Crypto Price Predictions for 2025

Predicting cryptocurrency prices is inherently speculative, relying on complex interplay of factors. However, by analyzing market trends, technological advancements, and regulatory landscapes, we can formulate educated estimations for major players in 2025. These predictions should be viewed as potential scenarios rather than definitive forecasts.

Bitcoin Price Predictions for 2025

Various sources offer diverse Bitcoin price predictions for 2025. Some analysts, basing their projections on continued adoption and technological improvements like the Lightning Network, predict prices ranging from $100,000 to $200,000. Others, considering potential regulatory headwinds or macroeconomic instability, offer more conservative estimates, in the range of $50,000 to $100,000. These discrepancies highlight the inherent uncertainty in the market. A significant factor influencing Bitcoin’s price will be the degree of mainstream adoption and integration into traditional financial systems. Increased institutional investment and the development of user-friendly applications could drive prices upwards. Conversely, unfavorable regulatory actions or a significant market correction could lead to lower prices.

Ethereum Price Predictions for 2025

Ethereum’s price trajectory is closely tied to the success of its ongoing transition to a proof-of-stake consensus mechanism and the expansion of its decentralized applications (dApps) ecosystem. Optimistic predictions suggest Ethereum could reach prices between $10,000 and $20,000 by 2025, fueled by the growth of DeFi and NFT markets. More conservative estimates place the price in the range of $5,000 to $10,000, factoring in potential competition from other layer-1 blockchains. The scalability and efficiency of Ethereum’s network will be crucial in determining its future price. Successful scaling solutions and increased adoption of Ethereum-based applications could significantly boost its value.

Other Top Cryptocurrency Price Predictions for 2025

Predicting the prices of other top cryptocurrencies like Solana, Cardano, and Binance Coin involves similar considerations to Bitcoin and Ethereum. Factors such as technological advancements, network growth, and regulatory developments will play a crucial role. For instance, Solana’s price could be influenced by its scalability and speed advantages, while Cardano’s price might depend on the adoption of its smart contract platform. Binance Coin’s price is intrinsically linked to the success and growth of the Binance exchange. It is important to remember that these are just potential scenarios, and the actual prices could vary significantly depending on market conditions.

Factors Influencing Bitcoin Price in 2025

Several key factors could significantly impact Bitcoin’s price in 2025. Regulatory clarity and acceptance from governments worldwide are paramount. Favorable regulations could stimulate institutional investment and mainstream adoption, driving price increases. Conversely, stringent regulations could hinder growth. The rate of adoption by both individuals and institutions is another critical factor. Widespread adoption could lead to increased demand and higher prices, while slow adoption could limit price appreciation. Technological advancements, such as improved scalability and privacy solutions, could also influence Bitcoin’s price positively. Finally, macroeconomic conditions, including inflation and global economic stability, will play a significant role in determining Bitcoin’s overall market performance. For example, periods of high inflation might increase demand for Bitcoin as a hedge against inflation.

Impact of Emerging Cryptocurrencies and Blockchain Technologies

The emergence of new cryptocurrencies and blockchain technologies could significantly reshape the crypto market by 2025. Innovative projects focusing on scalability, interoperability, and sustainability could challenge the dominance of existing cryptocurrencies. The development of new consensus mechanisms, such as proof-of-stake variants, could enhance efficiency and reduce energy consumption. Furthermore, the integration of blockchain technology into various sectors, including supply chain management, healthcare, and voting systems, could broaden the overall crypto market and drive demand for various cryptocurrencies. Competition and innovation within the blockchain ecosystem are likely to accelerate in the coming years.

Factors Influencing Crypto Price Targets

Predicting cryptocurrency prices is inherently complex, influenced by a confluence of macroeconomic conditions, technological advancements, regulatory landscapes, and market sentiment. Accurately forecasting price targets for 2025 requires a nuanced understanding of these interconnected factors and their potential interactions. This section will delve into the key drivers shaping potential price movements.

Macroeconomic Factors and Crypto Prices

Macroeconomic factors significantly impact cryptocurrency markets. Inflation, for instance, can drive investors towards assets perceived as inflation hedges, potentially boosting crypto demand. Conversely, high inflation might also lead central banks to increase interest rates, making riskier assets like cryptocurrencies less attractive. Global economic growth, or a recession, will influence investor risk appetite; strong growth typically correlates with increased investment in riskier assets, while a recession often leads to capital flight into safer havens. For example, the 2022 economic downturn saw a significant correction in the crypto market, highlighting the sensitivity of crypto assets to broader economic trends. The strength of the US dollar, often considered a safe haven, also plays a role, as a stronger dollar can negatively impact the price of cryptocurrencies denominated in USD.

Technological Advancements and Crypto Price Projections

Technological improvements within the crypto space directly influence price projections. Layer-2 scaling solutions, such as Polygon and Arbitrum, aim to alleviate network congestion and reduce transaction fees on major blockchains like Ethereum. These improvements can enhance the usability and scalability of cryptocurrencies, potentially increasing adoption and driving price appreciation. Advancements in security protocols, such as improved consensus mechanisms and enhanced cryptographic techniques, also contribute to market confidence. A more secure and efficient ecosystem fosters greater trust and investment, positively impacting prices. For example, the successful implementation of Ethereum’s transition to a proof-of-stake consensus mechanism (reducing energy consumption and increasing transaction speed) could be considered a positive technological development likely to influence future price trajectories.

Regulatory Developments and Government Policies

Government regulations and policies play a crucial role in shaping the cryptocurrency market. Clearer regulatory frameworks could increase institutional investment and legitimize the crypto space, potentially leading to price increases. Conversely, overly restrictive or unclear regulations can stifle innovation and adoption, negatively impacting prices. Different jurisdictions are taking varying approaches; some are embracing cryptocurrencies, while others are imposing stricter controls. The evolving regulatory landscape in 2025 will significantly influence the overall market sentiment and price targets. For example, the potential for a comprehensive regulatory framework in the United States could significantly impact the price of Bitcoin and other major cryptocurrencies.

Investor Sentiment, Market Speculation, and Major Market Events

Investor sentiment, market speculation, and major market events are powerful forces shaping crypto prices. Periods of high market enthusiasm or “bull markets” can lead to significant price increases, driven by speculation and FOMO (fear of missing out). Conversely, negative news, regulatory uncertainty, or significant market corrections can trigger widespread selling and price drops. Major events, such as the launch of a new cryptocurrency or a significant technological breakthrough, can also drastically influence prices. The 2021 bull market, fueled by widespread media attention and institutional investment, exemplifies the impact of positive sentiment. Conversely, the collapse of FTX in 2022 serves as a stark reminder of the volatility driven by negative market events and loss of investor confidence.

Bullish vs. Bearish Market Scenarios for 2025

Predicting the future of cryptocurrency markets is inherently challenging, but by analyzing current trends and historical patterns, we can construct plausible bullish and bearish scenarios for 2025. These scenarios offer a range of potential outcomes for major cryptocurrencies like Bitcoin and Ethereum, highlighting the factors that could drive prices in either direction.

Bullish Market Scenario for 2025

A bullish market in 2025 would likely be fueled by several converging factors. Widespread adoption of blockchain technology across various sectors, coupled with increased institutional investment and regulatory clarity, could significantly boost market confidence. Positive macroeconomic conditions, such as reduced inflation and stable economic growth, could also contribute to a favorable investment environment for cryptocurrencies. Technological advancements, such as the development of more scalable and efficient blockchain networks, would further enhance the appeal of crypto assets. This scenario envisions a continued maturation of the crypto ecosystem, moving beyond the speculative phase towards broader utility and acceptance.

Bearish Market Scenario for 2025

Conversely, a bearish market scenario would likely stem from a confluence of negative factors. Increased regulatory scrutiny and restrictive government policies could stifle innovation and dampen investor enthusiasm. A global economic downturn, characterized by high inflation and recessionary pressures, could lead to risk aversion among investors, pushing them away from volatile assets like cryptocurrencies. Major security breaches or hacks targeting prominent crypto platforms could erode investor confidence and trigger a market sell-off. Furthermore, a lack of significant technological breakthroughs or continued scalability issues could hinder the widespread adoption of cryptocurrencies.

Price Range Comparisons

Under a bullish scenario, Bitcoin could potentially reach price targets in the range of $150,000 to $250,000 by 2025, while Ethereum could see values between $10,000 and $20,000. This is based on projections considering sustained growth in adoption, positive regulatory developments, and ongoing technological improvements, mirroring the growth seen in previous bull runs but potentially at a more moderate pace. For example, Bitcoin’s price surge in 2021 was partially driven by increased institutional investment and retail FOMO, a factor that could be less pronounced in a more mature market. Conversely, a bearish scenario could see Bitcoin trading in the range of $20,000 to $40,000, and Ethereum between $1,000 and $3,000. This reflects a scenario where negative macroeconomic factors, regulatory uncertainty, and security concerns weigh heavily on market sentiment. This could be similar to the market correction seen in 2022, but potentially more prolonged and severe.

Key Factors Contributing to Bullish or Bearish Outcomes

The divergence between bullish and bearish scenarios hinges on several key factors. Regulatory clarity and supportive government policies are crucial. A positive regulatory framework fosters innovation and attracts institutional investment, contributing to a bullish market. Conversely, overly restrictive regulations can stifle growth and drive prices down. Macroeconomic conditions play a significant role. Stable economic growth and low inflation generally favor riskier assets like cryptocurrencies, while economic uncertainty and high inflation can trigger sell-offs. Technological advancements are also essential. Improvements in scalability, security, and interoperability enhance the functionality and appeal of cryptocurrencies, supporting price appreciation. Conversely, technological stagnation or security breaches can damage market confidence.

Comparison of Bullish and Bearish Scenarios

| Scenario | Bitcoin Price Target (2025) | Ethereum Price Target (2025) |

|---|---|---|

| Bullish | $150,000 – $250,000 | $10,000 – $20,000 |

| Bearish | $20,000 – $40,000 | $1,000 – $3,000 |

Investment Strategies Based on Price Targets

Investing in cryptocurrencies based on price target predictions requires a nuanced approach, balancing potential rewards with inherent risks. Different strategies cater to varying risk tolerances and investment horizons, emphasizing the importance of thorough research and diversification. The following Artikels potential investment strategies based on various 2025 price target scenarios.

Strategies for Short-Term Investors

Short-term investors, typically focused on quick profits, might employ strategies centered around short-term price fluctuations. These strategies often involve higher risk but potentially higher rewards. For instance, if a price target suggests a significant short-term surge, an investor might leverage trading strategies like day trading or swing trading to capitalize on these movements. However, this requires close market monitoring and a deep understanding of technical analysis. Conversely, a pessimistic price target might prompt short selling or other bearish strategies. It’s crucial to remember that short-term trading carries substantial risk, and losses can quickly outweigh gains.

Strategies for Long-Term Investors

Long-term investors, prioritizing steady growth over quick gains, typically employ a buy-and-hold strategy, particularly if price targets indicate substantial long-term appreciation. This strategy involves purchasing cryptocurrencies and holding them for an extended period, regardless of short-term price volatility. For example, if the price target for Bitcoin in 2025 is significantly higher than the current price, a long-term investor might allocate a portion of their portfolio to Bitcoin, expecting to realize the projected gains over time. This approach requires patience and a tolerance for market fluctuations.

Diversification Strategies for Risk Mitigation

Diversification is crucial in mitigating risk within a cryptocurrency portfolio. Instead of concentrating investments in a single cryptocurrency, investors should spread their capital across multiple assets with varying market correlations. For instance, an investor might allocate funds to Bitcoin, Ethereum, and several promising altcoins, balancing exposure to established and emerging projects. This reduces the impact of any single cryptocurrency’s price decline on the overall portfolio value. A sample diversified portfolio might include 50% Bitcoin, 30% Ethereum, and 20% allocated to a selection of altcoins carefully researched and deemed potentially promising.

Importance of Due Diligence

Thorough due diligence is paramount before investing in any cryptocurrency. This involves researching the underlying technology, the project’s team, its market adoption, and its overall potential. Analyzing whitepapers, reviewing community engagement, and understanding the cryptocurrency’s use case are crucial steps. For example, before investing in a new DeFi project, an investor should thoroughly examine the project’s smart contracts for vulnerabilities, its tokenomics, and the team’s track record. Ignoring due diligence significantly increases the risk of investing in fraudulent or underperforming projects. Remember, investing in cryptocurrencies involves significant risk, and losses are possible.

Risks and Uncertainties in Crypto Price Predictions

Predicting cryptocurrency prices is inherently fraught with risk and uncertainty. The cryptocurrency market is notoriously volatile, influenced by a complex interplay of factors that are often unpredictable and difficult to quantify. While analytical tools and historical data can offer some insights, they are far from foolproof, and relying solely on them for accurate predictions is unwise. The inherent speculative nature of the market, coupled with the rapid pace of technological advancements and regulatory changes, makes accurate long-term forecasting exceptionally challenging.

The limitations of using historical data to predict future prices are significant. Cryptocurrency markets are relatively young compared to traditional financial markets, meaning there is a limited amount of historical data to draw upon. Furthermore, the market’s structure and the factors influencing its behavior have changed dramatically over time. Past performance, therefore, is not necessarily indicative of future results. The emergence of new technologies, regulatory shifts, and macroeconomic events can drastically alter the market landscape, rendering historical trends less relevant. Moreover, the high volatility of cryptocurrencies makes even short-term predictions highly unreliable. Small events can cause large price swings, making it difficult to establish consistent patterns or trends.

Limitations of Historical Data in Crypto Price Prediction, Crypto Price Targets 2025

Using historical data to predict future cryptocurrency prices is problematic due to the market’s rapid evolution and the absence of a long, established track record. Unlike traditional assets with decades of price history, cryptocurrencies have a relatively short history, making it difficult to identify reliable long-term trends. For example, Bitcoin’s price history shows periods of explosive growth followed by sharp corrections. While these patterns might seem cyclical, applying them to future predictions is risky because unforeseen events could easily disrupt any perceived pattern. The emergence of new cryptocurrencies, technological advancements (like improvements in blockchain technology or the rise of new consensus mechanisms), and regulatory changes can all fundamentally alter market dynamics, rendering past data less relevant. Consider the 2017-2018 Bitcoin bull run, followed by a significant bear market. Applying the patterns observed during that period to predict future price movements would have been inaccurate, as the market conditions and influencing factors significantly changed in subsequent years.

Examples of Inaccurate Crypto Price Predictions

Numerous instances exist where highly publicized crypto price predictions proved wildly inaccurate. Many analysts predicted Bitcoin would reach $100,000 or even higher in 2021. While the price did rise significantly during that period, it fell short of those predictions. Similarly, numerous predictions regarding the price of other major cryptocurrencies, such as Ethereum or Solana, have missed the mark significantly. These inaccuracies highlight the inherent difficulty in forecasting the behavior of such a volatile and rapidly evolving market. The unpredictability is amplified by the influence of social media sentiment, news cycles, and the actions of large market players, all of which can cause sudden and significant price fluctuations that are difficult to anticipate.

Potential “Black Swan” Events in the Crypto Market

The cryptocurrency market is susceptible to “black swan” events – highly improbable events with significant impact. These events are difficult to predict and can cause dramatic shifts in market sentiment and price movements.

- A major security breach of a leading cryptocurrency exchange, potentially leading to significant loss of funds and a collapse in investor confidence.

- The sudden and unexpected collapse of a major cryptocurrency, triggering a cascading effect throughout the market.

- A significant regulatory crackdown by a major global government, leading to restrictions on cryptocurrency trading or ownership.

- The widespread adoption of a competing blockchain technology that renders existing cryptocurrencies obsolete.

- A major geopolitical event that triggers a global financial crisis, negatively impacting the cryptocurrency market alongside traditional assets.

Frequently Asked Questions (FAQs): Crypto Price Targets 2025

This section addresses some common questions regarding cryptocurrency price predictions for 2025, focusing on Bitcoin and the broader market landscape. Understanding the inherent uncertainties and potential risks is crucial for informed investment decisions.

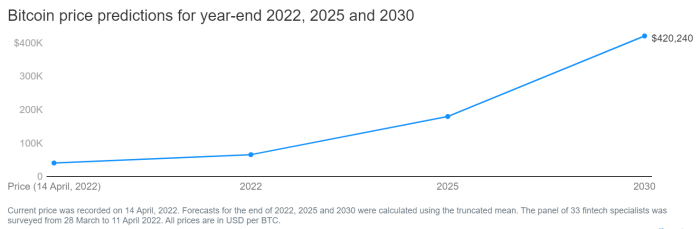

Most Optimistic Bitcoin Price Predictions for 2025

Several analysts have offered highly optimistic price predictions for Bitcoin in 2025, although it’s crucial to remember these are speculative and based on various assumptions. Some predictions reach into the hundreds of thousands of dollars per Bitcoin. For instance, a report by Finder.com in 2023 surveyed a panel of fintech specialists, some of whom predicted prices exceeding $100,000 by 2025. However, these projections often rely on factors like widespread adoption, positive regulatory developments, and continued technological advancements. It’s important to note that such predictions should be viewed with a high degree of caution, as the cryptocurrency market is notoriously volatile and influenced by numerous unpredictable factors. These high predictions should not be taken as guaranteed outcomes. Other analysts, employing different models, might provide significantly lower estimates.

Biggest Risks Facing the Cryptocurrency Market in 2025

The cryptocurrency market faces significant risks in 2025, including regulatory uncertainty, market manipulation, technological vulnerabilities, and macroeconomic factors. Regulatory changes, particularly differing approaches across jurisdictions, could significantly impact the market’s stability and growth. The potential for large-scale market manipulation, especially through coordinated attacks or the exploitation of vulnerabilities in exchanges or protocols, remains a serious concern. Furthermore, the inherent technological vulnerabilities of certain cryptocurrencies, including smart contract flaws and security breaches, pose a constant threat. Finally, macroeconomic conditions, such as inflation, interest rate changes, and global economic downturns, can profoundly affect the value of cryptocurrencies. The collapse of FTX in late 2022 serves as a stark reminder of the potential for systemic risks within the ecosystem, highlighting the need for robust risk management strategies.

Protecting Crypto Investments from Market Volatility

Protecting crypto investments from market volatility requires a multi-faceted approach. Diversification across different cryptocurrencies and asset classes is paramount. Investing only a portion of your portfolio in cryptocurrencies, while allocating the rest to more stable assets like bonds or real estate, can help mitigate losses during market downturns. Dollar-cost averaging (DCA), a strategy that involves investing a fixed amount of money at regular intervals regardless of price fluctuations, can help reduce the impact of volatility. Furthermore, employing strong security measures, including the use of hardware wallets and robust passwords, is crucial to protect against theft or loss of funds. Staying informed about market trends and technological developments is also essential for making well-informed investment decisions. Remember that no strategy guarantees complete protection from market volatility, but a diversified and well-managed portfolio can significantly reduce risk.

Reliability of Crypto Price Predictions

Crypto price predictions are inherently unreliable. The cryptocurrency market is highly speculative and influenced by a complex interplay of technological, regulatory, economic, and psychological factors. While technical analysis and fundamental analysis can provide insights, they cannot accurately predict future price movements. Past performance is not indicative of future results, and many predictions fail to account for unforeseen events, such as regulatory crackdowns, security breaches, or sudden shifts in market sentiment. Therefore, it’s crucial to treat all price predictions with a healthy dose of skepticism and to avoid making investment decisions solely based on them. Instead, focus on building a well-diversified portfolio, employing risk management strategies, and conducting thorough due diligence before investing in any cryptocurrency.

Illustrative Examples

Predicting cryptocurrency prices is inherently speculative, but examining hypothetical scenarios based on plausible events can provide valuable insights into potential market movements. These examples illustrate how technological breakthroughs and regulatory actions can significantly impact cryptocurrency prices.

Technological Breakthrough: Quantum-Resistant Cryptography and Bitcoin’s Price Surge

Imagine a scenario where a team of researchers successfully develops and implements fully functional quantum-resistant cryptography for Bitcoin. This would address a major long-term concern about the vulnerability of current cryptographic algorithms to quantum computing. The successful implementation would be a monumental achievement, instantly bolstering Bitcoin’s security and long-term viability. The market would react swiftly and positively. News of the breakthrough would trigger a wave of buying, driven by institutional investors and retail traders alike, confident in Bitcoin’s enhanced security and future prospects. This would lead to a substantial price surge. For instance, if the breakthrough were announced mid-2024, the price could potentially jump from a hypothetical $30,000 to $70,000 within a few weeks, followed by a period of consolidation and further growth, potentially reaching $100,000 or more by 2025, depending on overall market sentiment and adoption rates. This rapid price increase would reflect not only the enhanced security but also the increased trust and confidence in Bitcoin as a long-term store of value.

Regulatory Crackdown: SEC Action Against a Major Stablecoin and its Price Impact

Consider a scenario where the US Securities and Exchange Commission (SEC) takes decisive action against a major stablecoin, like Tether (USDT), classifying it as an unregistered security. This action could trigger a significant market sell-off. The SEC’s decision would likely lead to immediate uncertainty and fear within the crypto market. Investors might lose confidence in the stability of the stablecoin, fearing a potential de-pegging from the US dollar. This would cause a domino effect, leading to a widespread sell-off across various cryptocurrencies. The price of the affected stablecoin would likely plummet, potentially losing its peg completely. This instability would ripple through the market, causing a significant price drop in other cryptocurrencies, including Bitcoin and Ethereum. For example, a scenario where the SEC successfully prosecutes Tether could see Bitcoin’s price fall from a hypothetical $30,000 to $15,000 within a few days, impacting the entire crypto market significantly. The subsequent period would likely be characterized by volatility and uncertainty, with prices potentially remaining depressed throughout 2025 unless significant positive market events occur.

Crypto Price Targets 2025 – Predicting crypto price targets for 2025 is a complex endeavor, requiring careful consideration of various market factors. A crucial element of this prediction involves understanding Bitcoin’s trajectory, as it heavily influences the broader crypto market. For a detailed perspective on this, check out this comprehensive Bitcoin Price Analysis 2025 report. Ultimately, Bitcoin’s performance will significantly shape the overall crypto price targets we see in 2025.

Predicting crypto price targets for 2025 is challenging, with various factors influencing the market. A key component of these predictions often revolves around Bitcoin’s trajectory, and understanding its potential is crucial. For insightful analysis on this, you can check out this resource on Bitcoin Price At 2025 , which helps contextualize broader crypto market forecasts. Ultimately, accurate crypto price targets depend on a complex interplay of technological advancements and market sentiment.

Predicting crypto price targets for 2025 is a complex undertaking, involving numerous factors influencing market trends. A key component of these predictions often centers around Bitcoin’s projected value; understanding this is crucial. For insightful analysis on this aspect, check out this resource on Bitcoin Price On 2025 to better inform your own projections for the broader cryptocurrency market in 2025.

Ultimately, the overall crypto market’s performance will significantly depend on Bitcoin’s trajectory.

Predicting crypto price targets for 2025 involves considering numerous factors, including technological advancements and regulatory changes. A key element in these projections is the potential for a Bitcoin bull run, as detailed in this insightful analysis: Btc Price Prediction 2025 Bull Run. Understanding Bitcoin’s trajectory significantly impacts overall crypto market estimations for 2025, influencing the targets set for altcoins and the broader crypto landscape.

Predicting crypto price targets for 2025 is a complex endeavor, involving numerous factors and varying expert opinions. A significant part of this discussion revolves around Bitcoin, and you can find a wealth of community speculation on this topic by checking out the lively conversations on Bitcoin Price 2025 Reddit. Understanding these community perspectives provides valuable context when considering broader crypto price targets for 2025.