Bitcoin Halving 2025

The Bitcoin halving, a pre-programmed event reducing the rate at which new Bitcoin is created, is anticipated in 2025. This event has historically had a significant impact on Bitcoin’s price and overall market dynamics, making it a crucial topic for investors and enthusiasts alike. Understanding the mechanics of the halving and its potential effects is essential for navigating the cryptocurrency market.

Bitcoin Halving Mechanics and Historical Impact

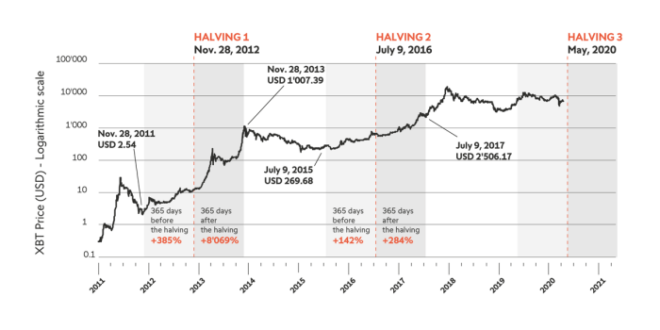

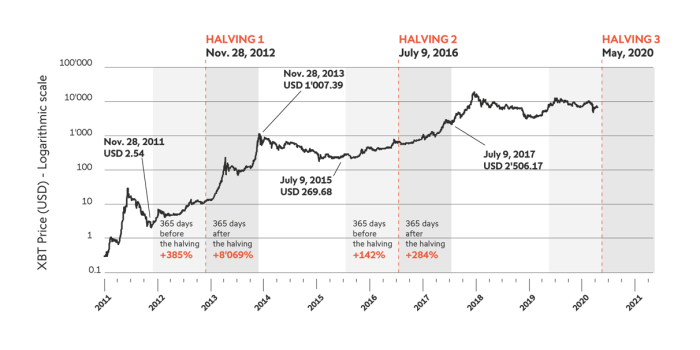

The Bitcoin halving mechanism is ingrained in the Bitcoin protocol. Approximately every four years, the reward miners receive for validating transactions and adding new blocks to the blockchain is cut in half. This directly impacts the rate of new Bitcoin entering circulation. Historically, halvings have been followed by periods of significant price appreciation, although the time lag and magnitude of these increases vary. The first halving in 2012 saw a subsequent price increase, followed by a similar pattern after the 2016 and 2020 halvings. However, it’s crucial to remember that numerous other factors influence Bitcoin’s price, and correlation does not equal causation. The halving is a significant event, but not the sole determinant of price movements.

Anticipated Effects of the 2025 Halving on Supply and Demand

The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC. This reduction in supply, coupled with potentially sustained or increased demand, is expected to exert upward pressure on the price. The decreased supply creates scarcity, a fundamental principle of economics that often drives up prices for limited resources. However, the actual impact will depend on several intertwined factors, including macroeconomic conditions, regulatory developments, and overall market sentiment. The anticipation of the halving itself can also lead to price increases well in advance of the event, as investors position themselves for the expected scarcity.

Comparison of the 2025 Halving to Previous Halving Events

While each halving shares the core mechanic of reducing the block reward, several differences exist. The overall market maturity and adoption levels differ significantly between 2012, 2016, and 2020, and the context surrounding the 2025 halving will undoubtedly be unique. The first halving occurred in a relatively nascent market with limited awareness and participation. Subsequent halvings happened within a more established and regulated environment, though regulation continues to evolve. The scale of market capitalization and the number of participants have grown exponentially since the first halving, making the impact of the 2025 halving potentially different, even if the underlying mechanism remains consistent.

Timeline of Significant Events Surrounding the 2025 Halving

Predicting precise dates for market events is inherently challenging, but a reasonable timeline could include:

- Increased Speculation (2023-2024): Market anticipation builds, leading to price volatility.

- Halving Event (Early 2025): The block reward is halved.

- Post-Halving Price Consolidation (2025-2026): The market adjusts to the reduced supply.

- Potential Price Surge (2026-2027): The impact of reduced supply on demand may lead to a price increase, though the timing and magnitude are uncertain.

Key Metrics Before and After the 2025 Halving

| Metric | Before Halving (Approx. Early 2025) | After Halving (Approx. Late 2025) |

|---|---|---|

| Block Reward (BTC) | 6.25 | 3.125 |

| Approximate Circulating Supply (BTC) | ~19,500,000 | ~19,500,000 + (newly mined BTC) |

| Estimated Inflation Rate (%) | ~1.7% | ~0.8% |

Predicting Bitcoin’s Price After the 2025 Halving: Cuando Sera El Halving De Bitcoin 2025

Predicting Bitcoin’s price after the 2025 halving is a complex undertaking, fraught with uncertainty. Numerous factors, interacting in unpredictable ways, will shape the cryptocurrency’s value. While historical precedent suggests a positive correlation between halving events and subsequent price increases, this is not a guaranteed outcome. A multitude of variables, both internal and external to the Bitcoin ecosystem, will determine the ultimate price trajectory.

Factors Influencing Bitcoin’s Price

Bitcoin’s price is a function of supply and demand, influenced by a confluence of macroeconomic conditions, regulatory actions, and market sentiment. Macroeconomic factors, such as inflation rates, interest rates, and overall economic growth, significantly impact investor behavior and risk appetite. High inflation, for instance, can drive investors towards Bitcoin as a hedge against inflation, increasing demand. Conversely, rising interest rates can divert capital away from riskier assets like Bitcoin, leading to price declines. Regulatory developments, including government policies regarding cryptocurrency adoption or restrictions, play a crucial role. Favorable regulations can boost investor confidence and market liquidity, while restrictive measures can dampen enthusiasm and reduce price. Finally, market sentiment, driven by news events, technological advancements, and overall investor psychology, creates significant price volatility. Positive news, such as institutional adoption or technological breakthroughs, can trigger price surges, while negative news, like security breaches or regulatory crackdowns, can lead to sharp drops.

Price Prediction Models and Their Limitations

Several models attempt to predict Bitcoin’s price, each with inherent limitations. Some models rely on historical price data and statistical analysis to identify patterns and project future prices. These models, however, struggle to account for unforeseen events and the inherent volatility of the cryptocurrency market. Other models incorporate macroeconomic indicators, such as inflation and interest rates, to forecast price movements. These models are still susceptible to inaccuracies in predicting macroeconomic trends. Finally, some models attempt to factor in market sentiment and social media activity, using sentiment analysis to gauge investor confidence. These models face challenges in accurately interpreting the complex dynamics of market sentiment and social media data. In summary, no single model provides a reliable prediction, highlighting the inherent uncertainty in forecasting Bitcoin’s price.

Potential Price Scenarios Following the 2025 Halving

Following the 2025 halving, various price scenarios are possible. A bullish scenario envisions a significant price increase, driven by increased scarcity, renewed institutional investment, and positive market sentiment. This could be similar to the price surge seen after previous halvings, though the magnitude would be uncertain. A bearish scenario, conversely, anticipates a price decline, potentially driven by macroeconomic headwinds, regulatory uncertainty, or a general decline in investor interest in cryptocurrencies. This scenario might see Bitcoin’s price stagnate or even fall below its pre-halving level. A neutral scenario suggests a moderate price increase or sideways movement, reflecting a balance between positive and negative factors. This would be a less dramatic outcome than either the bullish or bearish scenarios, indicating a period of market consolidation.

Illustrative Price Trajectories

Cuando Sera El Halving De Bitcoin 2025 – The following chart illustrates three potential price trajectories for Bitcoin following the 2025 halving: Bullish, Bearish, and Neutral. The chart plots Bitcoin’s price (in USD) against time (in months) following the halving. The Bullish scenario shows a sharp upward trend, reaching significantly higher prices within a year. The Bearish scenario depicts a downward trend, potentially falling below the pre-halving price. The Neutral scenario shows a relatively flat trajectory with modest price fluctuations.

Determining the precise date for the Bitcoin halving in 2025, “Cuando Sera El Halving De Bitcoin 2025,” requires careful consideration of the Bitcoin blockchain’s block generation time. For a comprehensive understanding of the event and its potential impact, refer to this helpful resource: Halving Day Bitcoin 2025. This information will assist in accurately predicting when the “Cuando Sera El Halving De Bitcoin 2025” event will occur.

Note: This chart is a hypothetical illustration and should not be considered financial advice. The actual price trajectory will depend on a multitude of factors, including macroeconomic conditions, regulatory changes, and market sentiment.

Determining the exact date for the Bitcoin halving in 2025 requires careful analysis of the blockchain’s block generation times. Predicting the price impact, however, is far more speculative. To explore potential price movements after the halving, you might find the analysis at Halving Bitcoin 2025 Precio helpful. Ultimately, the timing of the 2025 halving remains a key factor in future Bitcoin price projections.

[Imagine a chart here with three lines representing the Bullish, Bearish, and Neutral price trajectories. The X-axis would represent time (months post-halving), and the Y-axis would represent Bitcoin’s price in USD. The Bullish line would show a steep upward curve, the Bearish line a downward curve, and the Neutral line a relatively flat line with some minor fluctuations.]

Determining the precise date for the Bitcoin halving in 2025 requires careful consideration of the blockchain’s block generation times. To easily track the time until this significant event, you can utilize a helpful resource like the Bitcoin Halving 2025 Countdown Clock. This countdown provides a clear and readily accessible way to monitor the progress towards the 2025 Bitcoin halving, helping to answer the question, “Cuando Sera El Halving De Bitcoin 2025?”

Arguments For and Against Significant Price Increases After the Halving

Arguments for significant price increases after the 2025 halving center on the reduced supply of newly mined Bitcoin. The halving event cuts the rate of Bitcoin creation in half, creating a scarcity effect that could drive demand and increase prices. Historical precedent supports this argument, as previous halvings have been followed by periods of price appreciation. However, arguments against significant price increases highlight the influence of macroeconomic conditions and regulatory uncertainty. A global economic downturn or stringent regulatory measures could outweigh the positive impact of the halving, limiting price appreciation. Furthermore, the increasing competition from other cryptocurrencies could also divert investment away from Bitcoin, dampening price growth. Finally, the psychological impact of previous halvings might be diminished, as investors become more sophisticated and less susceptible to predictable price cycles.

The Impact of the 2025 Halving on Bitcoin Mining

The Bitcoin halving event of 2025, scheduled to reduce the block reward from 6.25 BTC to 3.125 BTC, will significantly impact the Bitcoin mining landscape. This reduction in newly minted coins directly affects the profitability of mining operations and necessitates adaptations within the industry to maintain viability. The consequences extend beyond individual miners, influencing the network’s security, decentralization, and overall energy consumption.

The reduced block reward presents several key challenges for Bitcoin miners. The most immediate concern is decreased profitability. Miners rely on the block reward and transaction fees to cover their operational costs, including electricity, hardware maintenance, and personnel. A halving directly cuts the primary income source, potentially leading to reduced profitability or even losses for less efficient operations. This financial pressure can force less profitable miners to shut down, potentially affecting the network’s hashrate and overall security.

Miner Adjustments in Response to the Halving

Miners will likely implement various strategies to adapt to the reduced profitability. These adjustments may include upgrading to more energy-efficient hardware, consolidating mining operations to benefit from economies of scale, and seeking alternative revenue streams, such as diversifying into other cryptocurrencies or offering hosting services. Furthermore, miners may focus on optimizing their operations to reduce energy consumption and improve efficiency, thereby mitigating the impact of the reduced reward. Successful adaptation will depend on factors such as the prevailing Bitcoin price and the overall competitiveness of the mining landscape. For example, miners may choose to invest in more advanced ASICs (Application-Specific Integrated Circuits) that are more efficient and consume less energy per unit of hash power.

Impact on Bitcoin Network Energy Consumption, Cuando Sera El Halving De Bitcoin 2025

The halving’s impact on the network’s energy consumption is complex. While the reduced profitability might lead some less efficient miners to exit the market, potentially lowering the overall energy consumption, the remaining miners may strive to maintain their hashrate by investing in newer, more powerful (and potentially less energy-efficient) hardware. The net effect on energy consumption remains uncertain and depends on the interplay of these opposing forces. A scenario where less efficient miners are replaced by more efficient ones could result in a decrease in overall energy usage. Conversely, if miners opt for higher-hashrate, less efficient equipment to compensate for the reduced reward, energy consumption could potentially increase. The evolution of mining hardware technology and the actions of individual miners will be crucial determinants.

Bitcoin Mining Profitability: Before and After the Halving

Profitability in Bitcoin mining is calculated by comparing the revenue generated (block rewards plus transaction fees) with the operational costs (electricity, hardware, maintenance, etc.). Before the halving, a miner’s profitability is directly linked to the 6.25 BTC block reward. After the halving, the reward drops to 3.125 BTC, significantly reducing the revenue stream. The profitability of a mining operation will depend heavily on the Bitcoin price, electricity costs, and the efficiency of the mining hardware. A higher Bitcoin price could offset the reduced block reward, maintaining or even increasing profitability for some miners. Conversely, a lower Bitcoin price could push many miners into unprofitability, forcing them to shut down.

Impact of Mining Difficulty Adjustments on Network Security and Decentralization

Bitcoin’s mining difficulty automatically adjusts to maintain a consistent block generation time of approximately 10 minutes. Following a halving, the reduced block reward initially decreases the incentive for mining. However, the difficulty will adjust downward to compensate, making it easier for the existing miners to maintain a consistent hashrate. This adjustment is crucial for the network’s security, as a lower hashrate would make the network more vulnerable to 51% attacks. The halving’s impact on decentralization is less direct but still relevant. The exit of less profitable miners could lead to a more concentrated hashrate among larger mining pools, potentially raising concerns about centralization. However, the possibility of new miners entering the space with more efficient hardware could also counterbalance this effect. The long-term effect on decentralization will depend on various factors, including the technological advancements in mining hardware, regulatory changes, and the overall economic conditions.

The Halving and Bitcoin’s Long-Term Future

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, has significant long-term implications for the cryptocurrency’s adoption, market position, and overall value. While past halvings have been followed by price increases, predicting the future with certainty is impossible. However, analyzing historical trends, technological advancements, and market dynamics offers insights into potential future scenarios.

The long-term success of Bitcoin hinges on several interconnected factors. Its decentralized nature, resistance to censorship, and transparent transaction history are key strengths. However, scalability challenges, regulatory uncertainty, and competition from alternative cryptocurrencies pose ongoing risks.

Bitcoin’s Adoption and Market Position

Increased adoption is crucial for Bitcoin’s long-term success. Wider acceptance as a store of value, a medium of exchange, and a unit of account will drive demand and potentially increase its market capitalization. Factors influencing adoption include technological advancements making Bitcoin more user-friendly, greater regulatory clarity in key markets, and successful integration into existing financial systems. A successful integration into mainstream financial systems, like the increasing acceptance by institutional investors, could drastically alter the trajectory of Bitcoin’s adoption rate. Conversely, sustained regulatory crackdowns or significant security breaches could severely hamper adoption.

Factors Determining Bitcoin’s Long-Term Success

Several key factors will shape Bitcoin’s future. These include the continued development and adoption of the Lightning Network for faster and cheaper transactions, the ongoing innovation in security and privacy technologies (like improved privacy coins), and the overall evolution of the broader cryptocurrency market. Furthermore, the level of institutional investment and the development of Bitcoin-related financial products (like ETFs) will play a significant role. The level of public trust and understanding of Bitcoin’s underlying technology is also critical for widespread acceptance. A lack of understanding could lead to decreased adoption and price volatility.

Expert Opinions and Forecasts

Predicting Bitcoin’s future price is inherently speculative. However, various analysts offer diverse forecasts based on different models and assumptions. Some predict continued price growth driven by increasing scarcity and institutional adoption, while others express concerns about regulatory risks and competition. For example, PlanB, a well-known on-chain analyst, has historically used the Stock-to-Flow model to predict Bitcoin’s price, but these predictions haven’t always been accurate. It’s crucial to remember that these are just opinions, and the actual price will depend on a complex interplay of market forces. The wide range of forecasts highlights the uncertainty inherent in predicting future price movements.

Potential Technological Advancements

Technological advancements could significantly influence Bitcoin’s future. Improvements in scalability, such as the widespread adoption of the Lightning Network, could address current transaction speed and cost limitations. Advancements in privacy-enhancing technologies could make Bitcoin transactions more confidential. Furthermore, the development of new consensus mechanisms or layer-2 solutions could enhance Bitcoin’s efficiency and security. The integration of Bitcoin with other blockchain technologies and decentralized applications (dApps) could expand its functionality and utility. However, the successful implementation and adoption of these advancements are not guaranteed and could be affected by factors outside the developers’ control.

Timeline of Potential Milestones

Predicting precise dates is impossible, but a potential timeline for significant milestones in Bitcoin’s development could include:

The following is a speculative timeline, based on current trends and expert opinions, and should not be interpreted as a definitive prediction.

| Year | Potential Milestone |

|---|---|

| 2025-2028 | Increased institutional adoption, wider regulatory clarity in key markets. |

| 2028-2030 | Widespread adoption of layer-2 scaling solutions, significant improvements in transaction speeds and fees. |

| 2030-2035 | Integration of Bitcoin with other blockchain technologies and DeFi platforms. Potentially increased use of Bitcoin as a form of payment. |

| Beyond 2035 | Further technological advancements, potentially including upgrades to the Bitcoin protocol itself, leading to improved efficiency and security. A significant increase in the number of Bitcoin users and widespread global acceptance. |

Frequently Asked Questions about the Bitcoin Halving in 2025

The Bitcoin halving, a pre-programmed event in the Bitcoin protocol, is a significant occurrence that impacts various aspects of the cryptocurrency’s ecosystem. Understanding this event is crucial for both investors and those involved in Bitcoin mining. This section addresses some frequently asked questions to clarify the mechanics and implications of the 2025 halving.

Bitcoin Halving Explained

A Bitcoin halving is a programmed reduction in the rate at which new Bitcoins are created and added to the circulating supply. This occurs approximately every four years, reducing the block reward miners receive for verifying transactions on the blockchain. The halving mechanism is designed to control Bitcoin’s inflation rate and maintain its scarcity over time. Each halving cuts the block reward in half. For example, the reward was initially 50 BTC per block, then reduced to 25 BTC, 12.5 BTC, and currently stands at 6.25 BTC. The next halving will reduce this to 3.125 BTC.

Timing of the 2025 Halving

While the exact date depends on the block time and mining difficulty, the 2025 Bitcoin halving is anticipated to occur sometime in April 2025. The specific date will be determined by the time it takes to mine the predetermined number of blocks. It’s a dynamic process influenced by factors such as the network’s hashrate and the computational power dedicated to mining.

Impact of the Halving on Bitcoin’s Price

Historically, Bitcoin’s price has shown a tendency to increase in the period following a halving. This is largely attributed to the decreased supply of new Bitcoins entering the market, potentially creating upward pressure on demand. The 2012 and 2016 halvings were followed by significant price increases, although other market factors also played a role. However, it’s crucial to note that past performance is not indicative of future results. The 2025 halving’s impact on price will depend on various factors, including overall market sentiment, regulatory developments, and macroeconomic conditions. The price surge after previous halvings wasn’t immediate; it unfolded over several months or even years.

Risks and Opportunities Associated with the 2025 Halving

The 2025 halving presents both risks and opportunities. A potential risk is the possibility of a price correction or stagnation, despite historical trends. Market sentiment and external factors could outweigh the impact of the reduced supply. On the other hand, the halving presents an opportunity for long-term investors who believe in Bitcoin’s value proposition. The reduced inflation rate and increased scarcity could contribute to a higher price in the long run. Investors should carefully assess their risk tolerance and investment horizon before making any decisions. The volatility of Bitcoin’s price necessitates a thorough understanding of the market.

Impact of the Halving on Bitcoin Mining

The halving significantly impacts Bitcoin mining profitability. The reduction in block rewards means miners will earn less Bitcoin per block mined. This could lead to some less efficient miners becoming unprofitable and potentially exiting the market. This, in turn, could affect the network’s overall hashrate and security. However, the price increase that often follows a halving can offset the reduced reward, potentially maintaining profitability for many miners. Technological advancements in mining hardware and energy efficiency could also play a significant role in determining the long-term viability of mining operations after the halving. The mining landscape may see consolidation, with larger, more efficient mining operations gaining market share.

Determining the precise date for the Bitcoin halving in 2025, or “Cuando Sera El Halving De Bitcoin 2025,” requires careful consideration of the Bitcoin network’s block generation times. To find a reliable prediction, you can check resources dedicated to tracking this event, such as this helpful page detailing the Date Of Bitcoin Halving 2025. Understanding this date is crucial for anticipating potential market shifts related to “Cuando Sera El Halving De Bitcoin 2025.”

Understanding “Cuando Sera El Halving De Bitcoin 2025” requires looking ahead. The next halving in 2024 is well-understood, but to plan further, you need to know when the subsequent halving occurs; for that information, check this resource: When Is The Next Bitcoin Halving After 2025. This knowledge helps accurately predict long-term Bitcoin supply and its potential impact on “Cuando Sera El Halving De Bitcoin 2025” and beyond.

Determining the precise date for the Bitcoin halving in 2025 requires careful analysis of the blockchain’s block generation times. To gain further insight into potential price movements following this significant event, you might find the predictions offered at Bitcoin Prediction Halving 2025 helpful. Understanding these predictions can inform your own assessment of when exactly the 2025 Bitcoin halving will occur.