Bitcoin USD Price Prediction

Predicting the price of Bitcoin, a notoriously volatile cryptocurrency, is a challenging endeavor. Its value fluctuates wildly based on a complex interplay of factors, making long-term forecasting inherently uncertain. Even the most sophisticated models struggle to account for the unpredictable nature of market sentiment, sudden regulatory shifts, and the rapid pace of technological advancements within the cryptocurrency space. This inherent uncertainty underscores the importance of considering multiple scenarios and perspectives.

This article aims to explore potential price scenarios for Bitcoin on January 28, 2025, by examining current market trends, analyzing historical price movements, and considering the opinions of various market analysts and experts. We will focus on identifying key drivers that could significantly impact Bitcoin’s price trajectory over the next few years, providing a framework for understanding the potential range of outcomes.

Factors Influencing Bitcoin’s Price

Several key factors significantly influence Bitcoin’s price. Regulatory clarity or uncertainty in major markets like the United States and the European Union can dramatically impact investor confidence and trading volume. Technological advancements, such as improvements in scalability and transaction speeds, or the emergence of competing cryptocurrencies, also play a crucial role. Finally, broader macroeconomic conditions, including inflation rates, interest rate policies, and global economic growth, can influence investor appetite for riskier assets like Bitcoin. The interplay of these factors creates a dynamic and often unpredictable market environment.

Potential Price Scenarios for January 28, 2025

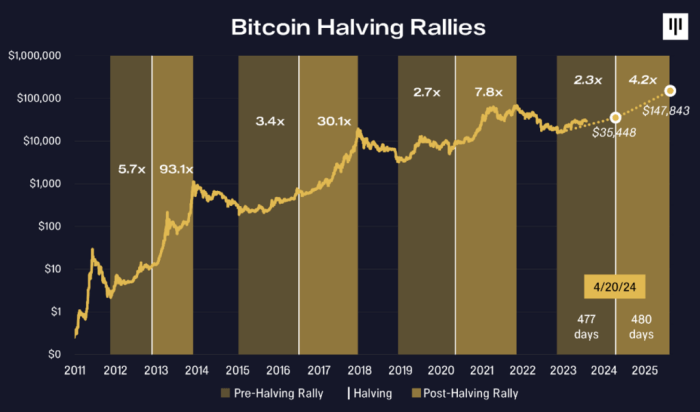

Considering the inherent volatility and the multitude of influencing factors, predicting a precise Bitcoin price for January 28, 2025, is impossible. However, we can explore several plausible scenarios based on different assumptions about the aforementioned factors. For instance, a scenario of widespread regulatory adoption and increased institutional investment could lead to a significantly higher price, perhaps exceeding $100,000 USD. Conversely, a scenario involving increased regulatory scrutiny and a broader cryptocurrency market downturn could result in a much lower price, potentially below $20,000 USD. A more moderate scenario, assuming continued growth but with periods of volatility, might see Bitcoin trading somewhere between $30,000 and $70,000 USD. These scenarios are not exhaustive, and the actual price could fall outside this range. It’s crucial to remember that these are merely potential outcomes based on current trends and expert opinions, and the actual price will depend on the complex interaction of numerous unpredictable factors. Past performance is not indicative of future results.

Factors Influencing Bitcoin’s Future Price

Predicting Bitcoin’s price in 2025, or any year for that matter, is inherently complex. Numerous intertwined factors influence its volatility and long-term trajectory. Understanding these key drivers is crucial for navigating the cryptocurrency market. This section will explore some of the most significant factors.

Macroeconomic Factors

Macroeconomic conditions significantly impact Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation. Conversely, rising interest rates, making traditional investments more attractive, could lead to a decrease in Bitcoin’s price as investors shift their capital. Strong global economic growth might boost overall investor confidence, potentially increasing demand for Bitcoin, while economic downturns could trigger risk-aversion, leading to sell-offs. The correlation between Bitcoin’s price and traditional market indicators like the S&P 500 is often observed, highlighting the influence of broader economic trends. For example, the 2022 bear market saw a significant downturn in both Bitcoin’s price and the S&P 500, reflecting the impact of rising interest rates and inflation fears.

Technological Advancements

Technological developments within the Bitcoin ecosystem play a vital role in its adoption and price. The Lightning Network, for example, aims to improve transaction speed and reduce fees, making Bitcoin more suitable for everyday transactions. Successful implementation of layer-2 scaling solutions could alleviate network congestion and enhance Bitcoin’s usability, potentially driving increased demand and price appreciation. Conversely, a failure to overcome scalability challenges could hinder wider adoption and limit price growth. The ongoing development and improvement of these technologies are critical to Bitcoin’s future.

Regulatory Developments, Bitcoin USD Prediction For 28 January 2025

Government regulations significantly impact Bitcoin’s price and market stability. Favorable regulatory frameworks, such as clear guidelines on taxation and anti-money laundering compliance, could foster institutional investment and increase mainstream adoption. Conversely, restrictive regulations or outright bans could stifle growth and lead to price declines. The regulatory landscape is constantly evolving, and differing approaches across jurisdictions create uncertainty and volatility. The example of China’s 2021 ban on cryptocurrency trading significantly impacted Bitcoin’s price at the time, demonstrating the profound influence of regulatory decisions.

Institutional Adoption and Investment

The involvement of institutional investors, such as large corporations and hedge funds, profoundly influences Bitcoin’s price. Increased institutional investment signals growing confidence in Bitcoin as an asset class, potentially driving price appreciation through increased demand. Conversely, a significant withdrawal of institutional funds could trigger price corrections. MicroStrategy’s substantial Bitcoin holdings serve as a prominent example of institutional adoption, influencing market sentiment and potentially contributing to price increases during periods of accumulation.

Public Sentiment and Media Coverage

Public perception and media coverage significantly influence Bitcoin’s price. Positive media narratives and growing public awareness can fuel demand and drive price increases, while negative news or FUD (fear, uncertainty, and doubt) can trigger sell-offs and price declines. Social media sentiment analysis often reveals correlations between public opinion and price fluctuations. Major news events, such as Elon Musk’s tweets about Bitcoin, have historically demonstrated the impact of public sentiment and media coverage on price volatility.

Potential Bitcoin Price Scenarios for January 28, 2025

Predicting the price of Bitcoin with certainty is impossible, but by analyzing current market trends, technological advancements, and macroeconomic factors, we can construct plausible price scenarios for January 28, 2025. These scenarios represent a range of possibilities, from highly optimistic to pessimistic outlooks. It’s crucial to remember that these are estimations and not financial advice.

Bitcoin Price Scenarios for January 28, 2025

The following Artikels three distinct scenarios: a bullish, a neutral, and a bearish prediction for Bitcoin’s price on January 28, 2025. Each scenario considers different factors that could influence Bitcoin’s trajectory. These factors include regulatory clarity (or lack thereof), widespread adoption by institutional investors, technological advancements within the Bitcoin network, and the overall state of the global economy.

Bullish Scenario: Continued Adoption and Growth

This scenario assumes continued widespread adoption of Bitcoin by institutional and retail investors, fueled by positive regulatory developments and technological improvements. Increased institutional investment, coupled with a growing understanding and acceptance of Bitcoin as a store of value and a hedge against inflation, could drive significant price appreciation. Technological advancements like the Lightning Network improving transaction speeds and scalability would also contribute positively. In this optimistic outlook, Bitcoin could see significant price increases.

Price Target: $200,000

Supporting Factors: Widespread institutional adoption, positive regulatory changes, significant technological advancements (e.g., Layer-2 scaling solutions), growing macroeconomic uncertainty driving safe-haven demand.

Potential Risks: Regulatory crackdowns in major markets, unforeseen technological vulnerabilities, a significant market correction due to overvaluation. Similar to the 2021 bull run, a rapid price increase could be followed by a substantial correction.

Neutral Scenario: Consolidation and Gradual Growth

This scenario anticipates a period of consolidation, where Bitcoin’s price fluctuates within a defined range, experiencing both upward and downward movements. While significant price gains might not be as dramatic as in the bullish scenario, gradual growth is still expected, driven by consistent adoption and technological improvements. This scenario assumes a relatively stable macroeconomic environment with no major disruptive events.

Price Target: $75,000

Supporting Factors: Steady adoption by both institutional and retail investors, ongoing technological improvements, relatively stable macroeconomic conditions. This scenario mirrors the steady growth observed in previous years following periods of volatility.

Potential Risks: Increased regulatory scrutiny, lack of significant technological breakthroughs, a downturn in the global economy impacting investor sentiment. The potential for sideways price action could discourage some investors.

Bearish Scenario: Market Correction and Price Decline

This pessimistic scenario considers a significant market correction, driven by factors such as increased regulatory pressure, a global economic downturn, or a major security breach impacting Bitcoin’s network. A lack of significant technological advancements or adoption could also contribute to a price decline. This scenario would represent a substantial reversal from current trends.

Price Target: $25,000

Supporting Factors: Stringent regulatory measures, a global economic recession, significant security vulnerabilities within the Bitcoin network, a loss of investor confidence. This scenario is analogous to the bear market of 2018-2020.

Potential Risks: Prolonged bear market, significant loss of investor capital, difficulty in attracting new investors. The risk of a prolonged downturn could lead to decreased market liquidity and exacerbate price volatility.

Summary of Bitcoin Price Scenarios for January 28, 2025

| Scenario | Price Target | Supporting Factors | Potential Risks |

|---|---|---|---|

| Bullish | $200,000 | Widespread adoption, positive regulation, technological advancements | Regulatory crackdowns, technological vulnerabilities, market correction |

| Neutral | $75,000 | Steady adoption, technological improvements, stable macroeconomic conditions | Increased regulatory scrutiny, lack of breakthroughs, economic downturn |

| Bearish | $25,000 | Stringent regulation, economic recession, security vulnerabilities, loss of investor confidence | Prolonged bear market, capital loss, difficulty attracting new investors |

Risks and Uncertainties

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently fraught with risk and uncertainty. While various models and analyses can offer potential scenarios, the volatile nature of the market and the influence of numerous unpredictable factors make definitive predictions extremely challenging. It’s crucial to understand these limitations before considering any investment strategy.

The inherent volatility of the cryptocurrency market is a significant risk. Bitcoin’s price has historically experienced dramatic swings, both upward and downward, often driven by factors outside the control of fundamental market forces. These fluctuations can be rapid and substantial, leading to significant gains or losses in a short period. For example, Bitcoin’s price has seen increases of several hundred percent in relatively short time frames, but also equally dramatic crashes. This volatility makes accurate long-term predictions difficult, if not impossible.

Regulatory Uncertainty and Government Actions

Government regulations worldwide significantly impact Bitcoin’s price. Changes in regulatory frameworks, such as increased taxation, stricter KYC/AML (Know Your Customer/Anti-Money Laundering) requirements, or outright bans, can drastically affect market sentiment and trading volume. The lack of a globally unified regulatory approach adds to the uncertainty. For instance, China’s previous ban on cryptocurrency trading led to a significant price drop. Conversely, positive regulatory developments in certain jurisdictions could potentially drive price increases.

Market Manipulation and Security Risks

The cryptocurrency market is susceptible to manipulation, including “pump and dump” schemes and coordinated efforts to artificially inflate or deflate prices. Moreover, security breaches on exchanges or the exploitation of vulnerabilities in the Bitcoin network itself could trigger sharp price drops due to loss of investor confidence. The Mt. Gox hack, a notorious example, demonstrated the devastating impact of security failures on the cryptocurrency market.

Technological Developments and Competition

Technological advancements within the cryptocurrency space pose both opportunities and risks. The emergence of competing cryptocurrencies with potentially superior technology or features could divert investment away from Bitcoin, impacting its price. Similarly, advancements in Bitcoin’s own technology, such as scaling solutions, could have either positive or negative effects depending on how they are implemented and adopted by the market.

Macroeconomic Factors and Global Events

Bitcoin’s price is not immune to macroeconomic factors and global events. Geopolitical instability, economic recessions, inflation, and changes in interest rates can all influence investor sentiment and, consequently, Bitcoin’s price. For example, periods of high inflation might lead to increased investment in Bitcoin as a hedge against inflation, but conversely, a global economic downturn might lead to a sell-off as investors seek safer assets.

Limitations of Price Prediction Models

Price prediction models, whether based on technical analysis, fundamental analysis, or machine learning, are inherently limited in their accuracy. These models rely on historical data and assumptions about future trends, which may not hold true. Unforeseen events and market shifts can render even the most sophisticated models ineffective. Furthermore, the inherent complexity of the cryptocurrency market makes it difficult to account for all the relevant factors influencing price. Over-reliance on any single prediction model is therefore risky.

Importance of Independent Research

Before making any investment decisions related to Bitcoin, it is crucial to conduct thorough independent research. This involves analyzing various sources of information, understanding the risks involved, and assessing your own risk tolerance. Do not solely rely on predictions or recommendations from others. Remember that past performance is not indicative of future results, and the cryptocurrency market is exceptionally volatile.

Expert Opinions and Market Sentiment: Bitcoin USD Prediction For 28 January 2025

Predicting Bitcoin’s price is inherently speculative, relying heavily on the confluence of expert opinions and prevailing market sentiment. While no one can definitively state the Bitcoin price on January 28th, 2025, analyzing prominent voices in the cryptocurrency space and gauging the overall market mood provides valuable context for our price prediction. Understanding the range of viewpoints and the prevailing sentiment helps to contextualize the potential price scenarios Artikeld previously.

Expert opinions on Bitcoin’s future price vary widely, reflecting the inherent volatility and uncertainty of the cryptocurrency market. Some prominent analysts, such as those at major investment banks like Goldman Sachs, have issued cautiously optimistic forecasts, suggesting a gradual increase in Bitcoin’s value driven by factors like increasing institutional adoption and its potential as a hedge against inflation. Conversely, other analysts, often those with a more bearish outlook on the overall financial markets, express concerns about regulatory uncertainty and potential market crashes, predicting more modest growth or even price declines. The divergence in these opinions highlights the significant uncertainty surrounding long-term Bitcoin price movements.

Prominent Analyst Views and Market Sentiment

The current market sentiment towards Bitcoin fluctuates frequently, influenced by macroeconomic conditions, regulatory developments, and technological advancements within the cryptocurrency space. At times, the market exhibits a bullish sentiment, characterized by optimism and price increases, driven by factors like positive news surrounding Bitcoin adoption by large corporations or positive regulatory developments in key markets. Conversely, periods of bearish sentiment are marked by pessimism and price decreases, often fueled by concerns about regulatory crackdowns, security breaches, or broader economic downturns. Currently, the market sentiment appears to be cautiously optimistic, with many investors anticipating long-term growth but acknowledging the potential for short-term volatility. This mixed sentiment is reflected in the range of price predictions offered by different analysts.

Impact of Differing Opinions and Sentiment on Predicted Price

The divergence in expert opinions and the fluctuating market sentiment significantly impact the predicted Bitcoin price for January 28th, 2025. A predominantly bullish market, fueled by positive news and widespread adoption, could push the price significantly higher than our base-case prediction. Conversely, a bearish market, characterized by negative news and investor fear, could result in a price considerably lower than anticipated. The interplay between these factors introduces a considerable degree of uncertainty into any long-term price prediction. For instance, a sudden surge in regulatory scrutiny or a major security incident could trigger a sharp downturn, while a successful integration of Bitcoin into mainstream financial systems could propel its price to significantly higher levels. Therefore, the predicted price should be viewed as a potential outcome within a broad range of possibilities, rather than a precise forecast.

Frequently Asked Questions (FAQ)

This section addresses common questions regarding Bitcoin’s price prediction for January 28, 2025, and the associated risks and strategies for investors. Understanding these points is crucial for making informed decisions about Bitcoin investment.

Bitcoin’s Most Likely Price on January 28, 2025

Predicting the exact price of Bitcoin on a specific date is inherently unreliable. Numerous factors, including technological advancements, regulatory changes, macroeconomic conditions, and market sentiment, can significantly influence its price. While various models and analysts offer price projections, these should be viewed with caution. It’s more prudent to consider a range of potential outcomes rather than relying on a single point prediction. For example, some analysts might predict a price between $100,000 and $200,000, while others might suggest a more conservative range. The actual price will depend on the interplay of various market forces.

Risks Associated with Investing in Bitcoin

Bitcoin’s price volatility is a significant risk. Its value can fluctuate dramatically in short periods, leading to substantial gains or losses. This volatility stems from its relatively small market capitalization compared to traditional assets and its susceptibility to market speculation and news events. Regulatory uncertainty is another major concern. Governments worldwide are still developing frameworks for regulating cryptocurrencies, and changes in regulations can significantly impact Bitcoin’s price and accessibility. For instance, a sudden ban in a major market could trigger a sharp price drop.

Protecting Against Bitcoin Price Volatility

Managing risk effectively is paramount when investing in Bitcoin. Diversification is a key strategy; spreading investments across different asset classes (stocks, bonds, real estate) can help mitigate losses if Bitcoin’s price falls. Dollar-cost averaging is another valuable technique. This involves investing a fixed amount of money at regular intervals, regardless of the price. This strategy reduces the impact of short-term price fluctuations and averages out the cost basis over time. For example, investing $100 per week consistently, rather than a lump sum, helps to reduce the risk of buying at a market peak.

Is it Too Late to Invest in Bitcoin?

Timing the market is notoriously difficult, and there’s no universally “right” or “wrong” time to invest in Bitcoin based solely on price predictions. Market timing strategies often fail, and trying to predict market bottoms or tops can be detrimental to long-term investment success. Investment decisions should be based on individual risk tolerance, financial goals, and a long-term perspective rather than short-term price fluctuations. Successful investing often involves staying invested through market cycles and focusing on the underlying technology and potential long-term growth of the asset.

Disclaimer

This analysis presents potential Bitcoin price predictions for January 28, 2025, based on current market trends and expert opinions. It is crucial to understand that these are merely educated estimations and not financial advice. The cryptocurrency market is highly volatile and unpredictable, and past performance is not indicative of future results.

The information provided here is for educational and informational purposes only. Any decision to invest in Bitcoin or any other cryptocurrency should be made after thorough independent research and consideration of your personal risk tolerance. We strongly advise seeking advice from a qualified financial advisor before making any investment decisions.

Investment Risks

Investing in cryptocurrencies like Bitcoin carries significant risks. Price fluctuations can be dramatic, leading to substantial gains or losses in a short period. Market manipulation, regulatory changes, technological vulnerabilities, and security breaches are all potential factors that can negatively impact the value of your investment. Furthermore, the lack of regulation in some jurisdictions adds to the uncertainty and potential for fraud. For example, the collapse of FTX in 2022 highlighted the inherent risks associated with centralized cryptocurrency exchanges, demonstrating how quickly market sentiment and asset value can change, resulting in significant financial losses for investors. The potential for complete loss of invested capital is a very real possibility.

Bitcoin USD Prediction For 28 January 2025 – Accurately predicting the Bitcoin USD value for January 28th, 2025, is challenging, requiring analysis of various market factors. To gain a broader perspective on potential price movements in the first quarter of 2025, reviewing predictions for a later date within that period is beneficial; for example, check out this resource on the Bitcoin Price Prediction March 2025 Usd to inform your understanding of Bitcoin’s trajectory.

Ultimately, the Bitcoin USD prediction for January 28th, 2025, will depend on numerous interacting economic and technological influences.

Accurately predicting the Bitcoin USD price for January 28th, 2025, remains challenging, however, analysts often consider long-term predictions to inform their strategies. For instance, understanding the implications of Plan B Bitcoin Prediction 2025 can provide valuable context. Ultimately, the Bitcoin USD prediction for January 28th, 2025, will depend on numerous market factors influencing its price.

Accurately predicting the Bitcoin USD price for January 28th, 2025, remains challenging, however, analysts often consider long-term predictions to inform their strategies. For instance, understanding the implications of Plan B Bitcoin Prediction 2025 can provide valuable context. Ultimately, the Bitcoin USD prediction for January 28th, 2025, will depend on numerous market factors influencing its price.

Accurately predicting the Bitcoin USD price for January 28th, 2025, remains challenging, however, analysts often consider long-term predictions to inform their strategies. For instance, understanding the implications of Plan B Bitcoin Prediction 2025 can provide valuable context. Ultimately, the Bitcoin USD prediction for January 28th, 2025, will depend on numerous market factors influencing its price.

Accurately predicting the Bitcoin USD price for January 28th, 2025, remains challenging, however, analysts often consider long-term predictions to inform their strategies. For instance, understanding the implications of Plan B Bitcoin Prediction 2025 can provide valuable context. Ultimately, the Bitcoin USD prediction for January 28th, 2025, will depend on numerous market factors influencing its price.

Accurately predicting the Bitcoin USD price for January 28th, 2025, remains challenging, however, analysts often consider long-term predictions to inform their strategies. For instance, understanding the implications of Plan B Bitcoin Prediction 2025 can provide valuable context. Ultimately, the Bitcoin USD prediction for January 28th, 2025, will depend on numerous market factors influencing its price.

Accurately predicting the Bitcoin USD price for January 28th, 2025, remains challenging, however, analysts often consider long-term predictions to inform their strategies. For instance, understanding the implications of Plan B Bitcoin Prediction 2025 can provide valuable context. Ultimately, the Bitcoin USD prediction for January 28th, 2025, will depend on numerous market factors influencing its price.