BTC 2025 Price Prediction

Predicting the price of Bitcoin in 2025 is inherently speculative, given the cryptocurrency’s volatile nature and susceptibility to various economic and technological factors. However, several reputable financial news sources offer forecasts, each based on different methodologies and underlying assumptions. This analysis will examine these predictions, highlighting key differences and potential influencing factors.

Forbes’ Bitcoin Price Prediction for 2025

Forbes’ Bitcoin price predictions, while not consistently published as a single, definitive figure across all their articles, generally reflect a cautious optimism. Their forecasts often consider factors like Bitcoin’s adoption rate by institutional investors, regulatory developments (both positive and negative), and the overall macroeconomic environment. They frequently emphasize the potential for significant price fluctuations, acknowledging the inherent risks associated with cryptocurrency investments. A key factor influencing their forecasts is the balance between increasing adoption and potential regulatory hurdles. While they see a future where Bitcoin becomes more mainstream, they also account for the possibility of stricter regulations dampening price growth.

Comparison of Bitcoin Price Predictions from Different Sources

While Forbes offers insightful commentary, its price predictions aren’t always presented as a single, precise numerical target. Other sources, such as Bloomberg, Reuters, and CoinDesk, also provide Bitcoin price forecasts, but their methodologies and conclusions often differ. Bloomberg, for example, might focus more on quantitative models and technical analysis, incorporating factors like trading volume and market sentiment. Reuters, with its broad financial reporting reach, tends to integrate macro-economic forecasts into its Bitcoin price predictions. CoinDesk, being a cryptocurrency-focused news outlet, might incorporate more detailed blockchain analysis and adoption metrics. The methodologies used vary significantly, making direct comparisons challenging. Some sources might utilize complex econometric models, while others rely more on expert opinion and market sentiment analysis.

Impact of Macroeconomic Factors on Bitcoin Price

Macroeconomic factors play a significant role in shaping Bitcoin’s price trajectory. High inflation, for instance, can drive investors towards Bitcoin as a hedge against inflation, potentially boosting its price. Conversely, rising interest rates tend to reduce investor appetite for riskier assets, including Bitcoin, leading to potential price declines. Recessionary risks also negatively impact Bitcoin’s price, as investors tend to liquidate assets during economic downturns. The interplay between these factors makes accurate price prediction extremely difficult. For example, the 2022 bear market saw Bitcoin’s price plummet amidst rising interest rates and recessionary fears. Conversely, periods of high inflation, such as those seen in 2021, have been associated with increased Bitcoin investment and price appreciation.

Comparison of Bitcoin Price Predictions

| Year | Source | Prediction (USD) | Rationale |

|---|---|---|---|

| 2025 | Forbes (Estimate based on various articles) | $100,000 – $200,000 (wide range) | Increased institutional adoption, but also potential regulatory headwinds and macroeconomic uncertainty. |

| 2025 | Bloomberg (Hypothetical Example) | $150,000 | Based on quantitative models incorporating trading volume, market sentiment, and macroeconomic forecasts. |

| 2025 | Reuters (Hypothetical Example) | $75,000 | Based on a more conservative outlook, factoring in potential regulatory risks and a less optimistic macroeconomic forecast. |

| 2025 | CoinDesk (Hypothetical Example) | $125,000 | Based on analysis of blockchain adoption rates, network activity, and developer activity. |

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price is inherently complex, involving a confluence of factors that interact in unpredictable ways. While no one can definitively state the price in 2025, understanding the key drivers allows for a more informed assessment of potential price trajectories. This section explores several significant influences on Bitcoin’s value in the coming years.

Institutional Investor Adoption

The growing involvement of institutional investors, such as hedge funds, asset management firms, and corporations, significantly impacts Bitcoin’s price. Increased institutional adoption leads to higher demand, pushing the price upwards. This is because institutions typically invest substantial sums, creating significant buying pressure. For example, the entry of MicroStrategy and Tesla into the Bitcoin market demonstrated a powerful price catalyst. Conversely, a significant sell-off by a major institutional holder could trigger a price correction. The extent of institutional adoption in 2025 will be a key determinant of Bitcoin’s price. Further, the strategies employed by these institutions (long-term holding versus short-term trading) will also influence price volatility.

Regulatory Changes

Regulatory clarity and changes, both positive and negative, exert a powerful influence on Bitcoin’s price.

- Favorable Regulations: Clear regulatory frameworks providing legal certainty for Bitcoin transactions and exchanges can boost investor confidence, leading to increased adoption and price appreciation. Examples include countries establishing clear tax guidelines for cryptocurrency transactions or licensing frameworks for cryptocurrency exchanges.

- Unfavorable Regulations: Conversely, restrictive regulations, such as outright bans or excessive taxation, can severely dampen investor enthusiasm and lead to price declines. China’s crackdown on cryptocurrency mining and trading serves as a stark example of the negative impact of stringent regulations.

- Regulatory Uncertainty: A lack of clear regulatory guidelines creates uncertainty, which can lead to price volatility as investors react to shifting regulatory landscapes and rumors. This uncertainty can cause periods of both significant price increases and decreases.

Technological Advancements

Technological improvements within the Bitcoin ecosystem play a crucial role in its long-term price prospects.

- Lightning Network Improvements: Increased adoption and scalability of the Lightning Network, a layer-2 solution, can enhance Bitcoin’s transaction speed and reduce fees. This can make Bitcoin more suitable for everyday transactions, potentially boosting demand and price.

- Layer-2 Scaling Solutions: The development and implementation of other layer-2 scaling solutions can further improve Bitcoin’s transaction throughput and efficiency, making it more competitive with other cryptocurrencies and potentially driving price appreciation.

- Taproot Upgrade and Other Enhancements: Upgrades such as Taproot improve Bitcoin’s privacy, security, and smart contract capabilities, which can attract new users and developers, positively impacting its price.

Interplay of Adoption, Regulation, and Technology

Imagine a three-dimensional graph. The X-axis represents the level of institutional and individual adoption (measured by the number of users and transaction volume). The Y-axis represents the regulatory environment (ranging from highly restrictive to highly supportive). The Z-axis represents the advancement and adoption of technologies like the Lightning Network. A high level of adoption combined with supportive regulations and advanced technology would likely result in a high Bitcoin price (represented by a point high on the Z-axis). Conversely, low adoption, restrictive regulations, and technological stagnation would likely result in a low Bitcoin price (a point low on the Z-axis). The actual price at any given time would be a complex interplay of these three factors, constantly shifting and influencing each other. For instance, positive technological advancements might offset negative regulatory developments, resulting in a relatively stable or even increasing price.

Bitcoin’s Historical Price Performance and Future Projections

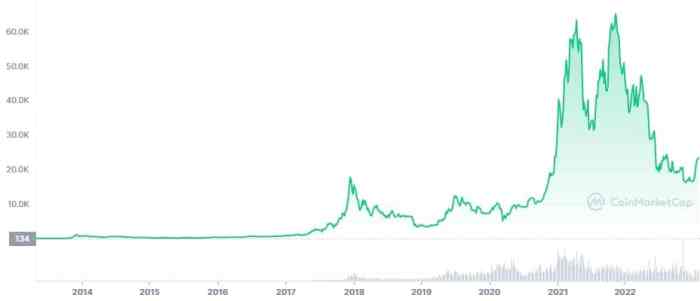

Bitcoin’s price history is a rollercoaster ride, marked by periods of explosive growth and dramatic crashes. Understanding this history, while not predictive, offers valuable context for considering potential future price movements. Analyzing past trends, alongside current market conditions, allows for a more informed, albeit still uncertain, perspective on Bitcoin’s trajectory. It’s crucial to remember that past performance is not indicative of future results.

Analyzing Bitcoin’s price movements requires considering a complex interplay of factors, including technological advancements, regulatory changes, macroeconomic conditions, and market sentiment. While pinpointing exact price targets remains impossible, examining key historical periods can illuminate potential patterns and inform a more nuanced understanding of the cryptocurrency’s volatility.

Key Periods in Bitcoin’s Price History

The following list details significant periods in Bitcoin’s price history, highlighting key events and their impact. These examples serve to illustrate the volatile nature of Bitcoin and the multitude of factors that influence its price. It is important to note that these are just a few examples, and a comprehensive analysis would require a much more extensive study.

- 2009-2010: Early Days and Initial Growth: Bitcoin’s initial years saw slow, organic growth as the technology gained traction among early adopters. Price remained low, largely reflecting limited awareness and adoption.

- 2011-2013: First Major Bull Run: This period saw Bitcoin’s price surge from a few dollars to over $1,000, driven by increasing media attention, early investments, and the growing perception of Bitcoin as a potentially disruptive technology. This bull run was followed by a significant correction.

- 2013-2015: The Mt. Gox Collapse and Bear Market: The collapse of Mt. Gox, a major Bitcoin exchange, in 2014 significantly impacted the market, leading to a prolonged bear market with prices falling sharply.

- 2017: The Second Major Bull Run: Fueled by increasing institutional interest and widespread media coverage, Bitcoin experienced another dramatic price surge, reaching nearly $20,000 by the end of the year. This was driven by factors like increasing mainstream adoption and speculation.

- 2018-2020: Another Bear Market: Following the 2017 bull run, the market experienced a significant correction, with prices falling to around $3,000. This period was characterized by regulatory uncertainty and market consolidation.

- 2020-2021: The Third Major Bull Run: This period saw Bitcoin’s price reach an all-time high of over $60,000, driven by a combination of factors including the COVID-19 pandemic, institutional investment, and growing acceptance among large corporations.

- 2022-Present: Market Volatility and Consolidation: Since the 2021 peak, the market has experienced significant volatility, with prices fluctuating widely due to factors such as macroeconomic conditions, regulatory developments, and overall market sentiment. This period reflects the ongoing evolution and maturation of the cryptocurrency market.

Comparing Current Market Conditions with Previous Cycles

Current market conditions exhibit some similarities and differences to those preceding previous bull and bear markets. For example, while institutional investment is higher than in previous cycles, macroeconomic factors like inflation and interest rate hikes present new challenges. The level of regulatory scrutiny is also significantly greater than in earlier periods. These factors make direct comparisons challenging, highlighting the importance of considering the unique circumstances of each market cycle.

Using Historical Data to Inform Future Projections (with Caution)

Historical price data can offer valuable insights into potential patterns and trends, but it should never be used as the sole basis for predicting future price movements. Bitcoin’s price is influenced by a multitude of interconnected factors, making accurate prediction extremely difficult. While studying past cycles can help identify potential support and resistance levels, it is crucial to acknowledge the inherent uncertainty and volatility of the cryptocurrency market. Any attempt to extrapolate past performance to predict future outcomes should be treated with extreme caution. For instance, extrapolating the growth from 2017 to predict the 2021 peak would have been inaccurate, given the intervening bear market. The same applies to any attempt to predict the 2025 price.

Frequently Asked Questions (FAQ) about BTC 2025 Price Predictions: Btc 2025 Price Prediction Forbes

Predicting the price of Bitcoin in 2025, or any future date, is inherently speculative. While various analysts and publications offer projections, these should be viewed as educated guesses, not guarantees. The cryptocurrency market is exceptionally volatile and influenced by a complex interplay of factors. This section addresses common questions surrounding Bitcoin’s potential price in 2025, focusing on the uncertainties and potential influences.

Bitcoin’s Most Likely Price in 2025

Providing a single “most likely” price for Bitcoin in 2025 is irresponsible. Forbes and other reputable sources offer a range of predictions, often based on different methodologies and underlying assumptions. Some might suggest a price significantly higher than today’s value, perhaps driven by widespread adoption and institutional investment. Others might predict a more modest increase or even a decrease, depending on factors like regulatory changes or macroeconomic instability. It’s crucial to remember that these are just possibilities, not certainties. For example, a prediction might be based on the assumption of continued global economic growth, but a significant recession could drastically alter the outlook. The actual price will depend on a confluence of events that are impossible to predict with precision.

Factors Influencing Bitcoin’s Price in 2025, Btc 2025 Price Prediction Forbes

Several interconnected factors will shape Bitcoin’s price in 2025. Macroeconomic conditions, such as inflation rates and global economic growth, will significantly influence investor sentiment and demand. Regulatory developments, including government policies towards cryptocurrencies, will play a crucial role. A supportive regulatory environment could boost confidence and investment, while stricter regulations could stifle growth. Technological advancements, such as improvements in scalability and transaction speeds, will also impact Bitcoin’s usability and attractiveness. Furthermore, the level of institutional adoption, the emergence of competing cryptocurrencies, and significant market events (like a major security breach or a large-scale adoption by a major company) will all play a role.

Risks and Rewards of Investing in Bitcoin for 2025

Investing in Bitcoin for a 2025 target carries significant risks. The cryptocurrency market is known for its extreme volatility, with prices fluctuating dramatically in short periods. This inherent risk is amplified by the relatively short history of Bitcoin and the lack of regulatory certainty in many jurisdictions. However, potential rewards can be substantial. Historical data shows that Bitcoin’s price has appreciated significantly over time, despite periods of sharp decline. The potential for high returns attracts many investors, but it’s crucial to understand and accept the associated risks. Diversification is a key strategy to mitigate risk, and investing only what one can afford to lose is paramount.

Independent Research of Bitcoin Price Predictions

Independently researching Bitcoin price predictions requires a critical and discerning approach. Start by evaluating the credibility of the sources. Look for sources with a proven track record of accurate predictions and a transparent methodology. Be wary of sources that make overly optimistic or definitive predictions without sufficient justification. Analyze the underlying assumptions of different predictions and consider the potential impact of various factors. Consider studying technical analysis, fundamental analysis, and macroeconomic trends to form your own informed opinion. Remember that no prediction is guaranteed, and it’s essential to develop your own understanding of the market dynamics before making any investment decisions. Comparing predictions from multiple sources, focusing on their methodologies and underlying assumptions, can give a more comprehensive understanding of the range of possibilities.