Did Bitcoin Halving Happen in 2025? – A Fact Check

No Bitcoin halving occurred in 2025. Bitcoin halvings are predetermined events coded into the Bitcoin protocol, occurring approximately every four years. Understanding this mechanism is crucial to comprehending Bitcoin’s deflationary nature and its potential impact on price.

The Bitcoin Halving Mechanism and its Impact

The Bitcoin halving mechanism reduces the reward given to Bitcoin miners for successfully adding new blocks to the blockchain by half. This directly impacts the rate at which new Bitcoins enter circulation. The halving event is designed to control inflation and maintain scarcity, theoretically increasing the value of existing Bitcoins over time due to reduced supply. While the halving itself doesn’t directly cause price increases, it’s often considered a significant catalyst influencing market sentiment and potentially leading to price appreciation. However, other market forces heavily influence the actual price movement.

Timeline of Past Bitcoin Halvings and Market Effects

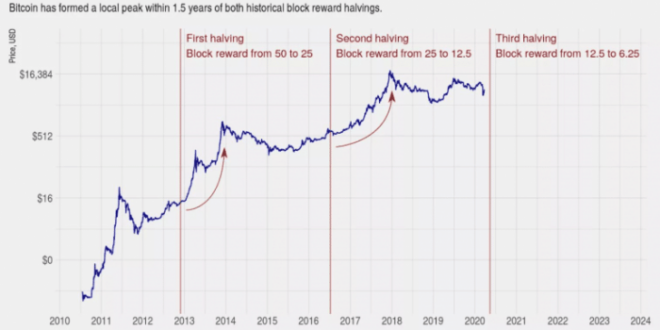

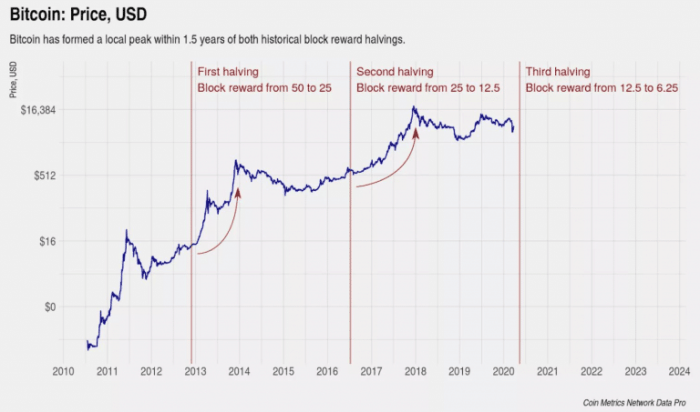

The Bitcoin network has experienced three previous halvings. Each halving has been followed by periods of price volatility, though the extent and duration of these price movements have varied considerably. The initial impact is often a period of uncertainty, followed by a gradual price increase in most cases. However, it’s essential to remember that other factors, such as regulatory changes, technological advancements, and macroeconomic conditions, play a significant role.

Comparison of Anticipated Effects of a Hypothetical 2025 Halving with Previous Halvings

A hypothetical 2025 halving, had it occurred, would likely have been similar in its core mechanism to previous events. The reward for miners would have been halved, further reducing the rate of new Bitcoin issuance. However, predicting the exact market impact is impossible. Past halvings have shown varying degrees of price increase following the event, with the time frame and magnitude of the increase differing significantly. This variation highlights the complexity of the cryptocurrency market and the influence of factors beyond the halving itself.

Factors Influencing Bitcoin’s Price Beyond Halving Events

Numerous factors beyond halving events significantly influence Bitcoin’s price. These include:

- Regulatory landscape: Government regulations and policies concerning cryptocurrencies globally have a substantial impact.

- Adoption rate: Increased adoption by businesses and individuals fuels demand and potentially drives price increases.

- Technological advancements: Upgrades and improvements to the Bitcoin network can positively or negatively influence market sentiment.

- Macroeconomic conditions: Global economic factors, such as inflation and interest rates, can significantly affect Bitcoin’s price.

- Market sentiment: Investor confidence and speculation play a crucial role in price fluctuations.

Key Metrics of Past Bitcoin Halvings

| Date | Block Height (approx.) | Reward Reduction | Price Before (USD) | Price After (USD) – 1 year |

|---|---|---|---|---|

| November 28, 2012 | 210,000 | 50 BTC to 25 BTC | 13.40 | 70.00 (approx.) |

| July 9, 2016 | 420,000 | 25 BTC to 12.5 BTC | 650.00 | 4,000.00 (approx.) |

| May 11, 2020 | 630,000 | 12.5 BTC to 6.25 BTC | 8,700.00 | 29,000.00 (approx.) |

*Note: These are approximate figures and the actual price movements are complex and influenced by many factors. The “Price After” reflects the approximate price one year after the halving event.

Understanding the Bitcoin Halving Cycle: Did Bitcoin Halving Happen 2025

The Bitcoin halving is a programmed event that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, significantly impacting the cryptocurrency’s inflation rate and, historically, its price. Understanding this cycle is crucial for navigating the Bitcoin market.

The Bitcoin halving schedule is governed by a mathematical formula embedded within the Bitcoin protocol. This formula dictates that the reward given to Bitcoin miners for successfully adding new blocks to the blockchain is halved at predetermined intervals.

The Bitcoin Halving Formula

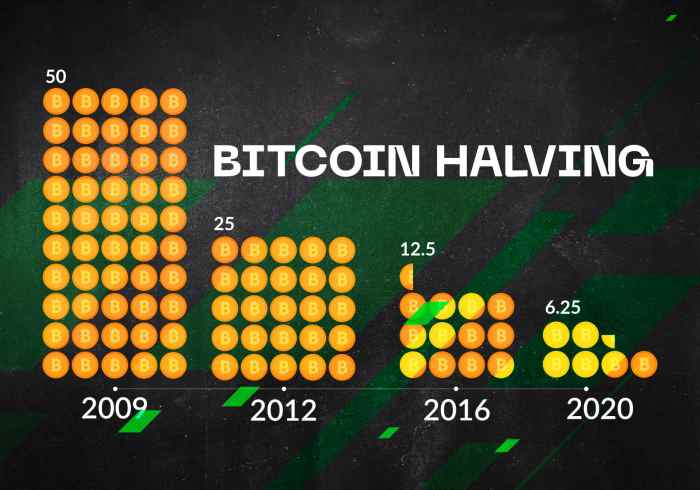

The core of the halving mechanism lies in the block reward reduction. Initially, the reward was 50 BTC per block. Every 210,000 blocks mined, this reward is halved. This means that the halving occurs approximately every four years, as the average block time is around 10 minutes. The formula itself isn’t explicitly stated as a single equation but is implicitly defined by the code: the block reward is divided by two after every 210,000 blocks. This process continues until the maximum supply of 21 million Bitcoin is reached, at which point the block reward will become zero. This programmed scarcity is a key feature of Bitcoin’s design.

The Scarcity Principle and Bitcoin’s Value

The halving reinforces the scarcity principle, a fundamental economic concept. Limited supply and increasing demand typically lead to higher prices. Bitcoin’s fixed supply of 21 million coins makes it inherently deflationary, contrasting with fiat currencies that can be printed indefinitely. This scarcity is a central argument for Bitcoin’s long-term value proposition, suggesting that its price will continue to rise as demand increases and the supply remains constrained. The halving events act as catalysts, emphasizing this scarcity by further reducing the rate of new Bitcoin entering circulation.

Historical Debate on Halving’s Price Influence

The impact of Bitcoin halvings on its price has been a subject of ongoing debate. While past halvings have been followed by significant price increases, it’s crucial to avoid drawing direct causal links. Other market factors, such as regulatory changes, technological advancements, and overall investor sentiment, also play significant roles. Some argue that the halving primarily acts as a psychological trigger, influencing investor behavior and creating anticipation, thereby driving up demand. Others believe the reduced inflation rate, inherent in the halving, is the primary driver of increased value. The reality likely lies somewhere in between these two extremes, with the halving acting as a catalyst within a broader context of market forces.

Potential Market Reactions to Future Halvings, Did Bitcoin Halving Happen 2025

Predicting the market’s reaction to future halvings, such as the one potentially occurring in 2025, is inherently speculative. However, we can explore potential scenarios.

A bullish scenario anticipates a significant price surge following the halving. This is based on the historical precedent of price increases following previous halvings and the expectation of increased scarcity. The anticipation leading up to the event could also fuel a price rally.

Conversely, a bearish scenario suggests that the market may not react significantly or even experience a price decline. This could be due to various factors, such as a prevailing bearish market sentiment, regulatory uncertainty, or a lack of significant new adoption. The price could be influenced by other macro-economic factors overriding the halving’s effect. The 2016 halving, for example, saw a relatively slow price increase in the months immediately following the event.

Bitcoin Supply Timeline (Illustrative)

The following timeline illustrates the expected changes in Bitcoin supply, leading up to and following a hypothetical 2025 halving. Note that these are estimations, and the actual timing may vary slightly due to fluctuations in block generation times. This timeline assumes a halving around late 2024 or early 2025.

| Year | Approximate Block Reward (BTC) | Approximate Annual Supply Increase (BTC) |

|---|---|---|

| 2020-2024 | 6.25 | ~650,000 |

| 2024-2028 | 3.125 | ~325,000 |

| 2028-2032 | 1.5625 | ~162,500 |

Note: These figures are approximate and subject to minor variations based on actual block generation times. The annual supply increase is an estimation based on the average number of blocks mined per year.

The 2024 Halving and its Projected Ripple Effects

The Bitcoin halving event, scheduled for 2024, is a significant event anticipated to impact the cryptocurrency market throughout 2025 and beyond. This reduction in the rate of new Bitcoin creation is expected to create a deflationary pressure on the supply side, potentially impacting price and market sentiment. The impact, however, is complex and dependent on numerous interacting factors.

The anticipated 2024 halving will likely lead to a period of increased scarcity of newly mined Bitcoin. This reduction in supply, coupled with potentially sustained or increased demand, could drive up the price. However, other economic factors, such as macroeconomic conditions and regulatory changes, will play a crucial role in determining the actual market response. The historical precedent of previous halvings suggests a period of price appreciation following the event, but the magnitude and duration of this effect vary.

Potential Market Conditions in 2025 Following the 2024 Halving

Several scenarios are plausible for the Bitcoin market in 2025 following the 2024 halving. A bullish scenario might see sustained price increases driven by the scarcity of new Bitcoin, positive regulatory developments, and increased institutional adoption. Conversely, a bearish scenario could involve a price correction due to macroeconomic headwinds, regulatory uncertainty, or a general market downturn impacting risk assets. A more moderate scenario might involve a period of consolidation, with price fluctuations around a new equilibrium level reflecting the reduced supply. The actual outcome will depend on the interplay of various factors. For example, if global inflation remains high and central banks continue aggressive monetary tightening, the demand for Bitcoin as a hedge against inflation might decrease, counteracting the effect of the halving. Conversely, a significant global economic downturn could increase demand for Bitcoin as a safe-haven asset, potentially driving prices upward despite the halving.

Comparison of Anticipated Market Reactions to the 2024 and a Hypothetical 2025 Halving

A hypothetical 2025 halving is, of course, impossible given the fixed four-year cycle. However, comparing the anticipated reaction to the 2024 halving with a hypothetical one allows for a discussion of potential market dynamics. The key difference would lie in the market’s prior experience with the 2024 halving. If the 2024 halving leads to significant price appreciation, the market might be less susceptible to extreme price movements during a hypothetical 2025 halving, as the effects of the halving cycle might be better understood and factored into market expectations. Conversely, if the 2024 halving leads to only moderate price changes or a price correction, the market might react more dramatically to a hypothetical 2025 halving, as the established expectations might be disrupted.

Miner Behavior and its Effect on the Bitcoin Network

The 2024 halving will significantly reduce the block reward miners receive for processing transactions and securing the Bitcoin network. This reduction will put pressure on miners’ profitability, potentially leading to some miners exiting the network if the Bitcoin price does not rise sufficiently to compensate for the reduced block reward. This could lead to a temporary decrease in the network’s hash rate, impacting its security and transaction processing speed. However, miners with lower operational costs and more efficient mining equipment are likely to remain, while others might consolidate or shut down. The long-term effect on the network’s security will depend on the balance between reduced profitability and the potential for price increases. Historically, miners have adapted to previous halvings, and technological advancements in mining hardware have often offset the impact of reduced block rewards.

Interaction of Market Factors Shaping the Post-Halving Landscape

The post-halving landscape will be shaped by the complex interplay of several factors. These include the Bitcoin price itself, the overall macroeconomic environment, regulatory developments, institutional adoption, and technological advancements in mining. For example, increased institutional investment might offset the impact of reduced miner profitability, while negative macroeconomic conditions could counteract the positive effects of scarcity. Technological innovations, such as more energy-efficient mining hardware, could also influence the profitability of mining and the overall network security. The interaction of these factors makes predicting the precise outcome challenging, highlighting the need for careful analysis and consideration of various scenarios.

No, the Bitcoin halving in 2025 hasn’t happened yet. We’re still anticipating this significant event in the Bitcoin ecosystem, which will reduce the rate of new Bitcoin creation. To keep track of the time until the halving, you can check out this helpful countdown: Bitcoin Halving 2025 Countdown. Therefore, the answer to “Did Bitcoin Halving Happen 2025?” remains a definitive no for now.

No, the Bitcoin halving did not occur in 2025; the last one happened in 2020. It’s important to distinguish this from other cryptocurrencies with different schedules. For instance, if you’re interested in a halving event this year, you might research the Bitcoin Cash Halving 2025. Therefore, focusing solely on Bitcoin, the next halving is still some years away.

No, the Bitcoin halving did not happen in 2025. To understand the precise timing of future halvings, it’s helpful to consult a reliable resource detailing the schedule, such as this page on the Halving Bitcoin 2025 Date. Therefore, any speculation about a 2025 halving is incorrect; the actual date will fall considerably later.

The question “Did Bitcoin Halving Happen in 2025?” is easily answered: no. Bitcoin halvings occur approximately every four years, and to find the precise date of the next halving, you’ll need to consult a reliable source. For instance, you can check this helpful resource to determine the exact date: What Date Is Bitcoin Halving 2025. Therefore, the answer to whether the halving happened in 2025 remains a definitive no.

The question of whether a Bitcoin halving occurred in 2025 is easily answered by clarifying the actual date. To find the precise date, you can consult this resource: When Was The Bitcoin Halving In 2025. Knowing the exact date will definitively confirm whether or not a halving event took place in 2025.

No, the Bitcoin halving didn’t occur in 2025; that event is scheduled for a later date. To understand the precise timing, you’ll need to know exactly when it’s expected to happen, which you can find out by checking this resource: What Time Is The Bitcoin Halving 2025. Therefore, the question “Did Bitcoin Halving Happen 2025?” is easily answered with a definitive no.