BTC Price Predictions for March 2025

Bitcoin, the world’s most prominent cryptocurrency, has captivated investors and technologists alike with its volatile price swings. Predicting its future value, particularly for a specific date like March 2025, presents a significant challenge, yet the potential rewards drive continued attempts at forecasting. Understanding the inherent risks and the factors influencing Bitcoin’s price is crucial for navigating this unpredictable market.

The price of Bitcoin is a complex interplay of several factors. Regulatory landscapes across different jurisdictions significantly impact market confidence and trading volumes. Technological advancements, such as the implementation of layer-2 scaling solutions or the development of new consensus mechanisms, can influence transaction speeds, fees, and overall network efficiency, thus affecting Bitcoin’s value proposition. Market sentiment, driven by news events, social media trends, and overall economic conditions, plays a pivotal role in shaping investor behavior and consequently, price fluctuations. Furthermore, macroeconomic factors such as inflation rates, interest rate changes, and geopolitical events can significantly influence investor appetite for risk assets like Bitcoin.

Challenges in Accurately Predicting Bitcoin’s Price

Accurately predicting Bitcoin’s price is exceptionally difficult due to its inherent volatility and the influence of numerous unpredictable factors. Unlike traditional assets with established historical patterns and relatively predictable valuation models, Bitcoin’s relatively short history and unique characteristics make precise forecasting exceptionally challenging. For example, unexpected regulatory changes, a sudden surge in adoption, or a major security breach could dramatically alter the price trajectory, rendering even the most sophisticated models inaccurate. Furthermore, the cryptocurrency market is highly susceptible to speculative trading and market manipulation, adding another layer of complexity to price prediction. The lack of a centralized authority controlling Bitcoin further exacerbates the difficulty in forecasting, as there’s no single entity influencing price movements in a predictable manner. Consider, for instance, the dramatic price swings Bitcoin experienced in 2021 and 2022, highlighting the unpredictable nature of the market and the limitations of predictive models. These fluctuations, often driven by factors external to Bitcoin’s underlying technology, demonstrate the significant challenges in creating accurate long-term price forecasts.

Factors Influencing Bitcoin’s Price in March 2025

Predicting Bitcoin’s price with certainty is impossible, but analyzing potential influencing factors allows for informed speculation. March 2025 is far enough in the future to allow for significant shifts in various economic and technological landscapes, impacting Bitcoin’s value. This analysis examines key factors likely to shape Bitcoin’s price by that time.

Macroeconomic Conditions and Bitcoin’s Value

Global macroeconomic conditions, specifically inflation and interest rates, will significantly influence Bitcoin’s price in March 2025. High inflation often drives investors towards alternative assets like Bitcoin, perceived as a hedge against inflation. Conversely, rising interest rates can make holding Bitcoin less attractive, as the opportunity cost of holding a non-yielding asset increases. For example, if inflation remains stubbornly high in 2024, pushing central banks to maintain aggressive interest rate hikes, Bitcoin’s price might be negatively impacted. However, a scenario of controlled inflation coupled with a stabilization of interest rates could create a more favorable environment for Bitcoin, potentially leading to price appreciation. The interplay between these two factors will be crucial.

Technological Developments and Bitcoin Adoption

Technological advancements, particularly in layer-2 scaling solutions, will play a pivotal role. Improved scalability, lower transaction fees, and increased transaction speeds offered by solutions like the Lightning Network could lead to wider adoption and increased utility, potentially boosting Bitcoin’s price. Similarly, increased institutional adoption, driven by the development of robust custodial solutions and regulatory clarity, could inject significant capital into the market. Consider the potential impact of a major financial institution launching a Bitcoin-backed ETF; such an event could trigger a substantial price surge.

Regulatory Frameworks and Government Policies

Government regulations and policies will undeniably influence Bitcoin’s price trajectory. Favorable regulatory frameworks, such as clear guidelines on taxation and custodial services, could encourage institutional investment and broader adoption, driving up the price. Conversely, restrictive regulations or outright bans could severely limit Bitcoin’s growth and negatively impact its price. The regulatory landscape in major economies like the US, China, and the EU will be particularly significant. For example, a clear, consistent regulatory framework in the US could unlock substantial institutional investment.

Impact of Significant Global Events

Geopolitical instability, economic crises, and unexpected global events can significantly influence Bitcoin’s price. During times of uncertainty, investors often seek safe haven assets, and Bitcoin, due to its decentralized nature, might be viewed as a store of value. However, a major global crisis could trigger a sell-off across all asset classes, including Bitcoin. The 2008 financial crisis, for example, initially led to a decline in Bitcoin’s value before it began its recovery and subsequent rise. The response of investors to such events will depend heavily on the specific nature and severity of the crisis.

Adoption Scenarios and Price Implications

The extent of Bitcoin’s adoption will profoundly affect its price. Widespread institutional adoption, fueled by factors like regulatory clarity and technological advancements, could lead to a substantial price increase, possibly reaching price points significantly higher than current predictions. Conversely, limited retail adoption, coupled with regulatory headwinds, could restrict Bitcoin’s price appreciation or even lead to price stagnation. The difference between these two scenarios could be measured in the billions of dollars of market capitalization.

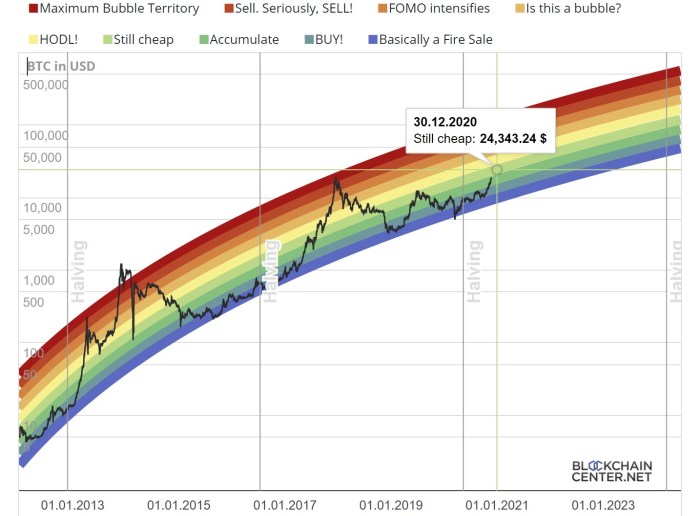

Analyzing Historical Bitcoin Price Trends

Bitcoin’s price history is characterized by periods of dramatic growth (bull markets) punctuated by sharp corrections (bear markets). Understanding these cycles, their durations, and the factors driving them is crucial for informed speculation about future price movements. Analyzing past trends allows us to identify potential patterns, although it’s vital to remember that past performance is not indicative of future results. The cryptocurrency market remains highly volatile and susceptible to unforeseen events.

Analyzing historical Bitcoin price data reveals recurring patterns of exponential growth followed by significant corrections. These cycles, though not perfectly predictable, exhibit some common characteristics in terms of duration and price action. Studying these patterns helps us understand the potential for both substantial gains and considerable losses within the Bitcoin market. We can compare the current market’s conditions to previous cycles to gain insights into the potential trajectory of Bitcoin’s price in March 2025.

Key Historical Price Trends and Patterns

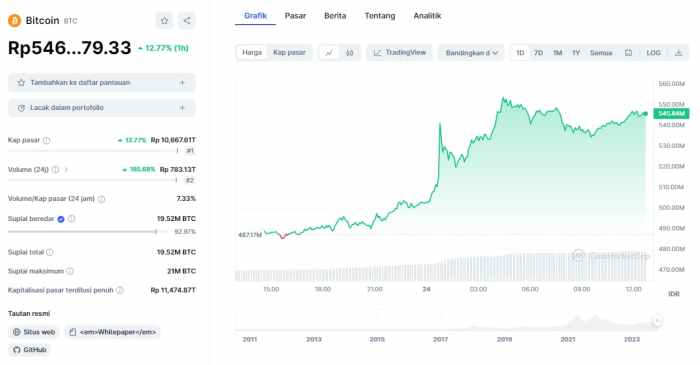

Bitcoin’s price has exhibited several distinct bull and bear market cycles since its inception. The first major bull run occurred in 2013, peaking at around $1,100 before a significant correction. Subsequent bull runs were witnessed in 2017, reaching almost $20,000, and again in 2021, surpassing $60,000. Each bull market was followed by a protracted bear market, with price declines ranging from 50% to over 80%. These cycles are generally characterized by periods of intense speculation and hype during bull markets, followed by periods of market consolidation and fear during bear markets. The duration of these cycles has varied, but they typically last between one and three years.

Previous Market Cycles and Their Relevance

The 2013, 2017, and 2021 bull markets share several similarities. Each began with a period of gradual price appreciation, followed by a phase of rapid, exponential growth fueled by increasing media attention, institutional investment, and retail investor enthusiasm. The subsequent bear markets were characterized by decreased trading volume, negative news sentiment, and a general loss of confidence. Comparing the current market conditions to these past cycles can help identify potential parallels and divergences. For instance, the current level of institutional adoption might influence the duration and intensity of the next bull market.

Comparison of Current Market Conditions with Previous Cycles

Currently, the market exhibits [describe current market conditions – e.g., signs of increasing regulatory scrutiny, growing institutional interest, macroeconomic factors affecting risk appetite]. Comparing this to previous cycles, we can observe [describe similarities and differences – e.g., similarities in regulatory uncertainty, differences in the level of institutional adoption]. For example, the 2017 bull run was heavily driven by retail investor speculation, while the 2021 bull run saw greater participation from institutional investors. Understanding these nuances is critical for forecasting future price movements.

Key Bitcoin Price Movements and Associated Events

| Year | Event | Approximate Price (USD) | Market Sentiment |

|---|---|---|---|

| 2013 | First major bull run | ~$1,100 (peak) | Extremely bullish, followed by significant fear |

| 2017 | Second major bull run | ~$20,000 (peak) | Extremely bullish, widespread media coverage, followed by a sharp correction |

| 2021 | Third major bull run | ~$60,000+ (peak) | Bullish, increased institutional investment, followed by a significant downturn |

| 2022-Present | Bear Market | Variable, significantly lower than previous peaks | Bearish, high volatility, uncertainty about future trends |

Expert Opinions and Market Sentiment: Btc Price March 2025

Predicting Bitcoin’s price is inherently speculative, yet analyzing expert opinions and prevailing market sentiment offers valuable insights into potential price movements in March 2025. The confluence of various forecasting models, analyst predictions, and overall market sentiment paints a complex picture, highlighting the uncertainties inherent in cryptocurrency markets.

Expert opinions on Bitcoin’s price in March 2025 are diverse, reflecting the inherent volatility and unpredictable nature of the cryptocurrency market. While some analysts maintain a bullish outlook, citing factors like increasing institutional adoption and technological advancements, others express caution, pointing to potential regulatory hurdles and macroeconomic uncertainties. The range of predictions is significant, illustrating the challenges in accurately forecasting Bitcoin’s future price.

Prominent Analyst Predictions

A variety of prominent crypto analysts and economists have offered their perspectives on Bitcoin’s price trajectory. For example, some analysts, basing their predictions on historical price cycles and technological advancements, predict a price exceeding $100,000, citing the potential for Bitcoin to become a more widely accepted store of value. Conversely, other analysts, considering macroeconomic factors like inflation and potential regulatory crackdowns, have suggested more conservative price targets, perhaps in the range of $50,000 to $70,000. These varying predictions highlight the inherent uncertainty in the market and the wide range of possible outcomes. It’s crucial to remember that these are just predictions, and the actual price could differ significantly.

Market Sentiment and its Impact

Market sentiment plays a crucial role in influencing Bitcoin’s price. A predominantly bullish sentiment, fueled by positive news and investor confidence, can drive prices upward. Conversely, a bearish sentiment, often triggered by negative news or market corrections, can lead to price declines. Currently, the market sentiment is relatively mixed, with some investors expressing optimism about Bitcoin’s long-term potential while others remain cautious due to macroeconomic uncertainties and regulatory concerns. This mixed sentiment reflects the ongoing debate surrounding Bitcoin’s future and the diverse perspectives of market participants. The interplay between bullish and bearish sentiment can create significant price volatility.

Comparison of Forecasting Models

Several forecasting models are employed to predict Bitcoin’s price. These include technical analysis, which relies on historical price charts and trading volume to identify patterns and predict future price movements; fundamental analysis, which considers factors such as adoption rates, technological advancements, and regulatory developments; and quantitative models, which use mathematical algorithms and statistical methods to forecast prices. Each model has its strengths and weaknesses, and the accuracy of their predictions varies significantly. For instance, technical analysis might accurately predict short-term price fluctuations but may struggle to anticipate long-term trends. Conversely, fundamental analysis might provide a better understanding of long-term price drivers but might overlook short-term market sentiment swings.

Visual Representation of Price Predictions

Imagine a bar chart with the horizontal axis representing different analysts or forecasting models and the vertical axis representing Bitcoin’s price in March 2025 (in USD). Each bar represents the price prediction from a specific source. Some bars might reach well above $100,000, reflecting the optimistic predictions, while others might cluster around the $50,000 to $70,000 range, illustrating more conservative forecasts. The chart would visually demonstrate the wide range of predictions and the uncertainty surrounding Bitcoin’s future price. The visual would also highlight the dispersion of predictions, emphasizing the difficulty in arriving at a single, definitive forecast. The chart would not include specific names of analysts to maintain generality, but the visual representation would be clear and effective in communicating the range of predictions.

Potential Price Scenarios for March 2025

Predicting the price of Bitcoin is inherently speculative, but by analyzing various factors and constructing plausible scenarios, we can gain a better understanding of potential price movements by March 2025. The following Artikels three distinct scenarios: a bullish, a bearish, and a neutral outlook, each based on different underlying assumptions and market conditions.

Bullish Scenario: Bitcoin Surges Past $100,000

This scenario envisions a significant surge in Bitcoin’s price, potentially exceeding $100,000 by March 2025. This optimistic outlook rests on several key assumptions. Firstly, widespread institutional adoption continues to accelerate, with major corporations and financial institutions increasing their Bitcoin holdings. Secondly, regulatory clarity emerges in key jurisdictions, reducing uncertainty and fostering greater investor confidence. Thirdly, the development and adoption of Bitcoin-related technologies, such as the Lightning Network, improve scalability and transaction speeds, making Bitcoin more user-friendly and attractive to a wider range of users. Finally, macroeconomic factors, such as persistent inflation and geopolitical instability, could drive further investment into Bitcoin as a safe-haven asset. This surge would likely have a positive ripple effect on the broader cryptocurrency market, attracting new investors and fueling further innovation.

Bearish Scenario: Bitcoin Price Falls Below $20,000

Conversely, a bearish scenario sees Bitcoin’s price falling below $20,000 by March 2025. This pessimistic outlook is predicated on several factors. Firstly, a major regulatory crackdown on cryptocurrencies in key markets could significantly dampen investor enthusiasm and reduce trading volume. Secondly, a prolonged period of macroeconomic stability, potentially leading to lower inflation, could diminish Bitcoin’s appeal as a hedge against inflation. Thirdly, the emergence of a superior competing cryptocurrency or technology could divert investment away from Bitcoin. Finally, a significant security breach or a major market manipulation event could erode investor confidence and trigger a price decline. This scenario would likely have a negative impact on the broader cryptocurrency market, leading to decreased investor participation and a potential “crypto winter.”

Neutral Scenario: Bitcoin Consolidates Around $40,000 – $60,000

A neutral scenario suggests that Bitcoin’s price will consolidate within a range of $40,000 to $60,000 by March 2025. This scenario assumes a relatively stable macroeconomic environment, with moderate institutional adoption and continued regulatory uncertainty. Technological advancements would continue, but their impact on price would be less dramatic than in the bullish scenario. Investor sentiment would be mixed, with some investors remaining cautious while others continue to hold Bitcoin as a long-term investment. This scenario represents a period of sideways movement, with potential for both upward and downward price swings within the defined range. The broader cryptocurrency market would likely experience moderate growth, with a focus on innovation and utility rather than speculative price increases.

Comparison of Price Scenarios

| Scenario | Price Range (March 2025) | Key Drivers | Potential Impacts |

|---|---|---|---|

| Bullish | >$100,000 | Widespread institutional adoption, regulatory clarity, technological advancements, macroeconomic instability | Significant positive impact on the broader cryptocurrency market, increased investor confidence, further innovation |

| Bearish | <$20,000 | Regulatory crackdown, macroeconomic stability, emergence of competing technologies, security breaches | Negative impact on the broader cryptocurrency market, decreased investor confidence, potential “crypto winter” |

| Neutral | $40,000 – $60,000 | Moderate institutional adoption, continued regulatory uncertainty, steady technological advancements, mixed investor sentiment | Moderate growth in the broader cryptocurrency market, focus on innovation and utility |

Risks and Uncertainties

Predicting Bitcoin’s price in March 2025, or any future date, is inherently fraught with risk and uncertainty. The cryptocurrency market is notoriously volatile, influenced by a complex interplay of factors that are often difficult to anticipate accurately. Forecasting models, while helpful, possess limitations that must be acknowledged.

The inherent volatility of the cryptocurrency market makes precise price prediction extremely challenging. Numerous unpredictable events can significantly alter the trajectory of Bitcoin’s price, rendering even the most sophisticated models inaccurate. Understanding these limitations and potential pitfalls is crucial for anyone attempting to navigate the Bitcoin market.

Limitations of Forecasting Models

Bitcoin’s price is influenced by a vast array of factors, including regulatory changes, technological advancements, macroeconomic conditions, and market sentiment. Many forecasting models rely on historical data and statistical analysis, but the cryptocurrency market is relatively young and has experienced periods of unprecedented growth and dramatic crashes. This makes extrapolating past trends to predict future performance unreliable. Furthermore, these models often fail to account for unforeseen events, such as a major security breach or a significant policy shift from a major government. For example, the collapse of FTX in 2022 demonstrated the potential for a single event to trigger a significant market downturn, something many models would not have predicted.

Potential for Unforeseen Events

The cryptocurrency market is susceptible to unexpected shocks. Black swan events – highly improbable but potentially devastating occurrences – are a significant risk. These could include significant regulatory crackdowns, large-scale hacks, the emergence of a competing cryptocurrency with superior technology, or unexpected geopolitical events. For instance, the COVID-19 pandemic initially caused a significant dip in Bitcoin’s price before a subsequent rebound, highlighting the market’s sensitivity to global crises. Similarly, the ongoing war in Ukraine has created uncertainty in global markets, impacting the price of Bitcoin and other assets.

Strategies for Mitigating Risk

Given the inherent risks, investors should adopt a risk-management strategy. Diversification is key; don’t put all your eggs in one basket. Investing only a portion of your portfolio in Bitcoin, alongside other asset classes, can help mitigate losses if the price declines. Furthermore, understanding your risk tolerance is crucial. Only invest an amount you are comfortable losing entirely. Regularly reviewing your investment strategy and adjusting it based on market conditions and your own financial situation is also recommended. Staying informed about market trends and potential risks through reliable news sources and analysis is essential for making informed investment decisions. Finally, adopting a long-term perspective can help reduce the impact of short-term price fluctuations. The volatility of Bitcoin is a double-edged sword; while it presents risks, it also offers opportunities for significant gains over the long term.

Investing in Bitcoin

Investing in Bitcoin, like any other asset class, requires a careful and informed approach. Understanding the inherent volatility and potential risks is crucial before committing any capital. Successful Bitcoin investment hinges on a well-defined strategy, diligent risk management, and a realistic understanding of market dynamics.

Responsible Investment Strategies for Bitcoin

Successful Bitcoin investment necessitates a robust strategy encompassing risk management and diversification. Ignoring these fundamental principles can lead to significant losses. A well-structured plan should account for your personal risk tolerance, financial goals, and investment timeline. Avoid investing more than you can afford to lose, as Bitcoin’s price is notoriously volatile.

Diversification and Risk Management

Diversification is paramount in mitigating risk. Don’t put all your eggs in one basket. Allocate only a portion of your investment portfolio to Bitcoin, balancing it with other assets like stocks, bonds, or real estate. This strategy helps reduce the impact of potential Bitcoin price crashes on your overall financial health. Effective risk management involves setting stop-loss orders to limit potential losses and regularly reviewing your investment strategy to adapt to changing market conditions. For instance, if you’re heavily invested in Bitcoin and the market shows signs of a significant downturn, you might consider selling a portion of your holdings to reduce exposure.

Investment Approaches

Several approaches exist for investing in Bitcoin, each with its own risk profile and potential rewards.

Long-Term Holding

This strategy, often referred to as “hodling,” involves buying and holding Bitcoin for an extended period, typically years, regardless of short-term price fluctuations. The rationale is that Bitcoin’s long-term value will appreciate significantly. This approach requires patience and a high risk tolerance, as it can withstand periods of considerable price volatility. For example, an investor who bought Bitcoin in 2011 and held onto it through the various market cycles would have seen substantial returns despite significant price dips along the way.

Short-Term Trading

Short-term trading involves buying and selling Bitcoin frequently to capitalize on short-term price movements. This requires significant market knowledge, technical analysis skills, and a higher risk tolerance. The potential for high returns exists, but so does the risk of significant losses if market predictions are inaccurate. This approach demands constant monitoring of the market and a keen understanding of technical indicators.

Potential Benefits and Drawbacks of Investing in Bitcoin

Bitcoin presents both significant potential benefits and drawbacks.

Benefits

Potential for high returns: Bitcoin’s price has historically experienced periods of significant growth.

Decentralization and security: Bitcoin operates on a decentralized network, making it resistant to censorship and single points of failure.

Accessibility: Bitcoin can be accessed globally, offering investment opportunities regardless of geographical location.

Drawbacks

High volatility: Bitcoin’s price is highly volatile, subject to significant fluctuations.

Regulatory uncertainty: The regulatory landscape surrounding Bitcoin is still evolving, creating uncertainty for investors.

Security risks: Investors need to take precautions to secure their Bitcoin holdings to prevent theft or loss. This includes using secure wallets and practicing good cybersecurity habits. Examples of security breaches resulting in significant losses for investors highlight the importance of robust security measures.

FAQ

This section addresses frequently asked questions regarding Bitcoin’s price in March 2025, encompassing various influencing factors, potential risks, and mitigation strategies. Understanding these aspects is crucial for informed decision-making in the volatile cryptocurrency market.

Factors Influencing Bitcoin’s Price in March 2025

Several interconnected factors will likely shape Bitcoin’s price in March 2025. These include macroeconomic conditions (global inflation rates, interest rate policies, and recessionary fears), regulatory developments (government policies on cryptocurrency adoption and taxation), technological advancements (scaling solutions and network upgrades), market sentiment (investor confidence and media coverage), and the overall adoption rate of Bitcoin as a payment method and store of value. For instance, a global economic downturn could lead to increased demand for Bitcoin as a hedge against inflation, while stringent regulations could dampen investor enthusiasm. Conversely, successful scaling solutions could boost transaction speeds and reduce fees, increasing Bitcoin’s usability and appeal.

Potential Risks of Investing in Bitcoin, Btc Price March 2025

Investing in Bitcoin carries inherent risks. Volatility is a primary concern, with Bitcoin’s price experiencing significant fluctuations in short periods. This volatility can lead to substantial losses for investors. Security risks, including hacking and theft from exchanges or personal wallets, are also significant. Regulatory uncertainty, with governments worldwide still grappling with how to regulate cryptocurrencies, adds another layer of risk. Finally, the relatively young age of Bitcoin and the lack of intrinsic value compared to traditional assets like gold or real estate present considerable uncertainty for potential investors. Consider the case of Mt. Gox, a major Bitcoin exchange that was hacked in 2014, resulting in significant losses for its users. This exemplifies the security risks associated with cryptocurrency investments.

Realistic Price Predictions for Bitcoin in March 2025

Predicting Bitcoin’s price with certainty is impossible. However, considering historical trends, technological advancements, and market sentiment, several scenarios are plausible. Bullish predictions suggest prices exceeding $100,000, fueled by widespread adoption and positive macroeconomic conditions. Bearish predictions, on the other hand, anticipate prices below $50,000, possibly due to regulatory crackdowns or a prolonged economic downturn. A more neutral scenario suggests a price range between $50,000 and $100,000, reflecting a balance between positive and negative influences. These predictions should be viewed as potential outcomes, not guaranteed results. For example, the price of Bitcoin in March 2020 was around $5,000, while it reached approximately $69,000 by November 2021, demonstrating the significant price swings possible within a relatively short time frame.

Mitigating Risks Associated with Investing in Bitcoin

Several strategies can help mitigate the risks of Bitcoin investment. Diversification across different asset classes (not putting all your eggs in one basket) is crucial. Only invest what you can afford to lose, recognizing the potential for significant price drops. Secure storage of your Bitcoin using hardware wallets or reputable exchanges is vital to reduce the risk of theft or loss. Staying informed about market trends, regulatory developments, and technological advancements through reputable sources helps make more informed decisions. Consider dollar-cost averaging (investing a fixed amount at regular intervals) to reduce the impact of volatility. Finally, seeking advice from qualified financial advisors can provide valuable insights and guidance.

Key Differences Between Bullish, Bearish, and Neutral Scenarios for Bitcoin’s Price

The bullish scenario envisions significant price appreciation, driven by factors such as widespread adoption, positive regulatory developments, and strong macroeconomic conditions. This would lead to prices significantly exceeding current levels. The bearish scenario anticipates price declines due to factors like regulatory crackdowns, negative macroeconomic conditions, or a loss of investor confidence. This would result in prices falling below current levels. The neutral scenario represents a balanced outlook, with price movements relatively moderate, reflecting a mix of positive and negative factors, leading to price stabilization or modest growth within a defined range. Each scenario carries different implications for investors, highlighting the importance of understanding the underlying factors driving each prediction.

Btc Price March 2025 – Predicting the BTC price in March 2025 is challenging, relying heavily on various market factors. To gain a broader perspective on potential price movements, understanding the overall trajectory of the Bitcoin Price In 2025 Year is crucial, which you can explore further by visiting this insightful resource: Bitcoin Price In 2025 Year. Ultimately, the BTC price in March 2025 will depend on the broader trends established throughout the year.

Predicting the BTC price in March 2025 is challenging, given the inherent volatility of the cryptocurrency market. To gain a better understanding of potential future values, it’s helpful to consider broader predictions; for example, you might find the analysis at What Will Bitcoin Be Worth 2025 insightful. Ultimately, the BTC price in March 2025 will depend on a confluence of factors, including regulatory changes and overall market sentiment.

Predicting the Bitcoin price in March 2025 is inherently speculative, relying on numerous factors like adoption rates and regulatory changes. For diverse perspectives and community discussions on this volatile market, check out the insightful threads on Bitcoin Price 2025 Reddit , which often offer a wide range of opinions. Ultimately, the BTC price in March 2025 will depend on the collective market sentiment and technological advancements within the crypto space.

Predicting the Bitcoin price in March 2025 is challenging, but several factors could influence its value. Understanding the broader implications of a potential surge is crucial, and for a comprehensive analysis, you should refer to this insightful resource on Bitcoin Price Surge 2025 Implications. Considering the information provided there, we can better contextualize potential price movements for Bitcoin in March 2025, and assess the overall market sentiment.

Predicting the Bitcoin price in March 2025 is inherently speculative, but understanding broader market trends is crucial. To gain some insight into potential price ranges, it’s helpful to consider the bigger picture; a resource like How Much Will Bitcoin Be Worth 2025 offers valuable perspectives. Ultimately, the BTC price in March 2025 will depend on a confluence of factors including adoption rates and regulatory changes.