BTC Price Prediction 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, relying on numerous interconnected factors. However, by analyzing historical trends, considering macroeconomic influences, and evaluating technological advancements, we can formulate potential scenarios for a bullish run. This analysis will examine contributing factors, historical patterns, contrasting prediction models, and the impact of external forces on Bitcoin’s future price.

Factors Contributing to a 2025 Bitcoin Bull Run

Several factors could contribute to a Bitcoin bull run in 2025. Increased institutional adoption, driven by regulatory clarity and the maturation of Bitcoin as an asset class, could significantly boost demand. Growing global adoption in emerging markets, coupled with continued technological innovation, such as the development of the Lightning Network for faster and cheaper transactions, will likely play a significant role. Furthermore, a potential macroeconomic shift, such as persistent inflation or geopolitical instability, could increase Bitcoin’s appeal as a hedge against traditional assets. Finally, the halving event scheduled for 2024, reducing the rate of new Bitcoin creation, historically precedes periods of price appreciation.

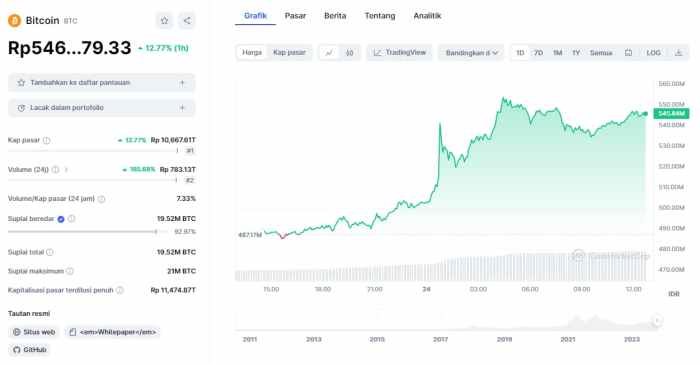

Analysis of Historical Bitcoin Price Trends, Btc Price Prediction 2025 Bull Run

Bitcoin’s price history reveals cyclical patterns, characterized by periods of rapid growth (bull runs) followed by corrections (bear markets). Analyzing these cycles, particularly the time between halving events and subsequent price surges, can provide insights into potential future price movements. The 2012 and 2016 halvings were followed by substantial price increases, suggesting a potential for similar growth after the 2024 halving. However, it’s crucial to remember that past performance is not indicative of future results, and other factors significantly influence price.

Comparison of Bitcoin Price Prediction Models

Various prediction models exist, ranging from technical analysis based on chart patterns and indicators to fundamental analysis focusing on adoption rates and network metrics. Some models predict extremely high prices in 2025, while others offer more conservative estimates. Discrepancies arise from differing assumptions about adoption rates, regulatory developments, and macroeconomic conditions. For example, models relying heavily on network effects might predict higher prices than those emphasizing potential regulatory headwinds.

Impact of Macroeconomic Factors on Bitcoin’s Price

Macroeconomic factors, such as inflation, interest rates, and global economic growth, exert significant influence on Bitcoin’s price. High inflation, for example, could drive investors towards Bitcoin as an inflation hedge, increasing demand and potentially pushing prices higher. Conversely, rising interest rates might divert investment away from riskier assets like Bitcoin, leading to price declines. Geopolitical events and global economic uncertainty can also significantly impact investor sentiment and, consequently, Bitcoin’s price.

Role of Technological Advancements

Technological advancements within the Bitcoin ecosystem play a crucial role in shaping its price trajectory. Improvements in scalability, such as the adoption of the Lightning Network, can enhance Bitcoin’s usability and potentially drive broader adoption. Developments in privacy-enhancing technologies could also increase Bitcoin’s appeal to a wider range of users. Conversely, technological setbacks or security vulnerabilities could negatively impact investor confidence and lead to price drops.

Bullish and Bearish Bitcoin Price Predictions for 2025

| Prediction Source | Predicted Price | Rationale | Date of Prediction |

|---|---|---|---|

| Analyst A (Example) | $150,000 | Based on historical halving cycles and increasing institutional adoption. | October 26, 2023 |

| Analyst B (Example) | $75,000 | More conservative estimate, considering potential regulatory uncertainty. | November 15, 2023 |

| Research Firm X (Example) | $200,000 | Model based on network growth and adoption in emerging markets. | December 1, 2023 |

| Research Firm Y (Example) | $50,000 | Predicts a prolonged bear market due to macroeconomic headwinds. | December 10, 2023 |

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently complex, relying on a confluence of factors that interact in unpredictable ways. While no one can definitively state the price, understanding these influential elements provides a framework for informed speculation. This analysis explores key drivers likely to shape Bitcoin’s trajectory.

Regulatory Changes and Bitcoin’s Price

Regulatory clarity and acceptance are pivotal to Bitcoin’s mainstream adoption. More defined regulatory frameworks, whether supportive or restrictive, will significantly impact investor confidence and market liquidity. For example, a clear regulatory path in major economies like the US and EU could unlock substantial institutional investment, driving price appreciation. Conversely, overly restrictive regulations could stifle growth and depress prices. The ongoing evolution of regulatory landscapes globally will be a major determinant of Bitcoin’s price in 2025. The introduction of a comprehensive regulatory framework in a large market, like the US, could lead to a significant price surge, mirroring the positive effects seen in some countries that have embraced cryptocurrencies. Conversely, a sudden crackdown on cryptocurrency trading in a key market could result in a substantial price drop.

Technological Developments and Bitcoin’s Value

Technological advancements within the Bitcoin ecosystem will also play a significant role. Improvements in scalability, such as the Lightning Network’s wider adoption, could enhance Bitcoin’s usability and transaction speed, potentially boosting demand. Conversely, the emergence of competing cryptocurrencies with superior technological features could divert investment and negatively impact Bitcoin’s value. The successful implementation of layer-2 scaling solutions, like the Lightning Network, could significantly reduce transaction fees and increase transaction speeds, making Bitcoin more attractive for everyday use and potentially driving up demand. On the other hand, breakthroughs in blockchain technology that create superior alternatives to Bitcoin could lead to a decline in its market share and value.

Institutional Adoption and Bitcoin’s Price

Increasing institutional adoption is a crucial factor. Continued investment from large corporations, hedge funds, and other institutional players can inject significant capital into the market, driving up demand and prices. However, a sudden shift in institutional sentiment, driven by factors like economic downturns or regulatory changes, could lead to significant sell-offs. For instance, the increased adoption of Bitcoin as a reserve asset by major corporations like MicroStrategy has historically been associated with price increases. Conversely, a mass sell-off by institutional investors, triggered by a negative market event, could lead to a significant price correction.

Market Sentiment and Public Perception

Market sentiment and public perception are powerful forces shaping Bitcoin’s price. Positive media coverage, successful adoption cases, and increasing public awareness can fuel a bull market. Conversely, negative news, regulatory uncertainty, or security breaches can trigger sharp price declines. For example, positive news surrounding Bitcoin’s environmental impact or its use in decentralized finance (DeFi) applications can boost investor confidence and lead to price increases. Conversely, a major security breach on a major exchange or negative regulatory news can cause a significant price drop.

Bitcoin’s Supply and Demand Dynamics

Bitcoin’s fixed supply of 21 million coins is a fundamental factor influencing its price. As demand increases while the supply remains capped, scarcity drives price appreciation. However, factors like the rate of Bitcoin adoption and the emergence of competing cryptocurrencies can affect the overall demand. The halving events, which reduce the rate of new Bitcoin creation, are known to have historically led to bull runs. The predictable nature of Bitcoin’s supply, coupled with the potential for increased demand, makes it a potentially valuable asset in the long term.

Potential Catalysts for a Bitcoin Bull Run in 2025

Several events could catalyze a Bitcoin bull run in 2025. The impact level is subjective and depends on various interconnected factors.

- High Impact:

- Widespread institutional adoption by major financial institutions.

- Positive regulatory developments in major global economies.

- Significant technological advancements improving scalability and usability.

- Medium Impact:

- Increased adoption of Bitcoin as a payment method by businesses.

- Growing integration of Bitcoin into traditional financial systems.

- Positive media coverage and increased public awareness.

- Low Impact:

- Minor technological upgrades within the Bitcoin ecosystem.

- Localized regulatory changes in smaller markets.

- Short-term fluctuations in market sentiment.

Potential Risks and Challenges for Bitcoin in 2025: Btc Price Prediction 2025 Bull Run

Investing in Bitcoin, while potentially lucrative, carries inherent risks. Understanding these risks is crucial for any investor considering exposure to this volatile asset class. The cryptocurrency market is susceptible to various factors, both internal and external, that can significantly impact its price and overall stability. This section will explore some of the key potential risks and challenges Bitcoin might face in 2025.

Regulatory Uncertainty and Government Intervention

Government regulation remains a significant unknown for Bitcoin. Increased regulatory scrutiny, differing regulations across jurisdictions, or outright bans could drastically reduce Bitcoin’s accessibility and liquidity. For example, a coordinated global crackdown on cryptocurrency exchanges or a strict ban in a major market like the United States could trigger a significant price drop. The uncertainty surrounding future regulatory frameworks presents a substantial risk for investors. The lack of a unified global regulatory approach creates a complex and unpredictable landscape for Bitcoin’s future.

Market Volatility and Price Fluctuations

Bitcoin’s price is notoriously volatile, subject to dramatic swings driven by various factors including news events, market sentiment, and technological advancements. Past instances like the 2018 bear market or the 2021 bull run illustrate the potential for extreme price volatility. A sudden negative news event, a major security breach, or a shift in investor sentiment could easily lead to significant price declines in 2025. Investors need to be prepared for substantial short-term losses.

Cybersecurity Threats and Hacks

The decentralized nature of Bitcoin doesn’t eliminate the risk of theft or loss. Exchanges and individual wallets remain vulnerable to hacking and theft. A large-scale attack on a major exchange, similar to the Mt. Gox incident, could erode investor confidence and negatively impact the price. Moreover, the increasing sophistication of cyberattacks poses an ongoing threat to the security of Bitcoin transactions and holdings. The potential for significant losses due to hacking and theft should not be underestimated.

Market Manipulation and Price Artificial Inflation

The relatively small size of the Bitcoin market compared to traditional financial markets makes it potentially vulnerable to manipulation. Large holders or coordinated groups could artificially inflate or deflate the price for their own benefit. Evidence of past manipulation attempts, although difficult to definitively prove, raises concerns about the integrity of the market. Such actions can lead to significant price swings, potentially harming unsuspecting investors.

Technological Risks and Scalability Issues

Bitcoin’s scalability continues to be a subject of debate. The network’s transaction speed and capacity limitations could hinder its wider adoption and potentially impact its price. Furthermore, the development of competing cryptocurrencies with superior technological features could attract investors away from Bitcoin, leading to a decrease in its value. Technological advancements and the emergence of alternative solutions pose a continuous challenge to Bitcoin’s dominance.

Visual Representation of Bitcoin Risks in 2025

A circular diagram, resembling a target, could effectively illustrate the various risks. The bullseye represents the core Bitcoin value proposition, while concentric circles represent increasing levels of risk. The innermost circle could list inherent volatility. The next circle would include regulatory uncertainty and cybersecurity threats. The outermost circle could show broader macroeconomic factors, such as inflation and global economic downturns, along with market manipulation and technological challenges. Each risk factor could be labeled clearly, with the size of the text or the width of the circle reflecting its relative importance. This visual representation would provide a concise overview of the multifaceted risks associated with Bitcoin investment in 2025.

Bitcoin’s Long-Term Outlook Beyond 2025

Bitcoin’s future beyond 2025 hinges on several interconnected factors, ranging from its adoption as a mainstream asset to its role in a potentially evolving global financial landscape. While predicting the future with certainty is impossible, analyzing current trends and potential developments allows for a reasoned assessment of Bitcoin’s long-term trajectory. Its success will depend on navigating technological advancements, regulatory changes, and evolving societal perceptions.

Bitcoin as a Store of Value

Bitcoin’s inherent scarcity, limited to 21 million coins, is a key factor contributing to its potential as a long-term store of value. Unlike fiat currencies susceptible to inflation through government printing, Bitcoin’s fixed supply makes it a hedge against monetary debasement. This characteristic has drawn considerable interest from investors seeking to preserve their purchasing power in the face of economic uncertainty. Historically, during periods of high inflation or economic instability, Bitcoin’s price has often risen, demonstrating its potential as a safe haven asset. For example, during periods of global uncertainty, we’ve observed significant price increases for Bitcoin, mirroring the behavior of traditional safe haven assets like gold.

Government and Central Bank Adoption of Bitcoin

The adoption of Bitcoin by governments and central banks remains a complex and uncertain prospect. While some countries are exploring the use of blockchain technology for various applications, widespread adoption of Bitcoin as a legal tender or reserve asset is still unlikely in the near future. However, a gradual shift towards greater acceptance is possible. Central banks are actively researching central bank digital currencies (CBDCs), which could potentially coexist with or even influence Bitcoin’s role in the global financial system. The potential for integration, rather than outright replacement, is a more realistic scenario. For example, El Salvador’s adoption of Bitcoin as legal tender, while controversial, represents a significant, albeit early, step towards government acceptance.

Long-Term Implications of Bitcoin’s Scarcity

Bitcoin’s fixed supply of 21 million coins creates a deflationary pressure, theoretically increasing its value over time as demand grows. This scarcity is a unique characteristic that differentiates it from most other assets. As more people and institutions adopt Bitcoin, the limited supply will inevitably lead to increased competition for the available coins, potentially driving up the price. This scarcity is analogous to the scarcity of precious metals like gold and platinum, which have historically held their value due to their limited supply.

Bitcoin as a Mainstream Financial Asset

The potential for Bitcoin to become a mainstream financial asset is closely tied to its increased adoption and integration into existing financial systems. Greater regulatory clarity, improved user experience, and the development of more robust infrastructure are crucial for driving mainstream adoption. As Bitcoin becomes easier to use and understand, and as its acceptance by financial institutions increases, its potential to become a widely held asset will grow. The increasing number of institutional investors holding Bitcoin signifies a growing acceptance within traditional finance.

Future Uses of Bitcoin Beyond Current Applications

Bitcoin’s potential uses extend beyond its current function as a digital currency and store of value. It could play a role in facilitating cross-border payments, enabling microtransactions, and supporting decentralized applications (dApps). The development of the Lightning Network, for instance, aims to improve the scalability and transaction speed of Bitcoin, making it suitable for a wider range of applications. Furthermore, Bitcoin’s underlying blockchain technology has the potential to be applied in various sectors, from supply chain management to digital identity verification.

Potential Milestones for Bitcoin Adoption and Price Growth Beyond 2025

The following timeline Artikels potential milestones, recognizing that these are speculative and subject to various unforeseen factors:

- 2026-2028: Increased regulatory clarity in key jurisdictions leads to greater institutional adoption and price appreciation. The Lightning Network gains wider adoption, improving Bitcoin’s scalability.

- 2029-2031: Bitcoin becomes a more widely accepted form of payment for goods and services. The development of new use cases for Bitcoin and its underlying blockchain technology accelerates.

- 2032-2035: Significant adoption by emerging markets drives further price growth. Bitcoin’s role in the global financial system becomes more established.

Frequently Asked Questions about BTC Price Prediction 2025

Predicting the price of Bitcoin in 2025, or any time for that matter, is inherently speculative. Numerous factors influence its value, and any prediction carries a significant degree of uncertainty. The following addresses some common questions surrounding Bitcoin’s potential price trajectory in 2025.

Bitcoin’s Most Likely Price in 2025

Predicting a specific Bitcoin price for 2025 is impossible. Numerous analysts offer price targets, ranging from wildly optimistic to cautiously pessimistic. These predictions often rely on various models, including technical analysis, fundamental analysis, and macroeconomic forecasts. However, the cryptocurrency market is highly volatile and susceptible to unforeseen events, rendering precise price predictions unreliable. Instead of focusing on a single number, it’s more prudent to consider a range of possibilities, acknowledging the inherent uncertainty. For example, some analysts might suggest a range between $100,000 and $200,000, while others might predict a lower or higher range, depending on their assumptions and methodologies. The actual price will depend on a complex interplay of factors discussed below.

Factors Significantly Influencing Bitcoin’s Price in 2025

Three key factors will likely dominate Bitcoin’s price action in 2025: global macroeconomic conditions, regulatory developments, and technological advancements within the cryptocurrency ecosystem.

Global macroeconomic conditions, such as inflation rates, interest rates, and overall economic growth, significantly impact Bitcoin’s appeal as an inflation hedge and alternative investment. Periods of high inflation or economic uncertainty often see increased demand for Bitcoin. Conversely, a strong global economy with low inflation could lead to decreased demand.

Regulatory developments across major jurisdictions will heavily influence Bitcoin’s price. Clearer and more favorable regulations could boost investor confidence and market adoption, driving price appreciation. Conversely, stringent or unclear regulations could stifle growth and negatively impact the price. The legal status of Bitcoin in various countries will play a critical role.

Technological advancements within the Bitcoin ecosystem, such as the implementation of the Lightning Network for faster and cheaper transactions, or the development of new applications built on the Bitcoin blockchain, can influence its utility and value proposition. Increased efficiency and scalability can attract more users and investors.

Investment in Bitcoin in Anticipation of a 2025 Bull Run

Investing in Bitcoin in anticipation of a 2025 bull run presents both significant risks and potential rewards. The potential for high returns is undeniable, given Bitcoin’s history of price appreciation. However, the market’s extreme volatility makes it crucial to approach such investments cautiously. Only invest what you can afford to lose. Diversification is key; don’t put all your eggs in one basket. Thoroughly research and understand Bitcoin’s technology, market dynamics, and associated risks before investing. Consider dollar-cost averaging—investing a fixed amount regularly—to mitigate the impact of volatility. Avoid emotional decision-making driven by hype or fear.

Potential Downsides of a Bitcoin Bull Run

While a Bitcoin bull run can be lucrative for investors, it also carries potential downsides. Increased volatility is a major concern; rapid price swings can lead to significant losses for those who fail to manage their risk effectively. Market manipulation, through coordinated buying or selling activity, is another risk. This can lead to artificial price inflations or deflations, impacting investor confidence and potentially triggering market crashes. Finally, a rapid price increase could attract excessive speculation and create a bubble, leading to a subsequent and potentially sharp correction.

Staying Informed about Bitcoin Price Predictions and Market Trends

Staying informed about Bitcoin requires accessing credible and unbiased information sources. Reputable financial news outlets, independent cryptocurrency research firms, and blockchain analytics platforms can provide valuable insights. It’s crucial to be critical of information and avoid sources promoting unrealistic expectations or biased narratives. Focus on understanding the underlying technology and market fundamentals rather than solely relying on short-term price predictions. Following several reliable sources and comparing their perspectives can help form a more balanced view.