BTC Price Prediction June 2025: Btc Price June 2025

Bitcoin, the world’s first and most well-known cryptocurrency, has captivated investors and technologists alike with its revolutionary potential. However, its price remains notoriously volatile, swinging wildly from record highs to significant lows. Predicting its future value, especially as far out as June 2025, is inherently speculative, but understanding the key drivers of its price movements can offer valuable insight. This analysis will explore the factors likely to shape Bitcoin’s price in the coming years, offering a reasoned perspective on potential price scenarios. The journey into the unpredictable world of Bitcoin’s price prediction begins now.

Bitcoin’s price is a complex interplay of several interconnected factors. Market sentiment, driven by news cycles, technological developments, and overall investor confidence, plays a crucial role. Regulatory changes, both globally and within individual countries, can significantly impact adoption rates and investor behavior, influencing price volatility. Technological advancements, such as the scaling solutions being developed to improve transaction speeds and reduce fees, also have the potential to drive price increases by enhancing Bitcoin’s usability and appeal. Furthermore, macroeconomic factors, like inflation and global economic uncertainty, can indirectly affect Bitcoin’s value as investors seek alternative assets.

Factors Influencing Bitcoin’s Price in 2025

The interplay of market sentiment, regulatory landscape, technological advancements, and macroeconomic conditions will significantly shape Bitcoin’s price trajectory by June 2025. For instance, widespread adoption by institutional investors could lead to substantial price increases, mirroring the impact seen in previous bull runs. Conversely, negative regulatory actions or a major security breach could trigger sharp price declines. Predicting the precise balance of these forces is challenging, but analyzing historical trends and current developments can help to formulate a reasonable prediction range.

Market Sentiment and Investor Behavior

Market sentiment, often driven by media narratives and social media trends, is a powerful force shaping Bitcoin’s price. Positive news, such as increased institutional adoption or the development of groundbreaking applications built on the Bitcoin blockchain, typically leads to price increases. Conversely, negative news, such as regulatory crackdowns or security vulnerabilities, can trigger sell-offs. The 2021 bull run, fueled by positive media coverage and growing institutional interest, serves as a prime example of how market sentiment can drive significant price appreciation. Similarly, the market crashes of 2018 and 2022 highlight the impact of negative sentiment and investor fear.

Regulatory Landscape and Global Adoption

The regulatory landscape surrounding Bitcoin varies significantly across jurisdictions. Favorable regulations, promoting clarity and facilitating institutional investment, can significantly boost Bitcoin’s price. Conversely, restrictive regulations or outright bans can stifle adoption and negatively impact the price. The regulatory approach taken by major economies, such as the United States, China, and the European Union, will play a crucial role in shaping the overall global adoption rate and, consequently, Bitcoin’s price. Examples of countries with relatively favorable regulatory frameworks often see increased Bitcoin adoption and trading activity.

Technological Advancements and Scalability Solutions

Technological advancements are crucial for Bitcoin’s long-term success and price appreciation. Improvements in scalability, such as the Lightning Network, aim to address limitations in transaction speed and fees. Successful implementation and widespread adoption of these solutions can increase Bitcoin’s usability and appeal, potentially driving price increases. The development and adoption of second-layer solutions directly impact transaction efficiency and user experience, influencing overall market sentiment and potentially driving price appreciation. The success of these solutions will be a key factor influencing the price trajectory.

Historical BTC Price Trends and Analysis

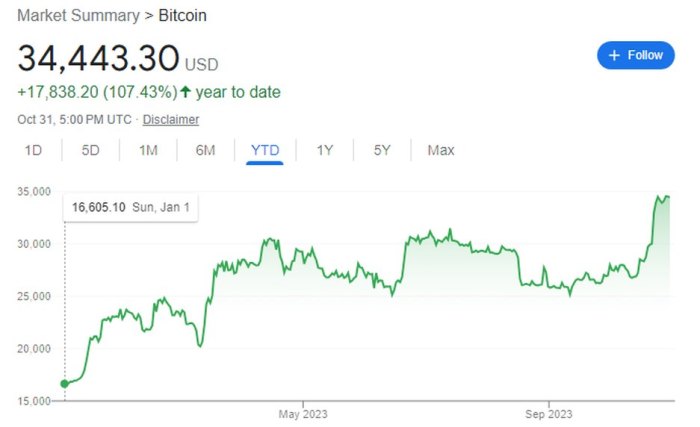

Bitcoin’s price history is characterized by extreme volatility, punctuated by periods of rapid growth (bull markets) and sharp declines (bear markets). Understanding these historical trends is crucial for informed speculation about future price movements, though it’s important to remember that past performance is not necessarily indicative of future results. Analyzing these cycles helps identify potential patterns and assess the current market’s position within the broader historical context.

Bitcoin’s journey since its inception in 2009 has been marked by several significant price fluctuations. The early years saw relatively slow growth, with Bitcoin trading at negligible prices for a considerable period. However, the first major bull market began around 2013, driven by increasing media attention and adoption. The price surged from a few dollars to over $1,000, before experiencing a significant correction. Subsequent bull markets, notably in 2017 and 2021, saw even more dramatic price increases, reaching all-time highs of nearly $20,000 and over $60,000 respectively, followed by substantial price drops. These peaks were often preceded by periods of hype and intense speculation, and followed by periods of market correction and consolidation. Key events like regulatory announcements, technological upgrades, and macroeconomic factors have consistently influenced these price swings.

Comparison of Bull and Bear Markets

Bull markets are typically characterized by sustained upward price trends, fueled by investor enthusiasm, technological advancements, and positive market sentiment. These periods are often accompanied by increased media coverage and a general sense of optimism. Conversely, bear markets are marked by prolonged price declines, driven by factors such as regulatory uncertainty, negative market sentiment, and economic downturns. These periods often involve increased volatility and investor fear. Comparing past bull and bear markets reveals some common patterns, such as the typical duration of each cycle and the magnitude of price changes. For instance, previous bull markets have lasted roughly 1-2 years, while bear markets have typically lasted anywhere from several months to a couple of years. However, it’s important to note that the intensity and duration of these cycles can vary significantly. The current market conditions can be compared to previous cycles by analyzing similar factors such as the adoption rate, regulatory landscape, and macroeconomic environment. Identifying similarities and differences can provide insights into potential future price movements, although it’s crucial to avoid drawing overly simplistic analogies.

Technical Indicators for Price Trend Prediction

Technical analysis employs various indicators derived from historical price and volume data to forecast future price trends. While not foolproof, these indicators can offer valuable insights when used in conjunction with fundamental analysis. Three commonly used indicators are moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD).

| Indicator | Description | Interpretation | Limitations |

|---|---|---|---|

| Moving Averages (MA) | Averages of prices over a specific period (e.g., 50-day, 200-day MA). Common types include simple moving average (SMA) and exponential moving average (EMA). | Crossovers of short-term and long-term MAs can signal buy or sell signals. Price above MA suggests bullish sentiment, while below suggests bearish. | Lagging indicator; may not capture short-term price fluctuations accurately. |

| Relative Strength Index (RSI) | Measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Typically ranges from 0 to 100. | RSI above 70 often indicates overbought conditions (potential for price reversal), while below 30 suggests oversold conditions (potential for price rebound). | Can generate false signals, particularly during strong trends. |

| Moving Average Convergence Divergence (MACD) | Shows the relationship between two moving averages. A histogram represents the difference between the two MAs. | Crossovers of the MACD line above the signal line suggest bullish momentum, while crossovers below suggest bearish momentum. Divergence between price and MACD can also signal potential trend reversals. | Can be prone to whipsaws (false signals) in choppy markets. |

Factors Influencing BTC Price in 2025

Predicting the price of Bitcoin in 2025 is inherently complex, relying on a confluence of interacting macroeconomic, technological, and regulatory factors. While precise forecasting is impossible, understanding these influences provides a framework for informed speculation. The following sections delve into the key drivers likely to shape Bitcoin’s value in the coming years.

Macroeconomic Factors, Btc Price June 2025

Global economic conditions significantly impact Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation, increasing demand and potentially pushing prices higher. Conversely, rising interest rates, often implemented to combat inflation, can make holding Bitcoin less attractive compared to interest-bearing assets, potentially leading to price declines. The overall global economic outlook – whether growth is robust or recessionary – also plays a crucial role. Periods of economic uncertainty frequently see investors flock to safe haven assets, potentially benefiting Bitcoin. For example, the 2022 economic downturn saw some investors shift funds towards Bitcoin, even amidst a broader cryptocurrency market correction. This illustrates the interplay between macroeconomic trends and Bitcoin’s price volatility.

Technological Developments

Technological advancements within the Bitcoin ecosystem are paramount. Layer-2 scaling solutions, such as the Lightning Network, aim to improve transaction speed and reduce fees, enhancing Bitcoin’s usability for everyday transactions. Wider adoption of these solutions could increase Bitcoin’s appeal to a broader range of users and businesses, potentially boosting demand and price. Similarly, increasing institutional adoption – the involvement of large corporations and financial institutions – brings greater legitimacy and liquidity to the market. Grayscale Bitcoin Trust, for instance, is a prime example of institutional investment in Bitcoin, demonstrating the growing confidence of large players in the cryptocurrency’s long-term prospects. This influx of institutional capital can provide significant price support and contribute to sustained growth.

Regulatory Landscape and Governmental Policies

Governmental regulations and policies worldwide significantly influence Bitcoin’s price and adoption. Clear and favorable regulatory frameworks can foster investor confidence and encourage wider adoption, leading to price increases. Conversely, restrictive or unclear regulations can create uncertainty and stifle growth, potentially depressing prices. Examples include the varying approaches taken by different countries; some actively promote crypto innovation, while others maintain a more cautious stance, even imposing outright bans. These differing approaches create a complex and dynamic regulatory landscape that impacts Bitcoin’s global valuation. The evolving regulatory environment will continue to be a significant factor shaping Bitcoin’s future price.

Btc Price June 2025 – Predicting the BTC price in June 2025 is challenging, with various factors influencing its trajectory. Understanding the broader cryptocurrency market is key, and a look at alternative cryptocurrencies can provide context. For instance, considering the potential performance of other digital assets like Bitcoin Cash might offer insights; you can explore projections for it at Bitcoin Cash Future Price 2025.

Ultimately, analyzing Bitcoin Cash’s predicted growth helps form a more comprehensive view when speculating about the BTC price in June 2025.

Predicting the BTC price in June 2025 is challenging, given the inherent volatility of the cryptocurrency market. Understanding related altcoin predictions can offer some context; for instance, you might find the insights in this report on the Bitcoin Diamond Price Prediction 2025 helpful. Ultimately, however, the BTC price in June 2025 will depend on a multitude of factors, making any prediction speculative.

Predicting the BTC price in June 2025 is challenging, given the inherent volatility of the cryptocurrency market. To gain a broader perspective on potential price movements, it’s helpful to consider longer-term forecasts; for example, check out this resource on Bitcoin Coin Price 2025 which offers insights into various prediction models. Understanding these broader trends can help contextualize any speculation about the BTC price in June 2025.

Predicting the BTC price in June 2025 is challenging, involving numerous factors influencing market volatility. To understand potential AUD valuations, it’s helpful to consider broader predictions for the year; a useful resource for this is the projection available at Bitcoin Price 2025 Aud. Ultimately, the Bitcoin price in June 2025 will depend on the overall market sentiment and technological advancements within the cryptocurrency space.

Speculating on the BTC price in June 2025 is inherently challenging, given the volatile nature of the cryptocurrency market. For a comprehensive perspective on potential price movements, it’s helpful to consult resources like the Bitcoin Price Prediction 2025 Walletinvestor analysis. Understanding their predictions can inform your own assessment of the BTC price in June 2025, though remember that all predictions carry inherent uncertainty.