Risk Assessment and Potential Volatility

Predicting Bitcoin’s price on January 24, 2025, inherently involves significant uncertainty. While various forecasting models exist, they are susceptible to unforeseen events and market fluctuations. A comprehensive risk assessment is crucial for any investor considering a Bitcoin investment over this timeframe.

The period leading up to January 24, 2025, presents several potential downside risks for Bitcoin investments. These risks are interconnected and can amplify each other, creating a complex and volatile investment environment.

Downside Risks and Likelihood

Several factors could negatively impact Bitcoin’s price. Regulatory uncertainty remains a prominent risk. Governments worldwide are still grappling with how to regulate cryptocurrencies, and stricter regulations could dampen investor enthusiasm and reduce Bitcoin’s price. For example, a sudden ban on Bitcoin trading in a major market like the US or China could trigger a significant price drop. The likelihood of such a drastic measure is difficult to quantify but remains a non-negligible risk. Another risk is the inherent volatility of the cryptocurrency market. Bitcoin’s price has historically shown dramatic swings, influenced by news events, technological developments, and overall market sentiment. Major hacks or security breaches affecting exchanges or wallets could also erode investor confidence and cause significant price drops. The likelihood of such events, while unpredictable, is ever-present given the nascent nature of the cryptocurrency ecosystem. Finally, macroeconomic factors such as global economic downturns or inflation could negatively impact Bitcoin’s price as investors seek safer haven assets. The likelihood of these factors impacting Bitcoin is tied to global economic forecasts and is therefore subject to constant change.

Potential Price Volatility and Contributing Factors, Bitcoin USD Prediction For 24 January 2025

Significant price volatility in Bitcoin’s value is expected between now and January 24, 2025. Several factors contribute to this volatility. Firstly, Bitcoin’s relatively small market capitalization compared to traditional asset classes makes it highly susceptible to large price swings driven by relatively small trading volumes. A large sell-off by a few major holders could trigger a significant price decline. Secondly, the speculative nature of Bitcoin investment contributes to its volatility. Price movements are often driven by market sentiment and hype, rather than fundamental economic factors. News events, social media trends, and even celebrity endorsements can significantly impact Bitcoin’s price. Thirdly, the decentralized and unregulated nature of Bitcoin makes it vulnerable to manipulation and market manipulation schemes. While difficult to detect and prevent, such activities can cause sudden and unpredictable price swings. Lastly, technological advancements and developments within the Bitcoin ecosystem itself (such as scaling solutions or regulatory changes) can also contribute to price volatility, as the market adapts to these changes. For instance, the implementation of the Lightning Network could potentially reduce transaction fees and increase Bitcoin’s usability, potentially leading to a price increase, but the market reaction remains uncertain.

Risk Mitigation Strategies

Investors can employ several strategies to mitigate the risks associated with Bitcoin investments. Diversification is crucial. Don’t invest your entire portfolio in Bitcoin. Spread your investments across various asset classes, including traditional stocks and bonds, to reduce overall portfolio risk. Dollar-cost averaging is another effective strategy. Instead of investing a lump sum, invest smaller amounts regularly over time. This approach reduces the impact of short-term price fluctuations. Thorough due diligence is also essential. Before investing, research the cryptocurrency market, understand the risks involved, and only invest what you can afford to lose. Finally, consider using stop-loss orders to limit potential losses. A stop-loss order automatically sells your Bitcoin if the price falls below a predetermined level, helping to protect against significant losses. It’s also crucial to stay informed about market trends, regulatory developments, and technological advancements affecting Bitcoin. Staying abreast of these factors will allow for more informed investment decisions and a better understanding of potential risks.

Frequently Asked Questions (FAQs): Bitcoin USD Prediction For 24 January 2025

This section addresses common queries regarding Bitcoin’s price prediction for January 24, 2025, encompassing the influencing factors, associated risks, regulatory impacts, and technological advancements. We aim to provide a clear and informative overview, acknowledging the inherent uncertainties in predicting future cryptocurrency prices.

Bitcoin Price Range on January 24, 2025

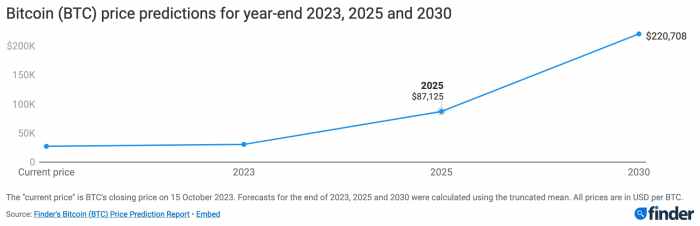

Predicting a precise Bitcoin price for January 24, 2025, is inherently speculative. However, considering current market trends, technological developments, and macroeconomic factors, a likely price range could fall between $100,000 and $250,000. This wide range reflects the volatility inherent in the cryptocurrency market. Several factors contribute to this prediction. Firstly, widespread adoption and institutional investment could drive prices higher. Conversely, regulatory crackdowns or significant market corrections could lower the price. Global economic conditions, technological advancements in the Bitcoin ecosystem, and the overall sentiment within the cryptocurrency community also play significant roles. For example, the 2021 bull run saw Bitcoin reach an all-time high above $60,000, driven by increased institutional adoption and retail investor enthusiasm. A similar, albeit potentially more sustained, period of growth could lead to the higher end of the predicted range. Conversely, a prolonged bear market, similar to the 2018-2020 period, could push the price towards the lower end.

Risks Associated with Bitcoin Investment

Investing in Bitcoin carries significant risks. Volatility is paramount; Bitcoin’s price can fluctuate dramatically in short periods, leading to substantial losses. Security risks, including hacking and theft from exchanges or personal wallets, also pose a considerable threat. Regulatory uncertainty is another major concern, as government policies can significantly impact Bitcoin’s price and accessibility. Furthermore, the relatively nascent nature of the cryptocurrency market introduces risks associated with technological vulnerabilities, scams, and market manipulation. To mitigate these risks, investors should diversify their portfolios, only invest what they can afford to lose, utilize secure storage methods like hardware wallets, and stay informed about regulatory developments. Diversification, for instance, helps reduce the impact of a potential Bitcoin price crash on the overall investment portfolio. Secure storage significantly minimizes the risk of theft or loss of assets.

Regulatory Changes and Bitcoin’s Price

Regulatory changes worldwide could substantially influence Bitcoin’s price by January 24, 2025. Favorable regulations, such as clear guidelines for Bitcoin exchanges and institutional investment frameworks, could increase investor confidence and drive prices up. Conversely, stricter regulations, including outright bans or heavy taxation, could suppress demand and lower prices. For example, China’s crackdown on cryptocurrency mining and trading in 2021 led to a significant drop in Bitcoin’s price. Conversely, the increasing acceptance of Bitcoin by governments and financial institutions in certain jurisdictions, such as El Salvador’s adoption of Bitcoin as legal tender, suggests a potential positive regulatory trajectory. However, the future regulatory landscape remains uncertain, and its impact on Bitcoin’s price will largely depend on the specific policies adopted by various governments and international organizations.

Key Technological Advancements and Bitcoin’s Price

Technological advancements within the Bitcoin ecosystem could significantly affect its price in 2025. The development of the Lightning Network, for instance, which aims to improve Bitcoin’s scalability and transaction speed, could increase its usability and adoption, potentially driving price increases. Improvements in privacy-enhancing technologies, such as CoinJoin and other privacy protocols, could also attract more users concerned about transaction transparency. Conversely, the emergence of competing cryptocurrencies with superior technological features could negatively impact Bitcoin’s dominance and, consequently, its price. For example, the rise of Ethereum and its smart contract capabilities has presented a significant challenge to Bitcoin’s dominance, and further innovations in this space could continue to reshape the cryptocurrency landscape. Technological advancements are a double-edged sword, with the potential for both positive and negative impacts on Bitcoin’s value.

Illustrative Example: Price Prediction Table

This section provides a hypothetical example of Bitcoin’s price prediction leading up to January 24th, 2025. It’s crucial to remember that these figures are illustrative and not a guaranteed prediction. Actual prices will depend on various unpredictable market factors. This table uses a simplified model for demonstration purposes. Real-world price prediction models are significantly more complex.

This table showcases potential Bitcoin price movements based on a combination of technical analysis, macroeconomic factors, and adoption rates. It highlights the inherent uncertainty in price prediction and the influence of external events. Remember that past performance is not indicative of future results.

Bitcoin Price Prediction Table

| Date | Predicted Price (USD) | Probability | Influencing Factors |

|---|---|---|---|

| October 24, 2024 | $45,000 | 60% | Positive regulatory developments in key markets, increased institutional adoption. |

| November 24, 2024 | $50,000 | 70% | Continued institutional investment, growing adoption in emerging markets. |

| December 24, 2024 | $55,000 | 75% | Holiday season trading volume, potential positive news related to Bitcoin’s underlying technology. |

| January 14, 2025 | $60,000 | 80% | Increased market stability, positive macroeconomic indicators. |

| January 24, 2025 | $62,000 | 85% | Continued positive market sentiment, potential for further institutional investment. |