Crypto Price Prediction Today 2025

Predicting cryptocurrency prices is notoriously difficult due to the inherent volatility of the market. Unlike traditional assets, cryptocurrency prices are susceptible to rapid and significant fluctuations driven by a complex interplay of factors, making accurate long-term predictions exceptionally challenging. Any attempt at forecasting should be viewed with a healthy dose of skepticism, acknowledging the high degree of uncertainty involved.

The cryptocurrency market is influenced by a multitude of interconnected factors. Regulatory changes, both domestically and internationally, can significantly impact prices. For example, a supportive regulatory framework in a major economy could lead to increased institutional investment and higher prices, while stricter regulations could trigger sell-offs. Technological advancements, such as the development of new blockchain protocols or scaling solutions, also play a crucial role. Innovations that improve transaction speeds or reduce costs can attract more users and boost demand. Finally, market sentiment, driven by news events, social media trends, and overall investor confidence, exerts a powerful influence on price movements. Fear, uncertainty, and doubt (FUD) can quickly lead to price drops, while positive news and hype can fuel dramatic rallies.

Factors Influencing Cryptocurrency Prices

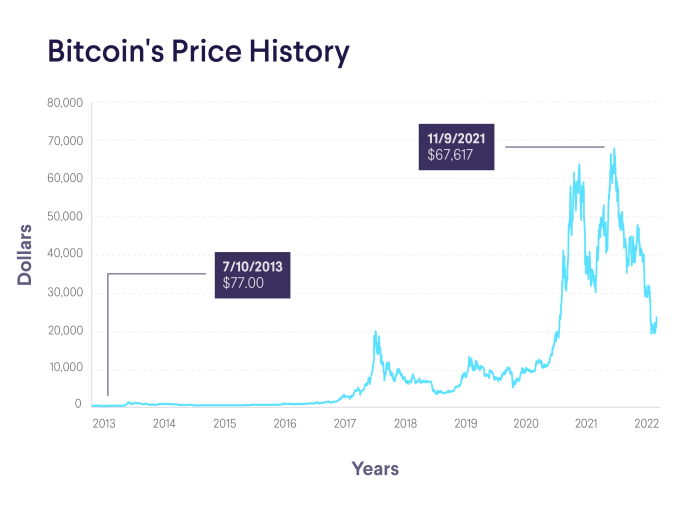

Regulatory developments, technological advancements, and market sentiment are key drivers of cryptocurrency price fluctuations. Consider Bitcoin’s price history: periods of regulatory uncertainty have often coincided with price corrections, while announcements of major institutional adoption or technological upgrades have frequently resulted in price surges. For example, the 2017 Bitcoin bull run was partly fueled by increasing media attention and growing institutional interest, while subsequent regulatory crackdowns in various countries contributed to significant price declines. Similarly, the development of the Lightning Network, a layer-2 scaling solution for Bitcoin, has been viewed positively by the market, potentially contributing to long-term price appreciation. Conversely, negative news, such as security breaches or high-profile scams, can severely impact market sentiment and lead to substantial price drops.

Limitations of Prediction Models and Investment Risks, Crypto Price Prediction Today 2025

No prediction model can guarantee accurate cryptocurrency price forecasts. Models rely on historical data and assumptions about future trends, but the cryptocurrency market is characterized by its unpredictability and susceptibility to unforeseen events. These events, ranging from unexpected regulatory shifts to technological breakthroughs or market manipulation, can render even the most sophisticated models inaccurate. Furthermore, many prediction models fail to adequately account for the psychological factors influencing market behavior, such as herd mentality and emotional decision-making. Investing in cryptocurrencies carries significant risk. Price volatility can lead to substantial losses, and the market is susceptible to manipulation and fraud. It is crucial to conduct thorough research, understand the risks involved, and only invest what you can afford to lose. Past performance is not indicative of future results, and any prediction should be treated as speculation, not a guarantee.

Major Cryptocurrencies in 2025: Crypto Price Prediction Today 2025

Predicting cryptocurrency prices is inherently speculative, relying on complex market forces and technological advancements. However, by analyzing current trends and potential future catalysts, we can formulate plausible price trajectories for leading cryptocurrencies by 2025. This analysis considers various market scenarios, ranging from bullish to bearish, to provide a comprehensive outlook. Remember that these are projections, not guarantees.

The potential price movements of Bitcoin, Ethereum, and other significant cryptocurrencies by 2025 are intertwined with broader economic conditions, regulatory changes, and technological developments within the crypto space. While Bitcoin’s dominance might slightly decrease, it’s expected to remain a key player, influencing the overall market sentiment. Ethereum, on the other hand, could experience significant growth due to its expanding ecosystem and role in decentralized finance (DeFi). Other prominent altcoins will likely experience varying degrees of success, driven by their individual utility and market adoption.

Price Range Predictions for Top Cryptocurrencies

The following table presents predicted price ranges for Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Cardano (ADA) based on three distinct market scenarios: bullish, bearish, and neutral. These predictions are based on a combination of technical analysis, fundamental analysis, and consideration of potential market-moving events. Note that these are estimates and actual prices may differ significantly.

| Cryptocurrency | Bullish Scenario (USD) | Neutral Scenario (USD) | Bearish Scenario (USD) |

|---|---|---|---|

| Bitcoin (BTC) | $150,000 – $200,000 | $50,000 – $75,000 | $20,000 – $30,000 |

| Ethereum (ETH) | $10,000 – $15,000 | $3,000 – $5,000 | $1,000 – $2,000 |

| Ripple (XRP) | $5 – $10 | $1 – $3 | $0.25 – $0.75 |

| Cardano (ADA) | $5 – $10 | $1 – $3 | $0.25 – $0.75 |

Potential Catalysts for Significant Price Movements

Several factors could significantly influence cryptocurrency prices by 2025. These catalysts represent both opportunities and risks within the market. A clear understanding of these factors is crucial for informed investment decisions.

The widespread adoption of cryptocurrencies by major institutions, such as banks and corporations, could trigger substantial price increases. For example, if a large financial institution integrates Bitcoin into its payment systems, it could lead to a surge in demand and price appreciation. Conversely, increased regulatory scrutiny or negative news from major players could negatively impact market sentiment.

Successful implementation of scaling solutions for major cryptocurrencies, such as Ethereum’s transition to proof-of-stake, could also lead to significant price growth. Improved scalability and transaction speeds would increase the efficiency and usability of these platforms, attracting more users and developers. Conversely, failures in scaling solutions or security breaches could negatively affect price.

Factors Influencing Crypto Prices in 2025

Predicting cryptocurrency prices is inherently complex, influenced by a confluence of macroeconomic conditions, technological advancements, and regulatory landscapes. Understanding these interacting factors is crucial for navigating the volatile cryptocurrency market in 2025. The interplay between these elements will significantly shape the value and trajectory of various cryptocurrencies.

Macroeconomic Factors Impacting Cryptocurrency Markets

Global economic events, inflation rates, and interest rate policies implemented by central banks worldwide significantly influence cryptocurrency markets. High inflation, for instance, can drive investors towards cryptocurrencies as a hedge against inflation, potentially increasing demand and prices. Conversely, rising interest rates can make holding cryptocurrencies less attractive compared to higher-yielding bonds, potentially leading to decreased demand and price drops. Major global economic events, such as recessions or geopolitical instability, can also trigger significant volatility in cryptocurrency markets, as investors seek safer havens or react to uncertainty. For example, the 2022 global economic slowdown correlated with a significant downturn in cryptocurrency valuations.

Technological Advancements Shaping Future Prices

Technological advancements within the cryptocurrency space play a pivotal role in determining future prices. Layer-2 scaling solutions, such as Polygon and Arbitrum, aim to improve transaction speeds and reduce fees on major blockchains like Ethereum. These improvements could make cryptocurrencies more user-friendly and accessible, potentially boosting adoption and driving price increases. Innovations in decentralized finance (DeFi), such as improved lending protocols and yield farming strategies, can also influence market sentiment and price movements. The evolution of decentralized autonomous organizations (DAOs) and their role in governance and project development is another important factor. For example, the increasing efficiency and scalability offered by Layer-2 solutions has already demonstrated a positive correlation with increased user activity on Ethereum.

Impact of Regulatory Frameworks and Government Policies

Government regulations and policies significantly impact cryptocurrency valuations. Clear and consistent regulatory frameworks can foster investor confidence and encourage institutional participation, potentially leading to price increases. Conversely, overly restrictive or uncertain regulations can create uncertainty and discourage investment, potentially causing price drops. Different jurisdictions adopting varying approaches to cryptocurrency regulation further complicates the market, influencing price discrepancies across exchanges. For instance, the implementation of comprehensive cryptocurrency regulations in a major market like the European Union could positively impact global cryptocurrency prices by creating a more stable and predictable environment for investors. Conversely, a sudden ban on cryptocurrency trading in a significant market could trigger a substantial price drop.

Risks and Opportunities in Crypto Investment by 2025

The cryptocurrency market, while offering substantial potential returns, presents significant risks. By 2025, these risks and opportunities will likely remain prominent, demanding a cautious yet informed approach from investors. Understanding the inherent volatility, the prevalence of scams, and the evolving regulatory landscape is crucial for navigating this dynamic investment environment. Simultaneously, the potential for long-term growth and diversification benefits remains compelling.

Potential Risks Associated with Cryptocurrency Investments

Cryptocurrency investments are notoriously volatile. Price swings can be dramatic and unpredictable, influenced by factors ranging from market sentiment and technological developments to regulatory announcements and macroeconomic conditions. For example, the Bitcoin price experienced significant drops in 2022, highlighting the inherent risk. Furthermore, the decentralized nature of cryptocurrencies makes them susceptible to scams and fraudulent activities, including pump-and-dump schemes, rug pulls, and phishing attacks. Investors need to be vigilant and exercise due diligence before investing in any cryptocurrency project. Regulatory uncertainty also poses a significant risk. Governments worldwide are still grappling with how to regulate cryptocurrencies, leading to inconsistent rules and potential legal challenges for investors. Changes in regulatory frameworks can significantly impact the value and usability of cryptocurrencies.

Potential Opportunities for Crypto Investors

Despite the risks, the long-term growth potential of cryptocurrencies remains a significant draw for investors. The underlying blockchain technology is transforming various sectors, from finance and supply chain management to healthcare and voting systems. This technological disruption creates opportunities for early adopters and long-term investors to participate in the growth of this nascent industry. Diversification is another key opportunity. Cryptocurrencies offer a unique asset class that can complement traditional investments like stocks and bonds, potentially reducing overall portfolio risk. By strategically allocating a portion of their investment portfolio to cryptocurrencies, investors can potentially enhance returns and mitigate risks associated with over-reliance on traditional asset classes. For example, an investor could diversify by investing in both established cryptocurrencies like Bitcoin and Ethereum, and newer, promising projects with innovative technologies.

Risk Mitigation Strategies for Crypto Investors

Investors can employ several strategies to mitigate the risks associated with cryptocurrency investments. Thorough research and due diligence are paramount. Understanding the underlying technology, the project’s team, and the market dynamics is crucial before investing. Diversifying the investment portfolio across multiple cryptocurrencies and asset classes can reduce exposure to the volatility of any single cryptocurrency. Only investing what one can afford to lose is a crucial principle of risk management in the crypto space. Avoiding impulsive decisions and sticking to a well-defined investment strategy are also important. Staying informed about market trends and regulatory developments is essential for making informed investment decisions. Using secure storage methods, such as hardware wallets, can help protect investments from hacking and theft.

Investing Strategies for 2025

Navigating the cryptocurrency market in 2025 requires a well-defined investment strategy. The volatile nature of cryptocurrencies necessitates a careful approach, balancing risk and potential reward. Understanding different investment strategies and their implications is crucial for successful participation in this dynamic market.

Comparison of Investment Strategies

Several distinct strategies can be employed when investing in cryptocurrencies. Each approach carries its own set of advantages and disadvantages, and the optimal choice depends on individual risk tolerance and financial goals. Dollar-cost averaging (DCA), value investing, and momentum trading represent three common approaches. Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy mitigates the risk of investing a large sum at a market peak. Value investing focuses on identifying undervalued cryptocurrencies with strong fundamentals, aiming for long-term growth. Momentum trading, on the other hand, capitalizes on short-term price trends, seeking quick profits from rapidly appreciating assets. While DCA offers risk mitigation through consistent investment, value investing emphasizes long-term growth potential, and momentum trading prioritizes short-term gains. The success of each strategy depends heavily on market conditions and the investor’s ability to accurately predict price movements. For example, during a prolonged bear market, DCA might prove more effective than momentum trading, while a bull market could favor momentum strategies. Value investing, however, requires thorough due diligence and a longer-term perspective.

The Importance of Diversification in Minimizing Risk

Diversification is a cornerstone of successful investing, and the cryptocurrency market is no exception. Spreading investments across multiple cryptocurrencies reduces the impact of any single asset’s price decline. A diversified portfolio might include a mix of established cryptocurrencies like Bitcoin and Ethereum, alongside promising altcoins with unique functionalities. This approach reduces overall portfolio volatility and lowers the risk of significant losses. For example, an investor holding only Bitcoin might experience substantial losses if Bitcoin’s price drops sharply. However, an investor with a diversified portfolio including other cryptocurrencies, such as Ethereum, Solana, or Cardano, would likely experience less dramatic losses due to the potential for other assets to perform well, offsetting the losses in Bitcoin. The optimal level of diversification depends on the investor’s risk tolerance and investment goals.

Examples of Successful Investment Strategies Employed by Seasoned Crypto Investors

Seasoned crypto investors often employ sophisticated strategies combining elements of the approaches discussed above. One common approach is to combine DCA with value investing. This involves regularly investing in a diversified portfolio of cryptocurrencies identified as having strong long-term potential. Another strategy involves employing technical analysis to identify entry and exit points for momentum trading, but only within a carefully diversified portfolio to limit risk. Successful investors often combine long-term holding strategies with short-term trading opportunities, carefully managing risk and capital allocation. For instance, a seasoned investor might allocate a portion of their portfolio to long-term value investments, while using another portion for short-term momentum trades, constantly rebalancing the portfolio based on market conditions and their risk tolerance. These strategies, however, require considerable market knowledge, technical expertise, and discipline. It’s crucial to remember that past performance is not indicative of future results, and even experienced investors can experience losses.

Illustrative Examples of Price Predictions

Predicting the price of Bitcoin in 2025 is inherently speculative, relying on various economic, technological, and regulatory factors. However, by considering different scenarios and underlying assumptions, we can illustrate potential price ranges. The following examples present three distinct scenarios, each based on a different set of assumptions regarding adoption, regulation, and technological advancements.

Bitcoin Price Scenarios in 2025

This section Artikels three potential price scenarios for Bitcoin in 2025: a bullish scenario, a neutral scenario, and a bearish scenario. Each scenario is based on a unique set of assumptions regarding the factors influencing Bitcoin’s price.

Bullish Scenario: Widespread Adoption and Institutional Investment

This scenario assumes widespread global adoption of Bitcoin as a store of value and a medium of exchange. Increased institutional investment, coupled with positive regulatory developments, drives significant demand. We envision a scenario where Bitcoin’s market capitalization surpasses several trillion dollars, leading to a price exceeding $200,000 per coin. This scenario assumes a continued narrative of Bitcoin as digital gold, attracting both individual and institutional investors seeking diversification and inflation hedging. Imagine a future where Bitcoin is accepted by major retailers and integrated into mainstream financial systems. The visual representation would show a steep upward trajectory, reaching the $200,000 mark by 2025.

Neutral Scenario: Gradual Growth and Market Consolidation

This scenario assumes a more moderate level of adoption and investment. While Bitcoin continues to be adopted by a growing number of users and businesses, the pace of growth is slower than in the bullish scenario. Regulatory uncertainty persists, limiting institutional investment to some extent. In this scenario, Bitcoin’s price could range between $50,000 and $100,000 by 2025. The visual representation would show a steady, but less dramatic, upward trend, remaining within the specified price range. This is a scenario where Bitcoin maintains its position as a significant digital asset but doesn’t experience explosive growth.

Bearish Scenario: Regulatory Crackdown and Market Correction

This scenario considers a more pessimistic outlook, where negative regulatory actions or significant technological disruptions negatively impact Bitcoin’s price. A major market correction, coupled with reduced investor confidence, could lead to a price significantly lower than current levels. In this case, Bitcoin’s price could fall below $25,000 by 2025. The visual representation would show a downward trend, potentially even a sharp decline, before stabilizing below $25,000. This scenario emphasizes the risks associated with cryptocurrency investments and the importance of careful risk management.

Methodology for Price Predictions

The price predictions presented are based on a qualitative analysis of various factors, including historical price data, adoption rates, regulatory developments, technological advancements, and macroeconomic conditions. No specific mathematical model or algorithm was used; rather, the predictions are derived from a reasoned assessment of these factors under different plausible scenarios. These scenarios are not forecasts but rather illustrative examples of potential price movements based on varying assumptions.

Disclaimer

It is crucial to understand that cryptocurrency price predictions are inherently speculative and should not be considered financial advice. The actual price of Bitcoin in 2025 could differ significantly from the scenarios presented here. Investing in cryptocurrencies carries substantial risk, and investors should conduct thorough research and understand the potential for both significant gains and losses before making any investment decisions. Past performance is not indicative of future results.

FAQ

Predicting the future of cryptocurrency prices is a complex endeavor, fraught with inherent uncertainties. This FAQ section addresses some common questions regarding the challenges, possibilities, and considerations involved in forecasting cryptocurrency prices and making informed investment decisions. Understanding these points is crucial for navigating the volatile cryptocurrency market.

Biggest Challenges in Predicting Cryptocurrency Prices

The inherent volatility and unpredictable nature of the cryptocurrency market make accurate price prediction extremely difficult. Several factors contribute to this unpredictability. Firstly, cryptocurrency markets are heavily influenced by sentiment and speculation, often driven by social media trends, news events (both positive and negative, such as regulatory changes or technological breakthroughs), and the actions of large investors (whales). These factors can lead to rapid and significant price swings that are difficult, if not impossible, to foresee with any degree of certainty. Secondly, the relatively young age of the cryptocurrency market means there is limited historical data to base reliable predictive models on. Established financial markets have decades of data to analyze, allowing for more robust forecasting techniques. Finally, the decentralized and global nature of cryptocurrencies makes it challenging to accurately account for all the influencing factors in any given prediction model. External events like macroeconomic shifts, geopolitical instability, and even technological advancements in competing blockchain technologies can significantly impact prices. In short, the complexity and interconnectivity of the factors involved create a highly dynamic and unpredictable environment.

Possibility of Accurately Predicting Cryptocurrency Prices

Accurately predicting cryptocurrency prices is exceptionally challenging, if not impossible. While various prediction models exist, they all have limitations. These models often rely on historical data, technical indicators, and fundamental analysis, but the volatile and speculative nature of the market often renders these methods unreliable. For instance, a model might accurately predict a price increase based on past trends and technical signals, but a sudden negative news event or a significant shift in market sentiment could completely invalidate the prediction. Therefore, instead of aiming for precise price predictions, it’s more prudent to focus on understanding the underlying trends and risks associated with specific cryptocurrencies. Effective risk management strategies, including diversification and careful position sizing, are far more crucial than trying to time the market perfectly. For example, an investor might predict Bitcoin’s price will increase over the long term but will only invest a small portion of their portfolio to mitigate potential losses if the prediction proves incorrect.

Factors to Consider Before Investing in Cryptocurrencies

Before investing in cryptocurrencies, thorough consideration of several crucial factors is essential. This includes a realistic assessment of your risk tolerance, your investment goals (short-term gains versus long-term growth), and a comprehensive understanding of the specific cryptocurrency you intend to invest in. Conducting thorough market research is paramount; this involves understanding the technology behind the cryptocurrency, its adoption rate, the team behind the project, and any potential regulatory hurdles. Furthermore, it’s crucial to understand the various risks associated with cryptocurrency investments, including market volatility, security risks (such as hacking or loss of private keys), and regulatory uncertainty. Diversification across different cryptocurrencies and asset classes is also a key risk mitigation strategy. Finally, only invest what you can afford to lose, and avoid making emotional investment decisions based on hype or fear. A well-defined investment plan aligned with your risk profile and financial goals is crucial for successful and responsible cryptocurrency investing.

Disclaimer and Conclusion (Summary)

Predicting cryptocurrency prices is inherently challenging due to the volatile nature of the market. Numerous factors, from regulatory changes to technological advancements and overall market sentiment, contribute to the unpredictable price swings we see. While attempting to forecast future prices can be insightful, it’s crucial to remember that these are estimations, not guarantees. Understanding this inherent uncertainty is paramount for any investor.

The information presented in this report serves as an overview of potential market trends and scenarios, drawing on current market conditions and historical data. However, the cryptocurrency market is dynamic and susceptible to sudden shifts driven by a variety of internal and external forces. Therefore, the projections offered should not be interpreted as definitive outcomes.

Key Takeaways Regarding Cryptocurrency Market Volatility and Responsible Investing

The cryptocurrency market’s volatility underscores the importance of careful consideration before investing. While potential rewards are significant, so are the risks. Investors should always conduct thorough due diligence, diversifying their portfolios and only investing amounts they can afford to lose. Remember, past performance is not indicative of future results.

- Cryptocurrency prices are highly volatile and subject to significant fluctuations.

- Price predictions are speculative and should not be solely relied upon for investment decisions.

- Thorough research and risk assessment are crucial before investing in any cryptocurrency.

- Diversification is key to mitigating risk in a volatile market.

- Only invest what you can afford to lose.

The Speculative Nature of Price Predictions and the Importance of Research

Many factors influence cryptocurrency prices, including technological developments, regulatory actions, market sentiment, and adoption rates. Attempting to predict these prices requires understanding complex interactions between these elements. For example, positive news about a specific cryptocurrency can lead to a rapid price increase, while negative news or regulatory uncertainty can trigger a sharp decline. Bitcoin’s price history illustrates this volatility vividly, with periods of dramatic growth followed by equally dramatic corrections. Therefore, relying on a single prediction is unwise.

This Information is Not Financial Advice

It is crucial to reiterate that the information provided in this report is for educational and informational purposes only and does not constitute financial advice. The cryptocurrency market is complex and risky, and making investment decisions requires careful consideration of your personal financial situation and risk tolerance. Consulting with a qualified financial advisor before making any investment decisions is strongly recommended.

Crypto Price Prediction Today 2025 – Predicting crypto prices in 2025 is inherently speculative, but understanding individual coin trajectories helps form a broader picture. A key component of this is analyzing altcoins like Bitcoin Cash; for a dedicated analysis of its potential, check out this resource on Bitcoin Cash Future Price 2025. Ultimately, the overall crypto market prediction for 2025 will depend on a multitude of factors influencing individual coin performances.

Accurately predicting crypto prices in 2025 remains challenging, with numerous factors influencing the market. Understanding individual coin projections, however, can offer valuable insights. For example, a detailed analysis of the Bitcoin Minetrix Price Prediction 2025 helps contextualize broader cryptocurrency market trends. Ultimately, this granular approach contributes to a more informed overall Crypto Price Prediction Today 2025.

Accurately predicting crypto prices in 2025 remains challenging, with various factors influencing the market. However, focusing on Bitcoin offers a clearer path, as seen through sophisticated AI analysis. For insightful projections, consider exploring resources like this Bitcoin Price Prediction 2025 Ai analysis. Understanding Bitcoin’s trajectory is crucial for broader crypto price prediction in 2025, as it often sets the tone for the overall market.

Predicting crypto prices in 2025 is challenging, with many variables influencing the market. A key component of any such prediction involves understanding Bitcoin’s potential trajectory, and a helpful resource for this is the article exploring the question, What Will Bitcoin Be Worth 2025. Ultimately, accurate crypto price prediction today for 2025 requires considering multiple factors beyond just Bitcoin’s performance.

Predicting cryptocurrency prices in 2025 is inherently speculative, but various factors influence these forecasts. A key component of any broader crypto price prediction today for 2025 involves analyzing individual coins, such as understanding the potential trajectory of Bitcoin Cash; for detailed insights, check out this analysis on Bitcoin Cash Price 2025. Ultimately, the overall crypto market’s health will significantly impact the success of individual coins like Bitcoin Cash in the coming years.