Date Bitcoin Halving 2025

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, and it’s designed to control inflation and maintain the scarcity of Bitcoin. Historically, halvings have been followed by significant price increases, although the exact impact is complex and influenced by numerous market factors beyond just the halving itself.

The anticipated 2025 Bitcoin halving is projected to occur sometime in the spring. While the precise date depends on the block generation time, which fluctuates slightly, the event is a highly anticipated occurrence within the cryptocurrency community. The halving will reduce the block reward for miners from 6.25 BTC to 3.125 BTC, effectively cutting the rate of new Bitcoin issuance in half.

Bitcoin Halving and Scarcity

The significance of the halving lies in its impact on Bitcoin’s scarcity. Bitcoin’s total supply is capped at 21 million coins. The halving mechanism gradually reduces the rate of new Bitcoin creation, ensuring that the supply remains finite and controlled. This inherent scarcity is a core principle of Bitcoin’s design and is often cited as a key factor driving its value. The predictable nature of the halving contributes to the long-term investment thesis for many Bitcoin holders, as the reduced supply is expected to increase its value over time, mirroring principles of supply and demand seen in precious metals like gold. The previous halvings in 2012, 2016, and 2020 have each been followed by periods of significant price appreciation, although other factors contributed to these price movements. For example, the 2020 halving coincided with increasing institutional adoption of Bitcoin, amplifying the impact of the reduced supply on the price. The 2025 halving is expected to have a similar, although potentially less dramatic, effect due to the market already anticipating this event.

Predicting Bitcoin’s Price After the 2025 Halving

Predicting the price of Bitcoin after any halving event is inherently speculative, but analyzing historical trends and considering influential factors can offer informed estimations. While past performance is not indicative of future results, studying previous halvings provides valuable context for understanding potential price movements. The 2025 halving, reducing the block reward for miners by half, is expected to significantly impact Bitcoin’s supply dynamics, a key factor influencing its price.

Historical Price Movements Following Previous Halvings

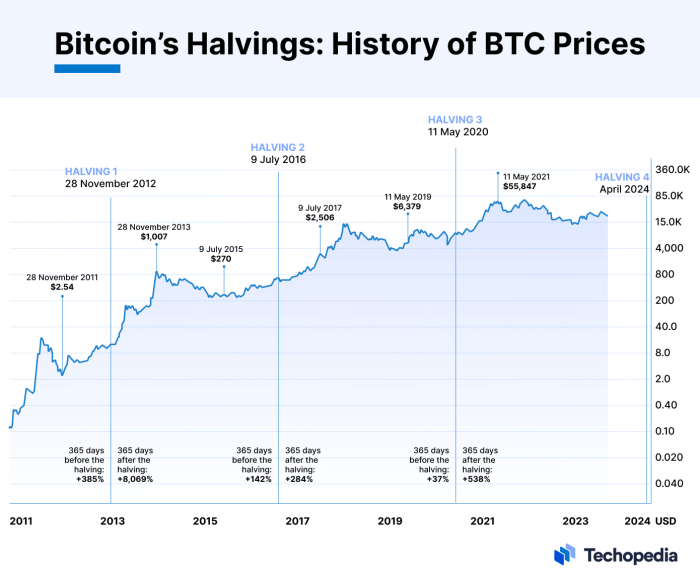

The following table compares Bitcoin’s price before and after its previous halvings. It’s important to remember that numerous other factors contributed to these price changes, making direct correlation difficult. The data presented aims to illustrate general trends, not establish a definitive causal relationship.

| Year of Halving | Price Before Halving (USD) | Price After Halving (USD) (Approximate Peak) | Percentage Change |

|---|---|---|---|

| 2012 | ~10 USD | ~1000 USD | ~10000% |

| 2016 | ~650 USD | ~20000 USD | ~3000% |

| 2020 | ~9000 USD | ~65000 USD | ~700% |

Factors Influencing Bitcoin’s Price Beyond the Halving

Several factors, beyond the halving itself, exert considerable influence on Bitcoin’s price. Regulatory landscapes in major economies play a critical role. Positive regulatory developments tend to increase investor confidence and drive price appreciation, while stricter regulations can trigger sell-offs. Macroeconomic conditions, including inflation rates, interest rates, and overall economic growth, significantly impact investor sentiment and risk appetite, influencing Bitcoin’s price as an asset class. Finally, the rate of Bitcoin adoption – measured by the number of users, merchants accepting Bitcoin, and institutional investments – plays a significant role in driving demand and price appreciation. Increased adoption generally leads to higher prices, while decreased adoption can negatively impact the market.

Comparison of Price Prediction Models

Various models exist for predicting Bitcoin’s price, each with its strengths and weaknesses. Some models utilize on-chain metrics, such as transaction volume and hash rate, to gauge network activity and predict future price movements. Other models incorporate macroeconomic factors and sentiment analysis to arrive at their predictions. Stock-to-flow models, for example, attempt to predict price based on the scarcity of Bitcoin and its rate of production. However, it’s crucial to remember that these models are not perfect and their predictions should be viewed with caution. The complexity of the Bitcoin market makes accurate long-term price predictions extremely challenging. Real-world examples show that even sophisticated models can significantly deviate from actual price movements, highlighting the inherent uncertainty in market forecasting. A diversified approach, considering multiple models and factors, offers a more comprehensive understanding of potential price scenarios.

The Impact of the 2025 Halving on Bitcoin Mining

The Bitcoin halving in 2025, scheduled to reduce the block reward from 6.25 BTC to 3.125 BTC, will significantly impact the Bitcoin mining landscape. This reduction in the primary revenue stream for miners will necessitate adaptations across the industry, affecting profitability, technological advancements, and the network’s overall decentralization. The consequences will ripple through the ecosystem, influencing everything from energy consumption to the geographic distribution of mining operations.

The reduced block reward directly impacts miners’ profitability. With half the Bitcoin earned per block, miners will need to adjust their operations to maintain profitability. This could involve increased efficiency through improved hardware, reduced operational costs (such as energy), or a consolidation of mining operations among larger, more established players. Miners operating at higher costs, particularly those with less efficient equipment or higher energy prices, may find themselves unable to compete and forced to shut down. This scenario could lead to a period of market consolidation and potentially impact the overall hashrate of the network, at least temporarily.

Reduced Block Rewards and Miner Profitability

The decrease in block rewards forces miners to re-evaluate their operational costs. Profitability hinges on the interplay between the Bitcoin price, the mining difficulty, and the cost of electricity and hardware. A lower block reward necessitates either a higher Bitcoin price, a reduction in operational expenses, or both to remain profitable. For example, a miner currently operating at a break-even point with a 6.25 BTC reward might find themselves operating at a loss after the halving, prompting them to seek efficiency improvements or to exit the market. This dynamic will shape the competitive landscape, favoring miners with access to cheaper electricity and more efficient equipment.

Changes in Mining Hardware and Energy Consumption

The halving will likely accelerate the adoption of more energy-efficient mining hardware. The pressure to maintain profitability will drive innovation in ASIC (Application-Specific Integrated Circuit) chip design, focusing on increased hashing power per watt. We can expect to see new generations of mining hardware with significantly improved efficiency compared to current models. This push for efficiency might also lead to a geographic shift in mining operations, with miners migrating to regions with lower electricity costs. Areas with abundant renewable energy sources, like hydroelectric or geothermal power, might become more attractive locations for mining farms. However, this shift could also centralize mining power in fewer hands, potentially impacting decentralization.

Implications for Decentralization of the Bitcoin Network

The impact of the 2025 halving on Bitcoin network decentralization is complex and multifaceted. While the reduced profitability could lead to a consolidation of mining power among larger players, it could also incentivize the development of more distributed mining models. For example, the increased efficiency of new hardware might lower the barrier to entry for smaller-scale miners, potentially counteracting the centralizing forces of reduced profitability. The outcome will depend on the interplay of several factors, including the Bitcoin price, the pace of technological innovation in mining hardware, and regulatory developments affecting the industry. A significant shift towards centralized mining could pose risks to the network’s security and resilience, while a more decentralized distribution of mining power would strengthen its robustness and resistance to censorship.

Investor Sentiment and Market Behavior Leading Up to 2025

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, historically triggers significant shifts in investor sentiment and market behavior. The anticipation leading up to the 2025 halving is already generating considerable discussion and speculation within the cryptocurrency community. Understanding these typical patterns can provide valuable context for navigating the market.

Investor sentiment typically undergoes a gradual transformation in the period preceding a halving. Initially, a cautious optimism prevails, with many investors acknowledging the potential for future price appreciation but remaining hesitant due to the inherent volatility of the cryptocurrency market. As the halving date approaches, this cautious optimism often intensifies, leading to increased buying pressure and a potential price surge. This is fueled by the expectation of decreased Bitcoin supply, a fundamental principle of economics that often drives up prices for scarce assets. However, it’s important to remember that this isn’t always a linear progression; periods of uncertainty and price corrections are common.

Market Behavior and Trading Strategies

The anticipation of the 2025 halving is expected to influence various market behaviors and trading strategies. Many investors may adopt a “buy-the-dip” strategy, purchasing Bitcoin during temporary price dips in the lead-up to the event, hoping to capitalize on the anticipated price increase. Conversely, some might employ short-term trading strategies, attempting to profit from price fluctuations around the halving date. Others may prefer a long-term “hodling” strategy, holding onto their Bitcoin investments regardless of short-term market volatility, believing in the long-term value proposition of the asset. The actual strategies employed will depend on individual risk tolerance and investment horizons.

Hypothetical Market Scenario

Let’s consider a hypothetical scenario. Imagine that, starting six months before the 2025 halving, Bitcoin’s price hovers around $30,000. As the halving approaches, positive news and increased media coverage fuel growing optimism. This leads to a gradual price increase, reaching $40,000 two months before the event. In the final month, a wave of speculative buying pushes the price to $50,000. Immediately after the halving, a short-term correction might occur, dropping the price to $45,000 as some investors take profits. However, if the broader market sentiment remains positive, the price could eventually recover and surpass its pre-halving peak, potentially reaching $60,000 or higher within the following year, based on historical precedent and the expectation of reduced supply. This scenario, while hypothetical, highlights the potential interplay of market forces and investor behavior around a halving event. It’s crucial to remember that this is just one possible outcome, and the actual market response could differ significantly. Past performance is not indicative of future results.

Long-Term Implications of the 2025 Halving

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation by half, is anticipated to have profound and long-lasting effects on the cryptocurrency’s value proposition and its adoption as a store of value. While the immediate impact is often debated, the long-term consequences are more significant and require careful consideration. The decreased supply coupled with potentially increasing demand could trigger a sustained bull market, but several factors could also moderate or even negate this effect.

The halving’s influence on Bitcoin’s value proposition hinges on its ability to maintain and enhance its scarcity and perceived security. A consistently lower inflation rate, resulting from the halving, strengthens Bitcoin’s case as a hedge against inflation and a potential store of value, particularly in comparison to fiat currencies subject to potentially higher inflation rates. However, the long-term success depends on continued technological advancements, robust network security, and the overall adoption and acceptance of Bitcoin within the global financial landscape.

Bitcoin’s Value Proposition as a Store of Value

The halving directly impacts Bitcoin’s scarcity, a key element of its value proposition as a store of value. Reduced supply, combined with sustained or increasing demand, could drive up the price, reinforcing its appeal as a hedge against inflation and a safe haven asset. Historically, previous halvings have been followed by periods of significant price appreciation, although this isn’t guaranteed to repeat. For instance, the 2012 and 2016 halvings were followed by substantial price increases, albeit with periods of volatility. However, macroeconomic factors and regulatory changes can significantly influence the price trajectory, making direct causal links between halving and price appreciation complex.

Potential Risks and Opportunities

The long-term effects of the 2025 halving present both substantial opportunities and significant risks. Understanding these is crucial for investors and stakeholders.

The potential for increased price volatility is a significant risk. While a price increase is anticipated by many, the magnitude and timing remain uncertain. Sharp price swings could negatively impact investor confidence and market stability. Conversely, a sustained bull market driven by the halving could lead to widespread adoption and increased institutional investment, solidifying Bitcoin’s position in the global financial system. This presents a significant opportunity for early adopters and long-term holders.

Another risk is the potential for increased competition from alternative cryptocurrencies. While Bitcoin maintains a dominant market share, the emergence of new technologies and improved cryptocurrencies could erode its dominance and impact its price. Conversely, an opportunity lies in the potential for Bitcoin to further solidify its position as the leading cryptocurrency, benefiting from network effects and brand recognition.

Finally, regulatory uncertainty remains a considerable risk. Government regulations and policies can significantly influence the price and adoption of Bitcoin. A restrictive regulatory environment could stifle growth, while supportive policies could fuel further adoption and price appreciation. Conversely, the opportunity lies in the potential for increased regulatory clarity, providing a more stable and predictable environment for Bitcoin’s long-term growth.

Alternative Cryptocurrencies and the 2025 Halving

The Bitcoin halving, a significant event reducing the rate of new Bitcoin creation, often has ripple effects across the broader cryptocurrency market. While Bitcoin’s price movements are the primary driver, the impact on alternative cryptocurrencies (altcoins) is complex and multifaceted, influenced by factors ranging from investor sentiment to the technological characteristics of each altcoin. Understanding this interconnectedness is crucial for navigating the cryptocurrency landscape around the 2025 halving.

The impact of halving events, or similar token emission reduction mechanisms, varies significantly across different cryptocurrencies. Some altcoins, particularly those with similar deflationary models, might experience increased investor interest mirroring the Bitcoin trend. Others, heavily reliant on Bitcoin’s price action for liquidity and investor confidence, could see their values fluctuate depending on Bitcoin’s performance. The level of correlation between Bitcoin and an altcoin’s price will heavily influence the impact of the halving.

Altcoin Price Reactions to Bitcoin Price Changes

A Bitcoin price surge following the 2025 halving could trigger a “bull market” across the altcoin market, as investors seek diversification and potentially higher returns. This is because a significant price increase in Bitcoin often leads to increased overall market liquidity and investor enthusiasm, boosting confidence in other cryptocurrencies. For example, the 2017 Bitcoin bull run saw numerous altcoins experience substantial gains, often exceeding Bitcoin’s own percentage increase. Conversely, a Bitcoin price decline post-halving could lead to a market-wide sell-off, dragging down altcoin prices alongside it. This is because investor sentiment frequently shifts in unison, with fear and uncertainty impacting the entire market, not just Bitcoin. The 2018 Bitcoin bear market serves as a stark example of this phenomenon, with many altcoins experiencing even steeper declines than Bitcoin.

Correlation and Diversification in the Altcoin Market

The degree to which altcoins are correlated with Bitcoin’s price is a critical factor determining their response to the halving. Highly correlated altcoins will likely follow Bitcoin’s price trajectory closely, regardless of their own fundamental characteristics. Less correlated altcoins, those with unique use cases or independent market drivers, may exhibit less sensitivity to Bitcoin’s price fluctuations. For example, altcoins with strong community support, active development, or significant real-world adoption might maintain their value or even experience growth even if Bitcoin experiences a temporary downturn. This diversification strategy, selecting altcoins with low correlation to Bitcoin, could offer a way to mitigate some risk associated with Bitcoin’s price volatility.

The Role of Investor Sentiment and Market Speculation

Investor sentiment plays a crucial role in shaping altcoin reactions to the Bitcoin halving. Anticipation of the halving often leads to a period of increased speculation, potentially inflating the prices of both Bitcoin and altcoins. However, this speculation can be highly volatile, with rapid price swings based on news, market analysis, and overall investor confidence. Post-halving, if Bitcoin’s price does not meet the expectations of investors, a significant correction could occur, leading to a cascade effect impacting altcoin valuations. This underscores the inherent risk in relying on speculative market forces when assessing the potential impact of the 2025 Bitcoin halving on altcoins. Historical examples abound where highly anticipated events failed to meet market expectations, leading to sharp price drops.

Frequently Asked Questions about the 2025 Bitcoin Halving

The Bitcoin halving is a significant event in the cryptocurrency world, generating considerable interest and speculation. Understanding its mechanics and potential impact is crucial for anyone involved in or observing the Bitcoin market. This section addresses some frequently asked questions surrounding the 2025 halving.

Bitcoin Halving Mechanism and Purpose

The Bitcoin halving is a programmed event that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. The mechanism halves the reward given to Bitcoin miners for successfully adding a block of transactions to the blockchain. The initial reward was 50 BTC per block; after the first halving, it became 25 BTC, then 12.5 BTC, and after the 2024 halving, it will be 6.25 BTC. The purpose is to control Bitcoin’s inflation rate, ensuring its long-term scarcity and potentially maintaining its value.

Expected Date of the 2025 Bitcoin Halving

While the halving is tied to the block creation rate, predicting the exact date requires estimating the average block time. Given historical data and current mining difficulty, the 2025 Bitcoin halving is expected to occur sometime in April 2024. However, minor variations are possible due to fluctuations in mining hash rate.

Bitcoin Price Impact of the Halving

Historically, Bitcoin’s price has shown a tendency to increase in the period following a halving. This is primarily attributed to the reduced supply of newly minted Bitcoins. The 2012 and 2016 halvings were followed by significant price rallies, though the timing and magnitude of these rallies varied. However, it’s crucial to note that other factors, such as market sentiment, regulatory changes, and overall economic conditions, also significantly influence Bitcoin’s price. Therefore, while a price increase is a common expectation, it is not guaranteed. The 2012 halving saw a price increase of approximately 8000%, while the 2016 halving was followed by a period of consolidation before a later substantial price surge.

Halving’s Guaranteed Price Increase

No, the halving is not guaranteed to increase Bitcoin’s price. While the reduced supply of new Bitcoins contributes to potential price appreciation, it’s only one factor among many. Market sentiment, regulatory pressures, technological advancements, and macroeconomic conditions can all significantly impact Bitcoin’s price, potentially overriding the halving’s effect. For instance, a negative market sentiment driven by external factors could outweigh the positive effect of a reduced supply.

Risks of Investing Around the Halving, Date Bitcoin Halving 2025

Investing in Bitcoin around a halving carries significant risks. The period leading up to and following a halving often sees increased price volatility. This means that prices can swing dramatically in both directions, leading to potential substantial gains or losses. Furthermore, the anticipation of the halving can create speculative bubbles, leading to inflated prices that may not be sustainable. Investors should be aware of these risks and only invest what they can afford to lose. The potential for market manipulation around major events like the halving also adds to the risk profile. Past price surges post-halving should not be considered a guarantee of future performance.

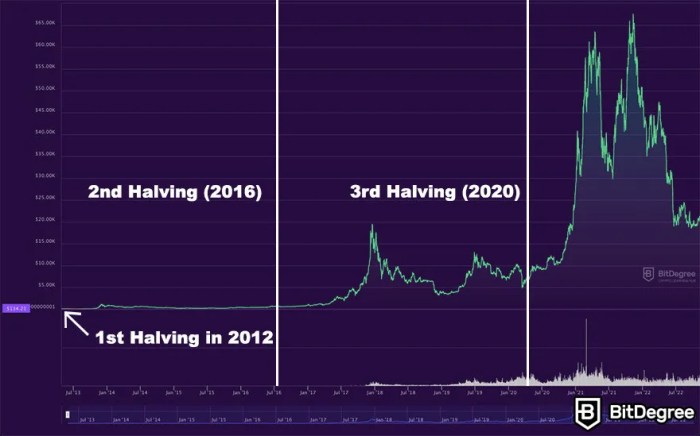

Illustrative Example: Bitcoin Price Movement After Previous Halvings: Date Bitcoin Halving 2025

Analyzing the price movements of Bitcoin following its previous halving events offers valuable insights into potential future behavior. While past performance is not indicative of future results, examining these trends helps contextualize expectations surrounding the 2025 halving. The halving events significantly impact the rate of new Bitcoin entering circulation, influencing supply and potentially affecting price.

The impact of each halving on Bitcoin’s price has varied in terms of timing and magnitude, influenced by a complex interplay of factors beyond just the reduced supply.

Bitcoin Halving 2012

Following the 2012 halving, Bitcoin’s price experienced a gradual increase over the subsequent year. The price initially remained relatively stable, before embarking on a significant upward trajectory. This period saw a slow build-up of positive sentiment, driven by growing awareness and adoption of Bitcoin. The visual representation would show a relatively flat line initially, followed by a steady, then accelerating, upward curve representing the price increase. Market sentiment shifted from cautious optimism to increasingly bullish expectations as the price rose.

Bitcoin Halving 2016

The 2016 halving was followed by a more pronounced and rapid price surge. The price increase began more quickly than after the 2012 halving, showing a steeper incline on the visual representation. This period saw increased institutional interest and a surge in media attention contributing to the significant price appreciation. The visual representation would depict a steeper, more rapid upward curve compared to the 2012 halving, reflecting the faster price increase. Market sentiment was significantly more bullish compared to the previous halving.

Bitcoin Halving 2020

The 2020 halving was followed by a period of substantial price volatility. The price initially saw a period of consolidation before experiencing a dramatic surge to all-time highs. The visual representation would show a period of relatively flat price action initially, followed by a sharp, almost vertical upward spike, reflecting the rapid price increase. However, this was followed by significant price corrections, showing a more volatile trajectory compared to previous halvings. Market sentiment was a mix of extreme bullishness and fear, driven by increased institutional and retail investor participation. The visual would reflect this volatility with periods of sharp increases and decreases.

Pinpointing the exact date of the Bitcoin Halving in 2025 requires careful consideration of block times. However, we can find comprehensive information about the event itself by visiting this helpful resource on the 2025 Bitcoin Halving. Understanding this event is crucial for anyone interested in predicting potential market impacts around the Date Bitcoin Halving 2025.

Pinpointing the exact date of the Bitcoin Halving in 2025 requires careful consideration of the block reward reduction mechanism. To understand the timing precisely, it’s helpful to consult resources dedicated to tracking this event, such as this comprehensive guide on Bitcoin Halving 2025 When. This information is crucial for accurately predicting the date of the Bitcoin Halving 2025 and its potential market impact.

Pinpointing the exact date of the Bitcoin halving in 2025 requires careful analysis of the blockchain’s block generation times. However, it’s interesting to compare this to other cryptocurrencies with similar mechanisms, such as the anticipated impact of the Bitcoin Cash Halving 2025 , which may influence Bitcoin’s price indirectly. Ultimately, the Bitcoin halving date remains a key factor in predicting future market trends.

Pinpointing the exact date of the Bitcoin halving in 2025 requires careful consideration of the block generation times. To clarify the precise timing, a useful resource is available: When Is Bitcoin Halving In 2025. This helps determine the date of the Bitcoin Halving 2025, which is crucial for market analysis and prediction. Understanding this date is key to assessing the potential impact on Bitcoin’s price and future trajectory.

Pinpointing the exact date of the Bitcoin Halving in 2025 requires careful consideration of block times. However, to stay updated on the precise countdown and projected date, you can check out this helpful resource: Bitcoin Halving Countdown 2025. This countdown provides a dynamic view of the time remaining until the halving event, helping you accurately anticipate the Date Bitcoin Halving 2025.

Pinpointing the exact date of the Bitcoin Halving in 2025 requires careful consideration of the blockchain’s block generation times. To fully understand the implications of this event, it’s helpful to first grasp the mechanics involved; for a clear explanation, check out this resource on What Is The Bitcoin Halving 2025. Knowing what a halving entails allows for a more informed prediction of the precise date for the 2025 halving.