly pessimistic outcomes. These scenarios are not exhaustive, and the actual price could fall outside these ranges.

Factors Influencing Bitcoin’s Price on January 19, 2025

Several interconnected factors will likely shape Bitcoin’s price in the coming years. Macroeconomic conditions, such as inflation rates and global recessionary pressures, will significantly impact investor sentiment and the overall demand for risk assets like Bitcoin. Regulatory changes, particularly those concerning cryptocurrency taxation, trading, and adoption, will influence market accessibility and liquidity. Technological advancements, including improvements in scalability and transaction speed, will also play a critical role in Bitcoin’s long-term viability and adoption. The development and adoption of competing cryptocurrencies and blockchain technologies will also influence Bitcoin’s market share and price.

Price Scenarios for Bitcoin on January 19, 2025

Several scenarios can be envisioned, each with a different price prediction and underlying rationale.

- Highly Optimistic Scenario ($200,000 – $500,000): This scenario assumes widespread global adoption of Bitcoin as a store of value and a medium of exchange, driven by persistent inflation and a lack of trust in traditional financial systems. Significant technological advancements leading to increased scalability and reduced transaction fees could also contribute to this outcome. This would parallel the adoption rate of the internet in the early 2000s, but on a global scale. Such growth would necessitate a substantial increase in the Bitcoin price to reflect its increased market capitalization and utility.

- Moderate Scenario ($50,000 – $150,000): This scenario assumes a more measured level of adoption, with Bitcoin continuing to gain traction but facing challenges related to regulation and competition from alternative cryptocurrencies. Macroeconomic conditions are relatively stable, with moderate inflation and no major global recession. This scenario is based on a continuation of current trends, with a moderate rate of growth reflecting a more realistic assessment of market adoption.

- Pessimistic Scenario ($10,000 – $30,000): This scenario assumes a negative impact from increased regulation, a global economic downturn leading to a flight from risk assets, or the emergence of a superior cryptocurrency technology. Negative media coverage and security breaches could also contribute to a decline in investor confidence and a lower Bitcoin price. This outcome mirrors past market corrections, but on a larger scale, reflecting the inherent volatility of the cryptocurrency market.

Comparison of Price Prediction Models

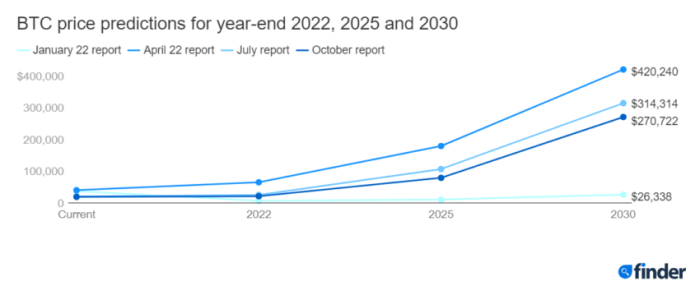

A visual representation comparing different price prediction models (for illustrative purposes only and not based on actual data) could be a chart with three lines representing each scenario:

Imagine a line graph with the x-axis representing time (leading up to January 19, 2025) and the y-axis representing Bitcoin’s price in USD. Three lines would be plotted:

* Line 1 (Optimistic): A steeply upward-sloping line, starting at a current price and reaching the $200,000 – $500,000 range by January 19, 2025. This line represents the optimistic scenario based on high adoption and technological advancement.

* Line 2 (Moderate): A moderately upward-sloping line, reaching the $50,000 – $150,000 range by January 19, 2025. This line reflects a more balanced projection, considering both positive and negative factors.

* Line 3 (Pessimistic): A line with some upward and downward fluctuations, but ultimately remaining relatively flat or showing a slight decrease, ending in the $10,000 – $30,000 range. This line incorporates potential negative factors such as increased regulation or economic downturn.

A legend would clearly label each line as “Optimistic,” “Moderate,” and “Pessimistic,” respectively.

Impact of Global Economic Events on Bitcoin Price, Bitcoin USD Prediction For 19 January 2025

Global economic events, particularly inflation and recession, will significantly impact Bitcoin’s price. High inflation erodes the purchasing power of fiat currencies, potentially increasing the demand for Bitcoin as a hedge against inflation. Conversely, a global recession could lead to a risk-off sentiment, causing investors to sell off Bitcoin and other risk assets in favor of safer investments like government bonds. The severity and duration of these events would directly influence the magnitude of the impact on Bitcoin’s price. For example, the 2008 financial crisis led to a significant decline in many asset classes, including Bitcoin (though it was still in its early stages). A similar, but potentially larger, event could impact Bitcoin’s price significantly on January 19, 2025. Conversely, periods of high inflation, as seen in several countries in recent years, can drive increased demand for Bitcoin as a store of value.

Factors Affecting Bitcoin’s Price Volatility

Bitcoin’s price has been notoriously volatile since its inception. Understanding the factors driving these fluctuations is crucial for anyone involved in the cryptocurrency market, especially when attempting to predict its future value. This section will examine several key influences on Bitcoin’s price volatility, both historical and prospective.

Historical Volatility and Key Events

Bitcoin’s history is punctuated by dramatic price swings. The early years saw periods of exponential growth followed by sharp corrections. The 2017 bull run, for example, saw Bitcoin’s price surge to nearly $20,000, only to crash significantly in the following year. This volatility was largely driven by a combination of factors including increasing media attention, speculative investment, and a lack of regulatory clarity. Other significant events include the collapse of Mt. Gox, a major Bitcoin exchange, which caused a significant price drop due to the loss of a substantial amount of Bitcoin. Similarly, regulatory crackdowns in various countries have also historically resulted in significant price decreases, while positive news and endorsements from influential figures have fueled upward price movements.

Impact of Regulatory Announcements

Regulatory announcements from governments worldwide significantly impact Bitcoin’s price. Positive news, such as the adoption of Bitcoin as legal tender in El Salvador, can lead to substantial price increases due to increased investor confidence and institutional adoption. Conversely, negative news, such as bans or strict regulations, can trigger sharp price drops as investors react to increased uncertainty and potential limitations on Bitcoin’s usage. The ambiguity surrounding global regulatory frameworks contributes to Bitcoin’s inherent volatility, as investors constantly react to evolving legal landscapes.

Influence of Market Sentiment and Technological Developments

Market sentiment plays a crucial role in Bitcoin’s price volatility. Positive news, such as the successful adoption of Bitcoin by large corporations, can trigger a surge in buying pressure, leading to price increases. Conversely, negative news, such as security breaches or significant market sell-offs, can result in sharp price declines driven by fear and uncertainty among investors. Technological developments, such as the introduction of new blockchain protocols or improvements in scaling solutions, can also impact price volatility. Positive technological advancements can increase confidence in the long-term viability of Bitcoin, potentially leading to price increases. Conversely, significant technical issues or vulnerabilities could lead to price declines.

Bitcoin’s Volatility and its Role as a Store of Value and Medium of Exchange

Bitcoin’s price volatility directly impacts its adoption as both a store of value and a medium of exchange. High volatility makes it less attractive as a store of value, as investors are hesitant to hold an asset that can lose a significant portion of its value quickly. Similarly, the volatility makes it less suitable as a medium of exchange, as the fluctuating value can create uncertainty and instability in transactions. However, some argue that the volatility is inherent to its nature as a nascent asset class and that as it matures, its volatility will decrease. The increasing institutional adoption of Bitcoin could also contribute to a reduction in volatility over time.

Potential Future Events Affecting Volatility (Leading to January 19, 2025)

Several potential future events could significantly impact Bitcoin’s price volatility before January 19, 2025. These include further regulatory clarity (or lack thereof) from major global economies, the continued adoption of Bitcoin by institutional investors, technological advancements within the Bitcoin ecosystem (such as the Lightning Network’s expansion), and the overall macroeconomic climate. For instance, a major global recession could lead to increased demand for Bitcoin as a safe haven asset, potentially increasing its price. Conversely, a period of sustained economic growth might reduce investor interest in riskier assets like Bitcoin, potentially leading to price declines. Significant security breaches or technological vulnerabilities could also significantly impact the price. The outcome of these events is inherently uncertain, contributing to the ongoing volatility of Bitcoin.

Bitcoin Adoption and Market Sentiment

Bitcoin’s adoption and the prevailing market sentiment are intrinsically linked to its price fluctuations. Understanding the current state of adoption across various demographics and regions, and anticipating shifts in investor confidence and media portrayal, is crucial for predicting Bitcoin’s price trajectory. This analysis will explore these factors, comparing Bitcoin’s progress with other cryptocurrencies and projecting a potential narrative leading up to January 19, 2025.

Bitcoin adoption is growing, albeit unevenly. While developed nations like the US and parts of Europe show higher levels of individual and institutional investment, adoption in developing economies is often driven by remittances and the need for alternative financial systems. Geographical disparities exist due to factors such as regulatory frameworks, internet penetration, and financial literacy. For instance, El Salvador’s adoption of Bitcoin as legal tender demonstrates a bold approach, while other countries maintain a cautious stance, impacting adoption rates within their borders. The level of user-friendliness of Bitcoin wallets and exchanges also plays a significant role.

Bitcoin Adoption Across Demographics and Regions

Current adoption shows a concentration among younger, tech-savvy demographics in developed nations. However, increasing awareness and the potential for Bitcoin to offer financial inclusion are driving adoption in developing countries, albeit at a slower pace. For example, the use of Bitcoin for cross-border payments in regions with unstable currencies is gaining traction, representing a significant potential growth area. Institutional investors are also playing an increasingly prominent role, with some large companies holding Bitcoin on their balance sheets. This demonstrates a growing acceptance of Bitcoin as a store of value and a potential hedge against inflation. However, widespread mainstream adoption remains a long-term goal, contingent upon improved usability and regulatory clarity.

Market Sentiment and its Influence on Bitcoin’s Price

Market sentiment, encompassing investor confidence, media narratives, and overall public perception, significantly influences Bitcoin’s price. Positive media coverage and increased investor confidence typically lead to price increases, while negative news or regulatory uncertainty can trigger sell-offs. For instance, Elon Musk’s tweets about Bitcoin have historically shown a correlation with price volatility. Similarly, announcements of significant regulatory changes or major institutional investments can have a substantial impact on market sentiment and, consequently, the price. Leading up to January 19, 2025, positive technological advancements, such as the scaling solutions improving transaction speed and reducing fees, could boost investor confidence and drive up the price. Conversely, negative regulatory developments or major security breaches could dampen sentiment and depress the price.

Comparison of Bitcoin’s Adoption with Other Cryptocurrencies

While Bitcoin maintains its position as the dominant cryptocurrency by market capitalization, its adoption rate isn’t necessarily faster than other cryptocurrencies in specific niches. For instance, Ethereum’s adoption is strong in the decentralized finance (DeFi) space, while other cryptocurrencies excel in specific applications like privacy coins or scalability solutions. This suggests that Bitcoin’s future price isn’t solely dependent on its adoption rate in isolation but also on its ability to maintain its position as the leading store of value and its continued relevance in the evolving cryptocurrency landscape. The continued development of the Lightning Network, for example, could enhance Bitcoin’s scalability and usability, potentially leading to increased adoption.

Potential Evolution of Market Sentiment Towards Bitcoin

Predicting market sentiment is inherently challenging, but considering various factors, a plausible narrative emerges. Technological advancements, such as layer-2 scaling solutions and improved privacy features, could enhance Bitcoin’s usability and appeal, leading to increased adoption and positive market sentiment. Conversely, regulatory uncertainty or significant security incidents could negatively impact investor confidence. A scenario where positive technological developments outweigh regulatory hurdles would likely result in a positive market sentiment leading up to January 19, 2025, potentially driving the price higher. However, a scenario with heightened regulatory scrutiny and lack of significant technological advancements could lead to a more subdued or even negative market sentiment, potentially impacting the price negatively. The interplay between these factors will ultimately shape the market sentiment and Bitcoin’s price in the period leading up to January 19, 2025.

Regulatory Landscape and Bitcoin

The regulatory landscape surrounding Bitcoin is a complex and rapidly evolving field, varying significantly across different jurisdictions. Understanding these differences is crucial for predicting Bitcoin’s price trajectory, especially in the lead-up to January 19, 2025. The level of regulatory clarity and acceptance directly impacts investor confidence and market participation.

Current Regulatory Approaches in Major Jurisdictions

Several major economies have adopted distinct approaches to regulating Bitcoin and cryptocurrencies. The United States, for example, lacks a unified federal regulatory framework, leading to a patchwork of state-level regulations and differing interpretations from agencies like the SEC and the CFTC. This fragmented approach creates uncertainty. In contrast, countries like El Salvador have embraced Bitcoin as legal tender, fostering a more supportive environment for its use and potentially driving adoption. The European Union is developing a comprehensive regulatory framework under the Markets in Crypto-Assets (MiCA) regulation, aiming to provide greater clarity and investor protection. China, on the other hand, has implemented a strict ban on cryptocurrency trading and mining, significantly impacting the global Bitcoin market. These diverse approaches highlight the lack of global consensus on Bitcoin regulation.

Potential Regulatory Changes Affecting Bitcoin’s Price

Several potential regulatory changes could significantly impact Bitcoin’s price before January 19, 2025. The ongoing debate in the US regarding the classification of Bitcoin as a security or a commodity remains a major uncertainty. A clear regulatory framework could boost investor confidence and potentially drive price increases. Conversely, stricter regulations, including increased Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance requirements, could dampen enthusiasm and suppress price growth. Furthermore, the increasing focus on environmental concerns related to Bitcoin mining could lead to stricter regulations on energy consumption, potentially impacting the cost of mining and the overall Bitcoin supply. The implementation of MiCA in the EU and similar regulations in other regions will also influence the global market.

Comparison of Regulatory Approaches and Their Impact

| Jurisdiction | Regulatory Approach | Potential Impact on Bitcoin Market Value |

|---|---|---|

| United States | Fragmented, evolving | Uncertainty creates volatility; clarity could boost price |

| El Salvador | Legal tender | Increased adoption, potentially positive price impact |

| European Union (MiCA) | Comprehensive framework | Increased investor protection, potentially stabilized price |

| China | Strict ban | Suppressed market activity, negative price impact |

Scenario: Major Regulatory Crackdown and its Price Impact

A hypothetical major regulatory crackdown, such as a coordinated global ban on Bitcoin trading or mining, could have severe consequences. Such an event would likely trigger a significant price drop, potentially mirroring the sharp declines seen in the past following similar regulatory actions in specific countries. The extent of the price decrease would depend on the scope and severity of the crackdown, as well as the market’s overall sentiment at the time. For instance, if the crackdown occurred in late 2024, the impact on the January 19, 2025 price would be considerable, potentially leading to a sustained bear market. A less severe scenario, such as increased KYC/AML requirements, might cause a temporary dip but could ultimately lead to increased market maturity and long-term price stability. The scenario’s impact would also depend on the reaction of other jurisdictions, and whether they follow suit or maintain a more lenient approach. This could lead to a shift in trading volume to jurisdictions with less stringent regulations.

Frequently Asked Questions (FAQs): Bitcoin USD Prediction For 19 January 2025

This section addresses common concerns and questions surrounding Bitcoin investment, providing insights into potential risks, the reliability of price predictions, long-term price influencers, and comparisons with alternative cryptocurrencies. Understanding these aspects is crucial for making informed investment decisions.

Biggest Risks Associated with Investing in Bitcoin

Investing in Bitcoin, like any other asset class, carries inherent risks. Volatility is a primary concern; Bitcoin’s price can fluctuate dramatically in short periods, leading to significant gains or losses. Regulatory uncertainty poses another risk, as governments worldwide are still developing frameworks for cryptocurrencies. This can impact trading, taxation, and even the legality of Bitcoin in certain jurisdictions. Security risks, including the potential for hacking or loss of private keys, are also substantial. Finally, the relatively nascent nature of the cryptocurrency market means there’s a higher degree of uncertainty compared to more established markets. Mitigation strategies include diversification (spreading investments across different asset classes), secure storage practices (using hardware wallets), and staying informed about regulatory developments. Careful risk assessment and a long-term investment horizon can also help manage these risks.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable. Numerous factors influence Bitcoin’s price, many of which are unpredictable. These include market sentiment, regulatory changes, technological advancements, macroeconomic conditions, and adoption rates. While technical analysis and fundamental analysis can provide insights, they are not foolproof and often fail to accurately predict short-term price movements. For example, predictions made in 2021 for Bitcoin to reach $100,000 by the end of the year were far off the mark. Instead of relying on specific price targets, it’s more prudent to focus on understanding the underlying factors that influence Bitcoin’s value and to develop a long-term investment strategy that accounts for potential volatility.

Factors Influencing Bitcoin’s Long-Term Price Trajectory

Bitcoin’s long-term price trajectory is influenced by a complex interplay of factors extending beyond short-term market fluctuations. Widespread adoption by businesses and institutions plays a significant role. Increased institutional investment, such as that seen from companies like MicroStrategy, can drive price appreciation. Technological advancements, like the Lightning Network improving transaction speeds and reducing fees, also positively impact Bitcoin’s appeal. Macroeconomic factors, including inflation and the performance of traditional financial markets, can influence investor interest in Bitcoin as a hedge against inflation or a safe haven asset. Regulatory clarity and acceptance by governments can significantly affect market confidence and price stability. Finally, the overall narrative and market sentiment surrounding Bitcoin, including its perception as a decentralized and censorship-resistant currency, are key long-term drivers.

Alternative Cryptocurrencies Offering Better Investment Potential

While Bitcoin remains the dominant cryptocurrency, several alternatives offer potentially different investment profiles. Ethereum, for instance, underpins a vast ecosystem of decentralized applications (dApps) and smart contracts, providing diversification beyond Bitcoin’s primary function as a store of value. However, Ethereum’s price is also highly volatile. Other cryptocurrencies, like Solana or Cardano, focus on scalability and improved transaction speeds, aiming to address some of Bitcoin’s limitations. Each cryptocurrency has unique characteristics, advantages, and disadvantages. The “better” investment depends on individual risk tolerance, investment goals, and understanding of the specific technology and market dynamics of each cryptocurrency. Thorough research and careful consideration of the risks involved are essential before investing in any cryptocurrency beyond Bitcoin.

Summary of Key Points

Predicting Bitcoin’s price on any given date, especially one as far out as January 19, 2025, is inherently speculative. Numerous intertwined factors contribute to its volatility, making precise forecasting impossible. While various analysts offer predictions, ranging from highly optimistic to considerably pessimistic, understanding the underlying complexities is paramount for informed decision-making.

The inherent uncertainty stems from the interplay of macroeconomic conditions, regulatory shifts, technological developments within the cryptocurrency space, and the ever-changing sentiment of the market. These factors are not isolated; they interact in complex ways, amplifying or dampening the impact of individual elements on Bitcoin’s price. For example, a global recession could negatively affect investor appetite for risk assets like Bitcoin, while positive regulatory developments in a major market could drive significant price increases. Conversely, a major technological advancement could attract new investors but might also be accompanied by security concerns that lead to a price drop.

Factors Influencing Bitcoin’s Price in 2025

Several key factors will likely shape Bitcoin’s price by January 19, 2025. These include the overall state of the global economy, the regulatory environment surrounding cryptocurrencies in key jurisdictions (such as the US, EU, and China), technological innovations in the Bitcoin ecosystem (like the Lightning Network’s adoption), and the prevailing market sentiment, which can quickly shift based on news events and social media trends. Consider the 2022 crypto winter, for instance, which saw a significant price drop driven by macroeconomic factors and regulatory uncertainty. A similar, or conversely, a highly positive, macroeconomic environment in 2024-2025 will have a major impact.

Risk Management and Investment Strategies

Given the inherent volatility and uncertainty, investors should prioritize risk management. This includes diversification of their investment portfolio, avoiding overexposure to Bitcoin, and only investing what they can afford to lose. A common strategy is to use dollar-cost averaging, gradually investing a fixed amount of money over time, mitigating the risk of investing a large sum at a price peak. This approach is particularly relevant in the highly volatile cryptocurrency market. Furthermore, investors should stay informed about the latest developments and changes impacting the cryptocurrency landscape. A sound understanding of the risks and potential rewards is crucial for navigating the Bitcoin market successfully.