Bitcoin USD Price Prediction: Bitcoin USD Prediction For 29 January 2025

Bitcoin, the pioneering cryptocurrency, has captivated the world with its volatility and potential. Its price has swung wildly, from near-zero to record highs, making accurate price predictions an extremely challenging endeavor. While its decentralized nature and underlying blockchain technology have revolutionized finance, forecasting its future value requires careful consideration of numerous interconnected factors. This article aims to explore potential Bitcoin USD price scenarios for January 29, 2025, by analyzing key market drivers and historical trends. Bitcoin’s journey, from its humble beginnings as a niche technology to its current status as a significant asset class, is a testament to its disruptive potential, yet its inherent unpredictability remains a defining characteristic.

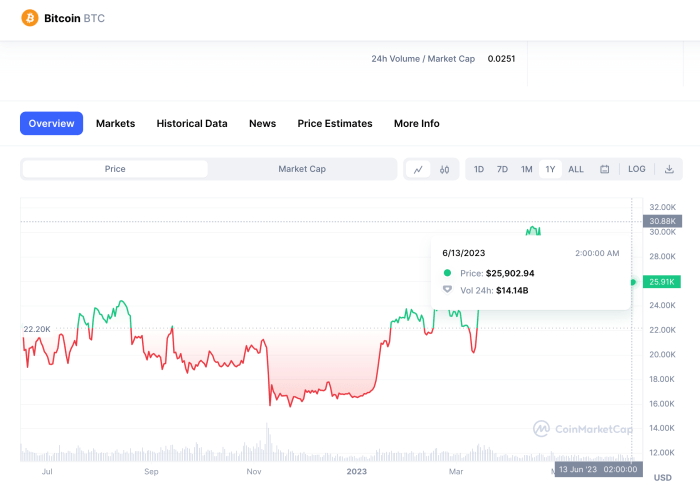

Bitcoin’s history is marked by periods of explosive growth and sharp corrections. Initially trading at a fraction of a dollar, it reached its first major milestone in 2017, exceeding $19,000. Since then, it has experienced significant fluctuations, influenced by factors such as regulatory changes, technological advancements, macroeconomic conditions, and market sentiment. Currently, Bitcoin holds a substantial market capitalization within the broader cryptocurrency landscape, making it a key player in the global financial system. Understanding its past performance, while not predictive of future results, provides valuable context for evaluating potential price movements.

Factors Influencing Bitcoin’s Price in 2025

Several key factors will likely influence Bitcoin’s price by January 29, 2025. These include the broader macroeconomic environment (e.g., inflation, interest rates, global economic growth), regulatory developments across different jurisdictions, technological advancements within the Bitcoin ecosystem (such as the Lightning Network’s adoption), and overall investor sentiment and market demand. For instance, a period of high inflation could drive increased demand for Bitcoin as a hedge against inflation, potentially pushing its price higher. Conversely, stringent regulatory crackdowns could dampen investor enthusiasm and lead to price declines. Predicting the interplay of these factors is crucial for formulating realistic price scenarios.

Potential Price Scenarios for January 29, 2025

Considering the historical volatility of Bitcoin and the range of potential influencing factors, several price scenarios are plausible for January 29, 2025. A bullish scenario, based on widespread adoption, positive regulatory developments, and sustained institutional investment, could see Bitcoin’s price reaching significantly higher levels than its current value. For example, a price of $150,000 or more is within the realm of possibility under such favorable conditions. Conversely, a bearish scenario, characterized by negative regulatory actions, a global economic downturn, or a loss of investor confidence, could result in significantly lower prices. A price range of $20,000 to $40,000, for instance, represents a more conservative estimate under less favorable circumstances. A neutral scenario, assuming a continuation of current market trends with moderate growth, would place the price somewhere between these two extremes. These scenarios are illustrative and do not represent definitive predictions. The actual price will depend on the complex interplay of various market forces.

Factors Influencing Bitcoin’s Price

Bitcoin’s price is a complex interplay of various factors, constantly shifting and influencing its value. Understanding these influences is crucial for navigating the cryptocurrency market. While predicting the precise price remains challenging, analyzing these contributing elements provides valuable insight into potential price movements.

Macroeconomic Factors and Correlation with Traditional Markets

Macroeconomic conditions significantly impact Bitcoin’s price. Inflation, for example, can drive investors towards Bitcoin as a hedge against currency devaluation. Conversely, rising interest rates can reduce the attractiveness of Bitcoin as investors seek higher returns in traditional assets. Recessionary fears often lead to increased risk aversion, potentially causing a sell-off in both traditional and cryptocurrency markets. However, the correlation between Bitcoin and traditional markets is not always consistent. While periods of negative correlation exist, suggesting Bitcoin can act as a safe haven during market downturns, positive correlations have also been observed, particularly during periods of high volatility. The degree of correlation fluctuates, making it difficult to predict its behavior reliably in any given economic climate. For example, the 2022 bear market saw Bitcoin’s price fall alongside major stock indices, while in earlier periods, Bitcoin showed some resilience even when traditional markets experienced declines.

Regulatory Developments and Government Policies

Government regulations and policies play a crucial role in shaping Bitcoin’s adoption and price. Favorable regulations, such as clear guidelines for cryptocurrency exchanges and tax treatment, can boost investor confidence and increase demand. Conversely, restrictive policies, like outright bans or heavy taxation, can hinder adoption and negatively impact price. The example of China’s 2021 crackdown on cryptocurrency mining and trading led to a significant price drop. Conversely, countries like El Salvador’s adoption of Bitcoin as legal tender initially caused a price surge, although its long-term impact remains to be seen. The regulatory landscape is constantly evolving, making it a dynamic factor affecting Bitcoin’s price.

Technological Advancements

Technological advancements within the Bitcoin network influence its scalability, transaction speed, and overall adoption. The Lightning Network, for instance, aims to improve transaction speed and reduce fees by enabling off-chain payments. Taproot, an upgrade to the Bitcoin protocol, enhances privacy and smart contract functionality. These advancements are comparable to previous iterations such as SegWit, which aimed to improve transaction scalability. Successful implementations of such upgrades often lead to increased investor confidence and wider adoption, potentially pushing the price upwards. Conversely, delays or failures in implementing these upgrades could negatively affect market sentiment.

Market Sentiment, News Events, and Social Media Trends

Market sentiment, fueled by news events and social media trends, significantly impacts Bitcoin’s price. Positive news, such as institutional adoption by large companies or positive regulatory developments, often leads to price increases. Negative news, such as security breaches or regulatory crackdowns, can trigger price drops. Social media platforms, particularly Twitter, play a significant role in shaping public perception and driving price volatility. The infamous Elon Musk tweets, for instance, have repeatedly demonstrated the power of social media influence on Bitcoin’s price. Major events like the collapse of FTX in 2022 caused a sharp decline in Bitcoin’s price, highlighting the impact of negative news on market sentiment.

Bitcoin’s Supply and Demand Dynamics and Halving Events, Bitcoin USD Prediction For 29 January 2025

Bitcoin’s fixed supply of 21 million coins creates a scarcity factor influencing its price. Halving events, which occur approximately every four years, reduce the rate of new Bitcoin creation by half. This reduction in supply, combined with relatively consistent demand, is predicted to exert upward pressure on the price. While past halving events have been followed by price increases, the magnitude and timing of these increases vary.

A simplified graph illustrating the impact of halving on price would show a step-like increase in price after each halving event, although the magnitude of the increase is not guaranteed to be consistent. The graph would have a horizontal axis representing time and a vertical axis representing price. Each halving event would be marked, and a noticeable upward trend in price would be observed after each halving, although periods of volatility and price corrections would also be evident. This is not a prediction of future price movements, but rather an illustration of the historical correlation between halving events and subsequent price increases.

Potential Price Scenarios for Bitcoin on January 29, 2025

Predicting the price of Bitcoin with certainty is impossible, given the volatile nature of the cryptocurrency market. However, by considering various macroeconomic factors, technological advancements, and regulatory changes, we can Artikel three plausible price scenarios for January 29, 2025. These scenarios represent a range of possibilities, from highly optimistic to pessimistic outlooks.

Bullish Scenario: Bitcoin Reaches $200,000

This scenario assumes widespread adoption of Bitcoin as a mainstream asset, driven by factors such as increased institutional investment, further development of the Lightning Network improving transaction speeds and reducing fees, and a growing recognition of Bitcoin’s scarcity as a hedge against inflation. Global macroeconomic instability could further fuel demand, pushing Bitcoin’s price significantly higher. We also assume a generally positive regulatory environment, with governments increasingly recognizing and adapting to the existence of cryptocurrencies.

The projected price trajectory would show a steady, albeit volatile, upward trend throughout 2023 and 2024. Imagine a graph starting at the current price, rising gradually with periodic corrections (minor dips), then accelerating its upward movement in late 2024, culminating in a price around $200,000 by January 29, 2025. This would resemble a hockey stick curve, reflecting a period of slower growth followed by a sharp acceleration. The limitations of this scenario include unforeseen regulatory crackdowns, a major technological flaw in the Bitcoin network, or a significant shift in investor sentiment. The success of this scenario hinges on Bitcoin maintaining its position as a leading cryptocurrency and a store of value. Similar growth, though on a smaller scale, was seen in the Bitcoin price increase from 2020 to 2021, fueled by institutional adoption and a growing belief in its potential.

Neutral Scenario: Bitcoin Stabilizes Around $50,000

This scenario assumes a more moderate level of growth, with Bitcoin consolidating its position as a digital asset alongside other established financial instruments. While institutional adoption continues, it progresses at a slower pace than in the bullish scenario. Regulatory uncertainty persists, preventing explosive growth but also avoiding a major market crash. Technological advancements are steady, but no groundbreaking innovations dramatically shift the market dynamics.

The price trajectory would be characterized by a more sideways trend, with periods of moderate gains and losses. Visualize a graph showing a fluctuating price range, centered around $50,000, with occasional spikes above and dips below this level. The range of fluctuation would gradually decrease over time, indicating increasing price stability. The uncertainty in this scenario lies in the unpredictable nature of global economic events and the potential for unforeseen regulatory changes. The price could be influenced by factors such as interest rate hikes or unexpected geopolitical events. This scenario is somewhat similar to the price stability Bitcoin experienced during parts of 2022, after the significant price increase of 2021.

Bearish Scenario: Bitcoin Falls to $20,000

This scenario involves several negative factors impacting Bitcoin’s price. A major regulatory crackdown on cryptocurrencies globally, a significant security breach impacting the Bitcoin network, or a prolonged period of macroeconomic instability could trigger a substantial price drop. A loss of investor confidence, perhaps driven by competing technologies or a broader shift away from risk assets, could also contribute to a bearish market.

The projected price trajectory would show a downward trend, with a series of sharp declines interspersed with periods of temporary recovery. Imagine a graph starting at the current price, gradually decreasing with occasional brief rallies, culminating in a price around $20,000 by January 29, 2025. This would resemble a steep downward slope with small, temporary upward blips. The limitations of this scenario are primarily the difficulty in predicting the magnitude and duration of a potential market downturn. A significant bear market could be influenced by factors beyond the control of the Bitcoin ecosystem, such as a global financial crisis. The 2018 Bitcoin bear market serves as a real-world example of such a drastic price drop, though the underlying causes were different.

Bitcoin USD Prediction For 29 January 2025 – Pinpointing the Bitcoin USD prediction for January 29th, 2025, requires considering broader market trends. To gain a better understanding of the potential price range, it’s helpful to examine the overall outlook for Bitcoin’s value in 2025, as detailed in this comprehensive analysis: What Is Bitcoin Price Prediction For 2025. Ultimately, the January 29th, 2025 prediction will depend on factors arising from the broader 2025 forecast.

Accurately predicting the Bitcoin USD price for January 29th, 2025, is challenging, given the cryptocurrency’s volatility. However, considering prominent analysts’ forecasts can offer some insight. For example, you might find it useful to review Tom Lee Bitcoin Prediction 2025 , which provides a perspective on potential long-term trends. Ultimately, though, the actual Bitcoin USD price on that date will depend on various market factors.

Accurately predicting the Bitcoin USD price for January 29th, 2025, is challenging, requiring analysis of various market factors. However, understanding broader long-term trends is helpful; for instance, consider the projections outlined in this insightful article on Bitcoin Prediction In December 2025. These longer-term forecasts can offer context for formulating more informed short-term predictions regarding the Bitcoin USD value on January 29th, 2025, allowing for a more nuanced perspective.

Predicting the Bitcoin USD price for a specific date like January 29th, 2025, is inherently challenging, relying heavily on speculation. However, gaining a broader perspective on potential future values is helpful; for a comprehensive overview, you might find the predictions at Bitcoin Price Usd 2025 Prediction insightful. Returning to our initial query, while a precise figure for January 29th, 2025, remains elusive, understanding the broader 2025 predictions offers valuable context.

Accurately predicting the Bitcoin USD price for January 29th, 2025, is challenging, but understanding key events influencing its value is crucial. A major factor is the impact of the Bitcoin Halving, and to understand its timeline, you should check out this resource on the Bitcoin Halving 2025 End Date. The halving’s effect on supply and subsequent price movements will significantly influence the Bitcoin USD prediction for that date.

Therefore, keeping an eye on the halving’s precise timing is essential for any accurate forecast.

Predicting the Bitcoin USD price for January 29th, 2025, requires considering various factors, including overall market trends and technological advancements. To gain a broader perspective on potential price movements, it’s helpful to examine broader predictions; for a comprehensive overview, check out this insightful article: What Is The Prediction For Bitcoin In 2025?. Understanding these wider predictions helps contextualize any specific date-based forecast, such as our target date for the Bitcoin USD prediction.

Predicting the Bitcoin USD price for January 29th, 2025, involves complex market analysis. However, effective marketing strategies are crucial for reaching potential investors, and a well-managed Google Ads Account can significantly enhance your reach. Therefore, understanding both Bitcoin’s volatility and the power of targeted advertising is key to navigating the future of cryptocurrency investments.