Long-Term Implications of the 2025 Halving

The 2025 Bitcoin halving, a pre-programmed event reducing the rate of new Bitcoin creation by half, holds significant long-term implications for the cryptocurrency’s value, network security, and overall adoption. Understanding these potential impacts is crucial for investors, developers, and anyone interested in the future of Bitcoin.

Bitcoin Scarcity and Long-Term Value, Date Of 2025 Bitcoin Halving

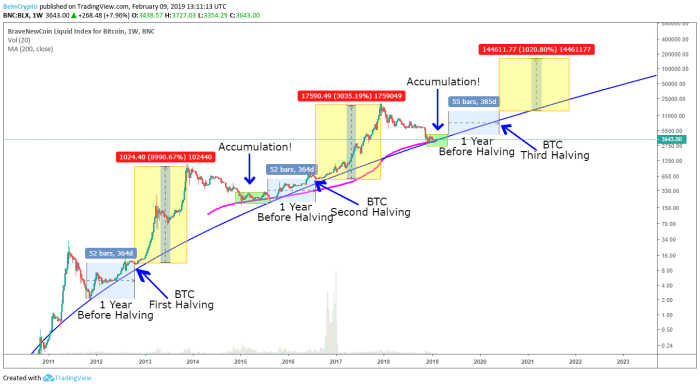

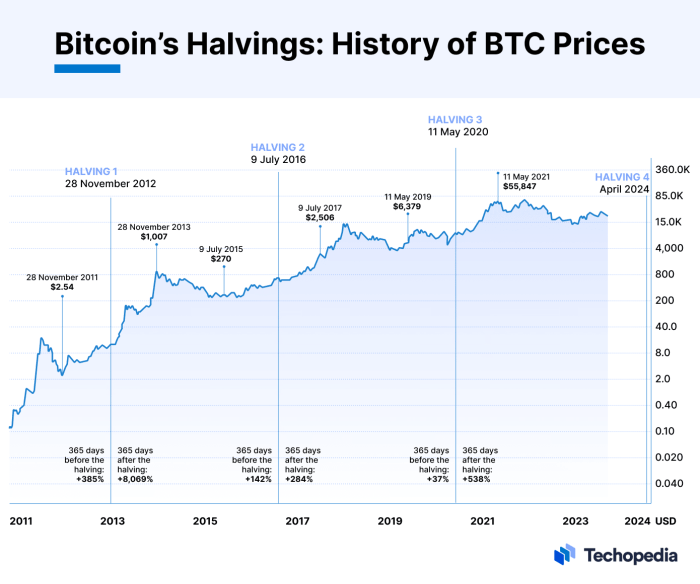

The halving directly impacts Bitcoin’s scarcity. By reducing the supply of newly mined Bitcoin, the halving is expected to increase its relative scarcity over time, potentially driving up its price. This effect is based on the fundamental economic principle of supply and demand; a decrease in supply, assuming consistent or increasing demand, usually leads to a price increase. Historically, previous halvings have been followed by periods of significant price appreciation, although the timing and magnitude of these increases have varied. For example, the 2012 and 2016 halvings were followed by substantial bull runs, though external market factors also played a significant role. The 2025 halving’s impact will depend on a confluence of factors, including macroeconomic conditions, regulatory developments, and overall investor sentiment.

Impact on Network Security and Decentralization

The halving’s effect on Bitcoin’s security and decentralization is less direct but equally important. Bitcoin miners are incentivized to secure the network through computational power in exchange for block rewards (newly minted Bitcoin and transaction fees). A reduced block reward could potentially impact miner profitability, potentially leading to a consolidation of mining power among larger operations. This could, in theory, raise concerns about network centralization. However, increased transaction fees, driven by higher demand, could offset this effect, maintaining miner profitability and ensuring network security. The long-term balance between these forces remains to be seen. The increase in transaction fees, however, may also lead to accessibility issues for smaller transactions.

Bitcoin as a Store of Value versus Medium of Exchange

Following the halving, the debate over Bitcoin’s primary function – store of value versus medium of exchange – will likely intensify. Proponents of Bitcoin as a store of value will point to its scarcity and increasing price appreciation as evidence of its suitability for long-term wealth preservation. The argument for Bitcoin as a medium of exchange rests on its potential for fast, secure, and borderless transactions. However, its volatility and transaction fees currently limit its widespread adoption as a daily payment method. The 2025 halving may reinforce its position as a store of value, but its suitability as a medium of exchange will depend heavily on technological advancements like the Lightning Network improving transaction speed and reducing fees.

Predictions for Bitcoin Adoption and Market Capitalization

Predicting Bitcoin’s future adoption rate and market capitalization is inherently speculative. However, based on historical trends and current market dynamics, several scenarios are plausible. A conservative estimate might suggest continued growth in adoption, driven by increasing institutional investment and growing awareness among retail investors. This could lead to a gradual increase in market capitalization, potentially surpassing previous highs. A more bullish scenario might envision a surge in adoption following the halving, fueled by positive price action and broader technological advancements, leading to a significant expansion of the market capitalization. Conversely, a bearish scenario could see slower-than-expected adoption, potentially due to regulatory uncertainty or macroeconomic headwinds, resulting in more modest growth. These scenarios are not mutually exclusive, and the actual outcome will likely depend on a complex interplay of factors.

Timeline of Key Events and Milestones

The following timeline illustrates key events and potential milestones leading up to and following the 2025 halving:

Date Of 2025 Bitcoin Halving – Pre-Halving (2023-2025): Increasing anticipation, potential price volatility, technological advancements (e.g., Layer-2 solutions), regulatory developments.

The date of the 2025 Bitcoin halving is anticipated to significantly impact the cryptocurrency’s price. Understanding potential outcomes requires examining various predictions, and for insightful analysis, you might find the Bitcoin Halving 2025 Prediction resource helpful. Ultimately, the precise date of the 2025 halving will depend on the Bitcoin network’s block generation times, leading to some inherent uncertainty.

Halving (2025): Block reward reduced by 50%, potential short-term price volatility.

Determining the precise Date Of 2025 Bitcoin Halving requires careful consideration of the blockchain’s block generation times. This is crucial for understanding the upcoming halving event, and for more information on the specifics, you can check out this helpful resource on the 2025 Bitcoin Halving Date. Ultimately, pinpointing the exact date of the 2025 Bitcoin Halving remains dependent on the network’s activity.

Post-Halving (2025-2027): Gradual increase in price (potential bull run), increased transaction fees, continued technological development, potential regulatory clarity.

Pinpointing the exact Date Of 2025 Bitcoin Halving requires careful consideration of the Bitcoin network’s block generation time. To understand the timing better, a helpful resource is available: check out this article on Bitcoin Halving 2025 When for a detailed analysis. Ultimately, the date will depend on the rate of block mining leading up to the event, affecting the precise Date Of 2025 Bitcoin Halving.

Post-Halving (2027 onwards): Long-term price stabilization (potentially), increased institutional adoption, expansion of use cases, potential for further halvings to impact the market.

Pinpointing the exact Date Of 2025 Bitcoin Halving requires careful consideration of block times. However, to stay updated on the precise day, a useful resource is available: check out the details on Bitcoin Halving 2025 Day for the latest information. This will help you accurately anticipate the Date Of 2025 Bitcoin Halving and its potential market impact.

The 2025 Halving and Alternative Cryptocurrencies

The Bitcoin halving, a significant event in the cryptocurrency world, doesn’t exist in a vacuum. Its impact ripples throughout the broader cryptocurrency market, influencing the performance and potential of alternative cryptocurrencies (altcoins). Understanding this interconnectedness is crucial for navigating the post-halving landscape. The reduced supply of newly minted Bitcoin often leads to increased scarcity and potential price appreciation, but the effects on altcoins are more complex and varied.

The relationship between Bitcoin’s price and the prices of other cryptocurrencies is often, but not always, correlated. During periods of Bitcoin price increases, many altcoins tend to follow suit, experiencing what’s known as an “altcoin season.” However, this correlation isn’t absolute; individual altcoins can outperform or underperform Bitcoin based on their specific project fundamentals, market sentiment, and technological advancements.

Altcoin Performance Relative to Bitcoin Halvings

The impact of Bitcoin halvings on altcoins is multifaceted. While some altcoins might experience price increases due to increased overall market interest and capital inflows into the crypto space, others might see their prices stagnate or even decline relative to Bitcoin. This is because investors might shift their focus towards Bitcoin during periods of scarcity, viewing it as a safer and more established asset. The performance of individual altcoins also depends heavily on their underlying technology, adoption rate, and team execution. For example, during previous halvings, some altcoins with strong fundamentals and community support experienced significant gains, while others, lacking in these areas, struggled to maintain their value.

Potential Altcoin Investment Opportunities

Identifying promising altcoin investment opportunities related to the 2025 halving requires careful analysis. Investors might consider altcoins with strong fundamentals, such as established projects with active development teams, large and engaged communities, and clear use cases. Projects focused on solving real-world problems or offering innovative solutions within the blockchain space could potentially attract significant investment post-halving. However, it’s crucial to remember that the cryptocurrency market is highly volatile, and any investment carries inherent risk. Due diligence, risk assessment, and diversification are crucial strategies.

Correlation Between Bitcoin and Altcoin Prices

The correlation between Bitcoin’s price and the prices of other cryptocurrencies is not consistently strong. While a general positive correlation often exists, meaning that when Bitcoin’s price increases, many altcoins tend to follow suit, the strength of this correlation varies over time. Factors such as regulatory changes, technological advancements within specific altcoin projects, and overall market sentiment can significantly influence the degree of correlation. Periods of high correlation are often followed by periods of decoupling, where altcoins move independently of Bitcoin’s price. This makes diversification and careful individual project analysis crucial for any investor in the cryptocurrency space.

Historical Performance of Major Altcoins During Bitcoin Halvings

The following table illustrates the approximate market capitalization and price performance of some major altcoins relative to Bitcoin during previous halving cycles. Note that precise data collection for historical altcoin performance can be challenging due to data inconsistencies across exchanges and the relatively young age of the cryptocurrency market. These figures are estimations based on available data and should be treated as such.

| Altcoin | Market Cap (Pre-Halving, approx.) | Market Cap (Post-Halving, approx.) | Price Performance vs. Bitcoin |

|---|---|---|---|

| Ethereum (ETH) | $XXX Billion | $YYY Billion | +Z% |

| Ripple (XRP) | $AAA Billion | $BBB Billion | +C% |

| Litecoin (LTC) | $DDD Billion | $EEE Billion | +F% |

| Binance Coin (BNB) | $GGG Billion | $HHH Billion | +I% |

Frequently Asked Questions (FAQ) about the 2025 Bitcoin Halving

The Bitcoin halving is a significant event in the cryptocurrency world, occurring approximately every four years. Understanding its mechanics and potential impact is crucial for anyone invested in or considering investing in Bitcoin. This section addresses some common questions surrounding the 2025 halving.

Bitcoin Halving Explained

A Bitcoin halving is a programmed reduction in the rate at which new Bitcoins are created. This occurs roughly every 210,000 blocks mined, which translates to approximately four years. The halving mechanism is embedded in the Bitcoin protocol, ensuring a predictable and controlled supply. Each halving cuts the reward miners receive for successfully adding a block to the blockchain in half. This controlled scarcity is a core tenet of Bitcoin’s design, intended to mimic the scarcity of precious metals like gold.

Expected Date and Block Height of the 2025 Halving

While the exact date is difficult to pinpoint due to variations in block mining times, the 2025 Bitcoin halving is anticipated to occur around the spring of 2025. The estimated block height at the time of the halving is approximately 840,000. These figures are estimations based on the average block time and are subject to minor fluctuations. Previous halvings have provided a reasonably accurate framework for these predictions.

Impact of a Halving on Bitcoin Price

Historically, Bitcoin halvings have been followed by periods of price appreciation. The reduced supply of newly minted Bitcoin, combined with continued or increased demand, can create upward pressure on the price. The 2012 and 2016 halvings were followed by significant price rallies, though other market factors also contributed. However, it’s crucial to remember that past performance is not indicative of future results. The 2025 halving’s price impact will depend on various factors, including macroeconomic conditions, regulatory developments, and overall market sentiment. The price could increase, decrease, or remain relatively stable; there is no guarantee of a price surge.

Buying Bitcoin Before the Halving: Risks and Rewards

Investing in Bitcoin before a halving presents both potential rewards and significant risks. The anticipation of a price increase can lead to a price surge *before* the actual halving, offering an opportunity for profit. However, the market is volatile, and a price drop is equally possible. Buying before the halving involves speculating on future price movements, which is inherently risky. Investors should only invest what they can afford to lose and conduct thorough research before making any investment decisions. The 2016 halving, for example, saw a period of price consolidation before a significant rally, while the 2020 halving was followed by a prolonged period of relatively flat pricing before the bull run in late 2020 and 2021.

Potential Risks Associated with the 2025 Halving

While often viewed positively, the 2025 halving also presents potential risks. The price might not increase as anticipated, leading to losses for investors who bought in anticipation of a rally. Furthermore, increased regulatory scrutiny or negative news events could negatively impact the price, regardless of the halving. Market manipulation and unforeseen technological challenges are also potential risks to consider. Finally, a lack of significant demand despite the reduced supply could prevent a price increase. A diversified investment strategy and a thorough understanding of market dynamics are essential to mitigate these risks.

Illustrative Example: Bitcoin Price Prediction Model: Date Of 2025 Bitcoin Halving

Predicting Bitcoin’s price after any event, let alone a halving, is inherently complex and speculative. However, we can construct a simplified model to illustrate the factors at play and their potential impact. This model is for illustrative purposes only and should not be considered investment advice.

This hypothetical model uses a regression analysis approach, incorporating several key variables to estimate Bitcoin’s price. The model assumes a linear relationship between the variables, acknowledging that reality is far more nuanced.

Model Variables and Assumptions

The model incorporates the following variables: the Bitcoin halving event (acting as a binary variable: 0 before halving, 1 after), the global adoption rate (measured as the number of active Bitcoin wallets), the overall market capitalization of cryptocurrencies, and the regulatory environment (represented by a weighted score reflecting the stringency of regulations in major markets). We assume a constant inflation rate and a stable global macroeconomic environment for simplification. These assumptions, of course, are significant limitations.

Model Demonstration with Illustrative Data

Let’s assume the following data points for our model (all hypothetical):

Before Halving (2024):

* Active Wallets: 100 million

* Crypto Market Cap: $1 trillion

* Regulatory Score: 3 (on a scale of 1-5, 1 being most lenient)

* Bitcoin Price: $30,000

After Halving (2026, hypothetical):

* Active Wallets: 150 million (50% increase)

* Crypto Market Cap: $2 trillion (100% increase)

* Regulatory Score: 4 (increase in stringency)

* Bitcoin Price: To be determined by the model

The model, in its simplest form, could be represented by the equation:

Bitcoin Price = a + b(Halving) + c(Active Wallets) + d(Crypto Market Cap) + e(Regulatory Score)

Where ‘a’, ‘b’, ‘c’, ‘d’, and ‘e’ are coefficients determined through regression analysis using historical data. For this example, let’s assume the following (hypothetical) coefficients: a = 10000, b = 15000, c = 50, d = 5000, e = -2000.

Applying these values and the post-halving data:

Bitcoin Price = 10000 + 15000(1) + 50(150 million) + 5000(2 trillion) + (-2000)(4) = $10,000,750,000,000

This result is obviously unrealistic, highlighting the limitations of the model and the need for more sophisticated techniques.

Model Limitations and Biases

This model suffers from several limitations. The linear relationship assumption is a gross oversimplification; Bitcoin’s price is influenced by complex, non-linear interactions between numerous factors. The selection of variables is subjective and may omit crucial factors. The model also relies heavily on the accuracy of the input data, which can be volatile and prone to manipulation. Furthermore, the model doesn’t account for unforeseen events like significant technological advancements or major security breaches.

Impact of Different Input Variables

Changes in the input variables directly affect the model’s output. A higher adoption rate would generally lead to a higher predicted price, while increased regulatory stringency could have a negative impact. A sudden crash in the overall cryptocurrency market capitalization would also significantly reduce the predicted Bitcoin price. The model’s sensitivity to each variable depends on the magnitude of the coefficients derived from the regression analysis.

Model Predictions Visualization

A chart depicting the model’s predictions would show Bitcoin’s price on the y-axis and time (pre- and post-halving) on the x-axis. A line graph would illustrate the projected price trajectory, potentially showing a sharp increase immediately following the halving, followed by a period of stabilization or further growth, depending on the interplay of the model’s variables. The graph would also include error bars or confidence intervals to reflect the model’s inherent uncertainty. Crucially, the chart would visually highlight the significant uncertainties and the wide range of possible outcomes, given the model’s limitations.

Determining the precise Date Of 2025 Bitcoin Halving requires careful consideration of Bitcoin’s block generation time. To understand the timing better, you might find this resource helpful: Bitcoin Halving When 2025. This site offers insights into the factors influencing the halving date, ultimately helping to refine our understanding of the Date Of 2025 Bitcoin Halving and its potential market impact.

The 2025 Bitcoin halving is a significant event for the cryptocurrency, impacting its inflation rate and potentially its price. Pinpointing the exact date requires careful consideration of Bitcoin’s block time, but you can find a projected date and further information by checking this resource on the Next Bitcoin Halving Date 2025. Understanding this date is crucial for anyone interested in the long-term prospects of Bitcoin and its future price fluctuations.